Technological innovation and community building are key. In the future, meme coins will still have a unique influence in the cryptocurrency field.

Written by: AquaTri

1. TL;DR

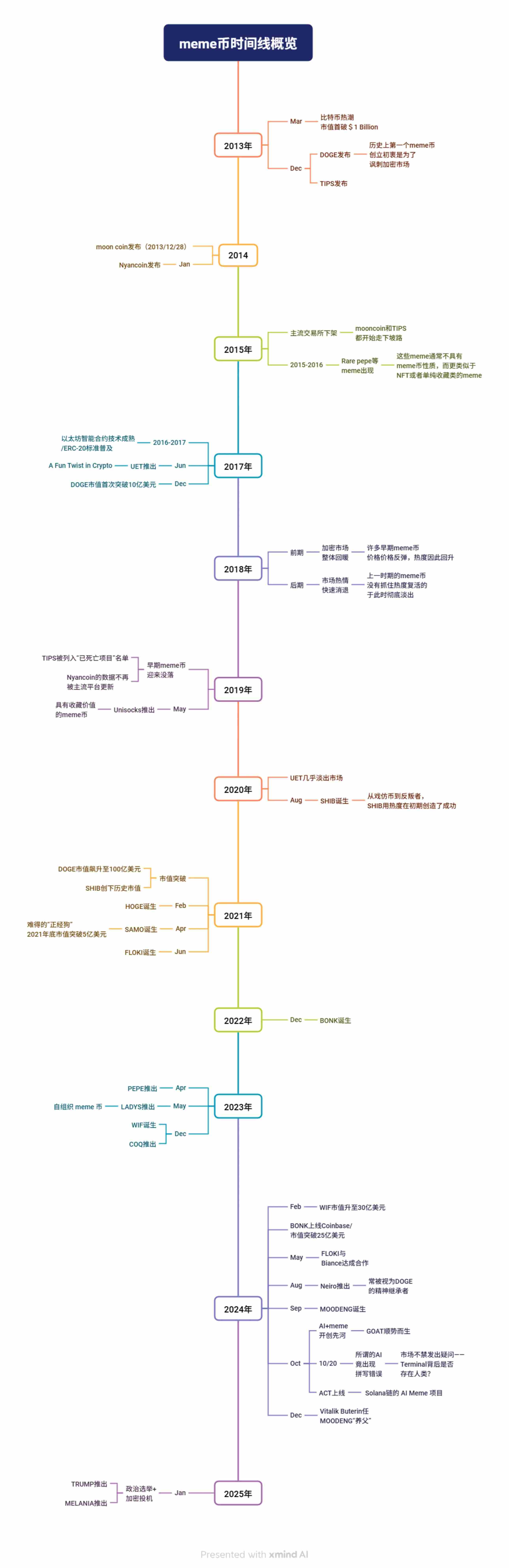

This article systematically reviews the development history of meme coins, analyzing typical cases and revealing their unique value logic: unlike traditional financial assets, the core value of meme coins is expressed as "cultural dissemination power × community consensus," rather than relying solely on technology or practical value. Based on their evolutionary characteristics, they can be divided into three key development stages:

1.1. Groundbreaking / Foundation Laying (2013-2016) — Wild Growth, Sifting Through the Sand

Ephemeral Type: Short-term popularity, lack of cultural accumulation, rapid extinction. (e.g., Mooncoin, TIPS, Nyancoin)

Ever-Victorious General Type: Cultural symbol + community-driven, long-term survival. (e.g., DOGE)

