For these established, relatively decentralized DeFi protocols, on one hand, there is a return to value, and on the other hand, the most important aspect is that they can now operate legally.

Written by: Will 阿望

On June 9, 2025, at a roundtable discussion themed "Decentralized Finance and the American Spirit," the new chairman of the U.S. Securities and Exchange Commission (SEC), Paul S. Atkins, delivered a very positive speech on decentralized finance (DeFi), laying the groundwork for the SEC's friendly regulation of DeFi in the future.

After the previous SEC chairman Gary Gensler's litigation and regulatory destruction, Uniswap founder Adams expressed on Twitter that happiness came too suddenly:

The rapid development of DeFi is truly incredible 🤯. Just in 2018, the launch of MakerDAO, Compound, and Uniswap felt like the real beginning of the DeFi movement. Before that, the term "DeFi" didn't even exist. Now, seven years later, government agencies openly acknowledge it as a national priority!

(https://x.com/haydenzadams/status/1932298054343733664)

Similarly, the crypto market has also responded positively, with the values of established DeFi projects like Aave, Uni, Mkr, and Comp soaring. Since these established DeFi projects are built on ETH, ETH has also risen accordingly. For these established, relatively decentralized DeFi protocols, on one hand, there is a return to value, and on the other hand, the most important aspect is that they can now operate legally.

Therefore, this article first compiles the content of the DeFi speech, then glimpses the embryonic form of U.S. crypto regulation (not just DeFi), and finally looks ahead to future crypto trends—On-Chain Financial Markets.

1. DeFi and the American Spirit

Paul S. Atkins: The decentralized finance (DeFi) movement itself embodies American values such as economic liberty, private property rights, and innovation.

1.1 What is a Blockchain Network

Blockchain technology is a highly creative and potentially revolutionary innovation that allows us to rethink ownership and the transfer of intellectual and economic property rights. A blockchain is a shared database that enables users to own digital assets (i.e., crypto assets) without relying on intermediaries or central institutions. Instead, these peer-to-peer networks incentivize participants to verify and maintain the database according to network rules through an economic mechanism. These are free market systems where users need to pay fees to network participants to have their transactions included in a limited-capacity "data block."

1.2 Participants in Blockchain Network Nodes

The previous U.S. government claimed through litigation, speeches, regulation, and threats of regulatory action that participants and Staking-as-a-Service Providers might be engaged in securities trading, thereby preventing Americans from participating in these market-based systems.

I am very grateful to the staff of the Division of Corporation Finance for clarifying their view that voluntary participation in proof-of-work (PoW) or proof-of-stake (PoS) networks as "miners," "validators," or "Staking-as-a-Service" providers is not within the scope of federal securities laws. While I am pleased with this initiative, it is not a formally promulgated rule with legal effect, so we cannot stop here.

The SEC must establish a regulation to clarify this based on the powers granted to us by Congress.

1.3 Self-Custody of Assets

Another core feature of blockchain technology is that individuals can self-custody their crypto assets in personal digital wallets. The right to self-custody one's private property is a fundamental American value that should not disappear when people log onto the internet.

I support giving market participants greater flexibility to self-custody crypto assets, especially when intermediaries have added unnecessary transaction costs or restricted the ability to participate in staking and other on-chain activities.

The previous presidential administration claimed through regulatory actions that developers of such software might be engaged in brokerage activities, thereby undermining the innovation of self-custody digital wallets and other on-chain technologies. Engineers should not be subject to federal securities laws simply for releasing such software code. As a court stated:

"It is unreasonable to hold the developers of self-driving cars liable because third parties misuse the cars to violate traffic laws or rob banks. In such cases, people would not sue the car companies for facilitating illegal behavior; they would sue the individuals committing the illegal acts."

1.4 Self-Executing Software Code

Many entrepreneurs are developing software applications designed to operate without any operator management. This self-executing software code, accessible to everyone but controlled by no one, may sound like science fiction for enabling private peer-to-peer transactions. However, blockchain technology makes a whole new category of software possible that can perform these functions without intermediaries.

