Regardless of market fluctuations, users can enjoy stable annual returns by depositing USDD in JustLend DAO, opening a new chapter for steady wealth growth.

Recently, the stablecoin sector has achieved a significant breakthrough, with USDC issuer Circle successfully listing on the US stock market, far exceeding expectations in stock performance, which has drawn global institutional attention to the stablecoin space. Major giants like Walmart, Amazon, JD.com, and Ant Group are also making moves to launch their own stablecoins, making the stablecoin sector a global focus.

In this stablecoin feast, TRON stands out as the core trading infrastructure in the stablecoin field, and its early bet on the stablecoin sector is truly commendable. In addition to actively expanding USDT, TRON announced earlier this year that it would upgrade its native decentralized stablecoin USDD to version 2.0. Now, with its outstanding performance and wide application, USDD is thriving within the TRON ecosystem, becoming the second-largest stablecoin after USDT and occupying an important position.

For users, stablecoins have long transcended the traditional intermediary tools in trading amidst the ups and downs of the crypto market. What users care about more is how to achieve wealth appreciation with stablecoins while ensuring safety.

Always at the forefront of the industry, TRON has keenly captured user needs. It cleverly combines USDD with DeFi applications like JustLend DAO and Sun.io within the TRON ecosystem, creating a "lazy income" scheme that can be described as "crypto money market funds," sparking a revolution in stable income. Regardless of market fluctuations, users can enjoy stable annual returns by depositing USDD in JustLend DAO, opening a new chapter for steady wealth growth.

The "Hard Currency" USDD in the TRON Ecosystem

In the stablecoin field, TRON has become the undisputed preferred destination for stablecoin development due to its leading ecological advantages. Even the highly anticipated USD stablecoin USD1, supported by the Trump family, successfully began its minting journey on its network on June 11. As the native stablecoin of the TRON ecosystem, USDD is naturally an important strategic move in its stablecoin layout.

USDD, as a fully decentralized stablecoin, fundamentally differs from traditional stablecoins. It operates without relying on centralized institutions, strictly pegging the USD 1:1 exchange rate through an over-collateralization mechanism. This decentralized and over-collateralized characteristic gives USDD high transparency and stability, winning the favor of many users and investors.

In the TRON ecosystem, USDD holds a crucial position. It can circulate across chains and participate in various DeFi activities to earn users profits. Notably, USDD has successfully entered practical applications in the real world, being used in physical retail scenarios.

On June 5, TRON announced a partnership with AEON, allowing users to use TRON's native assets TRX, USDT, and USDD for QR code payments in offline business stores through AEON's payment tool, AEON Pay. This move has made USDD not just a stablecoin in the crypto world but also a bridge between the real and virtual worlds, with its practicality and wide acceptance being regarded by many users as a true "hard currency."

Originally an algorithmic stablecoin in the TRON ecosystem, USDD underwent a significant upgrade in January this year, officially upgrading to version USDD 2.0. This upgrade is a qualitative leap, introducing a deeply optimized and meticulously crafted collateral mechanism and achieving a fully decentralized governance model. In the new version, the control of the minting mechanism is entirely handed over to the community, allowing users to deposit collateral according to their needs and customize the collateral ratio to mint new USDD. This highly autonomous minting method not only enhances the democratic nature of decentralized governance but also improves the efficiency of fund utilization, enabling users to participate more flexibly in the construction of the USDD ecosystem.

