Ethereum remains the most important infrastructure for on-chain finance.

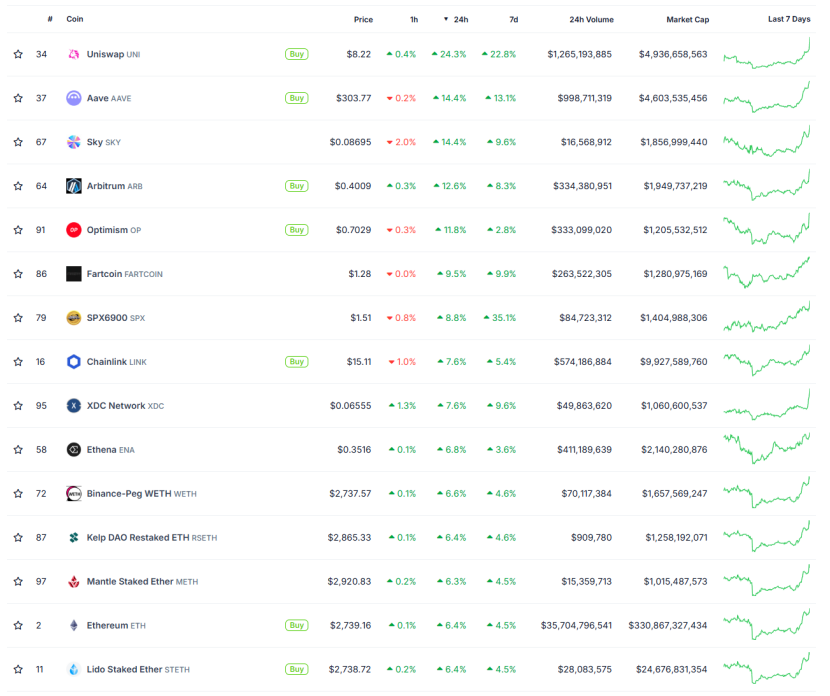

Yesterday, ETH and ecological blue-chip assets experienced a price surge, with ETH rising by 6.4%. UNI, which we mentioned in our previous research report, rose by 24.4%, AAVE by 13.1%, and ENA by 6.6%. In this round, Trend Research has acted consistently, building a position from $1,400 to the present, optimistic about and increasing holdings in ETH-related assets, and recently purchased ETH call options, becoming one of the earliest secondary investment institutions to publicly express confidence and disclose holdings.

Currently, we remain optimistic about the underlying logic of ETH: the Trump administration is committed to establishing a stablecoin system, utilizing the decentralized and on-chain characteristics of blockchain to absorb M2 liquidity from other countries around the world, thereby increasing demand for U.S. Treasury bonds. To this end, the Trump administration has relaxed macro regulatory measures on crypto, promoting the implementation of regulatory measures to standardize crypto from various aspects, allowing more funds to enter. The most important facility for stablecoins and on-chain finance (DeFi) is Ethereum. The influx of stablecoins and the continuous development of RWA will bring further prosperity to DeFi, driving increased consumption of Ethereum, increased GAS revenue, and boosting its market value.

1. Continued Optimism in Crypto Regulation

(1) Shift in Crypto Regulatory Philosophy

The Trump administration is a crypto-friendly government. SEC Chairman John Atkins, who took office in April 2025, has clearly promoted a transformation in the regulation of crypto assets.

- Simplified Process Public Statements

Rules take precedence over enforcement: Atkins criticized the previous administration's model of "defining compliance through litigation," emphasizing the need to establish clear and predictable rules to reduce industry uncertainty.

Categorized regulatory framework: Plans to release token classification standards within 90 days and establish a "safe harbor" system for compliant projects.

- Long-term Policy Direction

On-chain securities compliance: In May 2025, Atkins proposed exploring "on-chain securities exchange listings," which could restructure issuance and trading processes.

Cross-departmental collaboration: Plans to work with the CFTC and FTC to establish a joint regulatory framework to reduce jurisdictional conflicts.

DeFi aligns with core American values and will introduce an "innovation exemption" framework.

