引言

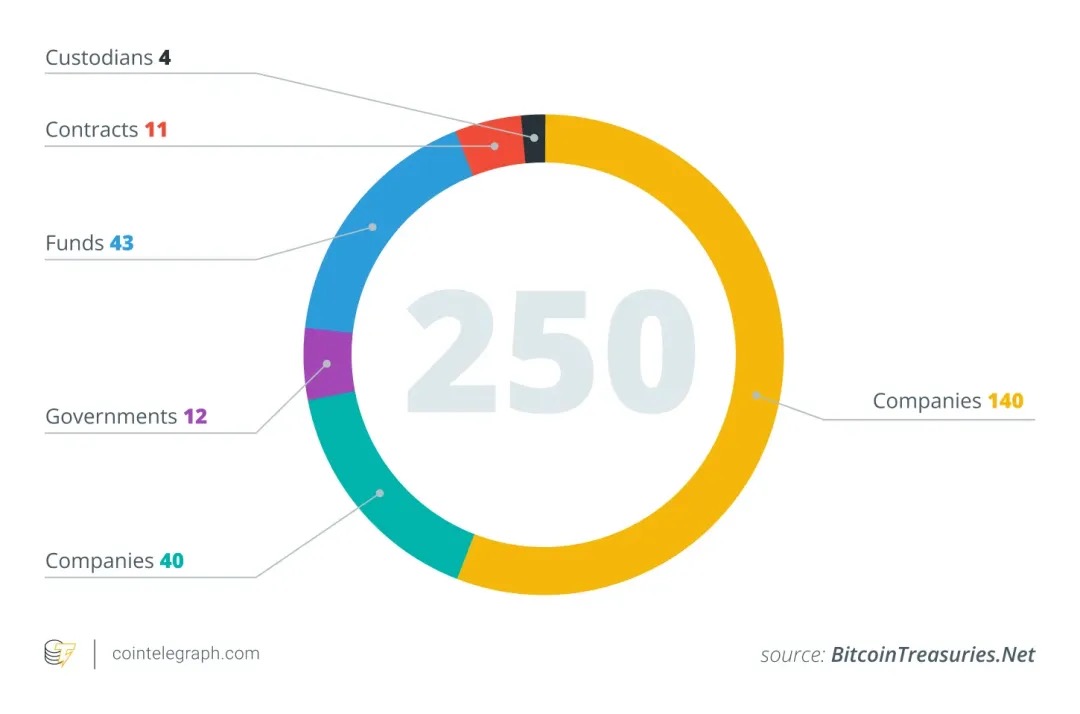

截至 2025 年中,越来越多的上市公司开始将加密货币(尤其是比特币)纳入公司金库资产配置中,受到了 Strategy($MSTR)成功案例的启发。例如,据区块链分析数据显示,仅在 2025 年 6 月,就有 26 家新公司将比特币纳入资产负债表,使全球持有 BTC 的公司总数达到约 250 家。

这些公司横跨多个行业(科技、能源、金融、教育等)和不同国家地区。许多公司将比特币有限的 2100 万供应量视为对抗通胀的对冲工具,并强调其与传统金融资产相关性低的特性。这种策略正悄然走向主流:截至 2025 年 5 月,已有 64 家在 SEC 注册的公司共持有约 688,000 枚 BTC,约占比特币总供应量的 3–4%。分析师估计,全球已有超过 100–200 家公司将加密资产纳入财务报表。

加密资产储备的模型

当一家上市公司将部分资产负债表配置到加密货币时,一个核心问题随之而来:他们是如何融资购买这些资产的? 与传统金融机构不同,大多数采用加密金库策略的公司,并不依赖于现金流充沛的主营业务来支撑。接下来的分析将以 $MSTR(MicroStrategy)为主要示例,因为大多数其他公司实际上也在复制其模式。

主营业务现金流(Operating Cash Flow)

虽然理论上最“健康”且最不具稀释性的方式,是通过公司核心业务所产生的自由现金流来购买加密资产,但在现实中这种方式几乎不可行。大多数公司本身就缺乏足够稳定且大规模的现金流,根本无法在不借助外部融资的情况下积累大量 BTC、ETH 或 SOL 储备。

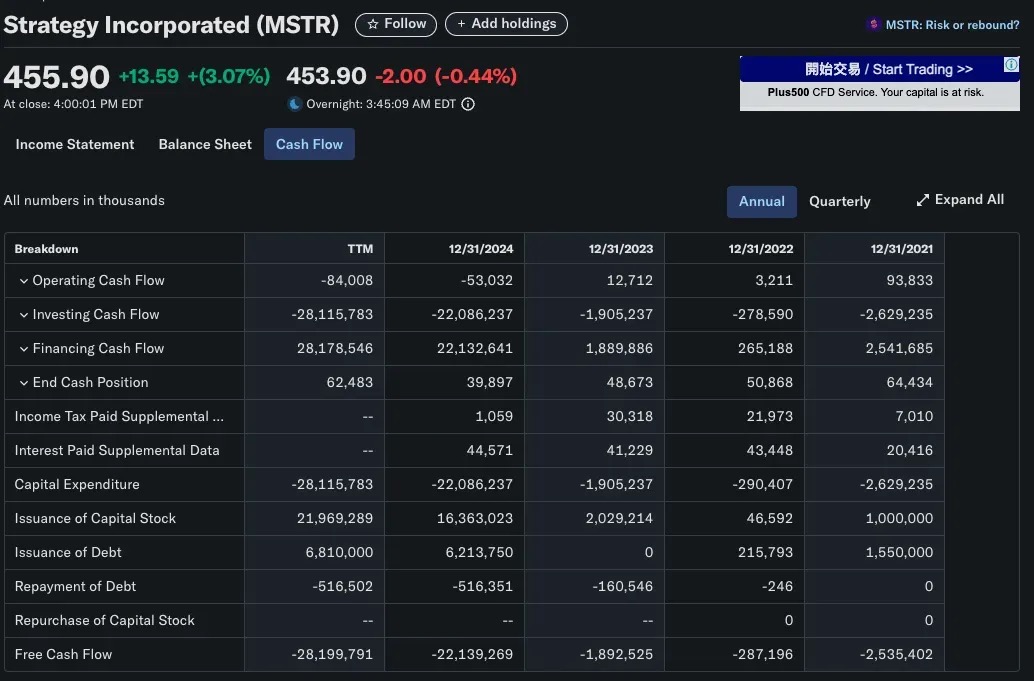

以 MicroStrategy(MSTR)为典型例子:该公司成立于 1989 年,原本是一家专注于商业智能的软件企业,其主营业务包括 HyperIntelligence、AI 分析仪表盘等产品,但这些产品至今仍只能产生有限的收入。事实上,MSTR 的年度经营现金流为负数,与其投资比特币的数百亿美元规模相去甚远。由此可见,MicroStrategy 的加密金库战略从一开始就不是基于内部盈利能力,而是依赖外部资本运作。

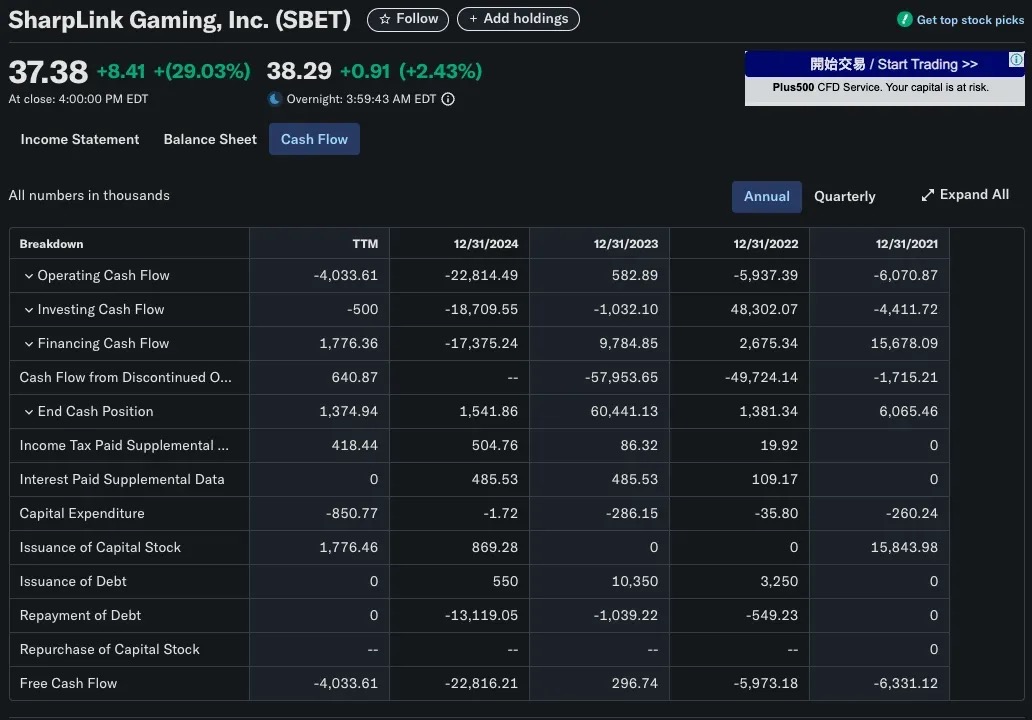

类似的情况也出现在 SharpLink Gaming(SBET)。该公司在 2025 年转型为以太坊金库载体,购入了超过 280,706 枚 ETH(约合 8.4 亿美元)。显然,它不可能依靠其 B2B 游戏业务的收入来实现这项操作。SBET 的资本形成策略主要依靠 PIPE 融资(私募投资公开股票)与直接股票发行,而非经营性收入。

资本市场融资

在采用加密金库策略的上市公司中,最常见且具可扩展性的方式是通过公开市场融资(public offering),通过发行股票或债券来筹集资金,并将所得用于购买比特币等加密资产。这一模式使公司能在不动用留存收益的情况下构建大规模加密金库,并充分借鉴了传统资本市场的金融工程方法。

发行股票:传统的稀释性融资案例

在大多数情况下,发行新股伴随着成本。公司通过增发股票来融资时,通常会发生两件事:

-

所有权被稀释:原有股东在公司中的持股比例下降。

-

每股收益(EPS)下降:净利润不变的情况下,总股本增加导致 EPS 降低。

这些效应通常会导致股价下跌,主要有两个原因:

