Written by: Glendon, Techub News

Today, Federal Reserve Governor Christopher Waller stated at the Global Interdependence Center conference that with the recent market sell-off, the cryptocurrency market frenzy brought about by Trump and the current U.S. government is fading, and the sell-off has shaken this asset class. He also mentioned that clarity in cryptocurrency regulation is stalled in Congress. His remarks have once again sparked industry attention regarding the complex narrative of power and wealth.

Last week, Bitcoin briefly fell to $60,000, not only reversing all the speculative gains triggered by Trump's re-election but also significantly dropping below the initial launch price. This downward trend swept across the entire cryptocurrency market, affecting related ETFs and companies holding large amounts of Bitcoin.

Over the past year, Trump's stance and a series of policies have undoubtedly been a powerful booster for Bitcoin's record highs. However, since the end of last year, the cryptocurrency industry has gradually shown signs of decline. As market momentum weakens, institutions begin to deleverage, and retail investor confidence is shaken, it suggests that the speculative cycle driven by the "Trump market" may be coming to an end.

Meanwhile, controversies surrounding Trump and his family have never ceased. Recently, there has been a resurgence of criticism within the industry, arguing that Trump's actions and those of his administration are harming the long-term healthy development of the cryptocurrency industry. These criticisms mainly focus on conflicts of interest, policy favoritism, corruption risks due to regulatory loosening, and improper exchanges between foreign capital and political power. For instance, earlier this month, U.S. Senator Elizabeth Warren called for a congressional hearing regarding the "purchase of a 500 million dollar stake in WLFI by UAE National Security Advisor Sheikh Tahnoon bin Zayed Al Nahyan." This transaction was signed by Trump's son Eric Trump, with $187 million flowing directly into Trump family entities and at least $31 million going to entities related to Trump's ally Steve Witkoff. Currently, the U.S. House of Representatives has launched an investigation into the relationship between WLFI and UAE entities.

Now, the cryptocurrency industry is facing multiple dilemmas. Bitcoin has fallen over 52% from its peak, the legislative process for the cryptocurrency market structure bill "CLARITY Act" is stalled, and criticisms against Trump are incessant. So, what impact can Trump still have on the cryptocurrency industry, and can the so-called "Trump effect" continue?

Igniting the "Golden Age" of Cryptocurrency

Perhaps Trump's foray into the cryptocurrency field was merely to extract more benefits rather than genuinely recognizing the value of cryptocurrencies. However, it is undeniable that his various actions and policies have objectively "helped" the rapid development of the cryptocurrency market.

Nevertheless, the current severe volatility in the cryptocurrency market indeed reflects a complex reality: Trump ignited the "golden age" of cryptocurrency while also sowing the seeds of turmoil. He is both a promoter and an amplifier, continuously magnifying various issues and risks in the market, with the final outcome depending on the rhythm of the policy and market interplay.

Trump's rise to power is seen as a significant "paradigm shift" for the cryptocurrency industry. Over the past year, the Trump administration has reshaped the rules of the cryptocurrency industry with an almost radical stance. During his campaign, Trump promised to make the U.S. the "world's cryptocurrency capital." After taking office, he immediately signed an executive order to establish a presidential digital asset working group led by cryptocurrency supporter David Sacks and announced the establishment of a "strategic Bitcoin reserve," integrating judicially seized Bitcoin assets, sending a strong signal of national recognition of the value of digital assets. This series of actions greatly enhanced market confidence, elevating cryptocurrencies from "marginal speculation" to "national strategy" level, and gradually leading the market to recognize the argument that "Bitcoin is becoming the new gold."

Subsequently, Trump pushed for the passage of the stablecoin bill "GENIUS Act," providing a legal framework for stablecoins, clarifying that issuers must hold sufficient reserves and accept bank-level regulation. At the same time, he stimulated institutional entry through regulatory loosening. For example, he appointed pro-crypto Paul Atkins as SEC chairman, promoted litigation reviews of cases involving Coinbase and Binance, alleviated regulatory pressure; abolished SAB 121 accounting rules, allowing companies to remove customer crypto assets from their balance sheets, reducing compliance costs, etc. As a result, last year the cryptocurrency market welcomed the "institutional era," with the ETF and DAT markets developing rapidly in a short period.

Meanwhile, the deep binding of the Trump family's cryptocurrency projects with their political brand has embroiled them in controversy. Nevertheless, projects like the meme coin TRUMP and World Liberty Financial (WLFI) still successfully attracted significant retail attention, creating a "politics + finance" linkage effect.

This unprecedented operation has brought politics and the cryptocurrency industry closer together. The result was that Bitcoin briefly broke through the historical high of $126,000 in October 2025, with the total market capitalization approaching $4 trillion. However, this "Trump market," interwoven with policy dividends and capital games, while allowing Bitcoin to break historical highs, also exposed its fragility in subsequent crashes.

