通货膨胀快速下降——高盛的美联储降息预测暗示九月

美联储终于准备放松政策了吗?根据高盛的说法,答案可能是肯定的——而且很快。作为一名密切关注宏观经济形势的加密分析师,我可以告诉你——事情正在迅速变化。

这家投资银行刚刚发布了一个大胆的预测:预计在2025年美联储将总共降息50个基点,首次行动可能在九月。这不仅仅是猜测。像Kobeissi Letter和Kalshi这样的主要预测市场显示出对这一结果的信心上升。

目前,最可能的情景包括两次利率下降,得益于通货膨胀数据的改善。高盛的美联储降息预测现在被视为交易台的基准。

美联储降息九月2025预测:赔率揭示了什么?

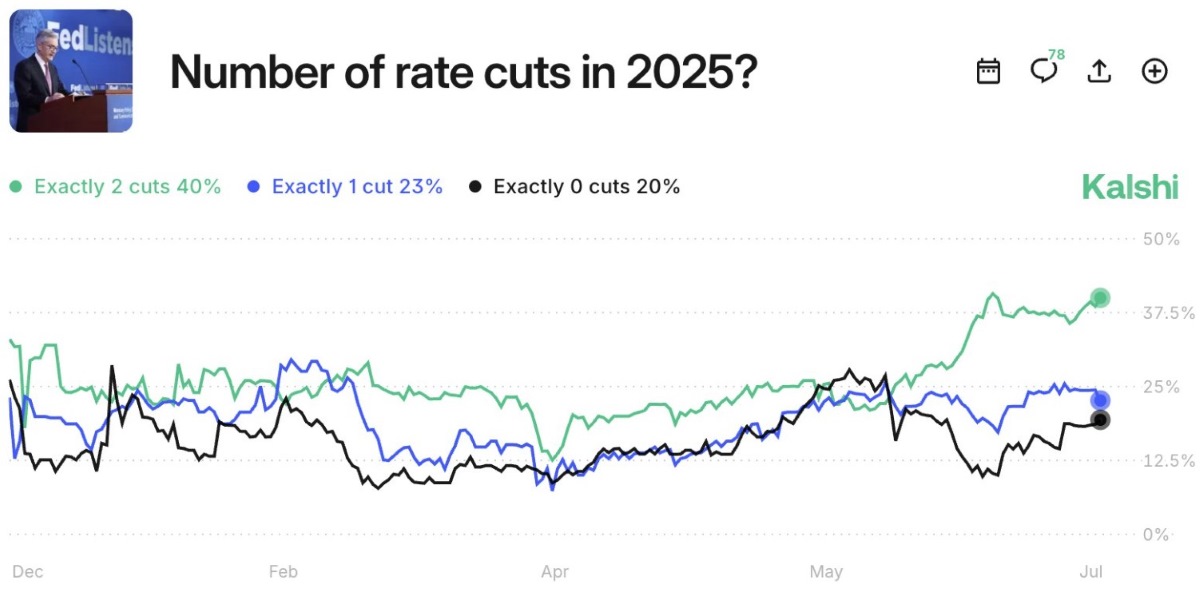

Kalshi赔率模型,通常被机构投资者和散户投资者使用,正在描绘出未来的更清晰图景。

以下是交易者对这一年的看法:

无降息的概率为20%

单次降息的概率为23%

两次降息的概率为40%

三次调整的概率为13%

超过三次的概率仅为8%

这些数字表明,美联储在2025年九月降息的预测已牢牢在雷达上——这是一个经过仔细计算的市场定位。

美国通货膨胀率预期下降:美联储有喘息的空间

支持这些预测的一个重要因素是——通货膨胀正在降温。根据最新的消费者调查,美国1年期通货膨胀预期在七月降至4.4%,为今年二月以来的最低水平。这在短短两个月内下降了2.2%。

与此同时,5年期通货膨胀预期也有所缓和,在过去三个月中下降了0.8%,降至3.6%。尽管这仍高于30年的平均水平,但趋势朝着正确的方向发展。

随着美国通货膨胀率的缓解,中央银行家有了更多的灵活性。美联储现在可以在不担心消费者成本突然上升的情况下探索政策放松。

为什么这一转变对加密牛市至关重要

从数字资产的角度来看,这非常重要。较低的借贷成本通常意味着更大的风险,尤其是对于投机市场。过去的周期表明,加密货币往往在货币宽松期间激增。

如果高盛的美联储降息预期在2025年实现50个基点的降息,这可能会推动新的资金流入比特币、以太坊和新兴的山寨币。我们甚至可能会比预期更早看到2025年的山寨币季。

这不仅仅是理论——这是我们在过去周期中看到的。而这一次,加密新闻界比以往任何时候都更加密切关注。

下周的美联储会议:市场的生死时刻

即将召开的会议可能会影响一切。投资者希望获得明确的信号。即使是语气的微妙变化也可能增强对高盛九月美联储降息预测的押注。

对于传统和去中心化金融的交易者来说,这是一个值得关注的时刻。随着今天的美联储降息新闻和美国通货膨胀预期的下降,接下来的一个月正在成为整个加密经济的转折点。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。