Author: Coingecko

Compiled by: Felix, PANews

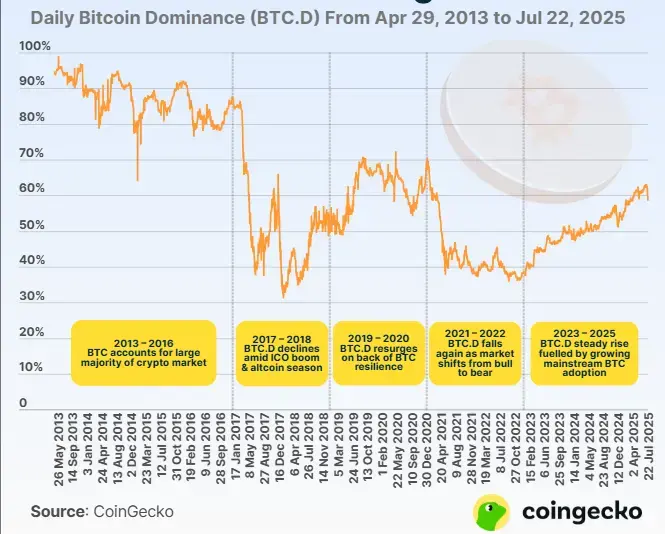

This study examines Bitcoin's daily market dominance from April 29, 2013, to July 22, 2025, with data sourced from CoinGecko.

How has Bitcoin's market dominance evolved over the years?

Over the 12 years from 2013 to 2025, Bitcoin's market dominance in the crypto market has fluctuated significantly, oscillating between a historical low of 31.1% and an early high of 99.1%. During this period, Bitcoin's daily market dominance has remained at 50.0% or higher for two-thirds of the time. In other words, Bitcoin has dominated the crypto market for as long as 8 years during these 12 years.

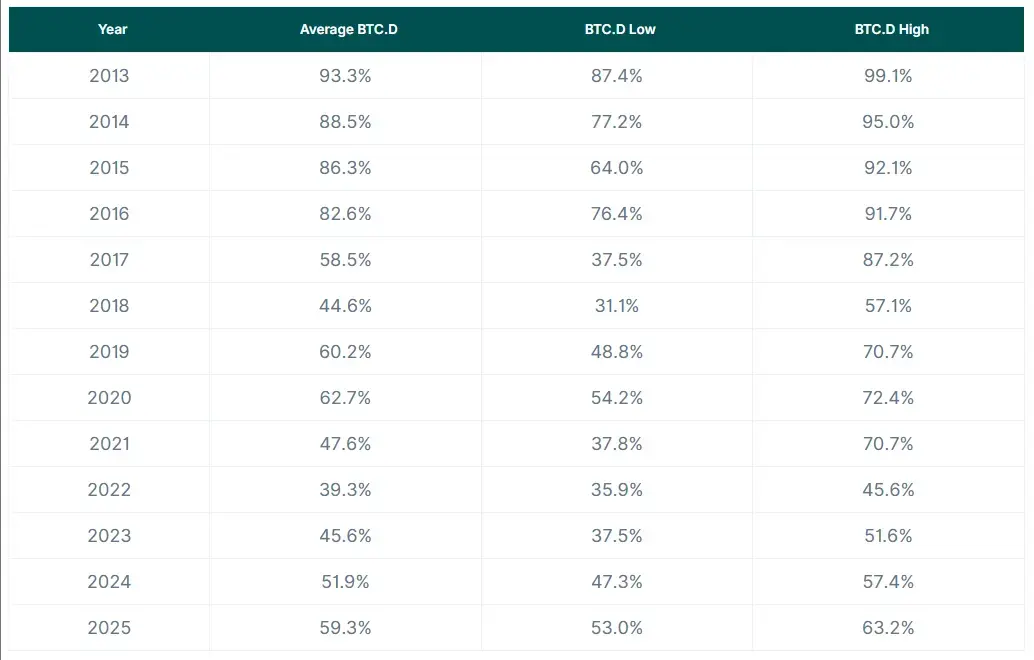

On an annual basis, Bitcoin's average daily market dominance has declined for five consecutive years, from 93.3% in 2013 to 44.6% in 2018. The market dominance rebounded to 60.2% in 2019, 62.7% in 2020, then fell again to 47.6% in 2021 and 39.3% in 2022.

Since 2023, Bitcoin's market dominance has steadily increased again, with an average of 45.6% in 2023, 51.9% in 2024, and currently 59.3% in 2025. This means that Bitcoin's market dominance in 2025 is currently hovering around the 12-year average of approximately 62.5%.

Bitcoin's market dominance is currently hovering around the 12-year average of 62.5%

Statistical date: April 29, 2013, to July 22, 2025

Key levels of Bitcoin's market dominance

Since February 2016, Bitcoin's market dominance has remained well below 90%. This reflects a turning point in the maturity of the crypto market following the ICO boom in 2017 and the first altcoin bull market, during which the number of mainstream altcoins increased, along with their market capitalization.

Similarly, after barely recording 70.7% on January 3, 2021, Bitcoin's market dominance declined and has remained below 70%. This means that over the past 12 years, Bitcoin's average daily market dominance has only reached 70% or higher for one-third of the time. Whether Bitcoin's market dominance will break the 70.0% threshold again remains to be seen.

