Author: Token Dispatch, Thejaswini M A

Compiled by: Block unicorn

Introduction

From a forgotten small town in the UK, to crime-ridden streets, to the pinnacle of the most adventurous trading in cryptocurrency.

Turning $7,000 in an overlooked meme coin into $25 million.

From a billion-dollar Bitcoin gamble that brought Wall Street traders to tears of envy.

To watching $100 million evaporate in the final liquidation, while the entire cryptocurrency world looked on in horror.

Meet James Wynn—this trader embodies the wildest dreams and the most terrifying nightmares of every "fallen" individual.

His story begins with a TRS-80 computer and a desire born from poverty, culminating in one of the most transparent trading collapses in cryptocurrency history.

The conclusion of the story raises a core question that strikes at the heart of the industry.

This person, known as "moonpig" on Hyperliquid, has become a significant lesson to be learned in the cryptocurrency space. Let’s delve into the rise and spectacular fall of this fallen king.

The Boy from a Forgotten Town

James Wynn did not come from a privileged background.

According to his own accounts on social media, he hails from a "forgotten small town" in the UK—a place characterized by high crime rates, drug abuse, alcoholism, and extreme poverty.

"I was born at the bottom," he says.

Image source: @JamesWynnReal

This is not the typical origin story of a Silicon Valley entrepreneur.

No Stanford MBA, no family connections, and no venture capital background.

He was just a kid "barely making ends meet each week," yet he developed a risk appetite that made hedge fund managers uneasy.

When you have nothing, betting everything seems like a rational choice. When survival is your baseline, extreme leverage is just another Tuesday.

Specific details about his early life are deliberately kept vague—James Wynn has always kept his personal identity a secret, trading under pseudonyms and wallet addresses. But the desire he describes is evident in every trade he made later.

By 2020, he entered the cryptocurrency space.

