Original | Odaily Planet Daily (@OdailyChina)

Author | Ethan (@ethanzhangweb3)_

In the early hours of June 6, when tech mogul Musk dropped the “Trump appears in the Epstein files” (a list of individuals involved in the sexual exploitation of minors by super-rich and elite individuals) bombshell on X, the entire U.S. political arena and financial market held their breath. Within just a few hours, the storm of this “century alliance” breaking apart had spread from the Oval Office to meme coins, NFTs, Bitcoin, Tesla stock prices, and even U.S. Treasury yields.

Around 11 PM Beijing time yesterday, Reuters reported Musk criticizing Trump’s tax bill (the “Big Beautiful Bill”), claiming it would lead to the beginning of “debt slavery.” Musk and Trump then engaged in an unprecedented “remote feud”:

At 12:11 AM, Trump stated: “Even without Musk, I can win Pennsylvania. I am disappointed in Musk; I have helped him a lot. Musk’s dissatisfaction is purely because the mandatory electric vehicle sales regulations were canceled. He hasn’t said anything bad about me yet, but that will happen soon.”

At 12:46 AM, Musk bluntly replied: “Without me, Trump would lose the election, the Democrats would control the House, and the Republicans would be at a 51 to 49 disadvantage in the Senate. Truly ungrateful.”

At 2:41 AM, Trump posted on Truth Social: “The simplest way to save the budget is to terminate government subsidies and contracts for Elon Musk, which would save billions of dollars. I have always been surprised that Biden hasn’t done this.”

At 3:18 AM, Musk dropped the aforementioned bombshell on X: “It’s time to drop the real big bomb, Trump appears in the Epstein files. This is the real reason these files have not been made public. Have a great day, DJT!”

Fifty minutes later, Trump posted on his social platform: “I don’t care about Musk’s opposition, but his position should have been made clear months ago. He called the current bill submitted to Congress ‘one of the greatest bills in history,’ including record $1.6 trillion spending cuts and the largest tax cuts ever. Trump warned that if this bill fails, taxes will rise by 68%, ‘and there are worse things than this.’ He emphasized that he is not creating chaos but is committed to fixing problems and making the country great again, calling for making America great again.”

Subsequently, Musk retweeted a discussion tweet stating “Trump should be impeached and replaced by JD Vance” and commented, “Yes.”

At 4:29 AM, Musk posted on X stating that Trump’s tariff policy would lead to an economic recession in the second half of this year.

Due to the sharp and intense remarks from both sides, the crypto market experienced significant volatility. After the feud, Bitcoin, which had previously been above $104,000, fell over $5,000 to nearly $100,000, a drop of about 5%. According to Coinglass data, during the peak of the “feud,” the total liquidation amount across the network reached $634 million within four hours, with long positions liquidating $606 million and short positions liquidating $27.49 million. “This week’s talkative king” James Wynn did not escape the disaster and was liquidated again, with total contract losses amounting to 155.38 BTC.

However, just as the feud was at its peak, the two “reconciled” — Musk retweeted Ackman’s call for reconciliation, and Trump stated in a recent interview that “progress is going very smoothly,” with White House aides having arranged a call between the two.

They have eased tensions, and Bitcoin’s price has also rebounded, currently reported at $103,690.25. But participants in the financial market have been left reeling from this dramatic turn of events.

In the U.S. stock market, Tesla’s stock price fell 15.8% in a single day, evaporating nearly $150 billion in market value, and Musk’s personal wealth shrank by nearly $20 billion; Trump’s media company TMTG saw its stock price drop by 7.82%, shaking the confidence of conservative voters and destabilizing Trump’s political brand.

Perhaps what we are witnessing today is a premeditated confrontation, but more likely, Musk and Trump, the two men most adept at “manipulating public opinion” in the American power scene, have come into direct conflict over fiscal policy, business interests, and the power structure of crypto. The alignment of the crypto community, the turmoil in the capital market, and the evolution of U.S. fiscal policy have all become more complex in the aftermath of this “tear.”

Background Review

In 2024, Musk is one of Trump’s largest financial backers for his re-election campaign, having donated nearly $300 million to help Trump win and personally serving as the head of the White House’s “Department of Government Efficiency” (DOGE), becoming a bridge between the tech circle and the political arena.

