Author: Nancy, PANews

As the first modular blockchain, Celestia once shone brightly, especially with the large-scale airdrop after its launch that ignited enthusiasm across the entire sector. However, a recent exposé has revealed controversies involving Celestia's executives cashing out, interest transfer, and public opinion manipulation, putting this star project under scrutiny. Although its co-founder responded that these claims are FUD, the undeniable fact is that the activity level of the Celestia ecosystem and the performance of its tokens have both seen a dramatic decline, and market interest has sharply cooled, putting the modular narrative to a severe test.

Accusations of Executives Cashing Out and Manipulating Public Opinion, Celestia Claims Over $100 Million in Reserves

On June 23, a lengthy post by Twitter user @0xCircusLover sparked widespread attention in the crypto community. Although these allegations have not all been confirmed, they have thrust Celestia into the spotlight.

Regarding token unlocking and cashing out, @0xCircusLover pointed out that all C-level executives of Celestia completed their token unlocks as early as early October 2024, while other team members unlocked their tokens later that month and continued to sell them. Notably, co-founder Mustafa was accused of selling over $25 million worth of tokens off-exchange before relocating to Dubai.

It is worth mentioning that in October 2024, Celestia's token TIA initiated a massive token unlock of up to $1 billion, with the unlocked amount accounting for about 80% of the circulating supply at that time, which triggered market panic. More controversially, just before the unlock, the Celestia Foundation announced the completion of a $100 million financing round, and its token surged on that day due to this positive news. However, this financing was revealed to be an off-market sale completed months earlier through OTC with certain institutions, which was repackaged as a financing announcement just before the unlock, raising community doubts about Celestia's intentions.

Additionally, the post exposed potential "gray areas" in Celestia's marketing strategy. Crypto KOL @ayyyeandy was accused of receiving large sums to promote Celestia and even deeply participating in the project's marketing. @0xCircusLover stated that specific evidence is yet to be made public. David Hoffman, co-founder of the media platform Bankless, also faced scrutiny for frequently recommending TIA. @0xCircusLover pointed out that he is not an end user of the project, has not built any DA protocols, and has not tweeted about other alt-DAs as frequently, with contradictory statements about whether he holds any positions.

In response to the allegations, David publicly stated, "I first bought TIA on February 26, 2024, and have disclosed my holdings on the Bankless page; I sold this portion of assets on May 30 and updated the disclosure page accordingly. Neither I nor Bankless has ever accepted any undisclosed compensation from the Celestia team."

In addition to the cashing out and promotional controversies, the post further revealed internal issues within Celestia. Former developer relations head Yaz Khoury was fired for "allegations of sexual harassment" and has exited the crypto industry. @0xCircusLover claimed to possess testimonies from victims and related evidence. Celestia was also accused of buying out competitor Abstract for seven figures, forcing it to abandon collaboration with EigenLayer, which is also in the modular direction, thereby suppressing potential competitors.

In the face of the public relations storm, Celestia co-founder Mustafa Al-Bassam recently responded, stating that despite the current FUD, all founders, early employees, and about 50 core engineers of Celestia remain committed to their positions, with the same work enthusiasm as when the project was founded five years ago. He bluntly stated that even if someone spreads absurd FUD claims that Celestia is the instigator of the 9/11 incident, he remains unfazed. Mustafa mentioned that he has been involved in the crypto field since 2010 and understands that survival in the industry requires a strong mindset and resilience, as all tokens will experience a 95% drop during their lifecycle.

At the same time, Mustafa emphasized, "We have over $100 million in reserves, enough to support operations for more than six years, and we are prepared for a protracted battle."

Multiple Data Points Show Significant Decline, Is the Modular Narrative Failing?

As the enthusiasm for the modular narrative wanes, Celestia is currently undergoing a dual test of market and technology.

According to data from CoinGecko, as of June 24, the price of TIA has dropped to $1.56, a decline of 91.75% from its historical peak of approximately $19.07. Its market capitalization has also fallen from a peak of over $3.9 billion to about $1 billion, with market interest significantly cooling.

