As Bitcoin reaches a historic high, attracting capital into the crypto space, the actual performance metrics of technical infrastructure become key screening benchmarks.

Bitcoin has just set a new all-time high, reaching $123,000. With cryptocurrency venture capital exceeding $10 billion in the second quarter, marking the strongest quarterly performance since early 2022, new funds are flowing back into the sector. However, with a dozen major blockchains vying for market attention, builders and investors must conduct due diligence. The blockchain rating project led by the Wyoming government provides data-driven assessment dimensions, which comprehensively evaluate various blockchain networks based on core metrics such as transaction speed, system security, and adoption rate.

We employ a modified optimization model to analyze various blockchain projects under equal benchmarking conditions, aiming to conduct a comprehensive assessment of their core metrics; at the same time, we explain the reasons why well-known blockchains like XRP and Tron are not included in the review.

Analyzing Core Assessment Metrics

To clarify the scoring basis, the following succinctly defines the indicators of the blockchain rating system:

● Network Stability Duration: Measures the continuous operational duration of a public chain without major reorganizations or technical failures. The operational duration reflects reliability and is the foundation for institutional users to establish trust.

● Daily Active Users: Based on the dynamic monitoring of the average daily active wallet addresses over a quarter, reflecting the actual user scale and ecosystem participation.

● Total Value Locked (TVL): The total dollar value of assets locked in on-chain DeFi applications. A high TVL reflects capital confidence and the depth of the ecosystem economy.

● Stablecoin Market Cap: The total value of on-chain stablecoins. This indicator reflects the actual utility scale of the blockchain as a financial settlement layer.

● Transaction Throughput (TPS): Measured network throughput. High TPS public chains can support transaction demands in real-world scenarios such as payments and gaming.

● Single Transaction Fee: The dollar cost required to complete a basic transaction. Low fees enhance accessibility for retail users and small payments.

● Block Generation Time: The time taken to produce a new block. Shorter times mean faster transaction confirmations and better user experience.

● Transaction Finality: The time required for a transaction to become irreversible. Quick finality is crucial for settlement, avoiding double-spending and delay risks.

● Privacy Protection Mechanism: Evaluates whether optional enhanced privacy modules are configured, balancing the needs of sensitive scenarios with regulatory compliance.

● Cross-Chain Interoperability: The ability to achieve multi-chain communication through native bridging or protocols like CCIP, supporting asset cross-chain flow.

● Smart Contract Functionality: The level of support for complex on-chain logic and programmability. This is the foundation for DeFi, automation, and customized application layers.

● Application Scenario Scale: The number and scale of actual deployment cases related to stablecoins, validating the ability to implement technology.

● Institutional Partnerships: Active collaboration with payment companies or governments, reflecting recognition in the real sector.

● Compliance Record: Evaluates the past legal/regulatory violations of the operating entity. A clean record can enhance credibility.

● Team Background: Review of the core team's legal background. A clean history can reduce governance and reputation risks.

● Resistance to Technical Threats: Evaluates the historical record of vulnerabilities, downtimes, or major hacking attacks. Secure chains earn more trust.

● Network Availability: Tracking operational duration and performance stability. This is a key guarantee for the continuous operation of stablecoins.

● Bug Bounty Mechanism: Whether a white-hat hacker reward mechanism is established. Incentivizes proactive security reinforcement, reflecting foresight in protection.

● Code Maintenance Intensity: Assessed through the frequency of codebase updates and developer activity, evaluating the vitality of technical iteration.

