撰文:Thejaswini M A

编译:Luffy,Foresight News

几个月来,你一直在关注美联储会议,知道他们即将调整利率。经济数据在大声预示,通胀数字在为之佐证,甚至鲍威尔措辞中的细微变化都在暗示这一时刻的到来。

但你该如何将这种判断转化为交易呢?

当然,你可以买债券,期待利率下降时债券上涨;或者做空美元,祈祷相关性保持不变;又或者重仓对利率敏感的科技股,寄希望市场会按你的预期解读新闻。

但如果…… 你可以直接交易美联储的决策呢?如果不用玩这些间接的 「衍生游戏」,而是直接下注 「美联储下次会议会降息吗」,猜对了就能每份合约赚 1 美元呢?

再说说体育博彩。你可以买新百伦的股票,期待 Coco Gauff 赢得澳网冠军能提振运动服饰销量;可以做空耐克,因为他们赞助的选手早早出局;还可以投资 DraftKings,赌网球收视率上升会带动博彩量增长。但如果…… 你可以直接下注 Gauff 是否能赢澳网呢?投 100 美元,猜对了拿 200 美元,完全不用去看企业财报分析了。

你可以买 TKO 集团的股票,盼着 WrestleMania 吸引创纪录观众;可以做空竞争对手的娱乐公司股票;或者赌周边销量飙升。但如果…… 你可以直接交易 Roman Reigns 是否能保住冠军头衔呢?把钱直接押在剧情结局上,跳过所有媒体公司的分析。

这正是 Kalshi 能让你做到的事。

Kalshi 是首家受美国商品期货交易委员会(CFTC)监管的预测市场,你可以在这里直接交易现实世界事件的结果——不是受事件影响的股票,不是可能因新闻波动的货币,而是事件本身。

让你的预测产生价值

美联储决策、选举结果、最高法院裁决、比特币是否能涨到 15 万美元、通胀是否会超过 4%、你支持的球队是否能夺冠…… 只要你能形成观点,且结果有客观衡量标准,Kalshi 上或许就有对应的市场。

Polymarket 开创了现代预测市场的概念,在美国大选中处理了数十亿美元交易量,证明了市场的巨大需求。而 Kalshi 刚刚以 20 亿美元估值融资 1.85 亿美元,Susquehanna 等大型交易公司为其提供流动性,Robinhood 将 Kalshi 市场直接整合进自家平台,让数百万散户交易者都能参与。埃隆・马斯克的 Grok 人工智能甚至嵌入了其交易界面。

这是一套受监管的、机构级的 「交易现实」 基础设施。在 Polymarket 全球布局的基础上,Kalshi 将预测市场带入了受监管的美国金融体系。

想想这意味着什么:你第一次能将预测现实事件的优势直接变现,无需承受传统金融市场的摩擦 —— 没有复杂衍生品,没有对手方风险,不用担心事件发生时你的对冲工具是否真的管用。

如果你认为下一份非农报告会出人意料,有对应的市场;如果你相信特朗普会赢得 2028 年大选,现在就能交易相关合约;如果你确信人工智能公司将主导下一个十年,你可以押注决定其命运的特定里程碑和监管结果。

这个平台将每一条非公开信息、每一个分析优势、每一个有依据的预测,都转化成了潜在的盈利机会。与传统市场通过复杂的策略套利信息优势不同,预测市场直接奖励知识。

Kalshi 的运作方式

理解 Kalshi 的机制至关重要,因为事件合约的运作方式与你交易过的任何金融工具都不同。让我用一个真实例子带你一步步了解。

步骤 1:账户设置与充值

在 kalshi.com 创建账户,完成必要的身份验证(KYC)。由于 Kalshi 受 CFTC 监管,你需要提供身份证件、地址证明等标准文件。

充值方面,Kalshi 提供多种选项,额度和到账速度不同:银行转账免费,但需要 1-2 个工作日;借记卡即时到账,但收取 2% 手续费,每日限额 2500 美元;加密货币用户可存入 USDC,每日上限 50 万美元,30 分钟内到账;电汇适合大额资金,但有最低要求。

