# I. Outlook

## 1. Macroeconomic Summary and Future Predictions

The Federal Reserve announced at its June meeting that it would maintain the federal funds rate at 4.25%-4.5%, marking the fourth consecutive time it has kept rates unchanged. Officials expect two rate cuts before the end of 2025 but remain vigilant about inflation risks. The S&P 500 index recently attempted to break through 6000 points but failed, with market volatility increasing due to the Fed's hawkish stance and geopolitical tensions in the Middle East. Trump's attack on Iran's nuclear facilities has heightened geopolitical risks, which will continue to affect market risk appetite in the short term.

## 2. Market Changes and Warnings in the Crypto Industry

Last week, the crypto industry experienced significant market volatility due to geopolitical shocks and macroeconomic uncertainties, with mainstream coin prices undergoing substantial short-term corrections, leading to a cautious or even panicked market sentiment. The continued entry of institutional investors and the development of decentralized finance provide long-term support for the market, but short-term risks remain high. The recent surge in crypto companies going public reflects a shift in capital market interest from crypto assets to traditional finance, but valuation bubbles and investor disagreements are worth noting.

Investors should closely monitor developments in the Middle East and the Fed's policy direction, remain alert to further geopolitical risks impacting the market, manage their positions prudently, and pay attention to technical indicators and on-chain capital flows to respond cautiously to market fluctuations.

## 3. Industry and Track Hotspots

Web3Auth is a pluggable embedded wallet infrastructure designed to simplify the integration and user onboarding process for Web3 wallets. The on-chain multi-strategy hedge fund Neutral Trader offers investors low-risk and yield-maximizing strategy solutions through its flagship product, Neutral Vaults.

# II. Market Hotspot Tracks and Potential Projects of the Week

## 1. Overview of Potential Projects

1.1. Analyzing How Web3Auth, Focused on Web3 Wallet Infrastructure, Ensures Non-Custodial Security by Splitting Wallets into Keys

Introduction

Web3Auth is a pluggable embedded wallet infrastructure designed to simplify the integration and user onboarding process for Web3 wallets. It supports OAuth-based login methods and multi-platform access, allowing users to quickly access Web3 applications in under a minute using familiar authentication methods.

While users enjoy a seamless onboarding experience, they still maintain complete control over their non-custodial wallets, achieving a dual guarantee of convenience and security.

Architecture Overview

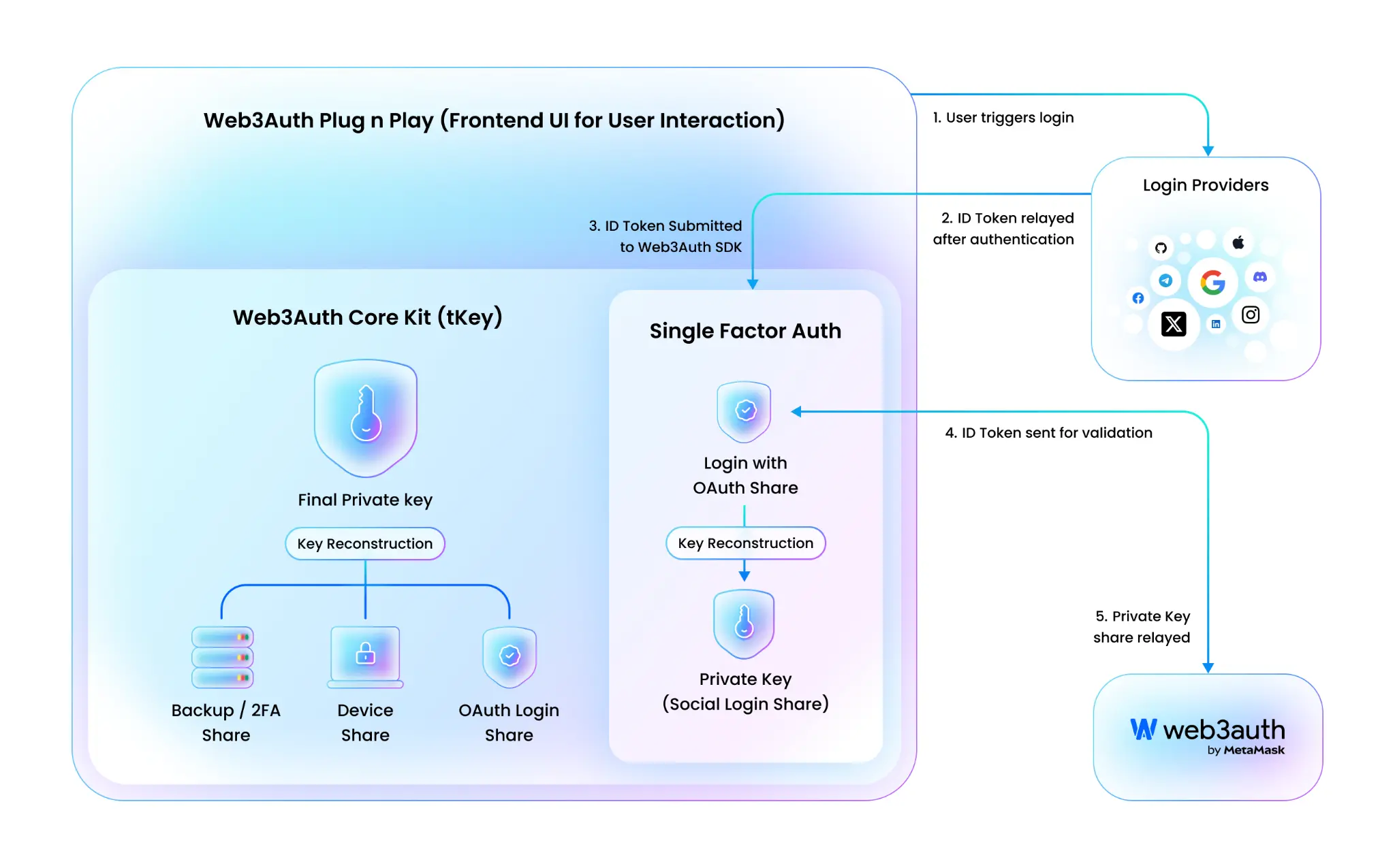

The Web3Auth SDK exists solely in the front-end client of the user or application and is responsible for handling interactions between the OAuth provider and the Web3Auth network.

The diagram below illustrates the relationship between the Web3Auth SDK and integrated applications, showcasing the different products offered by Web3Auth to facilitate a convenient integration experience for developers.

Web3Auth's wallet management infrastructure enhances security by decentralizing the user's wallet into multiple key shares, effectively avoiding the direct exposure of mnemonic phrases. These key shares form a "trust network," making wallet management similar to the operation of multi-factor authentication accounts. Users manage their cryptographic key pairs through OAuth login, trusted devices, and other factors. Notably, the entire wallet management system, including Web3Auth's database or any participating nodes, does not store complete private keys.

When creating social login key shares, users interact with the Web3Auth network, and the key generation is completed through a 5/9 consensus mechanism. This mechanism ensures that the wallet remains in a non-custodial state, meaning that neither Web3Auth, local social login providers, nor any third party holding key shares can independently possess complete control.

Web3Auth for Wallets

Web3Auth aims to be integrated into crypto wallets as a key management infrastructure. It provides each user with secure, exclusive cryptographic key services for transaction signing, message signing, and other wallet operations.

As a wallet developer, you can focus on building a custom user interface and user experience, while Web3Auth handles the complex tasks of key generation, management, and storage in the background. The wallet serves as a user-friendly interface responsible for managing private keys and accounts, while Web3Auth provides underlying key infrastructure support.

Advantages of using Web3Auth for wallet management:

- Complete Control Over Branding and User Experience — You can fully remove Web3Auth branding to achieve a custom brand style;

- Customizable Authentication Methods — You can integrate any OAuth 2.0/SSO process with just a JWT Token;

- Chain Agnosticism — The generated wallets can be used across any blockchain;

- Built-in Security Mechanisms — Native support for MPC (Multi-Party Computation), account abstraction, and key recovery;

- Cross-Platform Support — SDKs available for web, mobile, and gaming platforms.

