We originally wanted to use the wealth effect to compensate for the numbness after losing our belief in decentralization, hoping that we would not lose both freedom and prosperity.

Ethereum is shifting towards L1 scaling and privacy, while the US stock market's backend engine DTCC, holding $100 trillion, begins to migrate on-chain, suggesting that a beautiful new wave of crypto may be on the horizon.

However, the profit logic of institutions and retail investors is completely different.

Institutions have a strong tolerance in terms of time and space, with a ten-year investment cycle and small spread leveraged arbitrage being far more reliable than retail investors' fantasies of a thousandfold return in a year. In the upcoming cycle, it is very likely that we will witness a spectacle of on-chain prosperity, institutional influx, and retail pressure simultaneously.

Do not be surprised; the spot ETF for BTC and DAT, the complete disappearance of the four-year cycle of BTC and altcoin seasons, and the Koreans' "abandoning coins for stocks" have repeatedly validated this logic.

After October 11, as the last line of defense for project parties, VCs, and market makers, CEX officially enters garbage time. The greater the influence on the market, the more it leads to a conservative route, which will erode capital efficiency.

The lack of value in altcoins and the memes created by editors are merely interludes in a predetermined route collapsed by self-weight. The migration on-chain is an unavoidable move, but it will differ slightly from the free and prosperous world we imagined.

We originally wanted to use the wealth effect to compensate for the numbness after losing our belief in decentralization, hoping that we would not lose both freedom and prosperity.

Today will be my last time discussing concepts like decentralization and cypherpunk; the old stories about freedom and its betrayal can no longer keep up with the rolling wheels of the times.

Decentralization: The Birth of the Pocket Computer

DeFi is not built on the ideas and entities of Bitcoin; it never was.

Nick Szabo, who created "smart contracts" (1994) and Bit Gold (first proposed in 1998, perfected in 2005), inspired core concepts such as Bitcoin's PoW (proof of work) and timestamping.

He once affectionately referred to Bitcoin as a pocket computer and Ethereum as a general-purpose computer. However, after the 2016 DAO incident, when Ethereum decided to roll back transaction records, Nick Szabo began to criticize Ethereum.

During the ETH bull market from 2017 to 2021, Nick Szabo was seen as an outdated stubborn figure.

On one hand, Nick Szabo genuinely believed that Ethereum had surpassed Bitcoin, achieving better decentralization; at that time, Ethereum had fully implemented PoW and smart contracts.

On the other hand, Nick Szabo believed that Ethereum's reform of the governance system from the perspective of de-trust allowed for efficient interaction and collaboration among strangers on a global scale through the DAO mechanism.

