Rolex, the "Sentiment Barometer" of the Crypto Market.

Written by: Pix

Translated by: Luffy, Foresight News

In every crypto cycle, there comes a moment when wealth becomes visibly tangible. Not just on-chain or in portfolio screenshots, but in the real world.

A year ago, someone who was still relatively unknown walked into a dealer's store, bought a watch with cash, and then posted a photo of it on their wrist online. This moment, seemingly trivial, marks a significant shift in market psychology.

Why Watches?

The logic is simple. Rolex is a Veblen good (note: a good for which demand increases as the price increases).

The higher the price, the more people want to buy. They do not showcase value through functionality, but through price. Because what people are buying is not practicality, but status.

When the newly wealthy class becomes rapidly affluent, the first thing they want to do is let others know they are rich.

They won't buy farmland or government bonds. They will buy items that symbolize status. Watches, cars, and sometimes even JPEG-format NFTs (note: non-fungible tokens).

But the reality is not as simple as it seems…

Lagging Response

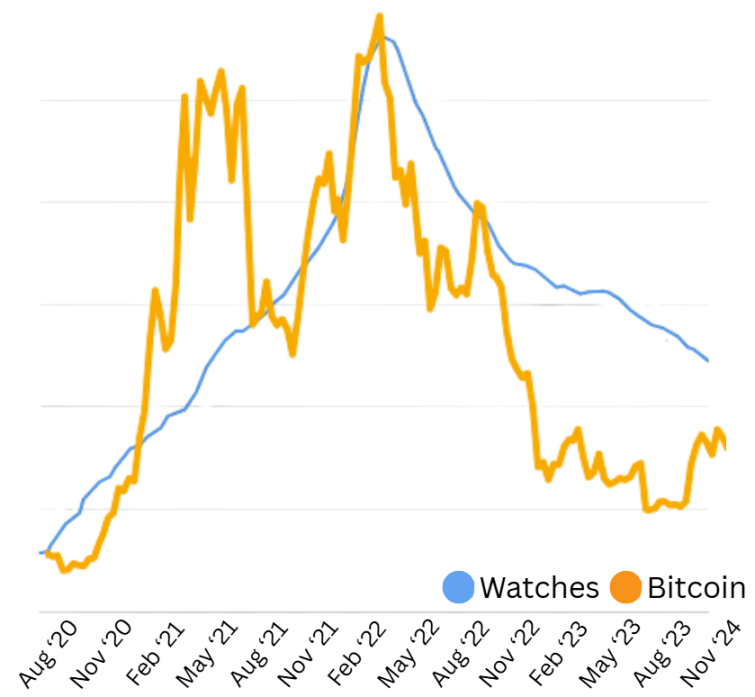

2020 - 2024, Comparison of Watch Index and Bitcoin Price

In 2021, most people believed that the luxury watch market would rise alongside cryptocurrencies.

However, if you look closely at the timeline, the watch market did not thrive when Bitcoin first hit an all-time high. Instead, it was during the second peak, when tokenized JPEGs (NFTs) were once traded at the price of houses.

The surge in Rolex prices was not the beginning of a bull market, but the peak of a bull market.

The value of this phenomenon lies in the lag in the luxury goods market. The lag is not long, but just enough to reflect the pattern. This can be seen in the data.

The watch index lagged during the rise of cryptocurrencies, peaking slightly later, and then almost simultaneously crashing.

In the year following the cryptocurrency crash, Rolex prices fell by nearly 30%. Not because demand disappeared, but because the identity-driven demand that fueled it had dried up.

This makes watches an unusual signal. They do not predict fundamentals but reflect market sentiment.

Moreover, they are clearer than most indicators we currently have…

A Different Type of Indicator

In traditional finance, there is a volatility index. In the cryptocurrency space, there are funding rates. But both are indirect measures of market behavior.

Luxury goods are different. They can not only tell you what investors are doing but also how they feel.

How wealthy they feel and how much they want the world to notice them.

This is not flawless. But when you see watches being resold at double their retail price, or someone posting their custom NFT Rolex, it usually means the market is nearing its peak.

Because at that point, wealth has been accumulated and has entered the consumption phase.

So, what stage are we currently in the cycle?

Current Cycle

Right now, we are returning to near historical highs. Bitcoin is rising, and Ethereum is also on the rise.

Even "mainstream" cryptocurrencies like ADA and XRP have increased by 50% in the past month.

However… the Rolex market is quite calm. Prices are stable, and some models are even unsold. Dealers are not reporting supply shortages, and premiums are not high.

At first glance, this seems like a bearish signal, but it may actually be the opposite. The fact is, the profits of this cycle have not yet widely spread.