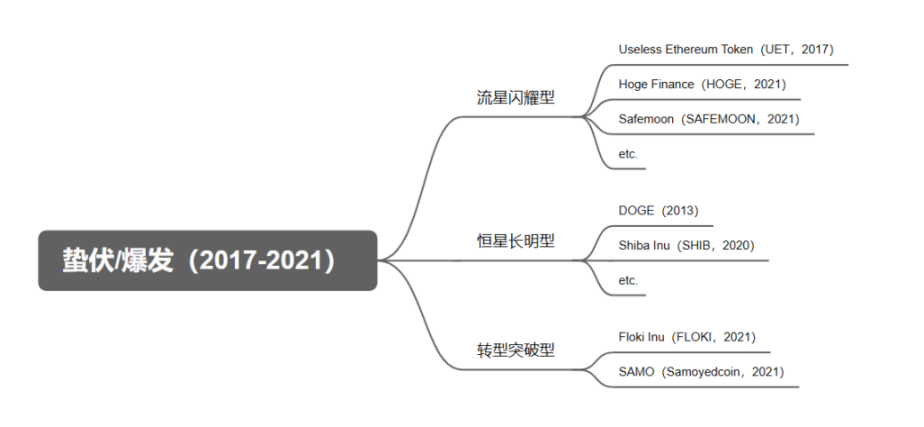

1.2. Dormancy / Outbreak (2017-2021) — The Era of Smart Contracts, Meme Coins Experience a Qualitative Change

Shooting Star Type: Speculation-driven, bubbles burst quickly. (e.g., UET, HOGE)

Stellar Type: Ecological expansion, breaking limitations. (e.g., SHIB's ShibaSwap)

Transformational Breakthrough Type: Attempts at innovation, but progress is slow due to various limiting factors. (e.g., FLOKI's metaverse blueprint, SAMO's public chain binding)

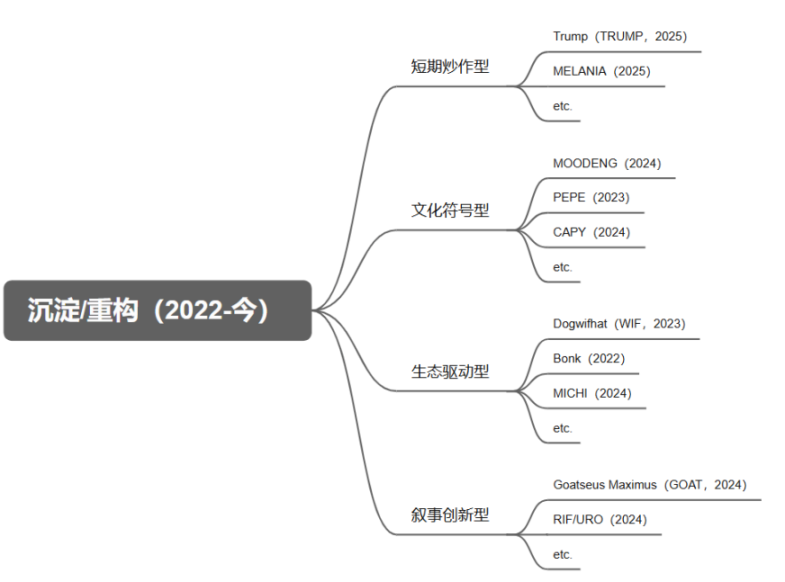

1.3. Sedimentation / Reconstruction (2022-2025) — New Narratives Rise, the Market Begins to Reshape

Short-term Speculation Type: Dependent on hot topics, extremely high risk. (e.g., TRUMP's political narrative craze)

Ecological Driven Type: Based on public chains, short-term explosion. (e.g., WIF, BONK)

Narrative Innovation Type: AI + Meme, concept speculation, trust crisis. (e.g., GOAT)

Cultural Symbol Type: Internet celebrity IP, short-term popularity. (e.g., MOODENG)

Meme coins will continue to face the balancing test of "speculation vs. substance," while technological innovation (e.g., AI, DeFAI) and community building will become key factors. Although the market is undergoing adjustments, as a typical product of the attention economy, meme coins will still maintain their unique position and influence in the cryptocurrency field.

2. Reviewing History, Tracing the Context:

As one of the most unique existences in the cryptocurrency field, meme coins possess both cultural attributes and financial characteristics. Reviewing the history of meme coins is also a review of the collision between internet culture and financial speculation.

From the beginning as a sarcastic joke to now occupying a place in the market, meme coins are telling us through their experiences — in today's era, perhaps cultural resonance and community belief drive value creation more than technical white papers. While the traditional financial world is still trying to create new value, meme coins have already reshaped people's understanding of "value" itself.

(Images are original / Source: Internet)

In the era dominated by social media, the speed and manner of information dissemination have undergone fundamental changes. A meme image that becomes popular on Reddit or Twitter can gain hundreds of millions of exposures worldwide within hours, and this viral dissemination power is now directly converted into financial value. As a perfect carrier of this transformation, meme coins have written their own stories and legends on the time-based coordinate axis.

