With the support of Microsoft, NVIDIA, and Chainlink, SXT has built a complete commercial ecosystem.

Written by: Oliver, Mars Finance

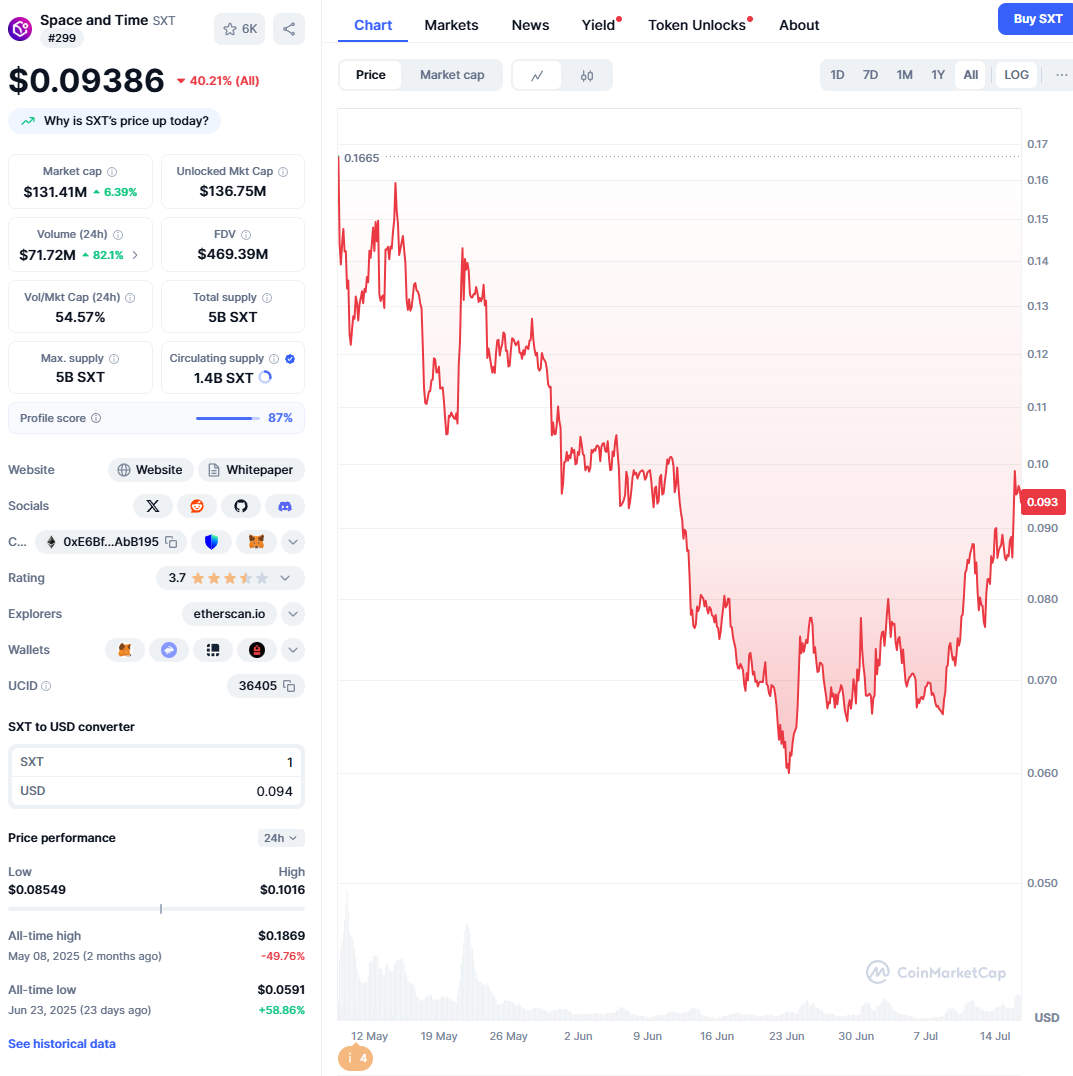

In the world of cryptocurrency, price surges are not uncommon, but certain reversal patterns resemble deep-sea currents, signaling structural shifts in the market. Recently, while many mainstream assets were still consolidating, a token that is somewhat unfamiliar to the public—Space and Time (SXT)—quietly traced a sharp "V-shaped reversal" curve in its price chart. This was not driven by community hype or the viral spread of a popular meme; the true driving forces behind it are Grayscale and Microsoft, two giants representing traditional finance and the tech world.

