Bitcoin should not just be a means of storing value.

Written by: Tanay Ved

Translated by: Luffy, Foresight News

Key Points:

Wrapped Bitcoin, such as WBTC and cbBTC, extends the utility of Bitcoin beyond its own network, enhancing cross-chain accessibility and interoperability.

Wrapped Bitcoin has different custody models and governance structures, ranging from fully centralized issuers (like Coinbase's cbBTC) to decentralized, smart contract-based systems (like Threshold's tBTC).

WBTC has the largest supply (approximately 129,000 BTC), but the share of cbBTC is rapidly increasing, with an issuance of about 43,000 Bitcoin on Base and Solana. Together, they represent over 172,000 wrapped Bitcoins, which are used differently across various blockchains.

Wrapped Bitcoin is widely adopted in the DeFi space. WBTC dominates Ethereum DEXs (led by Uniswap v3), while cbBTC is more active on DEXs like Aerodrome. Over $7 billion worth of WBTC and cbBTC is locked in lending protocols like Aave and Morpho, where users borrow against them as collateral.

Introduction

The scarcity and predictable monetary policy of Bitcoin make it an ideal "store of value," with ownership increasingly shifting to long-term holders, ETFs, and publicly traded companies. However, as BTC is heavily "hoarded," what does it mean that the utility of its $2 trillion native token has not been developed?

In response to this situation, an increasing number of products have emerged, all aimed at making Bitcoin work. From Bitcoin-based lending (such as the collaboration between Coinbase and Morpho, or the Bitcoin credit tools provided by Cantor Fitzgerald through Maple Finance) to Layer 2 solutions designed to expand Bitcoin's functionality, to wrapped Bitcoin for cross-chain interoperability, and enterprise financial tools like Strategy, all these efforts are aimed at making Bitcoin more productive.

In this article, we explore the evolving ecosystem of tokenized Bitcoin, focusing on Wrapped Bitcoin (WBTC) and Coinbase's cbBTC, analyzing how they extend the utility of BTC across chains.

The Current State of Tokenized Bitcoin Products

The demand for using Bitcoin on smart contract platforms has ultimately given rise to a series of tokenized Bitcoins, also known as "Bitcoin derivatives." Among them, wrapped Bitcoin is the largest category, representing tokenized versions of BTC issued on other blockchains, typically issued through minting and burning mechanisms, and backed 1:1 by custodial native Bitcoin.

