Hormuz Shock Triggers Bitcoin Price Crash: Why $95K Is Imminent Now?

If you're wondering why Bitcoin suddenly dropped below the $100,000 mark, the answer isn’t just about charts or technicals — it’s geopolitics.

On June 23, this cryptocurrency crashed to $98,200, sending crypto markets into a mini freefall. The trigger? Iran's parliament approved legislation to close the Strait of Hormuz, the world's most important shipping route of oil.

Even though the decision will ultimately be made by the Supreme National Security Council, the move caused immediate panic in world markets.

For crypto traders, this $BTC news today became a clear reason why Bitcoin is falling. Risk-off sentiment swept through exchanges, and Bitcoin price crash to $95,000 headlines flooded crypto news portals.

Hormuz Crisis Triggers Bitcoin Price Crash Below $100K — But Why?

According to latest reports from Wu Blockchain, the Strait of Hormuz handles over 20% of global LNG trade, with a majority flowing to Asia (especially China and India). Only 15% of supply goes to Europe, but the psychological impact on energy markets has been massive.

This sudden geopolitical shock explains the intensity of the price correction. Within hours of the announcement, more than $1 billion in crypto positions were liquidated.

The recent price action reflects not just crypto-specific triggers, but how Middle East conflicts like the Iran Israel war conflict can now cause real-time crypto volatility .

What’s more interesting is that this drop wasn’t completely unforeseen.

BTC Under $100K: Analyst Cas Abbe Prediction Nearly Came True

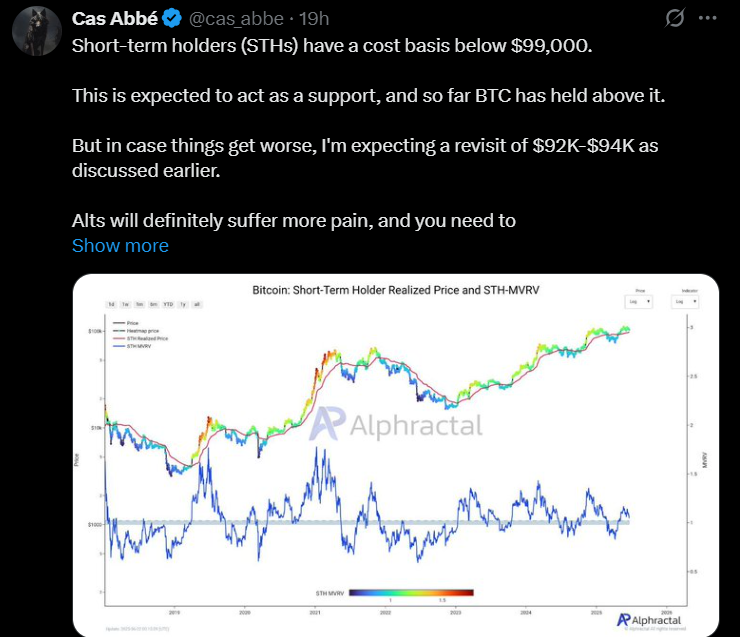

This week’s news also highlighted the accuracy of crypto analyst Cas Abbe, who warned of a worst-case dip to $93K–$94K just one day before the drop.

“People thought April’s tariff news was the bottom, but BTC actually hit the real bottom days later,” Abbe wrote on X. “This could play out the same.”

Source: Cas Abbe

And it almost did. The coin didn’t touch $94,000, but dropped to $98,000, validating his cautious outlook. The Cas Abbe BTC prediction gained traction as it mirrored April 2025’s market drop, which was followed by a delayed bottom four days later. However as per my analysis being a crypto analyst, looking at the technical aspect and price charts, the dip to $95,000 or $94,000 is not far away now.

Rebound or Trap? BTC Is Back at $101K — For Now

By the time U.S. markets reopened, this token had clawed its way back above $101,000. On paper, that sounds like a strong rebound. But underneath, the market still looks fragile.

Source: Coin Bureau

Here’s what the BTC liquidation chart is saying according to Coin Bureau reports:

-

If BTC moves above $102.5K, over $1 billion in short positions could get blown out

-

If it slips back below $100,000, $345 million in long positions are at risk

Bitcoin Price Prediction June Target and Beyond

With that in mind, let’s break down where it could head next, based on momentum, macro, and past behavior.

Source: TradingView

Short-Term (Next 3–7 Days): $98,000 – $95,000

As per coingabbar analysis observing tradingview charts suggests, Given the oversold RSI at 39.84 and bearish MACD, Expect sideways action or mild volatility soon.

Mid-Term (2–3 Weeks): $102,000– $106,000

If buyers defend the $100,000 level and RSI begins to rise, it could start crawling back toward resistance. This would likely depend on global sentiment and upcoming U.S. economic data.

Bitcoin price target for 2025 still leans bullish, but only if it holds current support levels.

Final Thoughts: Bitcoin Latest News Signals Volatility Ahead

The current Bitcoin price crash is not just a normal correction. It reflects how closely digital assets are now tied to geopolitical flashpoints like the Iran–Israel war conflict and energy supply chain risks.

So why Bitcoin is falling today has more to do with politics than price patterns, but one thing is certain: The $BTC under $100,000 zone isn’t just psychological — it’s the line in the sand. Bulls and bears are circling, and the next breakout (or breakdown) could be violent.

In the end, whether it rebounds or sinks further will depend less on charts — and more on headlines. The world is watching, and so is the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。