Assessment Ranking Update: Leading Blockchain Project Rankings and Core Advantage Analysis

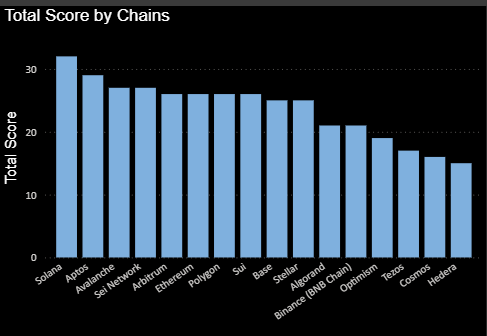

Figure 1: Comprehensive scoring update of mainstream blockchains (higher scores represent better overall performance) data source: Bitfox.ai

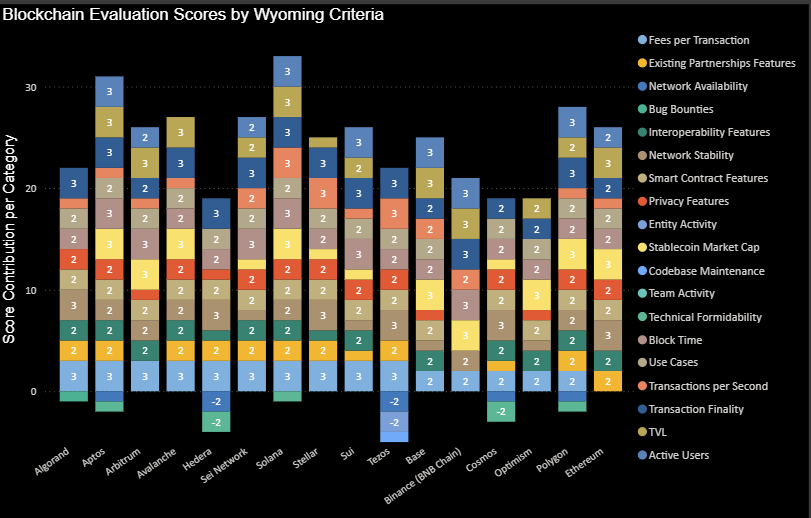

Based on the modified assessment model and excluding two inapplicable indicators, Solana ranks first with a total score of 32, followed by Aptos with 29. The current rankings are: Solana (32), Aptos (29), Sei and Avalanche (27), Arbitrum and Ethereum (26). This scoring comprehensively reflects the speed, cost, security, and usage of public chains. It should be noted that some data sources may show Aptos scoring 32, but this is due to the inclusion of two additional indicators not used in the early assessments of chains like Solana. To ensure fair comparison, we have uniformly adjusted the scores of public chains like Aptos, excluding the impact of these two indicators.

The core reasons for Solana and Aptos occupying the top of the scoring list lie in their excellent balance in transaction speed, cost-effectiveness, and ecosystem scalability. Solana's high score benefits from its outstanding throughput (thousands of TPS) and ultra-low fees, along with a large user base (peak TVL exceeding $10 billion) and DeFi ecosystem; while the newer Aptos, despite having only about two years of operational history (stability score slightly lower than Solana), its technology architecture based on the Move programming language, approximately 1-second transaction finality, and rapidly expanding developer ecosystem propel it to second place with 29 points. Avalanche and Sei excel in specific areas: Avalanche achieves scalability through fast finality and a unique subnet architecture, while Sei is built for high-speed transactions with instant finality—both received high scores of 27 in performance metrics, but are limited by Avalanche's current activity level and TVL being lower than Solana, and Sei's ecosystem is still under construction, hence their total scores are slightly lower than the leaders.

Ethereum, despite having a nine-year stable operational history, excellent security, and a large ecosystem (leading in this dimension), faces throughput bottlenecks (approximately 15 TPS) and high single transaction costs (average > $2) under current technical conditions, which restricts its performance evaluation dimension, resulting in a final comprehensive score of 26. This result highlights the emphasis of this assessment system on technical efficiency and cost metrics, which are seen as key elements in building a developer ecosystem. Among L2 solutions, Arbitrum scores 26 due to low fees and a considerable user base, but its transaction finality speed is limited by Ethereum's ten-minute settlement mechanism, and it has only two years of operational history; other public chains like Polygon, Sui, Base, and Stellar are concentrated in the 20-25 point range, each exhibiting differentiated strengths and weaknesses in the assessment metrics.