-

估值逻辑:如果市盈率(P/E)保持不变,而 EPS 下滑,股价也会下跌。

-

市场心理:投资者常将融资解读为公司缺乏资金或处于困境,尤其当筹得资金用于尚未验证的增长计划时,此外,新股大量涌入市场的供给压力也会拉低市场价格。

一个例外:MicroStrategy 的反稀释型股权模式

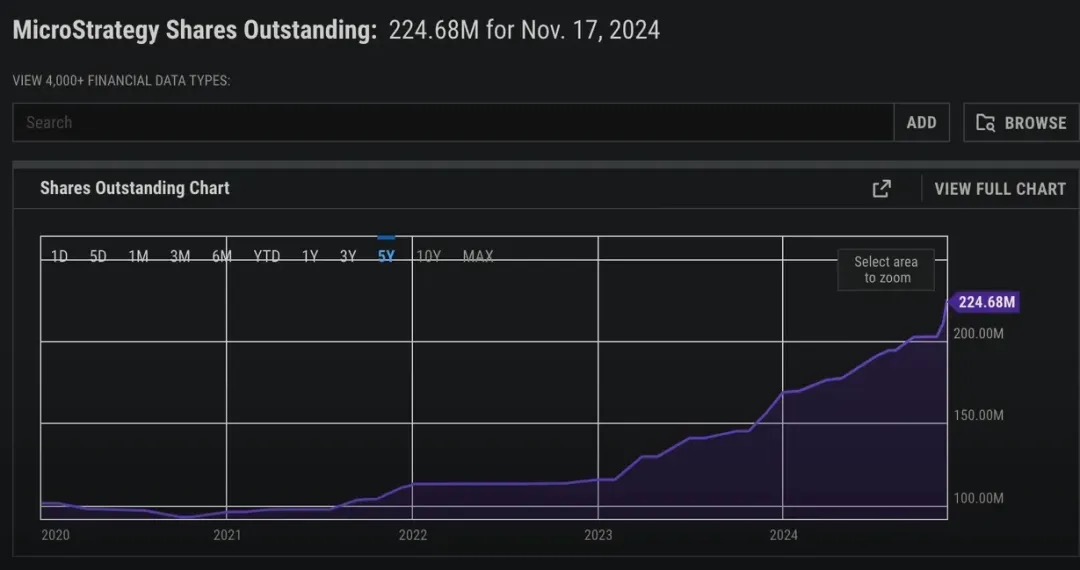

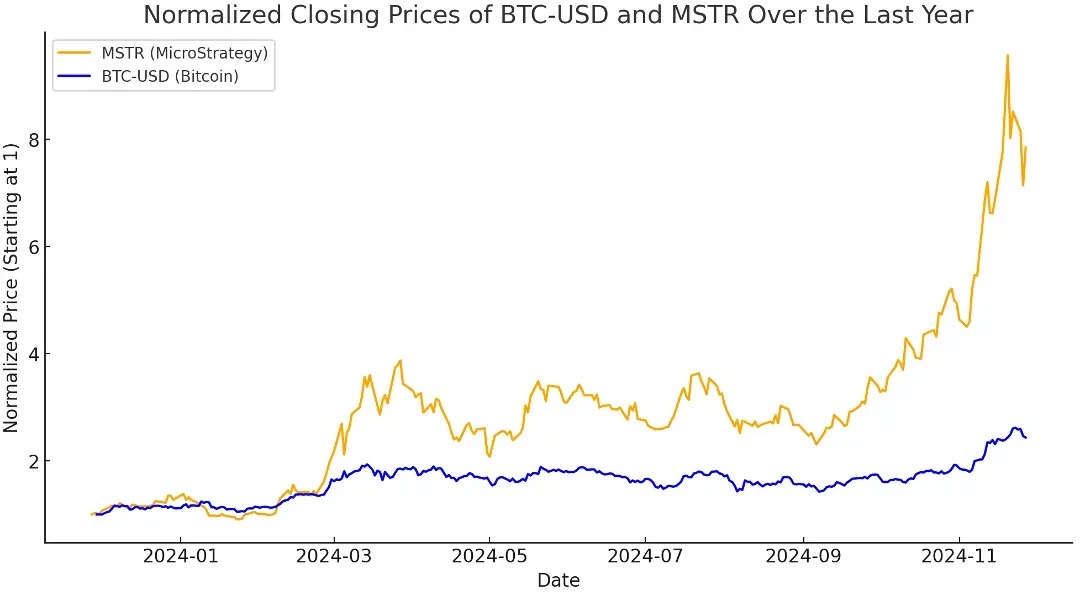

MicroStrategy(MSTR)则是背离传统「股权稀释 = 股东受损」叙事的一个典型反例。自 2020 年以来,MSTR 一直积极通过股权融资来购买比特币,其总流通股从不到 1 亿股增长到 2024 年底的超过 2.24 亿股

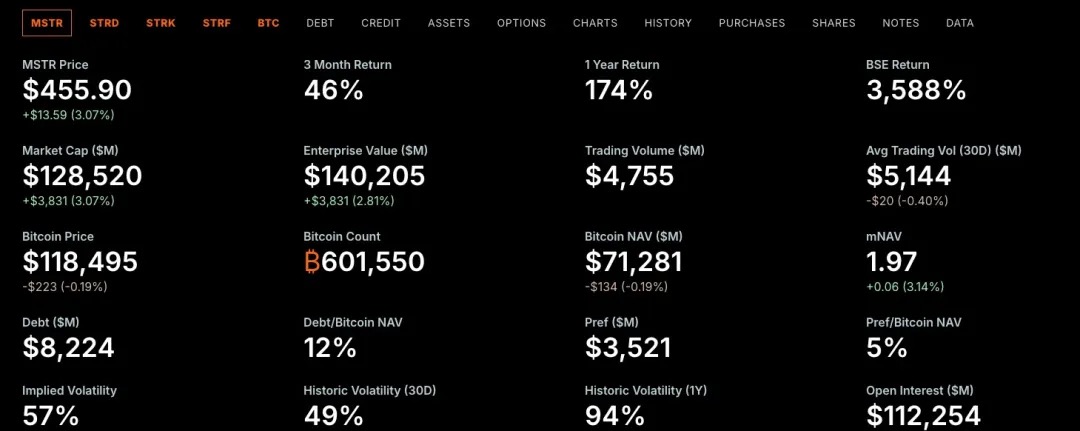

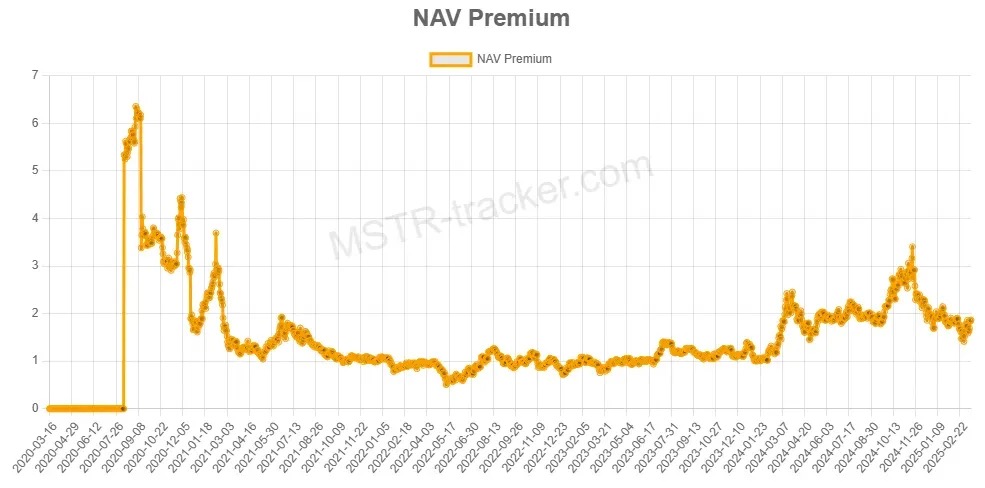

尽管股本被稀释,MSTR 的表现却往往优于比特币本身。为什么?因为 MicroStrategy 长期处于“市值高于其所持比特币净值”的状态,即我们所说的 mNAV > 1。

=

=

理解溢价:什么是 mNAV?

-

当 mNAV > 1 时,市场给予 MSTR 的估值高于其所持比特币的公平市值。

换句话说,投资者通过 MSTR 获取比特币敞口时,每单位支付的价格要高于直接购买 BTC 的成本。这种溢价反映了市场对 Michael Saylor 资本策略的信心,也可能代表市场认为 MSTR 提供了杠杆化、主动管理的 BTC 曝险。

传统金融逻辑的支持

尽管 mNAV 是一个加密原生的估值指标,但“交易价格高于底层资产价值”的概念在传统金融中早已普遍存在。

公司之所以经常以高于账面价值或净资产的价格交易,主要有以下几个原因:

贴现现金流(DCF)估值法

投资者关注的是公司未来现金流的现值(Present Value),而不仅仅是其当前持有的资产。

这种估值方法常常导致公司交易价格远高于其账面价值,尤其在以下情境中更明显:

-

收入和利润率预期增长

-

公司具备定价权或技术/商业护城河

📌 示例:微软(Microsoft)的估值并不基于其现金或硬件资产,而是基于其未来稳定的订阅类软件现金流。

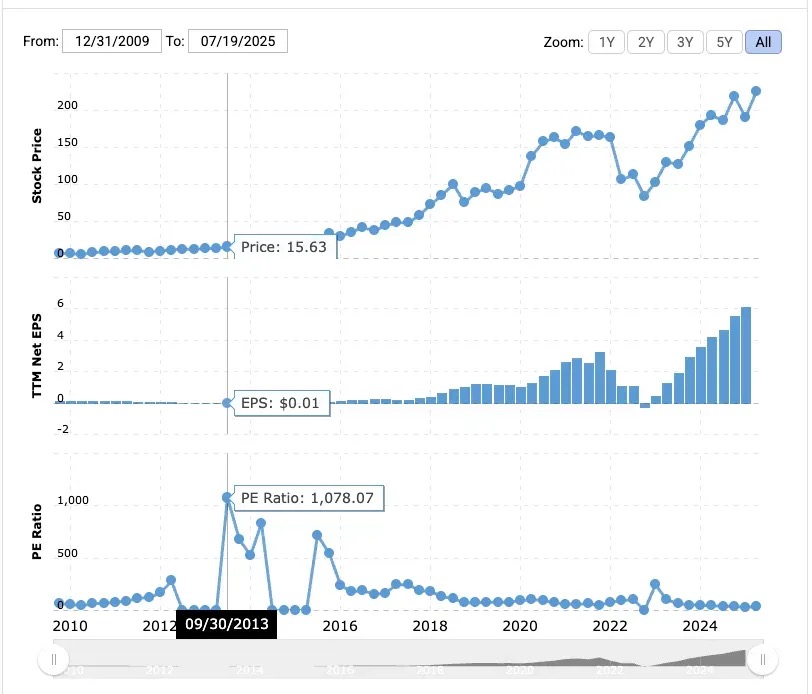

盈利与收入倍数估值法(EBITDA)

在许多高增长行业,公司通常使用 P/E(市盈率) 或收入倍数进行估值:

-

高增长的软件公司可能以 20–30 倍 EBITDA 的倍数进行交易;

-

早期公司即使没有利润,也可能以 50 倍营收 或更高的倍数交易。

📌 示例:亚马逊在 2013 年的市盈率高达 1078 倍。

尽管利润微薄,投资者仍押注其在电商和 AWS 领域的未来主导地位。

MicroStrategy 拥有比特币本身所不具备的优势:一个可以接入传统融资渠道的公司外壳。作为一家美国上市公司,它可以发行股票、债券,甚至是优先股(preferred equity)来筹集现金,而且它确实做到了,而且效果惊人。

Michael Saylor 巧妙地利用这个体系:他通过发行零利率可转债(zero-percent convertible bonds),以及近期推出的创新型优先股产品,筹集了数十亿美元,并将这些资金全部投入比特币。