步骤 2:了解市场定价

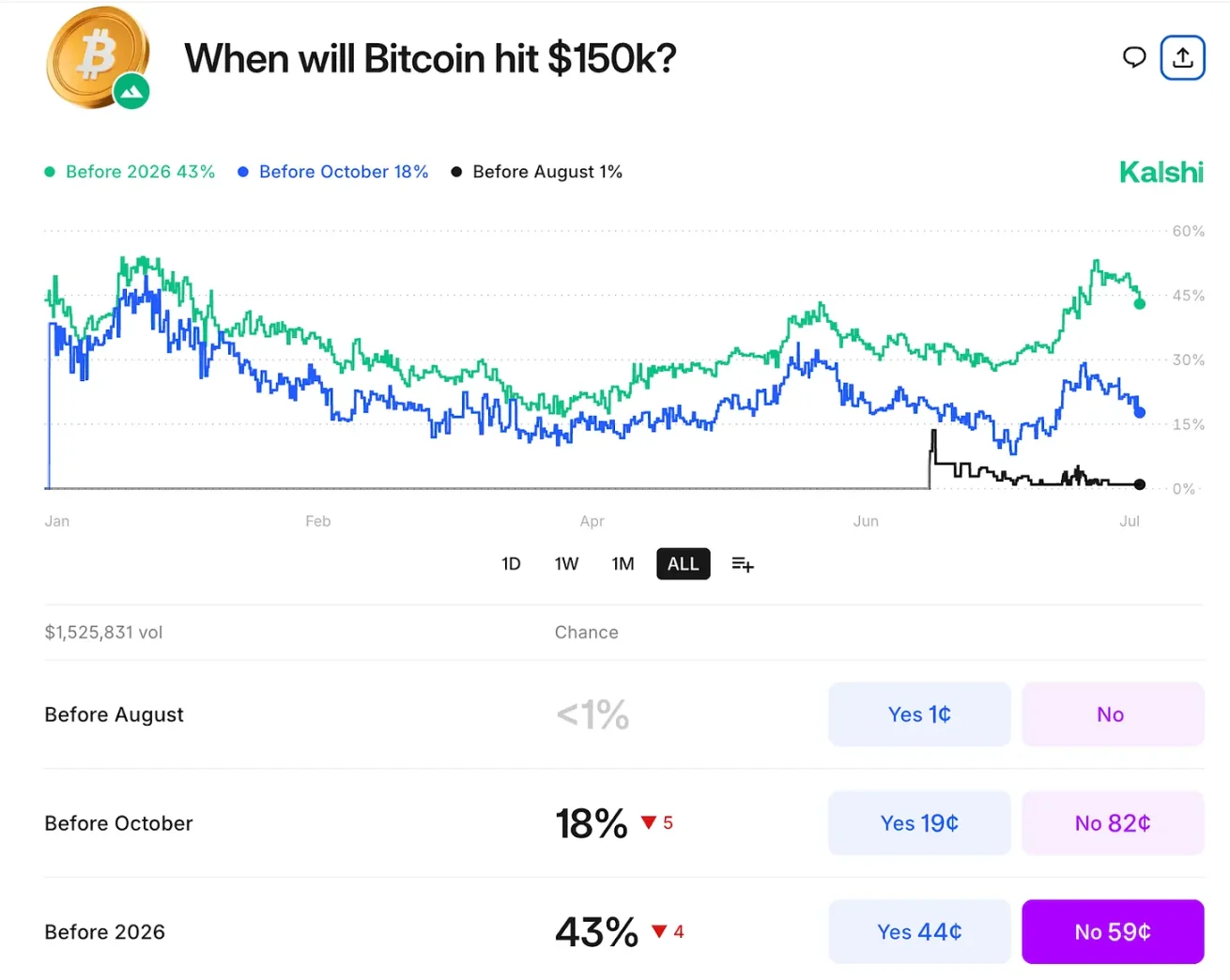

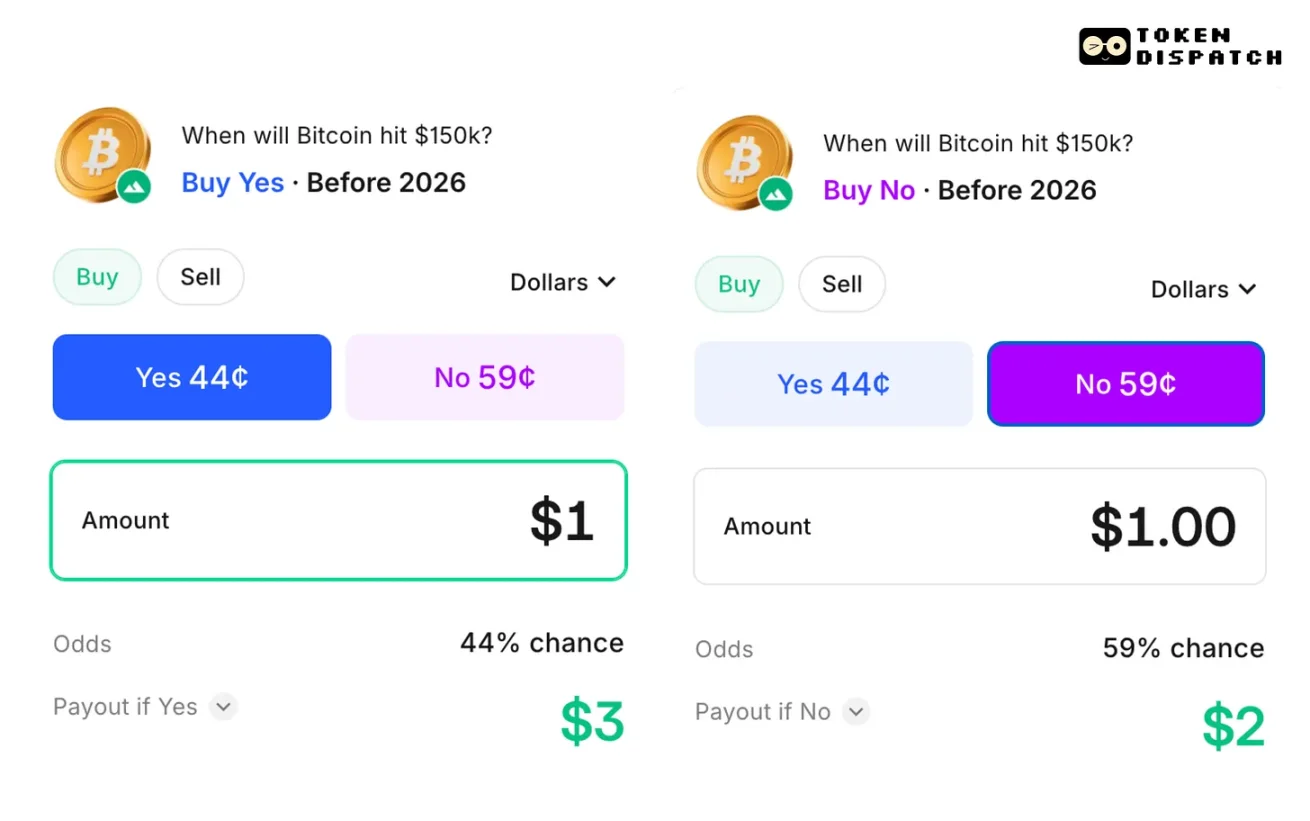

进入任意一个市场,查看当前定价结构。以 「比特币 2026 年前是否能涨到 15 万美元」 市场为例:目前 「是」 合约报价 44 美分,「否」 合约 59 美分,这意味着市场认为比特币 2026 年前涨到 15 万美元的概率是 44%。

