20 companies focus on BTC, 4 focus on SOL, 2 focus on ETH, and 2 focus on XRP.

Source: Galaxy Research

Translation: BitpushNews

Cryptocurrency Treasury Trends

The trend of publicly traded companies establishing cryptocurrency treasuries is expanding from Bitcoin to more cryptocurrencies, with the scale of allocations continuing to grow.

In just the past week, two publicly traded companies announced plans to purchase XRP as part of their treasury holdings, and another company stated it is acquiring ETH as reserves.

Bitcoin treasury companies have been in the headlines for most of this year, with Strategy (formerly Microstrategy) leading the way. VivoPower and Nasdaq-listed Webus announced intentions to initiate XRP treasuries of $100 million and $300 million, respectively, while SharpLink announced the establishment of a $425 million ETH treasury.

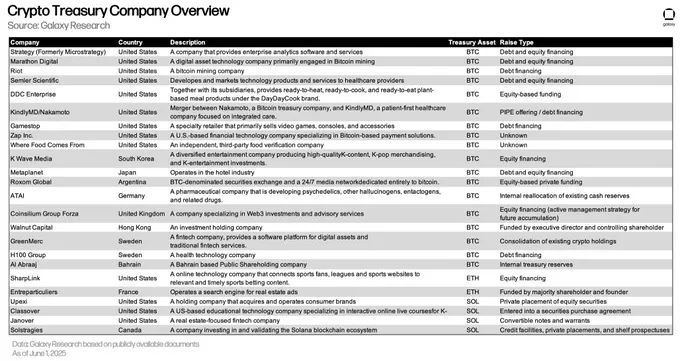

Including these companies, Galaxy Research has compiled a list of 28 cryptocurrency treasury companies:

20 focus on BTC, 4 focus on SOL, 2 focus on ETH, and 2 focus on XRP.

Overview of Cryptocurrency Treasury Companies

Our View

Given the momentum of existing companies and the apparent strong interest in funding these companies at a significant scale and across various assets, the trend of cryptocurrency treasuries is expected to continue to develop.

However, as more cryptocurrency treasury companies come online, skepticism continues to rise.

The main concern lies in the source of funding for some purchases: debt.

Some companies rely on borrowed funds, primarily zero-interest and low-interest convertible notes, to acquire treasury assets.

Upon maturity, these notes can be converted by investors into company equity, provided the notes are "in the money" (i.e., when the company's stock price exceeds the conversion price, making the conversion of equity economically advantageous). However, if the maturity date arrives and the notes are "out of the money," additional funds will be needed to cover the liabilities—this is the root of the concerns regarding treasury company strategies.

Additionally, although less frequently mentioned, there is also the risk that these companies may lack sufficient cash to pay their debt interest.

Regardless of the outcome, treasury companies have four main options. They can:

Sell their cryptocurrency reserves to supplement cash, which may harm asset prices, potentially affecting other treasury companies holding the same assets.

Issue new debt to cover old liabilities, effectively refinancing the debt.

Issue new equity to cover liabilities, which is similar in nature to how they currently fund treasury asset purchases through equity financing.

If the value of their cryptocurrency reserves fails to fully cover liabilities, they will enter default.

In the worst-case scenario, the path each company takes will depend on the specific circumstances and market conditions at that time; for example, treasury companies can only refinance when market conditions allow.

In contrast to treasury funding sources is equity sales, where treasury companies issue stock to fund asset purchases. Equity sales used to supplement asset purchases are less concerning from a broader perspective because, under this method, the company has no default obligations and incurs no liabilities for asset purchases.

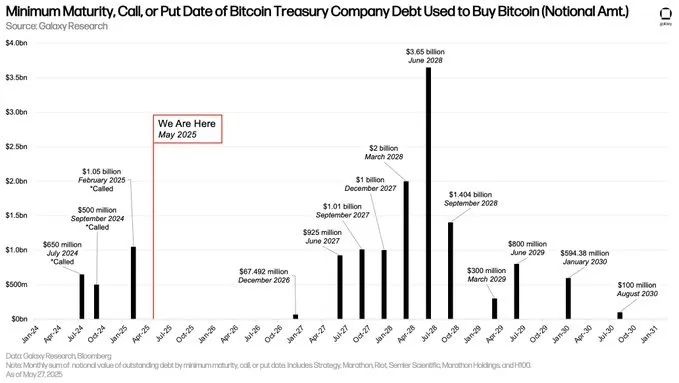

In a recent report on the cryptocurrency leverage landscape, we examined the scale and maturity timeline of the debt issued by some Bitcoin treasury companies.

Based on our findings, we believe that there is not an imminent threat as widely perceived in the market, as most of the debt matures between June 2027 and September 2028 (as shown in the figure below).

The above figure summarizes the debt issued by Bitcoin treasury companies for the purchase of Bitcoin and lists the earliest dates when these debts may be required to be repaid (maturity/redemption/exercise dates), along with the corresponding nominal amounts of the debt.

Considering the industry's past history with leverage, concerns about treasury companies' debt-driven strategies are not unreasonable, but currently, we believe this approach does not pose significant risks.

However, as debts mature and more companies adopt this strategy, there may be a tendency to take on higher-risk approaches and issue debt with shorter maturities, which may not remain constant.

Even in the worst-case scenario, these companies will have a range of traditional financial options to extricate themselves, which may not end with the sale of treasury assets.

– Galaxy On-chain Analyst @ZackPokorny_

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。