Web3Auth Solutions for dApps

Web3Auth enables decentralized applications (dApps) to create customized authentication and wallet usage processes, allowing developers to have complete control over the user experience. Instead of relying on external wallets and complex blockchain terminology (which may confuse users), you can build a simple and smooth process tailored to your application needs. Web3Auth supports you in building embedded wallets directly within your application.

Key Advantages:

- Seamless User Experience — Similar to Web2 login processes, usable without blockchain knowledge;

- Complete Brand Control — The authentication experience can be fully customized to match your application style;

- Built-in Embedded Wallet — You focus on developing application features, while Web3Auth manages the wallet, providing pre-built wallet interfaces, fiat deposits, and other wallet services;

- Multi-Chain Support — Thanks to its chain-agnostic architecture, applications can be deployed on any blockchain;

- In-App Transactions — Users can interact with the blockchain without leaving the application interface;

- Flexible Integration Methods — You can choose to use an embedded wallet or connect to an external wallet.

Single Factor Authentication (SFA) Mobile SDKs

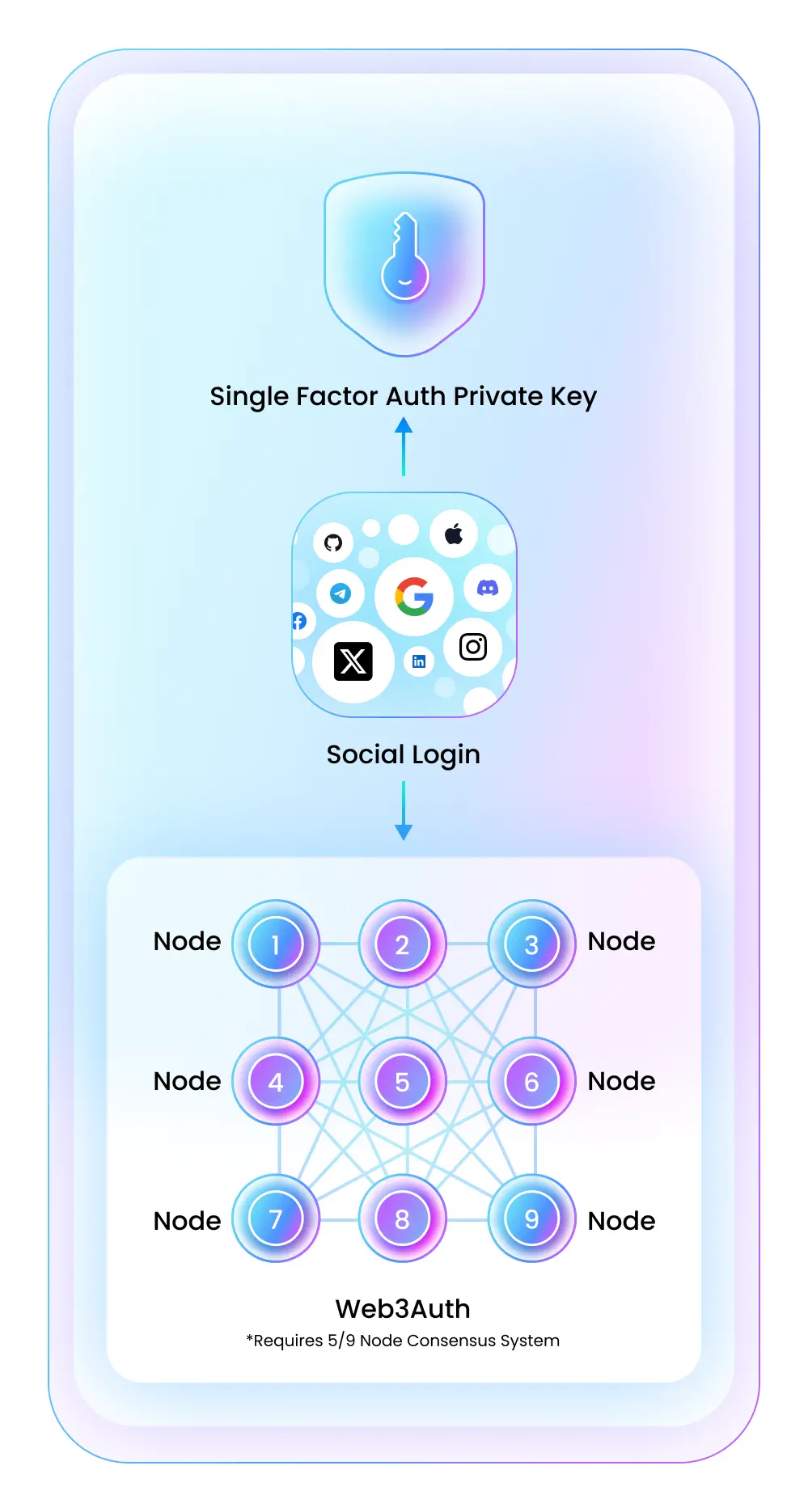

Single Factor Authentication (SFA) provides the most seamless Web3 onboarding experience, making it feel completely natural like Web2. Users can access your application with a single click using existing social accounts or passwordless methods, while Web3Auth automatically generates wallets in the background, making the entire process completely transparent to users. There are no redirects; all operations are completed within your application interface, providing a native and familiar experience for both Web2 and Web3 users.

How Single Factor Authentication Works:

The authentication process is simple yet secure:

- The user clicks to log in using their preferred method (such as social accounts, email, biometric, etc.), hosted by the application itself;

- Web3Auth generates the wallet in the background using Shamir’s Secret Sharing;

- The private key is split into multiple key shares and distributed to the Web3Auth network (using the 5/9 consensus mechanism), with these keys derived based on the user's identity;

- The wallet is automatically reconstructed in your application environment for user access.

The diagram below shows how Web3Auth's SFA infrastructure seamlessly integrates with applications.

Key Features:

- Complete Control Over the Interface: Customizable login interface and authentication process, fully aligned with brand visuals;

- Direct Integration: Wallet infrastructure is directly integrated within the application, without relying on external systems;

- No Redirect Experience: No need to redirect to external authentication pages; users remain within your application at all times;

- Multi-Platform Support: Supports Web, React Native, iOS, Android, and Flutter;

- Comprehensive Authentication Options: Supports social logins (Google, Twitter, etc.) and passwordless login methods (such as SMS, email, authenticator apps, Passkeys, etc.), and can seamlessly integrate existing authentication systems;

- Native Account Abstraction Support: Built-in support for smart contract wallets and multi-chain gasless transactions;

- Complete Wallet Services: Provides fiat deposits, token exchanges, NFT displays, transaction records, and more through pre-built wallet UI components;

- Integration with WalletConnect: Native support for WalletConnect, enabling seamless interoperability with the entire Web3 ecosystem.