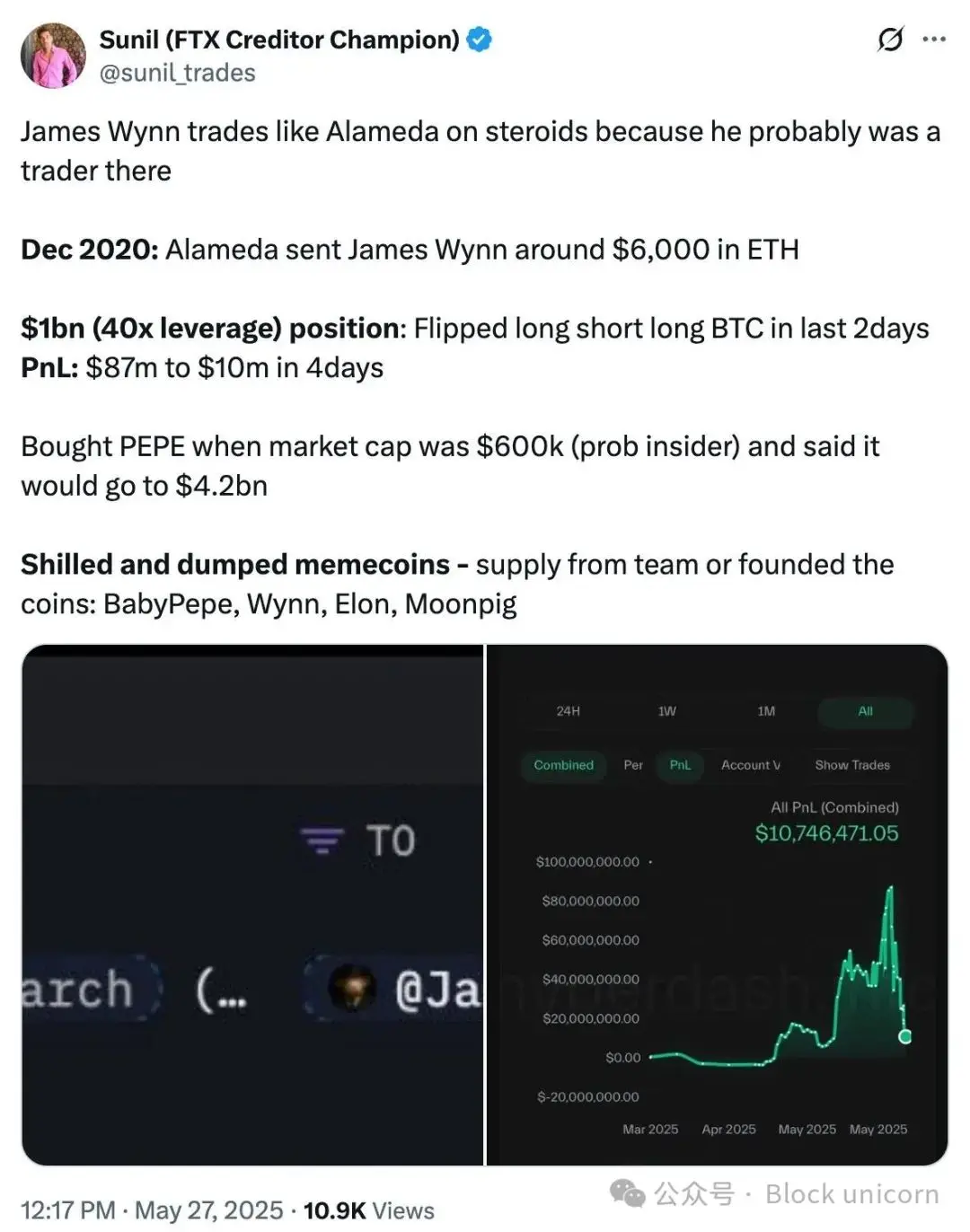

The first clue appeared in December 2020, when blockchain investigators discovered he received $6,000 worth of Ethereum from Alameda Research—the now-infamous trading firm of Sam Bankman-Fried.

Image source: @suniltrades_

Whether this funding was seed capital, a service fee, or something else remains unclear. What matters is that this funding gave Wynn his initial chips.

Because he was about to turn those chips into extraordinary wealth.

The PEPE Prophecy

The trade that made James Wynn famous began with boredom.

