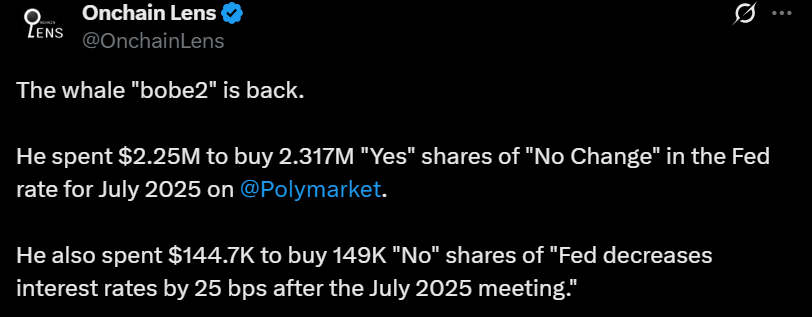

Fed Meeting Today: Bobe2’s Polymarket Prediction Hints No Rate Cut

As the FED Rate Cut Meeting wraps up today, whale Bobe2 has made a massive $2.4 million bet that the it won’t cut interest rates. His bold move on Polymarket is turning heads in the financial world and has everyone wondering—does he know something others don’t? Will the Federal reserve confirm Bobe2’s bold call—or surprise the market?

Source: Onchain Lens X Account

Bobe2 Polymarket Bet $2.4M Breakdown: July Prediction

Market whale has placed over $2.4 million in bets that the U.S. will not cut interest costs in its meeting scheduled today.

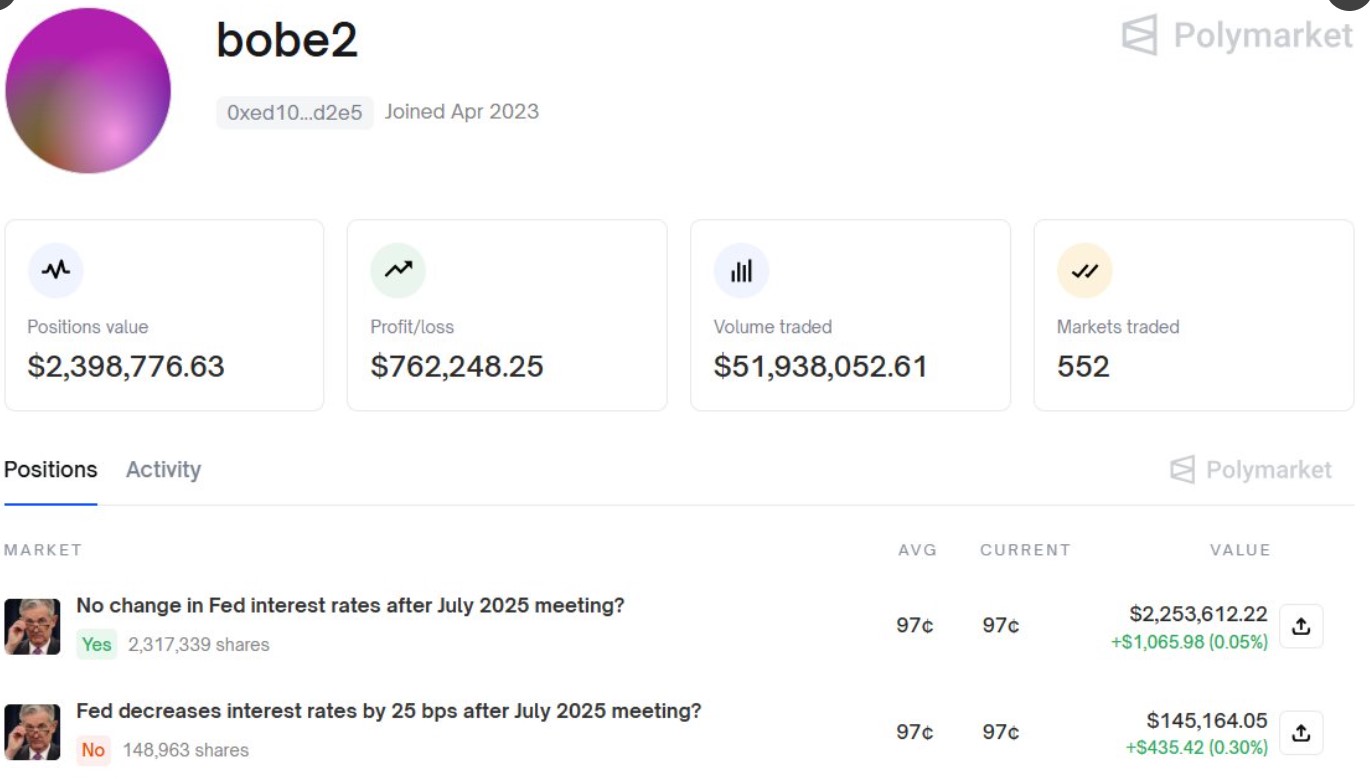

Using the Polymarket no fed rate cut July prediction platform, he bought 2.317 million “Yes” shares on “No Change” in rates at 97¢ per share, amounting to $2.25M.

