The outperformance of virtual currencies stems from payment convenience, technological innovation premiums, and supply scarcity, providing investors with an alternative allocation to combat the weakening of the dollar's credit, especially during periods of frequent geopolitical conflicts.

Written by: Li Xiaoyin, Wall Street Insights

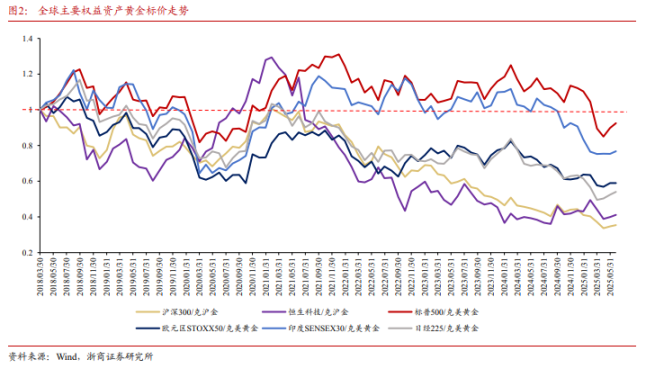

In the context of the normalization of global geopolitical risks, the weakening of the dollar credit system, and rising economic uncertainty, gold has become the "yardstick" for measuring asset value.

Analysts Liao Jingchi and Wang Daji from Zheshang Securities stated in a research report released on the 16th that under the hypothetical "gold standard" framework, the assets that have outperformed gold since 2018 are extremely limited, with only a few virtual currencies, micro-cap stock indices, precious metals industries, and small-cap factor strategies recording positive returns.

The report indicates that this reflects macro characteristics such as the weakening of the dollar's credit, the normalization of global geopolitical risks, and rising economic uncertainty, highlighting the long-term allocation value of gold as a safe-haven asset.

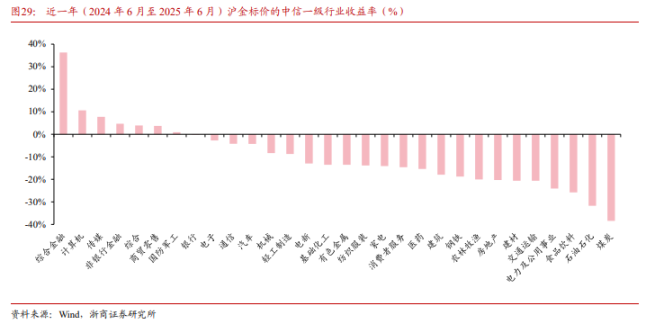

From an industry perspective, Zheshang Securities pointed out that only high-dividend stocks have shown relative resilience in the long term, while recently, financial technology, especially virtual currencies, has significantly outperformed; within secondary industries, precious metals stand out, with new momentum outperforming old momentum; from a style and strategy factor perspective, small-cap stocks are the absolute winners, with the micro-cap stock index outperforming gold in all periods.

Major Asset Classes: Virtual Currencies Stand Out, Others Driven by Liquidity

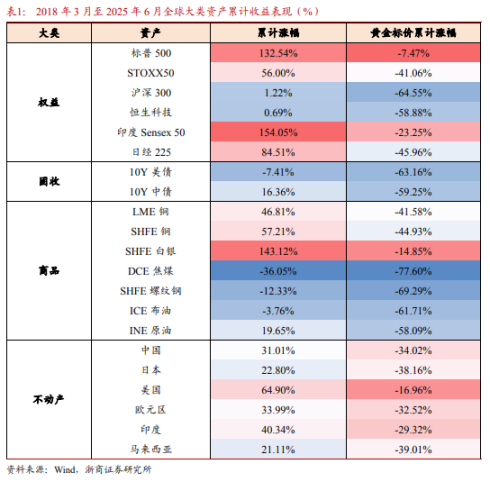

According to the Zheshang Securities report, from March 2018 to June 2025, among major asset classes priced in gold, only a few virtual currencies recorded positive returns, while other categories generally underperformed.

The report points out that the outperformance of virtual currencies is due to payment convenience, technological innovation premiums, and supply scarcity. For instance, Bitcoin's halving mechanism reinforces its "digital gold" attribute, providing investors with an alternative allocation to combat the weakening of the dollar's credit, especially during periods of frequent geopolitical conflicts.

Equity assets show strong nominal growth but are weak when priced in gold, primarily relying on liquidity injections, such as the peak growth rate of the U.S. M2 at 26.7% driving U.S. stocks. However, after excluding "monetary illusion," real returns are limited, warning investors to be cautious of downside risks when liquidity recedes.

