The high valuation premium of Metaplanet is not a coincidence, but a product of Japan's unique policy environment.

Written by: Deep Tide TechFlow

It is said that the altcoin season in the stock market is represented by Japan's Metaplanet and America's MicroStrategy, both of which have seen significant increases in stock prices as representatives of Bitcoin reserve strategies.

As of June 25, 2025, Metaplanet's stock price has risen about 300% since the beginning of the year, with a market capitalization of around $6 billion (854.8 billion yen); while MicroStrategy has only increased by 35% over the same period, with a market capitalization of about $105 billion.

Metaplanet is referred to as the "Japanese version of MicroStrategy," but public data shows that its Bitcoin reserves are only 11,111 coins, far less than MicroStrategy's 590,000 coins.

In comparison, Metaplanet has a lower market capitalization, fewer Bitcoin reserves, yet its stock price has risen more.

So, if we simply draw a conclusion — "the lower the market capitalization of a Bitcoin reserve company, the greater the potential for stock price increase," is this logic reasonable?

Yes, but also no.

Looking solely at the surface data, this logic certainly has no major issues and is similarly applicable when comparing high market cap coins and low market cap coins in the crypto space.

However, the uniqueness of Metaplanet lies in more financial data.

Metaplanet, a higher valuation premium

Currently, there are many comparative analyses of different crypto reserve companies on the market, but when looking at all the data together, the key indicator is the valuation premium.