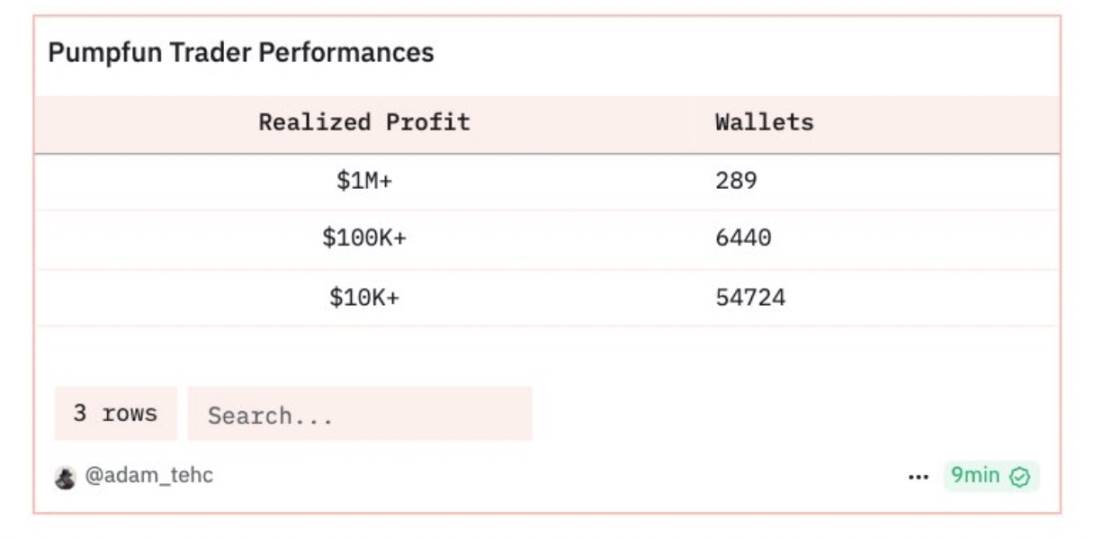

The recent Memecoin craze has only created a few hundred millionaires. This is not enough to drive a market (referring to the watch market) built on widespread speculative excess.

You can see signs of this pattern returning. More Rolex photos are appearing on Crypto Twitter (CT), and mentions are increasing, but it is still far from the heat of 2021.

It is also worth remembering that last time, the watch market did not show volatility until the later stages of the cycle.

Not at the first peak of Bitcoin, but after the second peak, when everyone felt wealthy and wanted to be noticed.

History does not repeat itself, but it does rhyme.