The weak performance of fixed income and commodities reflects rising economic uncertainty, while the tight supply and demand for silver makes it relatively resilient. However, oil has dropped 61.7% due to increased shale oil production, which may exacerbate volatility exposure for energy investors.

In real estate, U.S. and Indian housing prices have underperformed to a lesser extent, benefiting from economic resilience and demographic dividends, but overall lag behind gold.

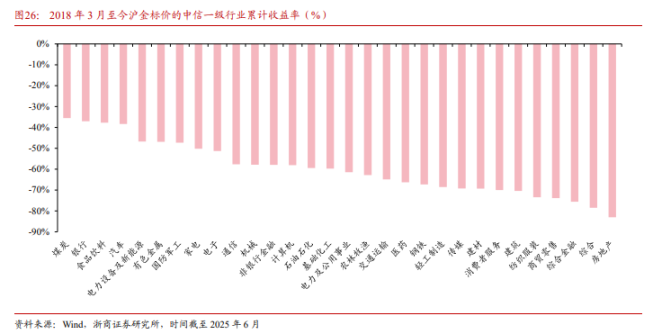

Industry Performance: New Momentum Outperforms Old Momentum, High Dividends Provide Buffer

The report shows that since 2018, all CITIC primary industries have underperformed gold, but resource products and new momentum have shown relative strength, with high dividends in coal and banking (averaging 5.8% and 4.8%) narrowing the gap; when accounting for dividends, the underperformance is even smaller.

At the same time, new momentum industries represented by electric new and TMT have underperformed less than old momentum represented by the real estate chain.

In the past year, alongside the transition of China's economy from old to new momentum, large finance and technology have outperformed comprehensive finance, non-bank finance, and sectors like computers, media, and defense industry, mainly benefiting from increased risk appetite, the catalyst of virtual asset themes, and the revaluation of technology assets. In contrast, resource products, consumer goods, and the real estate chain have significantly underperformed.

In secondary industries, from 2018 to the present, precious metals have exclusively outperformed, with emerging technologies like semiconductors outperforming old technologies since 2018. A barbell allocation (e.g., banking + consumer electronics) can narrow the decline by 39.8%, achieving more robust performance.

In the past year, large finance, new consumption, technology, and military industry have excelled, outperforming emerging financial services II (related to digital currencies), securities II, cultural entertainment (self-consumption), semiconductors, and weapons and equipment II, mainly benefiting from increased risk appetite, the catalyst of virtual asset themes, and the revaluation of technology assets.

Resource products and the real estate chain's weakness reflects insufficient demand, and investors may need to adjust to varieties with high profit certainty.

Style and Strategy: Small-Cap Dominates, Micro-Cap Stocks Highlight Reversal Mechanism

From the perspective of style and strategy factors, small-cap stocks have become the absolute winners.

In the A-share weight style, the report shows that since 2018, only the micro-cap stock index has outperformed gold, benefiting from a reversal investment mechanism, low valuations, and liquidity premiums, with its price fluctuations negatively correlated with ROE and positively correlated with PB.

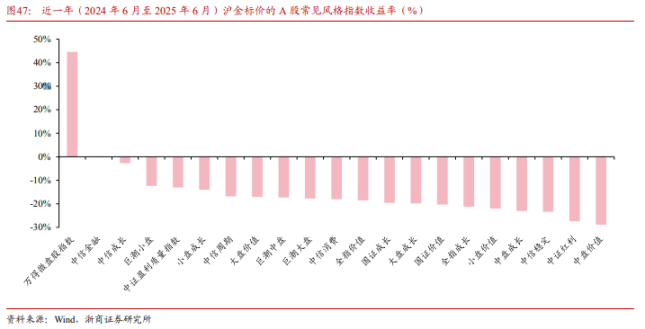

In the past year, micro-cap stocks and financial styles have outperformed gold. It is noteworthy that the dividend style has underperformed significantly, with severe internal differentiation; only banks have performed strongly, while other cyclical dividend varieties have not performed well.

In terms of strategy indices, the small-cap factor clearly leads, with relatively good performance forecasts. Since 2018, the small-cap factor has outperformed gold, while large-cap has lagged, reflecting that industry upgrades favor emerging small caps.

The main viewpoints of this article are derived from the report "Who Outperformed the 'Gold Standard'? — A Deep Review of Assets, Styles, Industries, and Gold" published by Zheshang Securities analysts Liao Jingchi, Wang Daji, and Gao Qisheng on July 16.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。