This reversal is less about price correction and more about value reassessment. It marks a shift in focus for the most astute capital in the market, moving from the frenzy of chasing the "next hundredfold coin" in the application layer to a deeper and more solid foundation. Grayscale's establishment of a single-asset trust for SXT acts like a starting gun, officially launching a grand experiment to forge "verifiable trust" into a core asset for institutional allocation. The price chart of SXT is merely the first heartbeat of this experiment in the public market.

From "Data Warehouse" to "Trust Engine": A Silent Infrastructure Revolution

How do smart contracts trust the world? We know that blockchain itself is a closed and deterministic system, like a sterile laboratory, unable to directly and safely access and process vast amounts of data from outside the lab (off-chain). This inherent "data blindness" greatly limits the imagination of decentralized applications (dApps), making it difficult for them to thrive in fields like finance, gaming, and AI, which require complex data interactions.

For years, oracles have partially solved the data feeding problem as "messengers," but they primarily transmit information rather than guarantee the absolute trustworthiness of the computation behind that information. It's like a messenger telling you, "Today's temperature is 30 degrees," but you cannot be 100% sure whether this data comes from an accurate sensor or is just made up by the messenger.

Space and Time (SXT) aims to tackle this "last mile" of trust. It is not merely building a "decentralized data warehouse," but rather a "verifiable trust engine." Its core weapon is a patented technology called "Proof of SQL." The brilliance of this technology lies in its perfect combination of cutting-edge zero-knowledge proof (ZK-SNARKs) cryptography with SQL, the database language most familiar to millions of developers worldwide.

As SXT's co-founder and CEO Nate Holiday stated, "Enterprises want to migrate their business logic and data onto the chain, but are constrained by costs, storage, and computation limits. What we do is connect off-chain large-scale data computation capabilities with on-chain smart contracts in a trustless manner." In other words, SXT allows anyone to perform complex SQL query analysis on vast amounts of data off-chain and then generate a small but unforgeable cryptographic "receipt." On-chain smart contracts can verify this "receipt" at minimal cost, trusting the absolute correctness of the query results like a mathematical axiom, without needing to worry about the complexity of the computation process or trusting the server executing the computation.

This represents a paradigm shift, moving the foundation of trust from a "probabilistic" reliance on economic incentives to a "deterministic" basis rooted in cryptography. This aligns perfectly with the vision of Ethereum founder Vitalik Buterin, who has repeatedly emphasized that ZK technology is the ultimate path to blockchain scalability and functionality expansion, as it allows networks to verify complex computations far beyond their own processing capabilities without sacrificing security.

The Alliance of Giants

If exceptional technology is the core of SXT, then the "Alliance of Giants" composed of Microsoft, NVIDIA, and Chainlink is the invincible fleet propelling it to market. The existence of this alliance also explains why Grayscale dares to establish a single-asset trust for it—this is not a bet on an isolated technology, but an investment in a complete, vertically integrated commercial ecosystem.