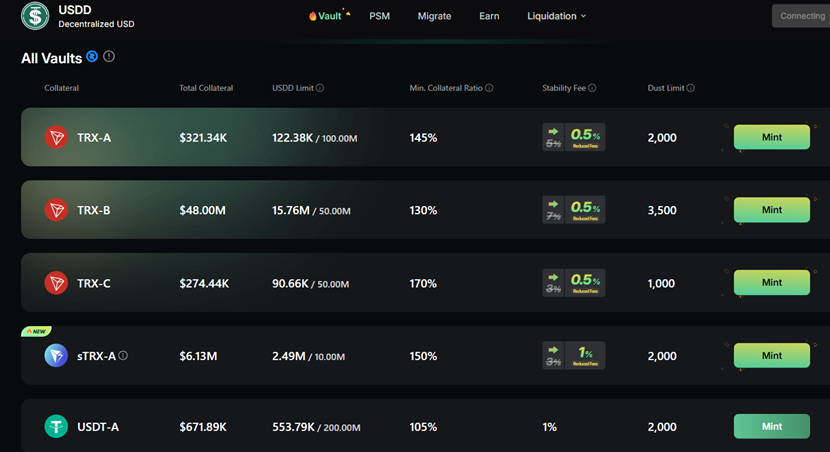

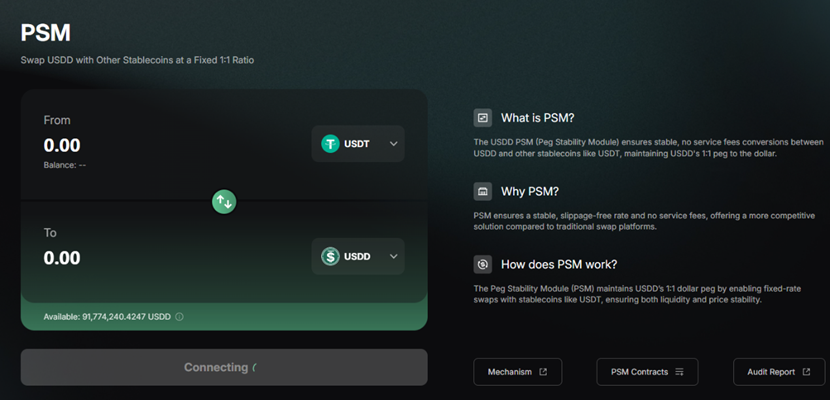

Currently, there are three main ways to obtain USDD. First, through over-collateralized minting, which currently supports various high-quality crypto assets like TRX, sTRX, and USDT as over-collateralized assets to mint USDD; second, through the PSM exchange tool, using USDT to directly exchange for USDD; third, by directly purchasing on exchanges, currently supported on platforms like HTX, Bybit, MEXC, and BingX.

(First, minting USDD through over-collateralized TRX, sTRX, USDT)

(Second, directly exchanging USDT for USDD through the PSM tool)

Regarding minting fees, USDD has launched a series of discount activities, bringing tangible benefits to users. On June 15, USDD launched a new round of minting fee discount activities. During the event, the stable fee rate for different collateral ratios and minting fee TRX-A, TRX-B, and TRX-C vaults was uniformly reduced to 0.5%, while the stable fee for the sTRX-A vault was significantly adjusted from the original 3% to 1%. The discount activity will end on July 15. This initiative greatly reduces the cost for users to mint USDD, stimulating their enthusiasm for minting and encouraging more people to participate in the USDD ecosystem.

In terms of expanding usage scenarios, USDD has been deeply integrated into multiple DeFi applications within the TRON ecosystem. Users can easily participate in a wider range of DeFi activities such as lending, staking, and trading to earn more profits. Clearly, USDD has become an indispensable "hard currency" in the TRON ecosystem, injecting strong momentum into the development of the entire ecosystem.

