Wait until sufficient liquidity and market price efficiency are formed before entering the market; otherwise, you are playing a dangerous game suited only for institutions and hedge funds.

Author: Steven Ehrlich

Translated by: Deep Tide TechFlow

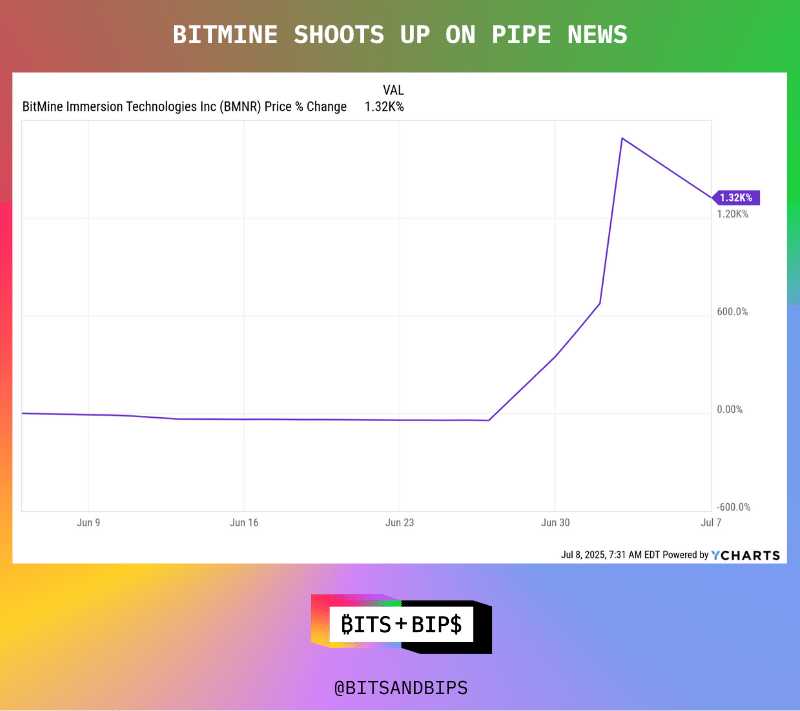

BitMine Immersion Technologies (BMNR), a Bitcoin mining company based in Las Vegas, Nevada, had a market capitalization of less than $30 million in June, placing it in the middle of a competitive industry. But everything changed on June 25 when the company announced a strategic shift to focus on Ethereum cryptocurrency funds. As part of this transformation, the company raised $250 million through a private investment in public equity (PIPE) and appointed cryptocurrency bull Tom Lee as chairman of the board.

The stock immediately soared over 1300%. Currently, the stock has a market capitalization of $4.6 billion, trading at 17.23 times its book value.

(Annual chart)

However, this success story comes with some significant caveats. Because Bitmine chose to raise funds through PIPE, a wave of selling pressure is expected in the near future. Historically, the stock could drop at least 60%. This could happen when the shares sold to wealthy institutional clients in the $250 million financing become available for public sale, likely at some point this summer.

How significant is the oversupply we are discussing? Before the financing, Bitmine's circulating supply was only 4.3 million shares. To raise $250 million, it had to sell an additional 55.56 million shares, which is an increase of 12.92 times the number of shares.

Bitmine is not the only one facing this challenge.