(2) Further Improvement and Relaxation of Crypto Regulatory Framework

- The CLARITY Act

The CLARITY Act aims to establish a structural regulatory framework for the crypto market, effectively addressing the regulatory challenges of the $3.3 trillion digital asset market. Its regulatory goals are to clarify asset classification, distinguishing between security tokens (regulated by the SEC), commodity tokens (regulated by the CFTC), and licensed payment stablecoins, resolving the long-standing "security or commodity" identification issue. It also aims to standardize institutional regulation, requiring financial institutions that custody digital assets to meet capital reserve and customer fund segregation requirements to prevent risks similar to FTX. The bill was passed by the U.S. House Committee on June 11, 2025, with 47 votes in favor and 6 against, and will be handed over to the House Financial Services Committee for the next stage of review.

According to the bill, mainstream cryptocurrencies like Bitcoin and Ethereum are classified as commodity tokens, while company equity tokens (representing ownership and enjoying voting or dividend rights), bond tokens (promising fixed interest returns), and DeFi governance tokens (relying on continuous operation by project parties) are classified as security tokens. This will change the previously ambiguous and unclear enforcement situation, providing clarity on rights and obligations, which will promote the prosperity of DeFi platforms.

The probability of mainstream infrastructure tokens like SOL being classified as commodities is increasing. On June 11, the SEC requested potential Solana ETF issuers to submit revised S-1 forms within the next week. The SEC stated it would provide feedback on the S-1 form within 30 days of submission. This indicates that regulatory recognition of crypto commodities is relaxing and accelerating.

- The Genius Act

The Genius Act aims to fill the regulatory gap for stablecoins, strengthen the dollar's status as a world currency, and address the demand dilemma for U.S. Treasury bonds. This is the first comprehensive regulatory framework for stablecoins at the federal level, clarifying the qualifications of issuers, reserve requirements, and operational norms. It mandates that stablecoins be pegged to the dollar at a 1:1 ratio, promoting the dollar's penetration into the global crypto economy and cross-border payment sectors through stablecoins, thereby consolidating the dollar's dominance in international finance. By enforcing reserve rules (requiring reserve assets to be short-term U.S. Treasury bonds or cash), it creates structural demand for the U.S. Treasury bond market and alleviates fiscal pressure on the U.S.

In recent years, stablecoins like USDT and USDC have faced regulatory and redemption risks, leading to a decoupling of over 10%. If they can be included in federal regulation, it will undoubtedly help strengthen the safety and credibility of stablecoins. Additionally, with a clear federal legislative stance, more issuers will participate in the issuance of stablecoins, attracting more funds into the crypto market. Standard Chartered Bank predicts that after the bill is passed, the scale of stablecoins may increase to $2 trillion by 2028.

- Relaxation of Regulations on Crypto Asset Issuance, Custody, and Trading

SEC Chairman Atkins mentioned in a speech that there will be more relaxed regulations in the three key areas of crypto assets—issuance, custody, and trading.

In terms of issuance, the SEC will establish clear and reasonable guidelines for the issuance of crypto assets under securities or investment contract constraints. So far, only four crypto asset issuers have issued securities under Regulation A. Regulation A is a simplified issuance exemption mechanism proposed by the U.S. SEC for small projects, allowing issuers below a certain amount to issue stocks and bonds through this mechanism. The biggest policy obstacle to crypto asset issuance is the unclear identification of whether the asset is a security and what type of security it is, leading issuers to worry about violating relevant legal provisions, which results in very few projects using this rule. Atkins has asked SEC staff to consider making the issuance of crypto assets in the U.S. smoother through business guidance, registration exemptions, and safe harbor measures.

In terms of custody, there will be greater autonomy for registrants to determine how to custody crypto assets. Investment advisors and fund companies can use self-custody solutions that are more advanced than current custodians' technologies to store crypto assets. This is mainly due to historical reasons, as traditional custodians' information technology levels are insufficient to adapt well to blockchain needs.

In terms of trading, there will be support for investors to trade a wider variety of assets on trading platforms, which can offer trading of both security and non-security assets, and even provide sales of other financial services. Staff have been asked to explore whether there is a need to specify some guidelines or rules to allow crypto assets to be listed and traded on national securities exchanges.

- DeFi Expected to Implement "Innovation Exemption"

SEC Chairman Paul S. Atkins clearly stated at the June 9, 2025, roundtable on "DeFi and the American Spirit": "The fundamental principles of DeFi (economic freedom, private property rights, and disintermediation) are highly consistent with core American values, and blockchain technology is a revolutionary innovation that the SEC should not obstruct."

The SEC is developing conditional exemption rules for DeFi to quickly allow registered and non-registered parties to bring on-chain products and services to market. The innovation exemption could make the U.S. the "global crypto capital" by encouraging developers, entrepreneurs, and other companies willing to comply with specific conditions to innovate in on-chain technology in the U.S.

