Ethereum Foundation Sell ETH: Will ETH Sparks Rally Above $3,000 Leve

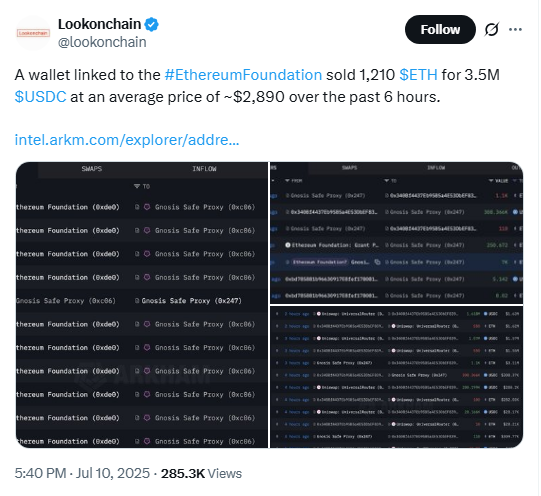

The Ethereum Foundation Sell ETH events that have drawn attention from across the crypto community. On-chain data revealed that sold 1,210 per unit worth roughly over $3.5 Million through Uniswap V4. The average selling price was $2,890 per unit.

Source: X

This transaction wasn’t random–it was part of a broader movement of funds. Over the last month, around 21,000 per unit was consolidated into a multisig wallet controlled. From there, 7,000 per unit has been redistributed. Including the latest sale via a secondary address. All of this was tracked in real-time by blockchain analytics platforms like Lookonchain.

Strategic Treasury Management, Not Market Fear

Despite speculation, this Foundation Sell ETH event seems far from panic-driven. The has diplomatically sold in small batches to support its mission– funding research, development, giants and operations that keep evolving.

The prioritizes flexibility instead of engaging than in staking or locking funds in DeFi. This method helps maintain steady financial support for the ecosystem while avoiding large market disruptions. It’s a calculated and transparent approach to treasury management that underlines maturity rather than uncertainty.

How does price react to this?

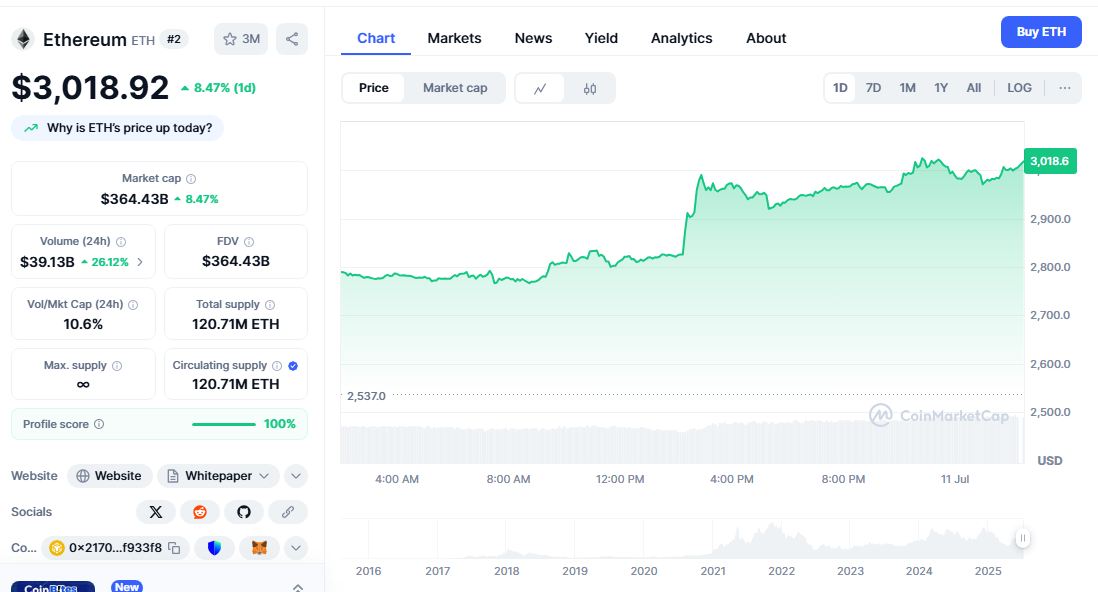

Foundation Sell ETH has made a strong comeback, surging nearly 17% between July 5 and July 11, 2025, and reclaiming the key $3,000 resistance level. This rally pushed from just under $2,776 to an intraday high of $3,036, with the current market cap standing at $362.08B.

Source: CoinMarketCap

Despite the Ethereum Foundation Sell ETH selling $3.5 million worth, the market showed strength, with whales and institutions stepping in to buy. This signals renewed confidence and suggests may be entering a fresh bullish phase.

Price Rise supported by Whales Accumulation

While the reduced its holdings, market sentiment hasn’t turned bearish. Ethereum Foundation Sell ETH price recently approached $3,036 before dropping to $3018, at the time of writing.

What’s more notable is the buying pressure from major players. In the past 24 hours, whales and institutional wallets have scooped up over $358 million worth. This suggests that while the Ethereum Foundation Sell ETH, smart money sees the dip as a buying opportunity. Their confidence helps stabilise price action and highlights long-term optimism in value propositions.

Network Growth Amid Lower Burn Rates

On-chain activity continues to expand. The total value locked (TVL) in based protocols has climbed from 50% billion to $73 billion in just three months, reflecting growing real-world usage.

However, there’s a twist, fees have fallen by 22% over the past month. While lower fees burned, slightly weakening defining appeal. This drop in burn rate might have played a role in the decisions to convert a portion of its into stablecoins, ensuring stable funding regardless of fee-based income.

Long-Term Outlook Remains Strong

At the end of the day, the Ethereum Foundation Sell ETH moves less about market timing and more about responsible financial planning. It shows a commitment to supporting growth while staying financially agile.

Even while a short-term dip in price, institutional interest, rising TVL, and growing adoption suggest the Ethereum ecosystem remains healthy. This controlled sale is a reflection of strategic foresight– not a signal of weakness.

Also read: GMX Hacker ETH Strategy: Bug Bounty Win or Exit Scam Move?免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。