Three Bad News for Circle: Interest Rate Cuts, Big Tech's Entry, and Coinbase's Threat

Author: Eastland

Article Summary

Stablecoin issuer Circle's stock surged 622%, but it faces a triple crisis: the Federal Reserve's interest rate cuts will compress its core income reliant on U.S. Treasury interest; partner Coinbase takes over 60% of profits and plans to increase its share; tech giants like Apple may enter the stablecoin market relying on U.S. Treasuries and brand trust, threatening Circle's survival.

• 💱 Nature of Stablecoins: Similar to U.S. dollar depositary receipts, they have a dual-layer intermediary structure and legal evasion function, but are defined as payment tools rather than securities.

• 📊 Competitive Landscape: USDC's market share is only 25% ($61 billion), far behind USDT's 62% ($150 billion), but it has a clear compliance advantage.

• 🏛️ Core Value of Compliance: Establishing a regulatory-friendly image through global licenses, 100% cash/Treasury reserves, and monthly audits, becoming a key leverage for listing.

• ⚖️ Coinbase's Profit-Sharing Mechanism: Partners take a fixed 50% of reserve income, and all user deposit income belongs to them, with profit-sharing exceeding 60% in 2024.

• 📉 Fatal Impact of Rate Cuts: 96% of income relies on U.S. Treasury interest; a 1% drop in yield will result in a $600 million annual loss, compounded by Coinbase's profit-sharing intensifying the profit crisis.

• 🚨 Threat of Big Tech Entry: Companies like Apple and Amazon may issue their own stablecoins, leveraging brand trust and U.S. Treasury reserves, potentially squeezing Circle's survival space.

On June 5, 2025, the first stablecoin stock Circle (NTSE: CRCL) was listed on the NYSE at an issuance price of $31, reaching a peak of $299 within just 12 trading days.

The closing price on July 18 was $223.78, up 622% from the issuance price, with a total market value nearing $50 billion. Although the stock price has since fallen 25% from its peak, risks remain high.

Stablecoin = Fiat Currency Depositary Receipt

Stablecoins are cryptocurrencies pegged to fiat currencies, serving as digital substitutes for fiat. To facilitate understanding, a comparison can be made—stablecoins are like fiat "depositary receipts."

Chinese concept stocks listed in the U.S. trade as American Depositary Receipts (ADRs). For example, Alibaba ADR represents 1 share of common stock, Baidu ADR represents 8 shares, Ctrip ADR represents 1 share, and JD.com ADR represents 2 shares…

There are four points of comparison between stablecoins and ADRs:

First, they issue certificates representing asset ownership. ADRs grant holders rights related to stock ownership, such as dividends and voting. The digital certificates issued by stablecoin issuers represent holders' ownership of reserve assets (fiat currency, government bonds);

Second, they adopt a "dual-layer intermediary structure." ADRs are issued by depositary banks, with the underlying stocks held by custodial banks. Stablecoins require collaboration between issuers (like Tether, Circle) and reserve asset custodians (like BlackRock) to complete asset backing and certificate issuance;

Third, they are used to circumvent "legal barriers." According to U.S. law, only domestic companies can go public. ADRs allow U.S. investors to indirectly invest in non-U.S. companies; stablecoin users can hold fiat currencies without opening fiat accounts (in USD, EUR, HKD);

Fourth, the anchoring mechanism. ADRs strictly anchor the underlying stocks, while compliant stablecoins maintain a 1:1 reserve of assets.

Despite the similarities, ADRs and stablecoins are fundamentally different—the former is a substitute for stocks and is classified as a security; the latter is a substitute for currency and is classified as money. This distinction is crucial, as the recently passed "Genius Act" in the U.S. clarifies that stablecoins are not securities, commodities, or investment products, but rather "payment tools."

In contrast to the "Genius Act," the "Anti-CBDC Act" prohibits the issuance of digital currencies in the U.S. This is in stark contrast to China's vigorous promotion of the digital yuan (note: the digital yuan is the actual fiat currency, not a substitute).

CIRCLE's Issuance Scale Fluctuations

Circle was founded in 2013 and is headquartered in Boston, initially providing Bitcoin payment and cross-border transfer services. It raised $26 million in Series A and B rounds; the D round in 2016 was led by IDG, with participation from Goldman Sachs and Baidu; and in 2018, Everbright Holdings joined in the E round.

