Author: 10K Ventures

This article attempts to comprehensively outline the technological path, market landscape, institutional evolution, and profit logic of stablecoins, constructing a panoramic framework for understanding stablecoin trends. This article is also the first in a series of studies, and we will subsequently release research on topics such as RWA and tokenized stocks.

Evolutionary Path of Stablecoins

The birth of stablecoins is a natural result of the cryptocurrency asset system's attempt to solve the fundamental problem of "currency value volatility." Whether it is Bitcoin, Ethereum, or other decentralized assets, their openness and scarcity form the foundation of the digital asset system. However, their severe price fluctuations and lack of a stable valuation anchor make it difficult for them to function as currency in daily transactions and payments. The introduction of stablecoins aims to bridge the gap between "censorship-resistant settlement means" and "predictable currency value."

The Prototype of Stablecoins: Tether and the Initial Attempts of On-Chain USD

The launch of Tether in 2014 marked the first structural attempt at stablecoins. Its principle is simple and straightforward: users transfer USD into Tether's company account, which then issues an equivalent amount of USDT stablecoins on the blockchain, promising a 1:1 redemption. This model of "fiat currency collateral + off-chain custody + on-chain issuance" essentially outsources the issuance rights of USD deposits to private institutions, forming a business model similar to a Narrow Bank.

The key to Tether's success lies in its first-mover advantage in the market, the on-chain liquidity network effect, and its ability to fill the gap in the demand for USD settlement in crypto trading. At the same time, the off-chain custody asset structure of USDT has also sparked controversy, as its held assets are not entirely cash or government bonds but include commercial paper, precious metals, and even Bitcoin. This mixed asset structure, while enhancing yield capability, also leaves a regulatory gray area in terms of trust.

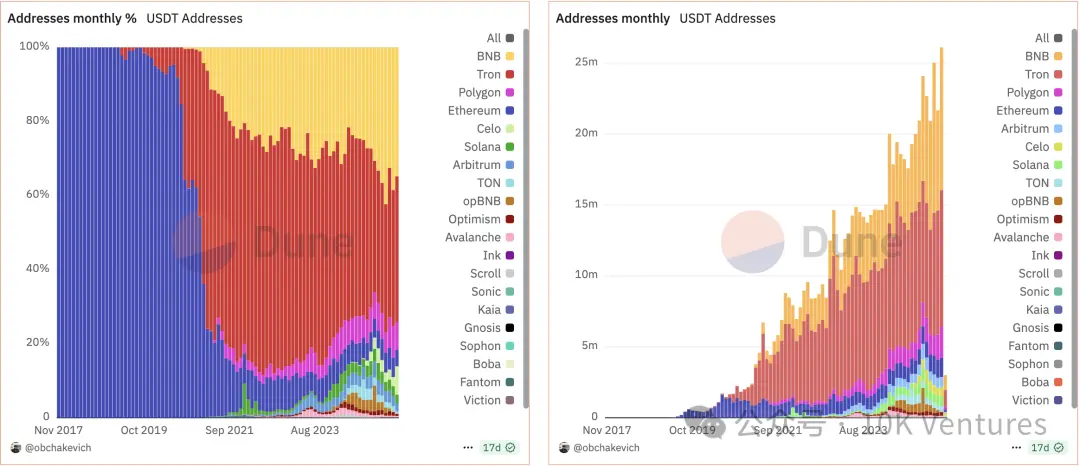

The Timeline of USDT Launch on Various Chains

Proportion of USDT Usage Among Various Blockchain Users

As regulatory requirements increased and the market's pursuit of transparency strengthened, Circle's USDC stablecoin gained favor among mainstream institutions in 2018. Unlike Tether, Circle operates under a regulated financial system in the U.S., jointly initiated with Coinbase, and its reserve assets consist entirely of cash and short-term U.S. Treasury bonds, which are regularly disclosed through third-party audit reports. USDC represents a path toward the compliance of stablecoins and has become a reference model for the U.S. government's push for compliance legislation on "payment stablecoins."

Crypto-Collateralized Stablecoins: The Emergence of DAI and the Foundation of the DeFi Ecosystem

If Tether and USDC are the "centralized tokenized versions" of on-chain USD, then the launch of DAI opened the stablecoin model under the decentralized finance (DeFi) paradigm. DAI, launched by MakerDAO in 2017, no longer relies on fiat currency custody and bank accounts but instead uses on-chain collateralization of Ethereum assets, with smart contracts automatically minting and burning tokens.

The issuance of DAI relies on an over-collateralization mechanism. Users need to collateralize ETH worth more than 150% to obtain an equivalent amount of DAI and can retrieve their collateral after repaying the loan. This mechanism initially operated well, addressing the demand for decentralized USD among on-chain users and becoming the foundational currency for "interest markets" and "leverage structures" in the rise of DeFi applications.

However, this model, centered on ETH as the core collateral asset, faces risks related to volatility and liquidation efficiency. During the "3.12 crash" event in 2020, DAI encountered issues such as a clogged liquidation system and debt black holes, prompting widespread reflection within the community on the model's safety. Subsequently, MakerDAO added diverse collateral options such as USDC, WBTC, and even real-world assets (RWA), significantly reducing its degree of decentralization but enhancing its stability. DAI gradually transformed from a fundamentalist "crypto-collateralized stablecoin" to a "multi-collateral synthetic dollar system."

The Rise and Disillusionment of Algorithmic Stablecoins: The Systemic Warning of the UST Incident

While fiat-collateralized stablecoins like Tether and USDC provide compliance and stability, and crypto-collateralized stablecoins like DAI explore decentralized paths, another type of algorithmic stablecoin model claiming "no collateral needed" quickly attracted market attention. This model attempts to maintain price anchoring through protocol-driven supply and demand adjustments, achieving a stability mechanism driven purely by mathematical logic.

UST in the Terra system is the most representative case. UST does not rely on fiat or crypto asset collateral but anchors itself through a dual-token adjustment mechanism with its sister coin LUNA—when UST is above $1, users can mint 1 UST by using $1 worth of LUNA; when UST is below $1, they can exchange 1 UST for $1 worth of LUNA, thus achieving arbitrage hedging. However, this model lacks real asset support at its core, and its stability relies entirely on market confidence in LUNA.

As the incentive mechanisms of the Terra ecosystem expanded, the total issuance of UST surpassed $10 billion by the end of 2021, making it the third-largest stablecoin after USDT and USDC. However, a massive redemption wave in May 2022 triggered UST's de-pegging, and the protocol's automatic minting of LUNA failed to stem the collapse of confidence, leading LUNA into a "death spiral" and UST to zero. This collapse directly resulted in the evaporation of hundreds of billions of dollars in assets and caused algorithmic stablecoin models to collectively "exit" in the face of global regulation.

The Emergence of New Forms: The Financial Engineering and On-Chain Interest Rate Mechanism of USDe

The failure of UST did not end the exploration of stablecoin models; rather, it sparked the emergence of a new generation of stability mechanisms. At the end of 2023, the USDe stablecoin launched by Ethena proposed a different approach: using a "Delta-Neutral" structure to hedge against stablecoin price fluctuations while relying on on-chain interest income for support.

The issuance of USDe is based on a collateral asset portfolio primarily consisting of Ethereum, combined with a strategy of shorting perpetual contracts to hedge against volatility risks. Users can deposit ETH, stETH, or USDC, and the platform will convert them into delta-neutral structured assets before issuing USDe. This structure theoretically stabilizes net asset value through a combination of spot long and contract short positions. Additionally, Ethena's sUSDe allows users to stake USDe to participate in profit sharing, with annualized returns derived from the combination of perp funding rates and stETH staking rates, potentially reaching 20-30%.

The key to the USDe model lies in its "yield stability mechanism" based on real on-chain arbitrage income. Unlike traditional stablecoins that rely on external assets or redemption confidence, this model uses on-chain interest differentials as a source of reserve support, tightly binding the stablecoin to on-chain liquidity and market expectations. Meanwhile, Ethena provides additional insurance mechanisms and redemption windows for USDe, aiming to enhance its systemic resilience and transparency.

The effectiveness of this model still requires periodic validation, especially during low funding or fluctuations in on-chain liquidity. However, it is undeniable that USDe brings a new direction to stablecoins: generating sustainable income through on-chain mechanisms, providing asset support with market-neutral strategies, and embedding native protocols into DeFi application scenarios, representing a transition attempt from static "token mapping" to dynamic "yield assets."

Current Market Landscape of Stablecoins: Four Major Classification Logics and Institutional Reconstruction

With the introduction of the "U.S. Stablecoin National Innovation Act" (GENIUS Act), the global stablecoin market is entering a new stage of institutional reconstruction. This legislation clearly regulates core issues such as issuance thresholds, reserve structures, payment functions, and the pathways for technology companies to participate, with far-reaching implications comparable to a "watershed event." Under this new institutional framework, the stablecoin market is showing clearer factional differentiation, which can be preliminarily summarized into four main forces: the compliant sovereign faction, the efficiency pragmatist faction, the political capital faction, and the institutional counterattack faction of traditional banks/tech giants.

Compliant Sovereign Faction: USDC Alliance

Representatives: Circle (USDC), Paxos (PYUSD), Gemini (GUSD)

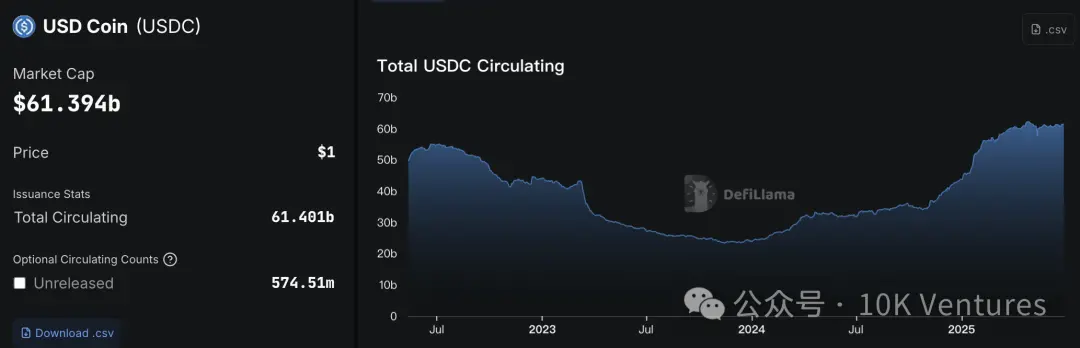

As regulations become clearer, stablecoin issuers that first adapt to the regulatory framework gain a first-mover advantage. For example, Circle's USDC is projected to have a market value close to $61 billion by June 2025, with its reserve structure entirely composed of cash and short-term U.S. Treasury bonds, meeting the "≤93 days" requirement for reserve assets under the STABLE Act.

USDC, as a representative, strictly adheres to the provisions of the GENIUS Act, with a reserve structure primarily consisting of 100% cash and short-term government bonds, and regularly discloses audit reports, making it highly compliant and favored by institutional clients, custody platforms, and mainstream financial infrastructure.

Total Market Value of USDC, Source: Defillama

These issuers generally possess:

State-chartered bank or trust licenses

Monthly reserve audit reports

A clear 1:1 redeemable mechanism

However, Circle faces a significant issue of high dependence on Coinbase's distribution channels in its revenue model. According to reports, Circle's total revenue for 2024 is expected to reach $1.68 billion, but its profit is only $167 million, primarily because Coinbase takes a large portion of the channel fees and marketing rewards. (This will be elaborated in the "Profit Models of Leading Stablecoin Companies" section)

In terms of revenue structure, stablecoin issuers can achieve billions in annual interest income by managing reserve assets (such as U.S. Treasury bonds). For instance, Circle's annual revenue for 2024 is projected to reach $1.68 billion, with approximately 99% coming from reserve investment income.

