Author: Frank, PANews

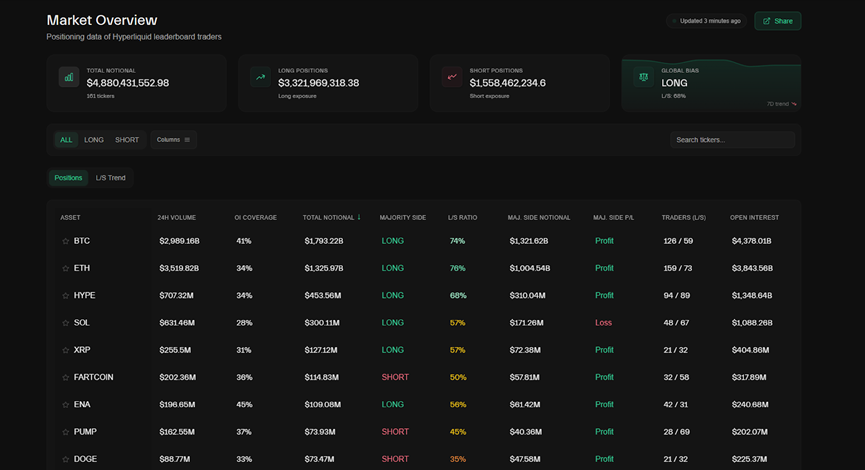

In the unpredictable cryptocurrency market, the movements of whales have always been an important barometer of market trends. To gain insight into the true flow of "smart money," PANews conducted an in-depth analysis of the latest leaderboard data from the decentralized derivatives exchange Hyperliquid. As of July 30, the whales on the Hyperliquid leaderboard opened positions worth a total of $4.6 billion, with long positions dominating at $3 billion. However, beneath this seemingly optimistic overall data lies a starkly contrasting strategic divergence: traders are firmly bullish on mainstream assets like BTC and ETH, while simultaneously shorting numerous altcoins and MEME coins. What does this significant differentiation indicate about the market direction?

Overall Trend: Bulls Still Dominate, but Frenzy Shows Signs of Cooling

From a macro perspective, bullish forces currently hold the upper hand. As of July 30, the total position volume of Hyperliquid's top traders is approximately $4.6 billion, with long positions around $3 billion and short positions about $1.57 billion, resulting in an overall long-short ratio of approximately 66%.

However, cautious signals lurk beneath the optimistic data. Firstly, the bullish trend has shown signs of decline, with the long-short ratio falling from a peak of 76% on July 27. Secondly, in terms of profit efficiency, short positions have performed better: among the tokens that whales are shorting, as much as 79% of the positions are in profit; whereas, among the tokens they are bullish on, this ratio is only 53.5%. This indicates that although whales generally lean towards bullishness, their short-term bearish decisions are more likely to yield profits.

Additionally, Coinglass data shows that among the top 125 wallet addresses on Hyperliquid, short positions have also become the mainstay, diverging from smaller wallet addresses, which generally remain bullish.

Whale Big Data: Sticking to Mainstream, Shorting Altcoins

The core strategic divergence among whales is reflected in their token choices, presenting a clear picture of "sticking to mainstream, shorting altcoins."

In terms of mainstream assets, whales exhibit a firm bullish stance. Taking BTC and ETH, which have the highest positions, as examples, their long-short ratios far exceed 66%. Specifically for BTC, the total long position amounts to $1.2 billion, while the short position is only $479 million. Interestingly, the average liquidation distance for short positions is a substantial 48.3%, much higher than the 14% for long positions, suggesting that many short positions may not be purely bearish but are used for risk hedging. Additionally, tokens like TON ($19.83 million position) and AAVE ($25.18 million position) also have high long-short ratios, making them some of the few altcoins favored by whales.

Conversely, the attitude of whales towards altcoins and MEME coins is starkly different. A series of tokens, including FARTCOIN, PUMP, DOGE, SUI, BONK, PEPE, and even BNB, have long-short ratios below 50%, indicating that shorts dominate. For tokens like MOODENG, SYRUP, S, and JUP, the long-short ratios are even below 10%, reflecting extreme bearish sentiment. These short positions are generally in profit, further confirming the effectiveness of the whales' shorting decisions.

Overall, while the bullish trend for all tokens remains mainstream, it has shown signs of decline since July 27, with the long-short ratio dropping from over 76% on July 28 to 66%. Among the tokens that whales are bullish on, 53.5% are overall in profit. Among the 29 tokens that are generally bearish, 79% are in profit.

Specifically for BTC, 71.7% of the traders on the leaderboard hold long positions, totaling $1.2 billion in long positions. The average entry price is approximately $114,000, with an average liquidation distance of 14%, currently yielding an overall profit of $27.82 million. In terms of short data, the positions are significantly lower, around $479 million, with an average entry price of $115,000, but the average liquidation distance remains at 48.3%, indicating that the whales' short positions seem more inclined towards hedging orders.