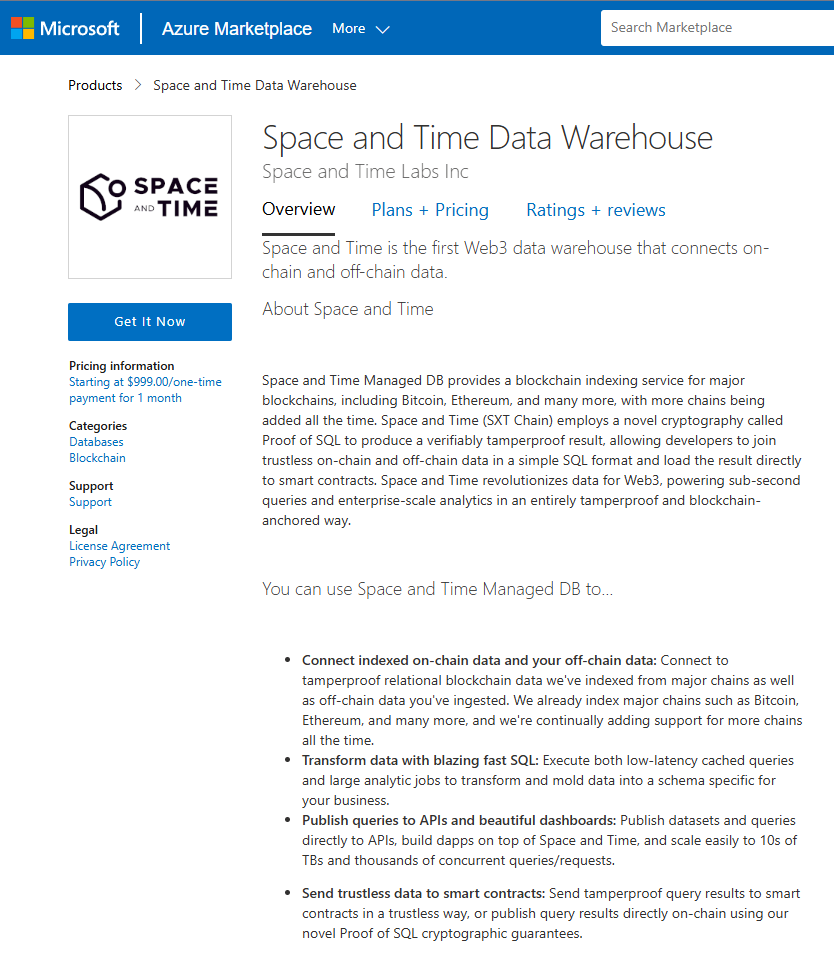

Microsoft's role is as a "superhighway" to the vast enterprise market. Microsoft's venture capital arm, M12, not only led SXT's strategic financing but also integrated deeply into Microsoft's strategic core. SXT's services are not only already listed on the Azure cloud marketplace but have also been natively integrated into Microsoft's flagship enterprise analytics platform, Microsoft Fabric, becoming its first and only Web3 native data provider. Reports indicate that this integration is purely a strategic collaboration, with neither party paying fees to the other. This clearly indicates that Microsoft views SXT as a strategic extension of its enterprise data landscape, a "Trojan horse" that seamlessly injects trustworthy Web3 data into its vast ecosystem.

If Microsoft provides the market, then AI hardware giant NVIDIA provides the powerful "computing engine." The generation of zero-knowledge proofs is a computation-intensive task, and SXT has gained top-tier support in hardware optimization and AI ecology from NVIDIA, which dominates the global GPU market, by joining the NVIDIA Inception program. This relationship also hints at SXT's ultimate ambition: to occupy the core hub of "trusted data sources" in the grand narrative of the fusion of AI and Crypto.

Finally, oracle leader Chainlink plays the role of the "last mile" deliverer. Through deep integration with Chainlink, the verifiable results generated by SXT can be securely and reliably delivered to any smart contract on a public chain. Thus, a commercial closed loop has formed, connecting underlying computing (NVIDIA), core logic (SXT), enterprise distribution (Microsoft), and ultimately reaching on-chain applications (Chainlink).