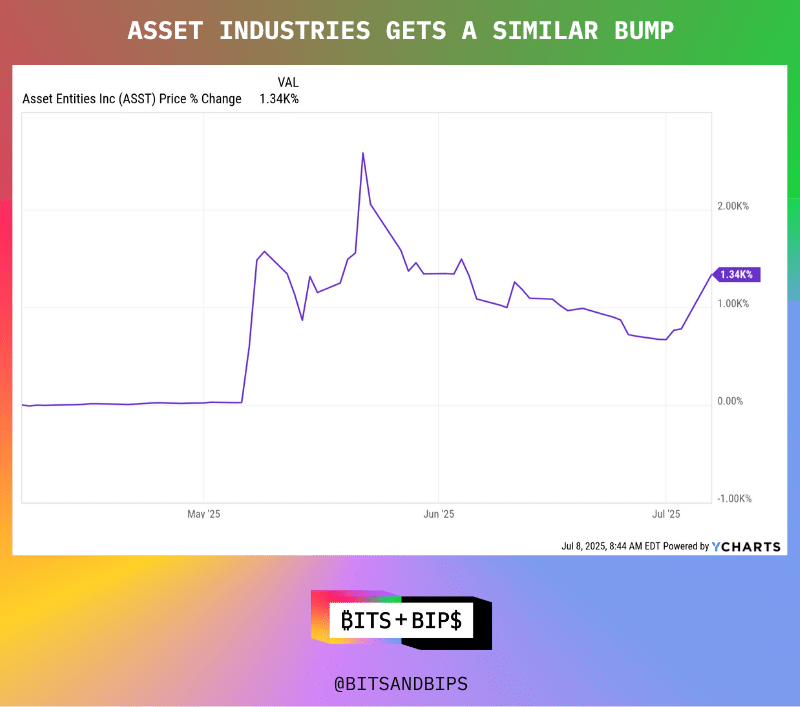

Asset Entities (ASST), a social media marketing company based in Dallas, Texas, is also facing similar challenges. At the beginning of May, the company's market capitalization was less than $10 million, with a supply of only 15.77 million shares. On May 27, the situation changed when the company raised $750 million through PIPE financing and merged with Strive Asset Management, led by former presidential candidate Vivek Ramaswamy. Its stock also rose over 1300%.

(Annual chart)

But like Bitmine, the company also faces significant selling pressure. The PIPE transaction increased Asset Entity's circulating shares from 15.77 million to 361.81 million, a 21.94-fold increase.

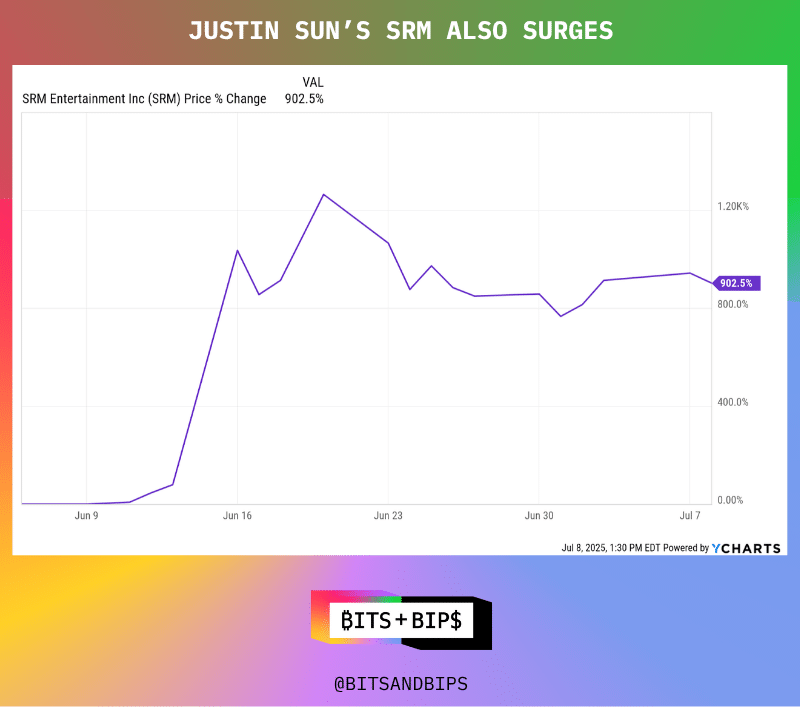

Sun Yuchen's SRM Entertainment also faces similar challenges. After reaching an agreement to transform the souvenir design company into a Tron financial company, the company's stock soared by 902.5%. As part of this $100 million PIPE financing deal, SRM Entertainment's original 17.24 million shares were expanded by 11.6 times to accommodate 200 million newly issued shares.