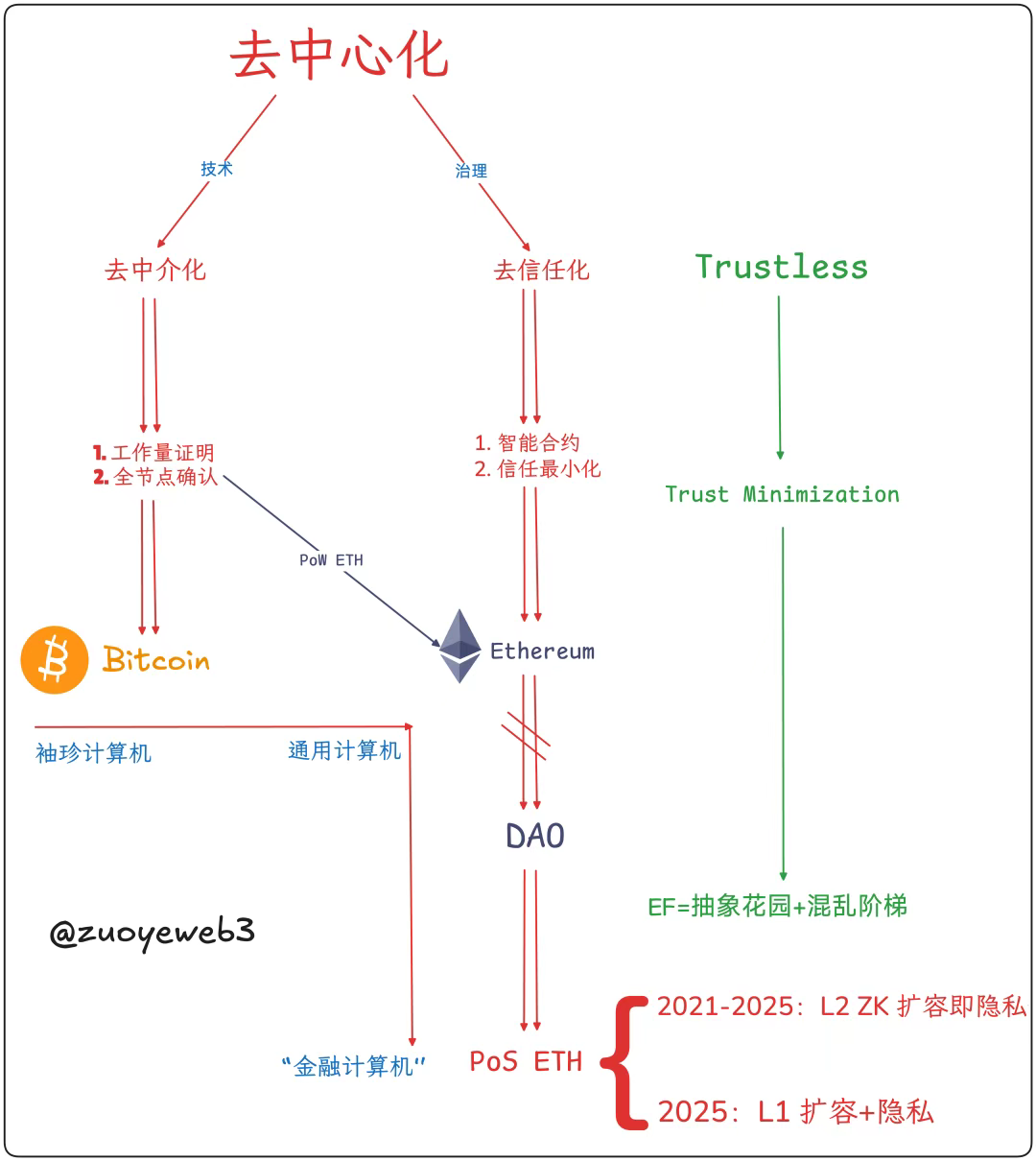

From this, we can outline what decentralization actually refers to: de-intermediation on a technical level -> pricing cost + transaction consensus, de-trust on a governance level -> minimizing trust.

Image description: Composition of decentralization

Image source: @zuoyeweb3

De-intermediation: No need to rely on gold or government, but rather on computational work as proof of individual participation in Bitcoin production;

De-trust: No need to rely on social relationships, but rather open to the outside world under the principle of minimizing trust, creating network effects.

Although Satoshi Nakamoto was influenced by Bit Gold, he did not take a definitive stance on smart contracts. Under the principle of simplicity, while retaining the possibility of complex operations through some opcode combinations, he focused on practical peer-to-peer payments.

This is also why Nick Szabo saw hope in PoW ETH, with complete smart contracts and "self-limitation." However, Ethereum faced similar L1 scaling obstacles as Bitcoin, and Vitalik ultimately chose L2 scaling to reduce harm to the L1 body.

This "harm" mainly refers to the full node size crisis. After losing Satoshi's optimizations, Bitcoin rushed down the irreversible path of mining machines and hash power competition, effectively excluding individuals from the production process.

Image description: Blockchain node size

Image source: @zuoyeweb3

Vitalik at least made an effort to resist. Before surrendering to the data center chain model in 2025, he shifted to PoS while trying to ensure the existence of individual nodes.

While PoW is equated with hash power + energy consumption to determine its basic production cost, in the early days of the cypherpunk movement, the combination of proof of work and timestamps was meant to confirm transaction times, thereby forming an overall consensus and facilitating mutual recognition.

Therefore, Ethereum's shift to PoS fundamentally excludes individual nodes from the production system. Coupled with the "no-cost" ETH accumulated from ICOs, nearly $10 billion from VCs directed towards the EVM+ZK/OP L2 ecosystem has, in effect, accumulated a massive institutional cost, which can be seen as a form of institutional OTC exit for ETH DAT.

After the failure of de-intermediation on a technical level, although the explosion of nodes was controlled, it led to mining pool clusters and hash power competition. Ethereum has experienced multiple cycles of L1 (sharding, sidechains) -> L2 (OP/ZK) -> L1, ultimately embracing large nodes.