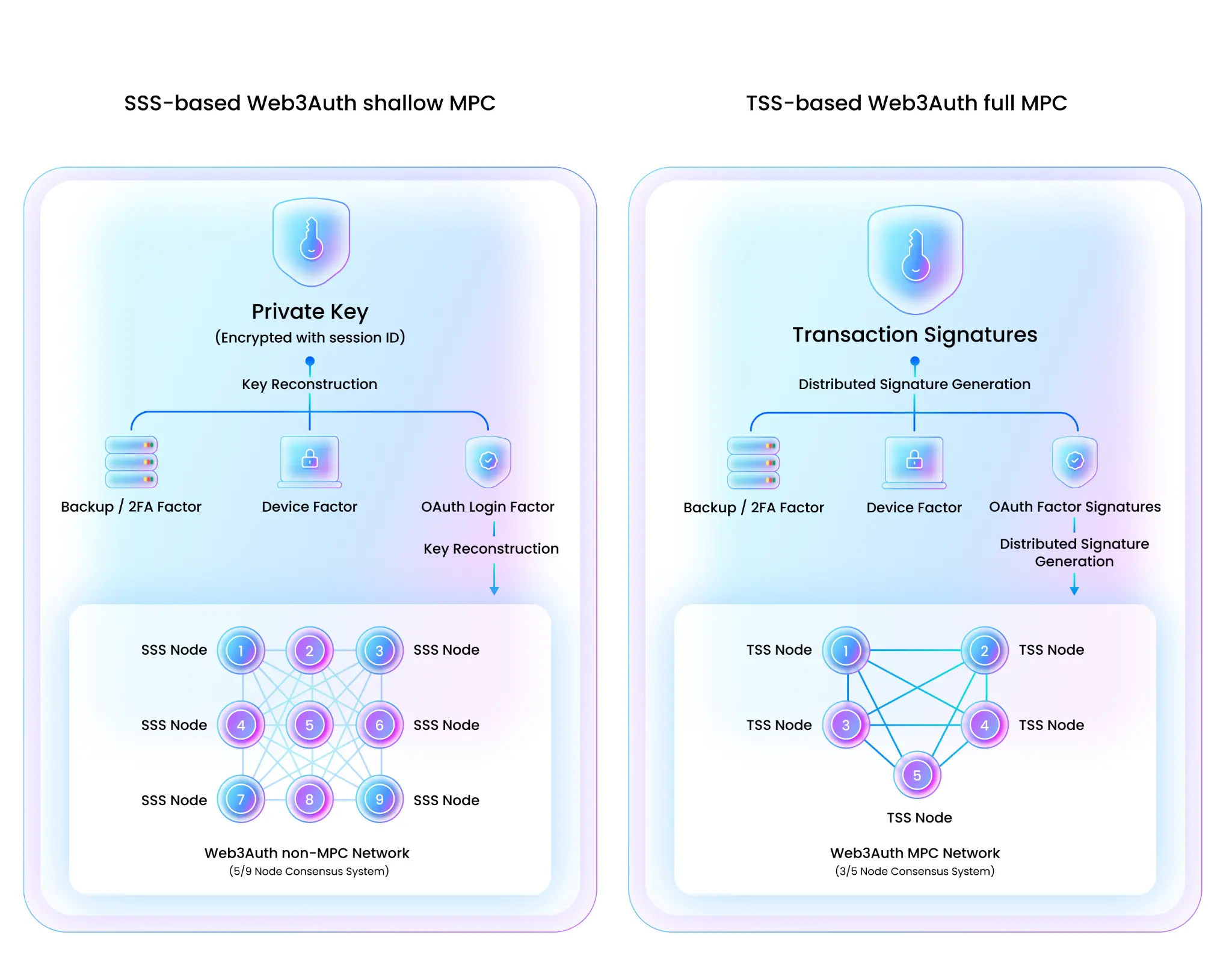

MPC Core Kit

MPC Core Kit is designed for applications that require advanced security and complete control over the authentication process. It provides the tools and flexibility needed to build complex authentication systems while maintaining high-security standards.

How MPC Core Kit Works

With Web3Auth's MPC Core Kit, developers can complete user authentication and blockchain transaction signing using distributed key shares without reconstructing private keys. This SDK employs a 2-of-3 threshold signing mechanism, with key shares distributed as follows:

- Web3Auth Network Share: Managed by the Web3Auth network and accessible via OAuth authentication methods like Google, providing users with a familiar authentication experience;

- Device Share: Securely stored on the user's device, supporting platform-level security mechanisms such as biometric authentication on mobile;

- Recovery Share: As a backup share, it can be stored on a second device, downloaded to offline storage, or derived from user input (such as passwords or security questions).

Signing Process

Users only need to access any two of the three key shares to complete the transaction signing. Each key share independently generates a partial signature, which is then aggregated into a valid signature through TSS (Threshold Signature Scheme) to complete the on-chain operation.

Key Features

- Uncompromising Security: Private keys are never reconstructed, eliminating the risk of private key leakage through a distributed MPC architecture.

- Seamless Integration: End-to-end authentication processes can be built directly within the application, providing complete UI/UX control.

- Enterprise-Level Infrastructure: Non-custodial MPC wallet architecture equipped with automatic recovery mechanisms, ensuring maximum security and reliability.

- Flexible Authentication Methods: Supports social logins, passwordless logins, and existing authentication systems, offering comprehensive identity verification options.

- Developer-First Design: Features direct integration capabilities and customizable interfaces, supporting the creation of complex authentication processes that closely match brand styles.

Commentary

Web3Auth greatly simplifies the onboarding threshold for Web3 users by seamlessly combining Web2 login experiences (such as social account logins and passwordless authentication) with decentralized wallets, making it one of the most user-friendly non-custodial wallet infrastructures available today. Its advantages include support for multi-chain and multi-platform integration, a highly secure MPC (Multi-Party Computation) key management system where private keys are never exposed or reconstructed, and a rich variety of authentication methods and UI customization options that facilitate developers in creating native experiences. However, Web3Auth also has certain disadvantages, such as an over-reliance on OAuth providers, which may raise centralization concerns in extreme cases, and a high level of abstraction in underlying key control that limits autonomy in certain security strategies for some advanced developers. Overall, Web3Auth is very suitable for dApp and wallet projects that prioritize user experience and rapid integration.

1.2. A Brief Overview of How the On-Chain Multi-Strategy Hedge Fund Neutral Trader Provides Low-Risk and Yield-Maximizing Strategy Solutions for Investors Through Its Flagship Product, Neutral Vaults

Introduction

Neutral Trader is an on-chain multi-strategy hedge fund founded by seasoned quantitative traders and trading experts from Goldman Sachs and the world's top three hedge funds.

We provide cutting-edge solutions for investors seeking stable, risk-adjusted returns through innovative Delta-Neutral trading and liquidity provision strategies to maximize profits. Our first product, the JLP Delta Neutral Vault, operates in the Drift perpetual contract market, employing advanced quantitative methods to ensure profitability with zero market volatility exposure.

This vault is designed to be non-custodial, meaning users always retain complete control over their funds.