(Annual chart)

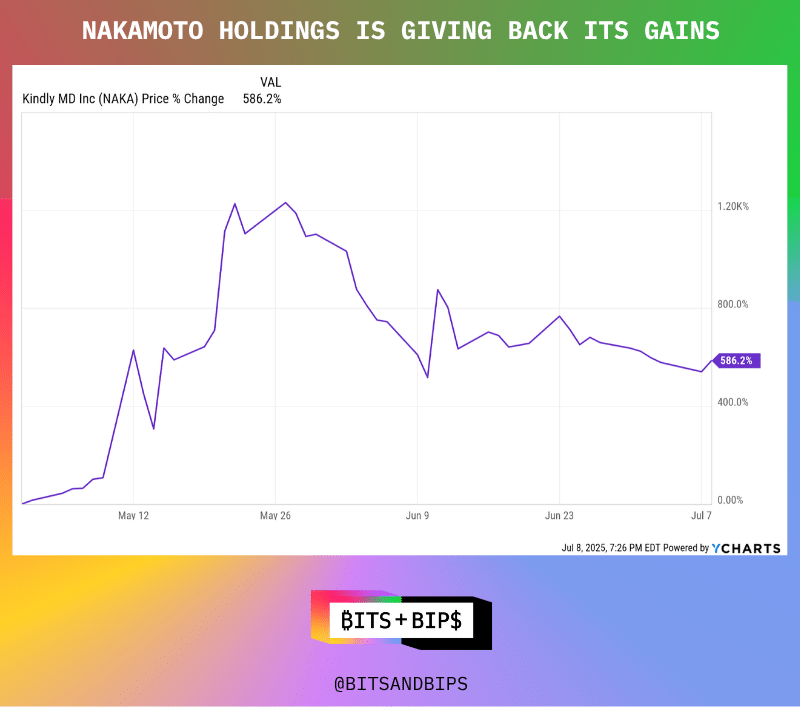

Finally, take David Bailey from Bitcoin Magazine as an example. He raised $563 million through PIPE to merge Nakamoto Holdings with KindlyMD (NAKA), which is part of a $763 million investment round that also includes debt financing. On May 12, 2025, the company announced the merger, increasing the number of shares from 6.02 million to 112.6 million, an 18.7-fold increase. After the announcement, the stock soared over 1200%, but subsequently retraced half of its gains, perhaps because the deal has not yet been completed and the company has not started to accumulate Bitcoin in earnest. Nevertheless, since the merger announcement, its stock price has still risen by 586.2%.

(Annual chart)

These companies are typical examples of the risks brought by the latest trends in cryptocurrency, where these funding companies are essentially leveraged hedge funds traded on the public market. If investors are not cautious, they may find themselves trapped in a liquidity exit dilemma for institutions that provide reasonable prices to participate in these trades before a significant rise in cryptocurrency.

In fact, an investor who has participated in multiple such transactions anonymously told Unchained: "This is a tricky game that most retail investors should not participate in. It is a game between institutional investors and hedge funds."

PIPE Financing Dream

Not all such transactions will trigger the same warnings as BitMine, Asset Entities, Nakamoto, and SRM. Several factors need to be considered in the transaction. For example, the companies involved in the transaction typically must be low-priced stocks with a low number of circulating shares (the number of shares available for sale in the public market) and total supply. The four companies mentioned above meet this criterion.