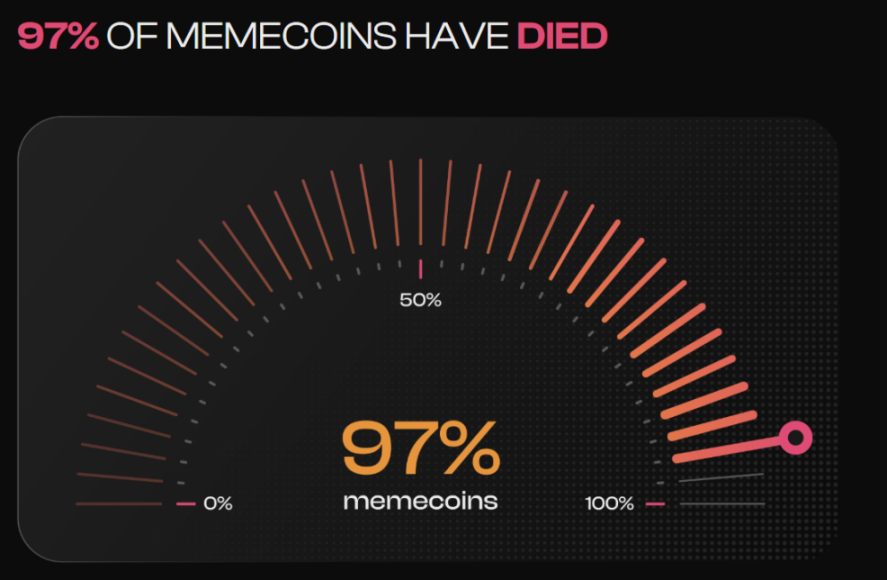

2.1. Groundbreaking / Foundation Laying (2013-2016) — In a Time of Flourishing, Pioneers Brave the Waves; In the Sifting Sands, the Disheartened Depart Silently

This period witnessed the original innovative journey of meme coins from zero to one, presenting a unique ecology of wild growth and natural selection coexisting. Marked by the birth of DOGE in December 2013 and ending with the maturity of Ethereum's smart contract technology in 2016, it constitutes the purest and most authentic "Genesis Era" in the history of meme coin development. (Due to limited information disclosure of early cryptocurrency projects, some data may come from historical forums or third-party archives.)

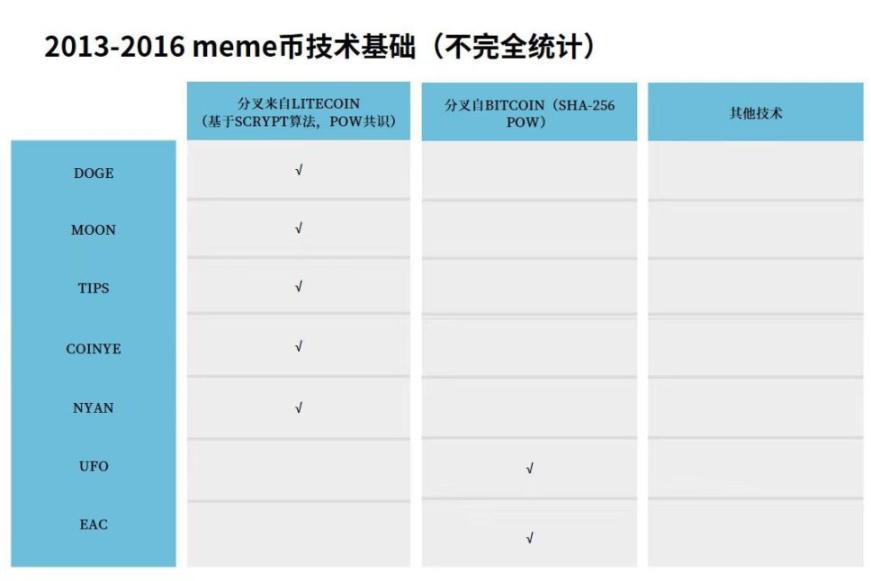

On the technical level, with few exceptions, almost all meme coins in this stage were based on forks of Bitcoin or Litecoin's code.