Circle successfully went public in 2025, with a clear strategic intent behind its IPO to reduce reliance on Coinbase, strengthen its independent issuance and compliance service capabilities, and gain more support from financial institutions and bank-level users. However, the issues cannot be overlooked—strong regulation also brings "channel dependence," with a significant portion of USDC's trading volume driven by Coinbase, which uses this bargaining power to suppress Circle's profits while retaining some custody rights over USDC. This structure of "compliant stablecoin × distribution oligopoly" has also raised new risks such as centralization and platform lock-in.

Efficiency Pragmatist Faction: USDT Alliance

Representatives: Tether (USDT), Ethena (USDe), DAI (MakerDAO)

Tether has built a typical operational system of "off-chain regulatory leniency + on-chain high efficiency," with the market capitalization of USDT issued by Tether consistently ranking first among global stablecoins. As of June 2025, the circulating market value of USDT is close to $150 billion, with its advantages lying in extreme efficiency and market network effects. Its reserve strategy is relatively flexible, with some funds allocated to high-yield assets that are not government bonds (such as Bitcoin, gold, and private debt), forming a "high-yield arbitrage" type of stablecoin.

The advantages of Tether include:

Extremely low global distribution costs, with chains like TRON and Solana heavily relying on its liquidity, and a more profitable reserve asset structure (including some Bitcoin, precious metals, and non-government bond securities), establishing strong demand barriers in markets with weak financial infrastructure such as Latin America and Southeast Asia.

Unlike Circle, Tether leverages its leading position to reverse harvest channel fees. Major exchanges actively integrate USDT to meet user demand, which helps Tether significantly reduce issuance costs, allowing its per capita profit level to surpass that of traditional financial giants at times.

In the face of the "high-pressure regulation" of the GENIUS Act, Tether adopts a "dual-track strategy": maintaining the flexibility of USDT in overseas markets while preparing to launch a fully compliant new type of stablecoin for the U.S. market. However, even with partnerships like Cantor Fitzgerald and political endorsements, its "global stablecoin" model remains in a gray area in the U.S.

On the other hand, representatives like USDe (Ethena) and DAI (MakerDAO) are moving towards on-chain synthetic models. DAI has transformed into a quasi-compliant hybrid model through "RWA + DSR + veToken governance"; while USDe adopts a "collateralized ETH + arbitrage hedging" model, constructing a "pseudo 1:1" redemption mechanism for yield-stablecoins.

Their common characteristics are: on-chain native, interest rate sensitive, and highly composable, but they also face "policy uncertainty"—for example, the "Endogenously collateralized stablecoins" clause in the STABLE Act may impose blanket restrictions on their role as "payment stablecoins."

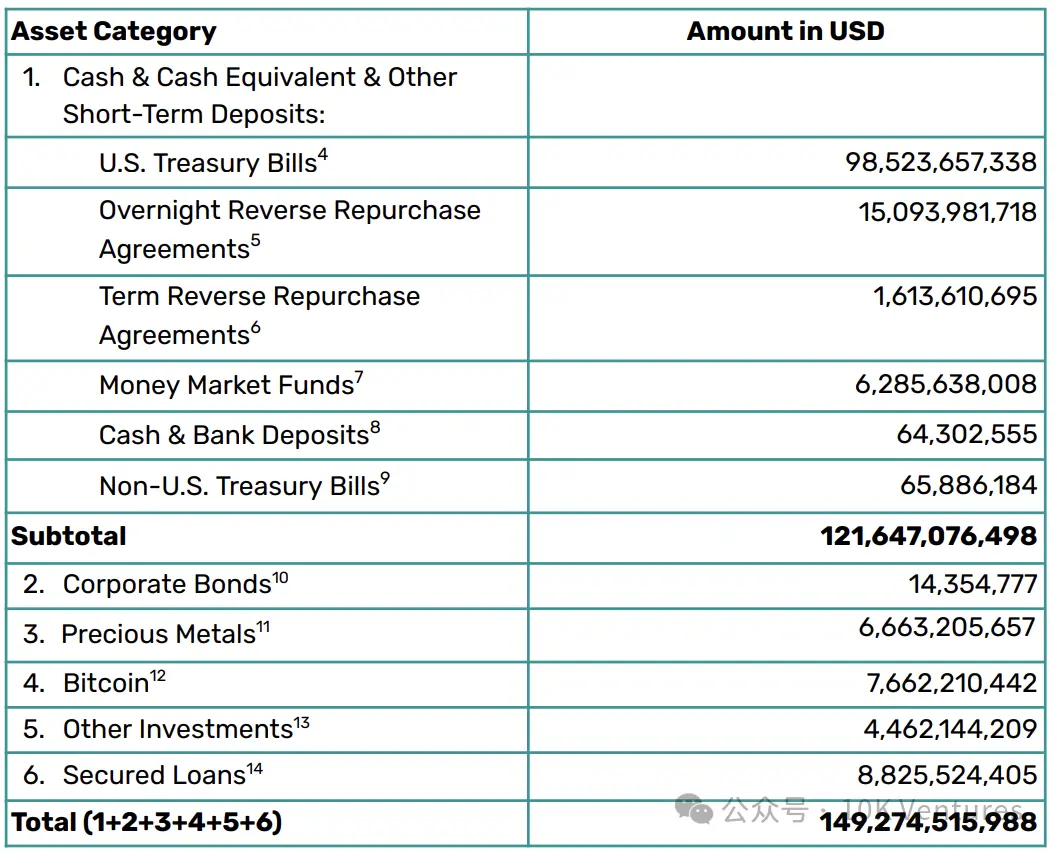

Composition of Tether's Reserve Assets in Q1 2025, Source: BDO Audit Report

Political Capital Faction: Building USD1 and Sovereign Trading Systems

Representative: USD1 (World Liberty Financial)

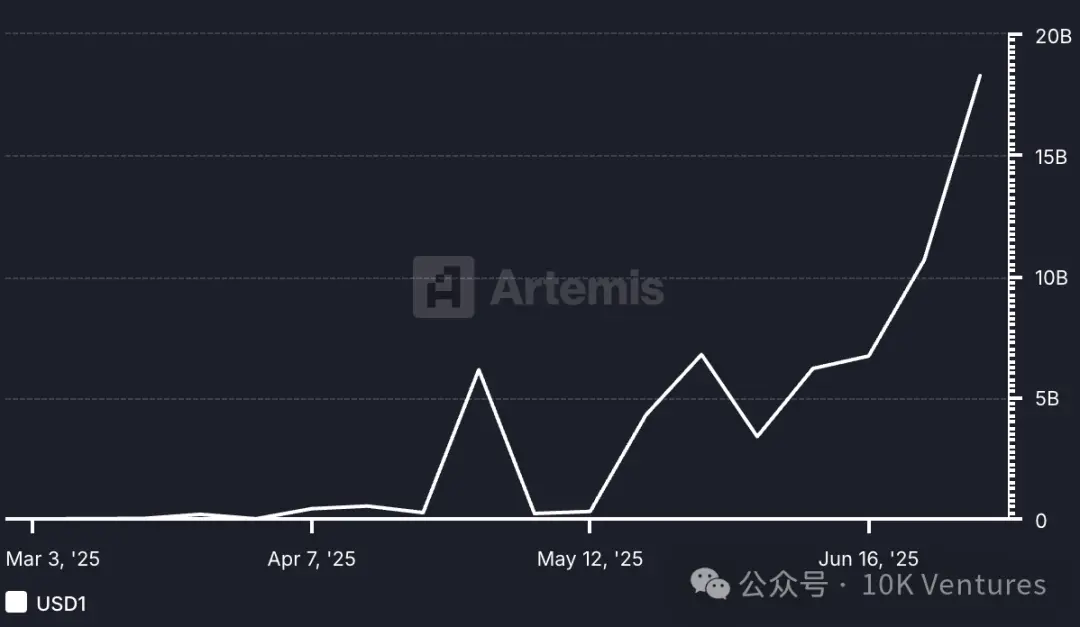

The USD1 stablecoin project, driven by World Liberty Financial and closely related to the Trump family, is characterized by its reliance on political resources and sovereign capital to leverage market application scenarios, such as a $2 billion investment partnership with the UAE sovereign fund MGX, utilizing Binance to build trading depth and liquidity.

Additionally, such projects focus more on "scenario building" rather than "technological breakthroughs." The arrangement of issuing on the TRON chain with Sun Yuchen as a strategic advisor is a strategic combination of "technical foundation + political cover."

Although USD1's path bypasses some traditional financial channels, its high dependence on political stability and Middle Eastern resource relationships also sows uncertainty for its future growth.

Changes in USD1's Trading Volume, Source: Artemis

Market Structure of Stablecoins: Scale, Participants, and Competitive Landscape

As stablecoins evolve from tools for matching crypto trades to the infrastructure for global digital payments, their market structure is showing a more layered and differentiated pattern. From issuance models, asset reserves, circulation mechanisms to regional compliance, various stablecoins form a complex network interwoven with multiple rule systems, interest entities, and usage scenarios.

Total Market Volume and Share Distribution

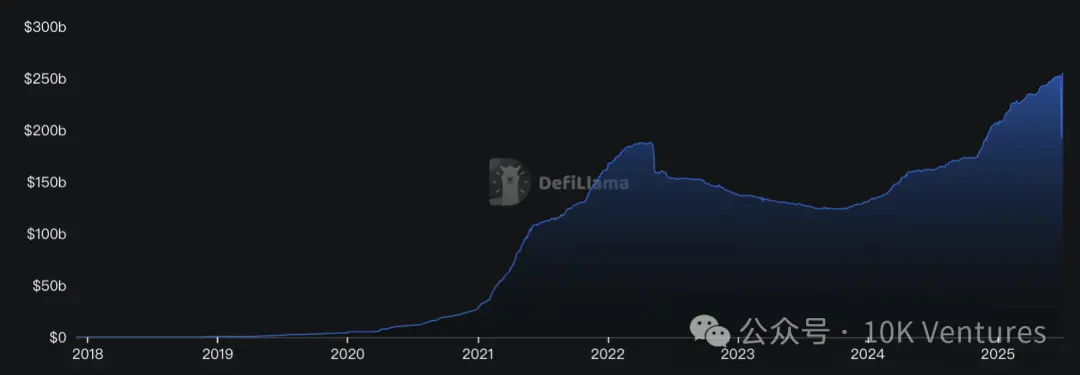

Global Stablecoin Market Capitalization Growth Trend (2019–2025): The total market capitalization of stablecoins has risen from less than $10 billion at the end of 2019 to over $250 billion by the second quarter of 2025. This represents an increase of more than five times since the end of 2020, reflecting an explosive expansion in demand for stablecoins and a rapid enhancement of their status in the crypto market.