I do not believe we should allow regulatory frameworks from a century ago to stifle technological innovations that could disrupt, and most importantly, improve and advance our current traditional intermediary models. We should not automatically fear the future.

These on-chain self-executing software systems have proven resilient in the face of crises. Despite the centralization platforms shaking and failing under pressure in recent years, many on-chain systems continue to operate according to open-source code design.

1.5 Innovative Regulatory Rules

Currently, most securities rules and regulations are based on the regulation of issuers and intermediaries, such as brokers, advisors, exchanges, and clearinghouses. The drafters of these rules and regulations may not have considered that self-executing software code could replace these issuers and intermediaries. I have asked the committee staff to explore whether further guidance or regulations are needed to help registrants transact with these software systems while complying with applicable laws.

I am also excited about issuers and intermediaries using on-chain software systems to eliminate economic friction, enhance capital efficiency, launch new financial products, and improve liquidity. Existing securities regulations have already considered the possibility of issuers and intermediaries using new technologies, but I have asked the staff to consider whether the committee's rules and regulations need to be revised to better facilitate issuers and intermediaries seeking to manage on-chain financial systems.

As the committee and its staff begin to develop suitable rules for On-Chain Financial Markets, I have instructed the staff to consider a Conditional Exemptive Relief Framework or "Innovation Exemption" to allow registrants and non-registrants to quickly bring on-chain products and services to market.

The Innovation Exemption helps realize President Trump's vision of making the U.S. the "global cryptocurrency capital" by encouraging developers, entrepreneurs, and other companies willing to comply with certain conditions to innovate on-chain technology in the U.S.

2. New Era of SEC Regulatory Thinking

2.1 SEC Regulatory Thinking During Gary Gensler's Tenure

In simple terms, the regulatory authority or controversy regarding DeFi under the previous leadership of Gary Gensler revolved around:

The token assets of project parties constituting "securities." A typical case is the Ripple XRP case. Reference article: Interpretation of SEC v. Ripple case, further clearing regulatory fog

Staking-as-a-Service Providers creating interest-bearing assets that fall under the category of "securities." A typical case is the SEC's lawsuit against Kraken's staking products; Reference article: In-depth analysis: Ethereum, ETH staking (Solo Staking) is not a security, Kraken's ETH staking product is a security

- If the assets traded on the platform involve "securities," then the platform will be deemed to be involved in the sale and brokerage of unregistered securities. A typical case is the SEC's lawsuit against the self-custody wallet Metamask, claiming that some of its services, such as staking and brokerage transactions, fall under "securities" trading.

Under such a regulatory logic, a very strict definition of "securities" is required, which not only challenges the U.S. Securities Act of 1933 but also challenges the existing judicial legislative process. Therefore, due to the lack of clear definitions and regulatory frameworks for crypto assets, the SEC at that time adopted a more enforcement-based regulatory approach, provoking a war against crypto projects like Coinbase, Metamask, Uniswap, and others.

2.2 SEC Regulatory Thinking During Paul S. Atkins' Tenure

Now, under the Trump administration led by Paul S. Atkins, the essential goal has shifted: "It is a new day at the SEC."

Whether in this speech or in the previous one on May 12 about "Assets on the Chain—The Intersection of Traditional Finance and Decentralized Finance," a signal has been sent:

To realize President Trump's vision of making the U.S. the "global cryptocurrency capital," by encouraging developers, entrepreneurs, and other companies willing to comply with certain conditions to innovate on-chain technology in the U.S., making the U.S. the best place for global participation in the crypto asset market.

Through Paul S. Atkins' two speeches, a regulatory approach for the SEC has been outlined:

For Real World Asset Tokenization (RWA Tokenization):

Establish a reasonable regulatory framework for the crypto asset market;

Issuance: Adopt a more flexible approach to crypto asset issuance rather than strictly applying traditional securities issuance methods;

Custody: Support providing registered institutions with more autonomy in the custody of crypto assets;

Trading: Support the launch of a wider variety of trading products based on market demand, breaking previous SEC restrictions on such trading activities;

Create more flexible conditional exemption measures to promote the return of blockchain innovation to the U.S., MAGA.