(Images are original; Source: Internet)

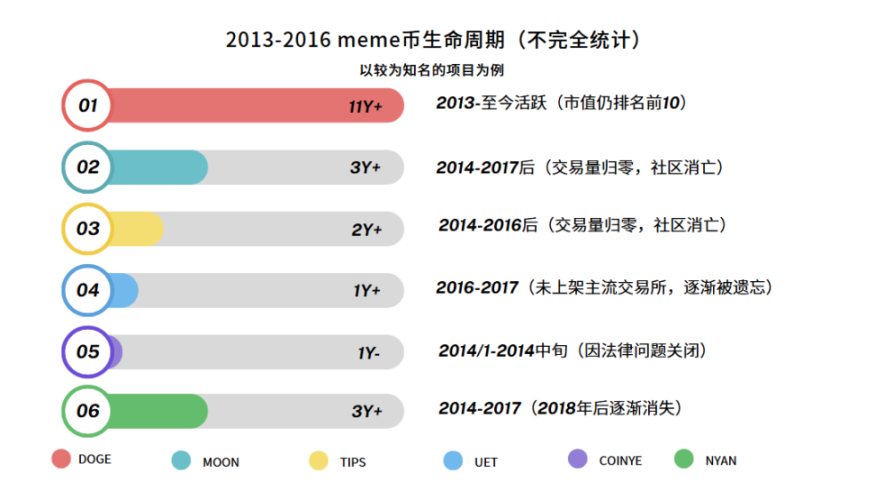

In terms of market performance, historical data from CoinMarketCap shows that the average active cycle of meme coins born during this period was only 11.7 months, but survivors like DOGE exhibited remarkable vitality.

The historical significance of this stage cannot be underestimated. In fact, history tells us: true innovation often arises when rules are not yet established, and the experimental field of 2013-2016 preserved the most precious rebellious genes and innovative spirit for the cryptocurrency world.

(Images are original; Source: Internet)

2.2. Dormancy / Outbreak (2017-2021) — Amidst the Tides, the Wise Rise to the Occasion; In the Changing Winds, the Powerful Meet Their Doom

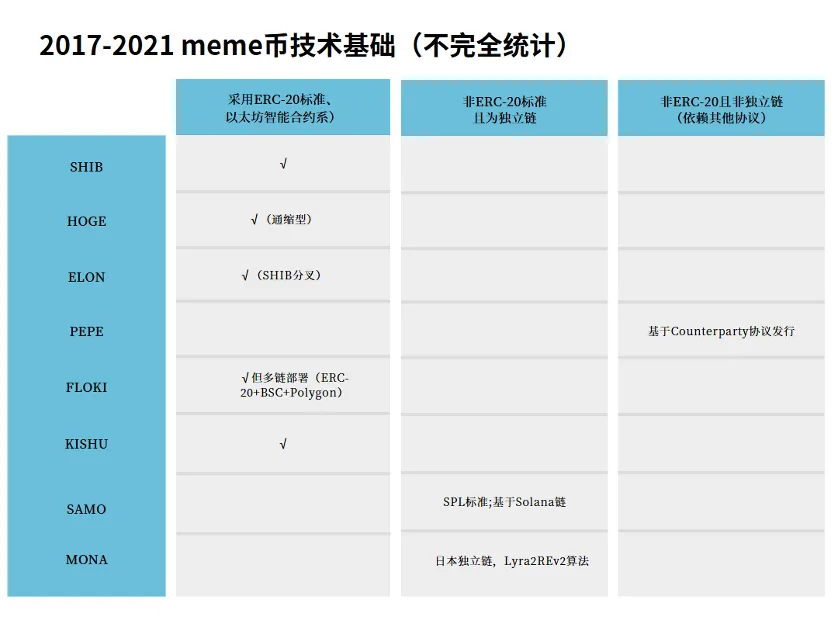

During these five years, the market witnessed the transformation of meme coins from marginal subculture to mainstream financial assets. Marked by the popularization of the ERC-20 standard in 2017 as a technical turning point, and culminating in 2021 when SHIB reached a historical market value, meme coins completed a qualitative change from "internet joke" to "phenomenal investment target."

On the technical dimension, the maturity of smart contracts completely restructured the issuance logic of meme coins. According to data on the Ethereum chain, most meme coins born between 2017 and 2021 chose to adopt the ERC-20 standard or rely on other protocols, reducing issuance costs to less than one-thousandth (compared to tens of thousands of dollars for independent chain development). This democratization of technology, akin to a double-edged sword, sparked a frenzy of "everything can be a meme," but also sowed the seeds of homogeneous competition.

