The tokenization of US stocks is merely a subset of the RWA tokenization process.

Written by: imToken

At the beginning of this month, Robinhood and others announced support for US stock trading on the blockchain and plan to launch their own public chain. Meanwhile, Kraken and others have also launched trading pairs for US stock tokens like AAPL, TSLA, and NVDA, sparking a wave of on-chain stock trading.

But is it really a new concept?

In fact, this seemingly sudden wave of tokenization is backed by a seven-year evolution of asset on-chain in the crypto world—from early synthetic asset experiments to the practical implementation of stablecoins, and then to the structured access of RWA (real-world assets). The narrative of "assets × blockchain" has never been interrupted; it is just now welcoming a more realistic and institutionalized restart.

The Tokenization of US Stocks: Old Wine in New Bottles

On the surface, stock tokenization seems to be a new trend in the Web3 world, but it is more like a resurgence of an old narrative.

Users who have experienced the last round of on-chain prosperity should remember the complete set of synthetic asset mechanisms pioneered by projects like Synthetix and Mirror, where users could mint "synthetic assets" (like sAAPL, mTSLA) that are pegged to US stocks, fiat currencies, indices, or even commodities by over-collateralizing native crypto assets (like SNX, UST), achieving an asset trading experience without intermediaries.

The biggest advantage of this model is that it does not require real asset custody and clearing, no counterparty matching, infinite depth, and zero slippage experience. However, the ideal is beautiful, but the reality is harsh—oracle distortion, severe asset volatility, frequent systemic risks, coupled with a lack of real regulatory alignment, have led to the gradual exit of these "synthetic assets" from the historical stage.

Today, the wave of US stock tokenization essentially transitions from "asset synthesis" to "real stock mapping," marking a new stage in the narrative of tokenization that moves towards "off-chain real asset integration."

Taking the US stock token trading products launched by Robinhood and others as an example, from the disclosed information, what is being activated is the on-chain channel for real stock assets and the reconstruction of the settlement structure, namely real stock custody, with funds flowing into US stocks through compliant brokerages.

Objectively speaking, although the tokenization of US stocks under this model still faces many challenges in terms of compliance pathways and cross-border operations, for users, it represents a brand new on-chain investment window:

No need for account opening, no identity verification, no geographical restrictions—just a crypto wallet and a stablecoin, allowing users to bypass the cumbersome processes of traditional brokerages and trade US stock tokens directly on DEX, achieving 24/7 trading, second-level settlement, and global borderless access. This experience is something that traditional securities systems find hard to reach, especially for non-US residents.

The establishment of this logic relies on the capability of blockchain as the infrastructure for "clearing + asset confirmation," and it reflects the significant leap of tokenization from technical experimentation to actual user application.

Furthermore, from a more macro perspective, "US stock tokenization" is merely a subset of the RWA (real-world assets) tokenization process; it reflects the continuous evolution of the asset on-chain narrative since the rise of the tokenization concept in 2017, from token issuance to synthetic assets, and then to RWA anchoring.

The Past and Present of Tokenization

Looking back at the development trajectory of tokenization, it is not difficult to find that it has almost run through the core narrative of every round of infrastructure innovation in the crypto world.

It can be said that from the "token issuance boom" in 2017 to the "DeFi Summer" in 2020, and then to the recent "RWA narrative" and the latest "US stock tokenization" landing, a relatively clear path of on-chain asset evolution can be outlined.

The earliest large-scale practice of tokenization began with the token issuance boom in 2017, when the idea of "tokens as equity" ignited the fundraising imagination of countless startup projects. Ethereum provided low-threshold issuance and fundraising tools, making tokens a digital certificate representing future rights (equity, usage rights, governance rights).

However, in the context of a lack of clear regulatory frameworks, missing value capture mechanisms, and severe information asymmetry, many projects fell into the bubble of air tokens, ultimately retreating with the tide of the bull market.

Fast forward to 2020, the explosion of DeFi marked the second peak of tokenization applications.

A series of on-chain native financial protocols represented by Aave, MakerDAO, and Compound built a complete set of permissionless and censorship-resistant financial systems using on-chain native assets like ETH, allowing users to complete complex financial operations such as lending, staking, trading, and leveraging on-chain.

In this stage, tokens were no longer financing certificates but evolved into a core asset class of on-chain financial tools, such as wrapped assets (WBTC), synthetic assets (sUSD), and yield-bearing assets (stETH). Even MakerDAO began to accept real-world assets like real estate as collateral to better integrate traditional finance and DeFi.

The restart of tokenization marked a watershed moment, beginning to attempt to introduce more stable and larger-scale real-world assets.

Therefore, starting in 2021, the narrative further upgraded, with protocols like MakerDAO beginning to attempt to integrate real estate, government bonds, and gold as underlying collateral. The definition of tokenization expanded from "tokenizing native assets" to "tokenizing off-chain assets."

