Based on this week's performance, Huobi HTX has balanced "high heat + high potential" in asset listings, accurately covering multiple narrative tracks. This not only provides users with diverse choices but also effectively captures the market rotation rhythm, boosting overall trading activity on the platform.

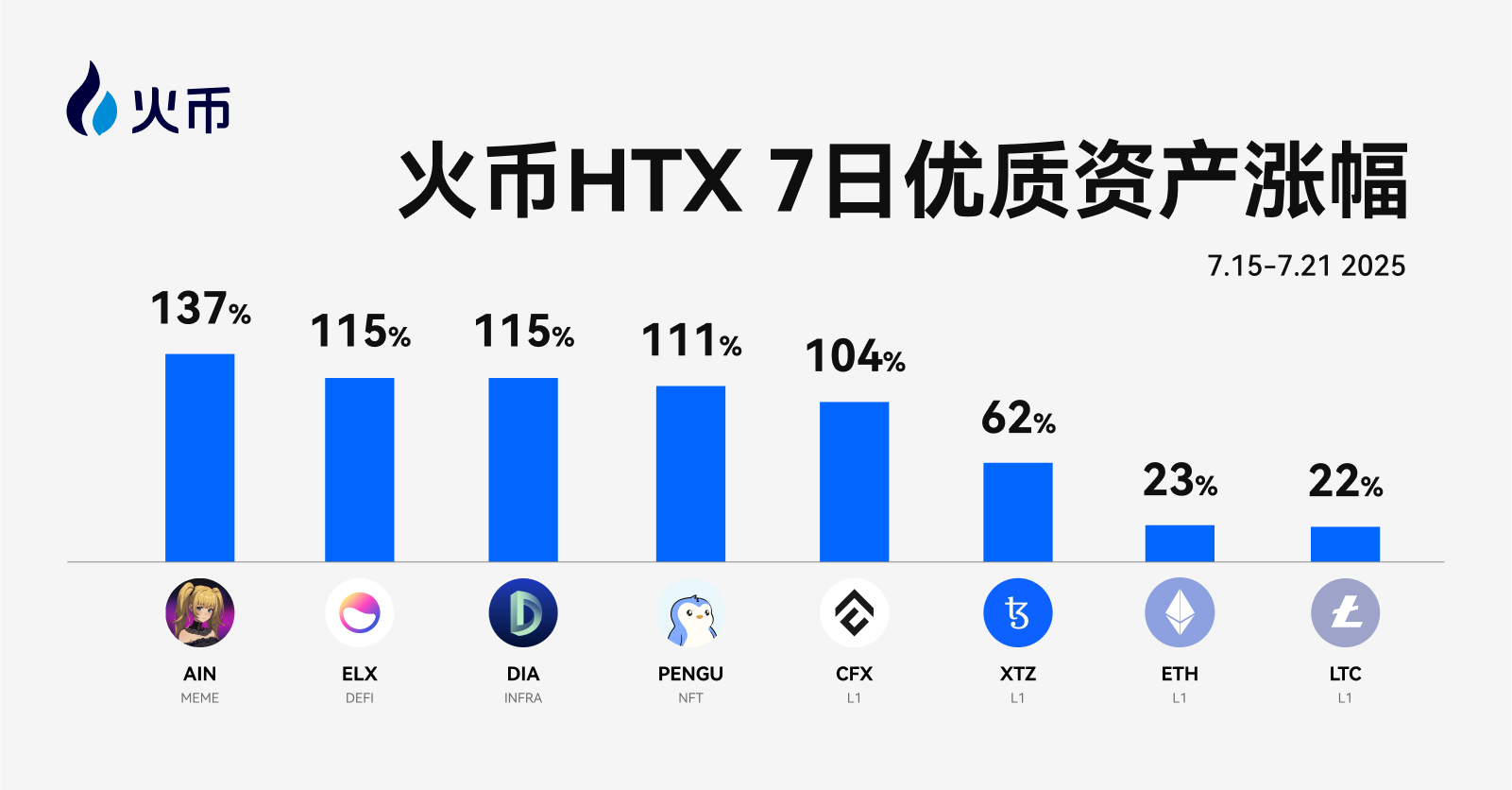

In the third week of July, the crypto market's hot spots continued to heat up, with trends shifting from mainstream coins to emerging assets and high-volatility tracks. Among them, Ethereum (ETH) regained its position as the "hottest mainstream asset" with a solid 23% increase. The newly listed and key assets on Huobi HTX continued to perform strongly, with several coins doubling in value within just a week, covering diverse tracks such as Meme, NFT, DeFi, social, and infrastructure, once again confirming Huobi HTX's precise selection and layout capabilities for hot assets. Here are the highlights of quality assets this week:

Emerging Assets Lead, Wealth Effect Continues to Amplify

● ANI (Ani Grok Companion) emerged as the weekly champion with a staggering 137% increase in just 7 days. This project represents the AI + Meme track, incorporating the "gooning" meme and the Grok image related to xAI and Elon Musk, blending AI trends with community-driven creative culture. With spontaneous community heat, innovative gameplay, and short-cycle trading opportunities, it became one of the fastest-growing coins in trading volume on the platform that week.