界面会清晰显示你的潜在收益:如果你以 44 美分买入 「是」 合约,比特币真的涨到 15 万美元,你每份合约能拿到 1 美元,每份盈利 56 美分;如果没涨到,合约到期作废。

交易流程是这样的:假设你认为比特币能涨到 15 万美元,想买 100 份 「是」 合约,每份 44 美分,总共支付 44 美元。如果 2026 年前比特币达标,每份合约兑付 1 美元,你总共拿到 100 美元,盈利 56 美元;如果没达标,合约作废,损失 44 美元。

步骤 3:下单交易

选择买入 「是」 或 「否」 合约,输入金额(最低 1 美元),平台会自动计算你能买多少份合约,以及最大收益。

还是比特币的例子:以 44 美分买入 1 美元的 「是」 合约,大约能买 2.27 份。如果猜对了,你能拿到 2.27 美元,盈利 1.27 美元。计算过程在确认交易前都是透明的。

这种模式的精妙之处在于简单:你的最大亏损就是买入成本,最大收益是每份 1 美元减去买入价,没有追加保证金通知,没有复杂的希腊字母,没有隔夜融资成本。

步骤 4:多种时间范围

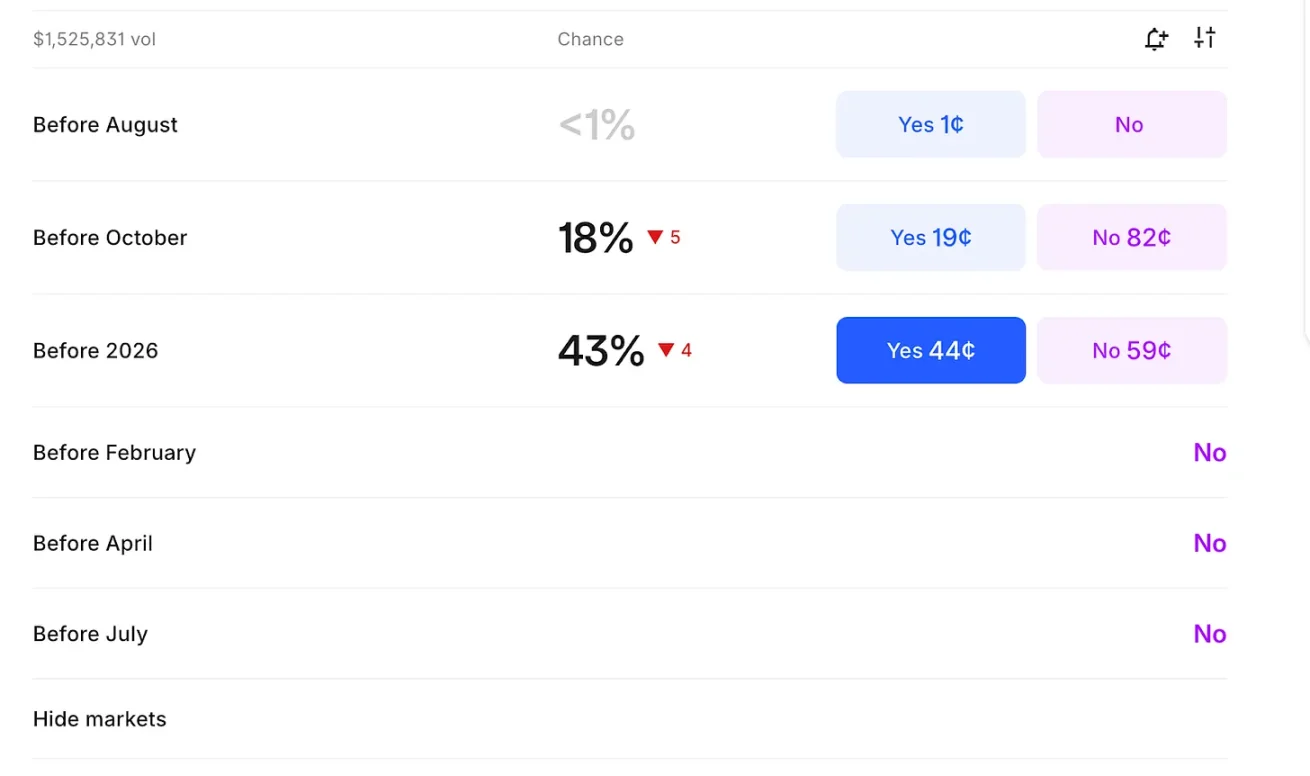

很多市场对同一事件提供不同时间范围的合约。比特币 15 万美元的市场就有 「8 月前」(当前概率 1%)、「10 月前」(18% 概率)、「2026 年前」(43% 概率)等选项。

每个时间范围的交易都是独立的。如果你认为比特币明年才能达到 15 万美元,那么你可以买入 2026 年到期的 「是」 合约,同时卖出 8 月到期的 「是」 合约。

步骤 5:监控与平仓

你不必持有到期,合约价格会随新闻和市场情绪实时变动。平台显示实时价格图表,让你追踪概率变化。

如果突发重大新闻影响你的持仓,你可以立即卖出。比如,你以 44 美分买入比特币 「是」 合约,利好消息推动价格涨到 60 美分,你可以立即卖出,每份赚 16 美分,不用等最终结果。

平仓操作很顺畅:你可以下市价单(立即按当前价格交易)或限价单(等待目标价格),确认交易前会显示潜在盈亏。结算通过预设数据源自动完成 —— 没有争议,没有解读空间,只看数据。

持仓限额可防止单一交易者操控市场。大多数散户每份合约最多能交易 2.5 万美元,而机构交易者则享有更高的限额。费用按合约价值的 0.7%-3.5% 收取,具体取决于市场概率,接近 50/50 赔率的合约费用比极端冷门合约高。

