Author: Nancy, PANews

Currently, various cryptocurrencies and stocks are competing to rally, showcasing dramatic surges in an effort to capture market attention. Unlike the front-line players competing for visibility, Galaxy Digital is one of the behind-the-scenes operators in this financial narrative. In fact, from asset management services to infrastructure development, and from direct investments to structured support, Galaxy is accelerating its compliance transformation and diversification strategy after entering the traditional capital markets.

Launching Two Types of Customized Services, Galaxy Becomes the Behind-the-Scenes Driver of Crypto Treasury

Currently, more and more companies are allocating part of their assets to mainstream cryptocurrencies like Bitcoin and Ethereum for asset reserves, inflation hedging, and even generating financial returns.

Although there are concerns in the market regarding the leverage levels and debt repayment capabilities of some crypto financial companies, Alex Thorn, head of research at Galaxy Digital, recently pointed out that these concerns are significantly exaggerated. He stated, "In terms of overall scale, the debt levels of these companies are relatively limited, and most of the debt is due in more than two years."

Behind Galaxy's confidence in the evolution of crypto finance trends is its role as a driving force behind this reserve craze. Whether it is new entrants allocating crypto assets for the first time or mature companies optimizing existing allocations, Galaxy is providing comprehensive support for major institutions to initiate and expand their crypto treasury operations, covering everything from trading, investment, structural design to technical deployment.

It is reported that Galaxy primarily serves two types of corporate treasury participants: (1) Self-managed enterprises: These can use Galaxy's institutional-grade technology platform to conduct trading, lending, and staking operations independently; (2) Custodial management-seeking enterprises: These can collaborate with Galaxy Asset Management to obtain comprehensive management strategies and infrastructure support.

According to official disclosures, in the past few weeks, Galaxy has become the preferred partner for over 15 leading companies' crypto treasury projects, such as SharpLink, BitMine, GameSquare, GameStop, AMC, Bit Digital, K Wave Media, TLGY Acquisition Corp, and ReserveOne, providing them with infrastructure, professional services, and end-to-end support. Some partners have already committed over $4 billion in funding for crypto assets. In some cases, Galaxy has also acted as a direct investor, funding these companies' digital asset strategies from their balance sheets.

Customized services for crypto treasuries are also becoming one of Galaxy's important sources of revenue. Taking SharpLink Gaming as an example, Galaxy not only invested in the company but also signed an asset management agreement to manage its Ethereum treasury. According to SEC filings, SharpLink must pay Galaxy and ParaFi Capital a tiered asset management fee ranging from 0.25% to 1.25% annually, with a minimum of $1.25 million per year. As SharpLink continues to expand its ETH treasury, Galaxy will also receive ongoing and substantial revenue returns.

Notably, as institutional staking demand increases, Galaxy is optimizing related services to achieve more revenue. For instance, not long ago, Galaxy announced a partnership with Fireblocks to directly introduce its staking services to over 2,000 institutional clients on the Fireblocks platform. Additionally, this year, Galaxy has collaborated with institutional custodians such as Zodia Custody, BitGo, and Liquid Collective to further expand its staking business. According to official sources, as of the first half of this year, Galaxy's staking asset scale reached $3.15 billion.

First Quarter Losses Consume Annual Profits, Accelerating Diversification Strategy Post-Listing

"Whether for institutions or innovators, a trusted partner is needed to meet the demands of a globalized, digitally connected financial system. Galaxy aims to become the preferred one-stop platform for institutions seeking financial services in the crypto economy," stated Galaxy founder Mike Novogratz in the prospectus.