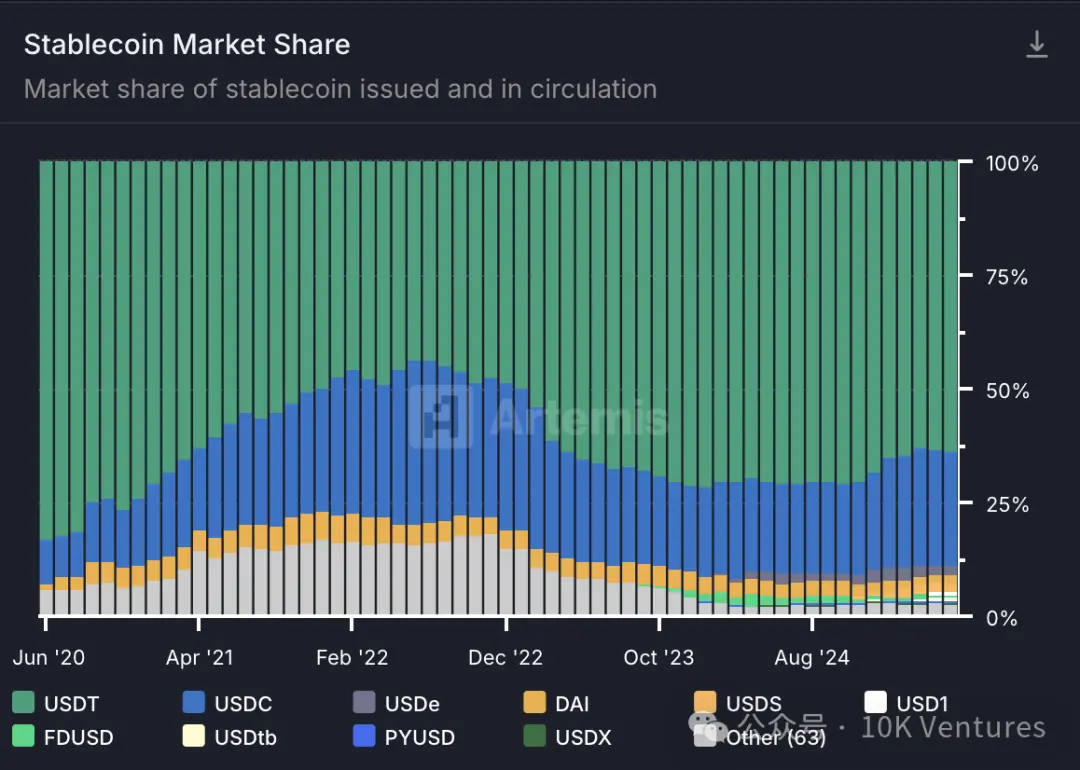

Currently, the total market capitalization of stablecoins accounts for about 7-8% of the total crypto market value. Among various stablecoins, USDT and USDC dominate, together accounting for over 88% of the market share (USDT: 63.5%, USDC: 24.9%).

USDT remains the largest stablecoin, with a supply exceeding $118 billion in 2024, accounting for nearly 75% of the stablecoin market value at that time; by mid-2025, the circulation of USDT further increased to about $150 billion, representing approximately 63% of the total global stablecoin supply.

USDC is the second-largest stablecoin, with a market capitalization in the range of $40-50 billion, accounting for about 20%. Additionally, other stablecoins such as DAI, FDUSD, TUSD, USDe, and PYUSD collectively make up the remaining market share, each forming a certain influence within specific user groups and scenarios.

Stablecoin Market Share Structure (by Market Capitalization)

As of the latest quarter, USDT accounts for approximately 69.0%, USDC for about 20.7%, DAI for around 3.1%, FDUSD for about 1.7%, and the emerging yield-type stablecoin USDe for about 1.5%, with other stablecoins collectively accounting for about 4.0%. It is evident that USDT and USDC hold an absolute dominant position in the stablecoin landscape. USDT occupies a leading position due to its long-established trading network effects, widespread user trust, and ample liquidity, with its user base valuing its network breadth, market depth, and relatively stable operational record. Meanwhile, USDC has gained favor among institutional and corporate users due to its highly compliant and transparent reserve management—its reserves are audited weekly by licensed accounting firms and primarily consist of cash and short-term U.S. Treasury bonds. This transparency and compliance advantage has allowed USDC to gain higher trust and adoption rates in formal financial channels such as banks and payment companies.

It is noteworthy that in a high-interest-rate environment, issuers of fiat-collateralized stablecoins also achieve considerable returns. For example, Tether disclosed that it holds approximately $97 billion in U.S. Treasury bonds and repurchase agreements in its reserves (as of Q2 2024), with monthly interest income nearing $400 million. This indicates that as the scale grows, the stablecoin business itself is becoming an important profit center, further reinforcing the advantages of leading stablecoins in terms of capital and credibility.

Looking ahead, as global regulations gradually clarify and user demand continues to grow, the stablecoin market still has room for expansion. The news of the U.S. Senate passing the stablecoin bill in June 2025 temporarily pushed the total global stablecoin market capitalization to a historic high of $251.7 billion, indicating that favorable policies may further enhance market confidence in stablecoins. Although the market structure of mainstream stablecoins is relatively stable, the rise of new types of stablecoins (such as the yield-generating USDe) is continuously expanding the boundaries of the stablecoin market, injecting new competitive dynamics into this field.

Regional Distribution

The global usage map of stablecoins is showing significant regional differences. On one hand, stablecoins have achieved the "spillover" of dollar value, acting as tools for inflation resistance and dollar substitution in emerging markets; on the other hand, the differing regulatory environments across regions also influence the types of stablecoins preferred locally and the level of on-chain activity.

United States and Developed Markets: In the U.S. market, due to stricter regulatory requirements, institutions and enterprises prefer compliant and transparent stablecoins. For example, USDC issued by Circle and PYUSD launched by payment giant PayPal have been adopted by many financial institutions and tech companies. On payment networks like Visa and Mastercard, USDC is being used for cross-border settlements and merchant payments, enabling instant payments in digital dollars. For instance, in June 2025, Shopify announced a partnership with Coinbase and Stripe to integrate USDC stablecoin payments, allowing a global e-commerce network worth over $140 billion to accept digital dollar payments. In these scenarios, stablecoins serve as a compliant and transparent payment loop, making their transparency and regulatory filing particularly important. Therefore, the U.S. market is dominated by stablecoins like USDC and PYUSD, which are anchored and issued through the Ethereum mainnet and trusted banking channels, with relatively limited speculative and trading demand. Additionally, regions like Europe, Singapore, and Japan are also formulating stablecoin regulatory frameworks (such as the EU's MiCA and Singapore's MAS regulations) to cultivate compliant local stablecoins (such as the euro EURS and Singapore dollar XSGD). The commonality among these developed regions is a greater emphasis on the issuer's licensing qualifications and reserve audits, with stablecoin usage more reflected in B2B cross-border payments, trade settlements, and wealth management rather than personal hedging.

Emerging Markets and Developing Countries: Regions such as Latin America, Africa, the Middle East, and South Asia have a particularly strong demand for stablecoins, viewed as tools for dollar substitution and financial inclusion. In countries with high inflation and currency depreciation, residents and businesses purchase stablecoins in large quantities to hedge against currency value declines, conduct cross-border remittances, or for daily settlements. According to Chainalysis data, Latin America is the leading region for the real-world application of stablecoins: 71% of surveyed institutions cite cross-border payments as the primary use case for stablecoins, significantly higher than the global average of 49%. Many Latin American businesses have achieved efficient cross-border remittance experiences that traditional banking systems struggle to reach by combining stablecoins with local payment networks. For example, Brazil received approximately $90.3 billion in crypto inflows from July 2023 to June 2024, ranking first in Latin America. Among the crypto flows from local exchanges to overseas, stablecoins accounted for as much as 70%. As the local currency, the real, depreciated, the trading volume of stablecoins on Brazilian exchanges surged by 207.7% year-on-year, far exceeding the growth of Bitcoin or Ethereum during the same period. This reflects that local businesses and individuals are increasingly turning to stablecoins as a vehicle for cross-border funds to gain exposure to the dollar and avoid exchange rate risks.

In Africa, stablecoins also play a role as an alternative for everyday finance. Nigeria's crypto inflows reached $59 billion between 2023 and 2024, with approximately 85% of the transferred amounts being below $1 million—indicating that the majority consists of small to medium retail transactions, showing a high level of grassroots adoption. Many Nigerians bypass bank regulations by using stablecoins like USDT in peer-to-peer markets to store value and transact instead of using the naira. The cost advantage of stablecoins compared to traditional remittance channels is particularly significant: cross-border remittances using stablecoins can incur fees as low as 0.1% of the transfer amount, while traditional remittance fees often reach 7-8% or more. This gap means that using stablecoins can save 98% of remittance costs, with funds arriving almost in real-time (completed within minutes), whereas traditional wire transfers may take 2-5 days. For example, after experiencing a 30% depreciation of its currency, the Ethiopian birr in 2024 saw a surge in the local retail-level stablecoin transfers, which increased by 180% year-on-year as the public flocked to stablecoins for hedging. Statistics show that stablecoins currently account for about 43% of the total crypto transaction volume in sub-Saharan Africa. It can be said that in African countries with weak financial infrastructure, stablecoins provide an unprecedented low-cost and fast means of value transfer, regarded as a "revolutionary" tool for improving remittance and payment systems.

Asia and Other Regions: The use of stablecoins in the Asia-Pacific region presents a more diversified landscape, encompassing institutional applications in developed economies as well as retail demand in developing markets. For instance, India ranks first in the global crypto adoption index, with about 68.8% of its crypto transaction volume coming from large transfers valued at over $1 million—indicating that it is primarily driven by institutions and high-net-worth individuals, with stablecoins widely used for trade settlements and fund management. In Southeast Asia, Singapore's XSGD stablecoin has processed over 10 billion Singapore dollars worth of on-chain transactions since its issuance in 2020. In the second quarter of 2024, Singapore's stablecoin payment volume reached approximately $1 billion for the quarter, reflecting a growing interest from local fintech companies and cross-border e-commerce in compliant stablecoin payments (with about 25% for small retail scenarios and 75% for corporate payments). Indonesia has emerged as a new leader in Asia: between 2023 and 2024, Indonesia received approximately $157.1 billion in crypto asset inflows, ranking third globally, with an annual growth rate close to 200%. Most of Indonesia's transaction volume is concentrated on decentralized exchanges and token trading, but stablecoins still play an important role, helping local users save about $300 million annually on cross-border payments and dollar preservation.

Overall, the penetration rate of stablecoins in developing countries is much higher than in developed countries. This is due to the strong demand for dollars under the pressure of exchange rate fluctuations and inflation in emerging markets, as well as the fact that stablecoins lower financial barriers and fill gaps in the traditional banking system. Research from the World Economic Forum indicates that stablecoin adoption rapidly increases when local currencies depreciate—this pattern has been confirmed in various regions including Latin America, Africa, and Southeast Asia. Conversely, in places like the U.S. and the EU, stablecoins are more often used as tools for tech companies and financial institutions to enhance payment efficiency rather than as a necessity for residents. Thus, we see "dollar stablecoins" spreading globally, but the adoption methods vary by region: on one end, companies like Stripe and Visa are embedding stablecoins into payment pathways, while on the other end, street vendors in Nigeria are quoting prices in USDT. This uneven geographical distribution suggests that the advancement of regulations and market education in various countries will profoundly impact the regional evolution of the stablecoin landscape.

Use Cases and Ecological Integration

The application of stablecoins has long surpassed the realm of transaction matching, deeply integrating into various financial scenarios such as payments, lending, wealth management, and remittances, becoming an indispensable component of the blockchain ecosystem. An increasing number of multinational payment companies are incorporating stablecoins into their channels; Visa has allowed the settlement of some cross-border credit card transactions using USDC through the Circle platform; remittance companies like MoneyGram also offer stablecoin cash-out services, enabling users in developing countries to send and receive USDC and immediately convert it to local fiat currency. In the e-commerce sector, platforms like Shopify have integrated stablecoin payments, allowing small and medium-sized merchants to easily receive digital dollars from overseas without worrying about high fees and settlement delays associated with traditional acquiring.

Global Payments and Remittances

The outstanding advantages of stablecoins in remittance scenarios focus on lower costs and faster speeds:

Fee Costs:

Traditional cross-border remittances through bank wire transfers or remittance companies (like Western Union) average fees of about 5% to 8%, with some small channels even reaching double-digit percentages. For example, in 2023, the average remittance fee rate in Latin America was 5.8%, while in Africa, it exceeded 8%.

In contrast, stablecoin remittances only require payment of gas fees, which in many cases are just a few cents at a fixed rate. For instance, in Africa, the average fee rate for remitting $200 using stablecoins is about 60% lower than traditional methods.