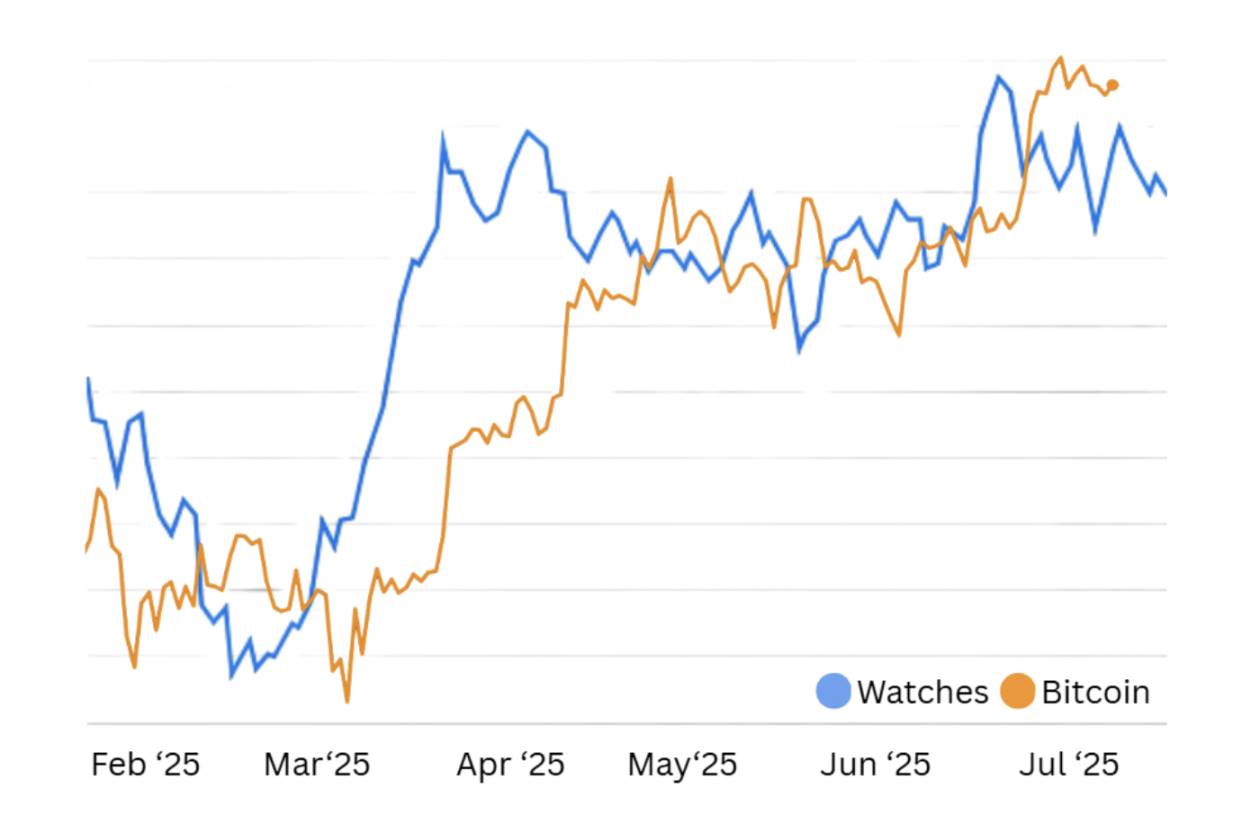

In the past few months, things have changed. Bitcoin and watch prices have begun to move in sync. Not perfectly synchronized, but a clear correlation has emerged.

The last cycle was not like this. In 2021, the watch market lagged. First, cryptocurrencies rose, then the NFT craze, and only then did Rolex prices soar.

And this time, have watches already started to move? Well, not entirely…

This time, the charts look different. Watches and Bitcoin have almost simultaneously started to rise.

Since March, their trends have been nearly synchronized. But if you extend the timeline, the situation changes.