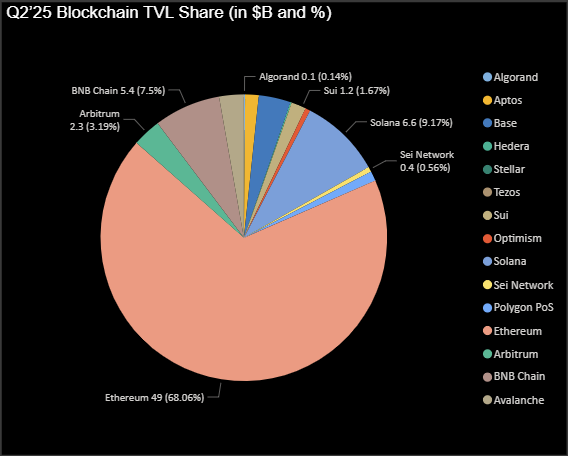

Figure 2: Ethereum dominates the DeFi market, but still lags due to low technical efficiency data source: Bitfox.ai

In summary, within the current assessment system, public chain platforms that combine high performance (processing speed and throughput capacity), low transaction costs, and sustained user growth generally surpass projects that are more mature but limited in performance or expensive. Solana and Aptos are exemplars of this balance. While Ethereum remains the most thoroughly tested and decentralized public chain, it loses points on "performance" metrics. It is noteworthy that this scoring model also includes some "additional" factors (beyond core speed and usage metrics), such as support for compliance features and completeness of development tools—these factors have previously provided extra points for Stellar and Solana (as well as early Aptos). It should be particularly noted that the latest revised model has excluded two inapplicable additional indicators from the initial assessment (such as compliance support tools, completeness of the developer ecosystem, etc.), which adjustment has lowered Aptos's score by 3 points, ensuring Solana occupies the top position. The assessment results highlight the core conclusion: in the market environment following Bitcoin's historic high, builders should place a high emphasis on fundamental metrics such as throughput, transaction finality, and user growth when choosing a public chain.

Figure 3: Comprehensive scoring structure of various public chain projects by dimension

In-Depth Comparison of Five Major Public Chains: Diverse Assessment Analysis

This section provides an in-depth analysis of the top five public chains—Solana, Aptos, Avalanche, Sei, and Ethereum—based on the scoring data from Wyoming for the fourth quarter of 2024 to the first quarter of 2025, examining broader dimensions such as compliance, privacy features, development tools, and ecosystem maturity.

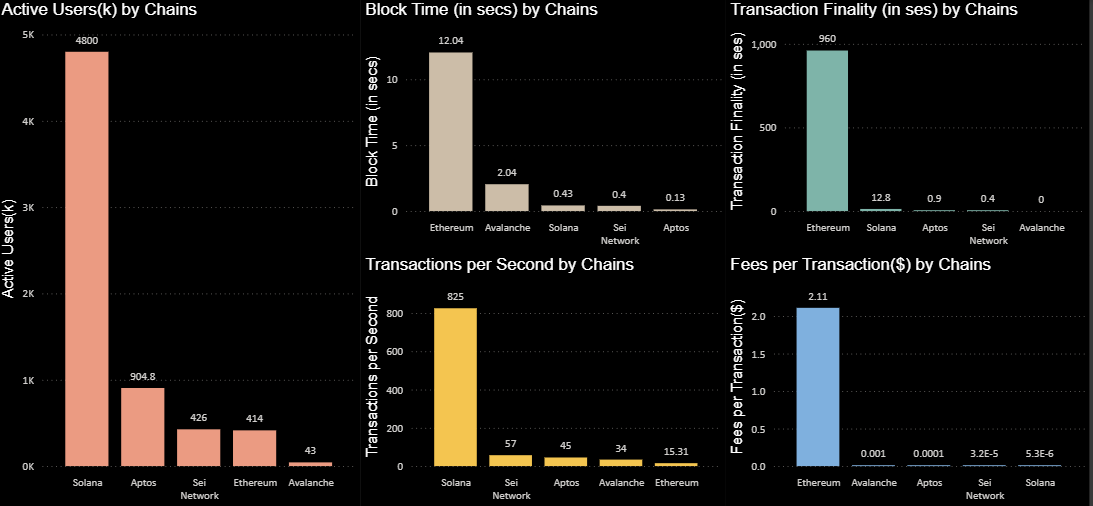

Figure 4: Key indicators of the five major blockchains (Solana, Aptos, Avalanche, SEI, Ethereum). data source: Bitfox.ai

1. Solana: High Performance, Low Cost, Vast Ecosystem

● Technical Advantages: Leading the industry with over 1000 TPS throughput and approximately $0.003 ultra-low transaction fees, while also achieving around 13 seconds of transaction finality and sub-second block generation speed.