(Images are original; Source: Internet)

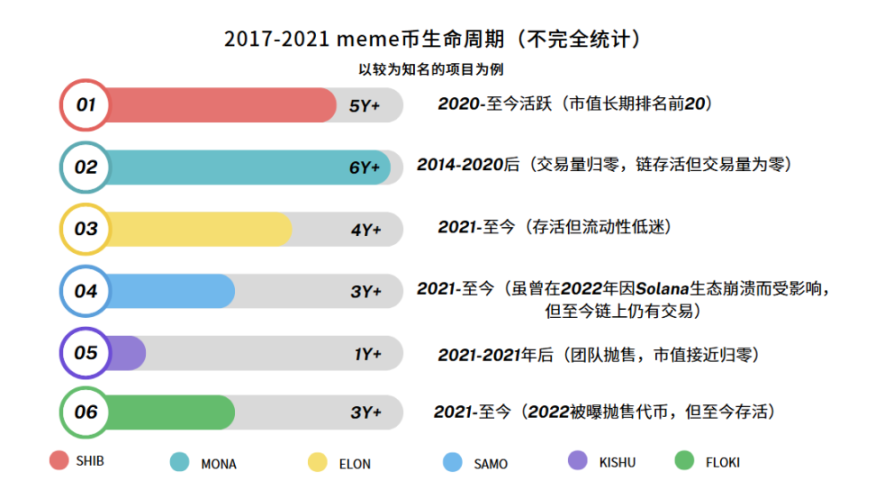

At the same time, in terms of market narrative, CoinGecko data shows that in December 2017, DOGE's market value first broke $1 billion, while in the peak period of 2021, the overall trading volume of the meme coin sector exceeded $30 billion in a single day, accounting for 12.3% of the entire cryptocurrency market. It is noteworthy that the meme coins born during this stage had a significantly longer lifespan compared to the previous period.

(Images are original; Source: Internet)

However, it should be noted that not all meme coins achieved higher survival rates and longer lifespans. According to a research report by Chainplay, meme coin projects experienced deaths on average every month in 2020.

(Translation: According to advanced cryptocurrency research tool AlphaQuest data, in 2020, meme coin projects died on average every month. The speed of meme coin extinction exceeded the speed of new project creation. / Source: chainplay)

(Images show DOGE's market value first breaking $1 billion in December 2017 / Source: coingecko)

Throughout the entire history of cryptocurrency, the most profound transformation during this period was the reconstruction of value perception. When DOGE was listed on mainstream exchanges like Coinbase in 2021, and when the SHIB founder could leverage a market value of tens of billions while remaining anonymous, traditional finance had to reassess the essence of meme coins — as revealed in the 2021 report "Meme Assets and Attention Economics" published by the MIT Digital Currency Initiative: "The value capture mechanism of assets like Dogecoin essentially transforms network attention into liquidity premiums." This shift in perception laid a crucial foundation for subsequent social finance experiments in the Web3 era.

2.3. Sedimentation / Reconstruction (2022-2025) — When the Tide Turns, True Gold Begins to Show Its Color; In a World of Great Strife, Patterns Finally Become Clear

Starting in 2022, the meme coin market began a deep adjustment from frenzy to rationality. Marked by the collapse of Terra in May 2022 as a watershed moment, and the rise of the BRC-20 standard in 2023 as a turning point, the meme coin ecology is undergoing a brutal yet necessary value reassessment.

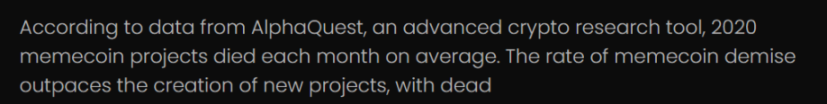

According to CoinMarketCap statistics, the overall market value of meme coins shrank by 82% in 2022, but leading projects like DOGE and SHIB still maintained their rankings in the top 20 by market value. A new report titled "State of Memecoin 2024" released by GameFi market data center Chainplay (which studied and analyzed over 30,000 meme coin projects on Ethereum, Solana, and Base) pointed out that "97% OF MEMECOINS HAVE DIED." The report further noted: "Different blockchain platforms exhibit different meme coin death rates. Base leads with a 66.91% death rate, followed by Solana at 54.03% and Ethereum at 36.59%."

(Source: chainplay)

(Source: chainplay)

Nevertheless, we should not underestimate or speculate whether meme coins have reached the end of their story. The cryptocurrency market has always been full of uncertainties, and meme coins, as a particularly distinctive category within it, are even harder to measure with conventional perspectives.

