The market is like a vast ocean; we cannot predict the storms, only adjust the sails during them.

Author: IOBC Capital

In the first half of 2025, the Crypto market was significantly influenced by various macro factors, with three key aspects being: the tariff policy of the Trump administration, the Federal Reserve's interest rate policy, and geopolitical conflicts in Ukraine and the Middle East.

Looking ahead to the second half of the year, the Crypto market will continue to navigate through a complex and changing macro environment, with the following major macro factors continuing to play an important role:

1. The Derivative Impact of Trump's Tariff Policy is Inflation Expectations

Tariffs are an important policy tool for the Trump administration, which aims to achieve a series of economic goals through tariff negotiations: first, to expand U.S. exports and reduce trade barriers in other countries; second, to maintain a base tariff of over 10% to increase U.S. fiscal revenue; and third, to enhance the domestic competitiveness of specific industries and stimulate the return of high-end manufacturing.

As of July 25, tariff negotiations between the U.S. and major world economies have made varying degrees of progress:

Japan: An agreement has been reached. U.S. tariffs on Japanese goods have been reduced from 25% to 15% (including auto tariffs), and Japan has committed to investing $550 billion in the U.S. (covering semiconductors and AI), opening its automotive and agricultural markets, and increasing the import quota for U.S. rice.

European Union: The deadline is August 1. EU negotiators arrived in the U.S. on July 23 for final consultations, but the results of the negotiations have not yet been made public.

China: The third round of trade negotiations will be held in Sweden from July 27 to 30. After the first two rounds of negotiations, U.S. tariffs on China were reduced from 145% to 30%, and China's tariffs on the U.S. were reduced from 125% to 10%; reports suggest that the deadline for U.S.-China tariff negotiations will be extended by 90 days, and if no new agreement is reached in the third round, a pause in tariff adjustments may occur.

Additionally, the U.S. has reached tariff agreements with the Philippines and Indonesia. The most closely watched is the third round of tariff negotiations between the U.S. and China. Although the uncertainty surrounding tariff policies is gradually decreasing, the possibility of negotiations with key economies failing to make substantial progress cannot be ruled out, which could lead to greater shocks in the financial markets.

From an economic theory perspective, tariffs represent a negative supply shock and have a "stagflation" effect. In international trade, while the tax subject of tariffs is businesses, companies often pass this tax burden onto U.S. consumers through price transmission mechanisms. Therefore, it is expected that the U.S. may experience a round of inflation in the second half of the year, which could significantly impact the Federal Reserve's interest rate cut pace.

In summary, the impact of Trump's tariff policy on the U.S. economy in the second half of the year may manifest as a phase of rising inflation. Unless data indicates that inflationary pressures are minimal, this will lead to a slowdown in the pace of interest rate cuts.

