Author: Zz, ChainCatcher

"The most interesting place on the internet" — this is how three British Gen Z founders described their creation, Pump.fun. Today, this phrase sounds more like dark humor.

In July 2025, this once-celebrated platform, which disrupted the Meme space with its "one-click token issuance" model, is facing an unprecedented crisis of trust and market challenges.

The company is not only under commercial pressure from competitors eroding its market share and a significant decline in key data but is also deeply mired in legal troubles, facing allegations of securities fraud and even RICO charges in the United States. The story of Pump.fun began with fervor and is now undergoing the trials brought on by that very fervor.

The Outbreak of the Trust Crisis

In July 2025, a decision changed everything.

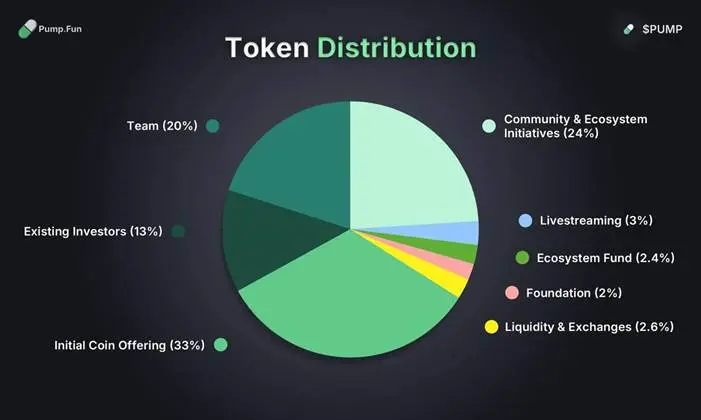

Pump.fun announced the issuance of its own token, PUMP, with a fully diluted valuation of up to $4 billion. This was supposed to be a milestone in the platform's development, but it became a turning point that shook the community's trust.

Ironically, the platform's founders had previously gained credibility with the declaration that "every presale is a scam." Now, they turned around and initiated a large-scale presale for PUMP, an action seen by the community as blatant hypocrisy and betrayal.

Notable venture capitalist Jocy, founder of IOSG Ventures, publicly stated on the X platform that it was a high-risk "Exit Liquidity event," arguing that raising funds at a $4 billion valuation during a down cycle for altcoins had severely overdrawn the future. The market's concerns quickly became reality.

According to CoinMarketCap data, the token's price plummeted by 75% within hours of its launch. As of the publication of this article, PUMP has dropped to 0.0024 USDT, more than a 30% decline from its public sale price of 0.004 USDT.

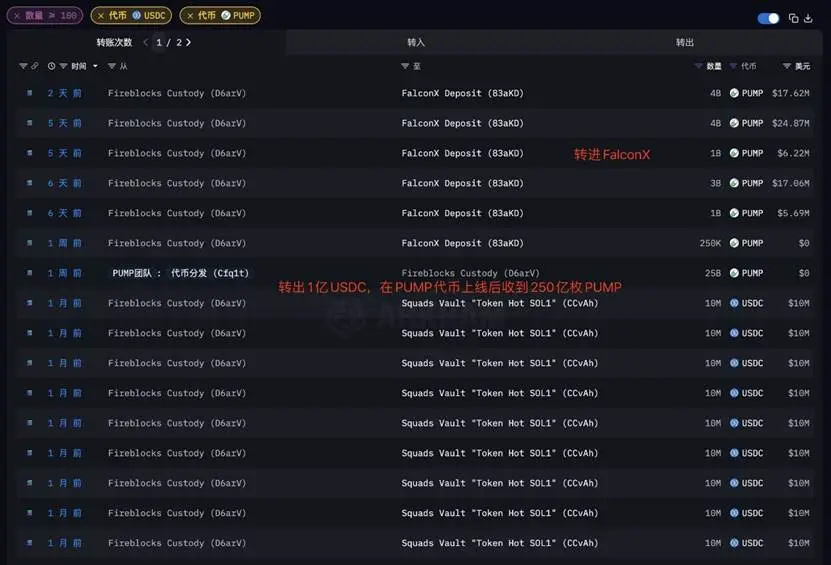

The underlying data is even more alarming: 340 whale wallets coordinated to sell off, controlling over 60% of the presale share. According to on-chain data from X user EmberCN, just two wallets from the private placement rounds sold tokens worth $141 million, profiting nearly $40 million.

On social media, the atmosphere shifted from celebration to despair. "We thought this was an opportunity to change our fate, but it turned out to be just fuel for their luxury yacht parties." This feeling of being fooled and harvested quickly spread, severely damaging the community foundation on which Pump.fun relied.

Share Price Collapse, Business Model Under Test

The loss of trust is directly reflected in the dismal market data.

Competitor LetsBONK.fun is rapidly eroding its market position at an astonishing pace. According to Dune Analytics data, within just one month, Pump.fun's market share in the new token issuance market plummeted from 90% to 24%, while LetsBONK.fun surged from 5% to 64%. This reflects a clash of two entirely different philosophies.

Pump.fun's model is centralized siphoning, while LetsBONK.fun's success lies in using 58% of its platform revenue for buybacks and token burns, building a strong value and trust flywheel through genuine profit sharing.

In the face of adversity, CoinCentral reported that although the team announced a multi-million dollar buyback, it was mocked by the market as "using retail investors' money to buy back at high prices." Analysts pointed out that selling at $0.004 and then using platform revenue to buy back at $0.0064 essentially means paying a 60% premium for market cap management.