Arrival Speed:

Traditional SWIFT cross-border transfers often take 2-5 business days, passing through multiple intermediary banks for settlement and can only be processed on business days, with delays during weekends and holidays. Stablecoins, on the other hand, are confirmed within minutes through peer-to-peer transmission on the blockchain. A stablecoin transfer on a high-performance chain can be credited in just a few seconds.

Moreover, stablecoin networks operate 24/7, unaffected by time zone differences and business hours. This is particularly crucial for small households that rely on immediate cash flow. Faster settlements also reduce the risk of exchange rate fluctuations; in traditional remittances, the exchange rate can fluctuate significantly during the days the funds are in transit, potentially eroding the value of the remittance, while stablecoins lock in value through instant conversion.

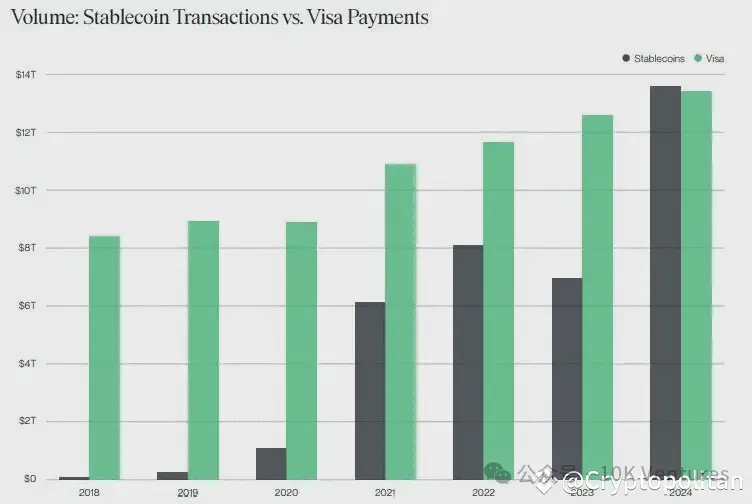

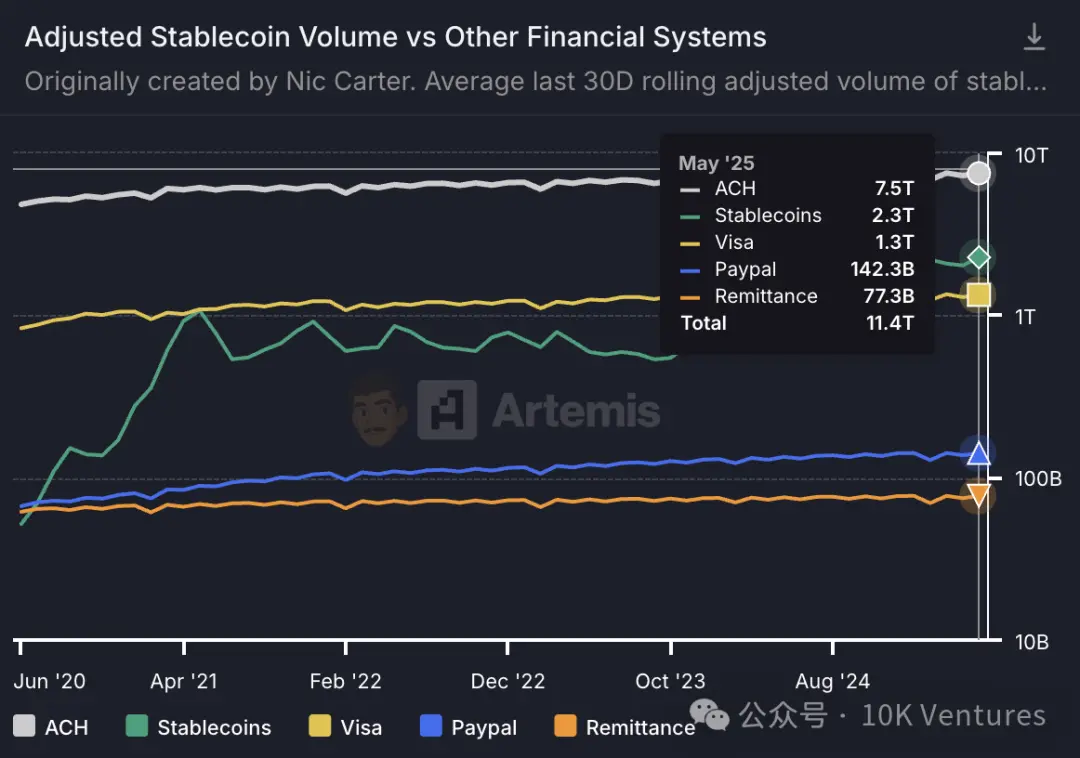

In summary, stablecoins are becoming a transformative force in cross-border remittances in emerging markets. Over the past year, the number of active stablecoin wallets globally has increased by 53% to over 30 million; the monthly on-chain transfer volume of stablecoins has surged from $1.9 trillion at the beginning of 2024 to $4.1 trillion at the beginning of 2025, cumulatively processing about $35 trillion in value transfers throughout the year, a scale that rivals or even exceeds the transaction volume of traditional international payment networks.

Numerous successful cases of stablecoin remittances in regions like Latin America, Africa, and Southeast Asia demonstrate that their low cost and high efficiency are meeting the urgent needs of ordinary users and small businesses. Of course, the large-scale application of stablecoins still relies on the support and cooperation of regulations in various countries, particularly in terms of anti-money laundering and user protection.

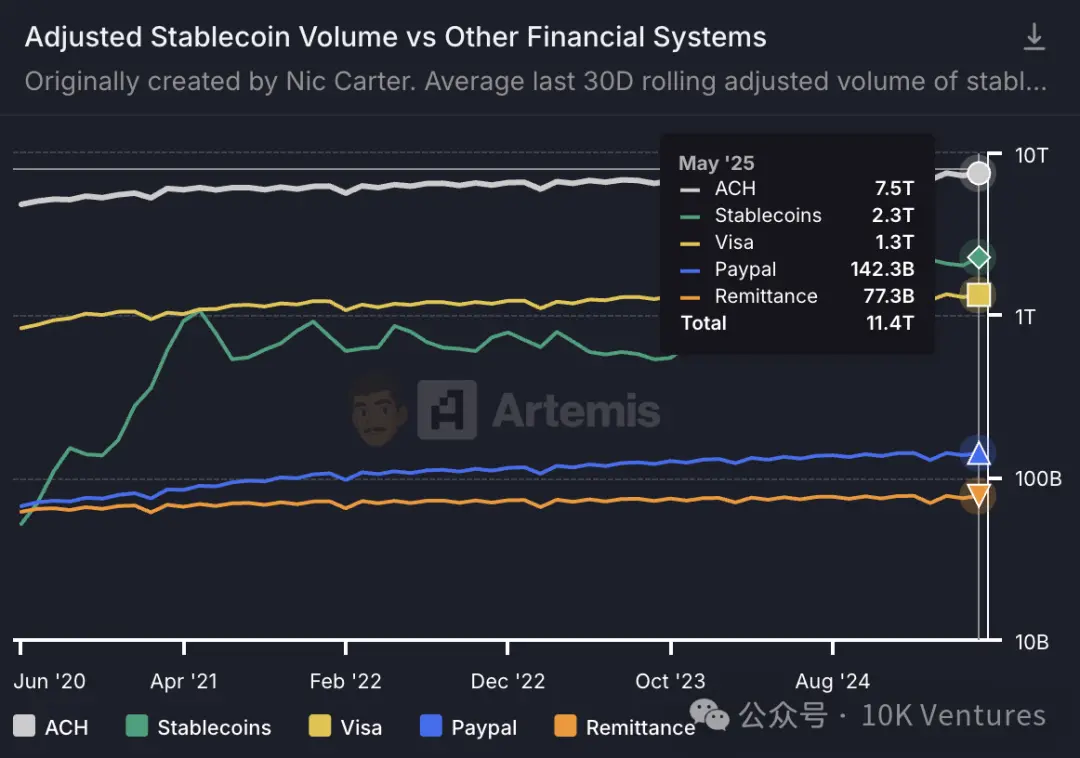

Source: aremisanalytics, the settlement amount of stablecoins exceeds Visa, becoming the world's second-largest settlement framework.

On-Chain Lending and Synthetic Finance

In the DeFi world, stablecoins are the most important base currency, widely used in activities such as collateralized lending, leveraged trading, and yield farming. Users can deposit stablecoins into lending protocols to earn interest or use them as collateral to borrow other assets. Many leveraged traders borrow stablecoins to amplify their positions, as stablecoin prices are stable and do not introduce additional volatility risks like borrowing BTC or ETH. Stablecoins are also commonly used as funds for arbitrage and market making: arbitrageurs borrow stablecoins to sell or buy assets on different exchanges, profiting from price differences; market makers hold both tokens and stablecoins simultaneously, providing liquidity in AMM pools to earn fees. It can be said that without stablecoins, there would be no thriving DeFi ecosystem today.

OTC Trading and Over-the-Counter Markets

Clearing Medium Function in Emerging Markets

Due to foreign exchange controls and restrictions on the inflow and outflow of fiat currency, OTC networks in emerging markets extensively use stablecoins for settlement. USDT plays a "shadow dollar" role in countries like Nigeria, Argentina, and Venezuela, used for pricing, exchanging, and saving goods. Local residents use USDT for payments through channels like Telegram, forming a parallel financial system.

After implementing foreign exchange controls, Nigerians found it difficult to obtain dollars on the black market, so they turned to Telegram groups to use USDT for payments related to imports and exports. In high-inflation countries like Argentina and Venezuela, residents immediately convert their pesos into USDT to preserve value and use peer-to-peer channels for consumption or to exchange back for cash. It can be said that stablecoins are acting as a parallel financial system in these regions: USDT/USDC serve as dollar substitutes, exchanges and wallets function as bank accounts, and blockchains serve as clearing networks. Although this portion of transactions largely operates outside traditional regulations, it meets real market demands and objectively promotes the growth of stablecoin circulation globally.

Commercial Payments and Supply Chain Finance

Multinational companies are beginning to adopt stablecoins for B2B settlements, shortening settlement cycles and reducing foreign exchange costs. Cross-border e-commerce uses USDC to directly pay overseas suppliers, while mining companies use USDT to pay for equipment, achieving near-instantaneous settlement. In the field of supply chain finance, stablecoins provide technical tools for accounts receivable securitization, accelerating cash flow. Some government agencies have already accepted stablecoin tax payments.

Competitive Landscape and Ecological Layout

The competition among stablecoins has shifted from stability of value to ecological competition. USDT dominates trading and OTC markets, while USDC leads in compliant payments and corporate services. Each issuer is actively expanding application scenarios: Circle provides USDC enterprise integration APIs, Tether invests in cross-border payment channels, and decentralized communities explore the integration of DAI with credit systems.

In summary, stablecoins are moving from the crypto sphere into mainstream finance, becoming a bridge connecting different economic systems. Future competition will focus on who can provide more efficient stablecoin services under the premise of security and compliance. The market structure is developing towards multi-layered division of labor and collaboration, and stablecoins are expected to become an important financial infrastructure in the digital economy era.