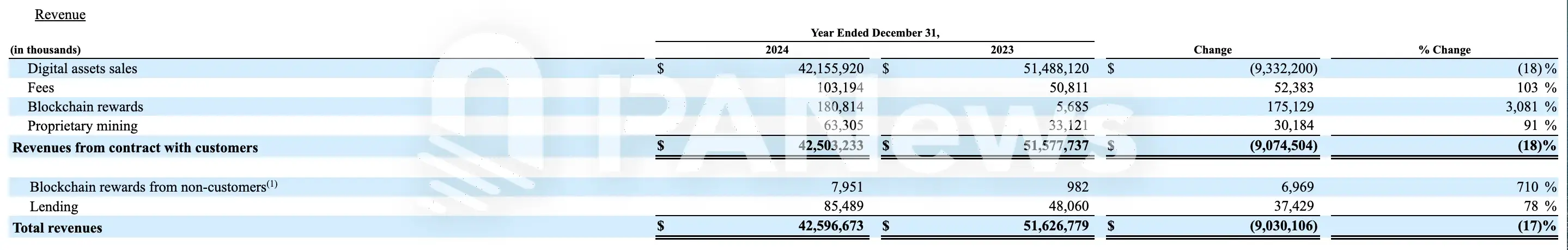

In fact, Galaxy is attempting to respond to the high volatility and uncertainty of the crypto market environment with a more diversified structural strategy. Currently, Galaxy's business structure revolves around three core segments: global markets (covering trading and investment banking), asset management, and digital infrastructure solutions (including mining, staking protocol support, and self-custody technology). Among these, trading is the cornerstone of Galaxy's revenue. According to the prospectus, Galaxy's total revenue is expected to approach $42.6 billion in 2024, with approximately 99% coming from digital asset trading. However, this single structure has exposed significant risks during market downturns.

This year, as trading activity in non-Bitcoin cryptocurrencies continues to decline, Galaxy has also been hit hard. By the end of the first quarter, Galaxy reported a net loss of $295 million, primarily due to falling crypto asset prices and the shutdown of its Helios data center mining operations. This quarterly loss nearly consumed the nearly $350 million net income expected for the entire year of 2024. Additionally, by the end of the first quarter, Galaxy's assets under management had significantly shrunk by 29% from the previous quarter, dropping to $7 billion, further demonstrating the pressure of crypto market volatility on its asset management business.

Despite short-term performance pressures, Galaxy still holds ample cash reserves. As of the end of the first quarter of 2025, the institution held $1.1 billion in cash and stablecoins, along with $1.9 billion in equity reserves.

In addition to its crypto treasury business, Galaxy is also expanding its other ecological layouts at this stage, promoting revenue diversification and striving to break free from its reliance on trading business.