While this move temporarily boosted the token price, it could not restore the severely damaged foundation of its value and market confidence. Meanwhile, the global regulatory network is tightening.

In December 2024, after receiving a warning from the UK's Financial Conduct Authority (FCA), Pump.fun was forced to block UK users, who accounted for 9% of its traffic.

This is not an isolated incident but a regulatory scrutiny that its "viral" growth model inevitably attracted. Pump.fun is caught in a severe negative feedback loop: intensified competition erodes revenue, declining revenue weakens buyback capacity, falling token prices damage confidence, ultimately leading to accelerated user loss.

RICO in the Hunt

An even more serious challenge comes from the legal front. Initially, multiple class-action lawsuits accused all Meme coins on the platform of being unregistered securities. Law firms like Wolf Popper LLP proposed the "joint issuer" theory, arguing that the platform was deeply involved in the creation, trading, and liquidity processes of the tokens, rather than being a neutral technology provider.

In July 2025, the legal battle escalated sharply. According to revised documents in the Aguilar case, plaintiffs added allegations based on the Racketeer Influenced and Corrupt Organizations Act (RICO) — a statute typically used to combat organized crime.

The scope of the defendants also expanded, with the Solana Foundation, Solana Labs, and even its co-founders listed as the "architects, beneficiaries, and accomplices" of the fraud. The impact of this move far exceeds the project itself, directly questioning the responsibility boundaries of the entire Solana ecosystem.

As underlying infrastructure, does Solana have an obligation to review or supervise its star projects within its ecosystem? This lawsuit has made all public chain platforms realize that their relationship with ecosystem projects may be far more dangerous than they imagined. The foundational behaviors of RICO charges include telecommunications and securities fraud, unlicensed money transmission, and aiding money laundering.

Among the most explosive allegations is that the North Korean hacker group "Lazarus" used Pump.fun to issue Meme coins to launder funds stolen in the Bybit hack.

Governance Defects, Hard to Prevent Internal Betrayal

However, perhaps the most shocking betrayal comes from within.

On May 16, 2024, the platform was attacked, and approximately $1.9 million was stolen. However, the attacker was not an external hacker but a disgruntled former employee.

This former employee, known as "Stacc," publicly admitted responsibility on social media platform X, with motives pointing to personal revenge and disdain for "terrible bosses." Technical analysis showed that the attack stemmed from the abuse of management privileges rather than a vulnerability in the smart contract.

The employee exploited their privileged position to illegally obtain withdrawal authorization, then quickly bought out the supply of multiple tokens through flash loans, ultimately intercepting the initial liquidity that should have entered the DEX. While publicly claiming to address the risk of Meme coins running away, the internal "backdoor" had already been wide open for disgruntled employees.

This incident serves as a mirror, reflecting Pump.fun's astonishing neglect of internal security and corporate governance amid rapid growth.

From Solving Runaway Risks to Running Away Themselves

The root of the story began with the "Solana Meme Coin Frenzy" that swept the globe in early 2024. Countless developers and speculators flocked to the Solana ecosystem, eager to create or capture the next hundredfold coin, but the process of creating tokens and providing initial liquidity pools (LP) was both expensive and complex, often requiring thousands of dollars in costs and expertise, which kept countless ideas and "grassroots" players at bay.

The protagonists are three British Gen Z founders: CEO Noah Tweedale (21), CTO Dylan Kerler (21), and COO Alon Cohen (23), who uses a pseudonym. They keenly identified this core pain point, claiming to solve the runaway risks of Meme coins, with a vision to create the most interesting place on the internet.

Pump.fun burst onto the scene in January 2024, with its core innovation: "one-click token issuance," simplifying a previously complex process to just a few clicks and a few dollars. This disruptive innovation led to explosive growth.

However, this talent quickly turned into a speculative tool. The entire business model amplified speculative sentiment. The presale of the PUMP token at a $4 billion valuation pushed this speculation to its peak.

Disregard for business rules ran throughout. They had once gained trust with an anti-presale stance, only to turn around and initiate a large-scale presale. When faced with FCA regulation, they chose to sever ties with the UK operating entity. The CEO denied that Pump.fun was a UK company, while the COO argued that an employment relationship does not imply ownership. To the public, these actions appeared calculated rather than ignorant.

A complex portrait emerges of technical geniuses, speculators, and rule disregards, presenting the complete trajectory of Pump.fun's rapid rise and swift fall. The young founders did not anticipate that this project, intended to bring fun, would thrust them into a complex legal and commercial whirlpool.

At a Crossroads

Pump.fun stands at a crossroads. Unresolved lawsuits, declining market share, and damaged user trust have plunged it into crisis.

This seems to be another brutal enactment of "DeFi Darwinism": a species rapidly thrives due to its unique adaptability (low barriers, high virality) but ultimately faces challenges because it cannot evolve to cope with complex environments (regulation, trust, security).

For the entire crypto industry, Pump.fun's predicament raises a serious question: to what extent should platforms be responsible for the actions within their ecosystems when innovation treads the legal edge?

As regulatory scrutiny shifts from centralized exchanges to more complex DeFi applications, the next Pump.fun may already be brewing.

For every surfer, the ability to distinguish between fun and traps has never been more important than it is today. This story of rising from grassroots to the peak and then falling from that peak may be laying the groundwork for the next chapter in the crypto world.

Recommended Reading:

Crypto Beast Manipulates $ALT Plummeting, Adding Another Entry to KOL's Collapse History

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。