Texas Approves Public Bitcoin Reserve Under SB 21

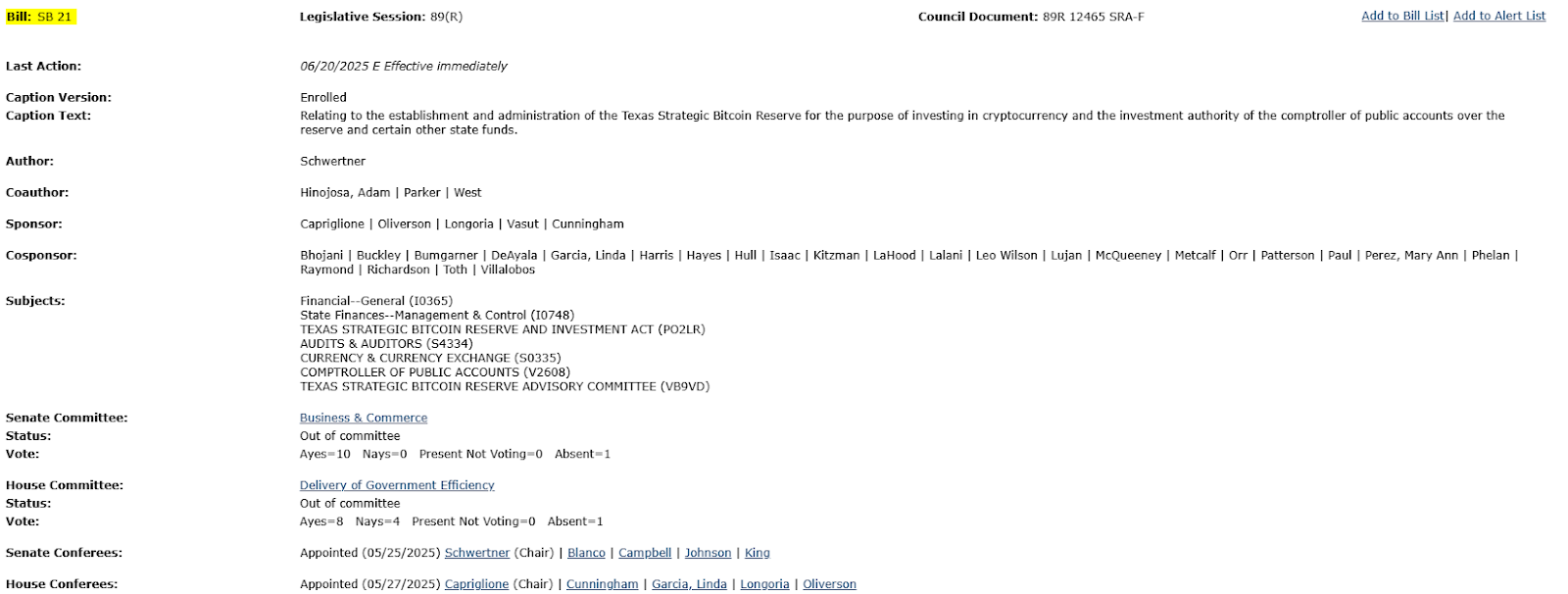

Texas, a state in the US, has now become the third state to pass a bill i.e SB 21, which establishes a nationwide strategic Bitcoin reserve after the state governor.

What happened

Governor of Texas, Greg Abott has recently signed SB 21 into becoming a law by a vote of 101 to 42, on 21 June. Now, it has become the latest place in US to step into the adoption of BTC, following Arizona and New Hampshire.

However , it stands out by creating the third state-run BTC reserve that is funded publicly and operates independently from the regular state treasury system.

Source: X

The fund will be viewed by the comptroller of Public Accounts, Glenn Hegar. This gives it unique flexibility in how it holds and manages the digital assets.

Source: Texas

What is SB 21

SB 21 stands for Senate Bill 21 which is also known as Texas Strategic Bitcoin Reserve Act .It allows the financial manager to manage the funds outside, invested in BTC and other digital currencies.

It is funded by the fees, investment returns, legislative appropriations and donations.

Breaking down the Texas Bitcoin Reserve Initiative

No doubt that SB 21 would create the Texas BTC Reserve as a special fund outside the state’s treasury but only digital currencies which have an average market capitalization of minimum $500 billion over the initial 12 months are eligible for the investment.

It is a safeguard which is designed to restrict the holdings to quietly stable, digital assets having high profiles like Bitcoins . This move shows Texa’s attempt to align its crypto goals with the responsible and well regulated investment practices.

For donation to the reserve,SB 21 allows only domiciled citizens of State. It also gives power to the Comptroller to reject any donation for any reason. And donors are not allowed to influence the management of their digital asset contributions.

The structure aims to prevent unlawful donations and political interference, the legislation lacks robust transparency measures and comprehensive anti-money laundering protections.

Public firms drive Bitcoin adoption

More public companies are adopting Bitcoin as a treasure asset, following the strategy popularized by Michael Saylor.

Nakamoto Holdings, founded by Donald Trump’s crypto adviser David Bailey, has recently secured $51.5 million through a PIPE stands for Private Investment in Public Equity, which deals to purchase more coins.

Following the same move, Paris-listed tech firm The Blockchain Group expanded its holdings by acquiring 182 BTC worth $19.6 million which is bringing its total reserves to 1,653.

These moves reflect a rising trend of companies turning to Bitcoin as a long term financial asset.

CONCLUSION:

The state is taking a cautious yet progressive step towards integrating Bitcoin into its financial structure through SB 21 which is emphasizing stability, regulation and donor’s accountability. At the same time, public firms worldwide are increasingly embracing BTC as a strategic asset, showing increasing confidence in its long-term value.

Combinedly, these developments, BTC's evolving role in government policy and corporate finances.

Also read: Hacken Suffers Major Breach: 900M HAI Tokens Minted—What’s Next? 免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。