The "Frenzy" of Trump Retreats

With increasingly open cryptocurrency policies and regulations, and institutions continuously entering the market, why is this "frenzy" still retreating?

As the saying goes, "Trump is both the cause of success and the cause of failure." The problem lies precisely in the politically driven "double-edged sword" nature; favorable policies can drive up prices, but policy uncertainty itself also becomes the biggest source of volatility.

The trigger for the retreat of the cryptocurrency market's "frenzy" was Trump's policy "flip-flop."

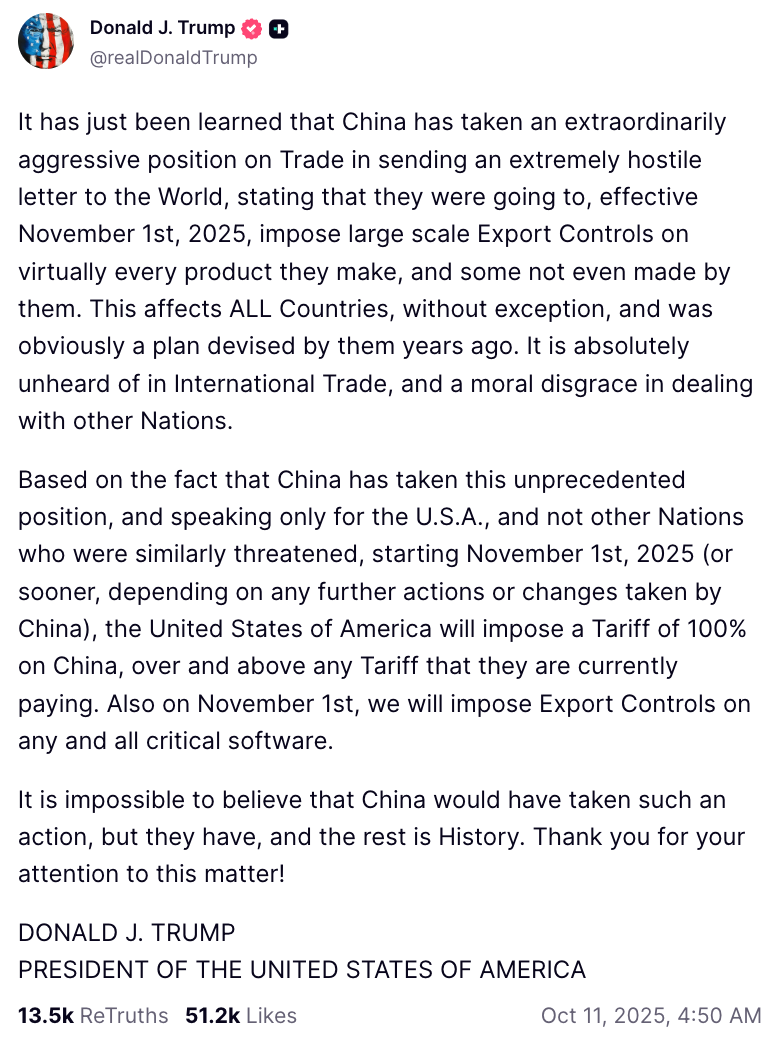

On October 11, 2025, Trump suddenly announced plans to impose a 100% tariff on China, triggering a global sell-off of risk assets. Bitcoin plummeted in a single day, with the market evaporating $19.1 billion within 24 hours, and 1.62 million people facing liquidation, setting a record for the largest single-day liquidation in history. Although he later retracted this decision, the market had already lost its trust inertia.

On the other hand, when the market is booming, the industry may choose to turn a blind eye to the profit-seeking behaviors of Trump family projects. However, once the market begins to decline, controversies regarding their family's "policy arbitrage" quickly spread and are continuously amplified.

The core criticism is the deep binding of policy and family interests, which is suspected of systemic corruption. Several U.S. Congress members, media, and independent institutions have accused the Trump administration of using White House resources to promote its family's cryptocurrency business, constituting an unprecedented conflict of interest. For example, Democratic members of the U.S. House Judiciary Committee released a report accusing the Trump administration of "using the White House to profit from its family's cryptocurrency business," claiming that the family earned $800 million in the first half of 2025 through the issuance and sale of tokens, significantly increasing their net worth. According to a Financial Times investigation, as of last October, the Trump family had earned over $1 billion in pre-tax profits from cryptocurrency businesses in the past year, covering multiple projects including the meme coin TRUMP and MELANIA, WLFI token sales, USD1 stablecoin, and NFTs.

Additionally, there are also suspicions of "quid pro quo." Elizabeth Warren stated that a member of the UAE royal family secretly invested $500 million to support the Trump family's cryptocurrency project WLFI before the Trump administration approved their acquisition of sensitive AI chip technology. Shortly after the transaction was completed, the Trump administration promised to provide the UAE with approximately 500,000 advanced AI chips annually, raising strong doubts about "exchanging policy for investment."