Profit Models of Leading Stablecoin Companies

Circle

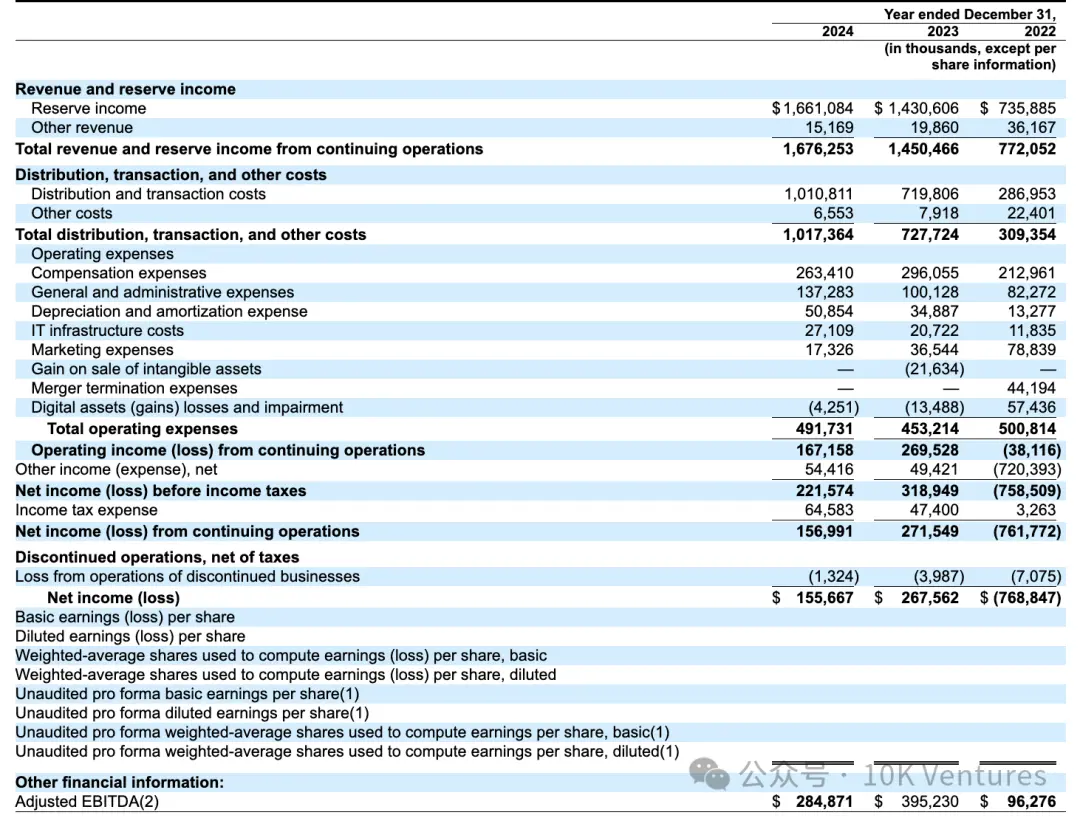

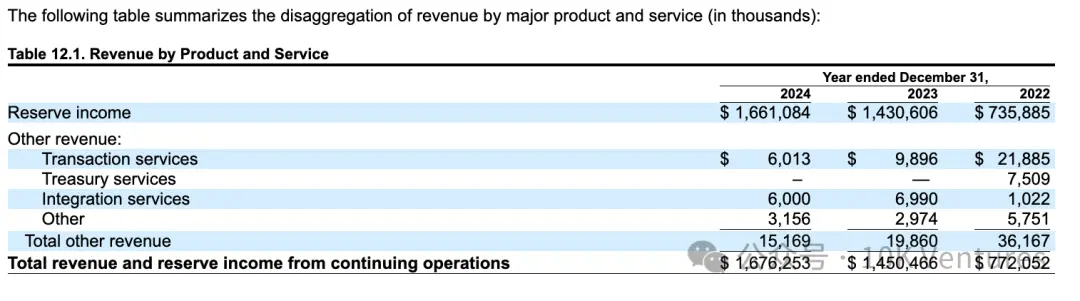

Circle Internet Financial's core revenue source is derived from the interest on USDC reserves: over 90% of Circle's revenue comes from USDC reserve interest, primarily from investments in U.S. Treasury bonds and reverse repurchase agreements, with a small portion from bank deposit interest;

Collaboration with Coinbase allows most interest income to be distributed to token holders in the form of "user rewards," which is treated as marketing expenses;

By reclassifying part of the "distribution expenses" as marketing costs, Circle significantly improves its reported gross profit margin;

Additionally, Circle's revenue from its enterprise payment network, developer APIs, and other sources currently accounts for a small proportion (less than 5%), but has growth potential in the future.

Composition and Trend Changes of Interest Income

Reserve interest is the absolute main source of Circle's income. Circle's revenue model is extremely simple: it invests the dollar reserves obtained from issuing USDC into safe, short-term interest-bearing assets to earn interest income. According to Circle's disclosures, over 99% of its revenue in 2024 came from interest generated by USDC reserves, up from 98.6% in 2023 and 95.3% in 2022, showing a trend of increasing concentration as interest rates rise.

Specifically, Circle's reserve interest income was only $735 million in 2022, skyrocketing to $1.43 billion in 2023, and further increasing to $1.66 billion in 2024. This surge is primarily attributed to the rise in short-term interest rates in the context of the Federal Reserve's rate hikes. Even though the circulation of USDC declined in 2023, it still drove a significant increase in interest income.

Composition of Reserve Assets

U.S. Treasury bonds are primarily used for reverse repos, supplemented by bank deposits. According to Circle's S-1 filing, the company adheres to strict reserve management standards, with 80-90% of USDC reserves allocated to cash equivalents such as short-term U.S. Treasury bonds and overnight reverse repos, while the remaining 10-20% is kept as demand deposits in banks for liquidity.

Since January 2023, Circle has concentrated its reserves in the Circle Reserve Fund managed by BlackRock (a government money market fund open only to Circle), which invests in U.S. Treasury bonds maturing within three months, overnight U.S. Treasury repurchase agreements, and a small amount of cash. For example, in 2024, Circle held an average of about $37.5 billion in this fund, with approximately $6.4 billion deposited in accounts at globally systemically important banks (GSIBs). The bank deposit portion also generates interest (with an average rate of about 3.96% in 2024), but due to its smaller proportion, its contribution is far less than that of Treasury bonds and repurchase agreements. In other words, Circle's interest income mainly comes from U.S. Treasury bond interest and reverse repo earnings, while bank deposit interest accounts for only a small fraction.

Trend Changes: Rising Interest Rates Drive Surge in Interest Income

The rapid interest rate hikes by the Federal Reserve have caused the yield on Circle's reserve investments to rise from less than 0.5% at the beginning of 2022 to around 5% in 2023. In 2022, Circle's average reserve yield was only 2-3%, but by 2023, it had exceeded 5%. Despite a decline in USDC circulation following the Silicon Valley Bank incident in mid-2023, rising interest rates still doubled Circle's interest income. Throughout 2024, interest rates remained high (with the U.S. 3-month Treasury yield around 5.1%), and Circle's reserve interest continued to grow. It can be said that during the analysis period, Circle's income was highly benefited by the macro interest rate environment: rising rates were "favorable" for Circle's profitability, while entering a rate-cutting cycle would put downward pressure on its income. According to the sensitivity analysis in the prospectus, if interest rates were to decrease by 200 basis points, Circle's annual profit could drop by as much as $414 million (equivalent to nearly 1.6 times its net profit in 2024).

Cooperation Mechanism with Coinbase and USDC Interest Sharing

Coinbase is both an important distribution channel for USDC and a key partner for Circle. In 2018, the two parties jointly established the Centre consortium, initially agreeing to share interest income based on the proportion of USDC they each issued or held in custody. Under this model, "the more USDC one issues (or holds), the more interest they receive," effectively incentivizing Coinbase to actively promote the adoption of USDC. In August 2023, the Centre consortium was dissolved, and Circle took full control of USDC governance while granting Coinbase a minority stake and signing a new three-year collaboration agreement.

The new agreement adjusted the revenue-sharing mechanism: Circle first deducts a small portion of the issuer retention fee to cover compliance and operational costs, and then the remaining interest income is split into two tiers for Coinbase:

Platform Share (Party-product slice): Allocated to Coinbase based on the proportion of USDC held on Coinbase's platform relative to the total circulation; USDC on Circle's own platform also receives a proportionate share of the earnings.

Ecosystem Share (Ecosystem slice): After the above distribution, if there are still remaining earnings, Circle and Coinbase each take 50%, but Coinbase must fulfill its obligation to promote USDC (ensuring users can easily purchase USDC, integrating it into key products, and participating in policy support, etc.).

This new revenue-sharing arrangement means that Coinbase can obtain a considerable interest share from USDC, regardless of whether it is within or outside its platform. The higher the proportion of USDC held on Coinbase's platform, the more Coinbase earns; conversely, if more USDC circulates on Circle or third-party platforms, Coinbase's share decreases. In recent years, the proportion of USDC on Coinbase's platform has significantly increased, rising from about 5% at the end of 2022 to about 20% by the end of 2024, and further to 25% by March 2025. Coinbase has become one of the most important issuance and custody channels for USDC, which not only brings scale growth to Circle but also means that a significant portion of the revenue must be shared with Coinbase.

USDC interest sharing is used to issue "rewards" to users. Coinbase uses the USDC interest share it receives from Circle primarily to pay USDC balance rewards to users holding USDC on its platform (similar to a return of interest income). This essentially means that Coinbase subsidizes user holding income with its own earnings to enhance the attractiveness of USDC to users. For example, in the second half of 2023, Coinbase raised the annualized rewards for ordinary users holding USDC to nearly 5%, significantly stimulating the retention and growth of USDC on its platform. In accounting treatment, Coinbase classifies these USDC user rewards as marketing expenses, included in sales and marketing costs. In 2024, Coinbase's USDC user rewards expenditure reached $224 million, a staggering increase of 542% compared to $34.94 million in 2023. Coinbase explained that increasing the USDC reward rate aims to enhance customer acquisition, retention, and platform engagement, representing a marketing investment. Therefore, although this portion of interest comes from USDC reserves, it is ultimately treated as Coinbase's marketing cost in the form of "user rewards."

In 2024, the scale of revenue sharing greatly benefited Coinbase. As USDC interest income surged, the amount shared with Coinbase increased correspondingly. According to the prospectus, Circle confirmed a total of $1.017 billion in "distribution, transaction, and other costs" in 2024, of which approximately $908 million was paid to Coinbase.

In other words, about 54% of Circle's total revenue that year was transferred to Coinbase as a revenue share. This figure was approximately $248 million and $691 million in 2022 and 2023, respectively, corresponding to 40% and 50% of the annual revenue. It is evident that Coinbase, with its strong user base and distribution capability, is capturing an increasingly larger share of the revenue within the USDC ecosystem. Some analyses suggest that after deducting the rewards paid to users, Coinbase's net earnings from the USDC business may even exceed Circle's own. This highlights Coinbase's strong position in the USDC ecosystem: it is both the "rainmaker" for Circle's revenue growth and the "toll booth" for capturing profits.

Classification of Distribution Costs Reduces Reported Gross Margin

Circle classifies channel distribution expenses related to the issuance and circulation of USDC as "distribution and transaction costs," directly included in operating costs and deducted from revenue. The $908 million paid to Coinbase and the $74.1 million strategic fee paid to Binance are processed in this manner, resulting in a reported gross margin of only 39%.

These distribution expenses are economically akin to customer acquisition costs and have the nature of marketing expenses. If reclassified as marketing expenses rather than cost of goods sold, Circle's gross margin would approach 100%, as acquiring interest income itself incurs almost no direct costs. However, regardless of accounting classification, Circle still needs to share over 60% of its revenue with partners, with the proportion of distribution costs rising from 40% in 2022 to over 60% in 2024.

Marginal Income: Enterprise Payment Network and API Services

Currently, other income remains limited in proportion. Apart from reserve interest, Circle also has a small amount of income from transaction and infrastructure services, referred to as "other income." This includes fee income from providing payment settlement, digital wallet, and blockchain integration services to enterprise clients through APIs, as well as technical service fees charged for assisting new blockchains in integrating USDC. However, at present, this portion of income is quite small.

The prospectus reveals that in 2024 and 2023, Circle's other product income accounted for only 1% of total revenue, and just 5% in 2022. In monetary terms, other income in 2024 was approximately $36.17 million, which is negligible compared to the total revenue of $1.676 billion. Circle has yet to effectively break free from its single reliance on interest income.