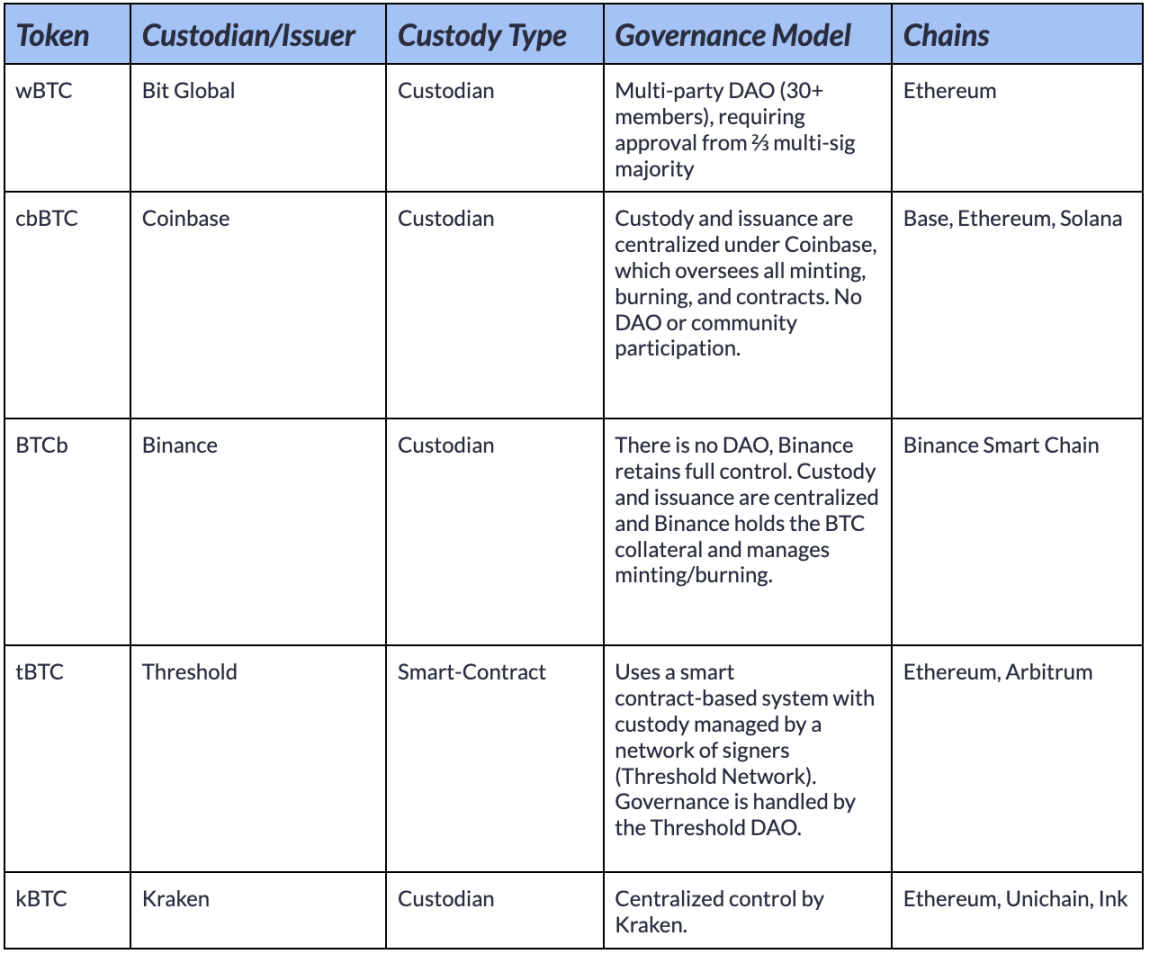

Wrapped Bitcoin tokens are designed to enhance the accessibility and interoperability of BTC, bringing programmability and low-cost execution capabilities that native Bitcoin lacks. The table below outlines the major wrapped Bitcoins and compares their custody models, issuing entities, governance structures, and supported blockchain networks:

While these tokens are all aimed at extending Bitcoin's utility, their trust assumptions vary. Today's solutions are diverse, ranging from fully custodial models like Coinbase's cbBTC to DAO-based multi-signature systems like WBTC, and distributed smart contract-based systems like Threshold's tBTC. In all these models, users entrust the custody of their Bitcoin to third parties in exchange for a tokenized representation.

In addition to the major wrapped Bitcoins mentioned above, liquid-staking Bitcoin derivatives are also on the rise. For example, Lombard's LBTC provides security for proof-of-stake (PoS) chains through the Babylon Protocol, allowing BTC holders to earn staking rewards.