市场分类与发现

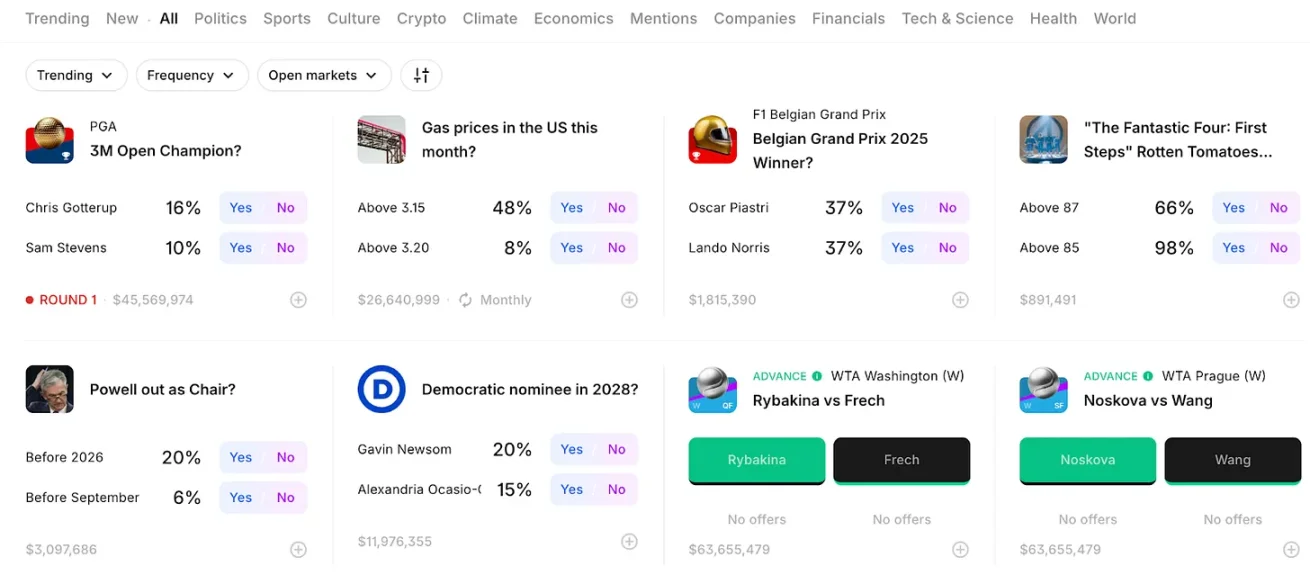

Kalshi 将市场分为多个类别:政治、体育、经济、加密货币、气候等。热门板块突出活跃度高或近期价格波动大的市场。

平台还有 「观点」 板块,用户在这里讨论市场分析,分享交易逻辑。这种社区属性帮你发现新市场,了解对事件概率的不同看法。

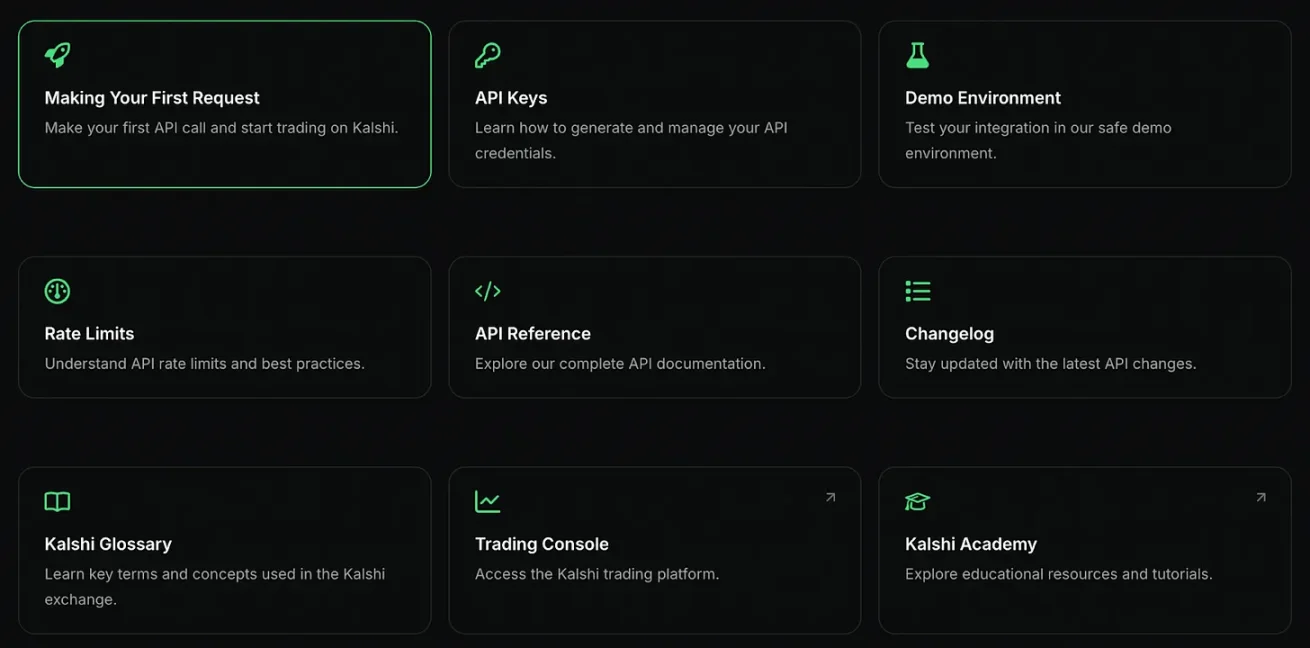

对活跃交易者,Kalshi 提供 API 接口,支持算法交易和数据分析:你可以获取历史价格数据、自动下单,将 Kalshi 市场整合进更广泛的交易策略。

平台还提供每份合约的详细成交量和持仓量数据,帮你在大额交易前评估流动性。

其精妙之处在于简单:没有复杂衍生品,没有杠杆,对手方风险仅限于交易所本身,只有纯粹的信息市场,结算透明且受监管。

投资经理用 Kalshi 对冲传统工具难以高效覆盖的特定事件风险:清洁能源基金担心监管变化,可以直接交易政策结果合约对冲;重仓科技股的投资组合可以通过交易相关法律市场,对冲反垄断行动风险。