It must be objectively pointed out that Bitcoin has lost the "personalization" of smart contracts and hash power, while Ethereum has lost the "personalization" of nodes but retained the ability to capture the value of smart contracts and ETH.

Subjectively, Bitcoin achieves minimal governance but heavily relies on the "conscience" of a few developers to maintain consensus. Ethereum ultimately abandoned the DAO model and shifted to a centralized governance model (theoretically not, but in practice, Vitalik can control the Ethereum Foundation, which can lead the direction of the Ethereum ecosystem).

There is no ulterior motive to belittle ETH to elevate BTC; from the perspective of wealth effect and coin prices, early investors in both have been successful. However, from the practice of decentralization, it is no longer possible to see a chance for either to change course.

Bitcoin is unlikely to support smart contracts, and the Lightning Network and BTCFi are still focused on payments, while Ethereum retains smart contracts but abandons the pricing benchmark of PoW, and beyond de-trust/minimizing trust, it has chosen to build a centralized governance system, reversing history.

The merits and demerits will be left for future generations to evaluate.

Intermediary Economy: The Fall of the World Computer

As long as there is organization, there will inevitably be internal strife; as long as there is talk of unity, there will inevitably be a center, followed by bureaucratic self-generation.

In terms of token pricing mechanisms, there are two types: narrative and demand. For example, Bitcoin's narrative is application-oriented—peer-to-peer electronic cash—but people's demand for Bitcoin is digital gold. Ethereum's narrative is "world computer," but people's demand for ETH is application-oriented—Gas Fee.

The wealth effect is more friendly to the PoS mechanism. Participating in Ethereum staking first requires ETH, and using Ethereum's DeFi also requires ETH. The value capture ability of ETH, in turn, enhances the rationality of PoS. Under the pull of real demand, abandoning PoW is the right choice for Ethereum.

However, on the narrative level, the model of transaction volume ✖️ Gas Fee is highly similar to SaaS and Fintech, failing to correspond to the grand narrative of "computing everything." When users who do not use DeFi leave, the value of ETH cannot be continuously supported.

In the end, no one uses Bitcoin for transactions, but there will always be someone who wants to use Ethereum to compute everything.