投资者认识到,MicroStrategy 能够利用“别人的钱”大规模购买比特币,而这种机会并不容易被个人投资者所复制。MicroStrategy 的溢价“与短期 NAV 套利无关”,而是来自市场对其资本获取能力与配置能力的高度信任。

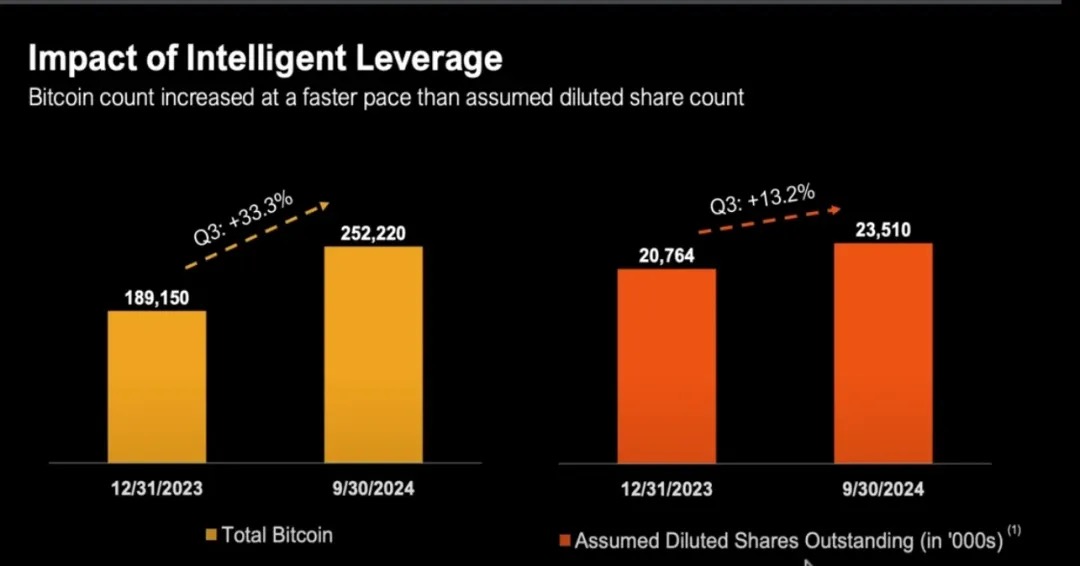

mNAV > 1 如何实现反稀释

当 MicroStrategy 的交易价格高于其持有比特币的净资产值(即 mNAV > 1)时,公司可以:

-

以溢价价格发行新股

-

将募集资金用于购买更多比特币(BTC)

-

增加总 BTC 持仓

-

推动 NAV 和企业价值(Enterprise Value)同步上升

即使在流通股增加的情况下,每股 BTC 持有量(BTC/share)也可能保持稳定甚至上升,从而使得发行新股成为反稀释操作。

如果 mNAV 1 会发生什么?

当 mNAV 1 时,意味着每一美元的 MSTR 股票代表的 BTC 市值超过 1 美元(至少从账面上看是如此)。

从传统金融的角度看,MSTR 正在以折价交易,即低于其净资产值(NAV)。这会带来资本配置上的挑战。如果公司在这种情况下用股票融资再去买 BTC,从股东角度来看,它其实是在高价买入 BTC,从而:

-

稀释 BTC/share(每股 BTC 持有量)

-

并減少现有股东价值

当 MicroStrategy 面临 mNAV 1 的情况时,它将无法继续维持那种「发行新股 → 购入 BTC → 提升 BTC/share」的飞轮效应。

那此时还有什么选择?

回购股票,而不是继续买入 BTC

当 mNAV 1 时,回购 MSTR 股票是一种价值增益行为(value-accretive),原因包括:

-

你是在以低于其 BTC 内在价值的价格回购股票

-

随着流通股数量减少,BTC/share 将会上升

Saylor 曾明确表示过:如果 mNAV 低于 1,最好的策略是回购股票而不是继续买入 BTC。

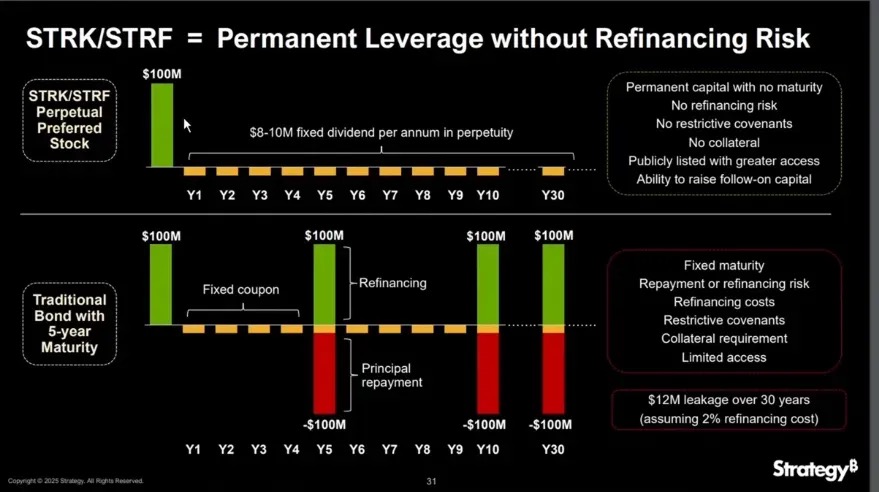

手段一:发行优先股(Preferred Stock)

优先股是一种混合型证券,在公司资本结构中介于债务与普通股之间。它通常提供固定分红,没有投票权,并且在利润分配和清算时优先于普通股。与债务不同,优先股不需要偿还本金;与普通股不同,它能提供更可预测的收入。

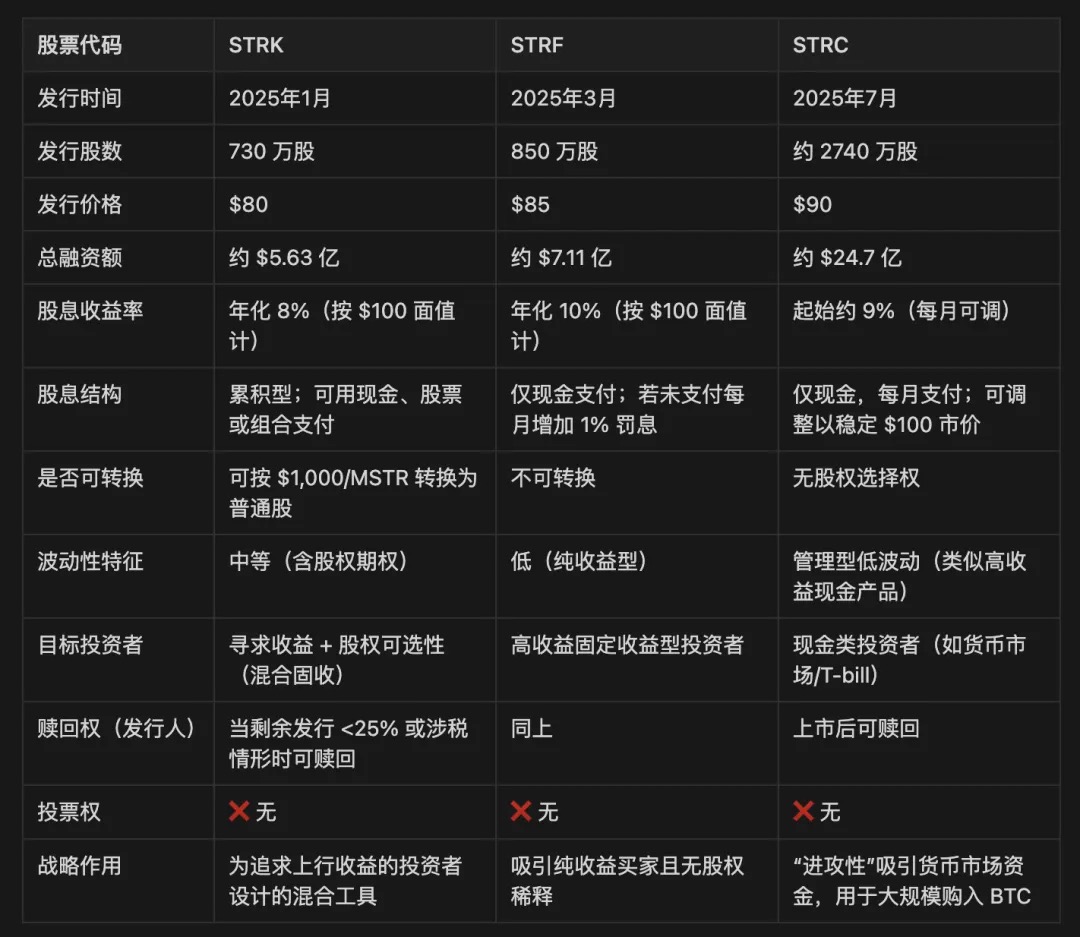

MicroStrategy 已发行了三类优先股:STRK、STRF 和 STRC。

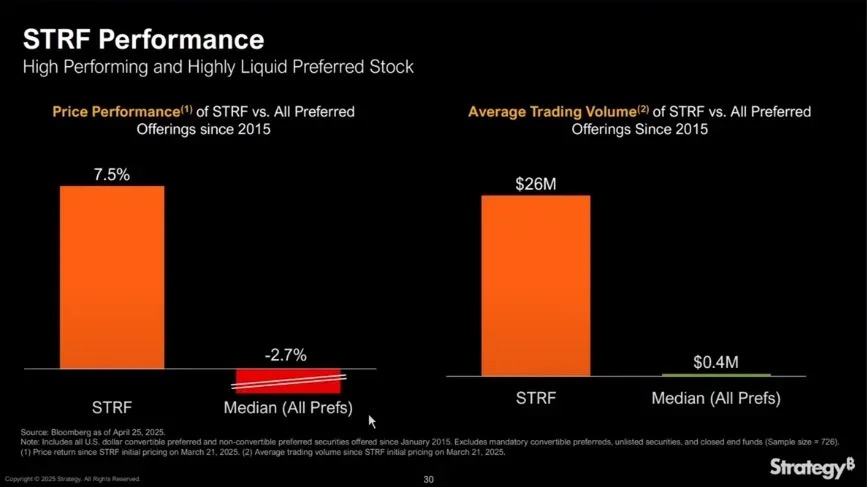

STRF 是最直接的工具:这是一种不可转换的永久优先股,按 $100 面值支付年化 10% 的固定现金股息。它没有股权转换选项,也不参与 MSTR 的股票上涨,仅提供收益。

STRF 的市场价格会围绕以下逻辑波动:

-

若 MicroStrategy 需要融资,会增发 STRF,从而增加供给并使价格下调;

-

若市场对收益的需求激增(如利率较低时期),STRF 价格会上涨,从而降低有效收益率;