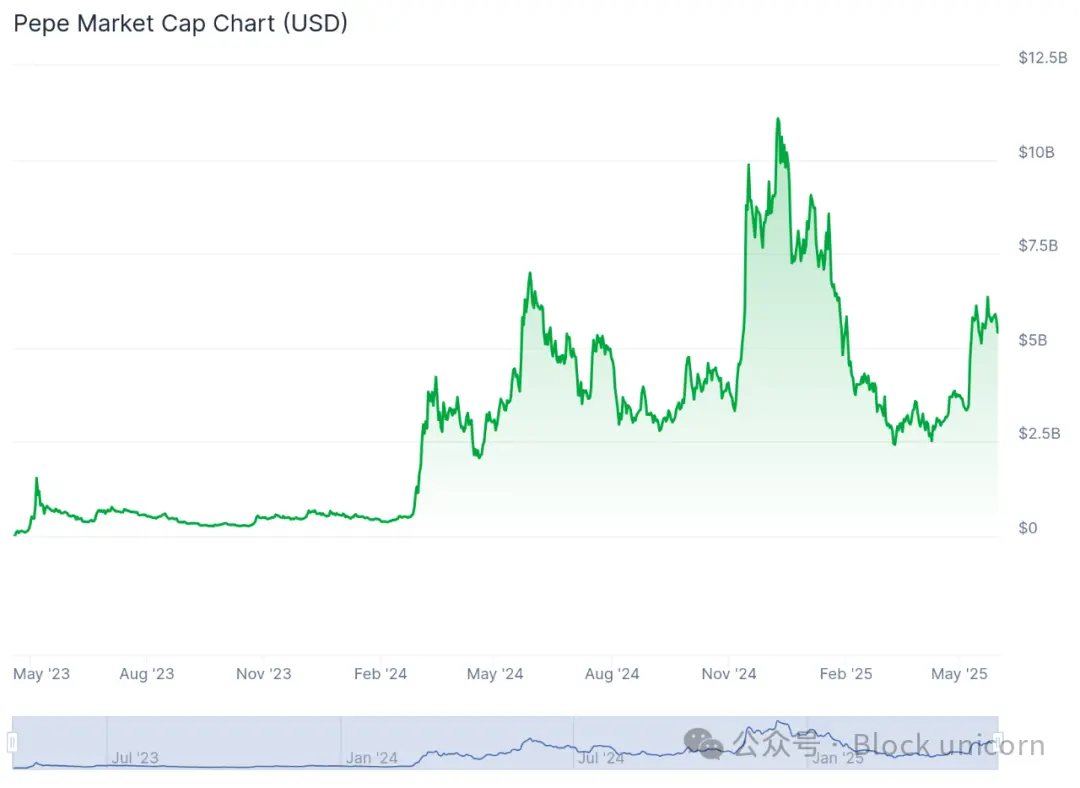

In 2023, as he mentioned in a post on X, he stumbled upon something that would change his life while browsing micro-cap meme coins on iToken: PEPE, inspired by the "Pepe the Frog" internet meme.

At the time, its market cap was only $600,000. Most traders couldn't even be bothered to pay the gas fees.

But Wynn saw something different.

With an initial capital of about $7,000, Wynn began accumulating PEPE tokens in near obscurity. Then, he did something that solidified his legend: he made a public prediction.

In April 2023, when PEPE's market cap reached $4.2 million, Wynn claimed it would reach $4.2 billion.

That was a 1,000-fold prediction. For a meme coin. Based on a cartoon frog.

The crypto world laughed at him. Then PEPE actually developed according to Wynn's prediction.

By December 2024, PEPE's market cap exceeded $10 billion. Wynn's $7,000 turned into about $25 million—over 3,500 times the return.

Image source: @Coingecko

But money was only part of the story. This prediction made Wynn a legend in the meme coin community.

He wasn't just lucky—he publicly stated his goal and achieved it.

The community dubbed him the "10U War God"—referring to starting small and expanding to millions. His Twitter followers hung on his every word.

Things began to get complicated from there.

The Influencer's Dilemma

Achieving success in the crypto world brings followers.

But followers also bring responsibilities.

And responsibility was never Wynn's strong suit.

By 2024, with the success of PEPE, Wynn began promoting other tokens. His model was simple: find a micro-cap meme coin, quietly accumulate, then publicly promote.