Over the past year, the Trump administration's decision to loosen regulations has also been accused of condoning industry risks and weakening investor protection. A New York Times investigation pointed out that after Trump's return, over 60% of cryptocurrency cases were paused or withdrawn by the SEC, and no new investigations were initiated against companies associated with Trump. Democrats criticized this move as weakening investor protection, allowing digital asset companies related to Trump to expand rapidly.

Although the White House has repeatedly publicly responded, stating that Trump and his family did not participate in government decision-making related to cryptocurrency projects and emphasized that their business assets have been isolated through trust structures, after experiencing the "10.11" flash crash, the market has begun to demystify the Trump administration, and its credibility has been continuously declining.

For this reason, critics argue that while Trump's support once propelled the cryptocurrency market to soar, this "policy-driven" prosperity is unsustainable, exacerbating financial risks and embedding systemic risks in the cryptocurrency market. These doubts and criticisms seem to have been validated by recent market conditions.

In early 2026, as the U.S. stock market, AI bubble, and geopolitical tensions intertwined, risk appetite was suppressed, and the volatility of cryptocurrencies continued to escalate. Waller's remarks may stem from the Federal Reserve's concerns about the overall stability of the financial system. His mention of "the frenzy in the crypto world is fading" serves as another warning to the market, reminding investors that policy dividends do not equate to price guarantees.

However, it is worth noting that Waller is not entirely pessimistic about cryptocurrencies. At the Global Interdependence Center conference, he stated that the fluctuations in the cryptocurrency market are normal, and the recent market volatility may stem from regulatory uncertainty and risk management operations of large financial institutions. He believes that many institutions entering the cryptocurrency market from mainstream finance have sold off to adjust their risk positions. This is a manifestation of market self-regulation.

From "Rhetorical Speculation" to "Institutional Binding"

Regarding regulatory uncertainty, the only cryptocurrency policy the industry can currently look forward to is the "CLARITY Act." However, market expectations for this bill have shifted from "market surge" to "confidence rebuilding." Previously, during the bill's advancement, the market absorbed the positive news, but Bitcoin's performance only saw a moderate rise, approaching the $100,000 mark, without any "event-driven" explosive growth.

Currently, the legislative process for the "CLARITY Act" regarding cryptocurrency market structure is stalled, and market regulation remains uncertain. Moreover, it is important to clarify that the bill's impact is more of a long-term effect, providing a clear compliance path for institutional investors (such as BlackRock and Grayscale), promoting large-scale entry of traditional capital, and thus forming a positive cycle from regulatory dividends to liquidity inflow and then to market capitalization expansion. Therefore, even if the bill passes, it may boost the market in the short term, but quickly reversing the market's downward trend is not an easy task.

Meanwhile, Trump's influence has shifted from "rhetorical speculation" to "institutional binding," and he is no longer the "emotional catalyst" capable of driving the market.

As Trump's second term enters its mid-point, his influence is facing the test of the "political cycle law." In the early stage of his term (2025): policy expectations were high, and Bitcoin once surged to $129,000; in the mid-term (2026 to 2027): policy implementation lagged, and the market experienced a "pullback after expectations were fulfilled" (i.e., Bitcoin fell over 50% from its peak). If he fails to push for the full implementation of the "CLARITY Act" or encounters resistance in Congress, his persona as the "crypto president" will face a trust crisis, and his influence on the cryptocurrency industry is likely to diminish rapidly.

Historically, the influence of political figures on the cryptocurrency market generally weakens after the mid-term of their tenure, as their attention often shifts to economic, diplomatic, and re-election issues. Therefore, although Trump still possesses strong public appeal, the cryptocurrency market has entered a "system priority" phase, where investors are more focused on the final text of the "CLARITY Act," the implementation details from the CFTC, and tax treatment rules. Presidential tweets are unlikely to genuinely drive capital inflow. The current core driving force of the market is "institutional certainty" far outweighing "personal worship."

It is worth mentioning that Trump's personal meme coin TRUMP is currently priced at about $3.30, having plummeted over 95% from its peak, and on October 11, it even dropped to $1.50, setting a new low for the past year. This also indicates that the market's perception of Trump's "personal symbol" has become more rational.

Conclusion

In short, Trump did not "destroy" the cryptocurrency market; his influence on the cryptocurrency industry is a double-edged sword. More precisely, he has reshaped the industry. He has indeed made the market more politicized, more emotional, and more fragile, but at the same time, he has also facilitated the gradual integration of crypto assets into the mainstream financial framework, although this process requires undergoing a "de-bubbling" baptism. Now, for the cryptocurrency industry, Trump is no longer a "price maker," but rather an "institutional accelerator." His value lies in whether he can promote the implementation of cryptocurrency legislation, rather than just creating topics.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。