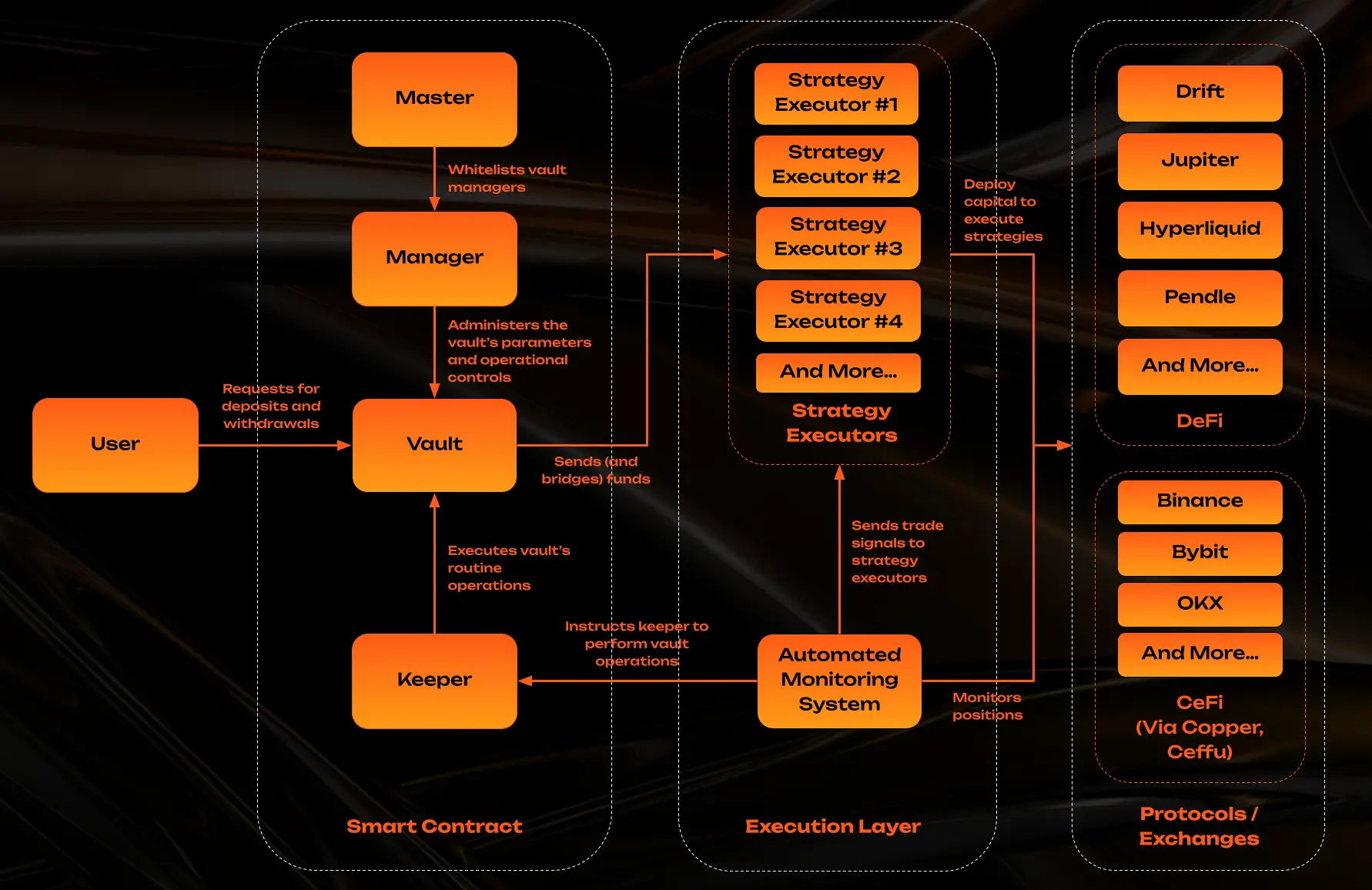

Architecture Overview

Neutral Vaults

- Core Features: Fully Automated Execution, No Manual Intervention Required

- From cross-chain bridging, fund deployment, to position management and exit execution, the entire process is automated and optimally configured.

- Utilizing hedge fund-level signal systems and real-time monitoring, we continuously seek the best yield and risk exposure opportunities.

- Minimizing manual intervention, strategies operate efficiently 24/7, unlocking scalable and capital-efficient execution capabilities.

Starting from Solana, Strategies Without Boundaries

- Users only need to complete a one-time deposit through Solana—no need for frequent cross-chain transactions or wallet switches.

- One-stop access to meticulously planned CeDeFi strategies covering mainstream public chains and trading platforms.

- Flexible fund scheduling capabilities, optimizing deployment locations based on market conditions to enjoy better quotes, lower slippage, and higher yields.

Institutional-Level Security Assurance, On-Chain Transparent Operations

- Assets are secured by trusted OTC settlement providers such as Copper and Ceffu.

- All transactions, strategy operations, and fund flows are recorded on-chain, ensuring complete transparency and verifiability.

- System Design

2.1 Core Roles in the System

- User: Users can deposit or withdraw funds to/from the Neutral Vault (NV) through the platform. User data and performance metrics (such as high-water marks and held shares) are recorded and updated on-chain in real-time.

- Neutral Vault (NV): The core fund pool of the system, responsible for circulating funds between users and strategy executors. NV manages all core operational data, including total shares, pending deposit/withdraw requests, deposit limits, and net asset value (NAV).

- NV Master Account: Holds protocol-level permissions, can whitelist and manage NV administrators.

- NV Manager: Can create and configure NV, adjust strategy parameters (such as fee structures), manage executors and keepers, and withdraw accumulated management fees and performance rewards.

- NV Keeper: Responsible for daily operations, such as batch processing deposit/withdraw requests, deploying funds to executors, calculating fees, and updating NAV records.

- Strategy Executors: Receive funds from NV and deploy them to major trading venues based on real-time trading signals.

- Automated Monitoring System: Writes strategy logic, monitors real-time trading environments, generates trading signals, and manages operational processes, including sending liquidation instructions, fund bridging, and transfers between NV and executors.

Protocols and Exchanges: The execution venues for strategies. CeFi platforms connect through secure OTC settlement services like Copper and Ceffu.

2.2 Operational Process

- Users submit deposit or withdrawal requests through the platform.

- NV Keeper periodically pauses new requests to batch process current deposit/withdraw requests.

- NV Keeper uses the latest NAV to batch process current pending deposit/withdraw requests. If a withdrawal is needed, some positions will be closed first.

- Processed deposits will be allocated to the corresponding strategy executors based on the fund allocation ratios set by NV.

- After processing, NV Keeper reopens the vault, allowing users to submit new deposit/withdraw requests.

2.3 Fee Types

- Management Fees: Charged linearly over time, based on the rates set by NV. Fees are deducted in the form of NV shares, reducing the shares held by users. NV managers can withdraw accumulated management fee shares at any time.

- Performance Fees: Charged when the current share price exceeds the user's high-water mark (HWM), calculated based on the excess amount at a preset rate. After collection, the user's HWM will be updated to the current share price. If a user deposits again when the current price is below their original HWM, the system will recalculate the HWM based on the weighted average between the old HWM (corresponding to the original shares) and the current price (corresponding to the new shares). Performance fees are also charged in the form of shares.

- Deposit Fees: Deducted from deposited funds before issuing NV shares, resulting in a reduction of the actual shares received by users.

- Withdrawal Fees: Charged on the redemption amount, reducing the net redemption amount received by users.

- Deposit and Withdrawal Process

3.1 Deposit and Withdrawal Operation Process

- Connect Wallet: Use your preferred Solana-compatible wallet to connect to the platform.

The platform supports connecting most mainstream wallets via WalletConnect. - Submit Deposit Request: Users can submit deposit requests to the Neutral Vault (NV).

All requests are typically processed within 24 hours.

Deposits must meet minimum amount requirements.

If the total locked amount (TVL) of NV has reached its limit, requests may be rejected.

Once a deposit request is submitted, users cannot submit new deposit or withdrawal requests until the current request is processed.

Cannot be canceled after submission. - Process Deposit and Issue Shares: The platform will batch process deposit requests (after deducting deposit fees).

Funds will be deployed to strategies after processing is complete.

Users will receive NV shares, representing their proportional ownership of NV assets. - Post-Deposit Phase: Share prices will fluctuate based on the performance of the underlying strategies.

There may be a certain lock-up period before submitting a withdrawal request.

The platform will periodically collect management fees and performance fees (if applicable). - Submit Withdrawal Request: Users can request to withdraw their held NV asset shares.

Depending on the strategy, requests may need to enter a cooling-off period.

During the cooling-off period, NV managers will prepare necessary assets through liquidation and other operations.

Once a withdrawal request is submitted, users cannot submit new deposit or withdrawal requests until the current request is processed.

Cannot be canceled after submission. - Process Withdrawal and Redeem Shares: After the cooling-off period ends, users will automatically receive their corresponding NV asset shares (after deducting any applicable withdrawal fees, performance fees, and management fees).

NV shares will be destroyed after the withdrawal is completed, reflecting the reduction in total holdings.

Withdrawals are typically processed within 24 hours after the cooling-off period ends.

Summary

Neutral Trader, as an on-chain multi-strategy hedge fund, is built by a quantitative team from Goldman Sachs and top global hedge funds, with advantages in its institutional-level strategy execution capabilities and automated infrastructure. Through products like the JLP Delta Neutral Vault, Neutral achieves market-neutral strategies and cross-chain deployment, combining CeFi/DeFi liquidity, non-custodial asset management, and on-chain transparency to reduce user risks and optimize returns. However, its high-threshold operational model (such as cooling-off periods, lock-up periods, and batch processing mechanisms) and complex fee structures may reduce the experience and fund flexibility for ordinary users, making it more suitable for professional investors.