WBTC and cbBTC

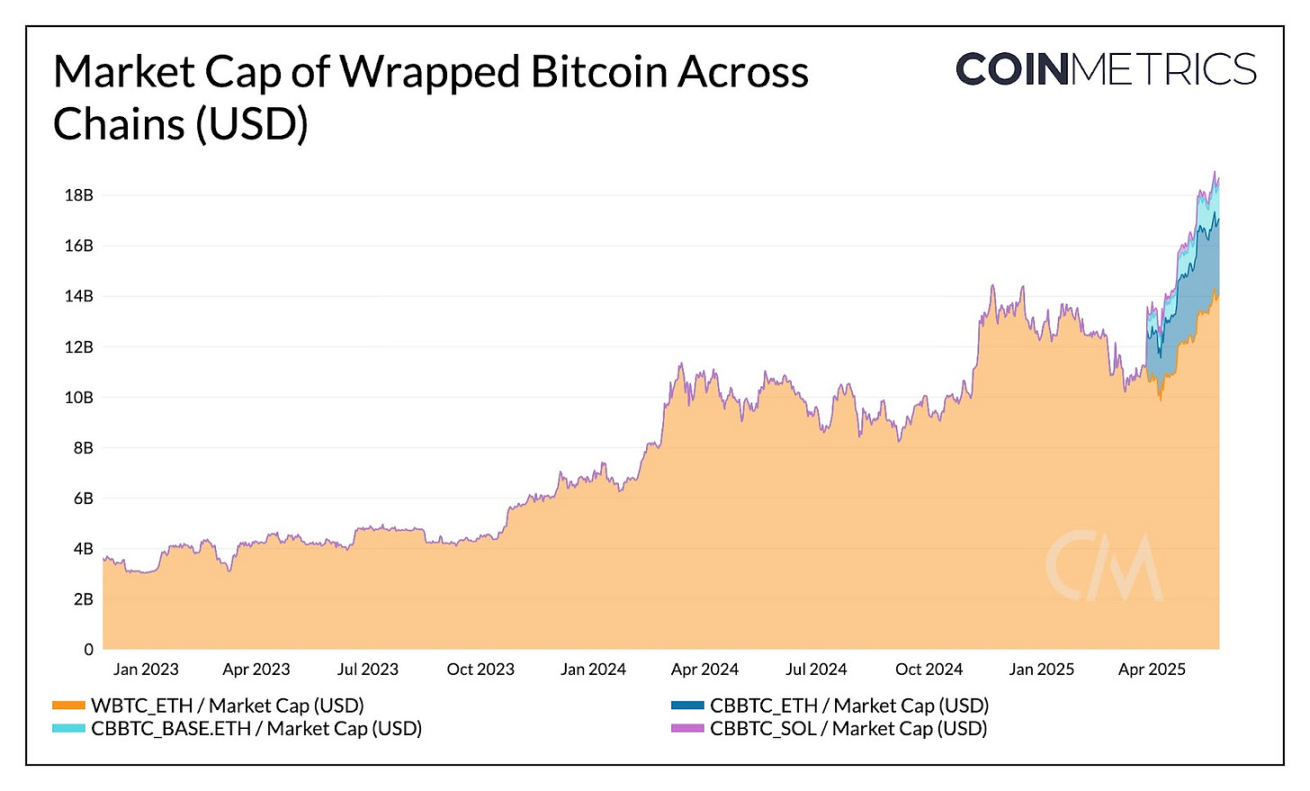

Since January 2023, driven by the rise in BTC prices and the launch of new cross-chain products, the market capitalization of wrapped Bitcoin has increased fivefold. The two largest tokens by market cap are WBTC and cbBTC, issued by BiT Global and Coinbase, with a total supply of 172,000 tokens.