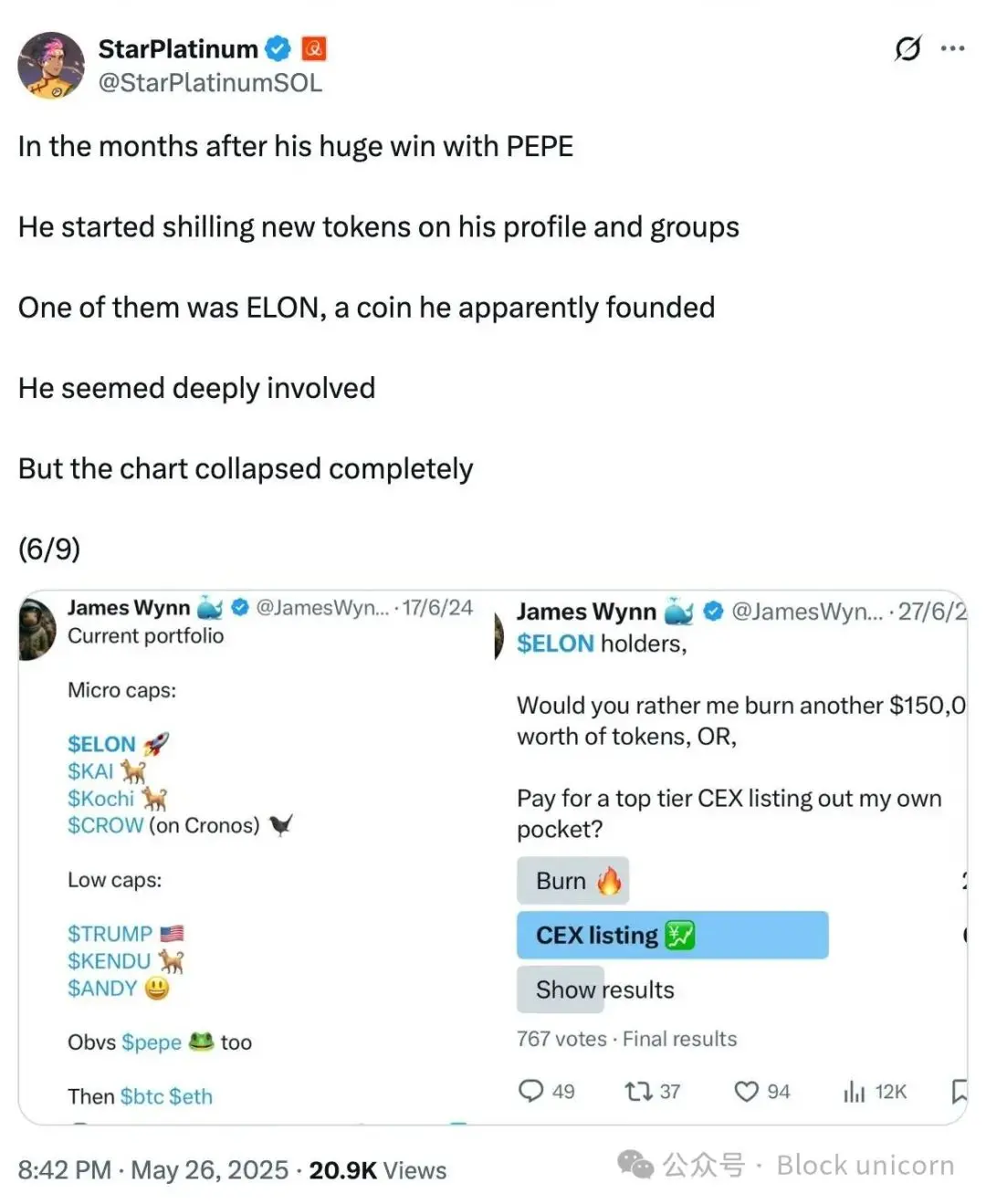

The ELON incident defined this phase of his career.

In April 2024, Wynn began promoting a token called ELON, with enthusiasm that rivaled his for PEPE. He issued "crazy orders" and ignited community excitement. His followers were unaware that he was quietly accumulating large amounts of assets in multiple wallets.

As ELON's price soared, Wynn claimed the token had "issues" and announced he would liquidate. The price plummeted nearly 70% almost immediately.

Image source: @StarPlatinumSOL

Followers who bought based on his recommendations found their tokens worthless, while Wynn walked away with profits.

This operation was swift and fierce. The community that once hailed him as a prophet now condemned him as a manipulator. His reputation, built on the success of PEPE, was shattered.

Similar accusations followed with other tokens.

BabyPepe: Wynn was accused of acquiring 2% of the token supply, promoting it in his Telegram group, then immediately selling for a profit of $68,000.

MOONPIG: He allegedly bought 3% of the total supply, pumped the price through social media, then sold his holdings.

WYNN and ELON tokens: Despite his support, both tokens plummeted after their launch.

Wynn denied any wrongdoing, claiming he was "just an investor, not involved in the development or manipulation of the tokens." But the damage was done.

The meme coin god had fallen. It was time to reshape himself.

The Hyperliquid Era

In March 2025, James Wynn made a defining decision for his legend: he deposited about $6 million into the decentralized perpetual contract exchange Hyperliquid.

This platform was perfect for Wynn's new strategy. High leverage, low fees, and complete transparency for all trades. Unlike centralized exchanges that hide the movements of large players, every position on Hyperliquid is public.

Wynn was not just trading—he was performing.

From March 2025 to May 23, he executed 39 leveraged trades with a win rate of 43.59%. But what drew attention was not the win rate, but the scale of the trades.

His leveraged operations were no small feat.

He regularly used 40x leverage on Bitcoin and 10x leverage on meme coins, with an average leverage of about 22x. This meant that the $55.8 million in collateral he held controlled positions worth over $1.25 billion.