He also purchased nearly 149K “No” shares on a 25 bps rate cut prediction, spending an additional $144.7K.

Source: PolyMarket

The whale’s strategy indicates strong conviction that there will be no change in monetary policy tonight, regardless of growing political chatter and economic pressure.

Kalshi Market Agrees: 95% Say No Change—Key Macro Signals

Kalshi, another prediction market following the FED Rate Cut Meeting , is backing Bobe2’s view. Right now, 95% of traders on the platform believe that they will keep rates steady in tonight’s decision.

Economic indicators further support this bet:

-

Inflation remains sticky, with core PCE still above target.

-

Unemployment is steady, not triggering urgent easing.

While political voices like Donald Trump hint at a Jerome Powell exit or shift, smart money is signaling steady rates over speculation.

Fed Meeting Today: Rate Decision + Policy Outlook Awaited

The two-day meeting concludes today, July 30, with markets awaiting clear guidance. While many expect the federal reserve to hold rates steady, investors are closely watching the policy statement and Powell’s speech for clues about a September or November rate reduction. This week’s gathering could set the tone for the rest of 2025 movements.

What If “bobe2” Is Right or Wrong? Clear Market Impact

If he is right and the they holds rates:

-

Short-term volatility may ease in the crypto market , as currently it is down around 1%, standing at $3.86T.

-

Stocks and crypto could rebound like Bitcoin, especially after last week’s pullback.

-

Confidence in Polymarket forecasting tools may strengthen.

However, if the White House unexpectedly slash rates today:

-

Bobe2’s $2.4M bet may collapse in value.

-

Risk-on assets may soar, led by small caps and high-beta tokens.

A surprise deduction could raise fresh worries about inflation in the bond market. No matter what happens, the outcome of this rate cut meeting will impact everything from stocks and crypto to commodities, making it one of the most closely followed Fed meeting decisions of 2025.

Conclusion: Fed Decision Will Test More Than Just Yields

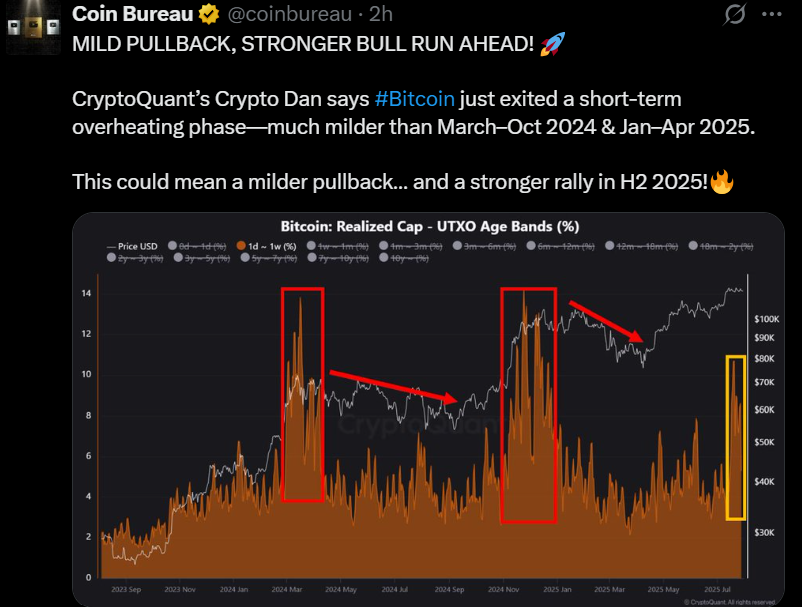

With crypto market cap now at $3.86T and daily volume dropping over 10%, broader sentiment is cautious. Yet voices like CryptoQuant’s Dan believe Bitcoin’s current phase is a mild cool-down, not a crash.

If Bobe2’s Polymarket prediction for the July 2025 FED Rate Cut Meeting is right, it could show just how accurate these prediction markets can be—and that he made a smart move at the right time.

But if it does something unexpected, like cutting rates, then this whale might lose millions. Right now, everyone’s waiting to see whether Jerome Powell sticks to the script or surprises the markets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。