Once again, I am captivated by the excellent design of Bitcoin.

Written by: Zuo Ye

Once again, I am captivated by the excellent design of Bitcoin.

DeepSeek R2 did not launch in May as rumored, but instead had a small version update R1 on May 28. Elon Musk's Grok 3.5 has also frequently missed deadlines, and it’s not as reliable as the Starship, which at least makes some noise.

With the fervent push of massive capital, the scaling law in the large model field has completed its lifecycle faster than Moore's Law in the chip industry.

If software, hardware, and even human lifespan, cities, and nations all have their limits of scale effects, then the blockchain field must also have its own rules. As SVM L2 enters the token issuance cycle and Ethereum returns to the L1 battlefield, I attempt to mimic the scaling law to provide a crypto version.

Ethereum's soft scale, Solana's hard cap

We start with the scale of full node data.

Full nodes represent a complete "backup" of the public chain. Owning BTC/ETH/SOL does not equate to owning the corresponding blockchain; only by downloading full node data and participating in the block generation process can one say, "I own the Bitcoin ledger," which corresponds to Bitcoin adding a decentralized node.

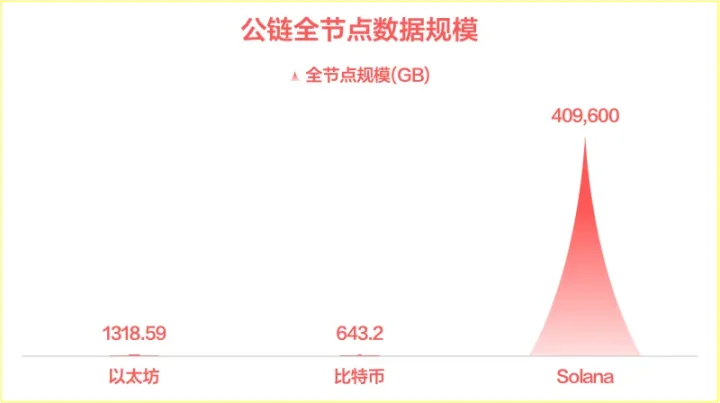

Solana's scale of 1,500 nodes struggles to maintain a balance between decentralization and consensus efficiency, while its 400T full node data scale leads among public chains/L2.

Image caption: Full node data scale of public chains, image source: @zuoyeweb3

If we do not compare with Bitcoin, Ethereum has already excelled in controlling data volume. Since the genesis block was born on July 30, 2015, the full node data volume of Ethereum has only been around 13 TB, far less than Solana's "killer" 400 TB, while Bitcoin's 643.2 GB is considered a work of art.

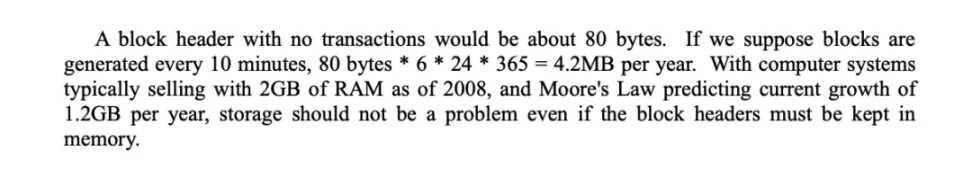

In the initial design, Satoshi Nakamoto strictly considered the growth curve of Moore's Law, limiting Bitcoin's data growth strictly under the hardware expansion curve. It must be said that the later support for large Bitcoin blocks is untenable because Moore's Law has already reached the edge of marginal effects.

Image caption: Comparison of Bitcoin node growth and Moore's Law, image source: Bitcoin white paper

In the CPU field, Intel's 14 nm++ can be considered a family heirloom. In the GPU field, Nvidia's 50 series has not "significantly exceeded" the 40 series, while advancements in storage, under Yangtze Memory's Xtacking architecture, have gradually reached their peak, with Samsung's 400 layers being the current engineering expectation high point.

In short, the scaling law means that the underlying hardware of public chains will no longer see significant advancements; it can even be said that this is not a short-term technical limitation but will maintain the status quo for a considerable time.

In the face of difficulties, Ethereum is focused on ecological optimization and reconstruction. The trillion-dollar RWA assets are its battleground, whether imitating Sony's self-built L2 or fully accelerating to embrace the Risc-V architecture, it is not about "finding the most extreme hardware-software synergy," but rather sticking to its own advantages.

Solana chooses to pursue the extreme of light speed; beyond the current Firedancer and AlpenGlow, the ultra-large node scale has effectively excluded individual participants. A 13 TB hard drive can still be assembled, but 400 TB is already a pipe dream. Theoretically, 600 GB of Bitcoin can also be satisfied under the daily firefighting conditions of Samsung, LG, and SK Hynix factories.

The only question is, where are the lower and upper limits of on-chain scale?