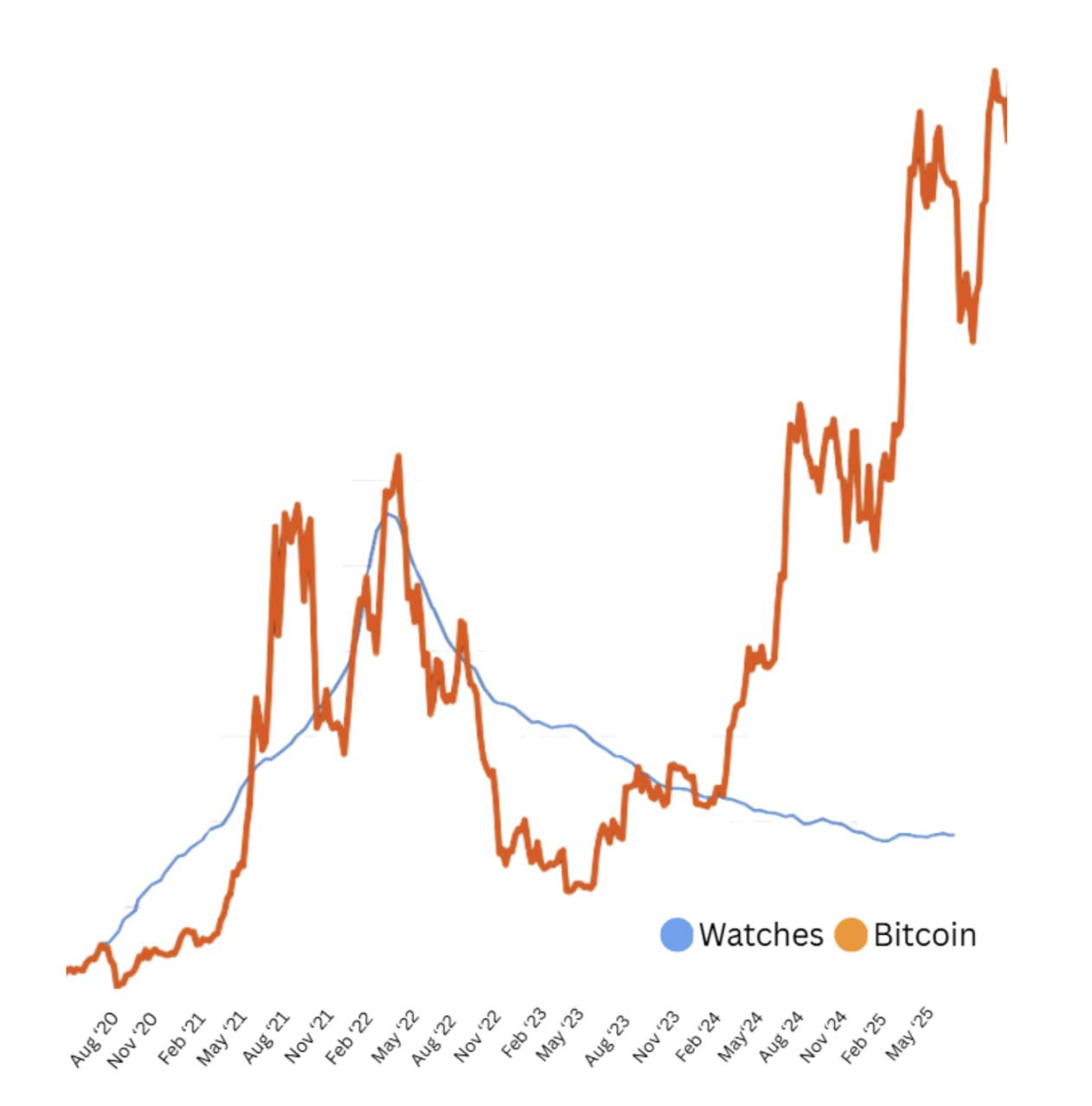

A More Macro Perspective

Bitcoin is close to its historical high, but watches are not. Most models are still far below their 2022 peaks.

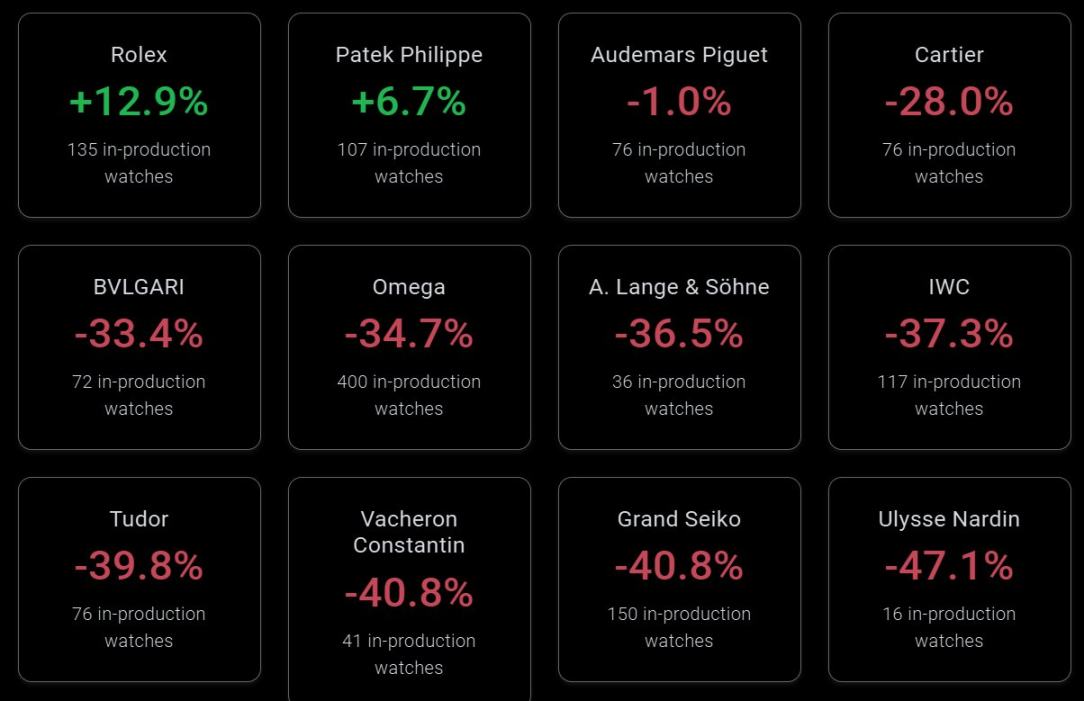

Aside from Rolex and Patek Philippe, the entire watch market is sluggish. Cartier, Omega, and even Audemars Piguet — prices are all 30% - 40% below retail.

This is important because it conveys two messages.

First, we are not yet in the frenzy stage. Second, most watches are currently poor investment items.

Their design purpose is not to retain value but to showcase status.

The rise in watch prices does not mean we have reached the top of the cycle, but it does indicate that we have passed a significant portion of the cycle.

People will start buying status symbols when they feel that the most difficult part is over.

Typically, this is in the middle of the cycle, around two-thirds of the way through.

Wealth is accumulating, confidence is returning, but the real consumption wave has not yet begun. When the consumption wave arrives, you won't need charts to notice; you will feel it.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。