As Mathew McDermott, head of digital assets at Goldman Sachs, stated: "Meme projects that can still secure funding after 2023 must prove their ability to capture long-term value beyond simple speculation." Similarly, an a16z researcher pointed out: "This winter is filtering out speculative bubbles, leaving behind truly culturally resilient digital assets." The future landscape may prove that meme coins capable of transcending cycles will ultimately become a key bridge connecting the crypto world with popular culture.

3. Breaking Down and Delving into Key Details:

3.1. Groundbreaking / Foundation Laying (2013-2016)

During this stage, coins can be roughly categorized based on their lifecycle, community activity, and market value changes as follows:

(Images are original; Source: Internet)

3.1.1. Ephemeral Type

In the rapidly iterating ecosystem of cryptocurrency, driven by innovation, projects lacking sustained vitality are destined to become fleeting visitors. They may attract market attention during specific periods, but ultimately struggle to escape the fate of being "ephemeral." Although they may shine brightly at their peak, maintaining that heat over the long term proves difficult.

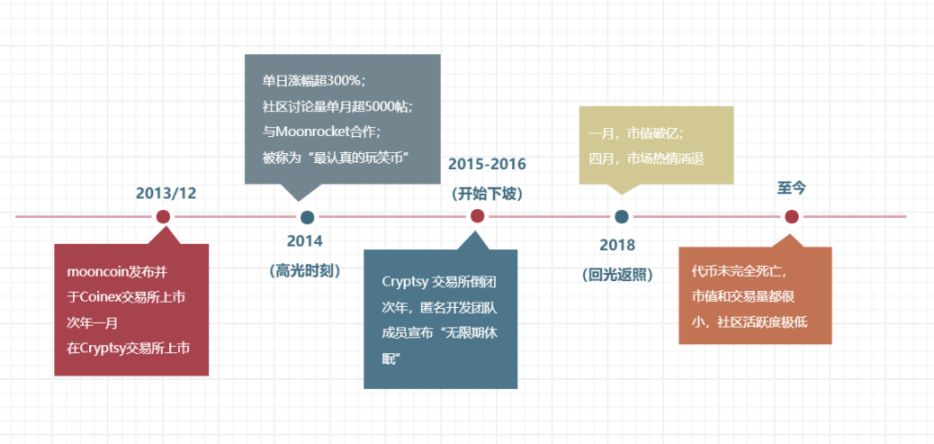

3.1.1.1. Mooncoin — An Unfinished "Moon Landing" Dream

As an entertainment meme coin with the slogan "To the Moon," its somewhat short life failed to carry the ambition of this grand narrative. As Crypto Briefing stated in 2015: "Mooncoin has no actual use cases related to space or moon landing, aside from its name."