-

这形成了一个价格自调机制,价格区间通常较窄(例如 $80–$100),由收益率需求与供需驱动。

示例:若市场要求 15% 收益率,STRF 价格可能跌至 $66.67;若市场接受 5%,则可能涨至 $200。

由于 STRF 是不可转换、基本不可赎回的工具(除非遇到税务或资本触发条件),它的行为类似于永久债券,MicroStrategy 可以反复使用它“抄底” BTC,无需再融资。

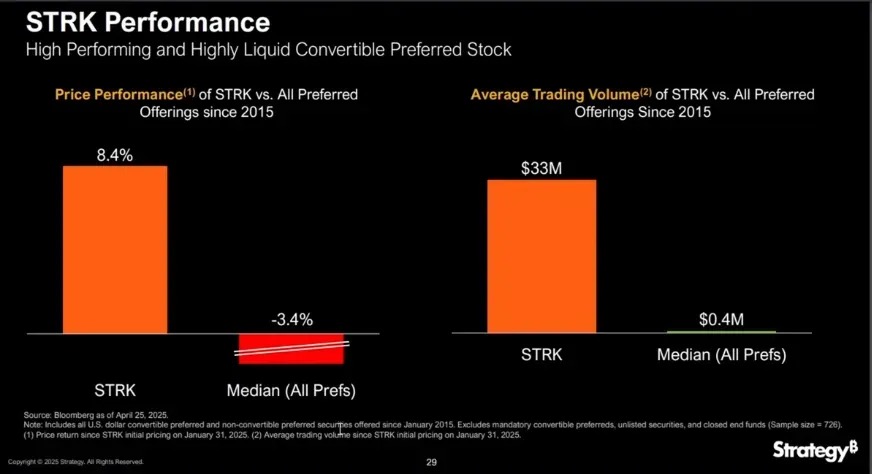

STRK 类似 STRF,年化股息为 8%,但增加了一个关键特征:当 MSTR 股价超过 $1,000 时可按 10:1 比例转换为普通股,相当于嵌入了一个深度虚值看涨期权(call option),为持有者提供长期上涨机会。

STRK 对于公司与投资者都有极强的吸引力,原因包括:

MSTR 股东的非对称上行机会:

-

每股 STRK 售价约 $85,10 股可筹资 $850;

-

若未来转换为 1 股 MSTR,等于公司以 $850 的代价在当前买入 BTC,但仅当 MSTR 股价涨超 $1,000 才会稀释;

-

因此,在 MSTR $1,000 期间是非稀释性的,即使转换后也反映了先前 BTC 累积所带来的升值。

收益自稳结构:

-

STRK 每季度派息 $2,年化 $8;

-

若价格跌至 $50,收益率会升至 16%,吸引买盘支撑价格;

-

这种结构使 STRK 表现得像一个“带期权的债券”:下行时防御,上行时参与。

投资者动机与转换激励:

-

当 MSTR 股价突破 $1,000,持有者有动力转换为普通股;

-

随着 MSTR 进一步上涨(如至 $5,000 或 $10,000),STRK 的股息变得微不足道(收益率仅约 0.8%),加速转换;

-

最终形成自然退出通道,把临时融资转化为长期股东结构。

MicroStrategy 也保留赎回 STRK 的权利,条件包括剩余未转股股数低于 25% 或出现税务等特殊触发情形。

在清算顺序中,STRF 和 STRK 优于普通股,但低于债务。

当公司处于 mNAV 1 的情况时,这些工具尤为重要。因为若以折价发行普通股,会稀释 BTC/share,从而減少价值。而像 STRF 和 STRK 这样的优先股,可使公司在不稀释普通股的前提下继续筹资,无论是用于继续买入比特币,还是回购股票,都能维持 BTC/share 的稳定性,同时扩大资产。

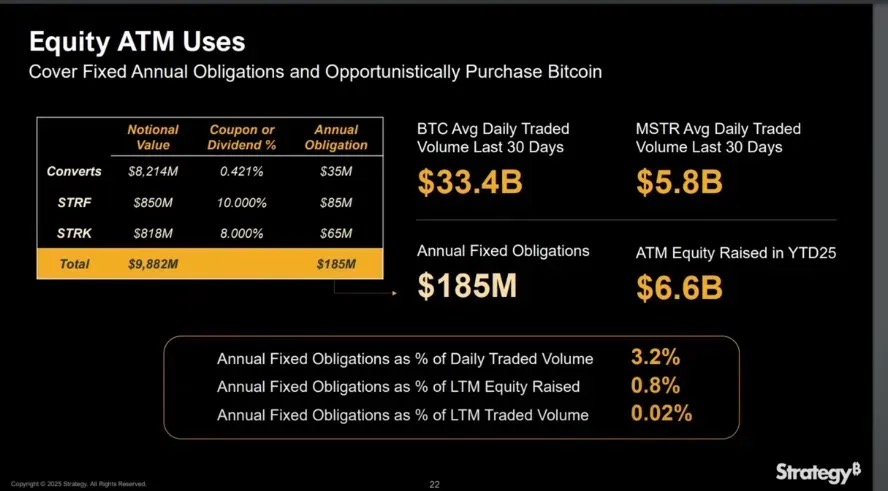

他们如何支付利息(股息)?

截至 2025 年 YTD,MicroStrategy 已通过 ATM(At-The-Market)股票发行 筹集了 $66 亿资金,远远覆盖了其每年所需支付的 $1.85 亿固定利息与股息成本。

当 mNAV > 1 时,通过股权发行支付优先股分红并不稀释 BTC per share,因为募集资金所带来的 BTC 增量超过了单位稀释。

此外,优先股不计入债务,使 MicroStrategy 能在不恶化净负债率的情况下继续扩表,这对维持市场对其资本结构的信心至关重要。

当 mNAV > 1 时

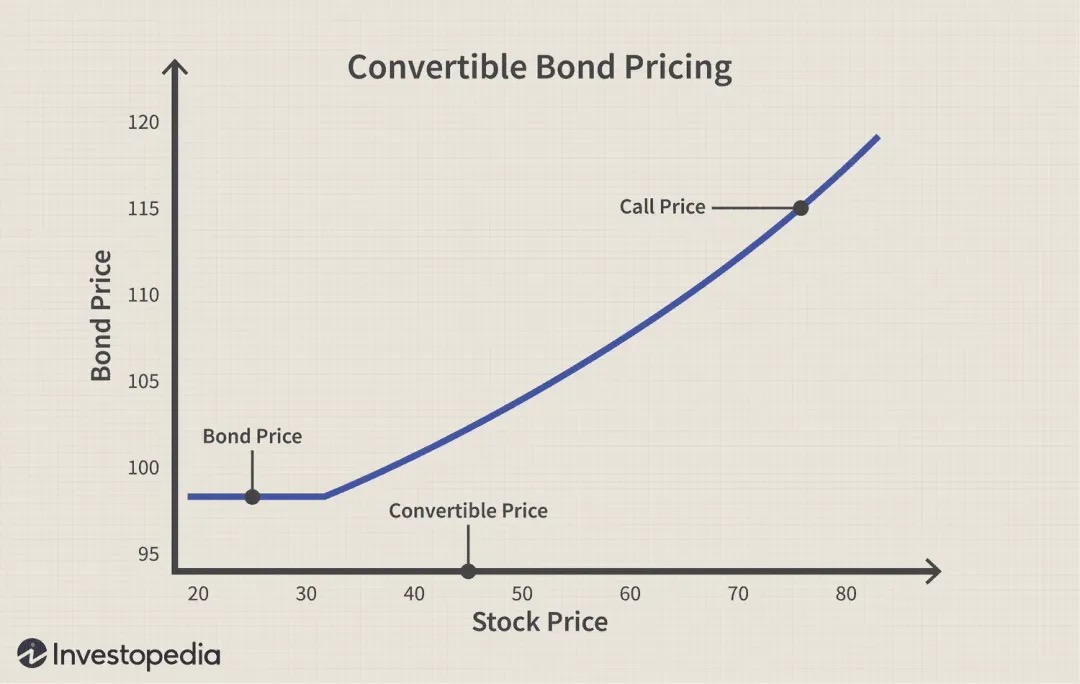

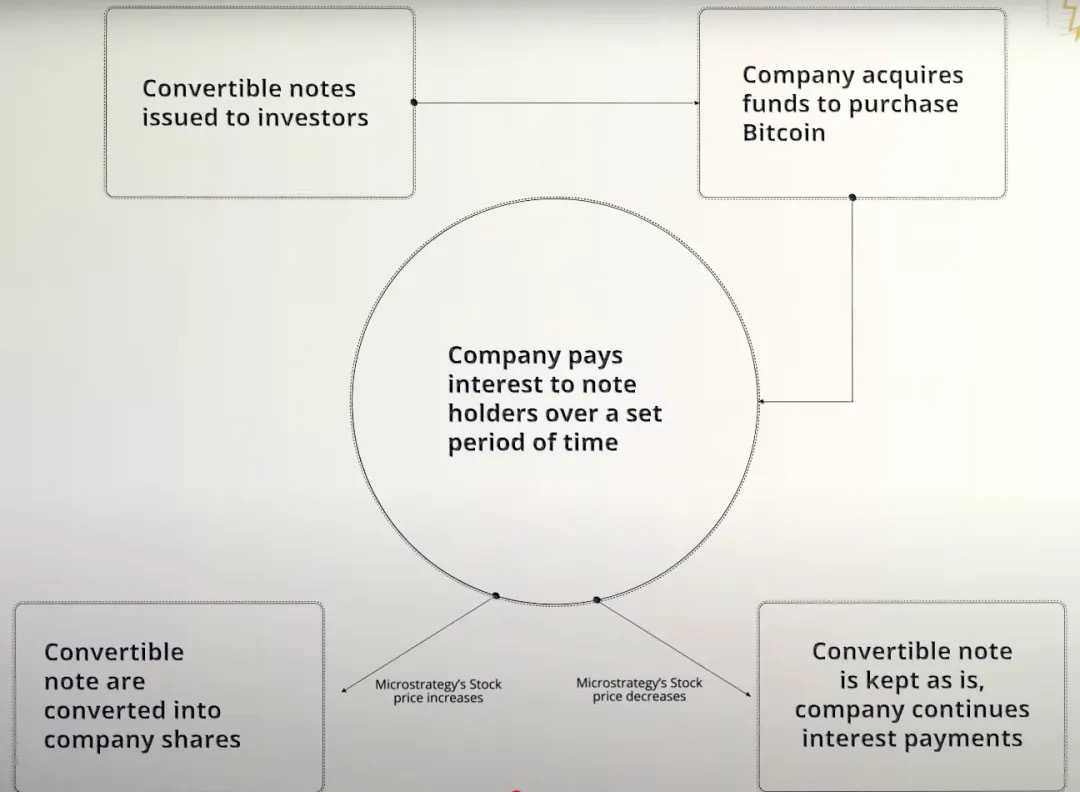

可转换债券(Convertible Bond)

可转换债券是一种公司债务工具,赋予债权人在未来以预定价格(称为转换价)将债券转换为发行公司股票的权利(但非义务),因此它本质上是 债券 + 看涨期权(call option)的结构。该工具常用于 mNAV > 1 的情境,因为它特别适合用来累积比特币。

以 MicroStrategy 的 0% 可转换债券为例:

-

在债券存续期间不支付利息;