In May 2025, after repeatedly vetoing Musk ally Jared Isaacman’s appointment as NASA director, rejecting the adoption of the Starlink plan, and refusing to extend his “special employee” status, Trump gradually marginalized this tech giant from the core of policy. On the 29th of the same month, under pressure from company operations (X servers were repeatedly attacked, Tesla’s stock price halved compared to its historical peak in March, etc.), Musk officially announced his departure from the Trump administration.

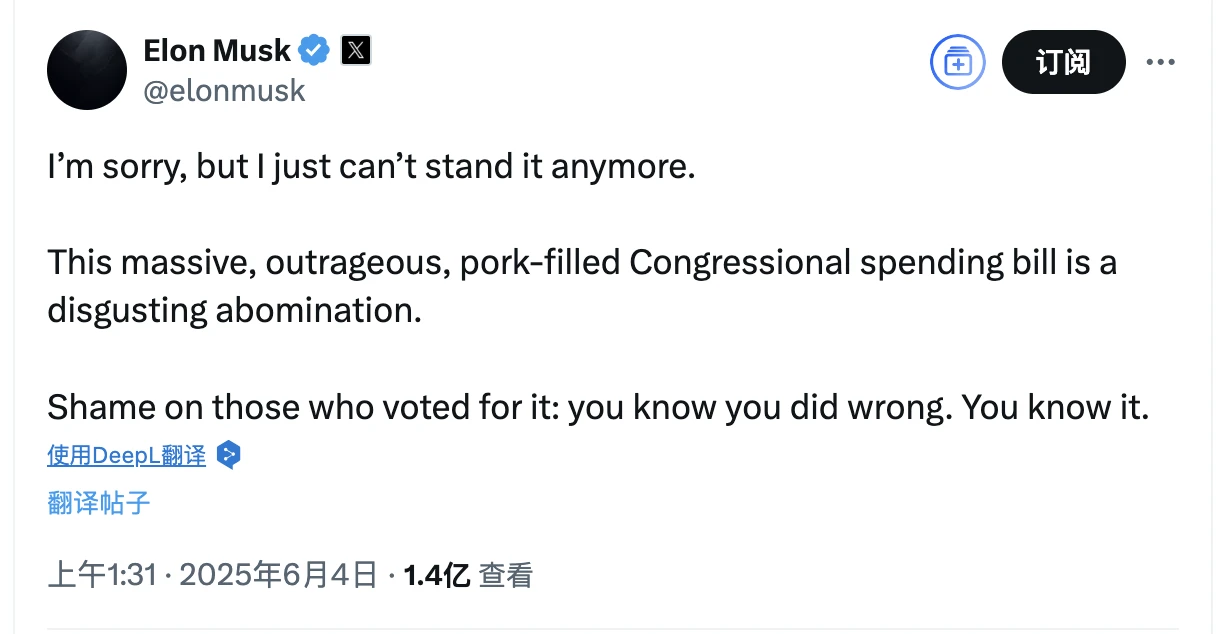

However, in the spring of 2025, conflicts began to surface: Trump’s promotion of the “Big Beautiful Bill” plan canceled electric vehicle subsidies and carbon credit mechanisms, directly cutting off Tesla’s profit pillar, infuriating Musk. The real spark was Musk’s public statement on June 3 on X, calling the bill a “disgusting fiscal monstrosity”, which led to that “nuclear-level” tweet.

Divided Opinions, Musk’s Influence Remains

Pershing Square CEO Bill Ackman stated: the two should “put national interests first,” as it would benefit both;

Trump’s former advisor Steve Bannon reacted extremely: calling for the cancellation of Musk’s green card, expelling him from the country, investigating his drug history, and terminating all government contracts with him;