UNI has previously faced compliance challenges, and although it is the most important DEX on-chain, its price performance has been poor. If the innovation exemption rules can be quickly applied, UNI may be among the first beneficiaries. This is also one of the important reasons for the significant price increase of leading DeFi tokens after the roundtable.

- Expectations for Ethereum ETF Staking Approval

On May 29, 2025, the U.S. Securities and Exchange Commission (SEC) Corporate Finance Division issued a statement clarifying that staking activities based on proof-of-stake (PoS) blockchain protocols do not constitute securities transactions. Atkins further clarified in his speech at the "DeFi and the American Spirit" roundtable that "voluntary participation in proof-of-work or proof-of-stake networks as 'miners,' 'validators,' or 'staking as a service' providers is not within the scope of federal securities laws." This will promote the formulation of relevant regulations, meaning that Ethereum's staking activities (including self-staking by nodes and staking through service providers) will not be considered securities transactions under specific conditions, paving the way for the currently approved Ethereum ETF to engage in staking.

If the SEC approves Ethereum ETFs that include staking rewards, it will allow institutional investors to obtain ETH staking rewards through ETFs, making ETH the "bond" of the crypto industry, with a massive influx of traditional institutional funds flowing legally into ETH. On one hand, a large amount of ETH will be staked and locked, further enhancing the decentralization and security of on-chain finance; on the other hand, compliant on-chain yields will significantly increase the demand for ETH, driving up its price.

In summary, the Trump administration is implementing a more systematic and adaptive regulation of crypto assets and markets, with regulations becoming clearer and more relaxed, encouraging blockchain innovation to attract more funds into crypto.

2. Ethereum Remains the Most Important Infrastructure for On-Chain Finance

The implementation of the "DeFi" declaration and specific legislation in the future will break down compliance barriers and open channels for traditional funds to enter, with trillions of incremental funds expected to flow into on-chain finance in the form of stablecoins, and the largest and safest "soil" for on-chain finance is Ethereum.

(1) Ethereum Foundation Promotes "Defipunk"

The Ethereum Foundation's 2030 plan clearly states that it will promote the establishment of an evaluation mechanism for "Defipunk" and facilitate the relevant transformation of DeFi projects. The core content of "Defipunk" revolves around building a DeFi ecosystem that aligns with Cypherpunk principles, aiming to ensure user autonomy, privacy, and censorship resistance through technological means.

The core principles of Defipunk include: first, security, prioritizing the selection of battle-tested, immutable, and open-source technological architectures, avoiding reliance on centralized trust mechanisms (such as multi-signature or legal recourse). Second, financial sovereignty, emphasizing users' complete control over their assets, supporting permissionless self-custody wallets and on-chain transactions, and reducing reliance on intermediaries. Third, technology takes precedence over trust, achieving disintermediation through cryptographic tools and smart contracts, such as using zero-knowledge proofs to enhance privacy protection. Fourth, open-source and composability, promoting transparent code development, ensuring interoperability between protocols, and encouraging modular design to foster innovation.

The Ethereum Foundation has high expectations for the development of DeFi, and the Ethereum ecosystem is vigorously developing DeFi-related businesses. Ethereum has the foundational conditions to become a new generation of on-chain financial paradigm.

(2) Current Status of Stablecoin Issuance and Distribution

- Total Stablecoin Supply

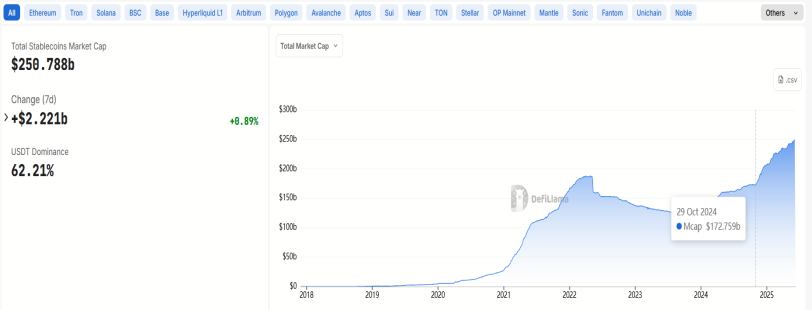

Since Trump took office, the total supply of stablecoins has increased by approximately $76 billion, with a growth rate of over 40% in just seven months. This growth rate significantly exceeds the total increase and growth rate of stablecoins during the market recovery in 2023.