By May 10, his profits were remarkable.

PEPE long position: $23.8 million unrealized profit

Bitcoin long: $5.4 million unrealized profit

Official Trump: $5.57 million unrealized profit

Fartcoin: $5.15 million unrealized profit

By May 23, his profits peaked at $87 million.

His trading brought in massive fees for Hyperliquid—over $2.3 million in just two months. Some speculated he was intentionally showcasing the platform's capabilities.

"They want me to trade on ByBit, but even if they offered me $1 million a month, I wouldn't stop using Hyperliquid," Wynn claimed. "I publicly promote my trades partly because I want Hyperliquid to dominate the exchange market share, as other exchanges are corrupt."

This transparency was intoxicating. This trader was willing to showcase every position, every profit, every loss. The crypto world was captivated.

They were about to witness history—just not the kind Wynn expected.

The Seven Days that Took Down the King

May 19, 2025. Bitcoin: $103,302.

James Wynn opened a 5,520 Bitcoin long position at 40x leverage for $103,302, with a liquidation price of $98,294.

In the following seven days, he experienced increasingly desperate trades, ultimately leading to a fortune turning to dust and triggering the most public collapse in cryptocurrency history.

Days 1-2 (May 19-20): Wynn expanded his position to 7,764 Bitcoin, with a nominal value of $830 million. His average entry price moved to $105,033, with a liquidation price of $100,330.

Day 3 (May 21): He increased his position to 9,371.71 Bitcoin, with a position value exceeding $1 billion. The unrealized profit for this trade was $10.71 million, with an average entry price of $108,005. Later that day, he closed 2,139 Bitcoin, realizing a profit of $11.92 million.

Day 4 (May 22): Opened a new long position of 10,200 Bitcoin at $108,065. As Bitcoin's price reached $111,900, the unrealized profit peaked at $39 million.