-

到期时仅需偿还本金(除非投资者选择转换为股票);

-

对 MSTR 来说,这是一个极高资本效率的融资方式:可募集数十亿美元购买比特币,且不带来即时稀释,也无利息负担,唯一风险在于未来若股价表现不佳需偿还本金。

案例一:股价超预期上涨

-

MicroStrategy 向投资者发行可转换债券;

-

公司即时获得 $30 亿资金,用于购买比特币;

-

由于债券为0% 利率,MicroStrategy 在债券存续期内无需支付利息;

-

若 MSTR 股价上涨,超过转换价门槛;

-

投资者选择转换债券为股票,或收回本金;

-

MicroStrategy 无需支付现金本金,而是通过发行新股来交付。

案例二:股价下跌未达转换价

-

MicroStrategy 发行可转换债券筹资购入比特币;

-

债券为 0% 利率,公司在存续期内无需支付利息;

-

MSTR 股价持续低于转换价;

-

投资者不会行权转换,因为转换将造成亏损;

-

债券到期时,公司需用现金偿还全部本金;

-

若现金储备不足,MicroStrategy 可能需再次融资来偿还债务。

值得特别强调的是:可转换债券本质上是“普通债券 + 看涨期权”的组合,尤其是在 MicroStrategy(MSTR)的案例中更为典型。公司持续发行 0% 年息的可转债,这意味着投资者在债券期间完全没有利息收入。

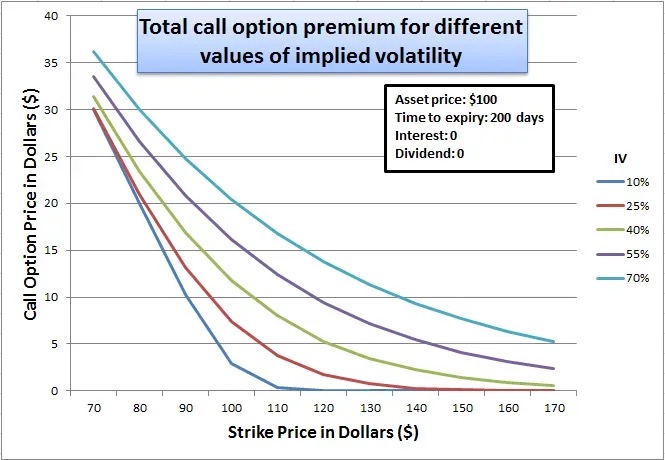

那为什么精明的机构投资者愿意接受这样的“低吸引力”结构?答案在于内嵌的看涨期权价值:这个 embedded call option 在市场对 MSTR 隐含波动率(implied volatility)较高的预期下尤其有价值,因为预期价格波动越大,捕捉上行机会的期权价值就越高。

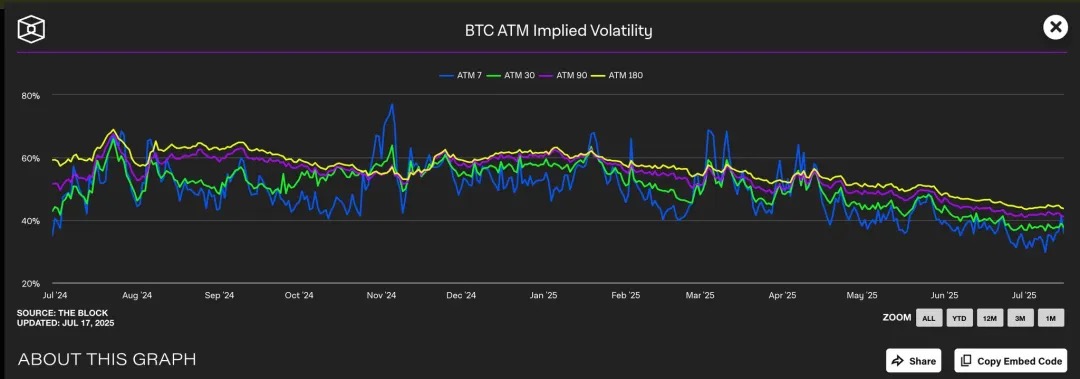

我们观察到,比特币的隐含波动率(IV)在不同期限下通常处于 40% 至 60% 之间。由于 MicroStrategy 的股价与比特币高度相关,这种较高的 BTC IV 间接抬高了 MSTR 股票期权的估值。

目前,平值看涨期权(执行价约为 $455)交易于 45% 的 IV 水平,而对应的看跌期权 IV 更高,显示出市场对未来波动的强烈预期。这样的高波动环境显著提升了 MSTR 可转债中内嵌看涨期权的价值。

从本质上来说,MicroStrategy 实际上是在以高溢价“出售”这个看涨期权给投资人。因为标的资产价格波动越大,期权到期时“价内”的概率就越高,这使得看涨期权在高波动期间会变得更贵。

从投资者角度来看,这是可以接受的,因为他们实际上是在购买一个加杠杆的波动率押注(leveraged volatility bet):如果 MSTR 股价大涨,他们可以转换为股票并获得巨大收益;如果股价不涨,债券持有人仍然可以在到期时收回本金。

对 MSTR 来说,这堪称双赢:一方面它可以在不支付利息、不立即稀释股本的情况下融资;另一方面,如果比特币策略成功,它可以仅通过股价上涨来服务或再融资这笔债务。在这个框架下,MSTR 不只是发债融资,而是在“货币化波动率”,将未来上涨预期兑换为当下的廉价资金。

Gamma Trading

Gamma Trading 是 MicroStrategy 资本结构可持续性的核心机制,尤其是在其反复发行可转债的背景下。该公司已经发行了数十亿美元规模的零息可转债,而其主要吸引力并不在于传统意义上的固定收益,而是来自于债券中内嵌的看涨期权(call option)价值。换句话说,投资人并非在意债券本身的利息收入,而是在意其中期权组件的交易性与波动性套利空间。

这些债券的买家并非传统意义上的长期债权人,而是采取市场中性策略(market-neutral strategy)的对冲基金。这类机构广泛从事所谓的 Gamma Trading(伽玛交易),其投资逻辑不是“买入持有”,而是依赖于不断的对冲调仓,在波动中捕捉利润。

MSTR 中的 Gamma Trading 机制:

基础交易结构:

-

对冲基金买入 MicroStrategy 的可转债(本质为债券 + 看涨期权);

-

同时,做空相应数量的 MSTR 股票,以保持Delta 中性(delta-neutral)。

为何成立?

-

如果 MSTR 股价上涨,债券中的看涨期权增值速度快于空头股票造成的损失;

-

如果股价下跌,空头头寸获利快于债券损失;

-

这种对称性收益结构使得对冲基金可以从波动率中获利,而不是方向性变化。

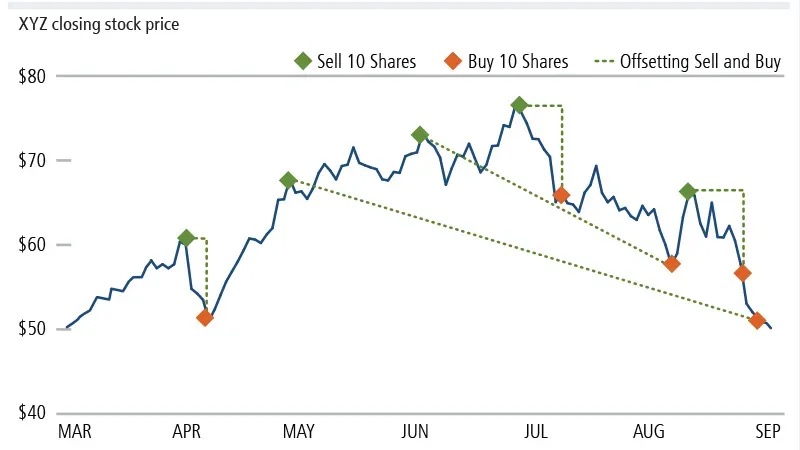

Gamma 与再平衡机制:

-

随着股价波动,对冲基金需不断动态调整空头仓位以保持 Delta 中性;

-

初始对冲按债券的 Delta 值设定,例如一张可转债的 Delta 是 0.5,则基金会做空等值 $50 的 MSTR 股票来对冲 $100 的债券;

-

但当股价继续波动时,可转债本身的 Delta 也会变化(即 Gamma 的体现),基金需持续动态再平衡:

-

股价上涨,Delta 增加(债券行为更像股票)→ 加空仓;

-

股价下跌,Delta 减少(债券行为更像债券)→ 回补空仓;

-

这种不断 “逢高卖、逢低买” 的对冲交易,称为 Gamma Trading。

-

际中,债券 Delta 随股价非线性变化,你需要不断调整空头头寸以保持中性。

-

绿色曲线:持有可转债的回报;

-

红色直线:空头股票的回报;

-

二者相减即为净收益 P&L;

-

在股票横盘、位于转换区间附近时,频繁对冲操作反而可能导致亏损,这被称为 Gamma Trading 的“成本区”(图中阴影部分)。

对 MSTR 溢价的影响:

-

这些 Gamma 对冲者并不是长期持有者

-

当 MSTR 股票达到可转债转换价,Delta → 1,Gamma 降至极低;

-

若波动性下滑或价差收窄导致 Gamma 交易亏损,这些基金将会退出市场,从而削弱可转债的需求。

次级影响(Second-Order Effects):

-

MicroStrategy 的可转债通常为零票息、但久期较长 → 低 Theta(时间价值衰减);

-

当波动性过低,Gamma 交易不再盈利,Gamma PnL ≪ Theta 损耗(时间损耗);

-

可转债销售将变得困难,影响其融资能力。

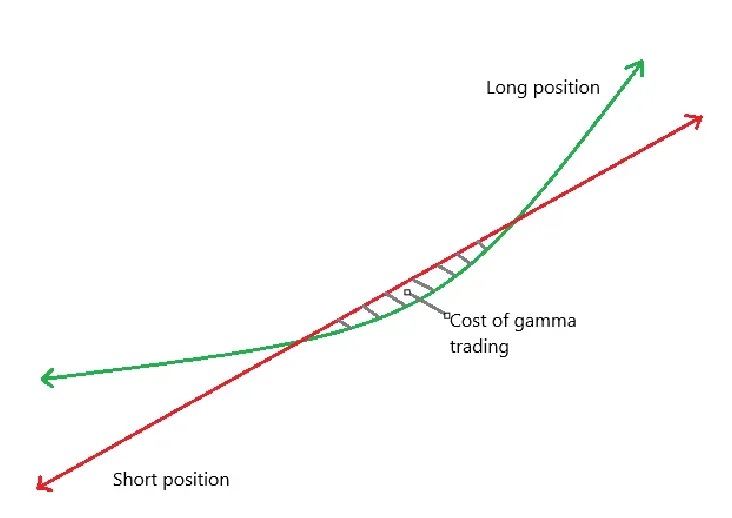

Short Float 的对比说明了这一策略的主导地位:

Short float 是指公司总流通股中被做空的比例。我们观察到,MicroStrategy 因其大量可转债发行,导致其 short float 高企,因为进行 Gamma Trading 的基金往往需要做空 MSTR 股票来进行 Delta 中性对冲。