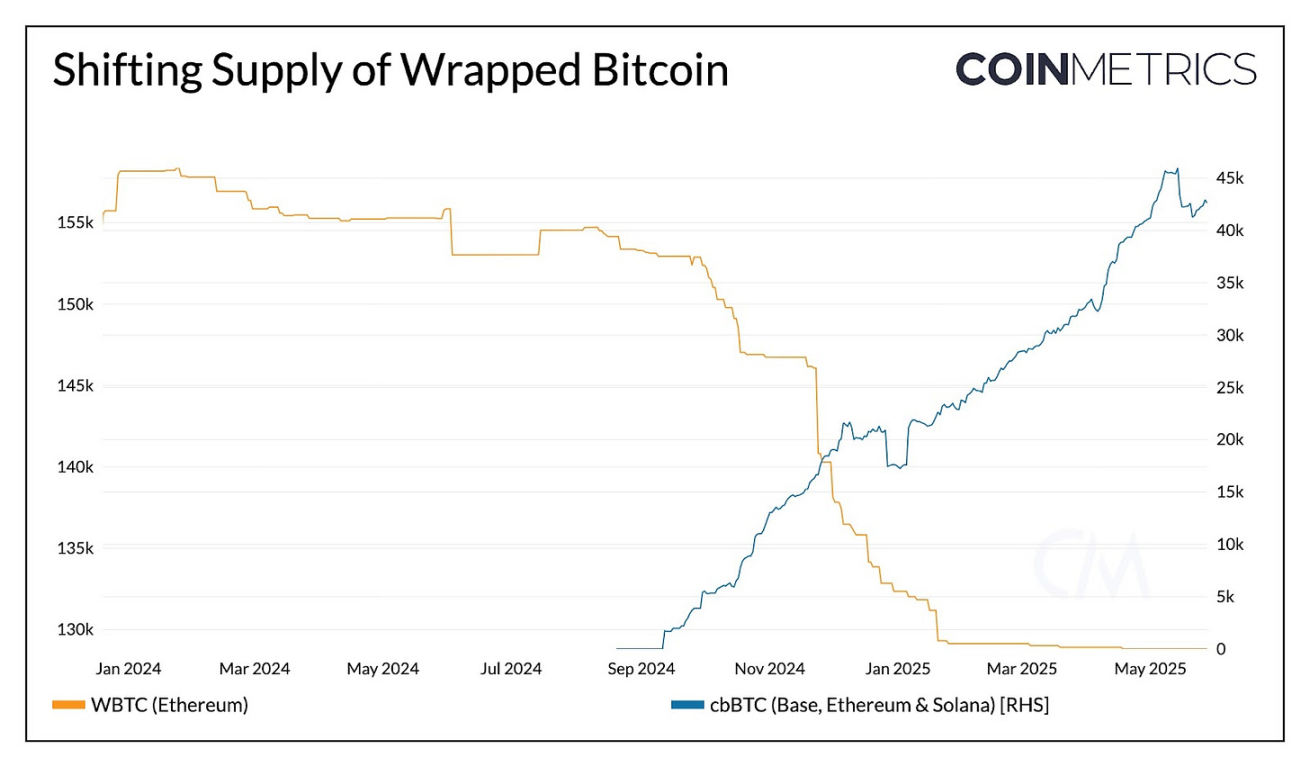

As the first wrapped Bitcoin launched in 2019, WBTC has historically dominated the market. However, as ownership of WBTC is set to transfer to BiT Global in September 2024, demand for WBTC seems to be waning. Meanwhile, Coinbase's cbBTC has launched on Base, Ethereum, and Solana, rapidly growing to compensate for the decline of WBTC.

As of June 1, 2025, WBTC accounted for 81% of the wrapped Bitcoin market, with a current supply of 128,800 BTC. In contrast, cbBTC accounted for the remaining 19%, with issuance on Ethereum, Base, and Solana at 27,600, 13,200, and 23,000 respectively.