In September 2023, the total supply of stablecoins reached a market value of approximately $123.7 billion, the lowest in nearly four years, and is expected to increase to $173.7 billion by November 2024, an increase of $50 billion, with a growth rate of about 40% over 13 months.

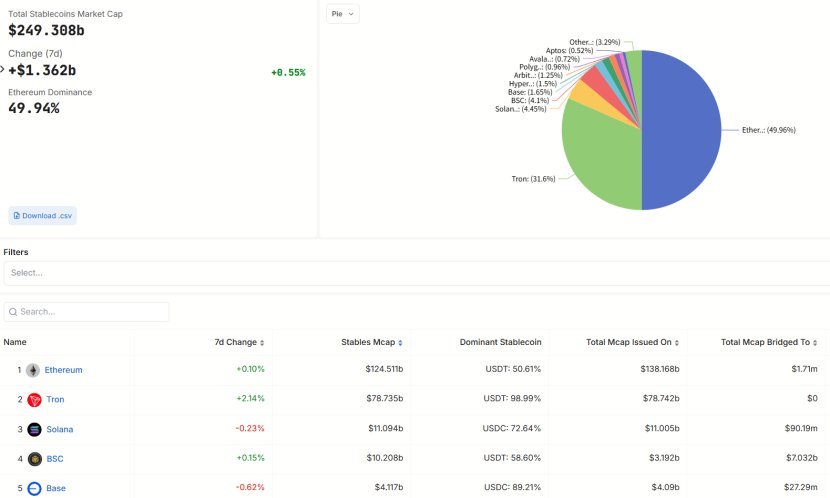

- Current Distribution of Stablecoins on the Chain

Approximately 50% of stablecoins are circulating on Ethereum, 31% on TRON, 4.5% on Solana, and 4% on BSC. Ethereum holds a significant share of stablecoin circulation.

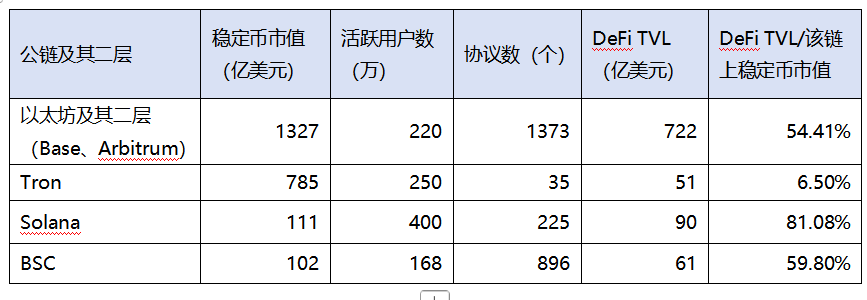

- Current Ecosystem Status of Major Public Chains and Stablecoins in DeFi

From the comparison in the above chart, it can be seen that over 50% of funds on Ethereum are locked in DeFi protocols, holding the largest DeFi TVL. Although TRON has a large amount of stablecoins, they are primarily used for payment, with a limited number of ecological protocols, resulting in a DeFi TVL share of only 6.5%. While Solana and BSC have relatively high DeFi TVL shares, their absolute scale is small, and their DeFi infrastructure maturity is average.

Based on the above, once the stablecoin bill is passed, Ethereum is most likely to receive the largest influx of funds.

(2) New Stablecoin Flows

Currently, it is speculated that new stablecoins will flow in four directions:

- Flowing into the crypto market's native DeFi market with higher yields

The high volatility of crypto creates many DeFi protocols on-chain that offer returns far exceeding those of traditional financial markets and are easily accessible. Incremental stablecoins entering the chain will inevitably lead some funds to freely choose more intelligent, efficient, and profitable investment opportunities. Ethereum's high level of decentralization, security, and scalability will make it the preferred choice for this influx of funds. Among them, UNI, as the largest on-chain DEX, and AAVE, as the largest lending protocol on-chain, are significant blue-chip assets, while smaller market cap DeFi protocols with good business data, such as COMP, are also worth attention.

In the DEX space, UNI currently holds a clear advantage with a TVL of $5.1 billion, a 7-day trading volume of $17.6 billion, and 7-day fee revenue of $19.26 million, significantly higher than other DEXs.