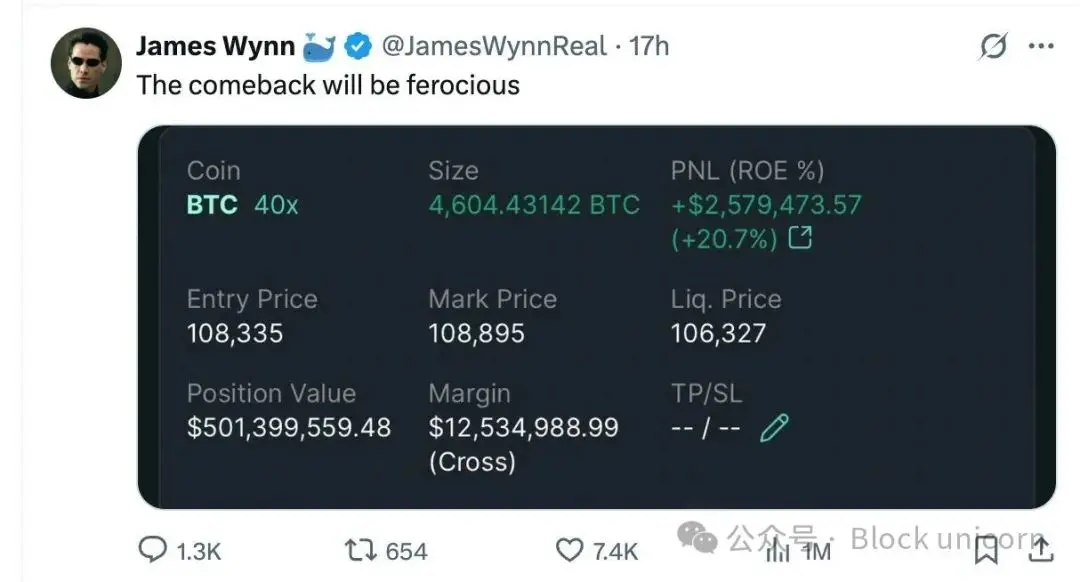

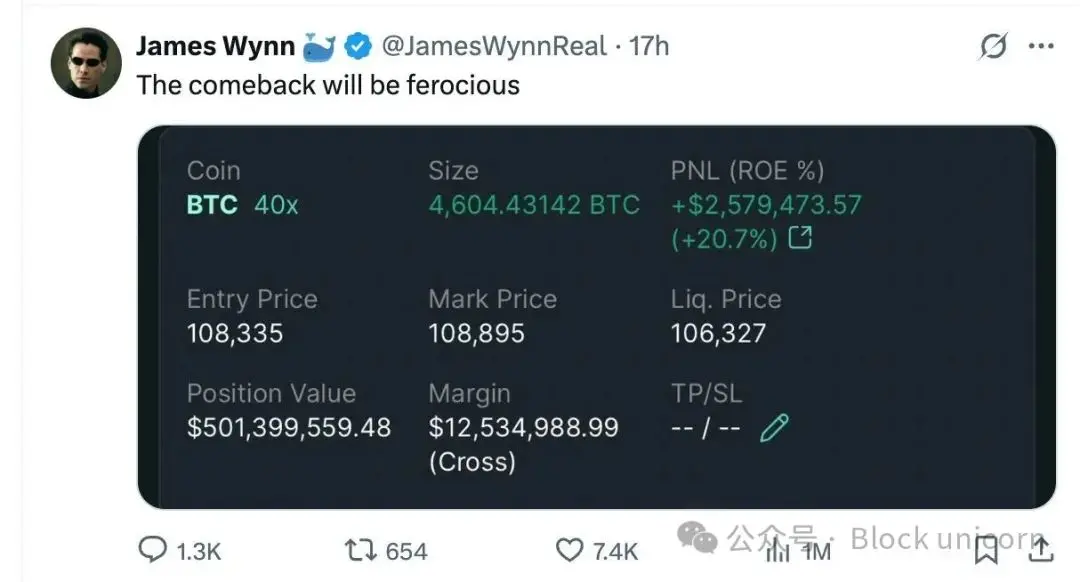

Day 5 (May 23): The turning point. After Trump announced a 50% tariff on EU imports, Bitcoin dropped 4% to $106,700. Wynn closed another PEPE position, realizing a profit of $25.18 million, and increased his Bitcoin long to 11,588 Bitcoin, with an average entry price of $108,243. Liquidation level: $105,180.

Image source: @JamesWynnReal

Day 6 (May 24): He closed at $107,746, incurring a loss of $13.39 million. In desperation, he turned to shorting, expanding his Bitcoin short position to 7,967.83 Bitcoin, valued at $856 million, ultimately closing at $111,280.

Day 7 (May 26): The final blow. Wynn closed a Bitcoin short position worth over $1 billion, losing about $15.87 million in 15 hours.

Total loss over seven days: approximately $65 million.

His peak profit had reached $87 million, but now it had fallen to about $27 million. However, this figure was misleading—because the losses were far from over.