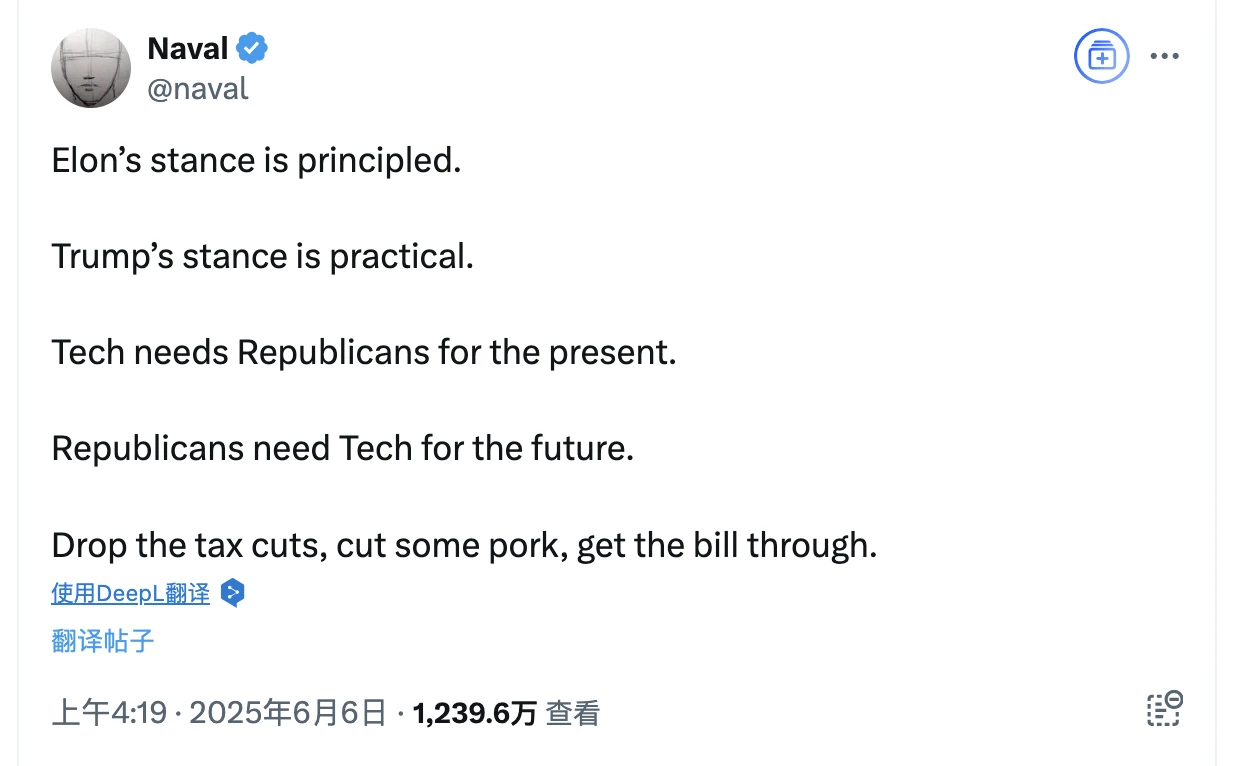

Silicon Valley investor Naval Ravikant stated on X: “Musk’s position is principled. Trump’s position is pragmatic. The current technology needs support from Republicans. Republicans need future technological development. Abandon the tax cut policy, cut some spending, and let the bill pass.”

Although Musk is at the center of controversy, he still holds the narrative power in the community, with each of his tweets affecting the nerves of both the crypto circle and traditional capital markets.

Potential Future Impacts: Policy, Crypto, and Complex Games

Policy Direction: Increased Risk of Division within the Republican Party

With the Democratic Party collectively opposing the “Beautiful Bill,” the Republicans can only afford to lose a maximum of three votes out of 53 seats in the Senate. Currently, conservatives like Rand Paul and Mike Lee have clearly expressed opposition, and Musk continues to retweet their statements to amplify their voices, leaving the bill’s prospects highly uncertain.

Musk’s influence in public opinion may further divide the Republican fiscal hawks and moderates, leading to substantial constraints on Trump’s policy push during his second term.

Crypto Ecosystem: Trust in Trump Coin Declines, New Factions Emerge

The Trump wallet incident has exposed the internal “multi-center loss of control” within the Trump crypto empire:

Fight Fight Fight LLC (Trump Meme) and WLFI belong to different family factions, with the former managing NFTs and memes, while the latter focuses on the stablecoin USD1;

The TRUMP Meme brand frequently faces “counterfeit” lawsuits, and details about the MELANIA token are concerning.

I believe it is foreseeable that Trump will increasingly rely on stablecoins and RWA-compliant projects, while the previously deeply bound “Meme or NFT” path may be marginalized.

Complex Variables: Will Reconciliation Truly Materialize?

Just as this farce was escalating, Musk and Trump suddenly reconciled, which was clearly surprising or unexpected.

Is it a “genuine emotional flip-flop”? Or is it a strategy to gain negotiation leverage through public opinion games? This remains to be seen. But it is certain that:

Musk is no longer Trump’s tool but an independent political force.

This complex power conflict surrounding finance, technology, and crypto may have only just begun. The statements from both sides will continue to manipulate the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。