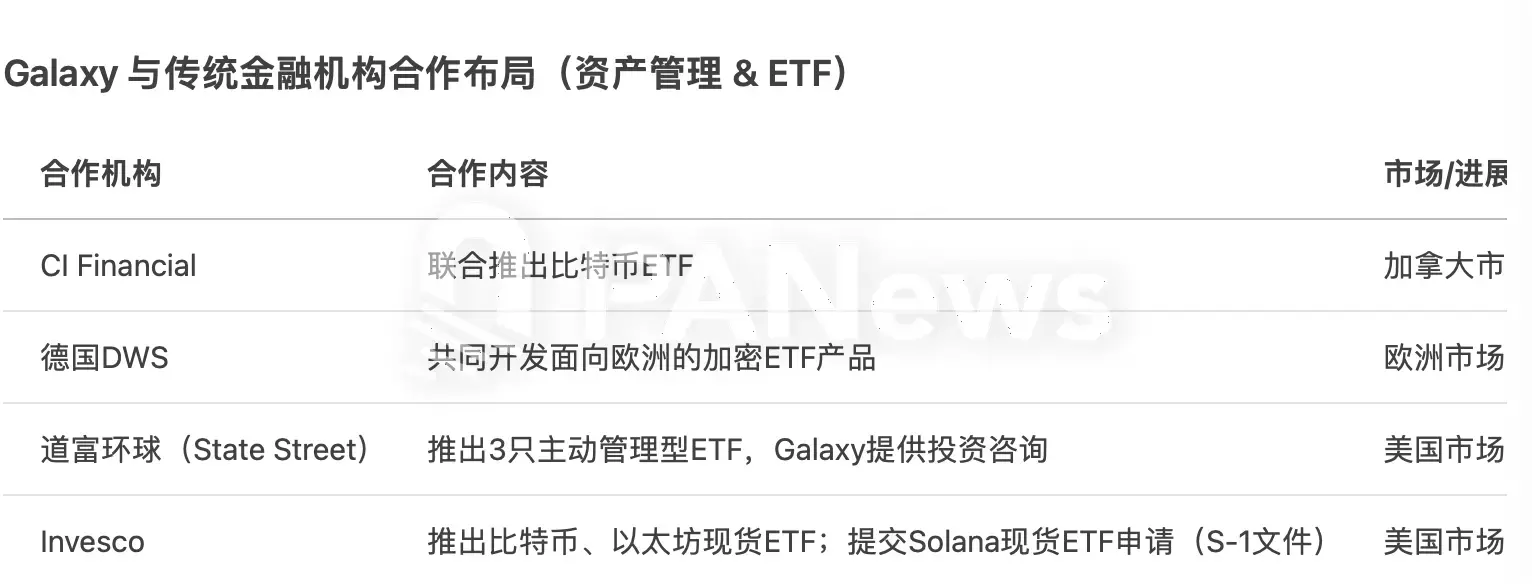

For instance, in asset management, Galaxy is expanding its layout for crypto ETFs through deep cooperation with multiple global financial institutions. As early as in the Canadian market, Galaxy partnered with CI Financial to launch a Bitcoin ETF, facilitating the rapid rollout of compliant crypto investment products in North America; in Europe, Galaxy reached a strategic cooperation with German asset management giant DWS to jointly develop crypto asset ETF products for the European market; in the US market, Galaxy has partnered with State Street Global Advisors, the third-largest ETF issuer, to launch three actively managed ETFs, with Galaxy Asset Management providing core investment consulting services. At the same time, Galaxy has also collaborated with Invesco to launch Bitcoin and Ethereum spot ETFs and submitted an S-1 application for a Solana spot ETF to the SEC in June this year, further expanding its product line. Additionally, Galaxy's new fund successfully raised $175 million last month, marking its first acceptance of external capital and providing retail investors with a rare opportunity to participate in a crypto venture capital portfolio.

Furthermore, in the digital infrastructure sector, Galaxy is building the next-generation AI infrastructure, Helios. At the end of May, Galaxy issued 29 million shares of its Class A common stock post-listing, planning to use the net proceeds from this issuance to acquire its subsidiary, Galaxy Digital Holdings LP, thereby continuing to expand its AI and high-performance computing infrastructure at its Helios data center campus in the narrow strip of West Texas. Previously, Rittenhouse Research had given GLXY a "strong buy" rating, citing its strategy of fully transitioning from Bitcoin mining to AI data centers. Rittenhouse expects Helios to generate $1.7 billion in EBITDA and $32 billion in equity value, far exceeding the volatility and high investment of mining operations.

Additionally, as the cryptocurrency industry gradually moves towards compliance and institutionalization, Galaxy has chosen to embrace the US market in its compliance process. In May of this year, Galaxy, which was originally listed in Canada, completed its restructuring from the Cayman Islands to the US and officially listed on NASDAQ under the ticker symbol GLXY. Market data shows that GLXY has risen 55.87% in the past month.

Galaxy's efforts to generate profits are also a way to "pay tuition" for compliance. Previously, to clear compliance hurdles and achieve a smooth transition, Galaxy did not hesitate to pay substantial sums to settle old cases. At the end of March, Galaxy reached a $200 million settlement agreement with the New York Attorney General's Office regarding the manipulation of the LUNA token (which generated hundreds of millions in profits before the LUNA crash). The agreement stipulates that Galaxy Digital must pay a $200 million fine over three years, with the first payment of $40 million due within two weeks.

Whether as a behind-the-scenes profit-maker for crypto treasuries or actively expanding into ETF products and AI infrastructure, Galaxy's strategies reflect its desire to address market uncertainties through diversified and compliant layouts.

Recommended Reading:

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。