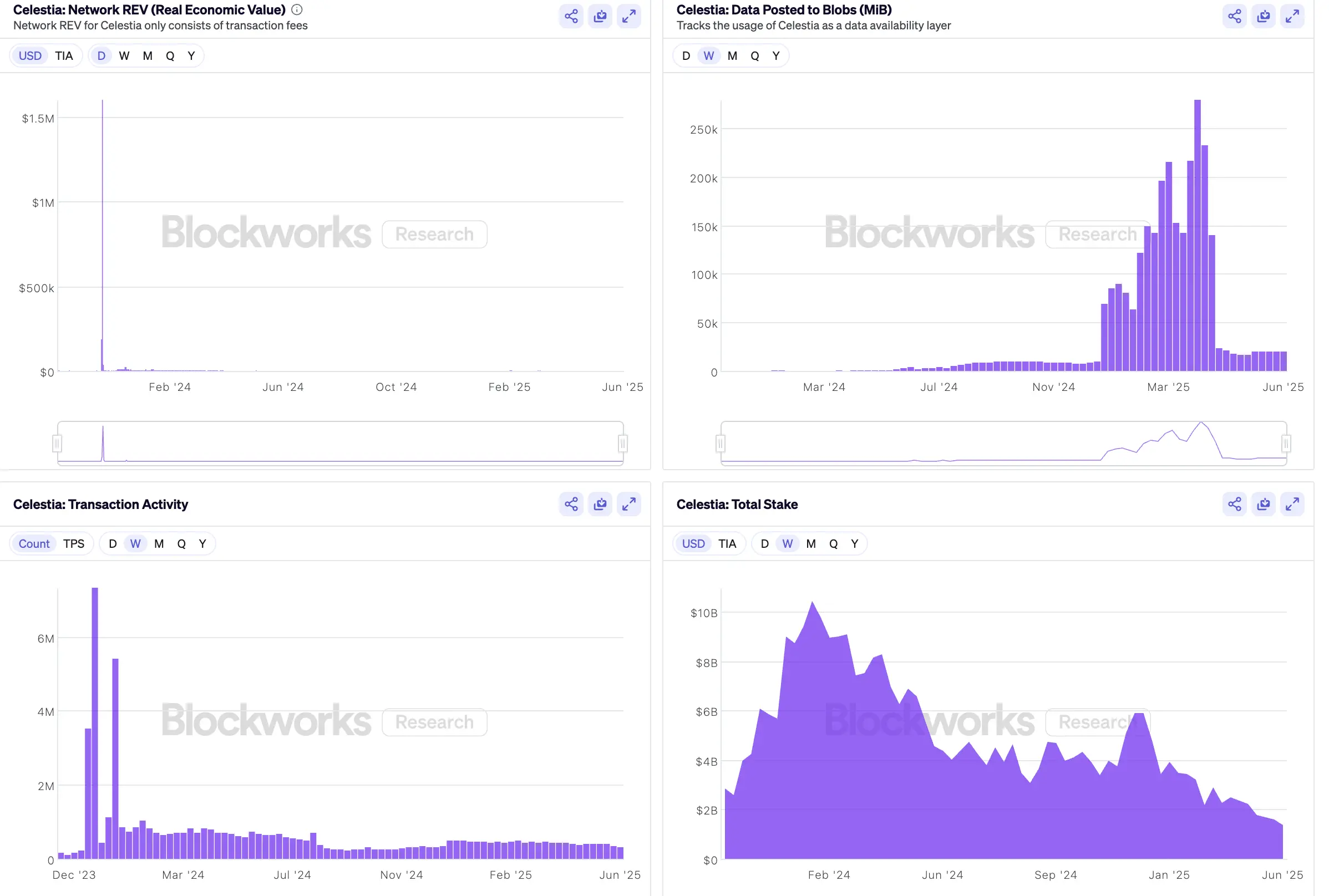

On-chain activity has also cooled. Data from Blockworks shows that Celestia's actual usage has significantly declined. Daily revenue, which once reached $1.6 million during the peak of the modular concept, plummeted to $99.7 by June 22, a drop of 99.9%; the number of transactions also fell from a peak of 5.8 million to only tens of thousands daily, indicating a sharp decline in user activity within the ecosystem; the amount of data transmitted to Blobs dropped from a peak of 279,934 MB to 21,135 MB, showing a drastic shrinkage in core usage of the DA layer; additionally, the scale of TIA staking has decreased from the tens of billions to just over a billion, reflecting weakened capital lock-up enthusiasm, which may be closely related to token price fluctuations and declining investor confidence.

These data points not only confirm the cyclical cooling of the modular narrative but also reveal the bottlenecks faced by projects like Celestia in terms of actual use case implementation.

Of course, Celestia is not lying down; despite the sluggish market performance, it has still made progress in technology research and ecosystem development in recent months.

For instance, in terms of technology, in April of this year, Celestia launched the mamo-1 public test network, increasing the block size to 128MB, which is 16 times the existing mainnet's 8MB block, and supports a throughput of 21.33MB per second for permissionless data. This test network consists of 21 validator nodes distributed in Amsterdam, Paris, and Warsaw, simulating a real-world network environment.

In governance, in June, Celestia co-founder John Adler proposed to adopt Proof-of-Governance (PoG) as the ultimate solution for liquid staking tokens (LSTs). This proposal aims to drastically reduce the unnecessary token issuance ratio in the Celestia protocol from 5% to 0.25%, fundamentally alleviating inflationary pressure. More importantly, the PoG scheme will ensure the security of the protocol while achieving seamless integration with LSTs, allowing TIA to be more conveniently used within Celestia's native DeFi ecosystem, enhancing the actual application scenarios and liquidity of the token, which will help Celestia accumulate value through revenue (REV) and transaction fees.

In terms of ecosystem, in April, the Converge chain, jointly created by Ethena and Securitize, made Celestia its data availability layer; VanEck listed a new exchange-traded product tracking TIA on the Euronext Amsterdam and Euronext Paris exchanges; in May, Celestia announced the integration of Hyperlane as its native interoperability solution; TIA was also listed on the South Korean exchange Upbit, among others.

Celestia's current predicament is, in fact, a reflection of the real state of most crypto projects after experiencing narrative prosperity. After the "storytelling" phase, the market begins to return to rationality, and only products that are genuinely used and validated have the ability to withstand the test of time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。