Hyperliquid enters the Solana ecosystem through Phantom, while Phantom abandons Jupiter and steps out of the Solana ecosystem.

GMX is busy dealing with theft, while Hyperliquid is busy expanding its business.

This time, Hyperliquid strides into the Solana ecosystem. Unlike a simple multi-chain deployment, this time it provides liquidity support through the Phantom wallet. It is surprising that Phantom chose Hyperliquid over Drift and Jupiter.

Compared to merely supporting the Solana chain and Phantom wallet login, Hyperliquid's approach differs from predecessors like dYdX and GMX. It resembles Binance's on-chain version, aiming to become the ultimate source and destination of liquidity for all protocols and dApps, establishing true on-chain foundations with super liquidity.

A Third Path

To understand Hyperliquid, one cannot simply discuss Hyperliquid itself.

It must be compared with spot DEXs like Uniswap. From the perspective of spot trading, contract products are akin to gambling with borrowed money to trade cryptocurrencies, making it extremely difficult to maintain liquidity. Note that the challenge for spot DEXs is liquidity creation, which is why AMM and Bonding Curve are incredibly important.

Uniswap can promote more assets to participate in trading through multi-chain deployment, even if it only operates on its own chain, it can still facilitate protocol TVL growth. However, contract DEXs, whether dYdX, GMX, or Hyperliquid, must "attract" liquidity to gather in one place, which is also a natural advantage of centralized exchanges like Binance.

Centralization naturally favors liquidity concentration.

It must be compared with peers like dYdX and GMX. GMX's perspective on Perp DEX combines dYdX's off-chain order book matching, on-chain trading, and liquidity tokenization, which is the essence of GMX's crazy revenue in 2022. It maintains liquidity through the "induction" from LP Token to GMX Token.

Hyperliquid is similar, but operates more delicately. The closed HyperCore is responsible for spot and contract trading, which is the main basis for considering Hyperliquid centralized. HyperEVM handles the "blockchain" part, leading to a vague operational concept that keeps Hyperliquid in a superposition of decentralization and centralization, with super liquidity and matching efficiency hidden within.

For the overall architecture of Hyperliquid, refer to: Hyperliquid: 9% Binance, 78% Centralization

Decentralization naturally favors brand effects.

It must grow alongside the dynamic game with Binance, aiming to become the strongest liquidity provider, combining centralized efficiency with decentralized experience. Improvements in dYdX's order book matching mechanism, GMX's liquidity token "bribery" mechanism, and the role of BNB connecting BNB Chain and the main site—$HYPE connecting HyperCore and HyperEVM.

Ultimately, Hyperliquid has resolved multiple contradictions that were previously difficult to couple. Systems engineering once again demonstrates its magic, stacking existing technological elements to create the optimal PMF in the current market, even improving upon Binance's approach.

• Multi-chain deployment / centralized liquidity

• Bridging / chain abstraction / aggregator / intent

• Decentralized UI / centralized UX

To become the market's infrastructure, it must capture as many entry points as possible. Phantom is well-suited as a traffic conduit for the Solana ecosystem, but it cannot subsidize to gain market share; profit-sharing is a wiser approach than token subsidies.