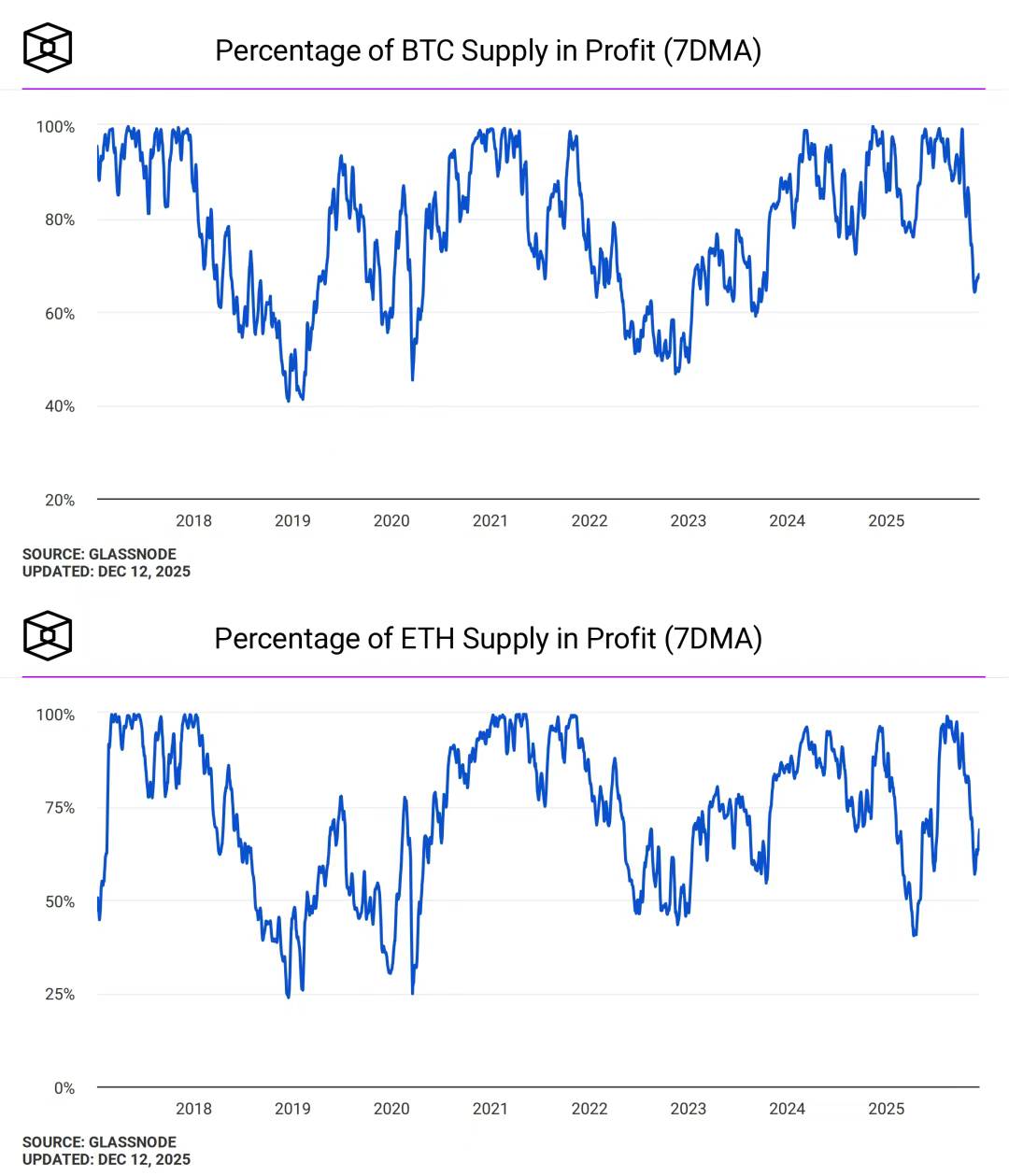

Image description: BTC and ETH address profitability

Image source: @TheBlock__

Decentralization ≠ wealth effect, but after Ethereum's shift to PoS, it has implicitly accepted that the capital value of ETH is its only pursuit. Price fluctuations will repeatedly attract excessive market attention, further questioning the gap between its vision and reality.

In contrast, the price fluctuations of gold and Bitcoin have been highly equated with changes in the fundamental emotions of the market. Some may worry about the world situation when gold surges, but no one doubts Bitcoin's fundamental value when it declines.

It is hard to say whether Vitalik and the Ethereum Foundation caused Ethereum's "de" decentralization, but it must be acknowledged that the Ethereum system is increasingly becoming intermediary.

Between 2023 and 2024, it has become fashionable for members of the Ethereum Foundation to serve as advisors for project parties, such as Dankrad Feist for EigenLayer, but few remember the unclear situation of The DAO and several core Ethereum members.

This situation did not come to an end until Vitalik publicly announced that he would no longer invest in any L2 projects, but the systemic "bureaucratization" of the entire Ethereum ecosystem has become inevitable.

In a sense, intermediaries do not necessarily imply negative connotations like brokers; rather, they refer to efficiently matching and facilitating each other's needs. For example, the Solana Foundation, once considered an industry model, generally promotes project development from the market and its own ecosystem.

However, for ETH and Ethereum, ETH should become an "intermediary" asset, but Ethereum should maintain complete openness and autonomy, preserving the technical architecture of a permissionless public chain.