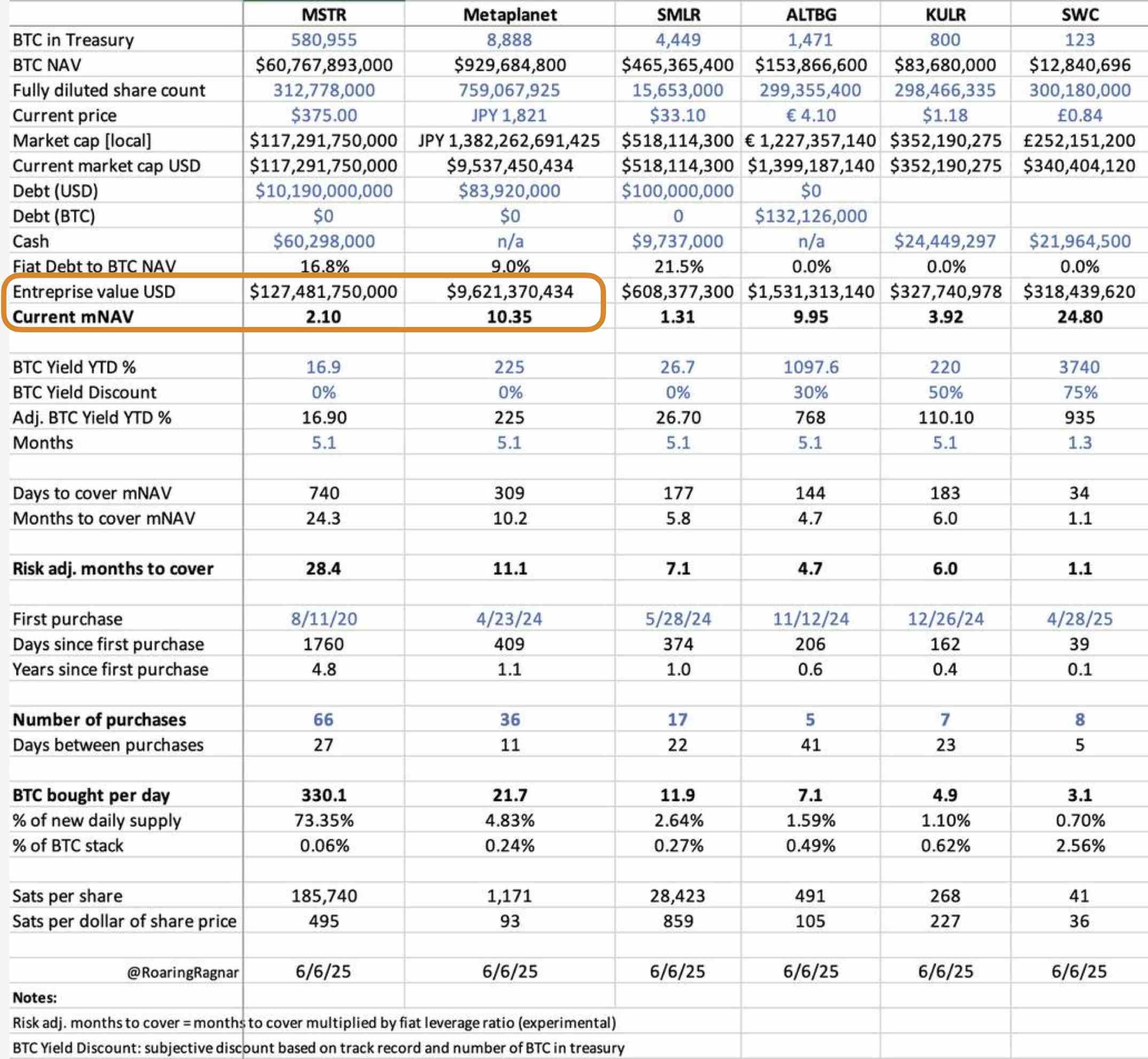

Last week, Primitive Ventures investment partner @YettaSing significantly pointed out the difference in market valuation premiums between the two companies through a table.

For example, the mNAV indicator (Multiple of Net Asset Value) in the table below shows that Metaplanet's mNAV is as high as 10.35, while MicroStrategy's is only 2.10, a difference of nearly 5 times.

What does this 5-fold difference mean?

In simple terms, mNAV is a measure of a company's valuation relative to the value of its Bitcoin assets. The higher the value, the more willing investors are to pay a premium for the company's exposure to Bitcoin.

Thus, it can also become a sentiment indicator, reflecting the strength of market confidence in Bitcoin investments and related companies. Quantitatively, this roughly equates to Metaplanet receiving about $9.35 in premium for every $1 of Bitcoin it holds, while MicroStrategy only receives $1.10.

In other words, participants in the Japanese stock market are more willing to buy Metaplanet stock than those in the U.S. stock market are to buy MicroStrategy.

We will not analyze the other data in the table further; just from this indicator, we can see that Metaplanet stands with a small-scale Bitcoin reserve and high premium, while MicroStrategy relies on massive assets to achieve stable valuation.

However, under the tens of times difference in Bitcoin reserves, why does Metaplanet achieve a higher premium? Is it simply because Metaplanet is a smaller company?

Buying Metaplanet is like buying tax-free BTC

One difference from the crypto space is that a country's stock market is more easily influenced by its domestic economic environment and policies. Japan's economy provides a unique soil for Metaplanet's high premium.