2. The Dollar Tide Cycle is in a Weak Dollar Phase Favoring the Crypto Market

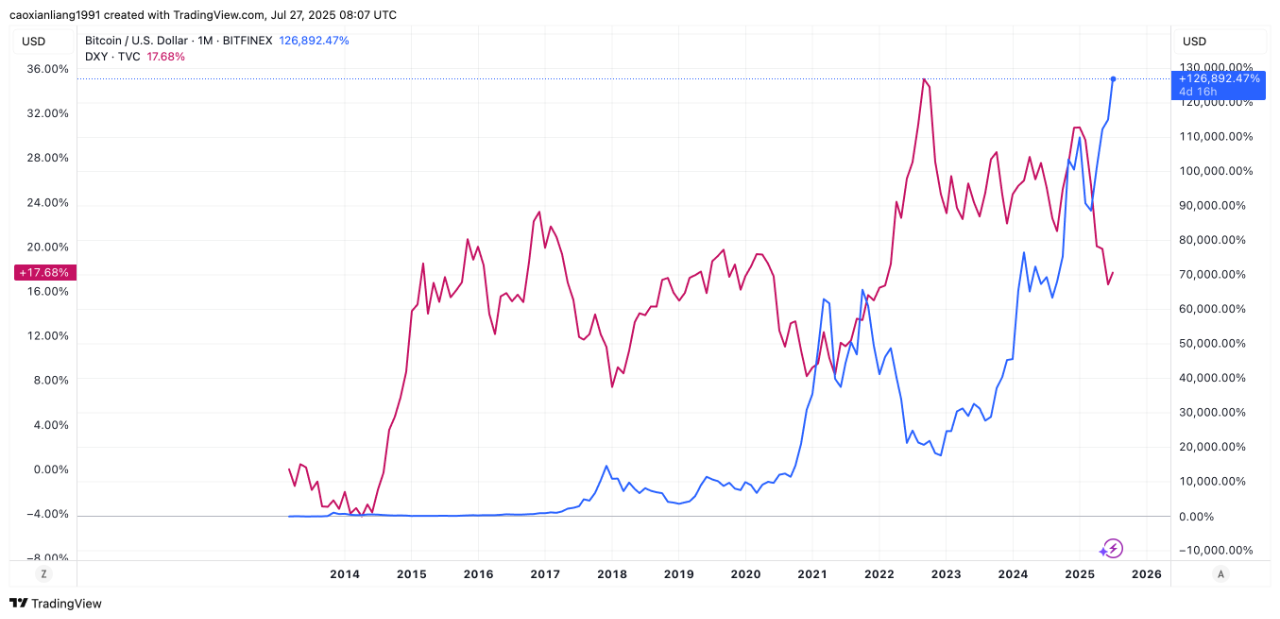

The dollar tide cycle refers to the systematic outflow and inflow of the dollar globally. Although the Federal Reserve did not cut interest rates in the first half of the year, the dollar index has weakened: from a peak of 110 at the beginning of the year to 96.37, showing a clear "weak dollar" state.

The weakening of the dollar may have multiple causes: first, Trump's tariff policy has suppressed the trade deficit, disrupting the dollar's circulation mechanism, while tariff barriers have weakened the attractiveness of dollar assets, raising market concerns about the stability of the dollar system; second, the fiscal deficit has burdened credit, with the continued rise in the scale of U.S. debt and repeated increases in U.S. debt rates deepening market doubts about fiscal sustainability; third, the expiration of the petrodollar agreement has not been renewed, with the proportion of global central banks' dollar reserves dropping from 71% in 2000 to 57.7%, while the proportion of gold reserves has risen, triggering attempts at "de-dollarization"; additionally, the policy direction reflected in the rumored "Mar-a-Lago Agreement" may also play a role in this.

Based on past dollar tide cycles, the strength of the dollar index has almost dominated the trend of global liquidity changes. Global liquidity typically follows a complete dollar tide cycle every 4-5 years, exhibiting cyclical fluctuations. The weak dollar cycle generally lasts about 2 to 2.5 years; if we start counting from June 2024, this weak dollar cycle may last until mid-2026.

Chart: IOBC Capital

As seen in the above chart, Bitcoin's price often shows a negative correlation with the dollar index. When the dollar weakens, Bitcoin typically performs strongly. If the "weak dollar" cycle continues in the second half of the year, global liquidity will shift from tight to loose, which will continue to benefit the crypto market.

3. The Federal Reserve's Monetary Policy May Remain Cautious

There are four Federal Reserve meetings scheduled for the second half of 2025. According to the CME "FedWatch" tool, the probability of an interest rate cut 1-2 times in the second half of the year is relatively high. Among them, the probability of maintaining the interest rate in July is as high as 95.7%; the probability of a 25 basis point cut in September is 60.3%.

Since Trump took office, he has repeatedly criticized the Federal Reserve's slow pace of interest rate cuts on X platform, even directly accusing Fed Chair Powell and threatening to fire him, which has put some political pressure on the Fed's independence. However, in the first half of the year, the Fed withstood the pressure and did not cut interest rates.

According to the normal term arrangement, Fed Chair Powell will officially step down in May 2026. The Trump administration plans to announce a new chair nominee in December 2025 or January 2026. In this context, the voices of the main dovish members within the Fed have gradually attracted market attention, seen as a potential reflection of "shadow chair" influence. Nevertheless, the market generally believes that the interest rate meeting on July 30 will maintain the current interest rate level.

The prediction of a delayed interest rate cut is based on three core reasons:

1️⃣ Continued inflation pressure—affected by Trump's tariff policy, the U.S. CPI rose by 0.3% month-on-month in June, and core PCE inflation rose to 2.8% year-on-year. It is expected that the tariff transmission effect will further push up prices in the coming months, and the Fed believes that the return of inflation to the 2% target is obstructed and requires more data to confirm the trend;

2️⃣ Economic growth slowdown—growth is expected to be only 1.5% in 2025, but short-term data such as retail sales and consumer confidence exceeded expectations, alleviating the urgency for an immediate rate cut;

3️⃣ Resilience in the job market—the unemployment rate remains low at 4.1%, but corporate hiring has slowed, and the market predicts that the unemployment rate may rise slightly in the second half of the year, with projected unemployment rates for Q3 and Q4 being 4.3% and 4.4%, respectively.