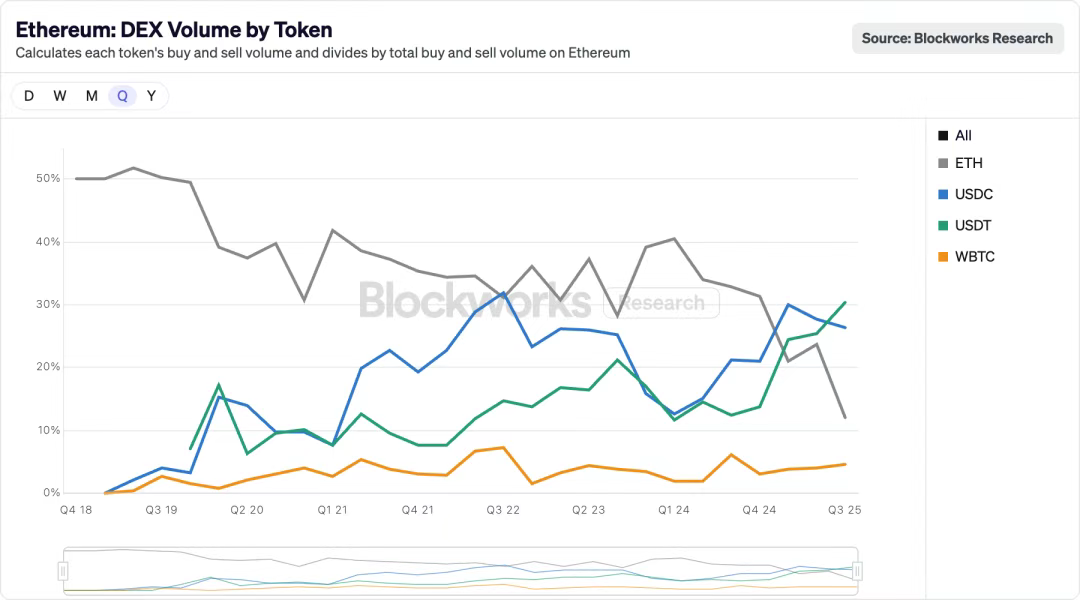

Image description: Ethereum DEX Volume by Token

Image source: @blockworksres

Within the Ethereum ecosystem, there are signs that stablecoins are gradually replacing ETH. Liquidity is migrating on-chain with Perp DEX, and USDT/USDC are profoundly changing the old patterns. The story of stablecoins replacing ETH/BTC as benchmark assets within CEX is set to be replayed on-chain.

And USDT/USDC are precisely centralized assets. If ETH cannot maintain a large application scenario, it can only be used as an "asset." In the context of speeding up and reducing costs, the consumption of Gas Fee must be sufficiently large to maintain the price of ETH.

Moreover, if Ethereum is to be completely open, it should allow any asset to act as an intermediary asset, but this would severely harm ETH's value capture ability. Therefore, L1 must reclaim power from L2, and L1 must expand again. Privacy, in this context, can be interpreted as a necessity for institutions or as a choice to remain true to one's original intentions.

There are many stories here, each worth listening to, but you must choose a direction to pursue.

Complete decentralization cannot achieve minimal organization, leading to everyone acting independently. Under the principle of efficiency, it can only continuously lean towards minimizing trust, minimizing trust relies on the order derived from Vitalik, and there is no difference from the extreme freedom given to the black and gray industries by Sun Ge.

We either trust Vitalik or we trust Sun Ge. Simply put, decentralization cannot establish a comfortable, self-sustaining order; people internally crave extreme chaos while their bodies intensely dislike environments lacking a sense of security.

Vitalik is an intermediary, ETH is also an intermediary, and Ethereum will be an intermediary between the traditional world and the on-chain world. Ethereum wants products without products, but any product inevitably carries marketing, falsehoods, and deception. Just using Aave and UST is fundamentally no different.

Only by repeating the actions that led to the first failure can the financial revolution succeed. USDT first failed on the Bitcoin network, UST failed in purchasing BTC, and then came the success of TRC-20 USDT and USDe.

In other words, people suffer from the decline and stagnation of ETH, and also from the expansion of the Ethereum system, leaving retail investors powerless to differentiate from Wall Street. It should have been Wall Street buying retail investors' ETH, but people are now reaping the bitter fruits of buying ETFs and DAT.

The limitation of Ethereum lies in the ETH capital itself, produced for the sake of production, produced for ETH. This is a two-sided coin, an obvious truth; the East and West do not take over from each other, preferring certain ecosystems, certain entrepreneurs' capital, and project parties. Ultimately, they are not producing for the tokens of the projects they invest in, but for ETH.

To—-> "Decentralization": The Future of Financial Computers

From the Second International to LGBT, from the Black Panther Party to the Black Panther, from Bitcoin to Ethereum.

After the DAO incident, Nick Szabo began to loathe everything related to Ethereum. After all, Satoshi Nakamoto has already largely disappeared from the public eye, but Ethereum's performance cannot be said to be poor. I am not schizophrenic; I criticize Ethereum and then turn around to praise V.

Compared to next-generation public chains like Solana and HyperEVM, Ethereum remains the best player balancing decentralization and the wealth effect. Even Bitcoin, which inherently does not support smart contracts, has this as its greatest flaw.

As a ten-year-old chain, ETH and Ethereum have transformed from "the opposition" to "the official opposition," needing to occasionally come out to rally for decentralization and cypherpunk ideals, and then continue to advance towards the realistic future of financial computers.

Minerva's owl can only take flight at night; the debate between the wealth effect and decentralization must be buried in Königsberg. The truly brutal historical practice has long since buried these two narratives together.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。