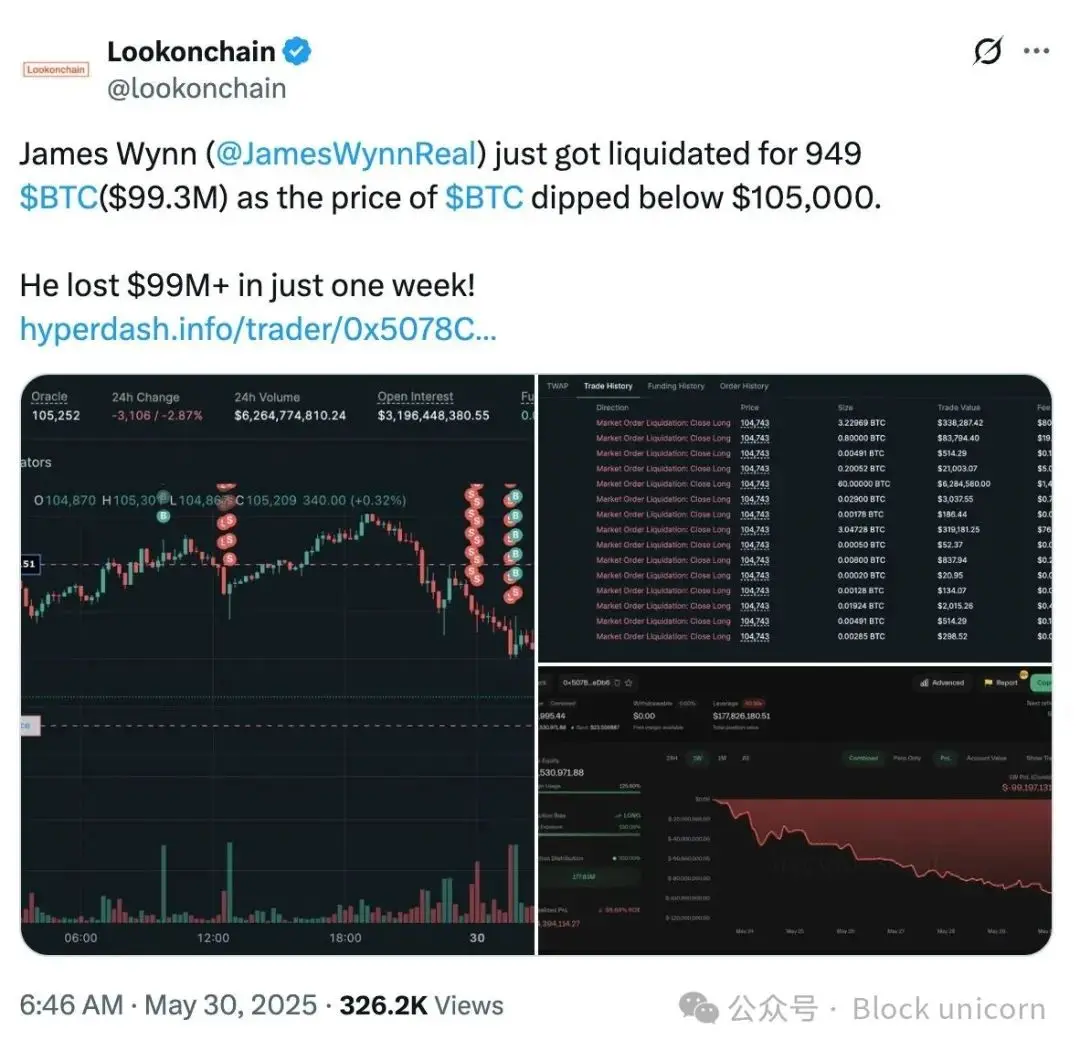

Day 8 (May 30): As Bitcoin fell below $105,000, James Wynn was liquidated, losing 949 Bitcoin, valued at $99.3 million.

Image source: @lookonchain

The reality of his Hyperliquid dashboard—a sea of red liquidation marks—told the story of his complete bankruptcy. The Arkham intelligence platform confirmed the scale of the losses:

Image source: @arkham

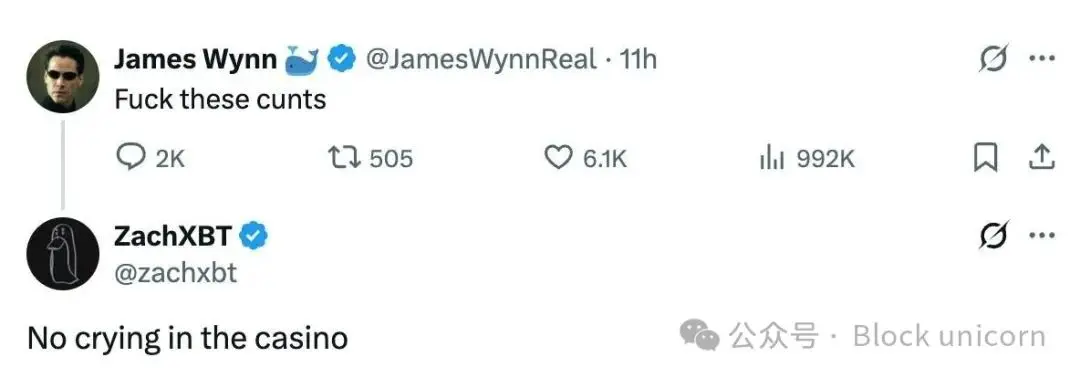

His response?