Outlook for Development Potential

The market has high hopes for Circle's ability to expand income beyond interest. Investors expect Circle to make substantial progress in areas such as cross-chain bridges (CCTP), merchant payments, and enterprise APIs, thereby "improving revenue quality." According to Tanay Jaipuria's analysis of the S-1, the public market has implicitly priced in Circle achieving double-digit USDC circulation growth in the future and gaining significant traction in fee-based products. Management has also stated that it will continue to invest in developing new products and gradually achieve revenue diversification. However, as of early 2025, these marginal revenues are still in the nurturing phase, contributing little to overall performance. Circle's short-term performance fluctuations still primarily depend on USDC interest income; only by deeply cultivating the stablecoin ecosystem and providing differentiated value-added services can it gradually increase the proportion of non-interest income and enhance business resilience.

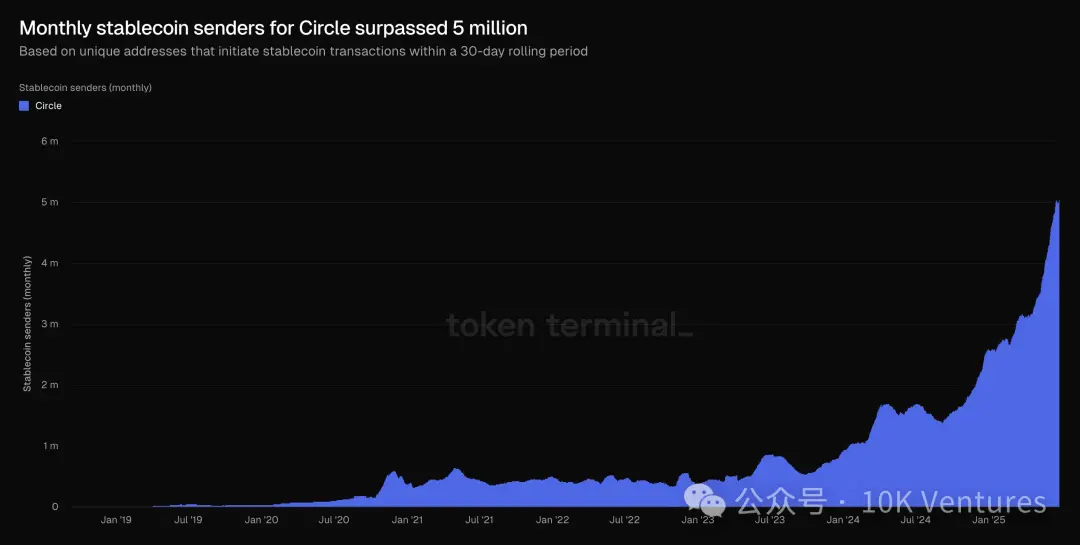

The incremental curve of USDC users, source: Token Terminal

Tether

U.S. Treasury Interest Income

Currently, Tether's main revenue comes from the interest generated by its substantial holdings of U.S. Treasury bonds. As the Federal Reserve's interest rate hikes have pushed up U.S. Treasury yields, Tether's short-term Treasury bond portfolio has become its core source of "low risk, high return" income in recent years.

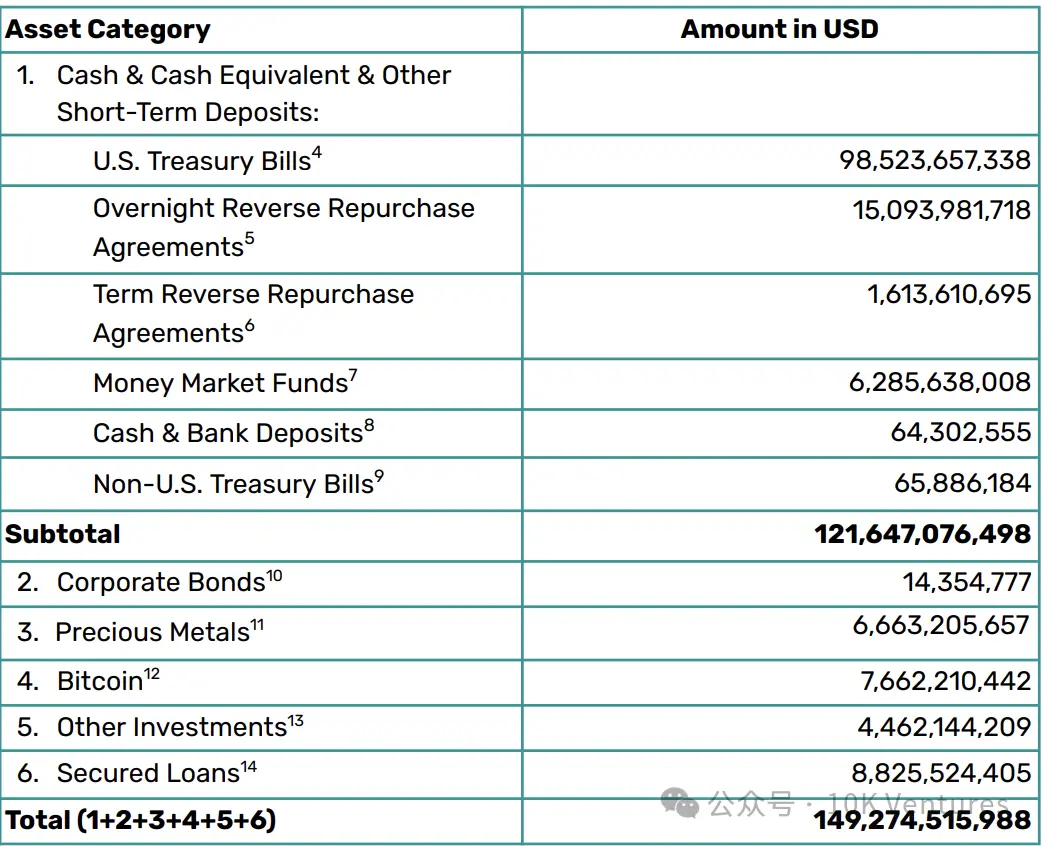

Currently, Tether directly holds $98.524 billion in U.S. Treasury bills, while its holdings in money market funds amount to $6.286 billion, with $4.885 billion held through funds; overnight reverse repurchase agreements total $15.094 billion, and U.S. Treasury bonds used as collateral amount to $15.087 billion.

Tether's exposure to U.S. Treasury bonds through various means reaches:

Directly held U.S. Treasury bills: $98.524 billion

Indirectly held (through money market funds): $4.885 billion

Controlled as collateral: $15.087 billion

Totaling approximately $118.496 billion related to U.S. Treasury bonds, accounting for about 79.4% of total reserves of $149.275 billion.

In the first quarter of 2024, Tether reported a record net profit of $4.52 billion, of which approximately $1 billion came from U.S. Treasury interest income. This figure represents a significant increase compared to previous quarters, reflecting the impact of rising U.S. Treasury rates combined with the expansion of Tether's reserves. In a high-interest environment, Tether's quarterly interest income has exceeded the billion-dollar mark.

Redemption and Transaction Fee Income

Tether also generates some fee income through the issuance and redemption of its stablecoin. According to its regulations, the minimum amount for purchasing or redeeming USDT directly on the Tether platform is $100,000, with a redemption fee of 0.1% (at least $1,000), and a purchase fee also set at 0.1%. These fees cater to the large redemption needs of institutions and provide Tether with a stable cash flow. During periods of significant market volatility, large redemption volumes can translate into company revenue: for example, during the turmoil in the crypto market in 2022, Tether redeemed over $20 billion in just a few weeks while maintaining redemption stability (the redemption volume in the second quarter alone brought in tens of millions of dollars in fees for the company).

Additionally, in a multi-chain environment, users frequently use USDT for transfers and transactions, reflecting its value as infrastructure in the crypto market. As of April 2025, Tether's cumulative revenue for the year was approximately $1.46 billion, significantly higher than other blockchain platforms (with Ethereum's revenue around $157 million and Circle's profit of about $620 million during the same period). Overall, compared to the massive interest income, the redemption/transaction fees, while secondary, provide a stable revenue supplement, reflecting the widespread application of USDT in transaction settlements.

Evolution of Asset Allocation and Profit Model

Tether's profit model is closely related to the composition of its reserve assets, which has undergone significant adjustments at different stages:

Early Stage (2019–2021)

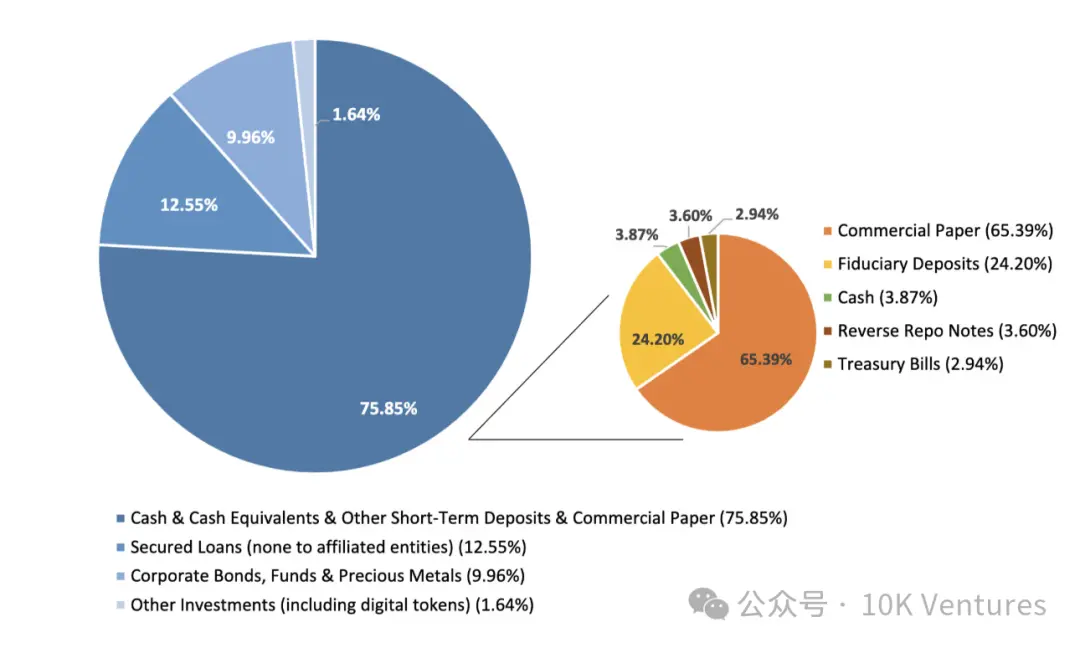

In a global low-interest environment, Tether allocated a large amount of credit assets and high-yield investments in its reserves to increase returns, with a low proportion of cash and Treasury bonds and a high proportion of risk assets. For example, in March 2021, when the reserve details were first disclosed (audited by Moore Global, a Caribbean auditing firm with only five employees at the time), only 2.94% of the reserves were U.S. Treasury bonds, while 49% consisted of relatively illiquid commercial paper, with the remainder made up of secured loans (12.55%), corporate bonds and precious metals (9.96%), and other investments (1.64%, including a small amount of digital currency).

At that time, U.S. Treasury rates were near zero, and the company sought additional returns by holding commercial paper and short-term credit assets, but it also took on higher credit and liquidity risks. During this phase, Tether's revenue structure can be described as a "high-risk, low-interest" model: interest income was limited, primarily relying on returns from risk investments and fees from stablecoin operations, while also facing market skepticism (such as early lack of independent audits and the opacity of commercial paper quality).

