When technological innovation meets political maneuvering, the "path to compliance" for cryptocurrencies is destined to be bumpy.

Written by: BitpushNews

What was once seen as the "highlight moment" for the cryptocurrency industry in Washington—"Crypto Week"—encountered a setback on Tuesday, as three cryptocurrency regulatory bills pushed by Trump unexpectedly "flopped" during a procedural vote.

The voting results on Tuesday were 196 votes in favor and 223 votes against. Among those opposing were 13 Republican representatives who joined Democrats in voting against the motion, effectively blocking the procedural motion to debate and advance the bill.

This means that unless the House of Representatives passes the relevant rules again, these bills, which carry the hopes of the industry, will not enter substantive debate.

"Crypto Week" Vision: Trump Personally Supervises

Earlier this week, the mood in Washington's cryptocurrency industry was high, with widespread expectations that these bills would pass smoothly.

Trump himself rallied for "Crypto Week" on his "Truth Social" platform, portraying it as a key step for the U.S. to become the "undisputed, number one leader" in the digital asset space. He called on all Republican representatives to vote in favor, firmly believing that the "GENIUS Act will make our great nation lead China, Europe, and all other countries by light-years, as they are endlessly chasing but just can't catch up."

The blocked cryptocurrency legislative "package" includes three bills crucial to the industry:

GENIUS Act: This bill on stablecoin regulation received some Democratic support and successfully passed in the Senate last month. It aims to provide a clear regulatory framework for stablecoins and is seen as a key to unlocking broader institutional adoption.

CLARITY Act: This bill aims to clarify the classification rules for digital assets, specifying which assets should be regulated as securities by the U.S. Securities and Exchange Commission (SEC) and which should be regulated as commodities by the Commodity Futures Trading Commission (CFTC), in order to end the long-standing "regulatory gray area" troubling the industry.

Anti-Central Bank Digital Currency (CBDC) Act: This proposal aims to prohibit the Federal Reserve from creating a central bank digital currency, reflecting concerns among some lawmakers about government control over digital currency.

These bills are seen as the cornerstone for establishing a comprehensive and predictable regulatory framework for digital assets in the U.S., and their passage could bring much-needed certainty to the market, attracting more capital and innovation.

Dissent Within the Republican Party Emerges

The most striking aspect of this vote was the "defection" of 13 Republican representatives. According to The Hill, several Republican representatives, including Marjorie Taylor Greene, Chip Roy, Michael Cloud, and Anna Paulina Luna, voted against the bills.

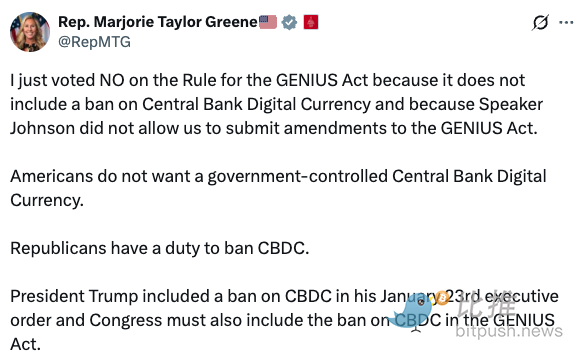

Georgia's Marjorie Taylor Greene publicly explained her position on social media.

She stated that the GENIUS Act failed to include a ban on central bank digital currencies (CBDCs) and that Speaker Johnson did not allow related amendments to be submitted. Greene emphasized that Trump had already included a CBDC ban in his executive order on January 23, so Congress must also incorporate it into the GENIUS Act, asserting that "Americans do not need a central bank digital currency controlled by the government."

House Speaker Johnson found himself in a dilemma. After the vote failed, he stated that Republicans "are still in dialogue, answering questions," trying to appease and garner support from these conservatives.

However, he also admitted that bundling all three bills (especially the stablecoin bill already passed by the Senate and the hardliners' demanded CBDC ban bill) into one "package" was not feasible. A senior Republican lawmaker bluntly stated, "Bundled voting will only cause these bills to die in the Senate." This statement reflects the strategic dilemma faced by Republican leadership in balancing the demands of different factions within the party while ensuring legislative feasibility.

Subsequent Voting Uncertainty: Compromise or Stalemate?

After the news of the vote failure broke, cryptocurrency-related stocks fell sharply: stablecoin issuer Circle's stock dropped over 7%, cryptocurrency exchange Coinbase fell more than 4%, and digital asset company MARA Holdings' stock also declined by 2%.

House Speaker Johnson has announced a desire to restart procedural voting on the cryptocurrency bills on Wednesday local time. The Louisiana Republican told reporters as he left the Capitol that the party is still "continuing communication, answering lawmakers' concerns," and emphasized that "these cryptocurrency bills are a joint priority for the White House, the Senate, and the House." According to Fox News, Trump himself expressed being very "angry" about the voting results and is communicating with relevant lawmakers.

Even so, some industry analysts remain optimistic about the future of the bills. TD Cowen policy analyst Jaret Seiberg noted in a report to clients: "We are likely to vote on the rules again in the House tomorrow (Wednesday). If it doesn't happen tomorrow, it may be postponed until next week." Seiberg further stated that he still expects the House to pass the GENIUS Act, as "Trump is pushing for its enactment." He believes that even if members of the House "Freedom Caucus" oppose accepting the Senate version of the bill, they may ultimately concede under the president's request.

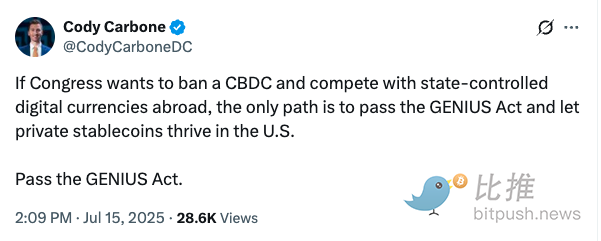

Cody Carbone, CEO of the Digital Chamber, also expressed confidence in the final passage of the bills. He pointed out on social media that the best way to address the prohibition of CBDCs is through the GENIUS Act: "If lawmakers are interested in banning CBDCs and competing with digital currencies issued by other countries, the way to do that is through the GENIUS Act, allowing the private stablecoin market to thrive in the U.S."

This setback underscores a reality: in Washington, even a presidentially pushed agenda can falter against the subtle power balances within the party. When technological innovation meets political maneuvering, the "path to compliance" for cryptocurrencies is destined to be bumpy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。