● Users and Adoption: Over 480 million active addresses per quarter, the highest user activity among all assessed public chains; with a TVL of $6.6 billion, it ranks second, demonstrating strong user trust.

● Compliance and Scalability: Meets core regulatory-friendly requirements (support for analytical tools, on-chain data traceability), but lacks built-in asset freezing functionality. Additional points are gained due to the completeness of developer tools, integration of analytical systems, and ecosystem maturity.

● Privacy and Risks: Has not focused on privacy features, and there have been historical network interruption incidents, but recent upgrades have significantly improved network stability.

2. Aptos: Instant Finality Speed, Emerging Ecosystem Rise

● Technical Highlights: Sets industry benchmarks with 0.9 seconds of sub-second finality and 0.13 seconds of block generation speed, with single transaction fees as low as $0.0001, achieving full marks in fees, finality, and smart contract capabilities.

● Adoption and Ecosystem: Active users exceed 904,000, with a continuously expanding decentralized finance ecosystem, receiving support from top venture capital, and over 1,000 active developers.

● Compliance and Rewards: APTOS continues to thrive in the decentralized finance ecosystem.

● Privacy and Risks: Lacks built-in privacy features, and its short operational time (since the end of 2022) affects stability scoring.

Maintains a record of zero major security incidents to date.

3. Avalanche: Fast Settlement and Custom Architecture

● Core Technical Advantages: Utilizes the Snowman consensus mechanism to achieve approximately 2 seconds of block generation speed and about 1 second of transaction finality, with actual TPS stabilizing at 5-10, but can flexibly scale throughput through subnet architecture.

● Ecosystem Status: Approximately 43,000 active users, with TVL maintaining at $1.2 billion; the user base and stablecoin metrics are limited by current adoption rates.

● Compliance Features: Provides asset freezing functionality and a robust governance toolkit, with additional points for cross-chain interoperability and customizable subnet architecture; development tool support and data analysis compatibility perform well.

● Privacy and Risks: Lacks a native privacy mechanism, with 1,500 verification nodes representing moderate decentralization; technical robustness has been validated through practice.

4. SEI Network: Professional Public Chain for Financial Scenarios

● Technical Advantages: SEI has near-instant finality (approximately 400 milliseconds) and negligible fees ($0.0005). It is tailored for high-frequency trading applications.

● Ecosystem Maturity: Approximately 426,000 quarterly users and $400 million TVL, with the ecosystem still growing.

● Compliance and Features: SEI scores highly on stability, analysis compatibility, and lack of reorganization among other standards. Its institution-centric design complies with regulatory use.

● Privacy and Risks: Lacks privacy features but maintains 100% availability; limited verification nodes and short operational time (since 2023) reduce decentralization and stability scores.

5. Ethereum: Security Giant with Performance Limitations

● Technical Advantages: Ethereum scores low on performance (15–30 TPS, 12-second block interval, $1 average fee), but is unparalleled in decentralization and security.

● Ecosystem Scale: Still the leader in DeFi, with approximately $49 billion in TVL and a wide application ecosystem, boasting tens of millions of users on both the mainnet and layer 2 networks.

● Compliance and Development Ecosystem: Lacks asset freezing functionality at the base layer, but excels in auditability, openness, and development tools, with robust support from major custodians and analytical services.

● Privacy and Risks: Does not natively support privacy transactions, but as the most stable and transparent platform, it receives the highest reliability rating.