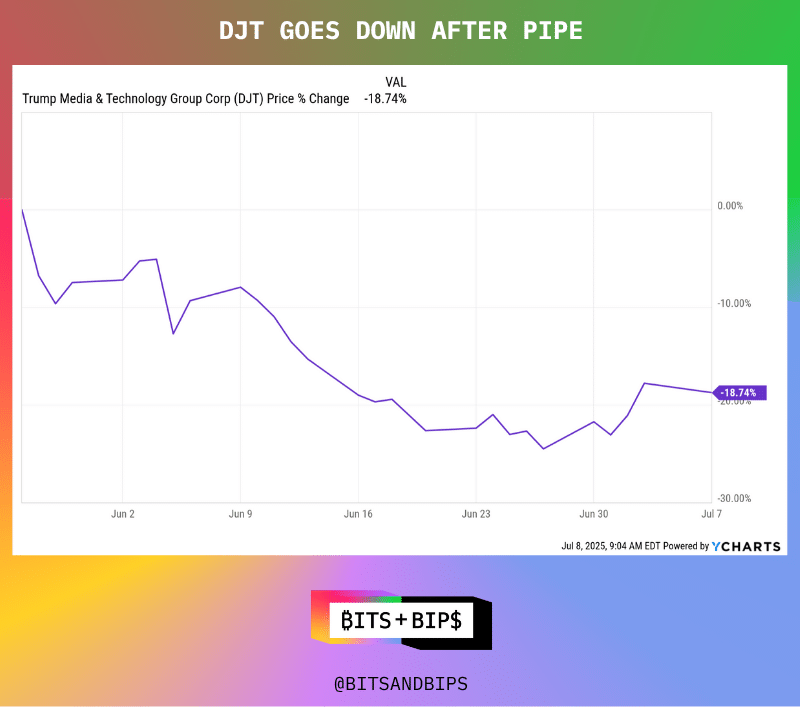

Then, PIPE transactions need to occur, significantly increasing both of these numbers. As shown in the figure below, not all financings meet the criteria. For example, Trump Media Group (DJT) raised $1.5 billion through PIPE on May 27 (as part of a $2.5 billion transaction that includes $1 billion of convertible debt), but its stock price was hardly affected. In fact, it even fell. Compared to the previous three companies, the newly issued 55.86 million shares only increased by 25.32% over its existing 220.62 million shares.

(Annual chart)

(Company press release and SEC documents)

When these stocks become available for sale, igniting the fuse becomes crucial. Unlike stocks sold through a typical IPO, stocks sold through PIPE do not have immediate liquidity because they do not need to be registered with the SEC. The registration process involves the company submitting a registration form to the regulatory agency, typically an S-1 or S-3 document, which contains all the information investors need to make informed purchasing decisions, such as company prospects, use of proceeds, risk factors, etc.

For PIPE companies, especially those based in the U.S. (the requirements and forms for foreign companies are slightly different), the typical route is to submit an S-3 form, as these companies are already publicly traded, making the paperwork less burdensome.

In most cases, companies that raise funds through PIPE will promise investors to submit a registration statement as soon as possible. After all, which investor wants their assets to be locked up? Take the Nakamoto/KindlyMD company presentation as an example. In the slide below, the company promises potential investors that it will submit the S-3 document as soon as possible and notes that PIPE investors have no lock-up period. The company cannot submit the registration statement until the merger is completed, which is expected to be finalized this quarter.

(Nakamoto/KindlyMD)

Unfortunate Encounters in PIPE History

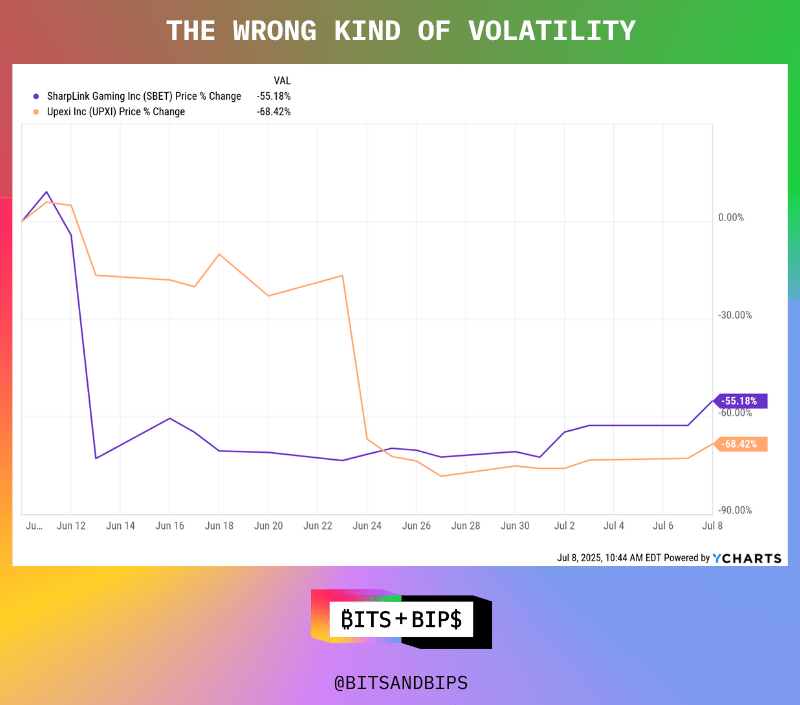

Two important cautionary cases that investors need to be aware of are Upexi (UPXI), a Solana fund management company, and Sharplink (SBET), which focuses on Ethereum. Both companies raised substantial funds through PIPE, and their stock prices plummeted after being listed for trading.