Notably, on April 7, 2025, Bitcoin's market dominance rose to 60.5%, marking the first time in over four years that it has surpassed the 60% threshold. The last time Bitcoin's market dominance exceeded this threshold was on March 15, 2021, when it reached 60.6%. Over the past 12 years, Bitcoin's market dominance has been below 60.0% for more than half of the time.

Historical development of Bitcoin's market dominance (2013 - 2025)

The annual average, minimum, and maximum values of Bitcoin's market dominance from 2013 to 2025 are as follows.

2013 to 2016: Bitcoin monopolizes the crypto market

During the period from 2013 to 2016, Bitcoin held a market dominance in the crypto market, with its average daily market dominance ranging from 82.6% to 93.3% each year. In this emerging period, despite Bitcoin's price corrections and significant regulatory actions taken by the U.S. against the then Bitcoin exchange Mt. Gox, Bitcoin's market dominance in the crypto space peaked at 99.1% on May 29, 2013.

Although Bitcoin held the vast majority of the market share in the crypto market, it experienced three major fluctuations in market dominance during this period:

- On March 29, 2014, Bitcoin's market dominance dropped by 10.9 percentage points from the previous day, falling from 89.6% to 78.7%. This occurred after the collapse of Mt. Gox and was attributed to a significant rise in the total market capitalization of cryptocurrencies followed by a correction.

- On January 15, 2015, Bitcoin's market dominance sharply declined by 16.2 percentage points, from 80.2% to 64.0%. This drop was driven by Bitcoin's price falling from $221 the previous day to $172, marking the bear market bottom after the Bitstamp centralized exchange was hacked.

- On January 16, 2015, Bitcoin's market dominance rebounded to 80.7%, an increase of 16.7 percentage points from the previous day, as Bitcoin's price also recovered to $211.

2017 to 2018: ICOs and altcoins overshadow Bitcoin

In the following two years, Bitcoin's market dominance further declined, dropping to new lows during the altcoin bull market driven by ICOs in 2017 and the bear market in 2018, falling well below the 80% and 70% thresholds. On May 16, 2017, Bitcoin fell below 50% for the first time, reaching 48.5%. Notably, on January 16, 2018, Bitcoin's market dominance hit a historical low of 31.1%, as Bitcoin's price plummeted from $14,412 to $11,724.

In the past 12 years, Bitcoin's market dominance fluctuated the most in 2017, starting the year at 87.2% and reducing to more than half by June 19, dropping to 37.6%. In the second half of the year, Bitcoin's market dominance briefly rose, then fell to an annual low of 37.5%, before rebounding to 66% on December 7, ultimately closing the year at 38.9%.

On the other hand, Bitcoin's market dominance showed an overall upward trend in 2018, growing from 37.4% at the beginning of the year to 52% by the end.

2019 to 2020: Bitcoin regains dominance at the time of the third halving

In 2019 and 2020, Bitcoin regained its dominance in the crypto market, maintaining a share between 48.8% and 72.5%. This resurgence of Bitcoin's dominance was the result of multiple factors: primarily the anticipation of the third Bitcoin halving in May 2020, as well as investors returning to quality assets after the ICO boom, with early institutions viewing Bitcoin as "digital gold," and Bitcoin's role as an entry point during the "DeFi summer" of 2020.

2021 to 2022: Altcoins reassert their influence

During the bull market of 2021 and the crash triggered by the pandemic in 2022, Bitcoin's market dominance continued to decline by 30.9 percentage points, from 69.5% to 38.6%. During these two years, as altcoins gradually established themselves and began to exert greater influence in the crypto market, Bitcoin's market dominance consistently decreased.

During this period, Bitcoin's market share was below 50% on 8 out of every 10 days. In other words, out of 730 days, Bitcoin's market dominance was below 50.0% for 624 days.

Specifically, in 2021, despite Bitcoin's price rising from $29,022 to a historical high and closing the year at $47,192, a 62.6% increase, Bitcoin's market dominance still fell from 69.5% at the beginning of the year to 38.2% by the end. In contrast, during the same period, the total market capitalization of the entire crypto market outperformed Bitcoin, soaring from $776 billion to $2.3 trillion, a 200.6% increase.

In 2022, Bitcoin's market dominance started at 37.9% and ended at 38.6%, as Bitcoin's price fell by 64.2%, consistent with the 64.1% decline in the overall crypto market. In other words, Bitcoin itself was directly affected by the collapses of Terra-Luna and FTX, as investors flocked to fiat currencies to reduce risk.

2023 to 2025: Bitcoin moves towards mainstream acceptance

In the past three years, Bitcoin's market dominance has steadily increased, growing from 38.4% at the beginning of 2023 to 58.5% as of 2025. The rebound in Bitcoin's market dominance reflects a structural shift in the crypto market, aided by the approval of the U.S. spot Bitcoin ETF in January 2024 and the increasingly clear regulatory environment following the FTX collapse, leading to mainstream recognition and institutional adoption of Bitcoin.

Notably, Bitcoin's market dominance has become increasingly stable, with smaller fluctuations ranging from -1.2 percentage points to +1.6 percentage points. In contrast, during the period from 2013 to 2016, Bitcoin's market dominance fluctuated between -16.2 percentage points and +16.7 percentage points; while from 2017 to 2022, the fluctuation range was -8.8 percentage points to +7.0 percentage points.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。