When Infrastructure is "Assetized"

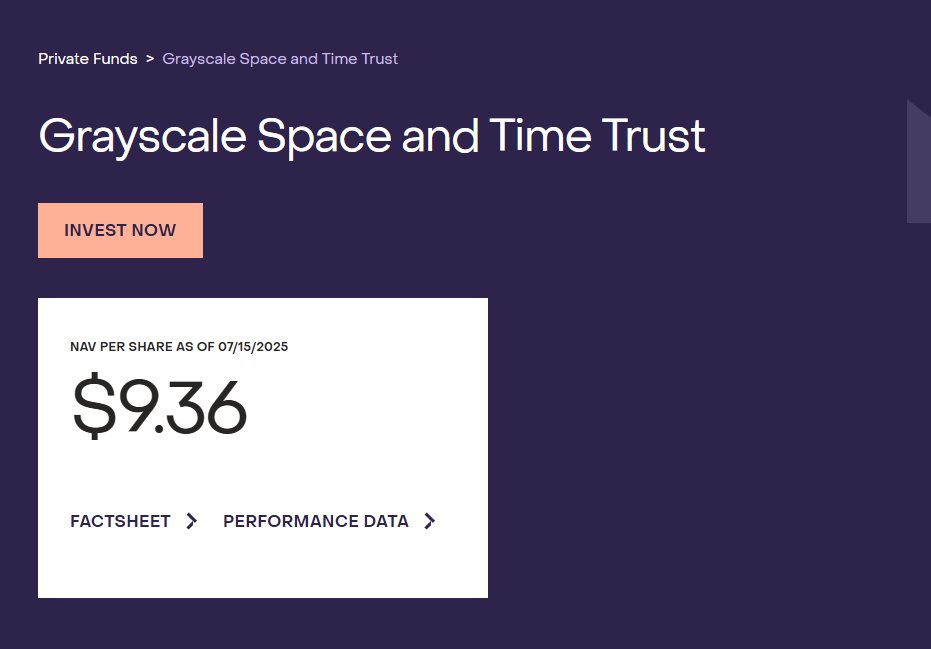

Now, let's return to the initial question: what does SXT's "V-shaped reversal" truly signify? When Grayscale announced the establishment of a single-asset trust for it, and this trust quickly attracted asset management on the scale of tens of millions of dollars, second only to established mainstream coins like XRP, the market finally understood this signal.

This reversal represents a "Davis Double Play" style of value discovery for SXT in the capital market. First, it is an acknowledgment of its technical value, namely that "Proof of SQL" is a key solution to the core contradictions of Web3. Secondly, and perhaps more importantly, it is an acknowledgment of its business model and strategic position. The market no longer views SXT merely as a "data project," but as a quasi-enterprise-level solution backed by technology and financial giants.

Grayscale's actions essentially represent a "capitalization of infrastructure" operation. It leverages its strong brand reputation and compliance channels to package the somewhat abstract technical concept of "verifiable computation" into a standard financial product (trust) that qualified investors can purchase. This sends a clear signal to Wall Street: investing in SXT is no longer about buying a high-risk startup token, but about allocating a "digital commodity"—verifiable trust—that will be indispensable in the future digital economy.

As a result, SXT's price fluctuations began to detach from the logic purely driven by retail sentiment and short-term narratives, instead anchoring to a grander valuation model: how large a slice of the future massive enterprise data service market and AI computing market can it capture? When a project's valuation logic shifts from "To C" to "To B," from "application layer" to "infrastructure layer," its price stability and imaginative potential undergo a qualitative change. This is the true language behind that "V-shaped reversal" curve.

When the noise settles, we will ultimately realize that the foundation for the next wave of monumental growth may no longer be faster chains or flashier applications, but those underlying infrastructures that we cannot see or touch, yet can provide the bedrock of trust for the entire digital world. Through the SXT trust, Grayscale not only opens a door to future investments for its clients but also points the entire market in a clear direction: value will ultimately return to those that can create trust, empower applications, and connect reality with the digital world. And this wave of capitalization centered around "trust" has only just begun.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。