Written by: Lucas Gui

Last Friday evening, eight national departments jointly published the “Notice on Further Preventing and Addressing Risks Related to Virtual Currencies” (hereinafter referred to as “the ‘Notice’”).

On the same day, the Securities Regulatory Commission released the “Regulatory Guidelines on the Issuance of Asset-Backed Security Tokens Overseas for Domestic Assets” (hereinafter referred to as “the ‘Guidelines’”).

Some say this marks the dawn of RWA in China, as the country has officially opened the channel for compliant RWA. But is this really the case?

In this article, we will thoroughly dissect the ‘Notice’ and ‘Guidelines’, analyzing the core context and regulatory framework to help you clarify the following questions from a more rational and objective perspective:

1. What is China's regulatory attitude towards virtual currencies and RWA? How has it changed compared to before?

2. How does the new policy construct a regulatory framework for compliant RWA? What details are worth noting?

3. How challenging is the compliant issuance of RWA based on domestic assets? What bottlenecks might be encountered in implementation?

1 Overall Conclusion and Judgment

First, let us give an overall judgment on this policy.

The Chinese government continues to maintain a strict crackdown on virtual currencies.

In contrast, this new policy opens up a clear compliant channel and regulatory guidelines for securities RWA issued overseas. However, from the perspectives of underlying assets, issuing entities, and issuance activities, the compliance threshold for RWA remains very high.

Whether compliant RWA can truly explode in China awaits further improvement of the rule details and the implementation of actual cases.

