The rise of Hyperliquid is the result of multiple factors including technology, product, marketing, and economic models.

Written by: Maggie @Foresight Ventures

From 2024 to 2025, Hyperliquid has rapidly emerged as a major liquidity hub on-chain. Its total open contracts exceeded $10.1 billion, with USDC locked exceeding $3.5 billion. Whales like James Wynn have showcased their skills here, leveraging hundreds of millions in positions with 40x leverage, driving market sentiment and harvesting liquidity. Meanwhile, the launch of HyperEVM further expanded the ecosystem, attracting multiple innovative projects.

Today, we delve into two key questions:

How did Hyperliquid rise?

What ecological projects on HyperEVM are worth paying attention to?

How did Hyperliquid rise?

Hyperliquid is a high-performance decentralized exchange (DEX) focused on spot and perpetual contract trading, and it launched HyperEVM, an EVM L2 on Hyperliquid. Most people became aware of Hyperliquid from the massive airdrop in November 2024; before that, many considered it just an ordinary perp DEX. Later, people gradually understood what made Hyperliquid special.

Technology:

- A decentralized trading platform without KYC, but with a CEX-like experience: Hyperliquid does not require users to undergo KYC verification, allowing for anonymous trading, which attracts privacy-focused traders and institutions sensitive to regulation. Hyperliquid offers a user experience similar to CEX (speed, UI/UX) without identity verification, lowering the entry barrier.

Product:

Low fees, high leverage: Market-making fee of 0.01%, taker fee of 0.035% (as low as 0.019% for large clients). Supports 50x leverage, far exceeding most DEXs (like dYdX's 20x).

High-yield HLP treasury: HLP offers an annualized yield of 14%-24%, allowing participation in market-making and liquidation profits by depositing USDC, attracting DeFi users seeking stable returns. The community-oriented design of HLP (no team cuts) further enhances user trust.

Community-oriented and deflationary mechanism: All transaction fees are allocated to the community (HLP and Assistance Fund), rather than to the team or insiders, enhancing decentralization. Buybacks and burns effectively reduce circulating supply, supporting long-term value growth.

Marketing:

High proportion of airdrops and wealth effect: The 31% HYPE airdrop in November 2024 (310 million tokens, worth $1.2 billion) is one of the largest airdrops in crypto history. The airdrop was based on user trading volume and referral points, incentivizing early user participation and enhancing loyalty. The HYPE price soared from $3.9 to $27 (peaking at $34.96), creating a significant wealth effect and attracting more users.

Whale effect, attention economy: Hyperliquid's opening position information is transparent; however, this transparency coexists with manipulation. On one hand, the public nature of on-chain data makes whale positions visible, allowing retail investors to track smart money movements; on the other hand, whales use this transparency to manipulate the market. Traders like James Wynn leverage Hyperliquid's high leverage (40-50x) and transparency to publicly disclose large positions (like $568 million BTC long), attracting follow-on funds and creating a positive feedback loop of "position-emotion-price."

Economic Model:

- Revenue closed loop and deflationary mechanism: Platform revenue is returned to token holders or ecosystem participants through buybacks, burns, and dividends. This forms a positive cycle of "increased usage → increased revenue → increased token value."

Hyperliquid's main revenue sources come from platform fees and HIP-auction fees.

Platform fees: Include fees for spot and perpetual contracts (market-making fee of 0.01%, taker fee of 0.035%, as low as 0.019% for high-volume users), funding fees, and liquidation fees.

HIP-1 auction fees: New tokens listed through the HIP-1 standard must pay auction fees, which all go to the Assistance Fund.

Fees are distributed to HLP and the Assistance Fund.

46% is allocated to HLP depositors as market-making and liquidation profits.

54% goes to the Assistance Fund for HYPE buybacks and burns.

The dual deflationary mechanism (buyback + burn) enhances the value stability of HYPE.

The Assistance Fund regularly uses accumulated USDC to buy back HYPE in the secondary market, creating continuous buying pressure.