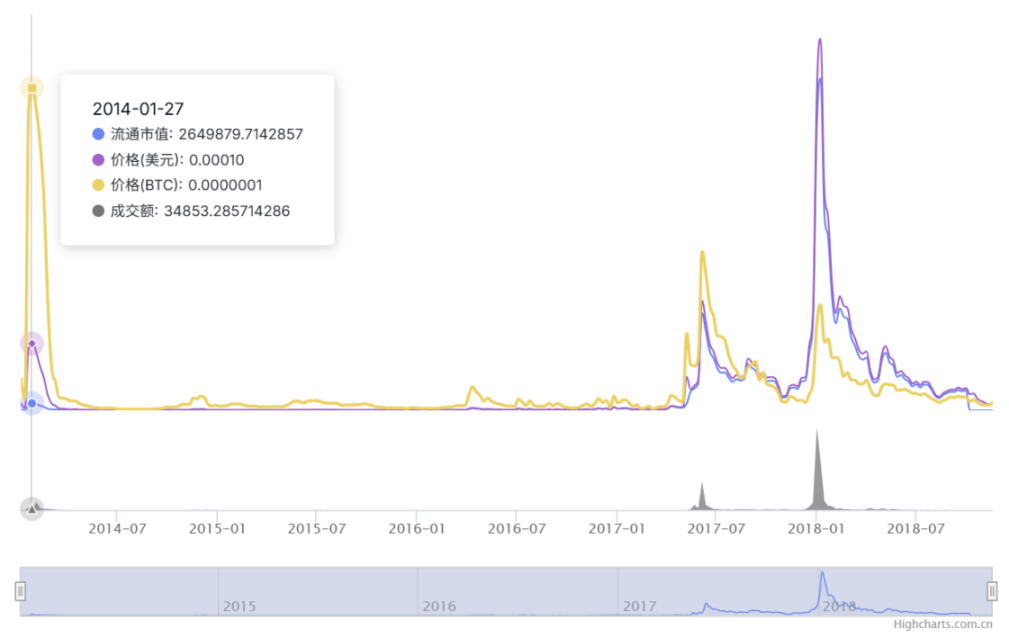

Looking back at its development trajectory from 2014 to 2018 (with its last GitHub submission in 2018 (v1.8.0), marking the project's effective demise), Mooncoin's early performance was quite stunning: it set a record for a single-day increase of over 300% in its first year; the Reddit community r/Mooncoin saw over 5,000 posts in a single month; it collaborated with the gaming platform Moonrocket (which later went defunct); and it was even referred to by Coindesk as "the most serious joke coin."

However, after the highlight came a long silence: in 2015, delisting from mainstream exchanges led to a market value drop of over 90%; the following year, anonymous development team members announced "indefinite hibernation"; it wasn't until 2018 that the project experienced a brief resurgence — but this was not due to its own breakthroughs, rather thanks to two external factors: first, the overall recovery of the cryptocurrency market (Bitcoin rebounded from $13,000 to $17,000 in Q1 2018, driving altcoins up); second, the launch of SpaceX's Falcon Heavy rocket reignited the "To the Moon" internet meme, and a parody video titled "Mooncoin Moon Landing Countdown" created by community members (with over 500,000 views on YouTube) unexpectedly brought traffic.

Unfortunately, Mooncoin failed to seize this last opportunity. The development team claimed to be building a "lunar base" metaverse game, but the white paper never materialized, and the so-called "metaverse game" was merely a Unity demo video. Afterward, with Bitcoin plummeting 60% in April 2018, market enthusiasm waned, and Mooncoin completely faded from the stage. As summarized in Delphi Digital's "Cryptocurrency Cycle Report" (2019): "This brief resurgence confirmed the cruel law of meme coins — projects lacking cultural accumulation find any technological updates to be mere life support."

(Source: Coin界网)

(Images show the latest interactive post in the Mooncoin community / Source: Reddit)

(Images are original; Source: Internet)

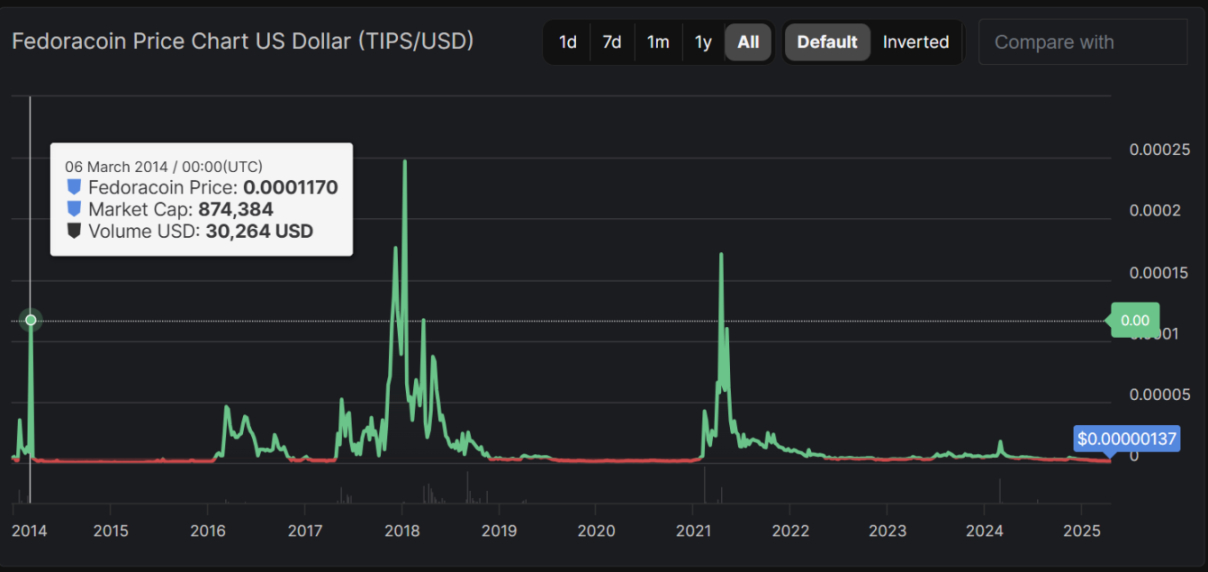

3.1.1.2. Fedoracoin (TIPS) — A Niche "Gentleman" Identity

FedoraCoin (TIPS) was born on December 22, 2013, and its core was not aimed at the mass market but precisely targeted the "Fedora-wearing neckbeard" subculture group on Reddit. This highly vertical positioning allowed it to quickly gain popularity within a specific community in its early days, but it also sowed the seeds for limited future development.