Reasons for Exclusion of Some Mainstream Public Chains

Not all popular public chains can pass Wyoming's entry screening. The state employs a strict binary filtering mechanism—public chains must fully meet all core requirements to enter the scoring phase; otherwise, they are directly eliminated. These entry requirements aim to ensure the project's regulatory compliance, operational transparency, and foundational level of decentralization. Core screening criteria include:

● Permissionless Network: Any user can transact or deploy applications without approval.

● Open Access for Validators: Verification nodes must support free entry, rather than being selectively designated.

● On-Chain Analysis Support: Public chains must support transaction tracking and integrate with analytical tools.

● Supply Transparency: The total token supply and issuance mechanism must be publicly verifiable.

● Asset Freezing/Seizure Functionality: The protocol layer must have the capability for asset control in legal scenarios.

● Custody and Compliance Support: Must receive technical support from mainstream custody service providers or compliance analysis platforms.

According to Wyoming's standards:

● Tron was excluded due to validator centralization (27 fixed representatives) and lack of compliance analysis and custody service support; its protocol layer's absence of asset freezing tools also does not meet requirements.

● XRP Ledger was excluded due to its validator access mechanism (Unique Node List, UNL) violating openness principles, despite supporting token freezing and having transparent supply.

● Cardano was primarily excluded due to the lack of asset freezing/seizure functionality at the protocol layer, with its architecture overly focused on decentralization at the expense of compliance.

● Monero was excluded due to its complete privacy model, which renders transactions unauditable and fails to meet on-chain analysis requirements.

● Other public chains like Cronos and EOS were also excluded due to restrictions on validator access or lack of transparency tools.

This screening mechanism does not assess technical parameters or user scale but focuses on whether public chains can support public sector and compliant stablecoin applications. Wyoming's framework indicates the core conditions that institutional-level public chains must meet in the future.

Conclusion: Breaking Away from Irrational Market Focus, Returning to the Core Value of Underlying Infrastructure

As Bitcoin reaches a historic high (ATH), attracting capital into the crypto space, the actual performance metrics of technical infrastructure become key screening benchmarks. As this assessment shows, core parameters such as throughput capacity, scalability, cost-effectiveness, transaction finality speed, and reliable operational records have a decisive impact on the practical utility of public chain technology. The leading advantages of Solana and Aptos indicate that the next-generation architecture significantly surpasses traditional networks in these key dimensions—providing a better user experience and scalability potential for decentralized applications (DApps). Meanwhile, Ethereum's ecosystem universality and security value are fully recognized, but builders must confront its existing performance bottlenecks (which is the fundamental reason for the existence of layer 2 solutions). However, as shown by the scores of arbitration chains like Arbitrum and Optimism, such solutions also exhibit technical trade-off characteristics.

More critically, institutional factors (governance structure, compliance capabilities, and supporting ecosystems) have non-negligible weight in assessment value. Several high-profile public chain projects have been entirely excluded from the assessment system due to the absence of key characteristics expected by real enterprises and regulatory bodies. This provides key insights for builders and investors: the choice of public chains should not be limited to quantitative indicators such as throughput (TPS) or total locked value (TVL), but should also consider their openness, regulatory operational transparency, and system scalability potential. Blockchain architectures lacking the capability for integrated compliance analysis tools or audit feasibility will carry systemic risks in the medium to long term.

In the post-historical peak (ATH) cycle, the focus of the blockchain industry is shifting from irrational arbitrage behavior to building application layers that can support millions of users. The construction of Wyoming's assessment system reflects this trend evolution—it emphasizes replacing the market speculation-dominated assessment paradigm with technical efficiency indicators (transaction speed, security mechanisms, cost structure, and community ecology). For decision-makers in smart contract deployment and ecological strategic layout, public chain projects that rank high in comprehensive performance (such as Solana and Aptos) demonstrate excellent performance across four core dimensions. By adopting a homogenized data analysis framework and combining key defect analyses of projects that did not pass screening (such as Tron’s validator mechanism centralization and Monero’s lack of audit feasibility), project parties and investors can accurately select blockchain infrastructure with successful carrying capacity in the new phase of the market cycle.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。