相比之下,SBET 没有发行可转债,而是依赖 PIPE 私募融资与 ATM 按市价增发机制,缺乏可转债+期权的结构套利机会,因此 short float 明显较低。SBET 的融资结构也更接近传统融资,无法吸引大规模套利型机构参与。

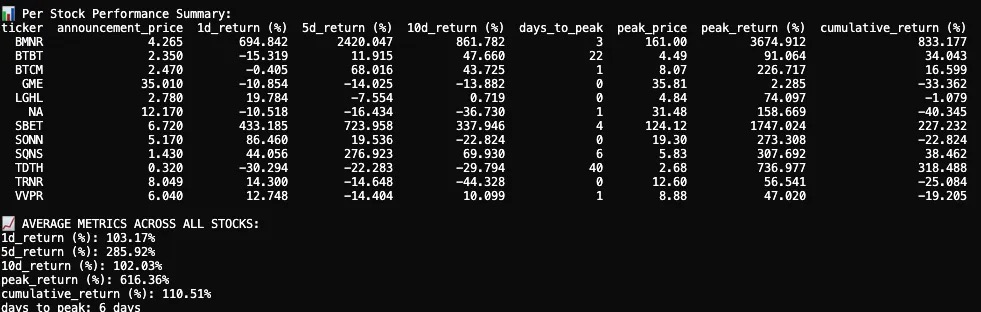

表现

我追踪并分析了 12 家上市公司在 2025 年宣布加密货币资产配置后的股价反应。我们的数据集包含了公告日期前后的股价数据、K 线图可视化以及关键表现指标。

2025 年首次加密金库公告后的股价反应平均来看是爆炸性的、短期的、但仍带来了正的累计回报。

在 12 家上市公司中,平均 1 日回报率为 +103.17%,显示出投资者的强烈即时反应。5 日回报率进一步飙升至 +285.92%,在第 10 日时出现回落,最终稳定在 +102.03%。虽然部分公司表现平淡甚至为负,但其中数家公司出现了极端的股价暴涨。

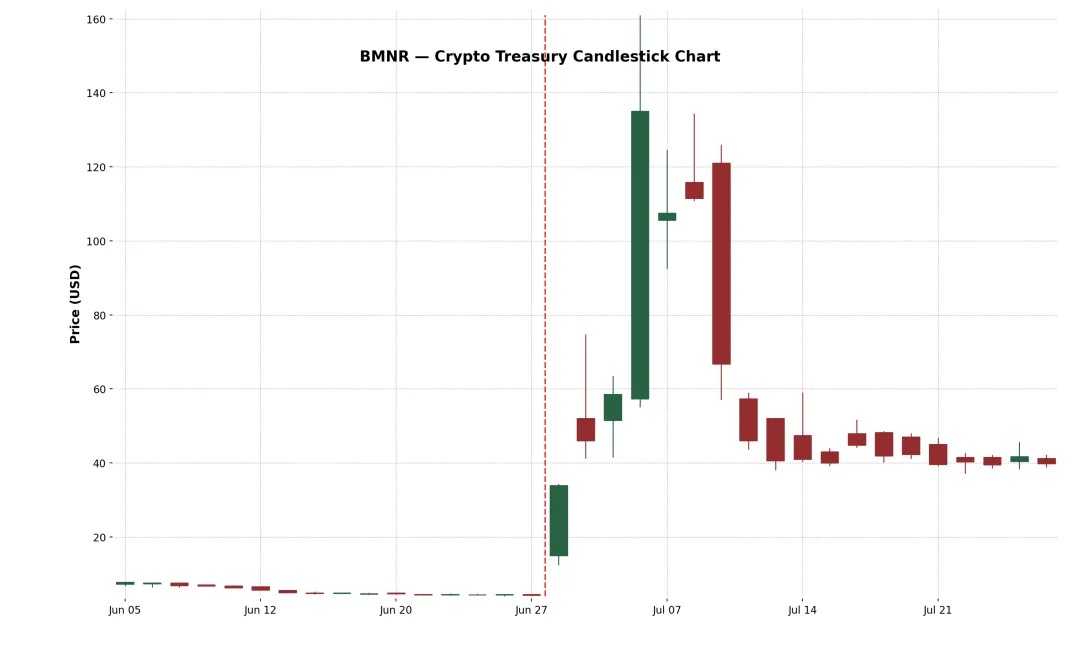

示例 1:BitMine Immersion Technologies Inc.(NYSE-American: BMNR)

这是一家总部位于拉斯维加斯的区块链基础设施公司,运营工业级比特币矿场、销售浸没式冷却硬件,并在德州和特立尼达等低电价地区为第三方设备提供托管服务。2025年6月30日,该公司通过私募配售方式发行了 5,560 万股、每股定价 4.5 美元,共筹资约 2.5 亿美元,用于扩张其以太坊金库。

公告发布后,BMNR 股价从 4.27 美元暴涨至 161 美元高点,3日内涨幅高达 +3,674.9%。这场史诗级暴涨很可能是由于股票流通盘较小(thin float)、散户热情高涨和 FOMO 动能所推动。尽管随后出现剧烈调整,两周累计涨幅仍达 +882.4%。这一事件强调了市场对“MicroStrategy 式”高信念加密金库策略的正面反馈。

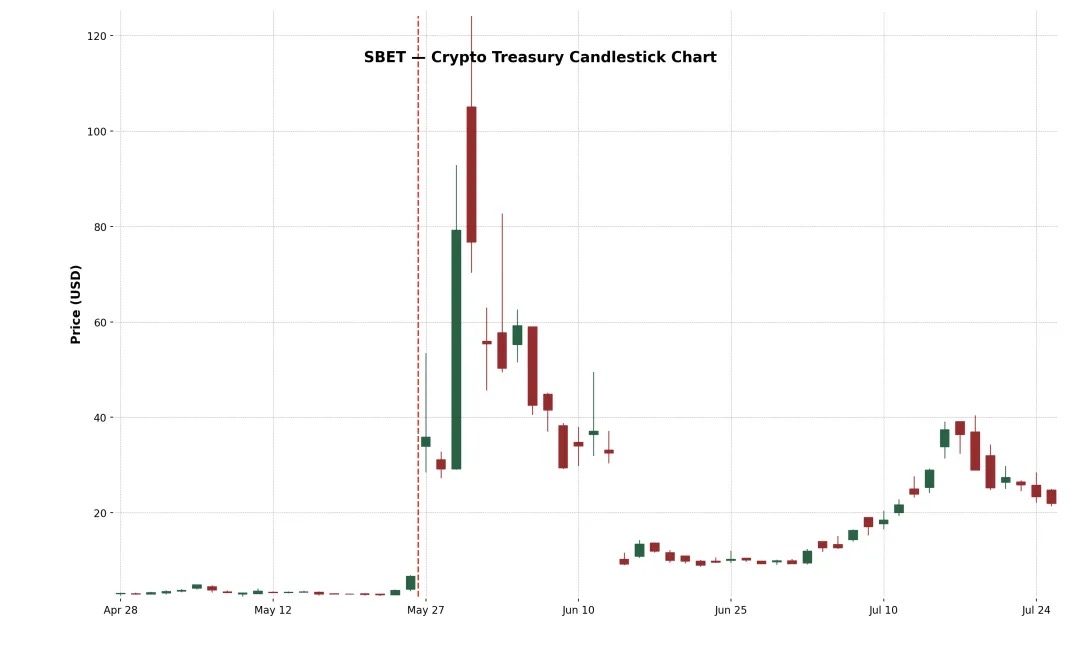

示例 2:SharkLink Gaming Ltd.(Nasdaq: SBET)

SharpLink 成立于 2019 年,是一家在线技术公司,专注于将体育迷转化为下注者,其平台可根据时效性为用户推送体育博彩和互动游戏优惠。该公司于 2025 年开始在资产负债表上积累 ETH,通过 PIPE(私募融资)和 ATM(按市价增发)方式融资。

股票最初反应极为强烈:SBET 首日上涨 +433.2%,在第 4 个交易日达到 +1,747% 高点。此次飙升由加密资产配置规模以及交易背后大佬支持共同驱动。零售投资者、加密基金与投机交易者蜂拥而入,将股价推至 120 美元以上。

然而,涨势短暂。6 月 17 日,SharpLink 向 SEC 提交了一份 S-3 注册声明,使 PIPE 投资者有可能转售其股份,引发广泛困惑。许多人误以为大股东正在出货。虽然 Consensys 联合创始人、SBET 董事长 Joseph Lubin 后来澄清“尚未有任何股份出售”,但为时已晚:SBET 股价暴跌近 70%,几乎抹去了公告后的大部分涨幅。

尽管出现剧烈回调,SBET 的累计涨幅仍为 +227.2%,表明市场依然给予其 ETH 金库战略显著的长期价值。从高点回撤,但在随后的几周内该股开始重新获得资金支持,说明市场对“以太坊作为储备资产”模式的信心正在回升。

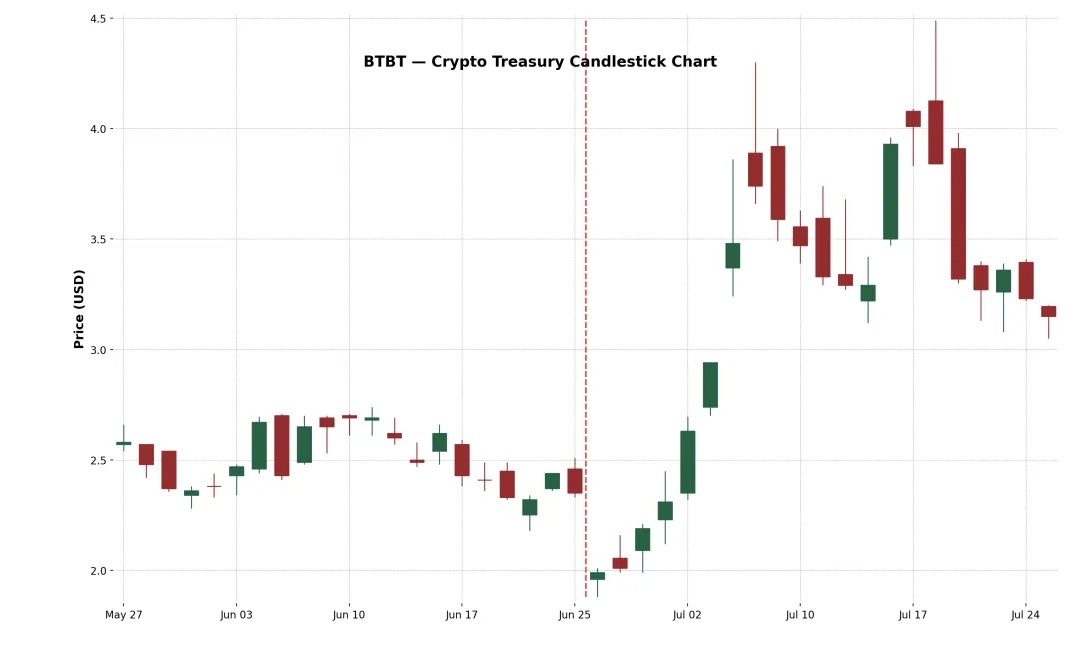

示例 3:Bit Digital Inc.(Nasdaq: BTBT)