Cross-Chain Usage of Bitcoin

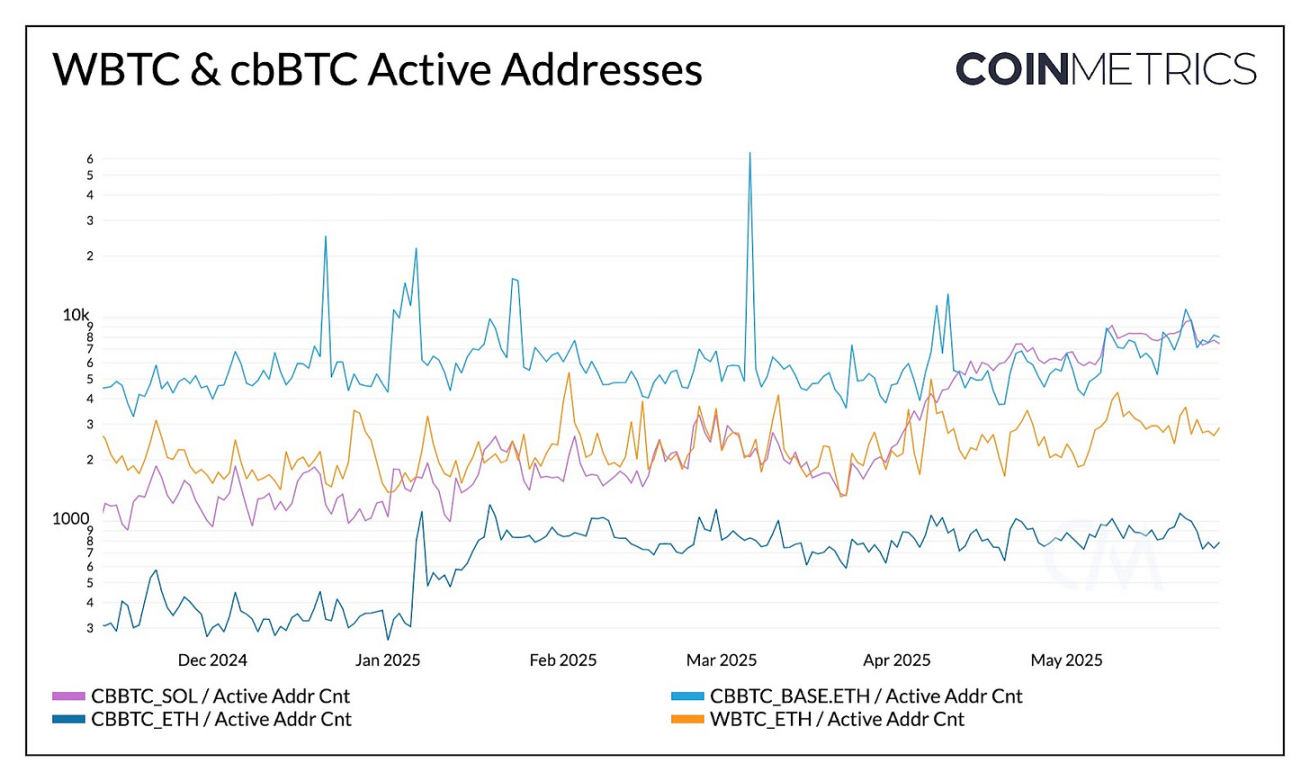

With the surge of Bitcoin on blockchains like Ethereum, Base, and Solana, on-chain activity provides deeper insights into its functional role within these ecosystems. Active addresses can help us understand the breadth of user interaction with cross-chain tokenized Bitcoin.

Thanks to Coinbase's extensive distribution and lower transaction costs, cbBTC on Base leads in this regard, with an average of about 7,000 active addresses daily. Solana follows closely, with its active address count steadily increasing since April, also benefiting from its low-cost, high-throughput infrastructure. Ethereum's participation appears limited to larger but less frequent transactions, indicating that while a significant portion of cbBTC and WBTC is on Ethereum, its usage activity is lower compared to Base and Solana.