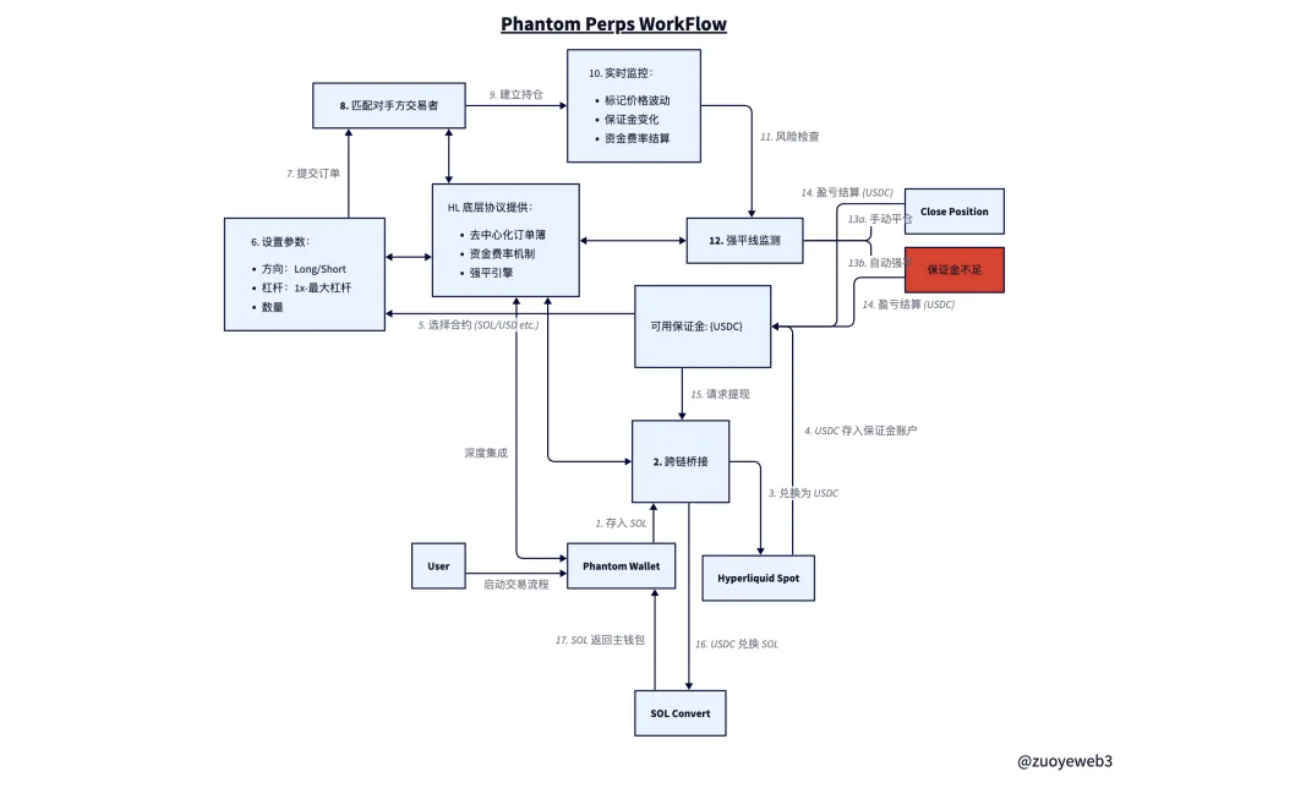

In the design concept of Phantom Perps, unlike logging into dYdX or Drift, it embeds Hyperliquid within its own interface. The premise is that SOL on Solana is bridged into Hyperliquid's spot account and exchanged for USDC, which is then transferred to Hyperliquid's contract account to serve as margin.

The bridging may be supported by Hyperunit provided by Unit protocol, but it is not entirely certain. Additional information is welcome, and security assessment is also crucial.

In the subsequent trading process and liquidation phase, the roles of Phantom and Hyperliquid are reversed. The Phantom interface only displays relevant information, while actual operations are entirely controlled by Hyperliquid. This is the biggest difference from dYdX and Drift, as user funds will genuinely enter the Hyperliquid system.

After deciding to close a position, the user's profit or loss will be denominated in USDC but will gradually unwrap into SOL. Specifically, USDC needs to first enter the spot account from Hyperliquid's contract account, then be exchanged for SOL in the spot market, and finally bridged back to the Solana chain, ultimately displayed in SOL form within Phantom.

The benefit of this approach is greater capital freedom.

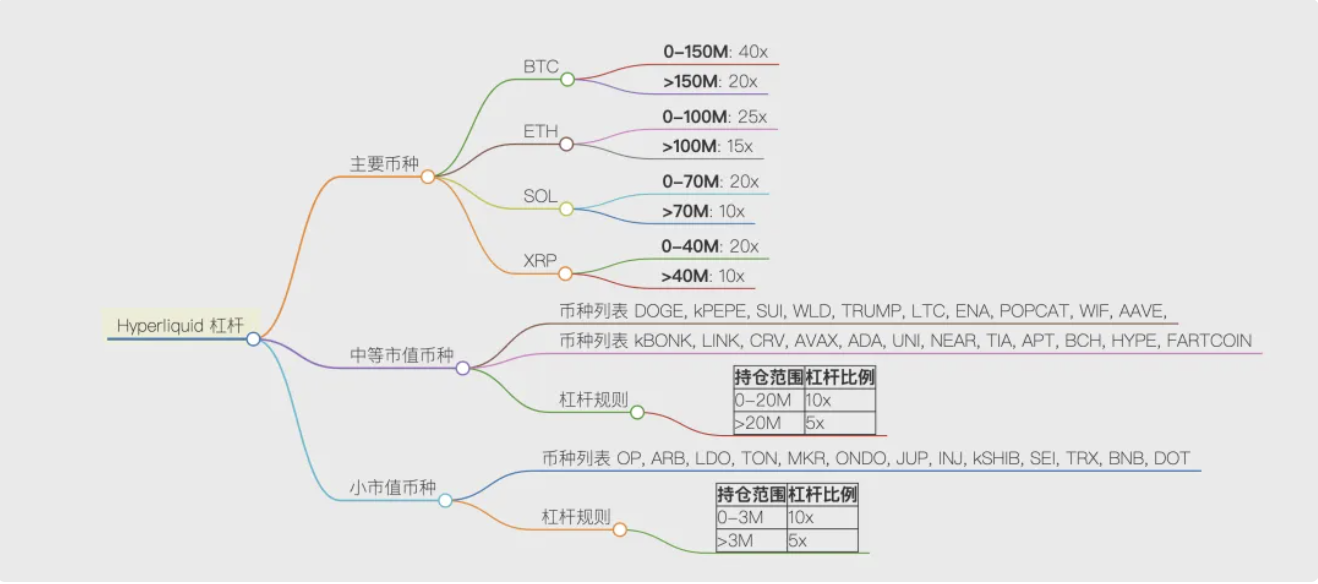

Once users' SOL enters Hyperliquid, they can trade any cryptocurrency supported by Hyperliquid. Depending on the amount of capital, they can choose up to 40x leverage. However, after frequently encountering attacks, Hyperliquid's style is that the more niche the cryptocurrency and the larger the position, the lower the leverage multiple will be.