In summary, the probability of an interest rate cut on July 30, 2025, is extremely low.

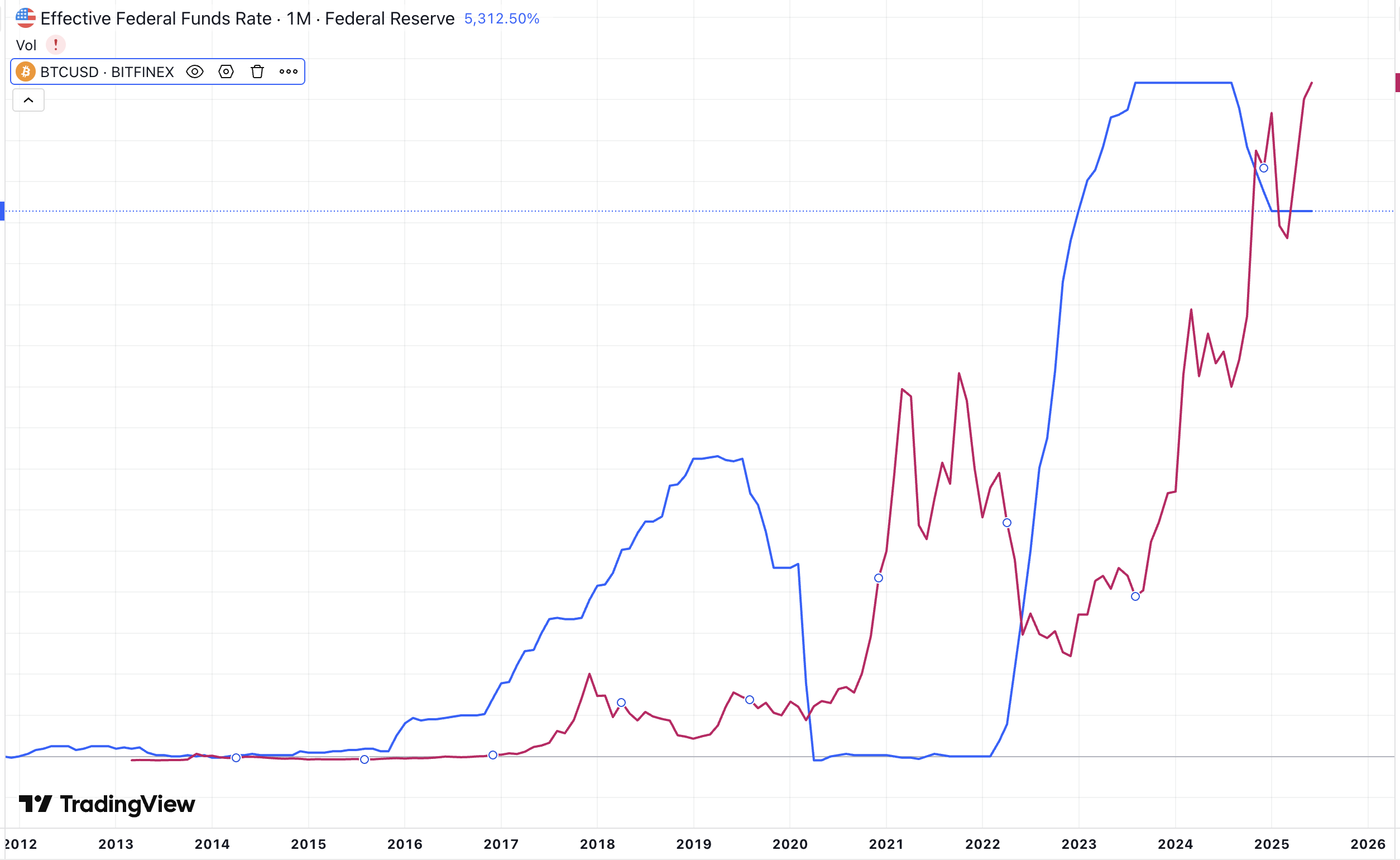

Chart: IOBC Capital

Overall, it is expected that the Federal Reserve's monetary policy will remain cautious, with the total number of interest rate cuts for the year likely being 1-2 times. However, observing past trends of Bitcoin and Federal Reserve interest rates, there is actually no significant correlation between the two. Compared to changes in Federal Reserve interest rates, the state of global liquidity under a weak dollar may have a greater impact on Bitcoin.