(Annual chart)

Sharplink raised $425 million and increased its outstanding shares from 659,680 to 58.7 million, an increase of 8,893%. On June 12, the company submitted a form called S-ASR, which led to a sharp decline in its stock price. S-ASR is a type of S-3 registration form but slightly different—since the company is a well-known seasoned issuer (WKSI), these shares can be sold immediately, essentially allowing the company to conduct private investment sales, such as PIPE.

A similar story occurred with Upexi, a company that had previously been engaged in real estate technology but repositioned itself as a financial company for Solana this spring. The company raised $100 million through PIPE financing, subsequently increasing its outstanding shares from 1.34 million to 35.97 million, a 25.69-fold increase. The company's S-1 filing became effective on June 23, and the stock price decline depicted in the chart above clearly reflects this.

Sharplink executives did not respond to interview requests regarding the stock price decline, but Upexi arranged for its new Chief Strategy Officer, Brian Rudick, to be interviewed. When asked if he expected such a decline after the effective notice was issued, he replied that there was always a possibility. Rudick stated, "For us, when we go out to raise PIPE, it’s unclear whether everyone will hold their shares for appreciation, or if the market is just worried about potential sell-offs (from nearly all 15 cryptocurrency venture capital firms involved in PIPE). We know that (sell-off) is always a possibility. But to get into the market as quickly as possible, I think the possibility of a sell-off is a trade-off we obviously want to make."

In fact, such a sell-off may be necessary to inject sufficient liquidity into the market for actual price discovery of the stock.

What Financial Companies and Investors Can Do

Given the precedents set by Sharplink and Upexi, Bitmine, Asset Entities, and SRM seem inevitably destined to undergo similar transitional periods. Moreover, they appear powerless to prevent this from happening.

A lawyer familiar with such transactions, who spoke to Unchained on the condition of anonymity, stated, "You can [reach an agreement to prohibit people from selling]. I think the reason you do this is to avoid this superficial phenomenon. Some people might say, 'We don’t want to sell anyway, so we agree to be locked up for a while,' which may superficially provide reassurance. When you have such a large group, it can be difficult to manage. In reality, will anyone do this? I doubt it, but if it can reassure the market, maybe you can."

Therefore, perhaps the next best hope is that investors hold these stocks to avoid paying income tax, opting instead for more favorable capital gains tax. An investor in Upexi and Sharplink, who also wished to remain anonymous and claimed not to have sold shares in either company, articulated his thoughts: "From a tax perspective, constantly buying and selling is inefficient. You only incur short-term capital gains, so you bear 40% tax. If you are directionally long and believe the net asset value premium will roughly stay at current levels, you might only save 20% in taxes."

However, this theory also has two problems. First, if investors believe others may start selling shares, they may panic sell. In other words, they may not want to be the first to sell, but they wouldn't mind being the second. Second, if a company has built a large position based on previously low circulating shares, it does not require everyone to sell shares to drive down the stock price.

Perhaps the best solution is to diversify funding sources when the company issues these bonds. Each option has its pros and cons. PIPE provides a convenient way to raise a large amount of capital in a short time. This helps kickstart accumulation strategies. However, it can also create significant sell-off barriers. Issuers can try different methods of selling stock, such as pre-registering shares with the SEC, but this may take longer to raise the necessary funds. Nowadays, more companies are adopting a hybrid approach, potentially raising one-third of their funds through PIPE, with the remainder coming from convertible bonds or credit arrangements. These methods can delay sell-off pressure but also increase leverage on the balance sheet, which could pose problems if stock prices plummet.

But in this world where scale is paramount, companies will always feel the pressure to raise funds as quickly as possible, which may mean fully committing to PIPE. The market will continue to exhibit a "Wild West" atmosphere, so investors should heed the advice of institutional investors: "Wait until liquidity is sufficient before buying. People should not speculate on how much the premium will rise relative to net asset value. They should wait for sufficient liquidity and market pricing efficiency."

Representatives from Sharplink, Bitmine, Asset Industries, Nakamoto/KindlyMD, and SRM Entertainment either did not respond to inquiries or declined to be interviewed.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。