Image source: @zachxbt

From a peak profit of $87 million to total liquidation. The transparency that had made him famous recorded every step of his bankruptcy for the world to see.

Hunting Season

Perhaps the most brutal aspect of Wynn's downfall was its public nature.

With Hyperliquid making all trades transparent, other traders could see his exact liquidation levels. What happened next was described by blockchain analyst Lookonchain as "brutal hunting."

Savvy traders deliberately targeted his stop-loss and liquidation levels. The transparency that had built his follower base turned into a weapon against him.

Some traders even adopted an "anti-Wynn strategy." According to on-chain data, one trader realized $5.6 million in profits within three days by taking positions opposite to Wynn's.

The psychological pressure was immense. Every move he made was under strict scrutiny, and every loss was celebrated by critics. The hunter had become the hunted.

In a moment of clarity, Wynn attempted to withdraw.

"Now I've decided to leave the casino with $25 million in profits," he posted on May 26. "It was fun, but now it's time for me to leave as a winner."

Five hours later, someone discovered he had opened a 10x leveraged long position on PEPE worth $20 million.

His addiction was too strong. The show must go on.

ZachXBT's Accusations

As Wynn's trading losses mounted, blockchain investigator ZachXBT launched a devastating attack on his reputation.

Just as Wynn warned fans to be cautious of scam tokens named after him, ZachXBT accused him of hypocrisy, claiming he was "gambling with stolen money" on Hyperliquid.

These accusations were specific and concrete.

Connection to Alameda: ZachXBT suggested that Wynn's trading funds came from suspicious sources related to the FTX/Alameda collapse, citing the ETH transfer from December 2020 as evidence.

Pump-and-dump scheme: Detailed accusations claimed Wynn promoted low-market-cap meme coins and then sold them for profit, causing losses for his fans.

BabyPepe incident: X user Dylan posted a 15-part thread claiming Wynn applied for and received a private allocation of BabyPepe tokens, publicly promoted them, then immediately sold them while cutting ties with the development team.

FTX creditor activist Sunil Kavuri bluntly stated: "James Wynn's trading is like a steroid version of Alameda because he likely traded there."

Wynn denied any wrongdoing but did not provide any detailed rebuttal to the specific accusations. His reputation was severely damaged and likely permanent.

Our Perspective

James Wynn represents the double-edged sword of cryptocurrency—both a prophet and a cautionary tale, embodying all the glories and flaws of our industry.

The good: Wynn proved that true insight remains crucial in the cryptocurrency space. His predictions about market caps were not based on luck but on research, conviction, and the courage to act when others hesitated. He demonstrated that a hungry outsider could outperform resource-rich institutional investors. His radical transparency challenged an industry built on opacity, showing retail investors how whale-sized positions operate in real-time.

The bad: Wynn's transition from trader to influencer exposed one of the most toxic dynamics in the cryptocurrency space—the monetization of followers. His alleged pump-and-dump schemes revealed how easily market insight can turn into market manipulation when the audience becomes a source of exit liquidity. His $100 million liquidation proved that when self-awareness overrides risk management, even true skill becomes irrelevant.

We have created an ecosystem where social media followers equate to financial credibility, transparency becomes performance art, and extreme risk is repackaged as "alpha generation." His downfall was live-streamed to nearly a million followers, who conflated gambling addiction with trading genius.

The deeper question is whether the transparency of cryptocurrency brings accountability or vulnerability. Traditional finance hides institutional failures behind closed doors, while cryptocurrency live-streams in 4K resolution with live commentary. This is not progress—it resembles voyeurism disguised as innovation.

Wynn's story forces us to reflect: Are we building a financial system that rewards skill and innovation, or are we merely creating the world's most complex casino, where the house always wins and the players are always performing?

The fallen king has collapsed, but the kingdom that created him grows ever stronger.

So are we now anticipating a comeback?

Image source: @JamesWynnReal

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。