BTBT 是一家总部位于纽约的数字资产平台,成立于 2015 年,最初运营比特币矿场,分布于美国、加拿大和冰岛。

2025 年 6 月,该公司完成了一次承销增发,筹资约 1.72 亿美元,并通过出售 280 枚 BTC 的额外收入,将资本重新配置到 ETH 上,共计购买了约 100,603 枚 ETH,正式完成向以太坊质押与金库模型的转型,由加密资深人士 Sam Tabar 担任 CEO。

初始市场反应较弱(首日下跌 –15%),但股价在接下来的两周内逐步上升,最终涨幅达到+91%。这种温和反应可能反映出市场对 BTBT 原本即从事加密挖矿业务的背景较为熟悉。然而,+34% 的累计回报仍说明了即使是老牌加密公司,进一步扩展加密资产配置仍能获得市场的积极认可。

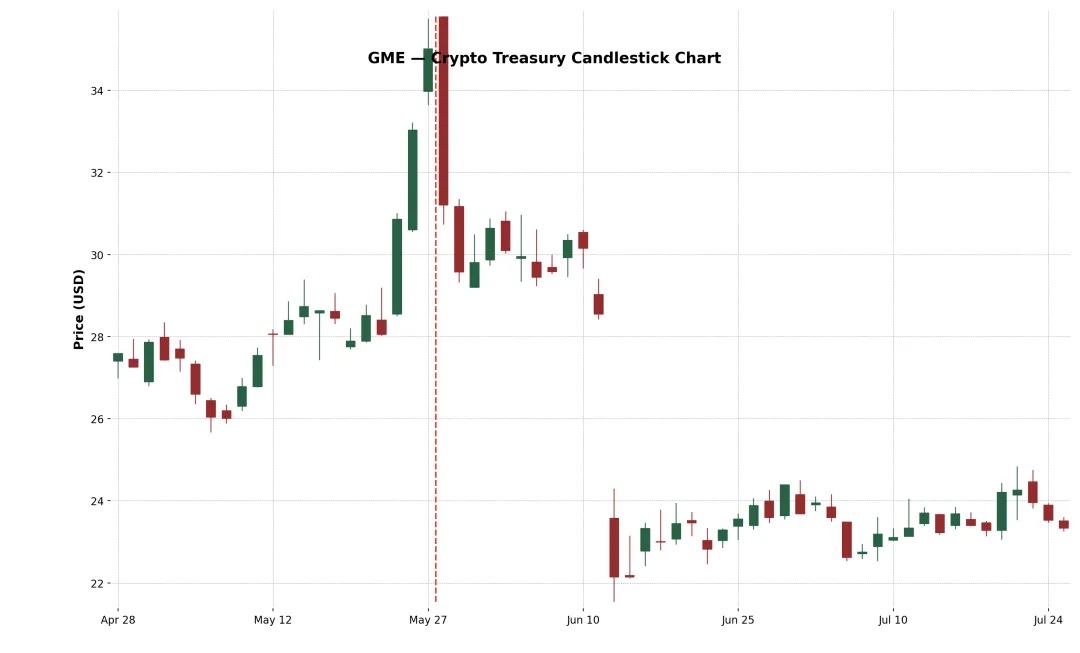

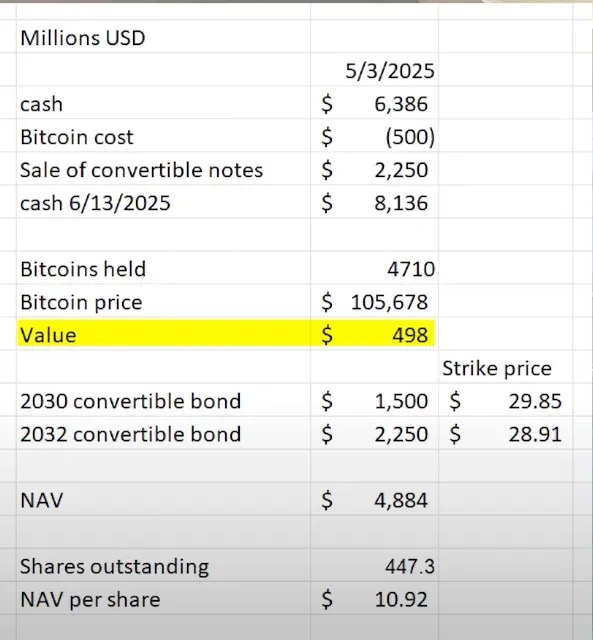

示例 4:GameStop Corp.(Nasdaq: GME)

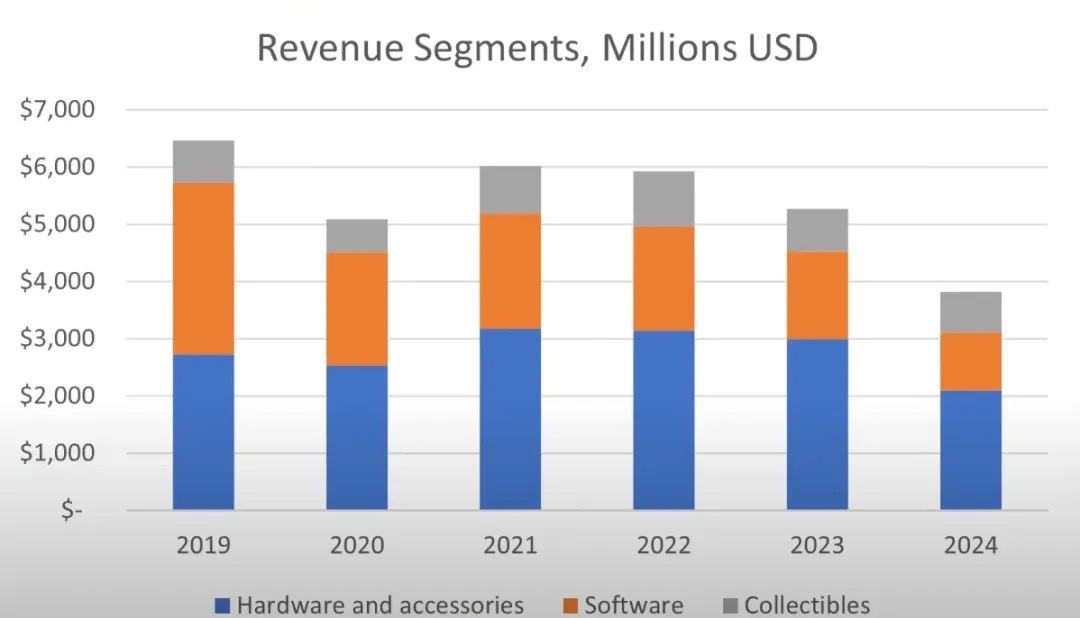

然而,GameStop(GME)在 2025 年 5 月宣布其首次购买比特币,并计划进一步转型为与加密货币相关的消费级游戏基础设施公司。尽管零售投资者高度关注,加上这家文化级 meme 股进军加密资产的象征意义巨大,GME 在公告后的第5天和第 10 天回报均为负。这种表现差异揭示了一个核心洞见:仅靠加密利好消息,并不足以持续推高股价。

GameStop 的比特币布局遭到市场质疑,原因在于其零售业务持续萎缩,而这次转型是在公司多次战略转向(如门店、NFT、元宇宙等)之后进行的。

它未能维持上涨趋势,反映出市场对其基本面和战略不确定性的质疑。公司的核心营收依然在下滑,管理层除了“买比特币”之外并未提出实质改革方案。传递出的信息也很混乱,从门店、NFT、元宇宙再到如今的加密货币,战略摇摆不定,严重削弱了市场信心。

加密货币资产配置趋势

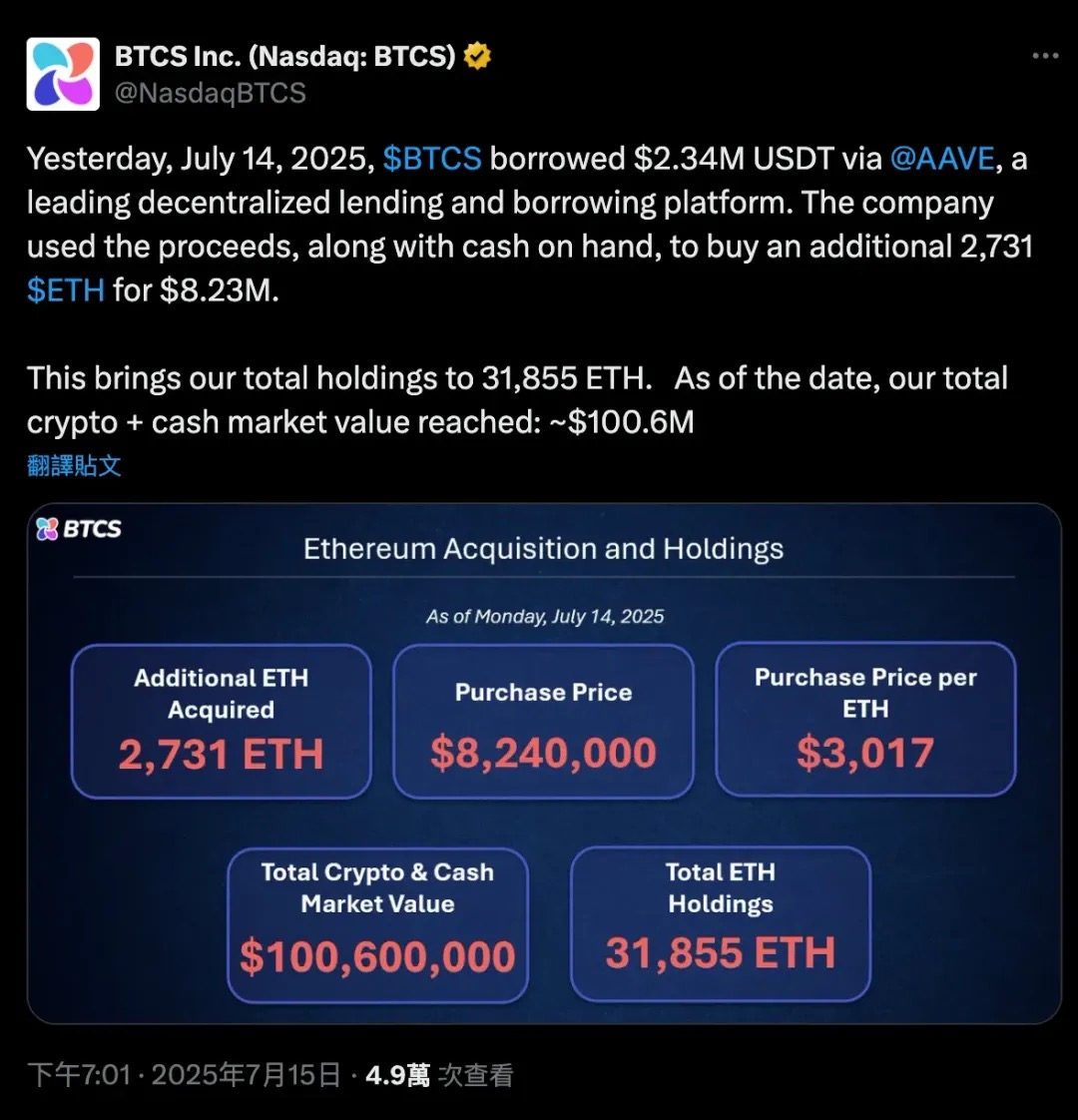

除了比特币,越来越多的公司开始将以太坊(ETH)作为其加密货币储备的主力资产。原因是多方面的。首先,以太坊被广泛认为是现实世界资产(RWA)代币化平台的底层基础设施,包括 Ondo、Backed Finance 和 Centrifuge 等协议均在以太坊结算层上构建面向机构级的金融产品。这使 ETH 成为押注“传统金融上链”趋势公司的战略性储备资产。