Tether's reserve structure during this phase:

Commercial paper accounted for 65.39% of cash and cash equivalents

U.S. Treasury bonds accounted for 2.94%

Secured loans accounted for 12.55% of total reserves

Corporate bonds and precious metals accounted for 9.96%

Other investments (including digital currency) accounted for 1.64%

Transition Phase (2022)

In response to regulatory pressure and industry concerns about reserve safety (events like the collapse of TerraUSD prompted scrutiny of stablecoin reserve quality), Tether significantly adjusted its asset allocation in 2022. The company gradually reduced its holdings of commercial paper and announced in October 2022 that it had completely eliminated commercial paper, shifting to primarily U.S. Treasury bonds and cash equivalents.

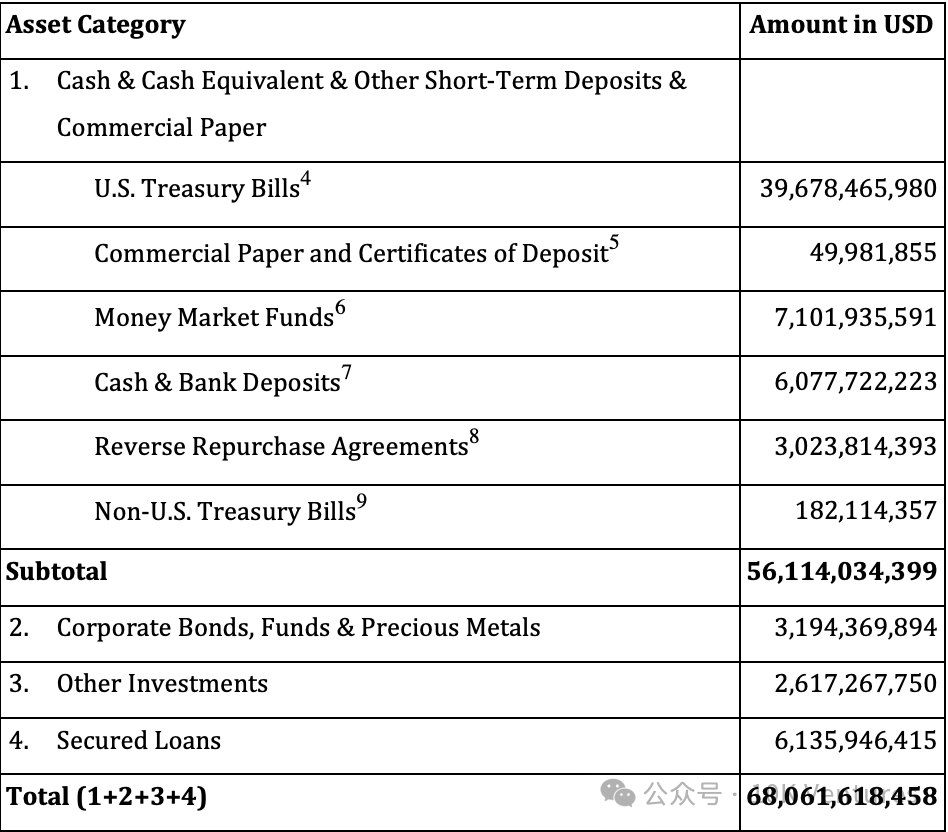

BDO's verification report indicated that by the end of September 2022, Tether held approximately $39.7 billion in U.S. Treasury bonds, accounting for over 58% of total reserves; simultaneously, 82% of its assets were "highly liquid" assets such as cash, cash equivalents, and short-term deposits. This adjustment greatly reduced the credit and liquidity risks of the reserves.

In the fourth quarter of that year, despite a severe downturn in the crypto market, Tether still achieved a net profit of over $700 million. The source of profit began to shift towards interest income, as the proportion of U.S. Treasury bonds exceeded half and interest rates rose, leading to a noticeable increase in the company's quarterly earnings. The profit model during this period can be summarized as "reducing risk exposure, weathering the winter steadily." On one hand, increasing the proportion of U.S. Treasury bonds ensured redemption liquidity and asset safety, successfully withstanding the test of approximately $20 billion in large redemptions in the second half of 2022. On the other hand, the interest income brought by the Federal Reserve's rate hikes gradually replaced the previously high-risk investment returns, becoming a new engine for profit growth.

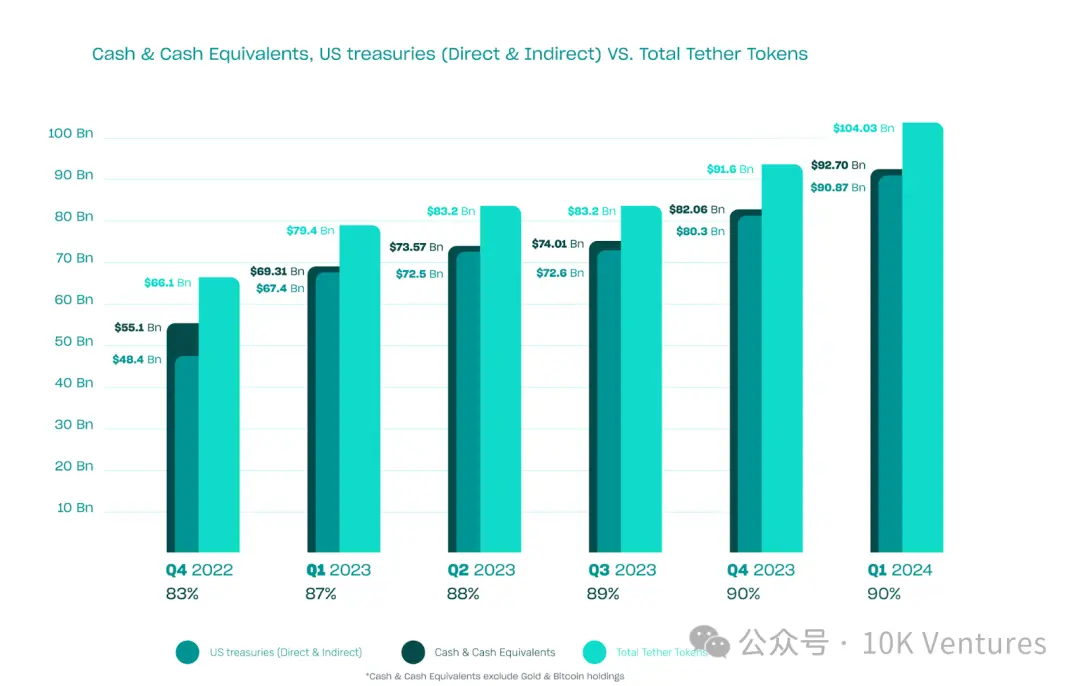

Current Stage (2023 to Present)

Starting in 2023, Tether's asset structure further tilted towards conservatism and high liquidity, benefiting from high interest rates, which significantly enhanced profitability. By the end of 2023, the proportion of U.S. Treasury bonds and cash equivalents in Tether's reserves exceeded 82%; in the first quarter of 2024, it even reached over 90%, setting a historical high. This means that the vast majority of reserve assets are low-risk assets such as short-term U.S. Treasury bonds, money market funds, and bank deposits, while the proportion of high-volatility investments (such as Bitcoin and gold) has dropped to around 10%.

This asset structure has brought substantial and stable returns during the rising interest rate cycle, with Tether achieving considerable profits in each quarter of 2023, resulting in a total net profit of approximately $6.2 billion for the year; in early 2024, there was even a surge in quarterly profits, with net profits reaching $4.52 billion in the first quarter of 2024, benefiting from both substantial U.S. Treasury interest income and additional gains from rising asset prices such as Bitcoin.

The proportion of U.S. Treasury bonds in reserves has jumped from less than 3% in 2021 to about 82% in 2024, with profits also rising year by year. Tether's revenue model has shifted from "high-risk, low-return" to "low-risk, high-return." This transformation not only increased total profits but also greatly improved the sustainability and stability of profits.

Figure: Composition of Tether's Reserve Assets from 2022 to 2024.

The above chart shows the proportion of different asset categories in reserves for each quarter, with the darkest to lightest shades representing: cash reserves, U.S. Treasury bonds (directly or indirectly held), and the total amount of Tether tokens, indicating a significant increase in the proportion of U.S. Treasury bonds since 2022.

This optimized asset allocation has led to a rise in Tether's total profits while significantly enhancing the stability and sustainability of its earnings. By the end of the first quarter of 2025, Tether's reserve assets had increased to approximately $149.3 billion, with circulating USDT reaching $143.6 billion; nearly $120 billion of this was allocated to U.S. Treasury bonds (including about $98.5 billion directly held and about $23 billion held indirectly through repurchase agreements and funds).

Source: Tether's Q1 2025 Financial Report

In the first quarter of 2025, the circulating volume of USDT increased by another $7 billion, and the number of user wallet addresses grew by approximately 46 million. During the quarter, Tether achieved operating profits exceeding $1 billion, primarily from U.S. Treasury investment income; in terms of risk assets, the gains from gold holdings largely offset the impact of price fluctuations in cryptocurrencies like Bitcoin, without significantly dragging down or boosting net profits.

Comparing the first quarter of 2024 with the first quarter of 2025, it can be observed that the former experienced substantial paper gains due to a surge in the crypto market, while the latter returned to a "normal" profit driven by interest income. This indicates that Tether's current profits primarily rely on predictable interest income, with additional volatility from risk assets being secondary and intermittent.

Profit Model of UST and USDe

In the development path of algorithmic stablecoins, UST is a landmark case and represents the industry's early large-scale experiment with a "non-collateral monetary policy model." Its core structure relies on a long-term commitment to an annualized 20% return from the Anchor Protocol, a commitment not based on real interest differentials or on-chain profitability, but rather supported by a subsidized system involving the Terra Foundation, the LUNA issuance mechanism, and external financing subsidies.

UST itself does not generate actual returns; instead, it continuously injects new capital to meet users' expectations for interest, thereby constructing a seemingly robust financial structure that is, in fact, highly dependent on incremental funds. In the Anchor protocol, a large number of users simply deposit UST to await high returns, while the protocol lacks clear lending targets or asset yield paths, creating the illusion that "subsidy equals income." When user confidence wavers and large-scale redemptions occur, LUNA is forced to mint devalued tokens to cope with redemption pressure, leading to an irreversible "death spiral" that causes the entire system to collapse in a short time. The so-called 20% annualized return from Anchor is, in fact, a prepayment for future ecological development, rather than any real, sustainable business profit. Once users begin to sell UST and mint LUNA to redeem dollars, the price of LUNA will collapse, which is precisely the source of funds for the subsidy system, forming a fatal self-destructive chain.

The initial 20% annualized return from Anchor came from the Terra community reserve pool (funded by LUNA) and subsequent investments from institutional investors (such as Jump Capital).

In this model, users receive high returns, while the protocol continues to burn cash. It is not the users who pay for the returns, but rather the LUNA holders and the Terra Foundation that bear the losses.

USDe attempts to construct a synthetic stablecoin system that does not rely on U.S. dollar reserves through a delta-neutral hedging structure. In the Ethena protocol, users stake ETH or stETH to mint USDe, while the protocol opens equivalent short positions on centralized exchanges or certain on-chain perpetual platforms, attempting to achieve price stability through the hedging of spot and derivative profits and losses.

In this structure, the stability of USDe does not come from asset collateral but from capital hedging. When the prices of assets like ETH fluctuate, the unrealized gains/losses of the collateralized assets offset the profits and losses of the contracts, achieving an approximate "risk-neutral" state, making USDe a "synthetic dollar" that does not rely on reserves, with its stability derived from hedging logic rather than reserve guarantees.

If users wish to obtain additional returns, they can convert their USDe into sUSDe and participate in the protocol's interest distribution. The source of income primarily comes from the funding rate obtained from short positions in the perpetual contract market, meaning that when long positions are more active, the reverse subsidy to short sellers becomes the interest source for holders. On the other hand, income comes from the interest or fees paid by collateralizers, with the protocol design redistributing systematic surpluses to sUSDe holders.