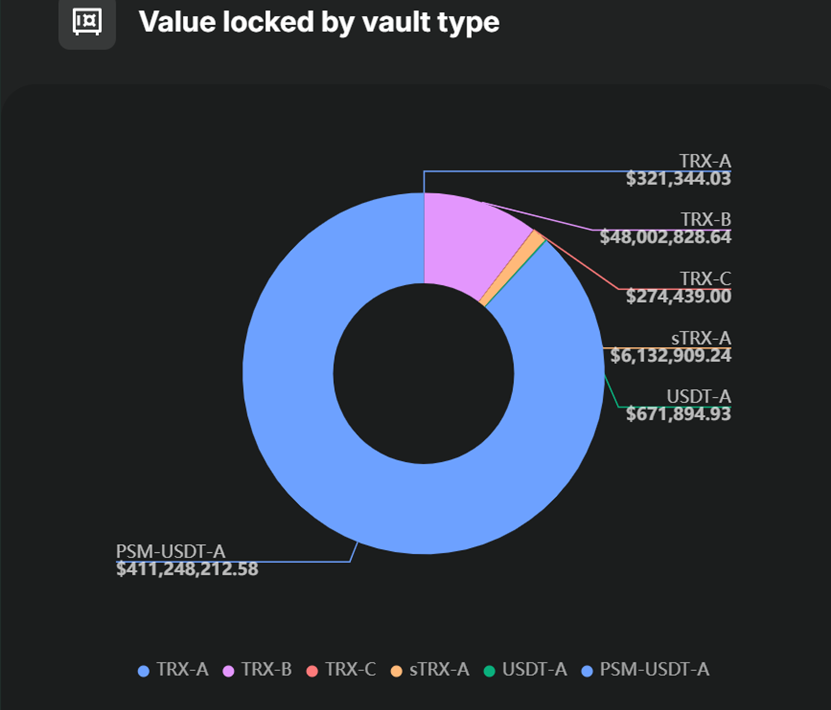

As of June 18, the issuance of USDD has surpassed 431 million, ranking third in the over-collateralized decentralized stablecoin sector (the top two are SKY (formerly Maker DAO)'s DAI and USDS). Among them, the assets collateralized in the USDD fund pool have exceeded $466 million, with a collateralization ratio of about 108%.

Three Tested Income Paths for Stablecoin USDD in JustLend DAO and Sun.io: Risk-Free Income Starting at 6% Annualized

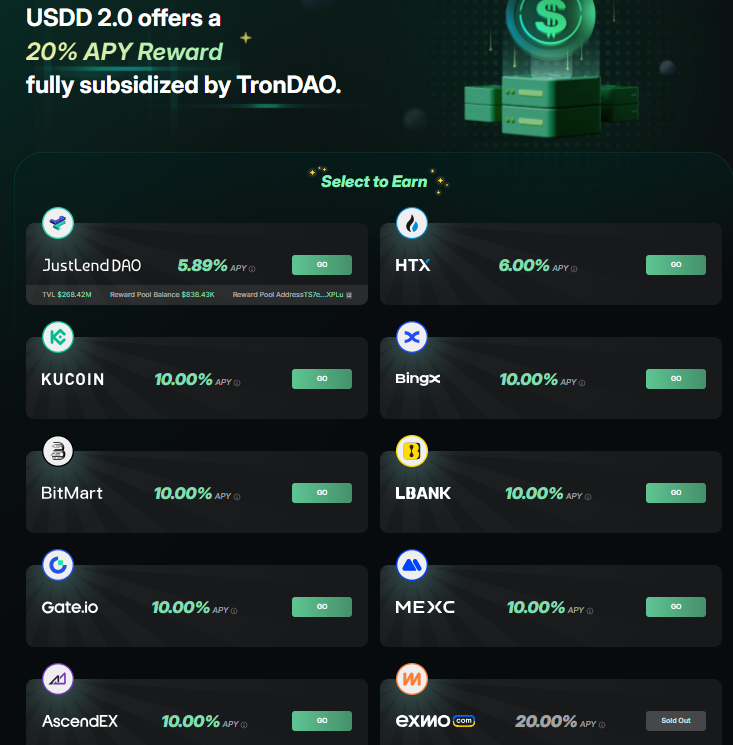

In the context of market volatility, how to achieve stable returns through stablecoins has become a focal point for many investors. In January this year, USDD launched the USDD Earn staking income activity. Users can earn interest simply by storing USDD stablecoins in JustLend DAO, with initial maximum returns reaching up to 20%. However, the returns decrease in stages as the amount of deposited funds increases, and all returns will be distributed in the form of USDD stablecoins, subsidized by the TRON DAO.

As of June 18, the USDD Earn staking income activity has entered its fifth phase, covering DeFi protocols JustLend DAO and several exchanges like HTX and GATE. According to the current tiered structure, the annualized return rate for USDD on JustLend DAO is about 6%, while the annualized return rate on partner exchanges can reach up to 10%.