The downside of this approach is that system security may decrease.

The entry and exit of bridged assets will be tested during extreme market fluctuations.

During the trading process, users need to trust Hyperliquid, essentially requiring a trust level equivalent to that of centralized exchanges like Binance, meaning the exchange will not misappropriate user assets and will execute matching according to user instructions.

Hyperliquid is not simply collaborating with Phantom; it aims to use it as an ally to penetrate and control Solana, undoubtedly launching an active attack on local DEXs in Solana. Centralized exchanges like Binance and local DEXs on various chains will need to consider how to face Hyperliquid.

BNB has outperformed any exchange token, representing Binance's grasp of liquidity. Hyperliquid is similar, spanning from spot to Perps, from Ethereum to Solana, and this is a charge that must succeed or perish.

Emerging Revenue Points

Hyperliquid is not cheap; in other words, it has strong profitability.

Compared to dYdX and Binance, Hyperliquid has never won by being cheap. Coincidentally, Phantom is also a small profit powerhouse, from SOL staking to trading, with strong capabilities for business diversification from single-chain to multi-chain.

MetaMask is already a distant myth in the wallet world, while Phantom is the reality.

However, it is not yet enough to be considered the future. Backpack also wants to compete in Solana, and OKX Wallet is a formidable competitor. Since the integration of CEX and DEX is the main theme of this cycle, Binance + Pancakeswap, OKX main site + OKX Wallet, Backpack Wallet + Backpack Exchange all have their own opportunities and strategies.

Stablecoins will continue to exist, but how long meme coins and on-chain issuance and trading tools can last is uncertain. Public chains and DEXs need to find new growth points. Hyperliquid itself is a repository for public chains, DEXs, stablecoins, and meme coins, but it lacks wallet tools, or rather, it needs to reach a broader retail and mass market.

This is indeed counterintuitive, but whales are the main players in Hyperliquid. Although they have sufficient capital, without a sufficient number of retail investors, it is difficult to operate stablecoins, meme coins, or even higher-frequency, daily-use products like RWA.

The significance of retail investors lies in conducting marginal innovations and reaching the masses. A sufficient amount of data is needed to "emerge" intelligence, and randomness can trigger countless possibilities for evolution.

Coincidentally, Phantom has a sufficient number of retail investors, at least the most in Solana.

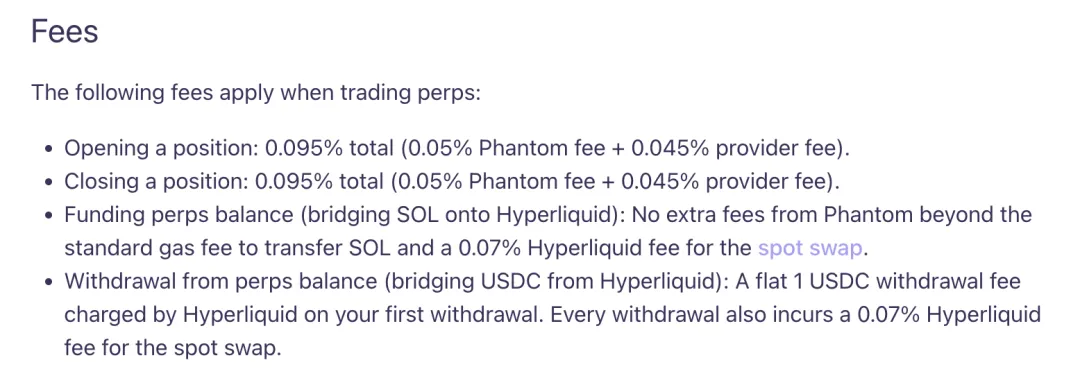

Moreover, the cooperation between the two is also profitable. Thoughtful charging points have been set up at various angles and entry/exit points. Both Phantom and Hyperliquid will charge at their gates. It remains to be seen if competitors have good ideas for speeding up and reducing costs. Will HL + Phantom also become a dragon?

Conclusion

HL decides to attract more new users through wallets, while Phantom hopes to break free from the stereotype of being a Solana wallet and move towards a more mainstream market.

CEXs compete in cryptocurrency stocks, while DEXs actively acquire customers. It can be seen that crypto traffic has reached a bottleneck; simple product types can no longer support their own business. Mutual competition, acquisition, and attacks will become increasingly frequent.

Each cycle will be an arena for exchanges and public chains. This time, will it be Hyperliquid against Binance, Solana against Ethereum?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。