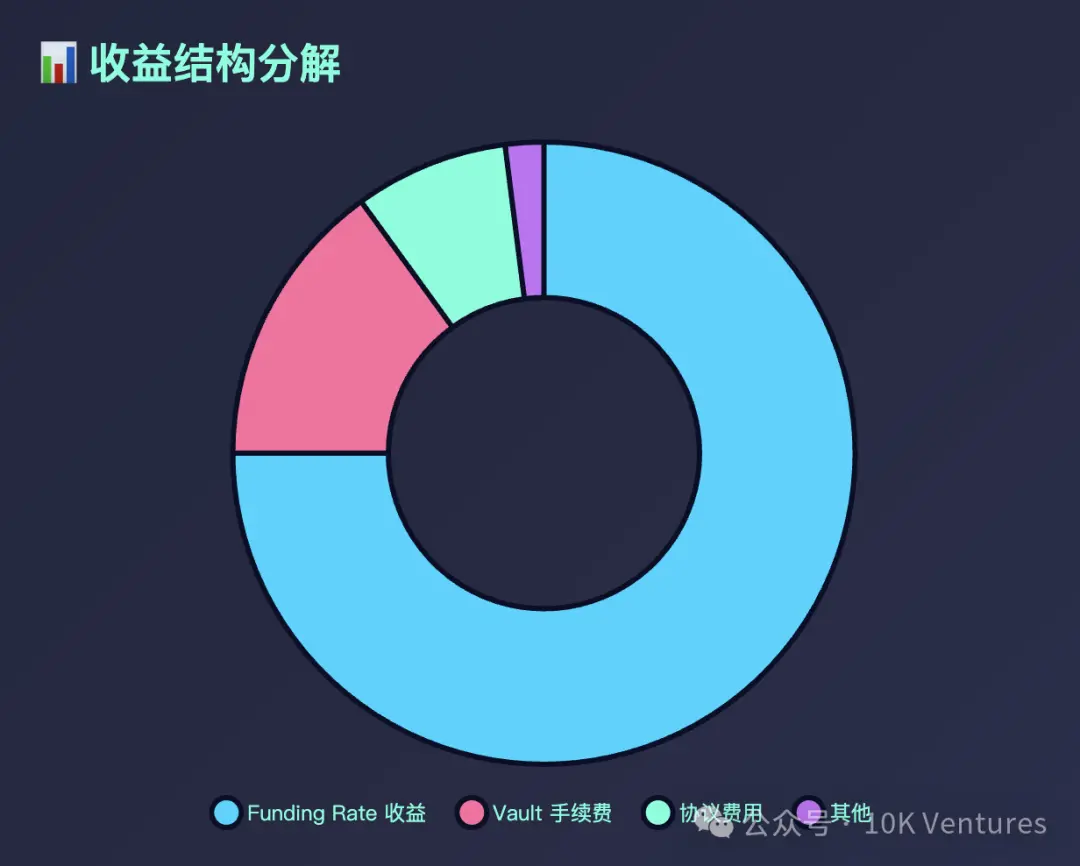

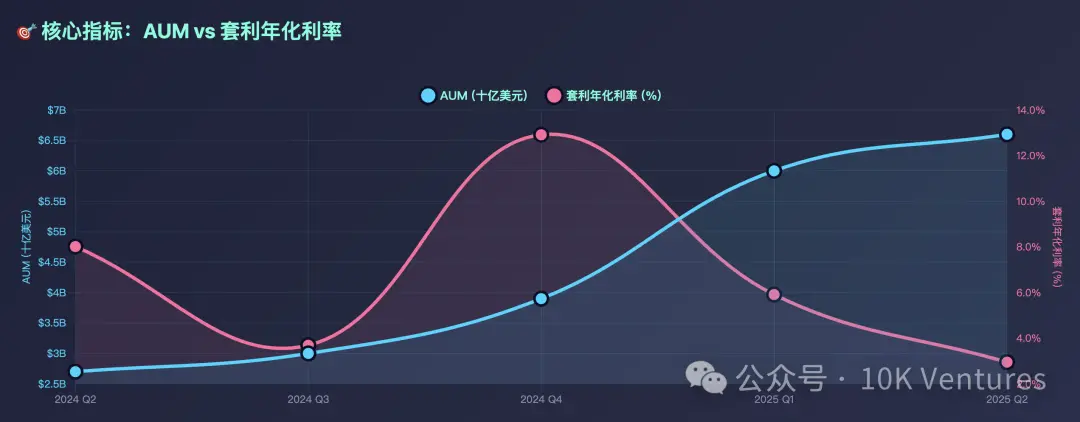

Core logic of the profit model: AUM (the dollar value of assets deposited by users in the protocol's smart contract) × annualized arbitrage interest rate.

Funding rate difference: The protocol opens short positions in the perpetual market, hedging against ETH volatility, while when market demand for long positions is strong (normal state), the funding rate paid by longs to shorts becomes the protocol's income.

Collateralizer fees / interest spread: USDe holders can convert their holdings into sUSDe to obtain interest income from the protocol layer.

Vault product fees: Institutions access hedging paths through customized strategies, allowing them to hedge directly in the futures market, increasing capital utilization efficiency and strengthening the fee income logic at the protocol layer, which is a relatively robust part of its profit model.

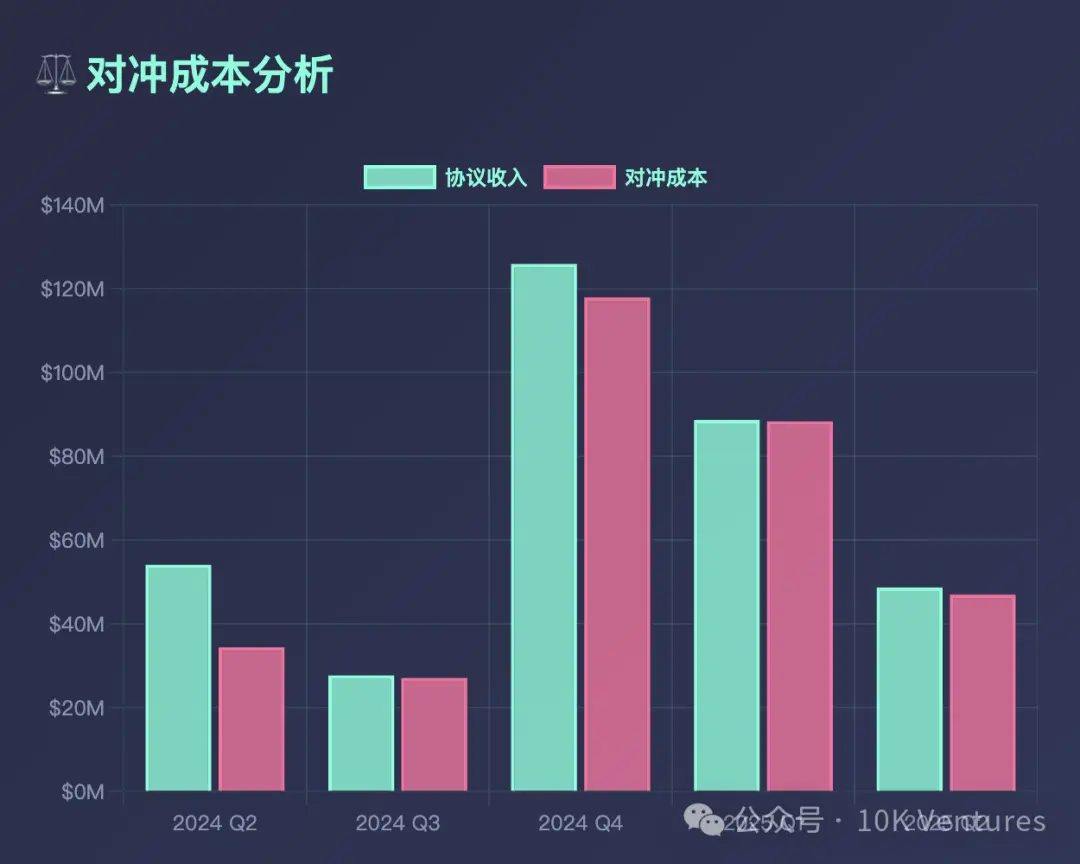

According to Token Terminal data, from Q2 2024 to Q2 2025, USDe's AUM fluctuated from $2.7 billion to $6.6 billion, with a growth rate of 144.6%. However, quarterly revenue fluctuated significantly, rising from $47 million to $126 million and then retracting to around $48 million.

Even so, its annualized arbitrage interest rate consistently maintained a range of 3% to 15%, indicating that Ethena does not rely on arbitrage from a specific exchange or node, but rather has built a relatively stable arbitrage strategy system, although the yield is dependent on a structurally bullish market.

Although this model represents a fundamental improvement over UST, it still heavily relies on the depth of the derivatives market, the positive sustainability of funding rates, and the liquidity of market makers. When the funding rate for derivatives reverses or when market volatility is too high and hedging fails, USDe could also face the risk of collapse. Therefore, "stable income" largely depends on the interest spread benefits when the overall crypto market is in a structurally bullish phase, making it difficult to claim complete sustainability.

The hedging costs of USDe have remained high.

From a profit model perspective, the so-called returns of UST rely more on issuance, subsidies, and narrative stacking, representing a risk model lacking a real trading loop; whereas USDe attempts to rebuild the "credibility" of algorithmic stablecoins with stronger financial engineering design, but its fundamental returns are still constrained by bull market capital premiums and the structure of the hedging market. The comparison between the two not only represents the rise and fall of algorithmic stablecoins but also outlines the real challenge in the innovation of stablecoin architecture, which lies in the unification of stability mechanisms and profit mechanisms.

Stablecoins are Revolutionizing Traditional Banks and Their Downstream Industries

The years of discussion around inclusive finance aimed to allow more underserved users to enjoy financial services such as bank wealth management, lending, and insurance. Why did China place such importance on inclusive finance, even incorporating it into the 13th Five-Year Plan? — Because the country needed to ensure that groups (such as rural residents, individual businesses, and small enterprises) that were previously overlooked by the mainstream financial system could also access basic financial services like loans, deposits, and insurance; finance is a tool for resource allocation, and if it only serves the top tier, it exacerbates wealth disparity. Inclusive finance can spread financial benefits to the middle and lower tiers, enhancing economic resilience. The core issue is that the customer acquisition cost (CAC) of traditional finance is actually very high, which leads traditional financial institutions like banks, insurance companies, and brokerages to be unwilling to reach out to underserved users. However, stablecoins are entirely different; the CAC for stablecoins is zero because all backend work is completed through blockchain. Due to network effects, Circle does not need to open storefronts in remote counties to attract customers. New users obtain USDC primarily through OTC or C2C transactions.

Moreover, stablecoins are more permissionless compared to traditional banks, with higher composability and privacy. Any USDC user can engage in permissionless wealth management, lending, and payments on-chain.

This has led to stablecoins reshaping traditional banks and their downstream industries. What is currently happening is that stablecoins are reshaping central banks (Tether/Circle), centralized exchanges (CEX) are reshaping traditional exchanges and commercial banks (Binance/OKX/Coinbase), asset management companies are reshaping private banking (Amber/Matrixport), and stablecoin payment companies are reshaping traditional cross-border payment companies (Bridge). In the future, more downstream industries of traditional banks will be reshaped; besides those mentioned above, brokerages and insurance companies may also undergo transformation.

Conclusion

Stablecoins are evolving from "digital dollar mapping" to digital assets with native yields and global applicability. Driven by both institutional restructuring and technological innovation, they are gradually replacing certain functions of traditional finance, becoming key infrastructure for cross-border payments, asset management, and financial inclusion. Their reshaping of roles traditionally held by central banks, commercial banks, payment institutions, and even brokerages and insurance companies has only just begun.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。