"We should invest 200% of our funds into this trade, not 100%."

Written by: Leo

Translated by: Luffy, Foresight News

The art of speculation can be boiled down to two points: how much can you earn when you're right, and how much can you lose when you're wrong. Everyone looks back at those trades they were certain would be a huge success and questions why their position was so light; similarly, they reflect on those hesitant trades and wonder why they kept adding to losing positions.

Position management is one of the hardest skills to master, but improving this ability is the most effective leverage. All top traders are constantly exploring how to enhance it because once a judgment goes wrong, the consequences can be dire. While I have many shortcomings in execution, position management is one of the things I have done best in my career, compensating for many other mistakes I have made.

One of my favorite stories is the one told by Stanley Druckenmiller and George Soros about "decisively increasing positions in asymmetric opportunities," as they are among the most outstanding fund managers.

In 1992, Druckenmiller was the chief portfolio manager at Soros's Quantum Fund. Druckenmiller noticed that the Bank of England was artificially supporting the pound and firmly believed that this support could not last long. He approached Soros and laid out his views.

"George, I want to sell £5.5 billion worth of pounds tonight and buy Deutsche Marks, which means we are betting 100% of the fund's capital on this trade."

As I spoke, he began to frown, as if to say, what is wrong with this kid? I felt he was about to overturn my argument. He said, "This is the most ridiculous money management method I have ever heard. What you are suggesting is an incredible one-way bet."

We should invest 200% of our funds into this trade, not 100%. Do you know how often this happens? About once every 20 years. What is wrong with you?

Druckenmiller ultimately executed the trade with a double position, which later became one of the most famous trades in history, earning $1 billion in a single day. Soros even earned the nickname "the man who broke the Bank of England" because of it.

The most profitable trade I have made to date was during the swing trading when Coinbase and Robinhood announced the listing of $PEPE in November 2024. While executing the trade, I was filled with thoughts of this legendary story, wondering, "What would Soros do?"

Around 6 AM that day, I was sitting on the toilet as usual, scrolling through my phone, checking group chat messages, monitoring Twitter updates, and observing charts. At that time, I had already taken a small long position in $PEPE because the chart looked great, and my intuition told me to buy, but the position had significantly lost value, making me a bit anxious.

I was intently staring at the 1-minute candlestick chart on the trading app when I suddenly saw a massive green candle shoot up, and I instantly broke even. Obviously, I was a bit excited but also very confused, and then I received a Twitter notification: "PEPE is listed on Robinhood." I was still doubting whether this was real news because it was so unexpected, so I verified it through group chats and Twitter. Once the news was confirmed, a switch in my mind was flipped, and I realized this would be "that once-in-a-lifetime trade."

At the moment the Robinhood news was released, its price skyrocketed from $0.000012 to $0.000016. The reason this news was so striking was that since $DOGE and $SHIB, no other memecoins had been listed on Robinhood. Moreover, there had been no convenient purchasing channels for PEPE in the U.S.; Americans either had to buy it on-chain or through unknown exchanges. Listing on Robinhood opened the floodgates for a large amount of retail capital for PEPE, and the market quickly understood this.

Background: At that time, the historical highest price (ATH) of $PEPE was $0.000017. One of my favorite trades is breaking through historical highs, and I realized that those selling at this price did not understand the significance of this news.

I bought five times the current position at market price, using almost the entire portfolio with 2x leverage (position size = 2 times the portfolio value). I looked at the dollar value on the trading app and felt a wave of nausea; if I had eaten breakfast, I would have definitely thrown up. I never thought I would invest so much in altcoins, let alone meme coins, but I felt very calm inside because I knew it was the right choice.

About an hour after the Robinhood news release, Coinbase also announced the listing of $PEPE, and the price broke through the historical high. Later that day, Upbit listed $PEPE, pushing the price to $0.0000255. I didn't even dare to look at the trading app because the fluctuations in profit and loss were too great and would affect my mood. At its peak, I made about 100% profit in less than 12 hours. It was a crazy day. Although I didn't close at the highest point, I still locked in considerable profits, exceeding the total profits of the past few months, highlighting the value of adjusting positions in asymmetric opportunities.