A notable exception is Pancake, which has a 7-day trading volume of $33.4 billion and 7-day fee revenue of $5.681 million. Its trading volume is significantly higher than UNI, mainly benefiting from Binance's alpha wash trading.

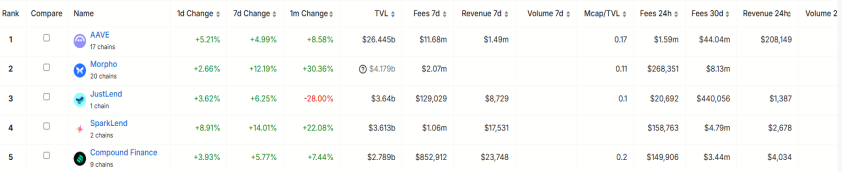

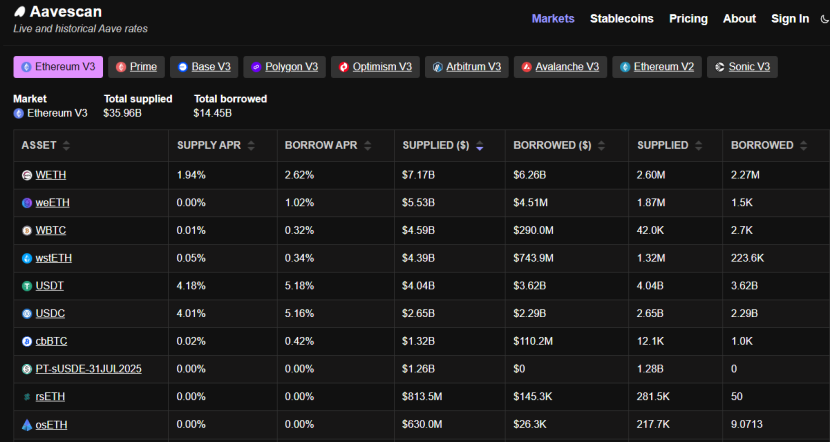

In the lending sector, AAVE holds an absolute advantage with a TVL of $26.4 billion, 7-day fees of $1.168 million, and 7-day protocol revenue of $149,000. The TVL of other lending markets is less than $5 billion.

- Flowing into the RWA market primarily built by U.S. compliant institutions

Many traditional funds entering the chain do not participate much in the altcoin market but instead flow into the RWA market built by leading institutions in this wave of financial innovation in the U.S., such as the BUILD fund issued on-chain by BlackRock.

The BUIDL fund primarily invests in: cash—highly liquid cash or cash equivalents to ensure the fund's stability and immediate redemption capability; U.S. Treasury bonds—short-term U.S. Treasury bonds, as low-risk, high-credit-rated assets providing stable income sources; repurchase agreements—short-term lending agreements, usually collateralized by Treasury bonds, ensuring the fund's liquidity and returns. This asset combination aims to maintain the stable value of the BUIDL token (targeting $1/token) and distribute dividends to investors through daily accumulated earnings, issued monthly in the form of new tokens. The fund is managed by BlackRock Financial Management, with custody provided by BNY Mellon and tokenization on the Securitize platform.

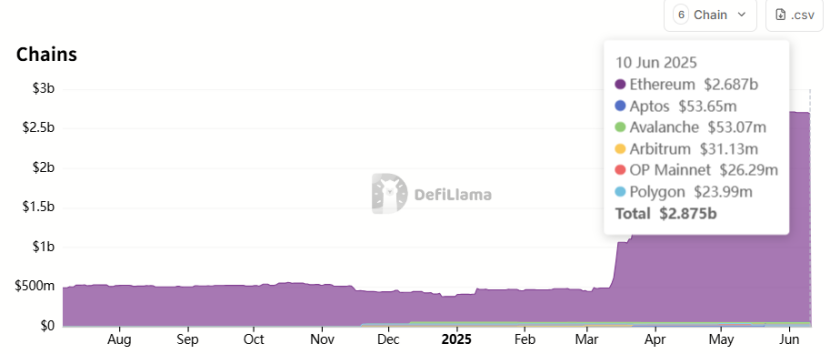

The platform's managed TVL has rapidly increased over the past three months, surpassing $1 billion in March 2025, and has now risen to $2.87 billion, a 187% increase; of which $2.687 billion is on Ethereum, accounting for 93% of the total.

Native projects in the crypto space are also closely monitoring the RWA market. USDC issuer Circle acquired Hashnote, the issuer of U.S. YieldCoin (USYC), to fill its business gap in RWA.