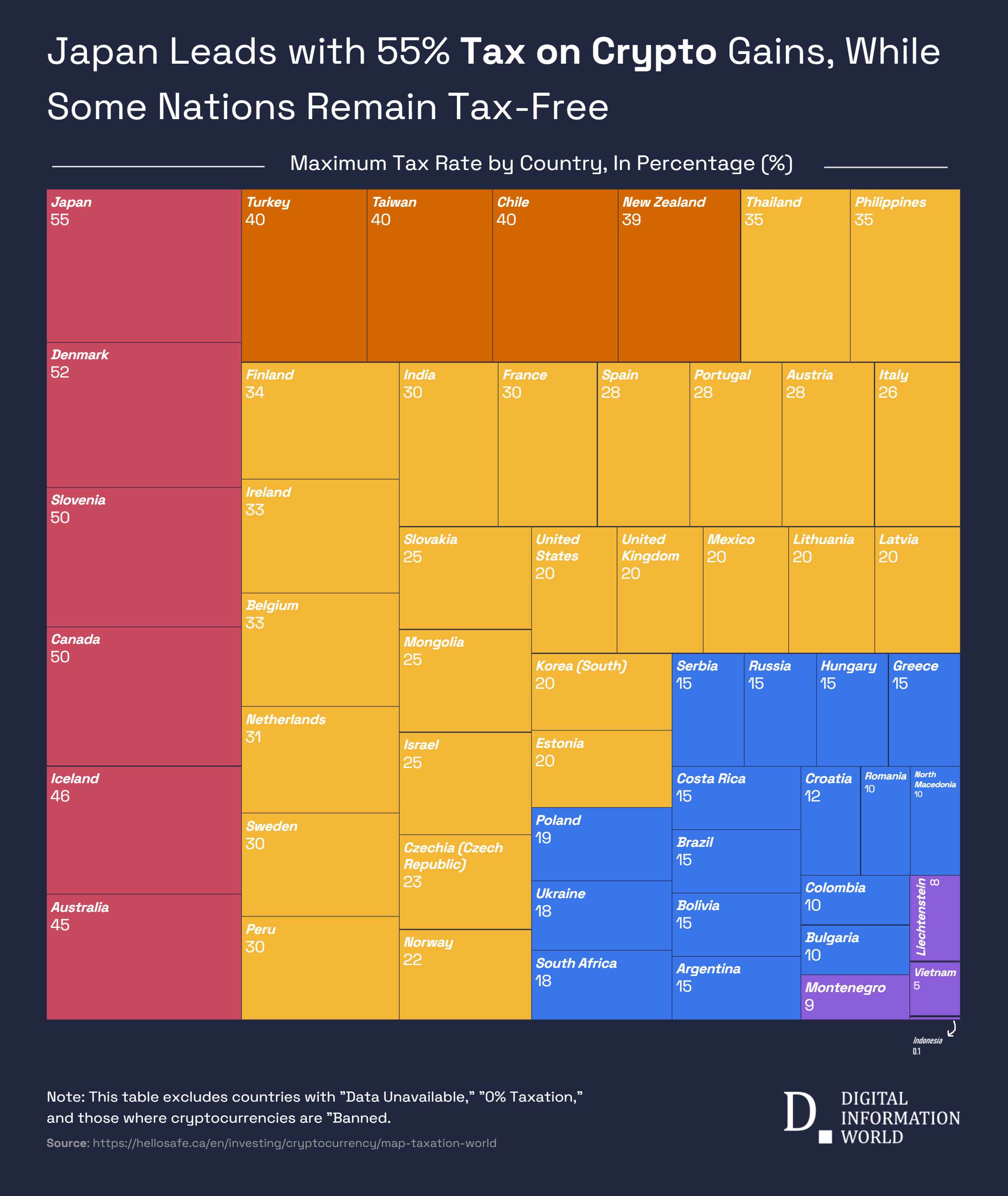

In Japan, income from cryptocurrency trading is classified as Miscellaneous Income, subject to a progressive tax rate of up to 55% (including local taxes). This tax rate applies to individual investors who directly hold and sell cryptocurrencies, whether through exchanges or peer-to-peer transactions.

In contrast, the capital gains tax on stock investments is only 20% (including local taxes).

Additionally, Japan has a favorable NISA plan (Nippon Individual Savings Account), which is a tax-exempt account system aimed at encouraging personal savings and investments.

Under the NISA plan, individual investors can invest up to 3.6 million yen (about $25,000) per year, with capital gains and dividend income from this investment completely tax-free. Starting in 2024, the investment limit under the NISA plan will be further increased to 6 million yen, covering a wider range.

In other words, investing in Metaplanet's stock through the NISA plan allows for completely tax-free returns within a certain range. This significant tax burden difference makes the cost of directly holding Bitcoin particularly high in the Japanese market.

Metaplanet's "Bitcoin reserve" strategy provides investors with a tax-optimized solution. By purchasing Metaplanet stock, investors can not only gain indirect exposure to Bitcoin but also enjoy lower tax costs.

This tax advantage directly drives market demand for Metaplanet stock and is an important source of its valuation premium being 5 times that of MicroStrategy.