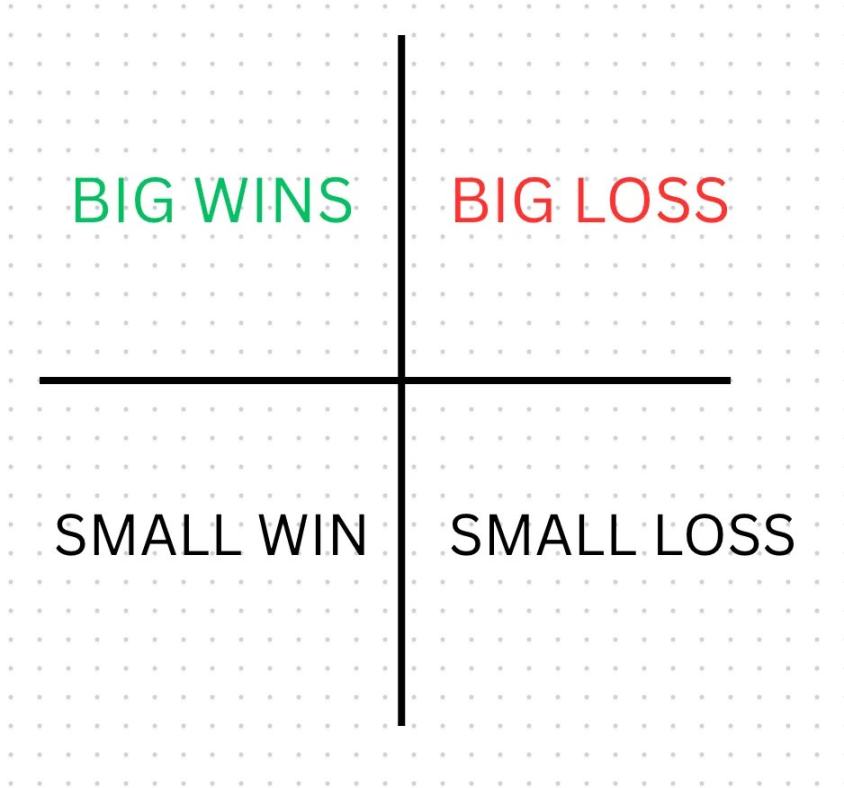

These are stories of being heavily positioned yet successful, but it would be a crime not to talk about the other side. Behind every story of a large-scale concentrated bet succeeding, there are countless stories of people who went all in and ultimately went bankrupt. This is precisely why investing correctly is so difficult: finding a balance between believing in your theory and boldly betting on it while respecting the market is not easy.

Sometimes you are full of confidence and heavily positioned, yet you incur losses for several days, leading you to decide to cut your losses and exit. Strangely, it seems as if the market god is watching your position; as soon as you close your position, the market immediately reverses, and the price moves entirely according to your argument. And sometimes you choose to hold on, only to wake up a week later to find your portfolio down 50%. Undeniably, this is a skill that is hard to master.

I have personally had many experiences of heavy position failures, but one thing has kept me going: very strict risk management. If the price action does not align with my theory and losses persist for a while, I will cut my losses. No matter how confident I am, the market is always right.

Never cling to losing trades; better trades are just around the corner. There will always be plenty of opportunities and trading ideas worth heavily investing in, but if I have lost a significant portion of my portfolio, I won't have enough position to execute the best opportunities.

Avoid major losses at all costs; this is indeed the most important concept in any risk game. What "major loss" means to you is relative. During my early days of building a smaller portfolio, I had to take on greater risks. I easily placed 10-15% of my portfolio on high-conviction trades because that was the nature of the market I was in. Everything on-chain was extremely illiquid and highly volatile, so I had to accept larger drawdowns to validate my theories. As my portfolio size grew, the liquidity of the markets I entered slightly improved, and I could not afford to take on such large risks. It is crucial to clarify your risk tolerance so that you know how much loss you can bear each time you trade. I have seen many talented and amazing traders exit the game due to an irretrievable massive loss.

That is why one of my favorite trading strategies is breakouts. I love top breakouts because they are trades with clear risk: either you profit, or it fails quickly. For example, my timing in the $PEPE trade was when the price struggled at the highest price level but failed to break through, or when it broke through and then fell back below the ATH. In both cases, I had clear exit points, so it made perfect sense to build a large position at that point.

Looking back at my trading career so far, all significant growth in my portfolio has come from "all-in" returns. Each year, only a few trades create most of the profits. Beyond that, it is truly a survival game. You must remain sharp enough to identify those trades that can yield massive returns, but also disciplined enough to avoid losing all your chips on ideas you lack confidence in and to refrain from doubling down on losing positions.

In the next phase of my life journey, one major area I am focusing on improving is position management. I excel at heavy bets but am very poor at holding positions with a lot of unrealized profits. This is my inner risk management awareness at play, but if I could apply my theories more often instead of frequently trading, I would go further.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。