In terms of position size, the average long position for BTC whales is $10 million, while the average short position is about $7.98 million.

Top Traders: Long-term Bullish, Short-term Cautious or Shorting

Beyond the overall data, the attitudes of top traders also provide insight into market sentiment.

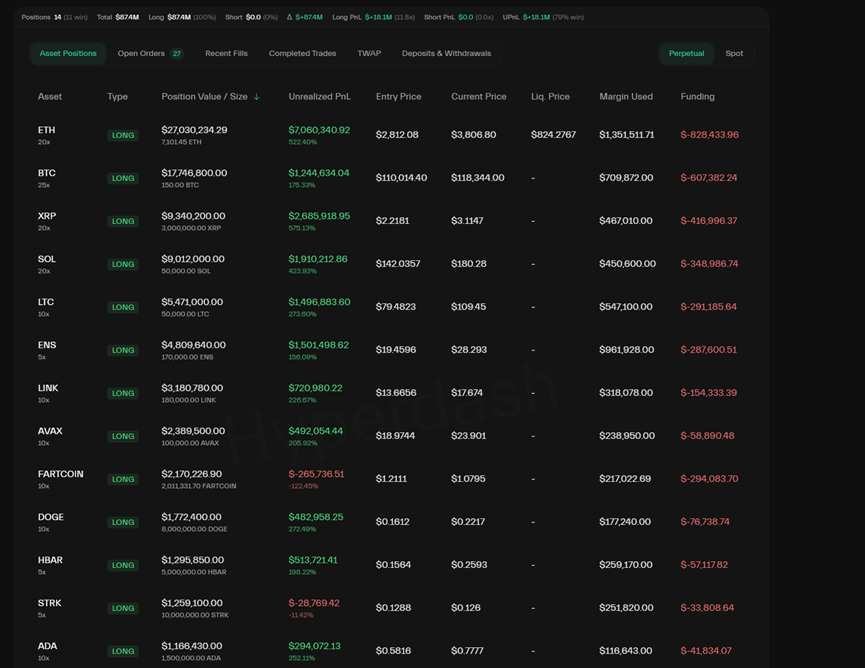

The trader with the highest profit on Hyperliquid, 0x8af700ba841f30e0a3fcb0ee4c4a9d223e1efa05, currently has total profits of approximately $54.86 million. This trader's profit curve has been steadily upward since December 2024, indicating a relatively stable and long-term trading style.

His positions are relatively balanced in total amount, with both long and short positions around $63 million. In terms of specific token choices, he predominantly holds short positions, with only a few long positions. The most profitable position is FARTCOIN, shorted at $1.44, with current unrealized gains reaching $1.12 million. Among his 16 profitable orders, only 2 are long positions with unrealized gains. AAVE has unrealized gains of $976,000. His positions align closely with the overall data, maintaining long positions on BTC and ETH while being bearish on altcoins in the short term.

The second-ranked trader, 0x15b325660a1c4a9582a7d834c31119c0cb9e3a42, currently has profits of about $35 million. This trader clearly maintains a long-term bullish outlook, with all positions being long and an overall leverage of only 3.6 times. In terms of cycles, this trader is evidently a long-term trader, with the opening price for ETH long positions at only $2,812, BTC long positions at $110,000, and SOL at $142, almost all held for the long term. However, not all of his long positions have realized profits, with FARTCOIN showing an unrealized loss of $235,000, BIGTIME an unrealized loss of $45,000, and STRK an unrealized loss of $18,000. The remaining orders are all in profit, with ETH long positions alone yielding unrealized gains of $7.21 million.

The third-largest trader, 0x2ba553d9f990a3b66b03b2dc0d030dfc1c061036, has unrealized gains of $40 million (he should actually be the second-highest in unrealized gains). Among this trader's positions, 78% are short. This trader appears to be a short-term trader, with an average holding time of less than 2 hours. Currently, his positions are not large, suggesting a cautious stance towards the market.

From the positions of these traders, long-term traders remain optimistic about the future, while short-term traders tend to be more bearish or cautious.

In summary, the whale data from Hyperliquid paints a picture of a market that "sticks to mainstream, shorts altcoins." Although overall positions lean towards bullishness, this bullish sentiment is primarily concentrated in a few core assets like BTC and ETH, and its advantage has shown signs of decline. Meanwhile, whales' short positions on altcoins are not only numerous but also have a higher profit ratio, indicating their general bearish sentiment towards high-risk assets and effective harvesting. From the personal strategies of top traders, long-term investors remain optimistic and patient, while short-term traders are more inclined to cautiously short or hold their positions. For ordinary investors, understanding the "dual-sided" strategy of whales may be more important than simply following the bullish or bearish direction.

Risk Warning: The content of this article is based on public data analysis for informational reference only and does not constitute any investment advice or opinion. The cryptocurrency market is highly risky, with significant price volatility. Investment should be approached with caution, and you must engage in independent thinking and bear all risks yourself.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。