Based on different factors such as return rates, participation methods, and involved DeFi protocols, the paths to earn returns can be categorized into the following three main types:

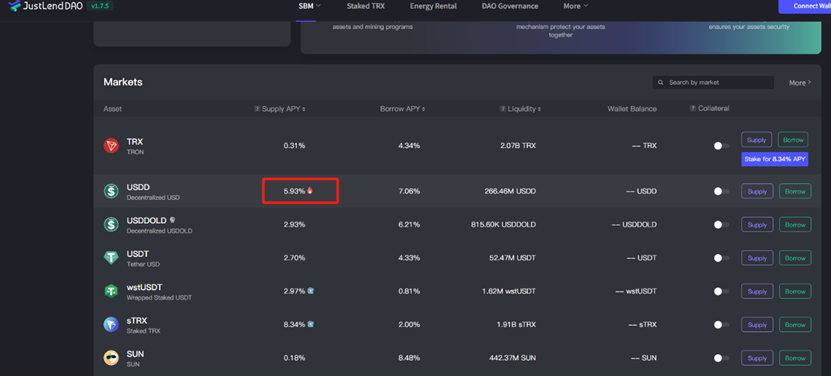

Path One: Risk-Free Demand Deposit, Returns 6%+ (Deposit USDD → Earn Interest Immediately)

The operation method is extremely simple: directly store USDD on the JustLend DAO platform to earn interest, with the current risk-free annualized return of about 6%. This model allows for flexible deposits and withdrawals, similar to a demand deposit account in a bank, with zero risk, absolute safety of principal, and no limit on the amount, making it very convenient for investors seeking stable returns. In comparison, the real-time storage interest rate APY for USDS in the same sector is only 4.5%, and DAI's real-time APY is just 3.25%.

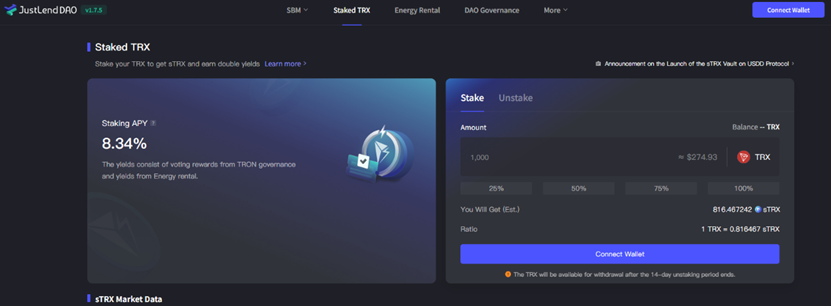

Path Two: "Yield Amplifier" for TRX Holders, Annualized Returns Up to 15%+ (sTRX Staking + USDD Earnings)

Users can stake TRX on the JustLend DAO platform to convert TRX into sTRX, then use sTRX as collateral to mint the stablecoin USDD, and deposit the minted USDD in JustLend DAO to earn interest. This way, TRX holders can enjoy dual rich returns from both sTRX staking and USDD storage earnings. In the past seven days, the sTRX staking yield was 8.34%. The USDD deposit yield is about 6%, resulting in a total yield of about 15% for TRX-sTRX-USDD. If a continuous cycle is adopted (TRX-sTRX-USDD-TRX), the cumulative yield in TRX terms exceeds 20%.

Path Three: Zero-Cost Exchange + Flexible Investment (Sun.io: PSM + SunSwap)

This can be achieved through the two functions of SunSwap and PSM exchange on the one-stop trading platform Sun.io, where SunSwap supports using USDD to purchase any asset, such as SUN, JST, etc., within the TRON ecosystem, further expanding investment channels; while the PSM exchange tool supports a 1:1 fixed ratio exchange between USDD and stablecoins like USDT/USDC/TUSD, with excellent experiences of zero slippage and zero fees.

If users hold USDT/USDC/TUSD, they can use PSM to exchange for USDD, and after the exchange, USDD can be used to purchase any token on SunSwap or directly participate in the USDD Earn storage income activity in JustLend DAO.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。