2. Detailed Projects to Watch This Week

2.1. In-Depth Look at the $8 Million Fundraising and Unique Dynamic Risk Layering System of the DeFi Protocol Avantis, Protecting Traders from Significant Price Fluctuations

Introduction

The Avantis Foundation is developing the Avantis protocol: an advanced on-chain exchange for cross-asset leveraged trading, allowing users to go long or short on synthetic cryptocurrencies, forex, and commodities, or provide liquidity to support trading in these markets.

Avantis has pioneered several innovative mechanisms in DeFi that do not exist elsewhere:

- Loss Rebate: Provides rebates on losses from certain trades to help balance the platform's open position deviations.

- Positive Slippage: Offers better entry prices than the market for trades that balance open position deviations.

- RWA Access: Trade multiple assets such as yen, gold, and Bitcoin on a single terminal.

- Advanced Risk Management for Liquidity Providers: Liquidity providers can passively deposit USDC or become active market makers by selecting risk tiers and deciding on lock-up times.

- Feature Analysis

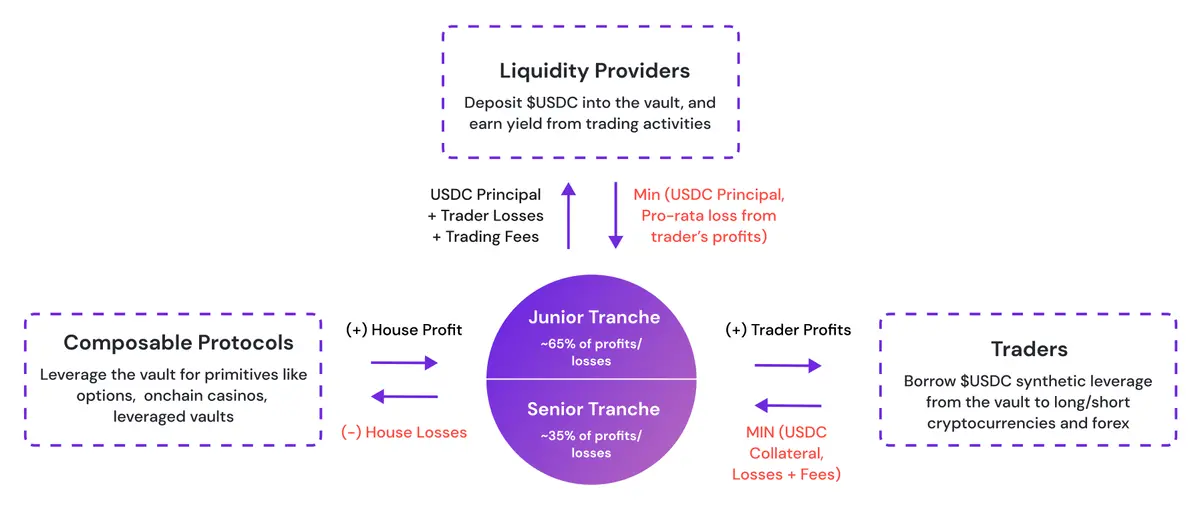

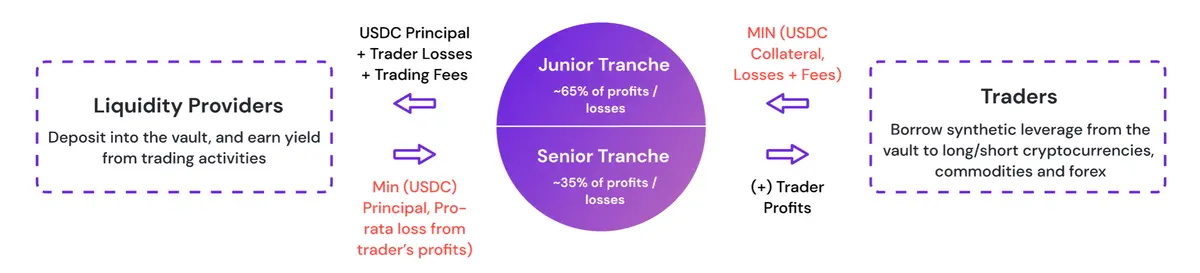

Liquidity Providers

- USDC Vault

Liquidity providers are at the core of Avantis, earning organic returns from all trades on the platform.

Currently, anyone can stake USDC in the vault to provide trading liquidity for the platform. In return, they will receive a portion of the trading fees generated by the market-making vault on Avantis. Avantis is a chain-based, margin-based native product ecosystem, and liquidity providers will be eligible for all rewards accumulated within this ecosystem.

The vault acts as the counterparty for all trades on the platform:

- When traders profit (positive PnL), their earnings come from the vault.

- When traders incur losses (negative PnL), their losses will be transferred to the vault.

In return, the vault will receive a portion of the trading fees. These fees will be distributed proportionally based on the avUSDC shares in each risk tier, incentivizing stakers to remain in the vault. Investing in the vault is not without risks, which is why different risk tiers (or "levels") are created. Higher and lower tiers earn (and share losses) at different rates, allowing users to choose different risk levels. Currently, we have two risk tiers for users to choose from:

- High Tier (Low Risk): Our low-risk product, earning approximately 35% of the liquidity provider fees. However, it only bears about 35% of the losses.

- Low Tier (High Risk): Our high-risk product, earning approximately 65% of the liquidity provider fees. However, it also only bears about 65% of the losses.

As long as the earned fees (trading fees + trader losses) exceed the PnL payouts (trader profits), stakers will receive positive returns.

PnL vs Fee Distribution

Note: The protocol does not distribute traders' PnL. Historically, there have been practices of distributing traders' PnL, which led to rapid increases in share prices but at the cost of increased volatility.

Traders' losses accumulate in a buffer pool and are ultimately paid to profitable traders. Overall, the protocol expects to be in a "Delta Neutral" state (i.e., traders' profits and losses are averaged out), meaning liquidity providers primarily benefit from trading fees rather than PnL. This is more favorable for liquidity providers seeking stable returns and wishing to protect their principal.