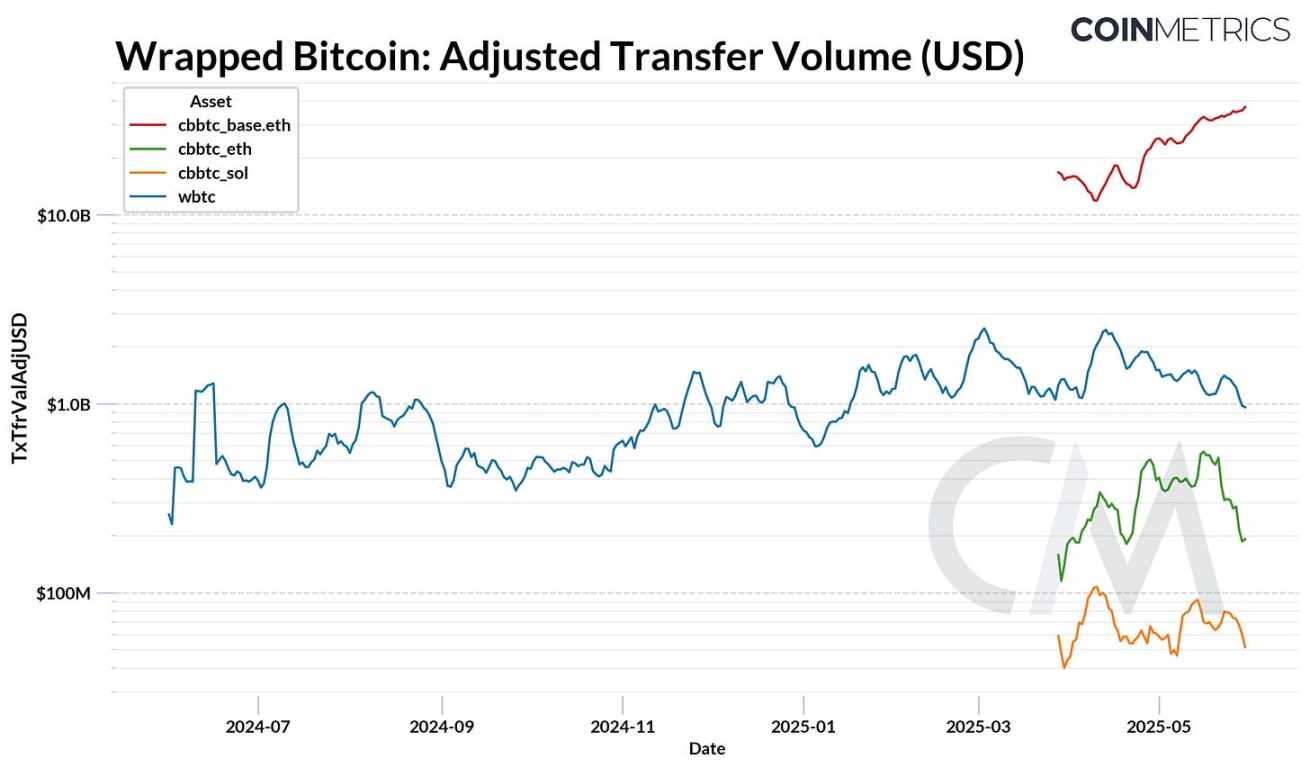

Transaction activity (measured by transaction count and native token transfer volume) shows a similar trend. The chart below illustrates the adjusted transfer volumes of WBTC and cbBTC across various chains. cbBTC on Base stands out, with an average weekly transfer volume of about $40 billion. This far exceeds the transfer volume of WBTC on Ethereum, which is around $1 billion.

Note: The adjusted transfer volumes of cbBTC spiked to $506 billion and $787 billion on April 22 and April 26, respectively. These outliers have been excluded due to non-organic activity caused by the "Impermax Exploiter" address engaging in repeated transactions with Morpho on Base.

The velocity of circulation further validates this trend, measuring the frequency of tokenized Bitcoin changing hands relative to its supply. cbBTC on Base has the highest trading volume, followed by cbBTC on Solana and Ethereum. All wrapped Bitcoin variants show higher velocity than native Bitcoin, highlighting their role in driving the activity of Bitcoin in on-chain applications.

Wrapped Bitcoin in DeFi

The primary driver of demand for wrapped Bitcoin is its ability to unlock on-chain financial services that the underlying Bitcoin cannot achieve. As a crucial component of DeFi, WBTC and cbBTC allow users to trade, lend, and provide liquidity without having to sell their held Bitcoin.