Unlike previous abstract assets anchored by code, RWA represents the confirmation, splitting, and circulation of real assets anchored by physical assets or legal rights on-chain. Due to their relatively stable value, clear valuation standards, and mature experience in compliance regulation, they provide a more realistic "value anchor" for on-chain finance.

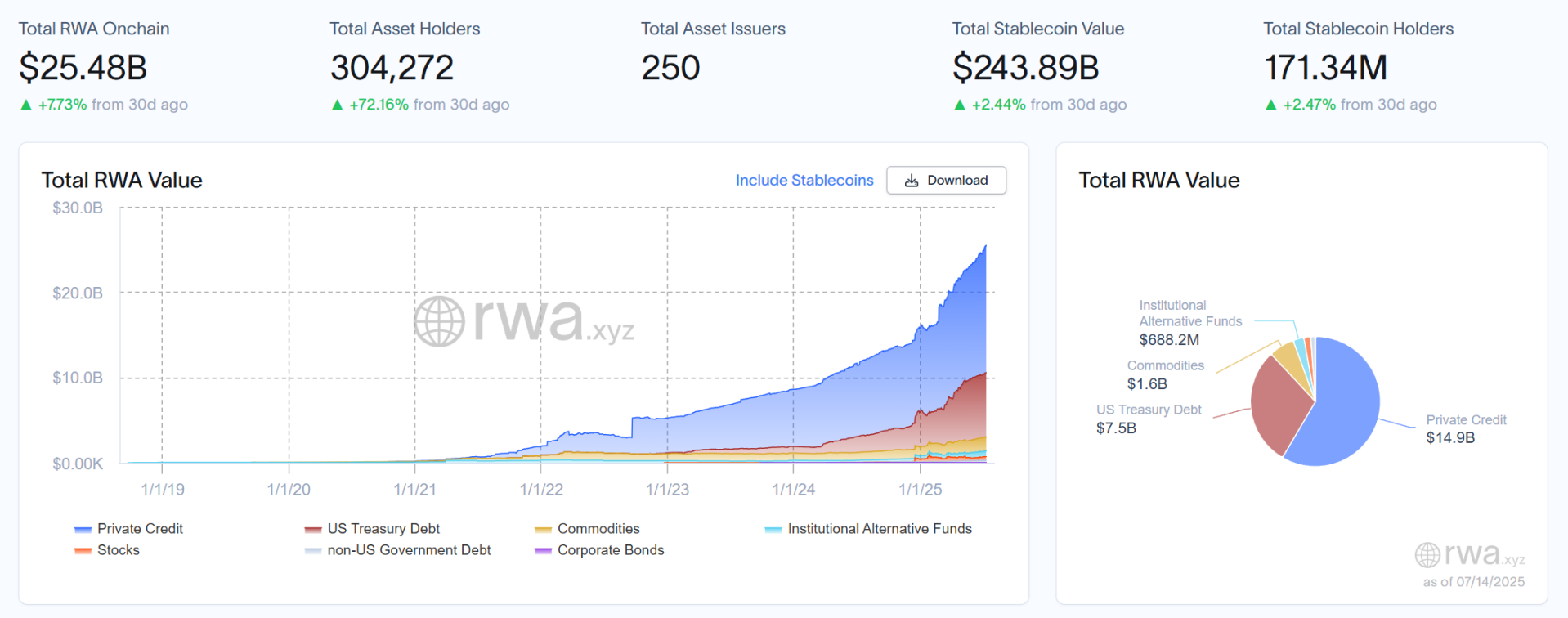

According to the latest data from the RWA research platform rwa.xyz, the total market size of RWA currently exceeds $25 billion, and BlackRock's forecast is even more optimistic, predicting that by 2030, the market value of tokenized assets will reach $10 trillion, which means the potential growth space in the next seven years could be as high as 40 times or more.

So, which real-world assets will be tokenized first and become the on-chain financialization anchor of RWA?

Who Will Be the Bridgehead of Tokenization?