4. Geopolitical Conflicts May Temporarily Impact the Crypto Market

The Russia-Ukraine war is currently in a state of stalemate, with bleak prospects for a diplomatic resolution. On July 14, Trump proposed a "50-day ceasefire deadline," stating that if Russia does not reach a peace agreement with Ukraine within 50 days, the U.S. will impose a 100% tariff and secondary tariffs on it, and provide military assistance to Ukraine, including "Patriot" air defense missiles, through NATO. However, Russia has gathered 160,000 elite troops, planning to focus on key strongholds along the Ukrainian Donbas front. Meanwhile, Ukraine has also been active, launching a large-scale drone attack on Moscow's airport on July 21. Additionally, Russia announced its withdrawal from a thirty-year military cooperation agreement with Germany, completely severing Russia-EU relations.

From the current situation, achieving a ceasefire by September 2 seems challenging. If a ceasefire is not reached by then, Trump's sanctions may trigger market turmoil.

5. The Crypto Regulatory Framework is Taking Shape, and the Industry is Entering a Policy Honeymoon Period

The U.S. "GENIUS Act" has been implemented as of July 2025, stipulating that "interest shall not be paid to token holders, but the interest on reserves belongs to the issuer and must disclose its use." However, it does not prohibit issuers from sharing interest income with users, such as Coinbase's USDC offering an annualized 12%. The prohibition on paying interest to token holders limits the development of "yield-bearing stablecoins," which was originally intended to protect U.S. banks from losing trillions of dollars from traditional bank deposits, as these deposits support loans to businesses and consumers.

The U.S. "CLARITY Act" clearly states that the SEC regulates security tokens, while the CFTC regulates commodity tokens (such as BTC and ETH). It introduces the concept of a "mature blockchain system," allowing for regulatory conversion through certification—decentralized, open-source code, and blockchain projects that operate automatically based on preset rules can be recognized as "mature" after certification (such as submitting proof of no centralized control), thus completing the regulatory compliance transition from "security" to "commodity," with regulatory authority fully belonging to the CFTC, and the SEC no longer exercising securities regulatory authority over them. Additionally, it provides some exemptions for DeFi—such as writing code, running nodes, providing front-end interfaces, and non-custodial wallets are generally not recognized as financial services, exempting them from SEC regulation. They only need to comply with basic terms such as anti-fraud and anti-manipulation.

Overall, the accelerated advancement of the "GENIUS Act," "CLARITY Act," and "Anti-CBDC Surveillance National Act" marks the transition of the U.S. from a "regulatory ambiguity" phase to a "sunshine regulation" era regarding cryptocurrencies. It also reflects its policy intention to "maintain the dollar's status as the global trade currency." As the regulatory framework gradually improves, the stablecoin market size is expected to further expand, benefiting those stablecoin projects and DeFi protocols that can meet compliance requirements.

6. The "Coin-Stock Strategy" Activates Market Enthusiasm, Sustainability to be Observed

As MicroStrategy completes its epic transformation with a "Bitcoin strategy," a revolution in crypto asset reserves led by publicly listed companies is sweeping the capital market. From ETH to BNB, SOL, XRP, DOGE, HPYE, TRX, LTC, TAO, FET, and more than a dozen mainstream altcoins have become new anchor points for corporate treasuries, and this "coin-stock strategy" is becoming a market trend this year.

Analyzing this capital alchemy with MicroStrategy's "triple flywheel":

Stock-Coin Resonance Flywheel: The stock price has a long-term premium relative to net asset value (currently 1.61x), creating a low-cost financing channel; fundraising → increasing BTC holdings → boosting coin prices → amplifying per-share value → feeding back into valuation, forming a spiraling upward closed loop.

Stock-Debt Synergy Flywheel: Zero-interest convertible bonds cleverly transform debt pressure, with no principal repayment burden, and the conversion rights remain with the company; attracting hedge funds for arbitrage capital, injecting low-cost liquidity.

Coin-Debt Arbitrage Flywheel: By depreciating fiat currency debt, replacing it with appreciating crypto assets, a long-term arbitrage layout is completed.

Moreover, a tiered sales strategy is employed to precisely capture three types of capital: preferred shares lock in fixed-income investors, convertible bonds attract arbitrage funds, and stocks carry risk speculation. For specific logic, please refer to “Understanding MSTR MicroStrategy's Bitcoin Strategy in One Article”.