如果你持有 100 万美元资产,特定政策变化可能让其缩水 20%,花 5 万美元买入概率 25% 的对冲合约,若事件发生,你能拿到 20 万美元,刚好抵消组合损失。

有专业知识的交易者可以直接将专长变现:政治圈内人交易选举市场,经济分析师交易美联储决策合约,行业专家交易监管结果市场。与股票市场不同 —— 在股市,信息优势会通过复杂衍生品策略快速被套利 —— 事件市场让优秀预测直接转化为利润。你预测 FDA 审批或最高法院裁决的优势,能立即变成交易收益。

Grok 整合

最近与 xAI 的合作让我们看到了信息交易的未来。

Grok 的整合在 Kalshi 界面内提供链上数据、历史赔率和突发新闻的实时分析。下单前,用户可以向 Grok 查询事件背景信息、概率评估和相关数据趋势。

这形成了一个反馈循环:人工智能帮交易者做出更好预测,预测市场结果又能训练 AI 系统的现实预测能力。Grok 在实时概率评估中接受检验,交易者则获得 AI 增强的信息分析。

其影响不止于个人交易决策:随着 AI 系统更擅长处理海量信息和识别概率模式,预测市场会更高效。这意味着点差收窄、价格发现更准确、对冲应用更实用。

Kalshi 与 Polymarket 对比

预测市场领域现在有两位理念互补的领导者:Polymarket 凭借加密原生创新开创了预测市场行业,而 Kalshi 则为华尔街而生。

核心差异

Kalshi 受 CFTC 全面监管,资金存在联邦保险账户,争议通过明确流程解决,一切运作方式与传统金融一致:用银行转账充值,用美元交易,提现到支票账户。

Polymarket 用 USDC 结算,通过去中心化预言机解决争议,证明了模式在全球的可行性,最近还获得美国适当牌照,准备拓展受监管市场。

受众差异

机构资金流向 Kalshi,因为监管带来确定性:Susquehanna 等大型做市商提供流动性,每月超 10 亿美元交易量证明主流市场偏爱合规平台。

Polymarket 的创新和全球覆盖吸引了加密原生用户和国际交易者,他们重视去中心化和无需许可的访问。其早期成功验证了整个预测市场品类的价值。

结论

对重视监管保护和传统金融整合的美国用户,Kalshi 优势明显;对适应加密基础设施、认可 Polymarket 创新的全球用户,后者有独特价值。两个平台从不同角度推动预测市场走向主流,共同增长反映了机构和散户对这一新资产类别的需求。

对你的策略意味着什么

无论你是管理投资组合、构建交易策略,还是想了解金融趋势,Kalshi 的崛起都值得关注。

对投资组合经理:事件合约提供精准对冲工具,覆盖传统工具难以处理的风险:政治风险、监管风险、宏观事件风险现在可以直接对冲,无需依赖不完美的相关性。

-

对活跃交易者:预测现实事件的信息优势可以直接变现,你在特定领域的专长有了清晰的盈利路径。

-

对长期投资者:理解预测市场的演变,有助于把握 「将所有可衡量的不确定性金融化」 。早期构建这类基础设施的公司可能获得丰厚的回报。

-

受监管的预测市场就像 2019 年的 DeFi:尚处萌芽阶段,但产品市场契合度明确,随着基础设施完善和采用率提升,增长潜力巨大。

Kalshi 20 亿美元的估值和不断增长的机构采用表明,我们已过了实验阶段,事件合约正成为合法资产类别,快速适应的交易者将在这个飞速扩张的市场中占据先发优势。

Kalshi 是 「交易现实」 的基础设施层,随着信息与市场的边界不断模糊,这种基础设施的价值也将日益凸显。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。