Crypto Market Surge Today as U.S. June PPI Data Hits Lowest Since 2024

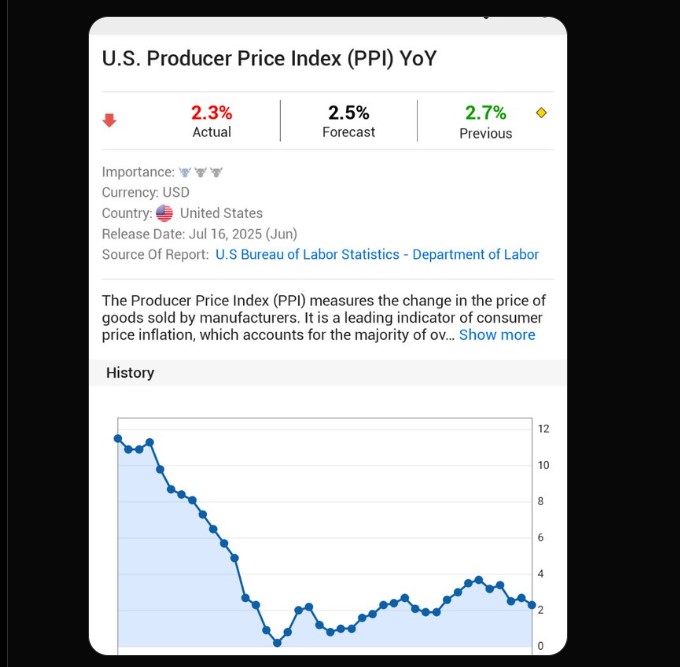

In a big surprise, the crypto market reacts to June US PPI data with renewed excitement. The Producer Price Index (PPI)—which tracks wholesale inflation in the U.S.—rose only 2.3% year-over-year, much lower than the 2.5% forecast.

In the latest crypto market news today , it is the lowest inflation rate since September 2024. On a monthly basis, inflation was flat at 0.0%, also below the expected 0.20%.

This drop in June US PPI data is a clear sign that inflation is cooling, and investors are already asking: Is this the moment that re-ignites the rally?

Fed Under Pressure: Will Weak PPI Push Rate Cuts Back on the Table?

With inflation falling to 2.3%, the pressure is now on the Federal Reserve to slow down or even reverse its interest rate policies. For months, markets have been stuck wondering—Will the Fed cut rates or not?

Source: Investing.com X account

This new US PPI data news today could be the final push. If the Fed hints at future rate cuts, it would signal a green light for both Bitcoin and altcoin rally expectations.

Bitcoin Rally: Can Cooling Inflation Finally Spark a $BTC Breakout?

After the news of inflation fell 2.3%, Bitcoin price today is hovering around $117,000 to $118,000, just under its recent peak near $120K. The charts look interesting:

-

The MACD indicator shows a bullish crossover, hinting at continued upward movement.

-

The RSI is at 69.33, just below the overbought zone, showing strength but also warning of possible cooling.

-

Strong support around $117K–$118K is holding up well after the latest dip.

With price rise down and Cryptocurrency Week heating up, could this be the moment BTC breaks out above $120K? If so, a fresh rally might not be far away.

Altcoins Explode: Ethereum, XRP, and Solana Rally on Cooling Inflation

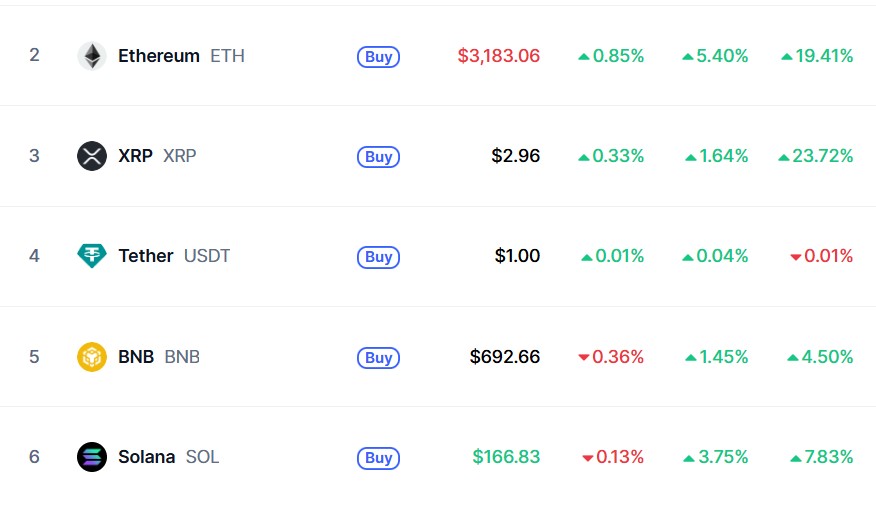

While BTC is building strength, the real action is happening in altcoins. The latest crypto market surge today has been led by these altcoins—each showing strong momentum after the June PPI inflation data.

-

Ethereum has surged past $3,180, helped by both macro trends and strong ecosystem activity.

-

XRP is climbing fast, now closing in on $3, as traders rotate capital from Bitcoin into altcoins.

-

Solana (SOL) remains above $166, with its weekly and monthly charts looking solid.

As per my analysis being a cryptocurrency writer, this shift suggests that traders are rotating funds into higher-risk, higher-reward tokens—especially now that its impact on market looks to be easing.

Crypto Week + Cooling CPI: A Perfect Setup for the Next Bull Run?

This week, things are aligning in a way the world hasn’t seen in a while. On one hand, we have price increase cooling, with both CPI and PPI data pointing lower. On the other hand, it’s Crypto Week in the US , with major bills like the Genius Act and Clarity Act being discussed.

President Donald Trump has even called this a "turning point" for digital assets. So, are we on the edge of a new bull run? Well yes, all the pieces are starting to line up.

Conclusion: Price Rise Is Cooling—But What’s the Bigger Picture for Cryptocurrency in 2025?

The latest crypto market reacts to June US PPI data story is more than just numbers. It’s a signal. Price rise is easing, the Fed may slow down, and crypto markets are responding fast.

Bitcoin may still be waiting for confirmation, but Ethereum, XRP, and Solana are already racing ahead. If this trend continues—and if regulatory clarity from Crypto Week lands as expected—2025 could become one of the most exciting years for investors in a long time.

Disclaimer: This article is for informational purposes only. Always do your own research and watch the market trends as they can shift quickly.

Also read: TON Station Daily Combo 17 July 2025: Win SOON Points!免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。