Author: Fairy, ChainCatcher

Editor: TB, ChainCatcher

On the chessboard of digital asset regulation in the United States, another heavyweight piece is accelerating its move, in addition to the stablecoin-specific legislation, the "GENIUS Act." The "CLARITY Act," hailed as a "turning point in crypto regulation," may completely rewrite the fate of the U.S. crypto industry.

Over the past few years, U.S. crypto projects, developers, and platforms have been navigating a murky regulatory environment. The unclear responsibilities of the SEC and CFTC have led many projects into a "trial and error" predicament, where being deemed an "unregistered securities offering" could result in fines or even existential crises.

The emergence of the "CLARITY Act" not only seeks to clarify the regulatory boundaries between the SEC and CFTC but also aims to establish a predictable and compliant development path for the digital asset industry.

Today, the bill has been unanimously approved by the House Financial Services Committee and the Agriculture Committee, and will next be submitted to the House for a vote. This marks not only the starting point for reshaping the U.S. crypto regulatory framework but may also become a critical juncture for accelerating institutional entry and genuine innovation.

Progress of the "CLARITY Act"

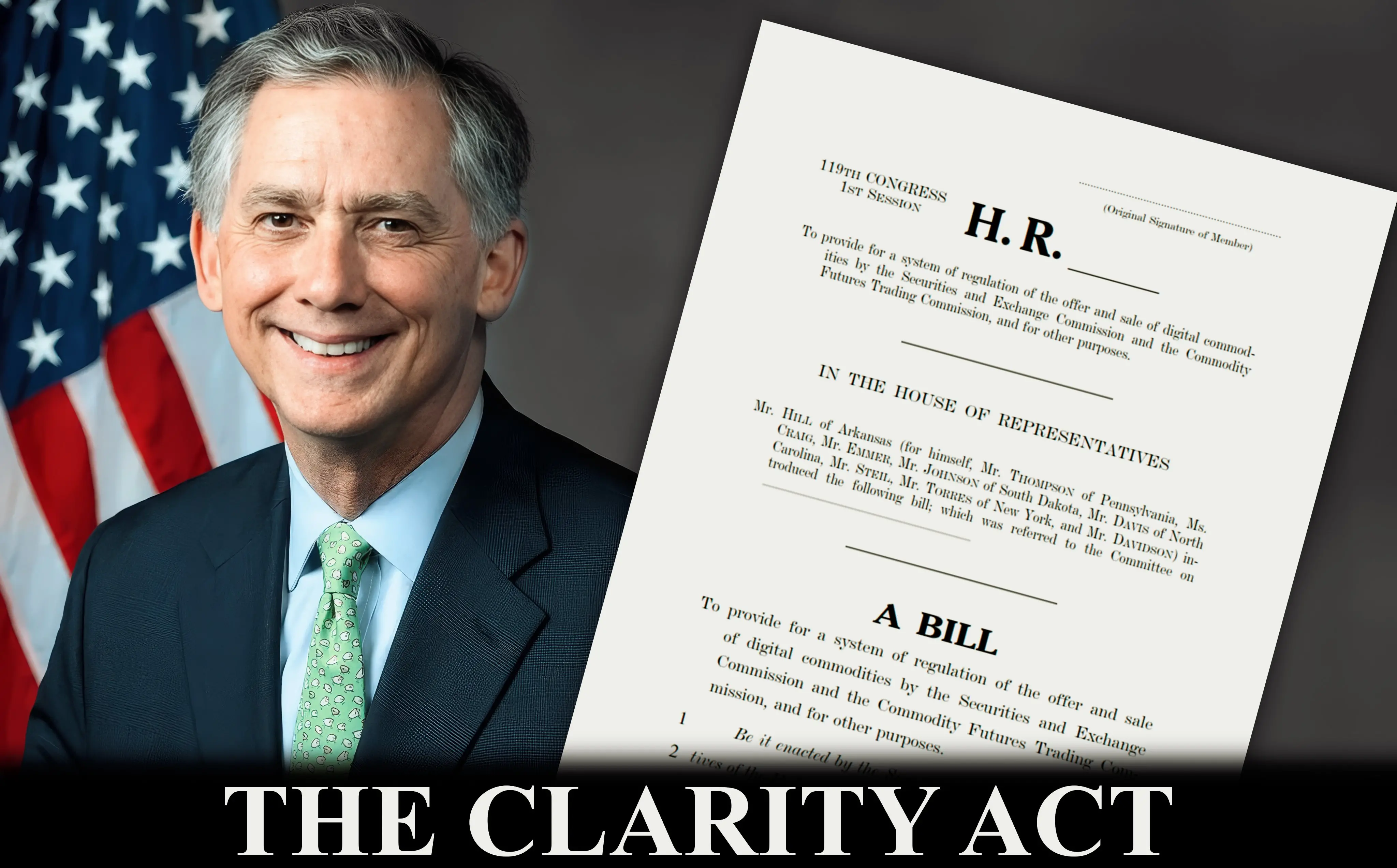

On May 29, French Hill, Chairman of the House Financial Services Committee, officially introduced the "CLARITY Act," which spans 236 pages. However, its progress has not been smooth.