The limits of the token economic system

AI has not embraced Crypto as expected, but this does not hinder the price surge of Virtuals. Even holding blockchain in one hand and AI in the other has become a companion of the current U.S. government's MAGA. 5G and the metaverse are both outdated; the prominent figures to watch are Sun Yat-sen and stablecoins.

Let’s briefly discuss the various limit indicators of the token economic system. Bitcoin, lacking practical use, has a market cap of $2 trillion, Ethereum $300 billion, and Solana $80 billion. Taking Ethereum as the standard value, the limit of the public chain economic system is $300 billion.

This does not mean that Bitcoin's valuation is too high, nor that new public chains cannot surpass this value. Rather, it is highly probable that the market performance of a public chain is the current optimal solution, i.e., "we believe the current market performance is the most reasonable existence." Therefore, directly selecting this value is more effective than complex calculations; if unnecessary, do not increase the entity.

We introduce two concepts from the book "Scale":

Superlinear scaling: When the system scale expands, its output or efficiency does not increase proportionally but grows at a faster rate.

Sublinear scaling: When the system scale expands, the growth rate of certain indicators (such as costs, resource consumption, maintenance requirements, etc.) is lower than linear proportion.

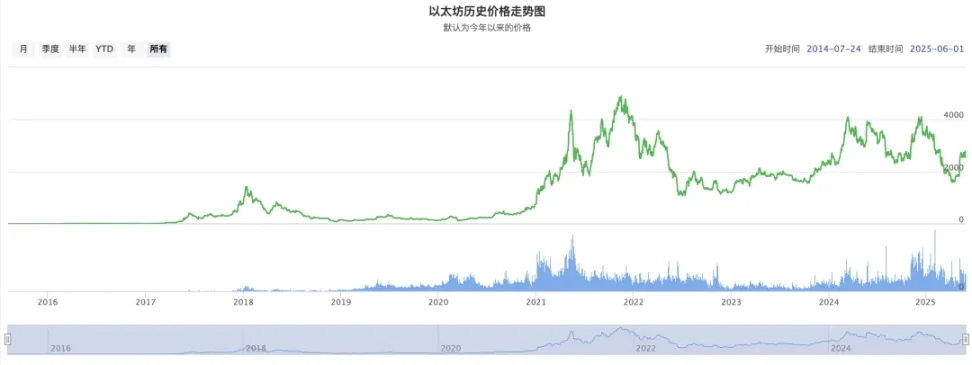

Image caption: Ethereum price trend, image source: BTC123

Understanding the two is not complicated. For example, Ethereum's growth from $1 (2015) to $200 (2017) belongs to superlinear scaling, while its growth from $200 to ATH (2021) took about half the time, which is a classic example of sublinear scaling.

Everything has its limits; otherwise, blue whales, elephants, and North American redwoods would all surpass themselves. However, Earth's gravity is a hard cap that is difficult to overcome.

Continuing to probe, has DeFi reached its limits?

The scale limit of DeFi can be encompassed by Ethereum, turning to examine yield, which is also the core proposition of DeFi. The driving force of entropy increase lies in the extreme pursuit of yield. We provide three standards: UST's 20% APY, DAI's 150% over-collateralization ratio, and the current Ethena's sUSDe's 90D MA APY of 5.51%.

We can assume that DeFi's yield capture ability drops from 1.5 times to 5%. Even with UST's 20% calculation, DeFi has already reached its upper limit.

It is important to note that the trillion-dollar RWA assets going on-chain will only lower the average yield of DeFi, not increase it. This aligns with the sublinear scaling law; the extreme expansion of system scale will not lead to an extreme rise in capital efficiency.

Also note that DAI's 150% over-collateralization ratio presents a market incentive: I can profit additionally outside the 150% collateralization ratio. Therefore, assuming it as a market benchmark is my personal view and may not necessarily be correct.

We can be blunt: currently, the on-chain economic system, based on token economics, has an actual scale limit of $300 billion, with a yield of around 5%. Again, this does not imply the total market cap or the upper or lower limits of a single token, but rather that the overall tradable scale is just this large.

In reality, you cannot sell $2 trillion worth of Bitcoin; even U.S. Treasuries cannot withstand such a large sell-off scale.

Conclusion

Looking back at the history of blockchain development since Bitcoin, the discrete trend among public chains has not been bridged. Bitcoin is increasingly decoupled from the on-chain ecosystem, and the failure of on-chain reputation systems and identity systems has led to the over-collateralization model becoming mainstream.

Whether stablecoins or RWA, they are leveraged on-chain assets from off-chain assets, as off-chain assets inherently possess higher credibility. Under the current on-chain scaling law, we may also be touching the upper limits of the scaling law or Moore's Law. Since DeFi Summer, it has only been 5 years, and since the birth of Ethereum, it has only been 10 years.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。