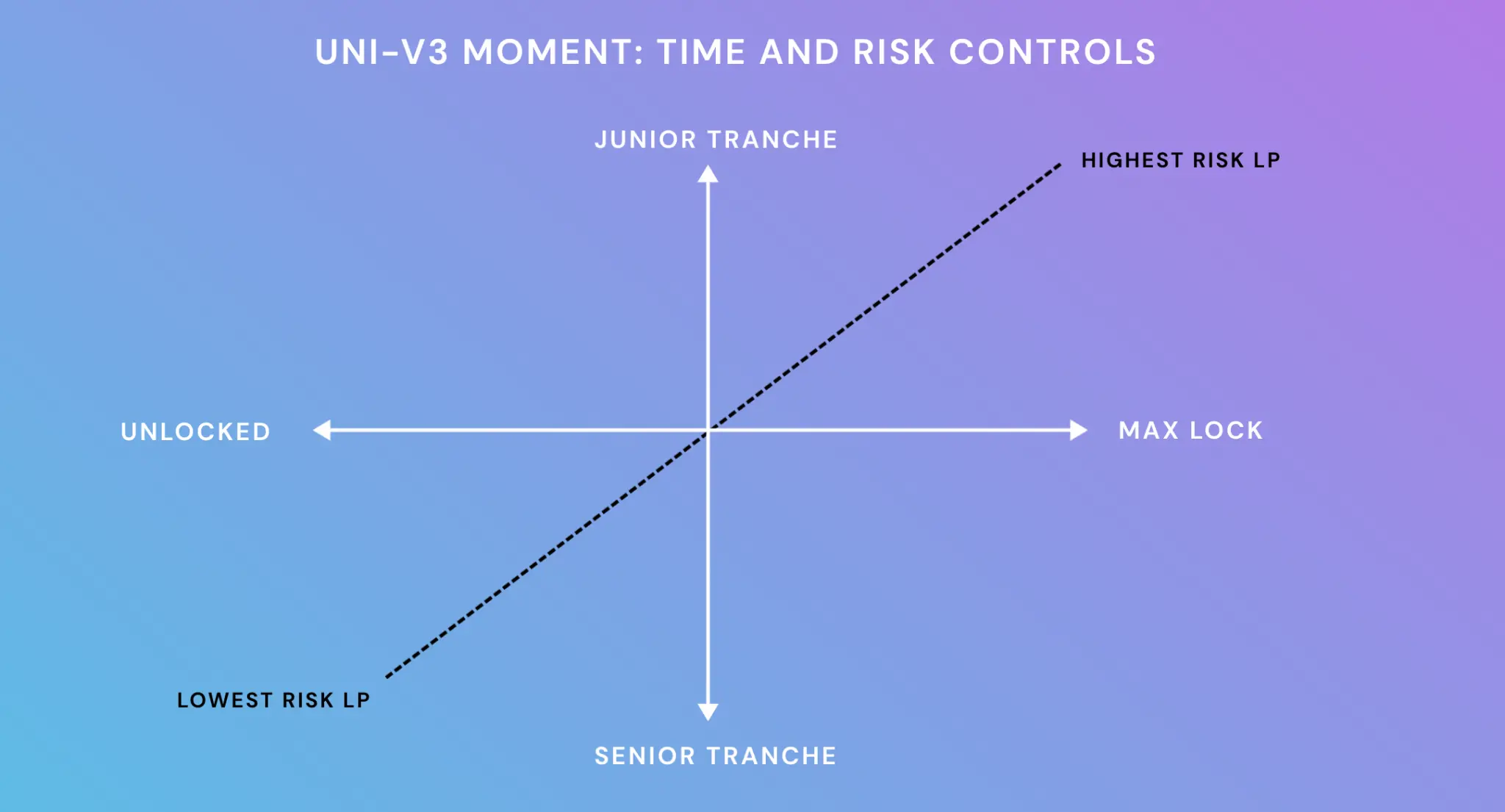

- UNI-V3 Moment: Time and Risk Avantis unlocks new design space for oracle-based trading protocols by providing liquidity providers with granular time and risk management.

Traditionally, liquidity providers (LPs) in oracle-based perpetual trading protocols (like GMX or Synthetix) have been very passive. This means that during bullish market conditions, each LP profits the same, and during bearish market conditions, each LP incurs the same losses. To enable oracle-based trading to achieve the trading volume of spot trading protocols, a robust parameter system is needed for LPs to fine-tune based on their market views.

Just as Uniswap's V3 architecture provides flexibility for spot automated market maker (AMM) LPs by allowing them to choose price ranges for liquidity provision, Avantis unlocks more flexibility for its LPs by adding time and risk parameters. This effectively means that as an LP, you can choose to be at the low or high end of the risk spectrum based on your market judgment.

- Risk Management: Risk Tiers Enhancing the scalability of liquidity providers (LPs) through customized risk-reward structures.

As mentioned in the USDC vault section, investing in the vault is not without risks. Liquidity providers are essentially making a bet that even if traders make profits, the trading fees should at least protect the LP's principal. Therefore, Avantis has designed a risk management system that ensures LPs can choose customized risk tiers:

High Tier (Low Risk): The protocol's low-risk product, earning approximately 35% of the liquidity provider fees. However, it only bears about 35% of the losses.

Low Tier (High Risk): The protocol's high-risk product, earning approximately 65% of the liquidity provider fees. However, it also only bears about 65% of the losses.

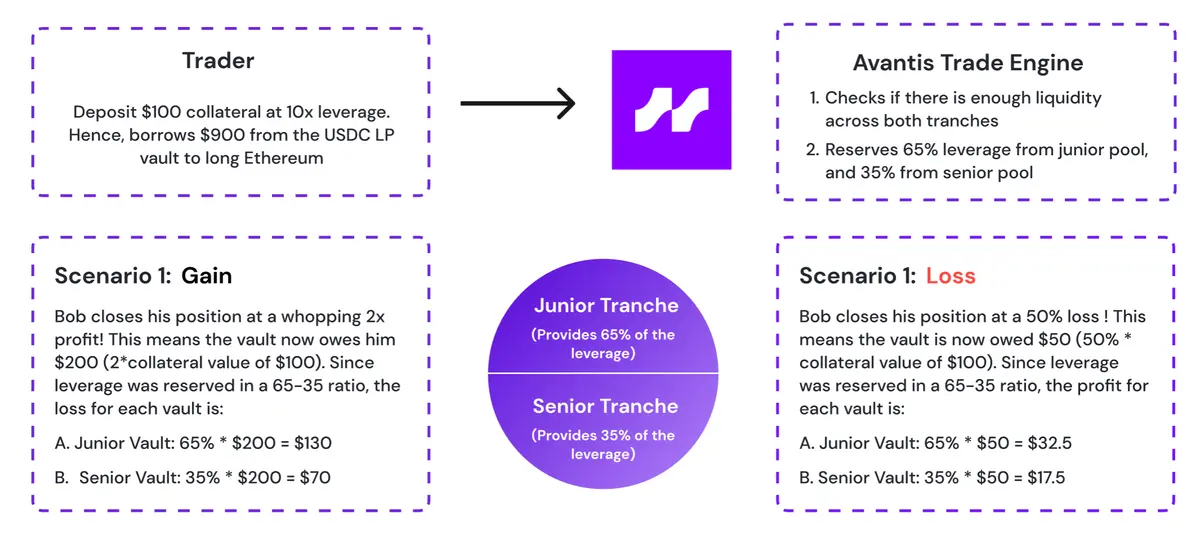

Avantis' smart contracts continuously monitor whether the protocol is in a "normal" or "constrained" liquidity state.

Normal Liquidity: This is the ideal state of the protocol, where there is sufficient liquidity between the two vaults to retain leverage within the desired profit-loss ratio.

Example: A trader wants to execute a trade worth $1,000. The high tier has $2,000, and the low tier has $1,500. In this $1,000 trade, $650 can be reserved from the low tier, and $350 can be reserved from the high tier.

Constrained Liquidity: This is a state of the protocol where there is insufficient liquidity between the two vaults to retain leverage within the desired profit-loss ratio.

Example: A trader wants to execute a trade worth $1,000. The high tier has $800, and the low tier has $400. In this $1,000 trade, $350 can be reserved from the high tier, but $650 cannot be reserved from the low tier.

In this case, the protocol is in a constrained liquidity state because Condition I has been violated. In this state, leverage will be reserved from both pools based on the actual balance ratio of the two pools (thus, approximately 33% of the trade, or $330, comes from the low tier, and approximately 67% or $670 comes from the high tier).

Yield Multiplier

When there is a significant gap between the high and low tiers, we apply a yield multiplier to encourage liquidity providers (LPs) to rebalance these two tiers. The yield multiplier is only applied when the gap between the two tiers exceeds 35%.

This multiplier increases exponentially as more people invest in the high tier (by making yields very attractive to new LPs, driving LPs towards the low tier). Conversely, when the low tier occupies too large a proportion of the overall tier liquidity, we do not provide additional returns for the low tier (while low tier LPs face higher loss risks than high tier LPs). From a game-theoretic perspective, these dynamic multipliers influence the flow of TVL between the two tiers to restore the protocol to a healthy state.