2 Bifurcation of Virtual Currencies and RWA

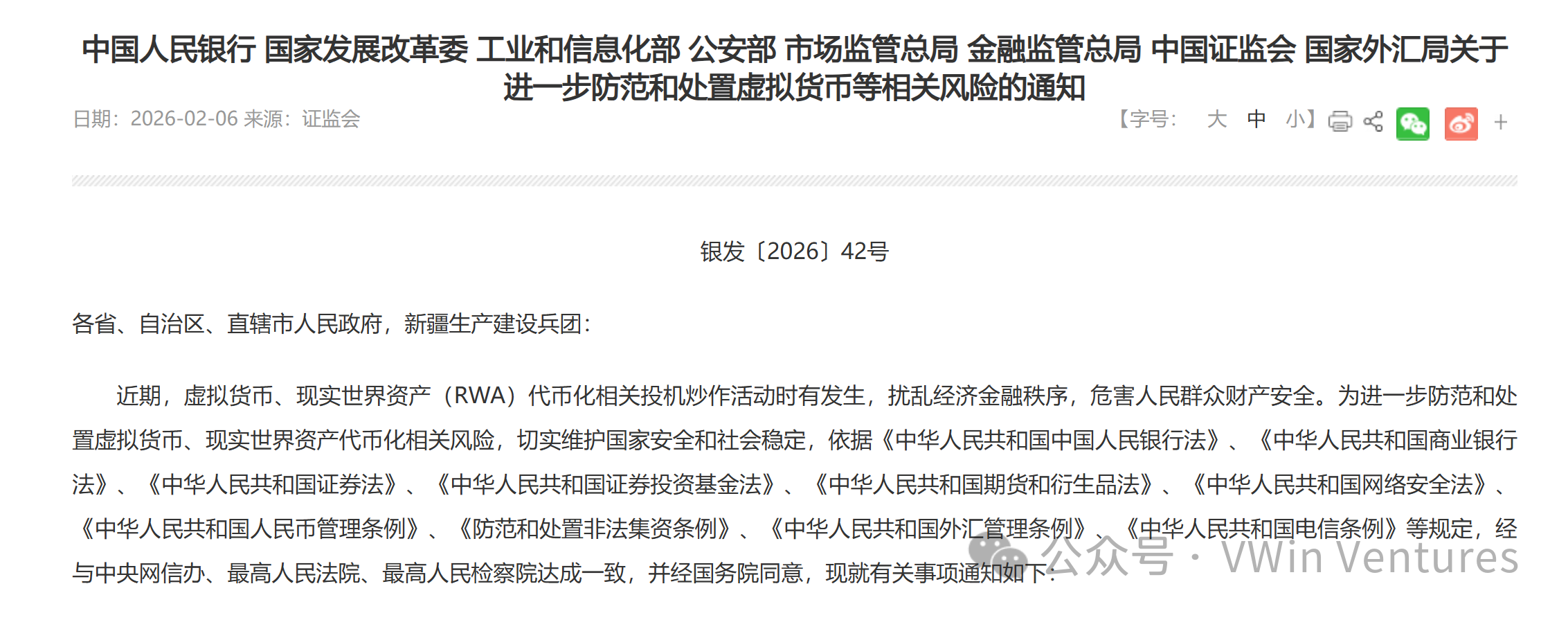

Based on the ‘Notice’ and ‘Guidelines’, the Chinese government has adopted a clear bifurcation in its regulation of virtual currencies—

that is, dividing them into general virtual currencies and asset-backed tokens based on real-world assets (hereinafter referred to as “RWA tokens”), and taking entirely different regulatory attitudes towards each.

(The above image illustrates the bifurcation of China's virtual currency regulation)

For general virtual currencies, the Chinese government still insists on a strict crackdown with no concessions.

Based on the core positioning of “illegal financial activities,” it further refines regulatory rules and methods of enforcement from the following dimensions: financial and intermediary services, technology service institutions; internet information content and access management; mining activities, etc.

As for RWA, the new regulatory policy provides a clear definition and regulatory path. This marks the first time RWA has a formal "status" within the regulatory context of China, which is indeed significant.

“Tokenization of real-world assets refers to the use of cryptographic technology and distributed ledgers or similar technologies to convert ownership rights, income rights, and other rights related to assets into tokens (certificates), or other rights with token (certificate) characteristics, and to engage in the issuance and trading of such activities.”

——‘Notice’

So what does the new regulation suggest regarding the compliant path for RWA? Then we must delve into the specific details of the documents to analyze the regulatory framework itself.