其次,与比特币不同,以太坊是可质押生息的、DeFi 可组合的资产,持有者可通过参与网络安全获得约 3–4% 的年化收益。这使 ETH 具备了可编程、可生息的资金特性,对于寻求优化闲置现金回报的 CFO 来说具有很强吸引力。

2025 年 7 月 14 日,BTCS 通过 Aave(一家去中心化借贷协议)借入了 234 万 USDT,再加上部分自有现金,合计购入了 2,731 枚 ETH,价值约 824 万美元,进一步扩大其以太坊持仓。这笔杠杆交易使得 BTCS 的 ETH 总持仓达到 31,855 枚,公司整体的加密+现金市值提升至 1.006 亿美元。

这个案例清楚展示了以太坊在 DeFi 中既是抵押品又是资本的独特双重角色。比特币更多地是“冷钱包”式的被动资产,或需通过包装(wrap)才能参与 DeFi;而 ETH 是原生可组合资产,企业可以在不出售资产的情况下,将其用于借贷、质押或参与收益协议。

以太坊现货 ETF 的推出进一步增强了机构对 ETH 的信心和流动性,净申购流入表明主流金融市场正逐步接受 ETH。因此,SharpLink(SBET)、Bit Digital(BTBT)甚至一些非上市公司也在调整资产负债表,增加 ETH 持仓,这不仅是投机性押注,更是在表达一种关于“以太坊是去中心化资本市场底层设施”的长期信仰。

这种趋势标志着加密企业资产配置战略的重大转变:从“比特币=数字黄金”到“以太坊=数字金融基础设施”。

以下是几个这种多样化配置的案例:

-

XRP 作为储备资产: VivoPower International(纳斯达克代码:VVPR)于 2025 年 5 月募集 1.21 亿美元,由一位沙特王子领投,成为首个采用 XRP储备战略的上市公司。不久后,新加坡的 Trident Digital Holdings(TDTH)宣布计划发行最多 5 亿美元股票以建立 XRP 储备;中国的 Webus International(WETO)也提交申请,将 3 亿美元投入 XRP 持仓,并计划将 Ripple 的跨境支付网络整合进其业务体系。这些举动受 Ripple 在美国获得法律合规地位的影响,市场反应不一,虽然 XRP 在 2025 年中上涨,但相关个股表现分化,但这些行动表明,加密资产配置正在超越 BTC 和 ETH 的传统双主线。

-

莱特币(LTC)储备: MEI Pharma(MEIP) 是一家小型生物医药公司,在 2025 年 7 月意外宣布转型,通过莱特币创始人 Charlie Lee 和 Litecoin 基金会参投的方式,融资 1 亿美元,创建第一个 机构级的 LTC 储备方案。这项计划同时伴随着管理层更替(Lee 加入董事会),市场认为这是尝试用加密资本为困境中的生物医药行业注入新动能。该股在“生物医药 + 莱特币”消息发布后股价暴涨,但因投资者对其最终商业模式存疑,股价波动剧烈。

-

HYPE Token 储备: 更加“异类”的案例来自 Sonnet BioTherapeutics(SONN),该公司于 2025 年 7 月宣布一项规模 8.88 亿美元的反向并购,成立 Hyperliquid Strategies Inc.,计划将 5.83 亿美元的 HYPE 代币纳入公司资产负债表。该交易由 Paradigm 和 Pantera 等主流加密风投支持,旨在打造全球最大的 HYPE 代币持有上市实体。SONN 在公告后股价暴涨(因 HYPE 是热门代币),但分析人士指出其结构复杂、代币本身尚处早期阶段。类似地,Lion Group(LGHL) 也获得 6 亿美元授信额度,用于储备 HYPE、Solana 和 Sui 等代币,打造多资产的加密金库。

Saylor 何时会卖币?

Michael Saylor 曾公开宣称 MicroStrategy 将会“永远 HODL”其比特币资产,也就是说,公司根本无意出售其 BTC 储备。事实上,MicroStrategy 甚至修改了公司政策,正式将比特币确立为其主要的国库储备资产,意味着这是一个极其长期的持有计划。然而,在现实的公司财务世界里,“永远不卖”并不是绝对。某些情境下,MicroStrategy 可能会被迫出售部分比特币。理解这些潜在情境非常关键,因为它们构成了整个“MicroStrategy 作为比特币代理资产”投资逻辑中的风险因子。

以下是一些可能挑战 MicroStrategy 决心,并“迫使”其出售 BTC 的情境:

-

在紧缩信贷市场下出现重大债务到期:MicroStrategy 当前有多笔债务未偿,包括到期时间为 2028 和 2030 年的可转债(此前已经用发行股票的方式赎回了 2025 和 2027 年的债券),也可能包括其他贷款。通常,公司会通过再融资来偿还旧债——发行新债或新股。2025 年初,MicroStrategy 成功地用股票赎回了 2027 年的可转债,避免了现金支出。但设想一种情况:2028 年,比特币深陷熊市,MicroStrategy 股价大跌,利率又高(新融资成本太贵),此时如果有 5–10 亿美元的债务到期,公司可能会面临现金流危机。

-

在这种情况下,传统资本市场可能会“关闭”大门,尤其当隐含波动率(IV)过低,导致没有投资者愿意买入嵌入期权价值的可转债,MicroStrategy 最擅长的融资工具将失效。

-

面对这样的信贷紧缩,公司很可能只能卖掉部分 BTC 来还债,就像“被迫平仓”一样。虽说 MicroStrategy 拥有规模巨大的 BTC(截至 2025 年价值超 700 亿美元),但一旦动用,市场信心势必动摇。这种卖出很可能是最后的选择,仅在所有其他融资途径都失败时才会进行。

-

高昂的利息负担或优先股分红压力:MicroStrategy 的融资结构虽然灵活,但也并非没有代价。2025 年,公司面临的固定支出包括:

-

STRK 年利率 8%(可用现金或股票支付)

-

STRF 年利率 10%(必须现金支付,违约有罚金)

-

STRC 月度利率 9–10%(现金支付,董事会可调整)

-

可转债利息(如 2030 年票息为 0.625%)

总计每年固定负债超过 1.8 亿美元,并且可能随着后续融资继续上升。

-

如果 MSTR 股价低迷,直接发股融资将造成严重稀释。

-

如果进入加密寒冬,MicroStrategy 可能会因维持 STRF、STRC 的现金分红而持续烧钱。如果 BTC 长期低迷,公司杠杆结构变得危险。董事会可能会决定出售一部分比特币来“买时间”,为未来一到两年的利息或分红提供现金流。这虽然违背初衷,但总比违约或触发 STRF 累积违约机制要强。

-

如果利率持续上升怎么办?那么所有未来融资都会变贵:

新发行优先股必须提供更高收益(例如 >10%)才能吸引投资者;

可转债必须搭配更高的隐含波动率才能被市场接受(熊市中往往难以达成);

如果 MSTR 股价低迷,直接发股融资将造成严重稀释。

换句话说,资本成本上涨,但收入并无增长,BTC 又处于低位。

总结:MicroStrategy 只有在极端压力或战略转向下才可能卖币。这些情景多与财务压力有关:债务难以展期、资本成本过高或市场对公司估值折价。正常情况下,Saylor 的策略是持续买入或持有,而非出售。事实上,公司早已展现出这种坚定:在 2022–2023 年加密市场暴跌时,MicroStrategy 并未像 Tesla 一样出售 BTC。而是在二级市场悄悄回购了部分可转债,实现了“打折还债”,在任何时候都优先选择其他手段,也不愿出售比特币,因为一旦卖币,整个“比特币国库”的故事就会崩塌,市场信仰也将随之动摇。

总结

MicroStrategy(MSTR)开创了一种全新的公司金融模式,将一家上市运营公司直接转化为加杠杆的比特币持仓工具。通过激进运用资本市场工具,特别是零息可转债,MSTR 实现了将其股票波动性金融化,从而在不依赖主营业务现金流的前提下,积累了超过 60 万枚比特币。

其核心机制简洁而强大:当公司股价相对于 BTC 净资产(mNAV)存在溢价时(即 mNAV > 1),通过发行股票或可转债(如“21/21”或“42/42”计划)融资,然后将所得资金全部换成 BTC。由于 MicroStrategy 的股价长期高于其 BTC 市值,该循环模式得以持续,并实现了边融资边增加“每股持币量”。

在这个模型中心,可转债起到了关键作用:它结合了债券的下行保护(债底)与股票的上行潜力(嵌入的看涨期权)。在高波动环境下(如 2025 年),投资者甚至愿意接受0% 利息,只因期权价值足够高。实质上,MSTR 不只是发债融资,而是在“出售波动率”,而且是以溢价卖出。市场愿意为这种未来增长潜力提前付钱,使得公司能够在不支付利息、不立即稀释股东的前提下,源源不断地融资买币。

但这种模式也存在局限:一旦隐含波动率收缩(无论是由于市场成熟,还是 BTC 缺乏动能),嵌入式期权价值会下降,未来再发行可转债的吸引力将大幅降低,公司将不得不依赖传统融资方式,或者在债务到期时用现金偿还。同时,支撑 MSTR 融资生态的“Gamma 交易者”与波动套利者是机会主义者,一旦波动率降低或市场情绪转变,对其证券的需求可能迅速枯竭。这种不是“Delta 风险”(大家都知道 MSTR 是 BTC proxy),而是“低 Gamma 风险”,即小幅的波动预期变化就能导致整个融资机制失效。

尽管如此,投资 MicroStrategy 已成为机构基金与散户的新趋势,他们将其视作比特币上涨的交易替代品。这种投机心理在链上也有体现:用户不断购买与“加密国库公司”相关的 meme 代币,或交易 MSTR、SBET 之类的股票来押注叙事。无论是传统市场还是 DeFi,背后的逻辑都是一致的:加密国库公司代表了一种高波动、高杠杆的 BTC 替代敞口,如果时机把握得好,回报甚至超过原始资产本身。

简而言之,MicroStrategy 不只是采用了比特币作为储备,而是围绕比特币构建出一套全新的金融结构。它是第一个成功的“加密国库公司”,并可能定义未来企业如何进行国库资产配置、波动率变现与股东价值创造的新范式,在这个比特币主导的金融世界中立下标杆。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。