Circle's turning point came in 2018 when it launched USDC in partnership with Coinbase, establishing a transparency benchmark with a 1:1 dollar reserve and monthly audit reports, competing with USDT in a differentiated manner.

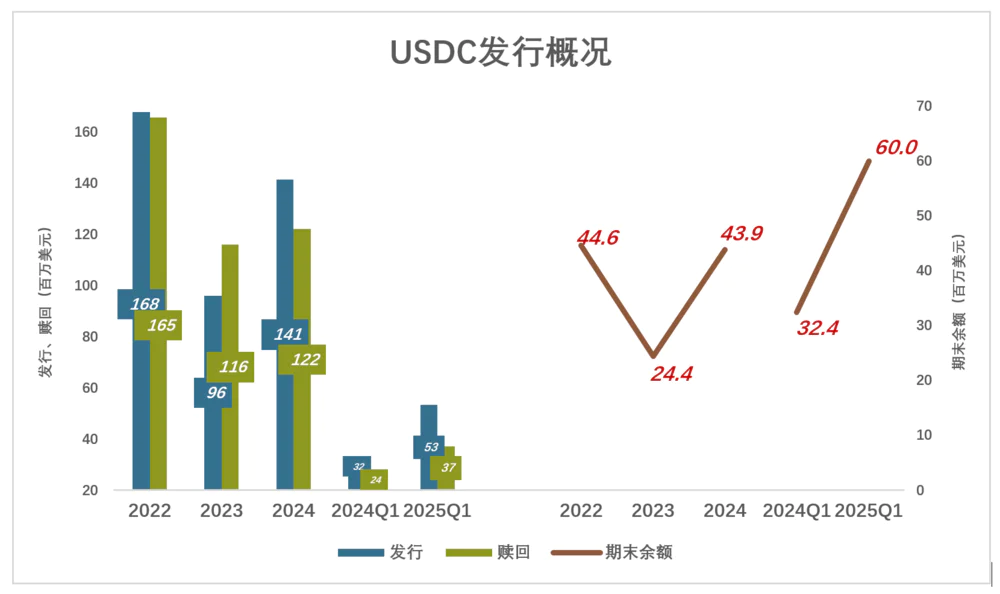

In 2022, Circle's issuance and redemption volumes were $167.61 billion and $165.47 billion, respectively, with a net issuance of $2.14 billion and an end-of-period circulation of $44.55 billion (circulation = issuance - redemption);

In 2023, Circle's issuance and redemption volumes were $95.83 billion and $115.98 billion, respectively, with a net redemption of $20.14 billion and an end-of-period circulation of $24.41 billion;

In 2023, following the collapse of Silicon Valley Bank, Circle's $3.3 billion deposit at the bank was temporarily frozen. On March 11, USDC's one-day drop exceeded 12%, hitting a low of $0.878; although USDC quickly regained its peg, user confidence was significantly impacted, and USDC's year-end circulation nearly halved;

In Q1 2024, confidence had still not recovered, with issuance and redemption at $32.15 billion and $24.14 billion, respectively, resulting in a net increase of $8 billion in circulation;

In the last three quarters of 2024, USDC truly recovered, with total issuance of $141.34 billion and a net increase in circulation of $19.44 billion, reaching $43.86 billion.

In Q1 2025, issuance and redemption were $53.22 billion and $37.1 billion, respectively, resulting in a net increase of $16.12 billion, reaching $60 billion;

From January 1, 2021, to March 31, 2025, USDC's total issuance and redemption volumes were $558 billion and $502 billion, respectively, totaling over $1 trillion.

By June 2025, USDC's circulation was approximately $61 billion, with a market share of about 25%, ranking second. Tether's USDT circulation was approximately $150 billion, with a market share of about 62%.

Outside the view of most Chinese citizens, the trading scale of stablecoins has been "growing wildly" at a rapid pace:

In 2024, the trading volume of stablecoins reached $15.6 trillion (approximately 110 trillion RMB), surpassing VISA and Mastercard!

Circle's prospectus disclosed that total trading volume in Q1 2025 reached $6 trillion; since its issuance, USDC's total trading volume has reached $25 trillion (approximately 180 trillion RMB).

In July 2025, the average daily trading volume of USDC and USDT was $60 billion and $120 billion, respectively. The trading volume of just the top two players reached an annualized trading volume of $70 trillion (approximately 500 trillion RMB)!