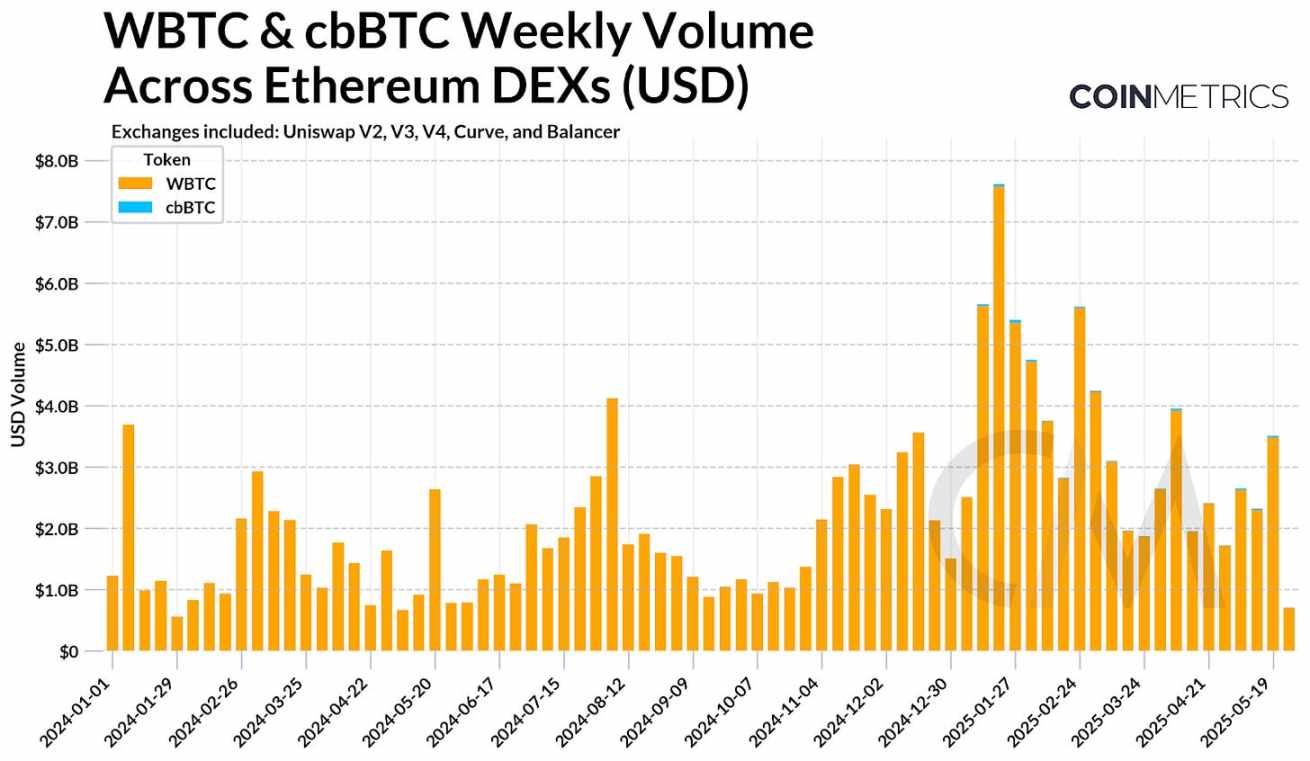

On Ethereum, WBTC remains the dominant wrapped Bitcoin in the DEX market, with Uniswap v3 accounting for the majority of its trading volume. While cbBTC is also traded on Ethereum DEXs, its scale is relatively small. To access applications on Ethereum scaling solutions, WBTC is often bridged to L2, while cbBTC is natively issued on Base and Solana, allowing for broader cross-chain usage.

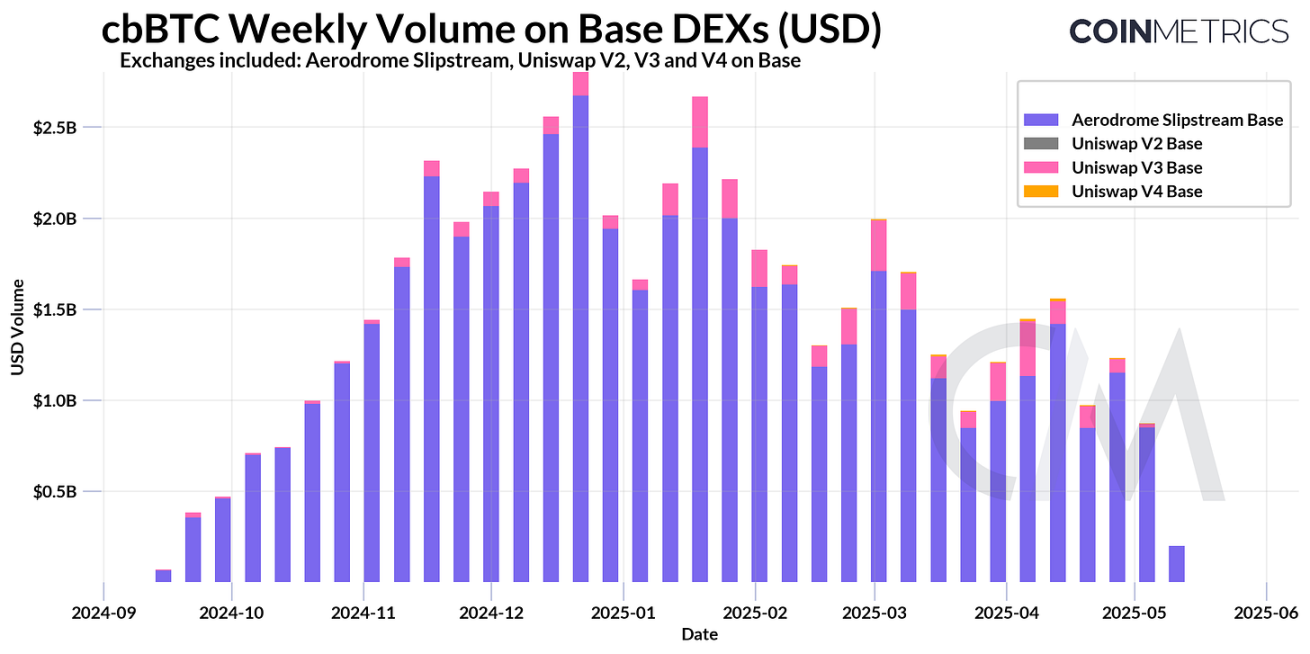

In contrast, cbBTC plays a more significant role in the L2 ecosystem, especially on Base, where it is the leading tokenized Bitcoin in DEX activity. Most trading volume occurs on Aerodrome, peaking at over $2.5 billion in early 2025, followed by Uniswap v3 on the Base chain.

Note: The trading volumes of Uniswap v3 Base on April 26 and April 30 have been adjusted to exclude a series of repeated cbBTC transactions initiated by a single address.