Since the beginning of this year, an increasing number of publicly listed companies have adopted the "coin-stock strategy" (i.e., allocating crypto assets as reserve assets on their balance sheets), with the scale of asset reserves continuously expanding and asset allocation showing a trend of diversification. According to incomplete statistics: 35 listed companies have collectively reserved over 920,000 BTC; 13 listed companies have collectively reserved over 1.48 million ETH; and 5 listed companies have collectively reserved over 2.91 million SOL. The rest are not listed here; we will provide a detailed analysis of each project's reserves in the next article.

The integration of traditional finance and the crypto world is a unique market variable in this cycle. When publicly listed companies transform their balance sheets into platforms for crypto asset operations, we must also be wary of the risks when the tide goes out.

Summary

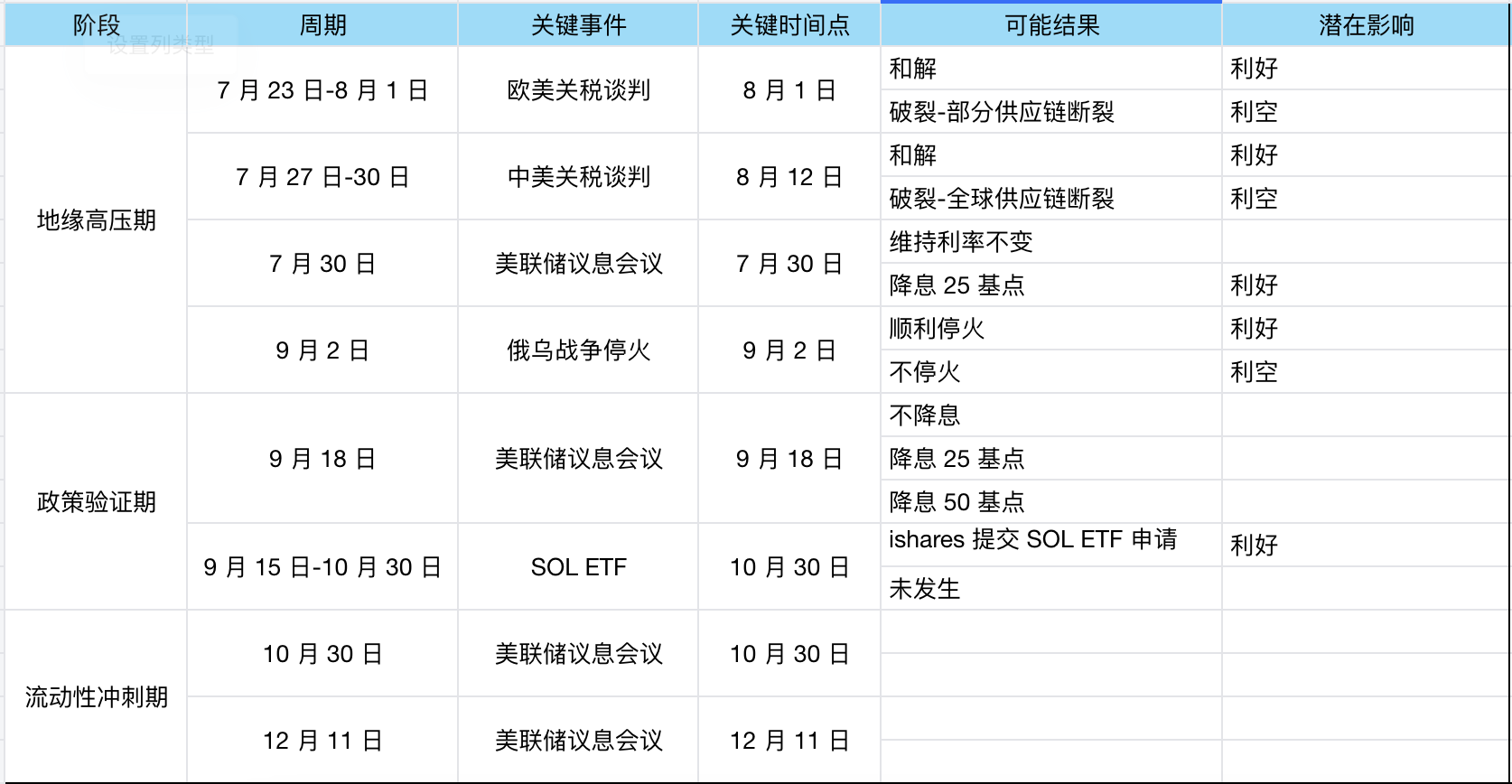

If we extrapolate the aforementioned foreseeable macro events in chronological order, the second half of the year can be divided into the following stages:

Chart: IOBC Capital

The market is like a vast ocean; we cannot predict the storms, only adjust the sails during them.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。