3 Compliance Path and Regulatory Framework for RWA

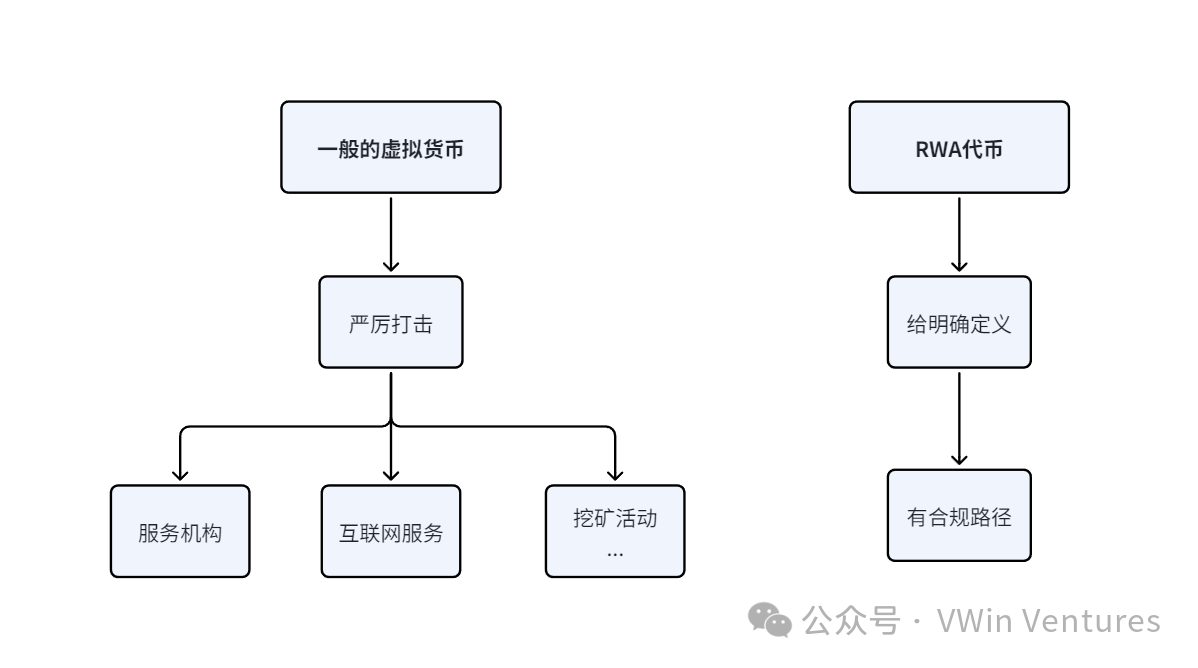

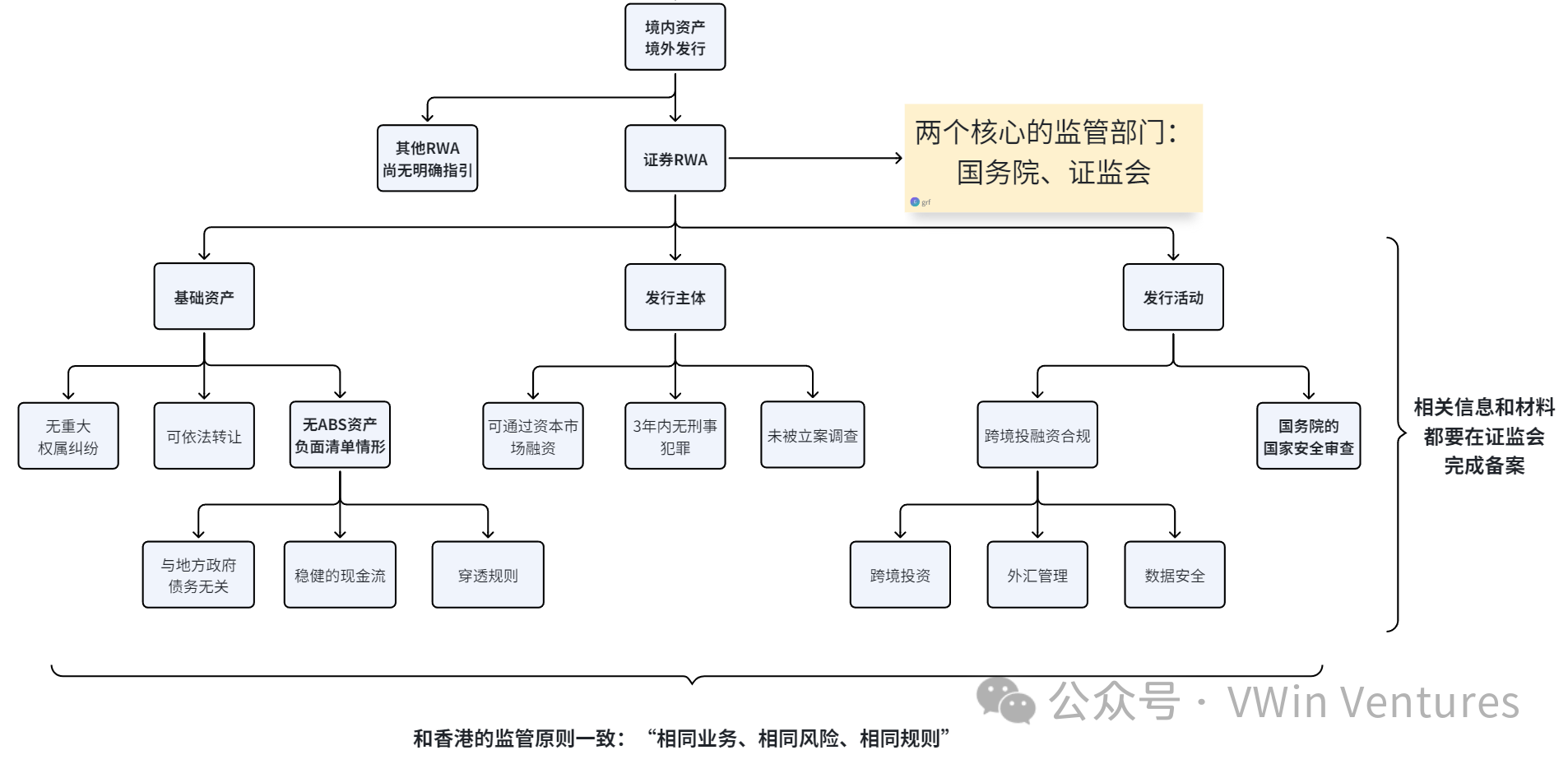

We can systematically gain insights into the RWA regulatory framework conveyed by the two documents through the following image:

From the image, we can see that the core distinction of the RWA regulatory framework lies in