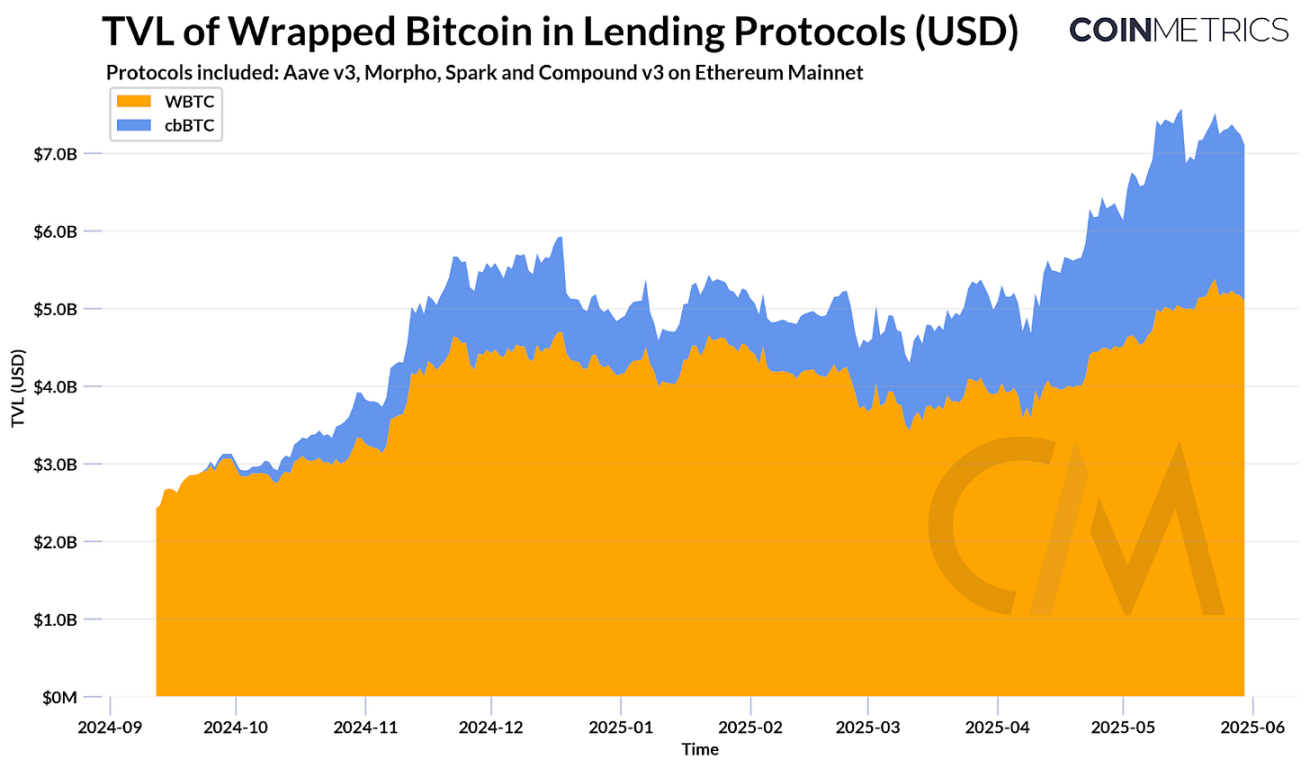

In addition to trading, Wrapped BTC is also a significant component of the Ethereum lending market. Both WBTC and cbBTC are widely used as collateral assets, with Aave v3, Morpho, and Spark being the largest holders of cbBTC. As of June 2025, over $7 billion worth of WBTC ($5 billion) and cbBTC ($2 billion) is locked in these protocols, reflecting the growing integration and demand for Bitcoin lending.

However, the introduction of different versions of wrapped Bitcoin as collateral also presents several drawbacks. Custodial models like cbBTC and WBTC may carry centralization risks. Users must weigh these risks against the liquidity and utility that wrapped Bitcoin provides.

Conclusion

While Bitcoin's role as a store of value remains entrenched, tokens like WBTC and cbBTC are continuously expanding Bitcoin's utility. With these products, Bitcoin can now seamlessly transfer across chains, participate in on-chain finance, and integrate into new execution environments. Although these models introduce different trust assumptions, their adoption indicates a market demand for enhancing Bitcoin's versatility. As parallel technologies like Rollups and sidechains develop, tokenized Bitcoin is likely to remain a key bridge connecting Bitcoin's monetary reserve status with the programmable economies built on other networks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。