In spot trading, the HYPE portion of the HYPE-USDC trading pair is directly burned, reducing circulating supply.

Many projects want to emulate this model, but it is not suitable for most projects because they lack the prerequisites for this model. 1. Insufficient revenue. Most projects have annual revenues below $1 million, and even a 100% return rate would have limited impact on token price. 2. Most projects' tokens lack supporting use value. 3. No cost structure advantage. Hyperliquid, as a derivatives platform, has marginal costs lower than DeFi projects that require substantial liquidity mining subsidies.

Ecosystem:

- HyperEVM, as Hyperliquid's EVM-compatible L2, attracts DeFi projects to migrate, forming a diverse ecosystem of derivatives + lending + memes.

In summary, the rise of Hyperliquid is the result of multiple factors: technology (no KYC, near CEX trading experience) + product (low fees, high leverage, high-yield HLP treasury) + marketing (large airdrop, whale effect) + economic model (revenue closed loop, buyback deflation) + ecosystem (HyperEVM). Its marketing strategy and economic model design are particularly worth learning from. However, two major risks should be noted: 1. Regulatory pressure: In an increasingly strict compliance environment, the no KYC model may face significant challenges. 2. Cycle test: The revenue structure is sensitive to market activity, and the sustainability of the business model in a bear market remains to be verified.

What ecological projects on HyperEVM are worth paying attention to?

As of May 31, 2025, data from DefiLlama shows that the TVL of the HyperEVM ecosystem has reached $1.8 billion, covering sectors such as lending, DEX, and memes.

(Data from DefiLlama: https://defillama.com/chain/hyperliquid-l1)

1. HyperLend

HyperLend is a lending project on HyperEVM, with a TVL of $370 million, making it one of the top projects on HyperLiquid and one of the DeFi trifecta. Website: https://hyperlend.finance/