(SEC Chairman Paul Atkins' First Crypto Speech Opens a New Chapter for Crypto Regulation)

For Decentralized Finance (DeFi):

Redefine the operation of staking businesses in blockchain network nodes to promote the healthy development of blockchain networks and attract nodes;

Provide flexibility for self-custody of assets, in line with the American spirit;

Clarify the responsibilities of self-executing software code;

Provide clear regulatory guidance for building on-chain financial markets (On-Chain Financial Markets) for DeFi;

Construct a conditional exemption framework & innovation exemption framework to encourage innovation.

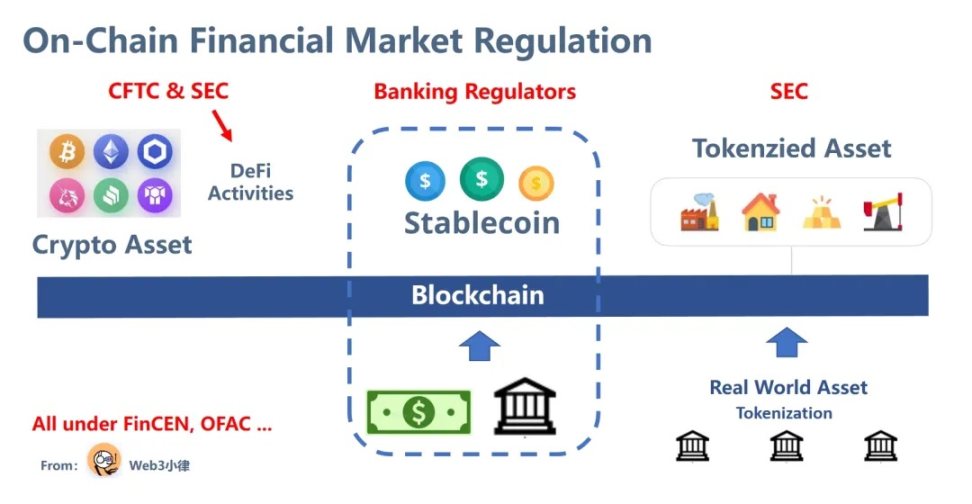

2.3 Emergence of the U.S. Crypto Regulatory Framework

Thus, a preliminary form of the crypto regulatory framework has basically taken shape:

Led by banking regulatory agencies, regulation of "payment stablecoins," Genuis Act;

CFTC regulates crypto assets;

SEC regulates DeFi activities;

SEC regulates tokenized assets;

FinCEN, OFAC, etc., regulate KYC/AML/CTF and economic sanctions.

### What Will the Future Hold?

Having clarified the regulatory framework in the U.S., we can begin to glimpse some future trends:

Established DeFi projects, having experienced significant ups and downs, remain robust and can now officially operate legally.

Innovative DeFi can also develop rapidly in the U.S. under the "innovation exemption," especially financial products related to yield-bearing stablecoins. These differ from the "payment stablecoins" defined in the Genuis Act; although they are called stablecoins, they are essentially wealth management products constructed using stablecoins.

The composability brought by relatively decentralized DeFi can lead to a greater variety of financial products as more stablecoins and tokenized assets go on-chain.

An increasing number of traditional Web2 fintech companies will engage in combinatorial innovation with Web3 DeFi.

This will lead to the emergence of on-chain financial markets (On-Chain Financial Markets).

This market will be globalized, democratized in investment, with low barriers to entry, low costs, global reach, and supported by global liquidity. Importantly, the internet has network effects.

However, based on the regulatory framework, all underlying assets will be dollar stablecoins, U.S. dollars, and U.S. Treasury bonds.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。