In 2024, the total transaction amount of Chinese bank cards was 99.25 trillion, including 79.17 trillion for transfers, 13.37 trillion for consumption, and 6.71 trillion for cash deposits/withdrawals.

The trading volume of stablecoins has only recently exploded in the past two years, now equating to half of all bank card transactions in China.

The Obedient "Good Student"

Circle's scale is only half that of Tether, yet it was the first to enter the mainstream capital market and received enthusiastic support, primarily due to its emphasis on compliance and regulatory friendliness, colloquially known as being the "obedient good student."

Circle's "obedience" is mainly reflected in two aspects:

First, actively obtaining licenses. It has secured payment and digital asset licenses in multiple regions, including the U.S., U.K., EU (MiCA certification), and Singapore;

Second, ensuring transparency measures. Reserve assets are 100% cash and short-term U.S. Treasury bonds, audited monthly by firms like Deloitte (following AICPA standards); users can check in real-time online.

Tether operates offshore, relocating its headquarters to El Salvador. Even more unreliable, its reserve assets include a large amount of commercial paper, accounting for over 60%! This alone makes Tether's reserve asset security incomparable to Circle's.

The USDC issued by Circle is a compliant stablecoin, while Tether's USDT is a non-compliant stablecoin, with non-compliance currently prevailing.

The recently passed Genius Act in the U.S. requires stablecoins to maintain 100% reserves in U.S. dollar cash and U.S. Treasuries, directly benefiting USDC, while USDT may face delisting from U.S. exchanges. However, in many "Asia, Africa, and Latin America" regions, USDT's non-compliance is ironically its biggest "selling point."

Circle's "Incompleteness"

Coinbase was founded in May 2012 and has gradually evolved from a trading platform into an ecosystem, with revenue reaching $3.99 billion in 2024.

Coinbase is also a good student, with core qualifications including: U.S. MSB (Money Services Business), U.S. FinCEN (Financial Crimes Enforcement Network), U.S. CFTC (Commodity Futures Trading Commission), U.S. SEC investment advisory (crypto asset advisory), and EU MiCA (highest level of crypto asset qualification in the EU).

Coinbase also employs predictive models to forecast regulatory changes and participates in policy formulation (such as the GENIUS stablecoin bill).

Coinbase prioritizes compliance, but its drawbacks include high fees and a limited number of cryptocurrencies.

Circle and Coinbase are a "natural pair." In 2018, they jointly established the Centre Consortium, each holding 50% equity. Circle is responsible for technology development and reserve management, while Coinbase handles distribution.

In August 2023, Circle acquired 100% of Centre Consortium for $210 million (paid with 4% equity in Circle).

However, the two have not parted ways; their interests are deeply intertwined, though the cooperation agreement appears to have an "unequal treaty" flavor:

First, reserve asset income. Coinbase receives a fixed 50% of total reserve income as a distribution fee; if users deposit USDC into Coinbase, this portion of reserve income entirely belongs to Coinbase. In other words: "Everything that is mine is mine, and half of what is yours is also mine."

Second, issuance rights and trademarks. If Circle defaults (e.g., fails to make timely payments), Coinbase has the right to issue USDC!

Third, user rewards. Coinbase offers "floating yields" as rewards to users who deposit USDC (4.1% in 2025).

Fourth, priority compensation. When Circle faces a de-pegging crisis (like in 2023), users storing USDC in Coinbase are prioritized for protection.

With high yields and strong guarantees, Coinbase's holdings increased from 5% to 20% in 2024, and further to 23% in Q1 2025.

Circle, lacking distribution/trading functions and relying solely on partners (like Coinbase), is incomplete.