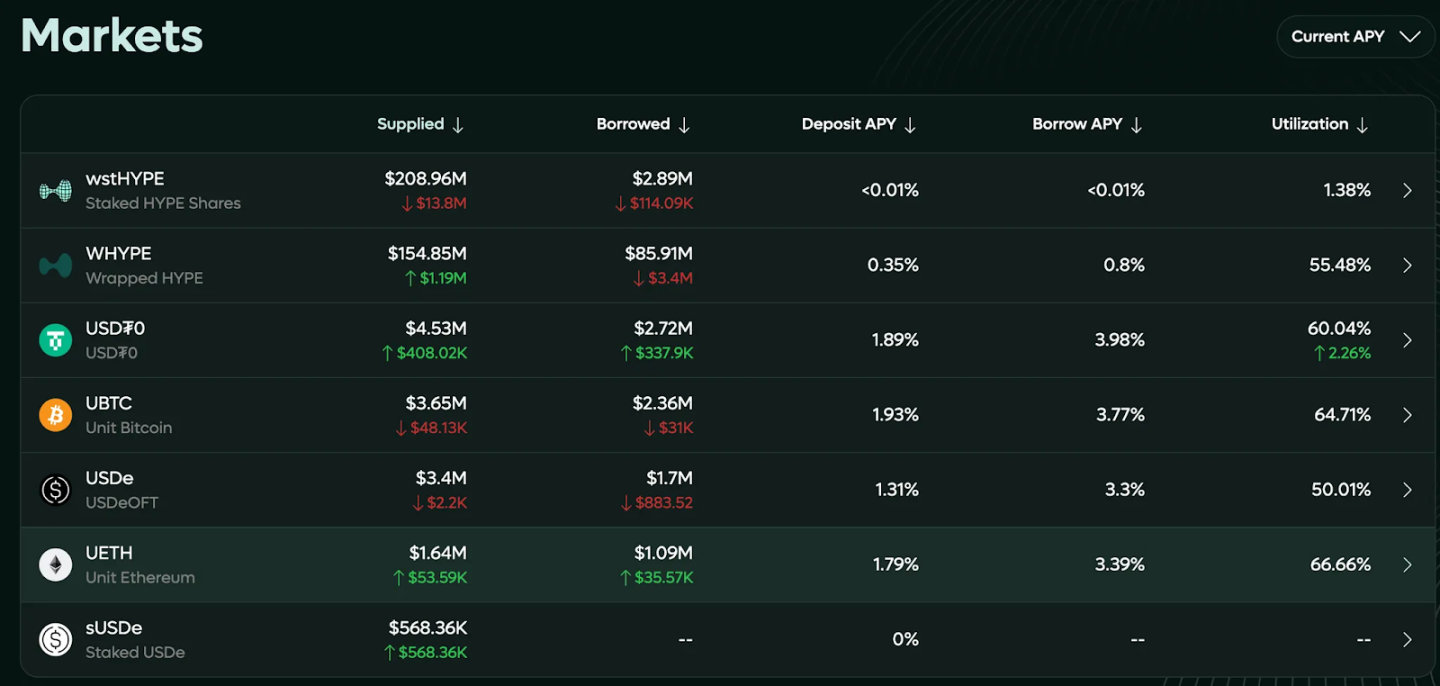

Currently, a large amount of wstHYPE and WHYPE is being staked on HyperLend to earn interest. However, since the HyperEVM ecosystem is still in its early stages, overall borrowing demand is low, resulting in temporarily low lending APR. As more applications are launched, user scale expands, and leverage demand increases, borrowing demand is expected to rise, thereby boosting lending APR.

HyperLend's lending framework features a three-tier lending architecture that is flexible and emphasizes risk isolation. It supports both pool-to-pool and peer-to-peer models. The breakdown is as follows:

Core Pool: Multi-asset shared liquidity, suitable for regular lending scenarios;

Independent Pool: Contains only two assets, achieving risk isolation to prevent cross-asset risk spread;

Peer-to-Peer Pool: Direct matching between borrowers and lenders, allowing for customizable interest rates and terms, with rates typically higher.

Also supports flash loans: Uncollateralized, repaid within a single block, supporting high-frequency arbitrage and liquidation.

After users deposit assets, they will receive yield tokens (hTokens), which represent their principal plus accumulated interest. The accounting positions are tracked through debt tokens (DebtTokens), which accumulate interest over time, ensuring transparency and traceability.

Additionally, HyperLend collaborates with HyperLiquid, allowing users to use hHLP as collateral to borrow additional assets and earn interest, thereby enhancing HLP capital utilization and providing users with additional returns.

HyperLend has established partnerships with several DeFi projects, including RedStone, Pyth Network, ThunderHead, Stargate, and Theo Network, enhancing its interoperability and influence within the Hyperliquid ecosystem.

HyperLend has launched a points reward program, where users earn points by using the protocol, potentially leading to future token airdrops.