Hashnote is a startup incubated with a $5 million investment from Cumberland Labs, focusing on tokenized U.S. Treasury products. Its core product, USYC (U.S. YieldCoin), is anchored to short-term U.S. Treasury bonds and reached a scale of $1.3 billion at the time of acquisition. Circle aims to deeply bind USYC with USDC, creating a closed loop of "cash + yield-bearing assets" to meet institutional demands for on-chain collateral and yield tools.

In addition to BUIDL and Circle, large RWA projects also include ENA and ONDO. ENA's issue lies in its primary use for arbitraging funding rates of crypto token contracts, with market scale limited by trading volume and a learning cost issue for outside funds, resulting in little growth in the past six months. ONDO has grown from $600 million to $1.3 billion since early 2025, an increase of about 116%. This indicates that although the stablecoin bill has not yet been fully passed, debt tokenization is already ongoing. Additionally, Chainlink plays a crucial role in RWA, serving as the largest oracle for bringing off-chain assets on-chain and integrating with on-chain DeFi.

- Flowing into the payment sector to solve traditional financial inefficiencies

A very important use of traditional funds becoming stablecoins is to address payment issues, such as optimizing the traditional SWIFT payment system to improve transaction efficiency. For example, JPMorgan's Kinexys platform (formerly Onyx) focuses on wholesale payments, cross-border payments, foreign exchange trading, and securities settlement. It supports multi-currency cross-border payments, reducing intermediaries and settlement times. It provides tokenization functions for digital assets and explores payment scenarios for stablecoins and tokenized bonds. Kinexys is also based on the Ethereum technology stack, utilizing its smart contracts and distributed ledger technology. Currently, Kinexys has an average daily trading volume exceeding $2 billion.

- Flowing into some crypto-native speculative markets

A small portion of the incremental funds will quickly flow into the crypto-native altcoin speculative market.

In summary, compared to other on-chain ecosystems, Ethereum and its on-chain DeFi are the largest destinations for incremental stablecoins. On-chain DeFi may welcome a new "DeFi Summer" in 2025, along with a further demand for staking to enhance network security. Meanwhile, the SEC's "DeFi" statement on June 10 may pave the way for ETH's ETF staking; if successfully passed in the future, ETH will become the "bond" of the crypto market, triggering massive purchases. A series of changes may push ETH back into a deflationary state (currently with an annual inflation rate of 0.697%).

3. Contract Market Reaches New Highs, Bearish Sentiment Persists; Spot ETF Continues to Flow In, Options Bullish

- Contract Positions Reach New Highs, Capital Active

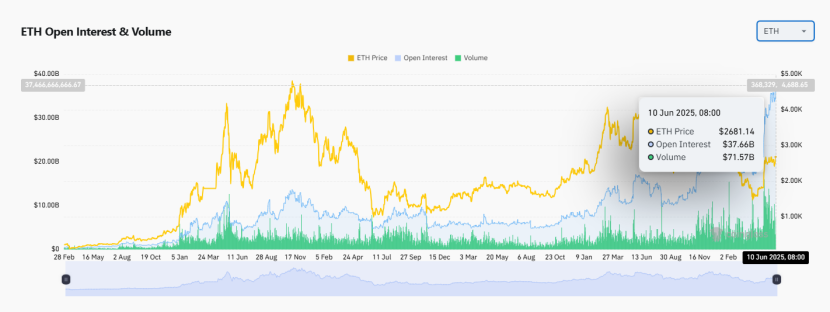

Currently, ETH is about 40% away from its ATH, but the total contract positions across the network have reached a historical high of $37 billion, indicating excellent liquidity in the contract market.

- Market Sentiment Has Not Yet Reached a Peak

At the same time, the current market sentiment has not yet peaked; the Fear and Greed Index has just shifted from neutral to greedy, and the peak of market sentiment has not yet arrived, with incremental funds from outside the market yet to begin entering.

- Increase in Short Positions on Exchanges

From the long-short ratio of contract positions on exchanges, the number of long positions is continuously decreasing while the number of short positions is increasing. Meanwhile, positions are continuously rising, indicating that overall short positions are also on the rise. However, the long-short ratio remains relatively balanced, with funding rates relatively stable.