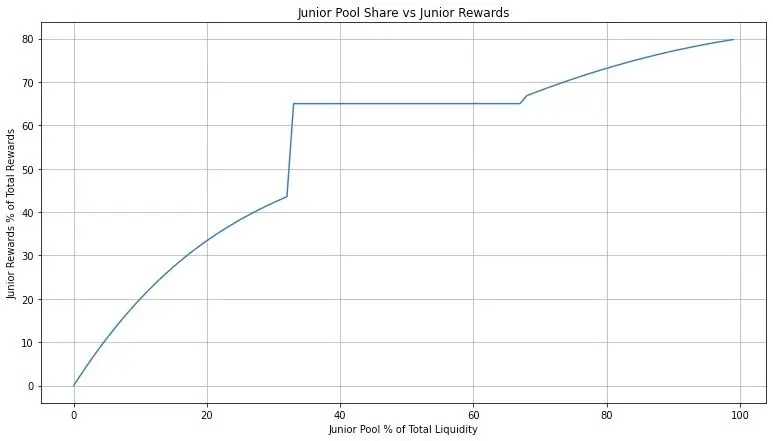

The chart below illustrates the effect of our dynamic multipliers. When the gap between the low tier and high tier is within an acceptable range (i.e., when the low tier occupies 32.5%-67.5% of the overall vault liquidity), the low tier will receive 65% of the trading fees. When the low tier's allocation is insufficient, it will receive disproportionately more fees (for example, at a 20% allocation, over 30% of the fees). Similarly, when the low tier's allocation is excessive, it will receive disproportionately fewer fees (for example, at an 80% allocation, below 75% of the fees). All of this is due to the effect of the dynamic multipliers.

Tier Balancing - Aligning Incentives

To encourage a healthy asset balance between the tiers, there are several ways to incentivize existing and new liquidity providers (LPs) to take the right actions to ensure the long-term sustainability of the protocol. Particularly when the liquidity between the low tier and high tier begins to deviate from the ideal 50-50 ratio, two types of fees will help balance these two tiers.

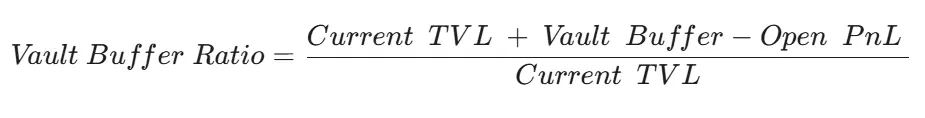

Vault Buffer Ratio - Maintaining Sustainability

In times of market volatility, sometimes the liquidity provider's buffer is insufficient to withstand the impact of traders' open profit and loss (PnL). The vault buffer ratio tracks how much buffer the vault has to cope with the negative effects of traders' profits and losses. A vault buffer ratio of 100% indicates that liquidity providers currently have no buffer to cope with open profits and losses (i.e., traders' unrealized profits). Similarly, a vault buffer ratio of 110% indicates that traders can withdraw 10% of the vault's value, before which existing liquidity providers will not lose their principal (note - this is just a simplified example and does not apply to all liquidity providers as they enter and exit the protocol at different times).

To avoid panic and maintain a healthy experience for traders, a vault buffer fee will be charged to manage the risks of liquidity providers and traders and prevent overuse, which is risky for liquidity providers. In the long run, this helps maintain healthy liquidity, boosts traders' confidence, and ultimately brings more fees to liquidity providers while reducing risks.

Where:

- Open PnL = The net profit/loss generated by trades that have not been closed on any given date. These are trades that have not been closed, so the open PnL has not been realized.

- Current TVL = The total value in the vault when calculating the ratio.

- Vault Buffer = The difference between the vault manager (holding all open collateral and undistributed profits/losses) and the open collateral in the system (i.e., collateral currently in open trades). The vault buffer shows how much excess capital is available in the liquidity provider pool to absorb profit and loss shocks during market volatility.

- Time Management: Locking Liquidity

The implementation of liquidity locking is designed to further align liquidity providers with the protocol. By locking low and high liquidity provider tokens, you can earn additional rewards based on the amount and duration of the lock.

How It Works: By default, all liquidity providers in the USDC vault (regardless of risk tier) will receive an automatically compounding vault token. However, liquidity providers can choose to soft-lock their capital into the protocol and receive higher fees in exchange, providing more stability to the protocol's total liquidity (TVL). Locking actually gives you an additional "points bonus" compared to liquidity providers who do not lock (each dollar of unlocked capital represents 1 point, with earnings distributed based on each liquidity provider's points). The minimum lock-up period is 14 days, and the maximum is 6 months. Depending on the duration of the lock-up, liquidity providers will receive at least a 1.2x points bonus (compared to unlocked liquidity providers), up to a maximum of 4x. This means that liquidity providers who lock for 6 months will receive a higher additional fee annualized return (APR) than those who lock for 14 days, and obviously higher than those who do not lock at all. Your APR bonus will depend on your lock-up duration and invested capital.

Example:

Liquidity Provider 1 invests $100 into the protocol. Liquidity Provider 2 invests $100 and locks it for 6 months. This means Liquidity Provider 1 has 100 points, while Liquidity Provider 2 has 500 points (100 base points + 4x bonus). If the total earnings for liquidity providers are $100, then:

- Liquidity Provider 1 receives: 100/600 * 100 = $14

- Liquidity Provider 2 receives: 500/600 * 100 = $84

Technical Details: The locking process will send the ERC-4626 LP tokens of the vault to a smart contract and mint an ERC721 token that tracks and represents the locked amount, deposited into the locker’s wallet. ERC721 is composable. This NFT accumulates transaction fees in real-time, and lockers can claim these fees without unlocking the NFT. Liquidity providers can also choose to unlock their capital early, but will incur a fee.

Points to Note About This Feature:

- Enhanced rewards only apply to the portion of capital locked by liquidity providers.

Example: A liquidity provider locks 100 USDC for 6 months and can only receive a 4x reward multiplier on that 100 USDC. If the same liquidity provider also invests an additional 1,000 USDC into the vault but does not lock it, they will not receive additional rewards for the extra 1,000 USDC. Both liquidity providers will receive the vault's regular unlocked rewards. - The reward multiplier will terminate after the lock-up period ends.

Users wishing to continue receiving the reward multiplier will need to re-lock their funds.

Example: A liquidity provider locks 100 USDC for 6 months and receives a 4x reward multiplier. After 179 days, the liquidity provider will still receive the same reward multiplier. However, on the 180th day, the additional rewards will stop, and the liquidity provider will need to re-lock to continue receiving the same rewards.

Early Unlocking

Liquidity locking is effectively considered a soft lock. This means liquidity providers can technically unlock various tiers early, but will incur a fee. This approach provides liquidity providers with more flexibility while maintaining fairness in rewards for other protocol liquidity providers, especially for those who do not lock. The unlocking fee is calculated from two components.

- A = Locked Amount

- Fₚ = Fee Percentage

- Tₗ = Remaining Lock Time

- Mₜ = Maximum Time

Morpho Integration

- Multi-Collateral USDC Lending

Avantis has integrated Morpho, a leading on-chain lending protocol. This integration brings the following features for liquidity providers and traders:

Multi-Collateral Trading

Use your existing crypto assets (such as BTC, ETH, and other altcoins) to borrow USDC on Base, allowing you to continue doing what you do best: perpetual contract trading!

After the trade is completed, you can easily repay the loan through a single bundled transaction. More USDC allows traders to achieve higher leverage and greater market exposure without selling your crypto assets.

Increase Avantis XP + Earnings

Avantis vault deposits sometimes offer higher annualized returns than Morpho's lending APY (for locked deposits).

Depending on the lock-up period and earnings, you can earn positive returns (and gain enhanced Avantis XP) without selling Bitcoin or Ethereum.

Supported Markets

Avantis has integrated multiple markets supporting USDC lending, including:

- cbETH (yield-bearing)

- wstETH (yield-bearing)

- cbBTC

- ETH

Additionally, the protocol will soon launch more new markets, allowing users to borrow USDC on Base using their entire crypto asset portfolio and maximize their potential.

Summary

Avantis offers a diverse range of trading options and innovative risk management mechanisms, providing liquidity providers and traders with higher earning potential and more flexible leveraged trading through liquidity tiering and integration with Morpho. Its dynamic yield adjustment and locking mechanisms effectively balance risk and reward, but the complex mechanisms and high risks may make it challenging for novice users. Additionally, liquidity pressure and market volatility may affect the safety of LPs' funds, especially during liquidity constraints or imbalances, potentially leading to earnings fluctuations.