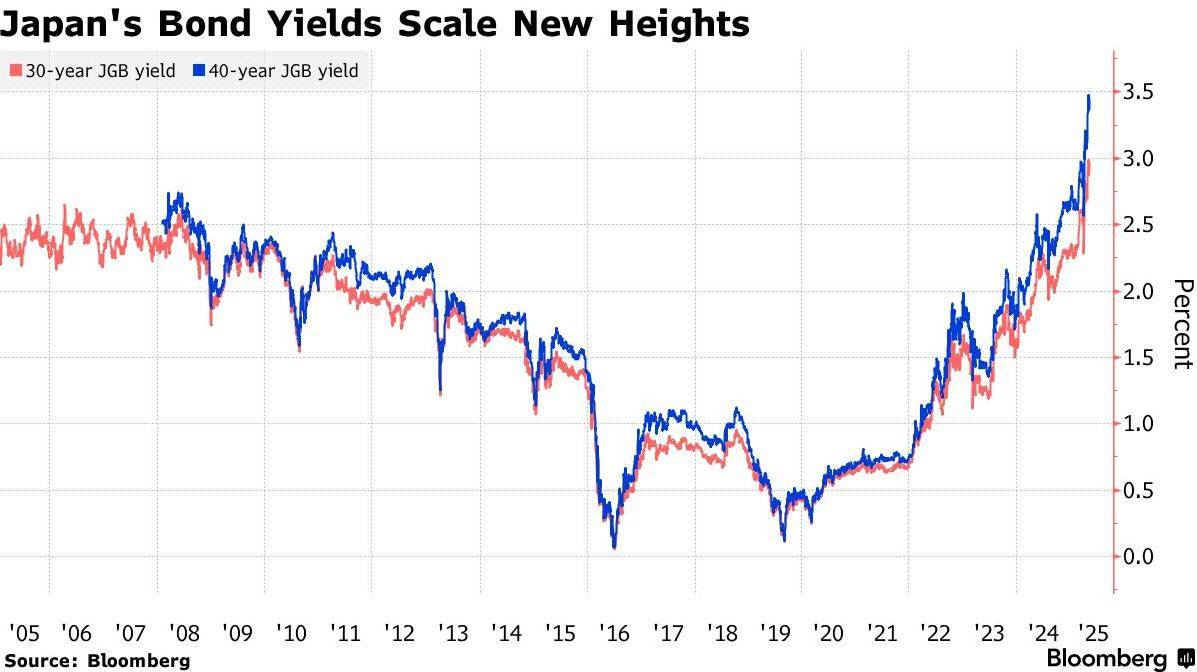

Moreover, Japan's macroeconomic situation also supports Metaplanet's valuation premium.

Japan's debt-to-GDP ratio is as high as 235%, and the yield on 30-year government bonds has risen to 3.20%, indicating structural pressure in the bond market. In such a macro environment, investors' concerns about yen depreciation and inflation have intensified.

Metaplanet's Bitcoin reserves are seen as a hedging tool, capable of hedging against yen depreciation risks and providing value preservation in a domestic inflationary environment. This macro hedging demand further increases its market premium.

Additionally, the investor structure in Japan's capital market is primarily composed of retail investors, while the U.S. market is more dominated by institutional investors. Retail investors are more easily influenced by policies and market sentiment, which may lead to a higher premium for Metaplanet.

In contrast, institutional investors in the U.S. market focus more on fundamentals and asset size, which explains why MicroStrategy attracts attention with its "massive Bitcoin reserves," while Metaplanet stands with "high premium and small scale."

When the environment becomes a new variable

Therefore, Metaplanet's high valuation premium is not a coincidence, but a product of Japan's unique policy environment. From tax policies to the NISA plan, and the structural characteristics of the capital market, these factors collectively shape the high premium of its stock.

Looking only at the number of Bitcoin reserves and the company's market capitalization does not actually allow for an analysis of these contents; the stock market may be more concerned with local customs and environment than the crypto space, where the environment is key.

Policy-driven premiums open new opportunities for crypto investment.

As the altcoin season in the stock market has become a consensus, it is not only about considering Bitcoin reserve amounts or market capitalization; policy dividends, investor structure, and macroeconomic pressures jointly determine the valuation of "coin stocks."

Moreover, more small and medium-sized crypto reserve companies are rapidly emerging, replicating Metaplanet's high premium model, but the reasons for the premium vary.

To some extent, this presents investors with more and more complex factors to consider than trading altcoins in the crypto space.

The rise of coin stocks not only expands the geographical landscape of Bitcoin and other cryptocurrency investments but may also reshape global capital flows, posing greater challenges to the energy and understanding of crypto investors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。