Bad News—Interest Rate Cuts

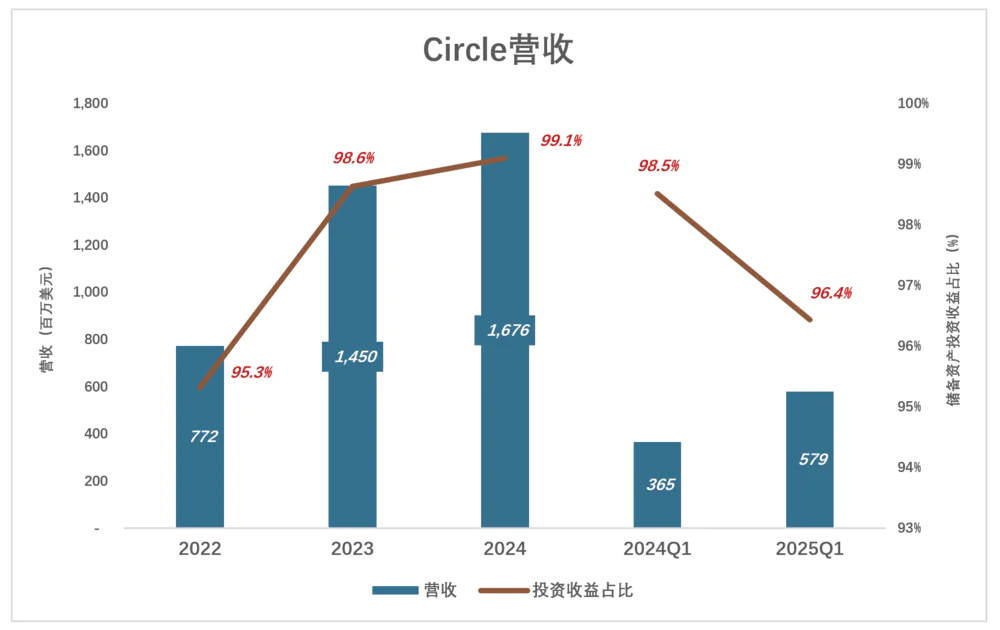

Over 90% of Circle's income comes from the investment income of reserve assets, primarily from U.S. short-term Treasury interest.

In 2023, reserve asset income was $1.43 billion, accounting for 98.6% of revenue;

In 2024, reserve asset income was $1.66 billion, accounting for 99.1% of revenue;

In Q1 2025, reserve asset income was $560 million, accounting for 96.4% of revenue;

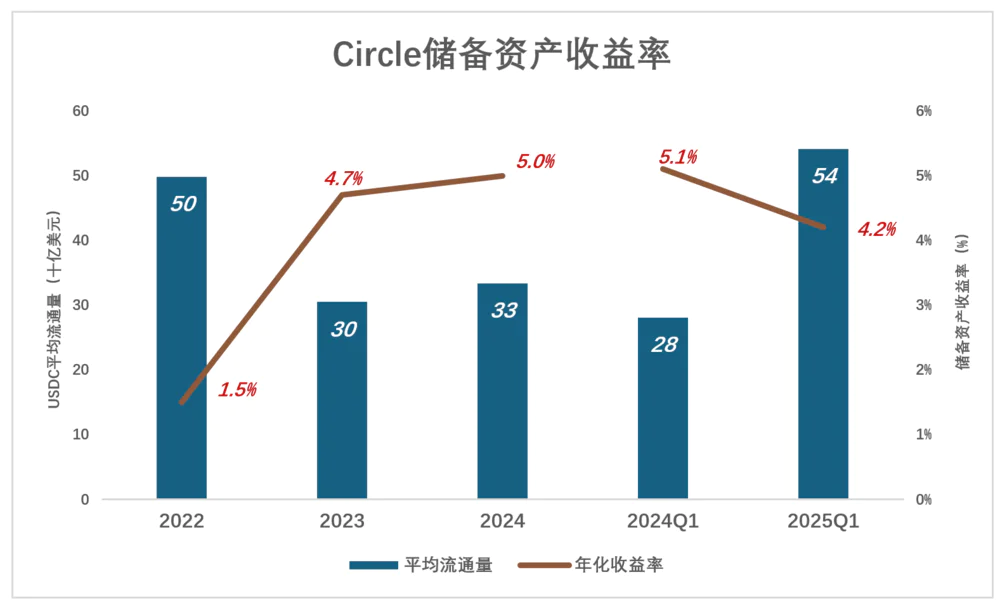

The circulation of USDC is approximately equal to the assets Circle can use for interest generation, thus it can be used as the denominator to calculate the yield on reserve assets.

In 2022, the average circulation of USDC reached $49.86 billion, with earnings of $740 million, yielding 1.5%;

In 2023, the average circulation of USDC dropped to $30.47 billion, but earnings increased to $1.43 billion, yielding 4.7%;

In 2024, the average circulation of USDC slightly rebounded to $33.34 billion, with earnings of $1.66 billion, yielding 5%;

In Q1 2025, the average circulation of USDC was $54.14 billion, with earnings of $560 million, annualized yield of 4.2%;

In 2022, the yield on U.S. short-term bonds reached 4.7%, while Circle's reserve asset yield was only 1.5%, indicating that nearly two-thirds of the reserve assets were non-earning cash;

In 2023 and 2024, the yield on reserve assets closely followed U.S. Treasury yields, indicating that the vast majority of reserve assets were bonds, leaving only a small amount of non-earning cash.