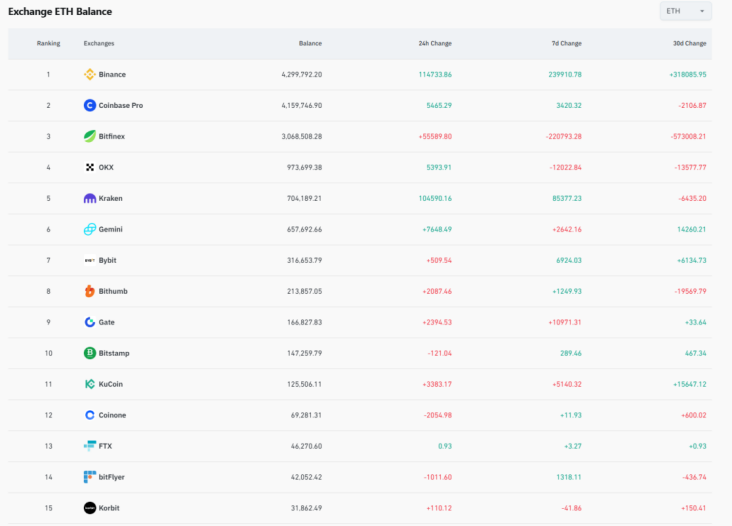

- Some Exchanges Have ETH Spot Holdings Lower Than Contract Holdings

When the trend reversal research report was released across the network in April, we observed that some exchanges had ETH holdings significantly lower than their contract holdings. This situation still exists; Bybit has a holding of 1.44 million ETH, while the exchange wallet balance is 316,000 ETH, which is 4.5 times the balance; Gate has a holding of 1.96 million ETH, while the exchange wallet balance is 166,000 ETH, which is 11.8 times the balance. Bitget has a holding of 1.52 million ETH, but the exchange wallet balance has not been disclosed.

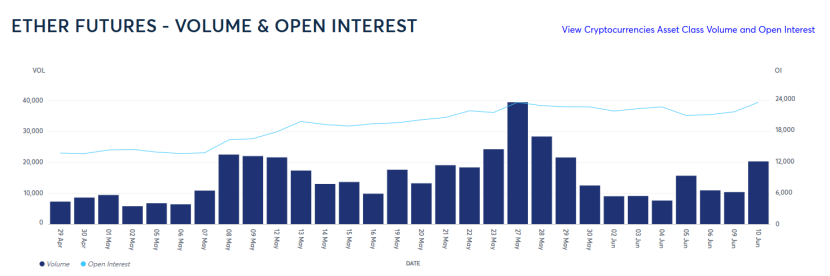

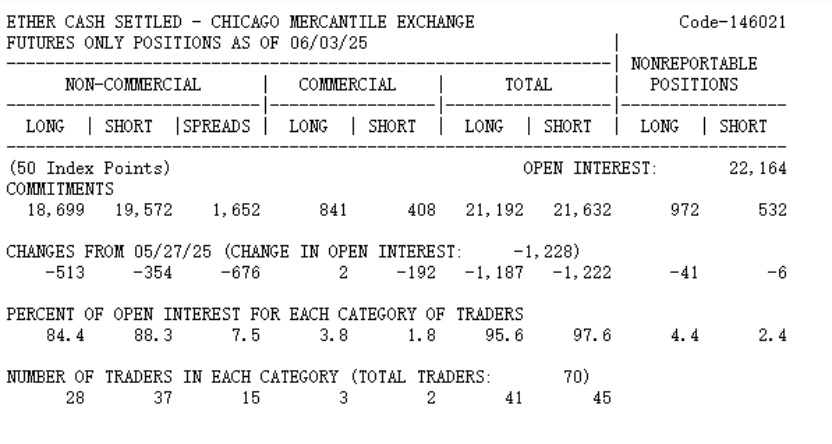

- CME Contract Positions Reach New Highs

From CME data, the current trading volume of ETH on CME has not reached a new high, but the open interest (OI) has reached near historical highs. In terms of long-short positions, non-commercial traders hold 18,699 long contracts and 19,572 short contracts, resulting in a net position of 873 short contracts, indicating a bearish sentiment among futures market speculators. If 30%-40% of the non-commercial traders' shorts are hedged, then the naked short positions account for 60%-70%. Based on a price of $2,750, the speculative naked short positions on CME are approximately $1.6–1.8 billion.

- AAVE Lends Out $6.8 Billion in ETH

Data from AAVE, the largest lending protocol on the chain, shows that the amount of ETH lent out on-chain is approximately $6.8 billion. According to market common sense, not all of these loans are fully hedged, and a significant portion is likely being used for leveraged shorting. We estimate that this naked short amount is no less than $1 billion.