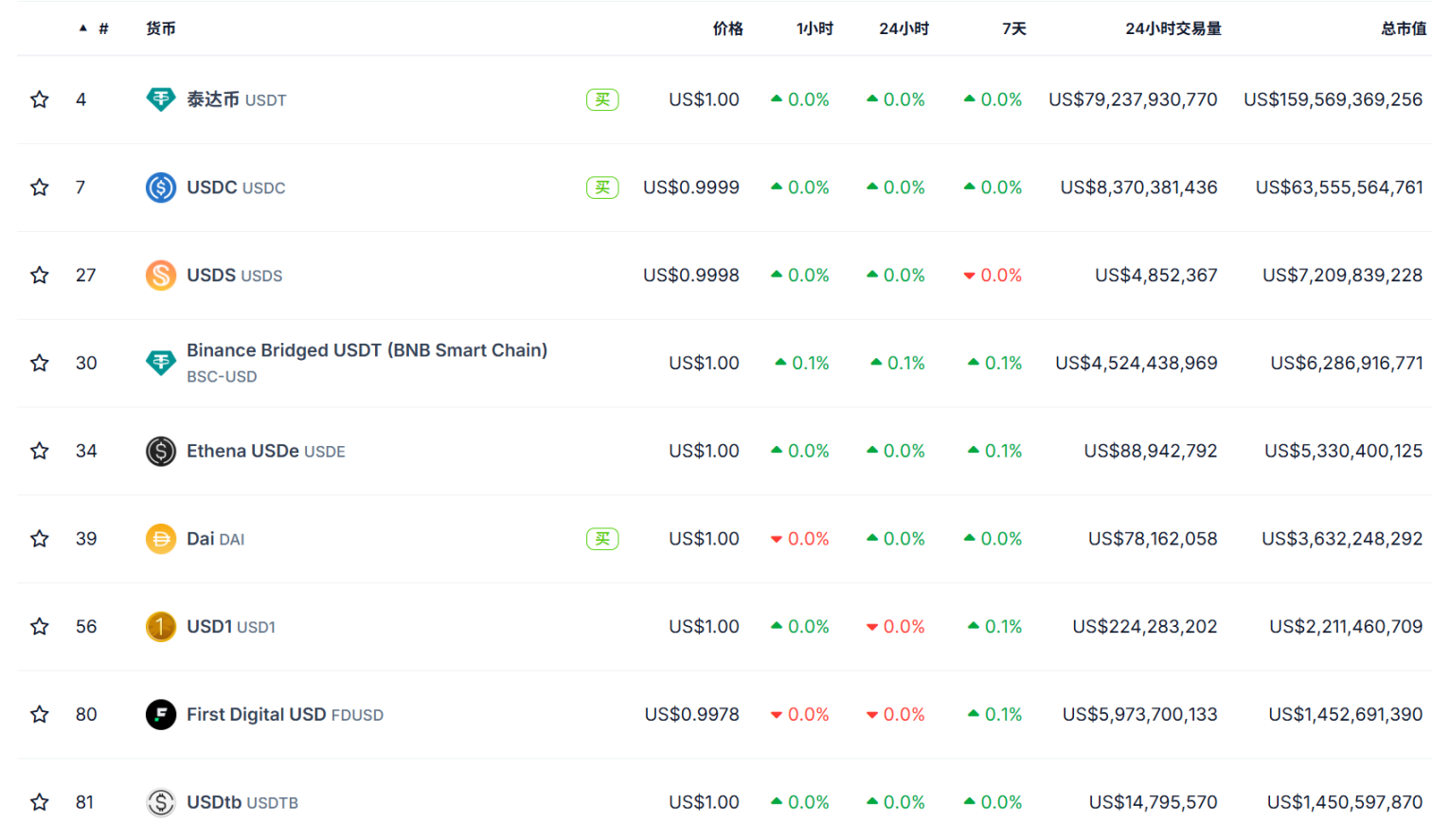

It is no exaggeration to say that in the past five years, the most successful tokenization product has been neither gold nor stocks, but—stablecoins.

It is the first tokenized asset that truly found the "product-market fit (PMF)": mapping cash, the most basic and liquid asset, into the on-chain world and building the first "value bridge" connecting TradFi and DeFi.

Its operational logic is also highly representative: real assets (like US dollars or short-term government bonds) are held off-chain by banks or custodians, and equivalent tokens (like USDT, USDC) are issued on-chain, allowing users to hold, pay, trade, or interact with DeFi protocols through a crypto wallet.

This not only inherits the stability of fiat currency but also fully unleashes the advantages of blockchain: efficient settlement, low-cost transfers, 24/7 trading capabilities, and seamless integration with smart contracts.

As of now, the total market value of global stablecoins has exceeded $250 billion, indicating that the true landing of tokenization depends on whether it solves the problems of asset circulation and trading efficiency in reality, rather than merely relying on technological innovation itself.

Today, US stock tokenization seems to be becoming the next landing point for tokenized assets.

Unlike previous synthetic asset models that relied on oracles and algorithms, today's "real stock token" solutions are increasingly approaching real financial infrastructure, gradually exploring a standard path of "real stock custody + on-chain mapping + decentralized trading."

A noteworthy trend is that mainstream players, including Robinhood, are successively announcing the launch of native chains or self-developed chains and supporting on-chain real stock trading functions. From the currently disclosed information, most of the underlying technical partners for these tokenization paths are still based on the Ethereum ecosystem (like Arbitrum, etc.), which undoubtedly reaffirms Ethereum's core position as the infrastructure for tokenization.

The reason is that Ethereum not only has a mature smart contract system, a large developer community, and rich asset compatibility standards, but more importantly, its neutrality, openness, and composability provide the most scalable soil for mapping financial assets.

Overall, if the previous rounds of tokenization were driven by Web3 native projects as crypto financial experiments, then this time, it seems more like a professional reconstruction led by TradFi—bringing real assets, real regulatory compliance needs, and global market demands.

Will this time be the true beginning of tokenization?

We shall see.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。