As of the end of March 2025, the circulation of USDC was $60 billion, and for every 1% drop in U.S. Treasury yields, annual earnings would decrease by $600 million.

Bad News—Coinbase's Threat

The Federal Reserve's interest rate cuts have become a foregone conclusion, and to make matters worse, Coinbase is set to take away a large portion of the earnings:

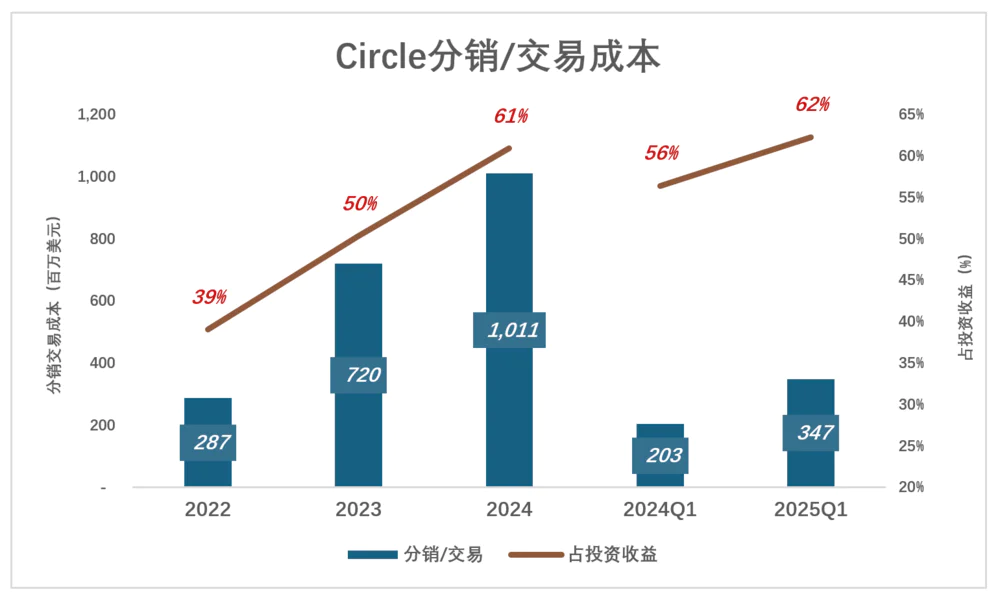

In 2022, Circle's distribution/trading costs were $290 million, accounting for 39% of investment income;

By August 2023, Coinbase began to "share the pie," and that year's distribution/trading costs skyrocketed to $720 million, accounting for 50.3% of investment income; during the same period, Circle's net profit was only $272 million;

In 2024, distribution/trading costs exceeded $1 billion (with Coinbase taking $908 million), accounting for 60.9% of investment income; during this time, Circle's net profit surprisingly dropped to $157 million, making the compensation for working for Coinbase increasingly lower!

In Q1 2025, distribution/trading costs were $350 million, accounting for 62.3% of investment income; during the same period, net profit was $64.79 million.

There are rumors that Coinbase plans to increase its share of the distribution of all reserve asset earnings from Circle from 50% to 70%.

Coinbase has become a noose around Circle's neck, tightening with each passing day. It used to be about money, now it's about survival.

Bad News—Big Tech's Entry

1) The U.S. Dislikes Stablecoins

The number one enemy of internet financial innovation is the vested interest groups within the traditional financial system, a phenomenon seen throughout history and across the globe!

Circle's vision is "Frictionless exchange of value," directly targeting SWIFT's "high fees."

SWIFT (Society for Worldwide Interbank Financial Telecommunication) provides telecommunication services for cross-border payments, connecting over 11,000 financial institutions in more than 200 countries. According to World Bank statistics, SWIFT fees account for 6.01% of remittance amounts, known in the industry as "friction costs."

In addition to the exorbitant fees, the SWIFT technology, which originated in the 1970s, is severely outdated, still relying on paper documents and obsolete processes, resulting in cross-border settlements taking 2-5 days.