● ELX (Elixir) gained 115% this week as a representative of the DeFi narrative's return. Elixir is a blockchain project focused on DeFi and liquidity solutions, aiming to provide efficient liquidity support for DEXs, with a protocol TVL exceeding $300 million. The protocol also launched a synthetic dollar stablecoin called deUSD, which maintains stability through a "Delta neutral strategy" and captures yields via funding rates.

● DIA (Decentralized Information Asset) also recorded a 115% weekly increase as an on-chain infrastructure token. DIA is a decentralized oracle platform focused on providing reliable data for DeFi applications and other blockchain applications. Its main functions include providing on-chain and off-chain market data, price information, and oracle services. Benefiting from increased Web3 development activity and expectations for application implementation, DIA's price performance has improved.

● Following last week's explosion of NFT concept assets, PENGU (Pudgy Penguins) performed strongly this week with an increase of 111%. The Pudgy Penguins NFT series was initially deployed on the Ethereum chain in July 2021, consisting of 8,888 unique penguin avatars, featuring complete IP characteristics and strong community attributes. Backed by digital IP and avatar community economic models, it demonstrates renewed vitality in the NFT field under the new cycle.

Infrastructure and Public Chain Tracks Rotate Actively, L1 Market Heats Up

This week, several Layer 1 assets surged strongly, forming a structural rotation market:

● CFX (Conflux) saw a weekly increase of +104%: Conflux is a public Layer 1 blockchain designed to power decentralized applications (dApps), e-commerce, and Web 3.0 infrastructure with greater scalability, decentralization, and security than existing protocols. Conflux makes it easier to transfer valuable assets by ensuring fast, efficient processes without network congestion and low transaction costs. Benefiting from increased on-chain activity in Asia and the implementation of ecological support programs, CFX performed impressively.

● XTZ (Tezos) recorded a weekly increase of +62%: As an established L1 asset, Tezos recognized the governance flaws of blockchain networks as early as 2014 and proposed on-chain governance solutions. Through its on-chain governance system, token holders can decide the upgrade path and priorities of the system, helping to resolve disputes and avoid hard forks. Recent upgrades have driven ecological expansion, while some institutions have begun pilot adoption.

● LTC (Litecoin) saw a weekly increase of +22%: Litecoin was developed in 2011 as a branch of the Bitcoin network, aiming to improve Bitcoin's shortcomings. It is the first altcoin, designed to provide a decentralized peer-to-peer (P2P) currency with faster transaction processing times and lower fees than Bitcoin. Over the years, Litecoin's use as a payment method has increased, with merchants including the American Red Cross, Newegg, and Twitch accepting LTC as a payment option. In addition to its stable price trend, its integration with traditional financial concepts has also attracted market attention—recently, LTC became one of the first assets linked to a "crypto stock fund" under a major U.S. brokerage, granting it new "crypto ETF-like" attributes.

It is worth mentioning that ETH, as the current market's largest hot mainstream coin, continues to maintain a steady upward trend with a weekly increase of 23%, becoming a primary allocation direction for capital seeking safety and stable growth. With ETH 2.0 staking yields continuing to rise, a thriving Layer 2 ecosystem, and institutions continuously increasing their positions, this asset has once again become a core allocation target for large funds.

Huobi HTX 7-Day Quality Asset Increases

Diverse Asset Layout Effectiveness Highlighted: Multi-Round Narrative Resonance, Quality New Assets Remain the Main Battlefield

From this week's performance, Huobi HTX has balanced "high heat + high potential" in asset listings, accurately covering multiple narrative tracks. This not only provides users with diverse choices but also effectively captures the market rotation rhythm, boosting overall trading activity on the platform.

With the three-round logic resonance of "Bitcoin ETF expansion—strong Ethereum ecosystem—active emerging application narratives," the market is entering a mid-stage of a structural bull market. Hot funds are gradually spreading from mainstream assets to small and medium-cap high-volatility projects, providing fertile ground for "early capture + value excavation." Huobi HTX will continue to focus on the selection of quality assets, providing users with new asset participation opportunities that are more explosive and promising, helping investors seize the next "wealth windfall."

About Huobi HTX

Huobi HTX was established in 2013 and has developed over 11 years from a cryptocurrency exchange into a comprehensive blockchain business ecosystem, covering digital asset trading, financial derivatives, research, investment, incubation, and other businesses.

As a global leading Web3 portal, Huobi HTX adheres to a development strategy of global expansion, ecological prosperity, wealth effect, and security compliance, providing comprehensive, safe, and reliable value and services for virtual currency enthusiasts worldwide.

For more information about Huobi HTX, please visit https://www.htx.com/ or HTX Square, and follow X, Telegram, and Discord. For further inquiries, please contact glo-media@htx-inc.com.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。