- Continuous Net Inflows into Spot ETFs, Bullish Sentiment in the Options Market

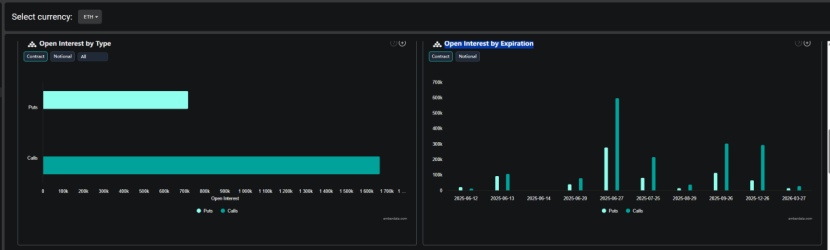

Based on futures derivatives data, we believe that the current market sentiment remains bearish, with a naked short situation at the billion-dollar level. However, the options and spot markets reflect a certain degree of bullish positioning.

In the spot market, the ETH ETF has reversed its previous weak state, with continuous net inflows over the past 15 days. On June 10, the single-day net inflow reached $125 million, with a total inflow of $450 million in June, of which BlackRock purchased $360 million, becoming the main buyer, indicating a bullish trend.

The changes in BlackRock's ETH spot ETF holdings are as follows, showing a continuous increase since May 2025.

BlackRock is selling some BTC spot and shifting to buy ETH spot.

Deribit shows that the number of call options in the current open interest far exceeds that of put options. For options expiring before June 20, the difference is not significant, but for options traded after June 20, call options are significantly higher than put options.

Liquidation monitoring indicates that $2.1 billion worth of ETH shorts will be liquidated at $3,000, and the market is expected to squeeze these shorts, potentially pushing ETH up to $3,000 in the short term.

- Ethereum Treasury SBET Brings New Demand

In a crypto-friendly and regulatory-loose environment, several companies in the U.S. stock market have emerged, mimicking MSTR's model by purchasing mainstream tokens like BTC, ETH, and SOL as underlying assets.

Joe Lubin, co-founder of Ethereum and founder and CEO of ConsenSys, announced that he will serve as the chairman of the board for SharpLink Gaming (stock code: SBET) and lead its $425 million Ethereum treasury strategy. The Ethereum treasury will be an actively managed treasury, where most ETH tokens will be used for staking, actively participating in network security, while investors can earn at least 2% staking income. This model will create new demand for ETH.

- Crypto Companies Going Public Create Continuous Funding Hotspots

Stablecoin Circle went public on Nasdaq in early June, with a first-day increase of over 200%, sparking high enthusiasm for crypto stocks in the market. Several crypto companies have revealed their plans to list on Nasdaq. Crypto asset exchange Bullish Global, backed by Peter Thiel, established exchange Kraken, crypto asset management firm Galaxy Digital, crypto custody and institutional service provider Bitgo, and crypto mining equipment manufacturer Bgin Blockchain all have listing plans, with some already having submitted applications. The successive listings of these projects will create ongoing funding hotspots, attracting more capital to crypto assets and participation.

In summary, we believe that ETH contract positions are at a high level, with active capital; market sentiment is warming up but has not yet reached the extreme greed phase; the number of short positions on exchanges is increasing, but there is no significant long-short imbalance yet. ETH spot is in a continuous inflow phase, with bullish sentiment in options. The price has broken through a key support-resistance exchange zone and further surpassed short-term resistance levels, while long-held short positions may further drive the upward trend. Coupled with the easing of cryptocurrency regulations, the gradual increase in stablecoin market capitalization, the growing Ethereum treasury strategy in the U.S. stock market, and the increasing acceptance of crypto companies in the U.S. stock market, ETH may potentially break through $14,000 in the medium to long term.

4. Conclusion

The U.S. is further systematizing, standardizing, and clarifying cryptocurrency regulations, simplifying the issuance, custody, and trading processes of crypto assets, promoting the issuance of stablecoins, and exploring the development of innovative assets such as DeFi and RWA. These series of measures will expand the scale of crypto assets. Ethereum has the most mature on-chain financial ecosystem and is most likely to absorb the funds brought by the compliance of stablecoins, benefiting the DeFi and RWA projects built on its foundation for long-term development.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。