whether the domestic assets are issued within the country or overseas. The two correspond to entirely different regulatory paths.

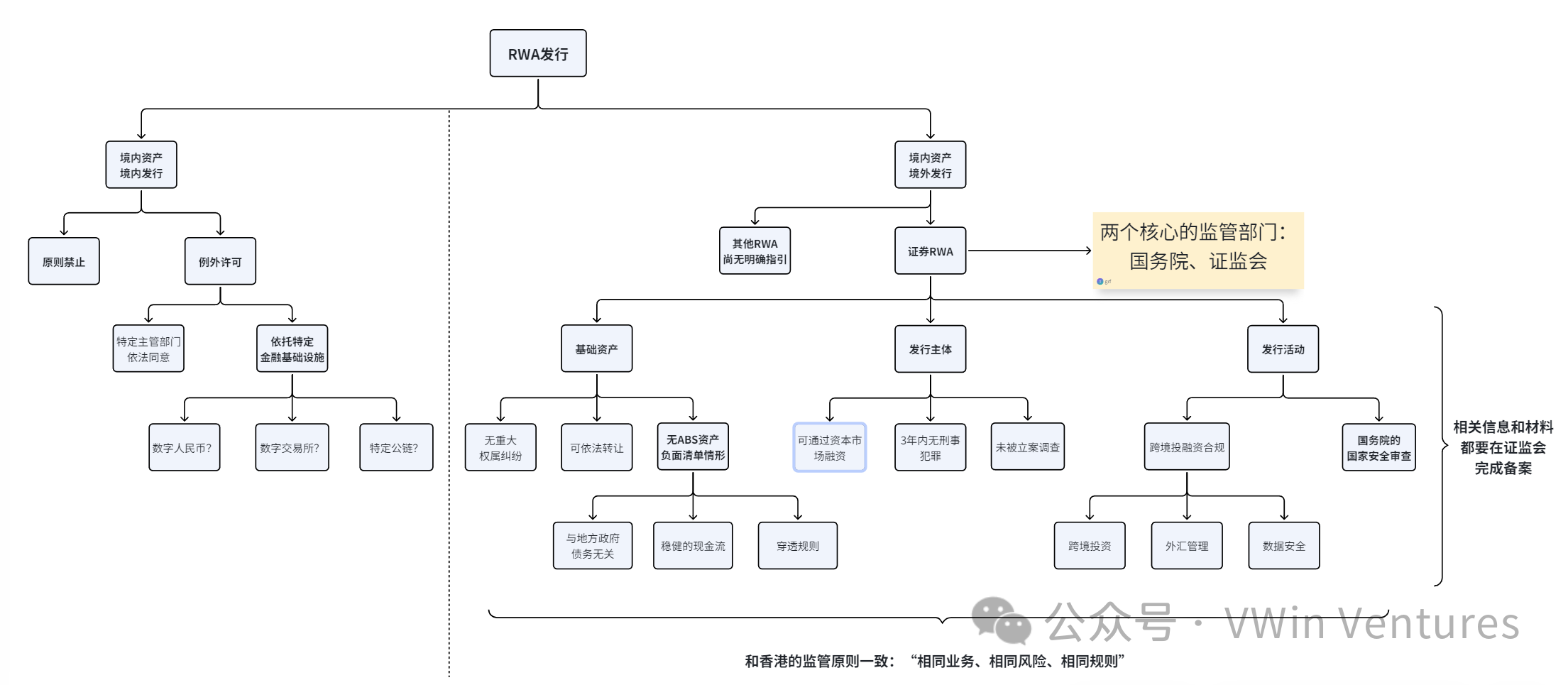

If RWA tokens based on domestic assets are issued domestically, then the overall regulatory attitude can be summarized as a “principle of prohibition + exceptional permission” model.