On June 3, the SEC faced strong criticism from House Democratic staff during a technical briefing on the "CLARITY Act," being labeled as "the worst technical assistance briefing." Staff accused SEC representatives of being unable to answer simple questions and even avoiding key information under the guise of "confidentiality," questioning their intent to obscure the truth and hinder legislation.

Meanwhile, some Democrats expressed concerns about Trump's involvement in the crypto industry, questioning potential conflicts of interest that could disrupt the legislative process.

Despite the controversies, the CLARITY Act has continued to improve under various pushes. On June 9, under a joint statement from eight major crypto policy organizations, the "Blockchain Regulatory Certainty Act" was successfully incorporated into the "CLARITY Act." This amendment is seen as a "firewall" for DeFi developers, aimed at protecting software developers and infrastructure providers who do not custody client assets.

To further clarify regulatory responsibilities, the Financial Services Committee and the Agriculture Committee each revised and reviewed the bill, introducing their adjusted versions. Today, both committees successfully passed the bill. According to Republican lawmakers, the two versions will ultimately be merged into a comprehensive bill to be submitted for a full House vote.

Bill Interpretation: Laying a Clear Blueprint for Digital Asset Regulation

The "CLARITY Act" is not starting from scratch but is continuously refined based on relevant legislation from the past few years, particularly as a continuation and expansion of the "Financial Innovation and Technology Act of the 21st Century" (FIT21).

Here are the core points of the bill:

Regulatory Authority Division: Clarifying SEC and CFTC Responsibilities

The core of the "CLARITY Act" is to clearly delineate the regulatory scope of the SEC and CFTC based on the nature of digital assets. The SEC regulates "digital asset securities," while the CFTC regulates "digital commodities." For "hybrid" assets that may possess both securities and commodity characteristics, the bill requires coordination between the two agencies. The goal is to confirm the CFTC as the primary regulator of the digital commodity spot market while retaining the SEC's regulatory authority over securities-like digital assets.

According to community member @realMaxAvery's interpretation, the bill establishes a pathway: projects can initially be treated as securities (high concentration, strong investment attributes), and once they achieve a certain level of decentralization, they can "graduate" to commodity regulation.

A major highlight is the concept of a "mature blockchain system." If a blockchain network is sufficiently decentralized (no single controller, open-source code, automatic operation), it can be certified as a "mature system." Once certified, its tokens will face more lenient regulation, as they resemble commodities rather than securities.

DeFi and Blockchain Participants: New Exemptions and Boundaries

As long as they do not engage in intermediary activities, developers and operators of decentralized blockchain networks are not required to register with the SEC or CFTC. The bill also recognizes the distinction between DeFi and traditional finance, protecting developers from inappropriate financial regulatory constraints. Writing code, running nodes, or providing front-end interfaces typically will not be classified as financial service providers, allowing developers to build Web3 infrastructure with peace of mind.

However, the bill still retains enforcement authority against fraud and manipulation, ensuring a balance between innovation and user protection.

Exchanges and Intermediary Registration: Establishing a Regulatory Framework

Platforms operating digital commodity trading markets must register with the CFTC as "digital commodity exchanges," including over-the-counter brokers and market makers. These entities will comply with strict federal regulatory requirements, such as minimum capital, risk management, trading records, regulatory reporting, and client asset protection.

If a company is involved in both securities and digital commodity businesses, it must register separately with the SEC and CFTC. Although the compliance burden is heavier, the bill clearly delineates the regulatory boundaries for both parties.

Encouraging Traditional Financial Institutions to Enter the Crypto Market

The "CLARITY Act" opens the door for traditional financial institutions to enter the crypto space. Banks can legally provide crypto custody services, and traditional exchanges can operate alternative trading systems that encompass both stocks and crypto assets, promoting institutional adoption and helping Wall Street embrace digital assets.

"Clarity" as a Dual Proposition of Reconstruction and Breakthrough

Whether clarifying the responsibilities of the SEC and CFTC or providing protection for DeFi developers and blockchain innovators, the "CLARITY Act" lays a predictable foundation for industry development. However, alongside the support, there are also many concerns emerging.

Some crypto-native companies point out that the bill may be more beneficial to traditional financial institutions at the execution level. For instance, large Wall Street firms like Charles Schwab, which are already registered with the SEC, could quickly engage in digital commodity-related businesses once the bill is enacted; meanwhile, many crypto-native companies may face unclear or even more cumbersome registration processes with the Commodity Futures Trading Commission (CFTC). This institutional design may inadvertently create unequal "regulatory thresholds."

Nevertheless, the gradual clarity of the regulatory framework remains an indispensable part of driving industry maturity. True "clarity" may signify new challenges, but it also heralds greater space for innovation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。