### Industry Data Analysis

1. Overall Market Performance (as of November 1, Eastern Time) Total net outflow of Ethereum spot ETFs: $10,925,600

1.1. Spot BTC vs ETH Price Trends

BTC

Analysis

Key support levels to watch: $98,000 (1st line), around $93,000 (2nd line)

Key resistance levels to watch: $103,000 (1st line), $106,400 (2nd line)

ETH

Analysis

Key support levels to watch: $2,110 (1st line), $1,970 (2nd line)

Key resistance levels to watch: $2,450 (1st line), $2,880 (2nd line)

2. Public Chain Data

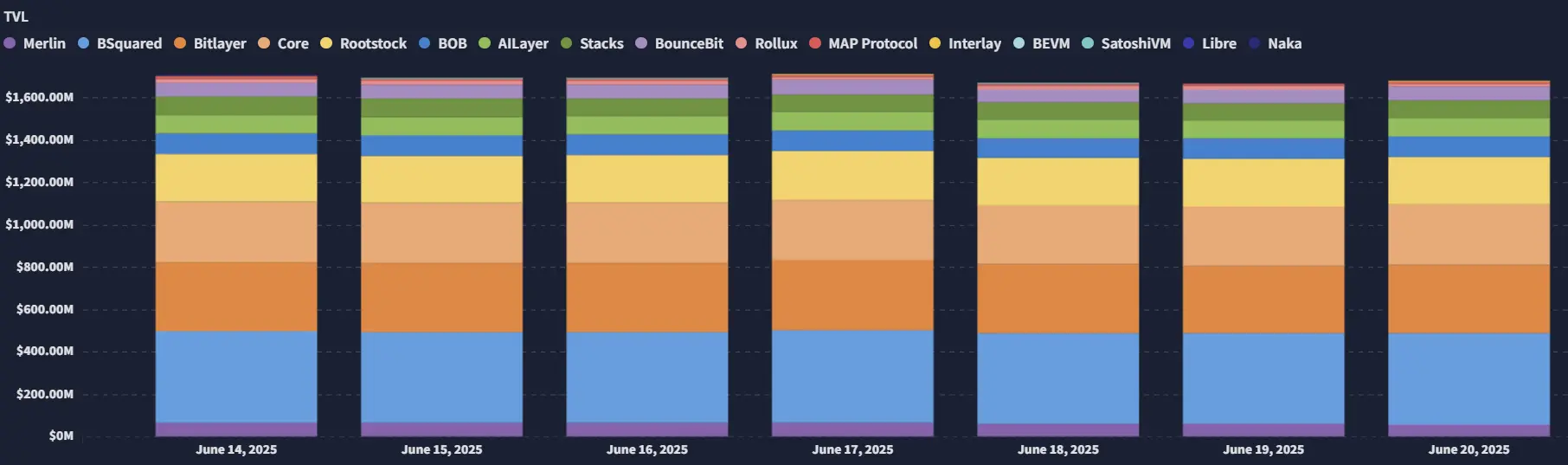

2.1. BTC Layer 2 Summary

Major Events:

- The presale of Bitcoin Hyper has become the biggest news this week, representing the rise of a new generation of high throughput, cross-chain secure L2.

- Lightning Network updates are accelerating the optimization of payment efficiency and asset flexibility.

- The Bitcoin L2 scene is diversifying from early payment/asset bridging to DeFi, smart contracts, and more, gradually heating up the industry landscape.

- Developer and capital attention has significantly increased, with L2 product competition becoming increasingly fierce, ushering in a new round of explosive opportunities.

2.2. EVM & Non-EVM Layer 1 Summary

Major Events:

1inch and Sonic Network Integration

- Event Overview: On June 20, DeFi aggregator 1inch announced its integration with the high-performance EVM-compatible chain Sonic Network. This update brought sub-second completion times, MEV protection, and bridge-less cross-chain exchange capabilities.

- Impact and Significance: After integrating Sonic, 1inch users can directly use Sonic liquidity within their wallets and dashboards, providing more competitive trading prices and lower slippage, further enhancing the DeFi experience.

Quranium Secures Investment from Animoca Brands

- Event Overview: On June 21, quantum-secure, AI-native, and EVM-compatible Layer-1 protocol Quranium announced a strategic investment from Web3 giant Animoca Brands.

- Impact and Significance: This investment will help Quranium expand into gaming, the metaverse, and AI applications, while leveraging Animoca Brands' global ecosystem network for implementation.

XRP Ledger's EVM Sidechain Set to Launch in Q2

- Event Overview: At the APEX 2025 conference in early June, Ripple executives confirmed that the EVM-compatible sidechain of XRPL is expected to launch in the second quarter of 2025, with the testnet rapidly growing and attracting about 87 new developers.

- Impact and Significance: This sidechain will allow XRPL to support Solidity smart contracts, DeFi, and NFT applications, significantly enhancing the developer ecosystem and asset liquidity.

2.3. EVM Layer 2 Summary

Major Events:

During the period from June 16-21, 2025, the EVM Layer 2 ecosystem exhibited the following trends:

- Comprehensive network upgrades: Especially with Arbitrum integrating Pectra, continuously enhancing technical capabilities;

- Market acceleration and concentration: Base, Arbitrum, and Optimism have become dominant, with other L2 shares significantly declining;

- Reconfiguration of capital flows: L2 ETH reserves have significantly decreased;

- Academic focus on MEV: In-depth analysis of MEV behavior and efficiency on L2;

- Active community governance: Optimism continues to advance the Superchain governance framework.

### 4. Macroeconomic Data Review and Key Data Release Points for Next Week

In May, U.S. retail sales fell by 0.9% month-on-month, below the market expectation of 0.6%, primarily affected by a decline in auto sales. However, retail sales excluding autos and gasoline only saw a slight decrease, and the control group retail sales still contributed positively to the second quarter GDP. New housing starts in May saw a significant month-on-month decline of 9.8%, and building permits were also weaker than expected, mainly due to high U.S. Treasury rates suppressing activity in the real estate market.

Important macroeconomic data points for this week (June 23 - June 27) include:

June 25: U.S. EIA crude oil inventories for the week ending June 20

June 26: U.S. initial jobless claims for the week ending June 21

June 27: U.S. May core PCE price index year-on-year; U.S. June Michigan University consumer sentiment index final value

### 5. Regulatory Policies

Norway

- Proposed temporary ban on new high-energy consumption mining farms: The government plans to suspend the approval of new high-energy cryptocurrency mining data centers starting in the fall of 2025 to conserve electricity resources. The reason is that mining output is low and contributes little to local employment and the economy.

UAE (Dubai)

- Strengthened regulations to combat money laundering: New regulations have been introduced to strictly control money laundering through crypto assets, particularly targeting the use of shell companies to transfer assets for property purchases, with tax authorities in India and other regions also increasing their focus.

United States

- GENIUS stablecoin bill quickly passes the Senate: The U.S. Senate passed the bill with a vote of 68-30, establishing regulatory standards and reserve requirements for stablecoins, and prohibiting members of Congress and their families from profiting.

- SEC significantly withdraws previous proposals: New SEC Chair Paul Atkins has repealed 14 regulations proposed by former officials, including strict regulations on cryptocurrency exchanges and AI advisors.

- Trump administration promotes crypto-friendly policies: Trump and other radicals are pushing for policies favorable to the crypto industry, with his private and Memecoin projects causing controversy.

South Korea

- Central bank cautiously supports the Korean won stablecoin: The central bank is taking a cautious stance on the Korean won stablecoin, paying attention to the potential impact of exchanges with U.S. dollar stablecoins on financial policy.

- Plans to launch a spot crypto ETF: Financial regulators are developing a roadmap to legalize spot crypto ETFs by the second half of 2025.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。