The principle of prohibition is not surprising, as domestic token issuance is currently not allowed. Therefore, what is more noteworthy is the defined exceptional circumstances mentioned in the notice, namely “with the consent of the competent business department in accordance with the law and regulations, relying on specific financial infrastructure.” However, currently, the stipulations are relatively vague and lack sufficient effective information.

As for the other regulatory path, it is to issue RWA tokens overseas based on domestic assets. The ‘Notice’ explicitly acknowledges the existence of a corresponding compliant path for this model, but specific details have not been elaborated.

The Securities Regulatory Commission simultaneously released the ‘Guidelines,’ providing more details on the compliant issuance of securities RWA tokens. By combining the two, we can see a more three-dimensional and comprehensive perspective.

In summary, the compliance standards for securities RWA can be analyzed according to “three perspectives, two departments, one principle.”

“Three perspectives” refer to the underlying assets, issuing entities, and issuance activities.

1. Underlying assets:

No significant ownership disputes and legally transferable.

Must not be prohibited by the negative list of underlying assets for domestic asset securitization.

2. Issuing entities:

Must be able to legally finance through capital markets.

The domestic entity or its controlling shareholders or actual controllers must not have any specific criminal offenses in the past three years.

Must not be under legal investigation.

3. Issuance activities:

Must strictly comply with laws and regulations regarding cross-border investment, foreign exchange management, and data security.

Must undergo national security reviews by relevant departments of the State Council.

Must complete filing with the China Securities Regulatory Commission.

“Two departments” refers to two core departments in the compliance framework —— the State Council and the Securities Regulatory Commission, which are separately responsible for national security review and filing registration.

And “one principle” is very clear: to adhere to the principle of “the same business, the same risks, the same rules” for penetrating regulation.

Having reached this point, I believe you have a relatively systematic theoretical understanding of the RWA regulatory framework of this new policy. Now, based on practical experience, what realistic bottlenecks might arise when trying to implement RWA under this regulatory framework?

4 Realistic Bottlenecks and Key Details

First, regarding the compliant path for issuing RWA domestically, we need to clarify the special permission conditions mentioned above.

“To engage in real-world asset tokenization activities in the country should be prohibited, except for relevant business activities conducted with the consent of the competent business department in accordance with laws and regulations, relying on specific financial infrastructure.”

——‘Notice’

Which specific agency and department does “competent department” refer to? What exactly does “specific financial infrastructure” refer to? Currently, this remains unclear.

Second, for the issuance of securities RWA tokens overseas, there are also several details that need to be particularly noted:

1. The underlying assets need to avoid the prohibited conditions outlined in the “Negative List of Underlying Assets for Domestic Asset Securitization,” which restricts the types of underlying assets that can be used for RWA issuance.

(The above image is a screenshot of the first item from the “Negative List of Underlying Assets for Domestic Asset Securitization.”)

2. There must be simultaneous compliance with the two major thresholds of national security review by the State Council + material filing with the Securities Regulatory Commission, the actual implementation depends on more specific regulatory window opinions, which while having high compliance requirements also carries significant uncertainty.

3. Besides special compliance standards, the basic compliance thresholds for cross-border investment and financing are also not low, such as those mentioned above regarding cross-border investment, data and network security, and foreign exchange management. RWA issuers' responsibilities in these areas for compliance should not be overlooked.

4. If issuing RWA overseas, then issues related to the joint regulation by the China Securities Regulatory Commission and overseas securities regulatory authorities will definitely come into play.

These issues still await further supplements and improvements in the regulatory guidelines. We will continue to follow related policies and actual cases to provide readers with systematic deep insights.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。