2. Hypurr Fun

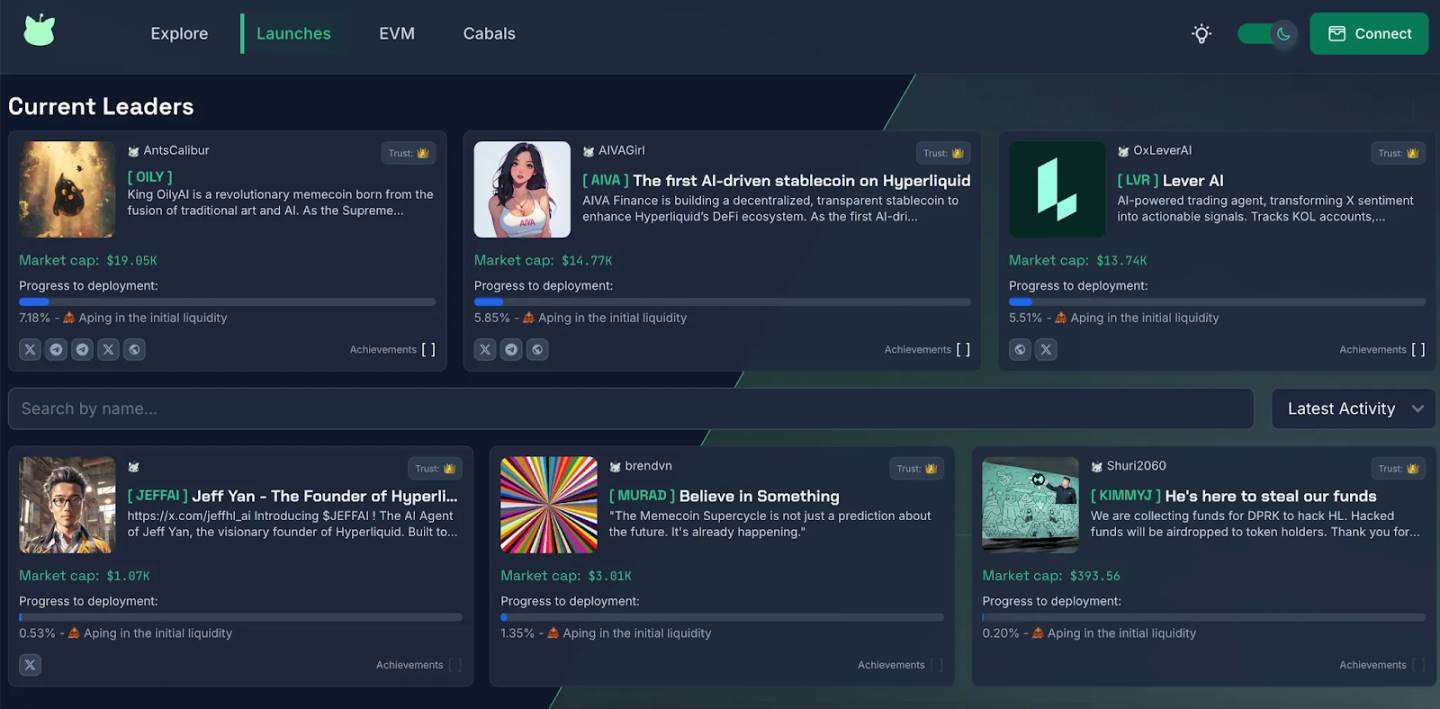

Hypurr Fun is a meme launch platform on HyperEVM, providing a Telegram bot and web interface for users to trade quickly, making it a major traffic entry point on HyperEVM. Website: https://hypurr.fun/

The main features include:

One-click issuance and trading: Users can easily issue new tokens and participate in trading through the bot.

Advanced trading tools: Supports features such as TWAP (Time Weighted Average Price), automatic sniping, and portfolio management.

Revenue buyback mechanism: All transaction fees will be used to buy back $HFUN tokens, enhancing their market value.

Community interaction: Provides social features like Whale Chats to facilitate communication among users.

$HFUN is the native token of Hypurr Fun, with a maximum supply of 1 million tokens.

3. HyperSwap

HyperSwap is a low-slippage AMM on HyperEVM.

The main features include:

Token trading: Supports the exchange of various tokens, providing a fast and low-slippage trading experience.

Liquidity provision: Users can create and manage liquidity pools to earn trading fees and platform rewards.

Token issuance: Allows users to issue their own tokens in a permissionless environment.

HyperSwap adopts a dual-token model, consisting of $xSWAP (liquidity mining token) and $SWAP (governance and revenue-sharing token). Users earn $xSWAP by providing liquidity and can convert it to $SWAP to participate in platform governance and revenue distribution.

Additionally, HyperSwap has launched a points program, where users accumulate points through activities such as trading, providing liquidity, and issuing tokens.

Summary

The rise of Hyperliquid is the result of multiple factors including technology, product, marketing, and economic models. Its marketing strategy and economic model design are particularly worth learning from. However, attention should be paid to the risks of regulatory pressure and cyclical tests. The HyperEVM ecosystem is still in its early stages and is rapidly developing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。