Stablecoin payments directly cut into SWIFT's market share; how can it not be "hated"?

Moreover, SWIFT, completely dominated by the U.S. and the West, has become an important tool for exercising hegemony. After the outbreak of the Russia-Ukraine conflict, the U.S. imposed thousands of sanctions on Russia, with the most effective being the expulsion of Russia from the SWIFT system, a move referred to as a "financial nuclear bomb." The U.S. and the West used SWIFT to sanction Russia, also sending an "unspoken" threat to China.

Given that stablecoin payments can circumvent the SWIFT system, the U.S. inherently dislikes them.

2) The U.S. Government's 180-Degree Turn

The U.S. has made a 180-degree turn in its attitude towards stablecoins, with the core demand being to expand the demand for U.S. Treasuries. This is a grand scheme that cannot be unraveled!

The grand scheme has two layers:

The first layer is that global dollar holders have the motivation to exchange for stablecoins. Safe, convenient, fast, and low-cost, it is as easy as using mobile payments in China. Not only for Americans, but for those in countries and regions with unstable financial systems, unpredictable currency exchange rates, and inflation rates soaring into the double digits, the advantages of stablecoins are even more pronounced.

The second layer is that stablecoin issuers already have the motivation to purchase U.S. Treasuries. The "Genius Act" requires reserves to be held in U.S. dollar cash and U.S. Treasuries, creating a mutually beneficial situation.

With these two layers of the grand scheme combined, dollar holders unknowingly become holders of U.S. Treasuries. Bessent predicts that by 2030, the issuance scale of stablecoins will reach $3.7 trillion. According to the "Genius Act," issuers will hold an equivalent amount in U.S. dollar cash or U.S. Treasuries.

A certain financial influencer believes that stablecoins will only increase the demand for U.S. short-term bonds, while there is no worry about selling short-term bonds; the concern lies with long-term bonds of ten years or more.

In reality, whether U.S. short-term bonds sell well depends on the yield:

In 2021, the yield on three-month bonds fluctuated between 0.02% and 0.06%;

In 2022, it surged to 4.7%;

In 2023, it peaked at 5.4%;

In 2024, it fell back to 3.36% (with the rate cut cycle starting in September);

On July 11, 2025, it reported 3.79%, which is 95 times the average of 2021!

Evergrande certainly wants to sell ten-year dollar bonds, but it won't refuse three-month short-term bonds. When in dire straits, it doesn't matter whether it's three months or thirty years; getting money to survive is the priority.

For Trump, as long as he can sell a large amount of Treasuries continuously, the term is not an issue. Besides, no one knows who will be president ten years from now; issuing long-term bonds for someone else to benefit is not his style.

Trump has been pressuring the Federal Reserve to cut rates, but interest rates are not set arbitrarily; the Fed is concerned that if rates are cut, Treasuries won't sell, forcing them to expand their balance sheet (essentially buying them themselves).

There is also a theory that Treasury holders will sell their Treasuries for stablecoins, which will not create new demand for Treasuries. The problem is that Treasury holders give up liquidity for interest; exchanging for stablecoins means giving up interest (the interest income from stablecoin reserve assets becomes the issuer's revenue). What’s the point?

The previously widely circulated "Mar-a-Lago Plan" aimed to coerce countries holding U.S. Treasuries to purchase 100-year bonds with zero interest through tariffs and other means.

As a result, even Japan, which was most likely to become the "victim," did not comply, leading to the failure of the "Mar-a-Lago Plan."

Now, this grand scheme orchestrated by Bessent is being referred to as the "Pennsylvania Plan," because the U.S. Treasury is located on Pennsylvania Avenue.

The core of the "Pennsylvania Plan" is to solve the U.S. debt problem through stablecoins, but the main players may not be Circle (and certainly not Tether) but rather tech giants like Apple and Amazon (e.g., AppleUSD, AmazonCoin).

The credibility of U.S. tech giants globally, combined with reliable underlying assets (short-term U.S. Treasuries), could allow them to capture a significant portion of the stablecoin market, which is certainly bad news for Circle. Conversely, Tether, which operates in a more unconventional manner, may face less impact.

Another possibility is that under Trump's threats and inducements, giants like Apple may use a portion of their massive cash reserves to purchase their own issued stablecoins.

In summary, there are three pieces of bad news for Circle: interest rate cuts, the entry of big tech, and the threat from Coinbase.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。