On the technical level, TIPS adopted the relatively common Scrypt algorithm at the time, and its design supporting GPU mining made it quite user-friendly for ordinary users. This simple and practical architecture helped it quickly accumulate a loyal following in its early stages.

At the same time, just two months after its launch, the r/Fedoracoin subreddit on Reddit set an astonishing record of over 2,000 posts in a single day, making it one of the most active meme coin communities for a time.

(Images show the most popular post sorted by heat in the community / Source: Reddit)

However, good times were short-lived, as TIPS soon encountered a predicament similar to that of Mooncoin. Due to a lack of practical application scenarios, this project built on subcultural memes could never break through the limitations of cultural symbols. Starting in 2015, as mainstream exchanges like Cryptsy and Bittrex gradually delisted TIPS, its liquidity experienced a cliff-like drop. The product's initial positioning to serve a specific subculture group reveals that while it precisely matched its target users, this niche attribute also made it difficult to expand into a broader market and subsequent marketing.

Although TIPS saw a brief price rebound during the overall recovery of the cryptocurrency market in 2018, unfortunately, like Mooncoin, TIPS failed to capitalize on this opportunity for a comeback.

During the period from 2014 to 2016, FedoraCoin gradually lost market attention. By the end of 2018, TIPS's GitHub repository stopped at version v1.8.0, and the last on-chain transaction record was from November. In 2019, this once-prominent project was officially listed on the "dead list" by Deadcoins.

(Images show the latest post related to TIPS in the community that is not an advertisement for other tokens / Source: Reddit)

(Source: coinmarketcap)

What it left for the crypto world is not only a vivid case of subcultural experimentation but also a mirror reflecting the essence of meme coins.

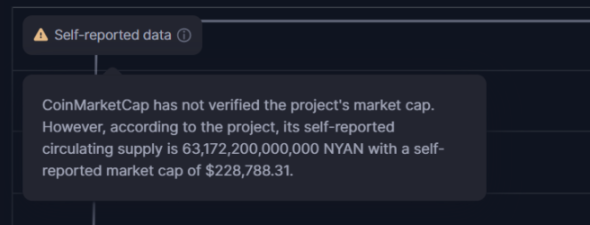

3.1.1.3. Nyancoin — A Brief "Rainbow" Shadow

As the second meme coin after DOGE, Nyancoin was released on January 6, 2014, and within a month, it gained the unique identity of "the first officially licensed cryptocurrency in history," yet it lagged far behind the former in market influence.

In terms of the project's essence, this gap is first reflected in the differences in cultural genes: the "Nyan Cat" meme on which Nyancoin is based has far less breadth and cultural penetration than DOGE's "Shiba Inu" meme — before encountering these two cryptocurrencies, most people may have never seen the rainbow cat, but almost everyone has been inundated with images of that charming Shiba Inu.

Moreover, in terms of application scenarios and development direction, this cultural recognition gap is directly reflected in Nyancoin's relative lack of breadth and depth compared to DOGE. DOGE built an application ecosystem covering multiple dimensions such as payments, tipping, and charity, while Nyancoin's application scenario, primarily for trading, is relatively singular.

(Images are from the internet)

In terms of external empowerment, Nyancoin's community activity and external traffic were also unsatisfactory. This vicious cycle — weak community support leading to sluggish project development, and stagnation further weakening community enthusiasm — ultimately led Nyancoin to gradually decline.

Nyancoin's community r/nyancoins has only 1.5k subscribers, and the last active post dates back two years. This community gap directly resulted in mainstream data platforms (such as CoinMarketCap and Coincarp) ceasing to update Nyancoin's real-time data after 2019 — at that time, its 24-hour trading volume had long been below $10,000, and liquidity exhaustion led to its gradual delisting from exchanges. The case of Nyancoin is sufficient to confirm a cruel market rule: in the era of attention economy, the backing of top IP often proves more decisive than the technical characteristics of the project itself.

(Source: reddit)

(Source: reddit)

(Source: CoinMarketCap)

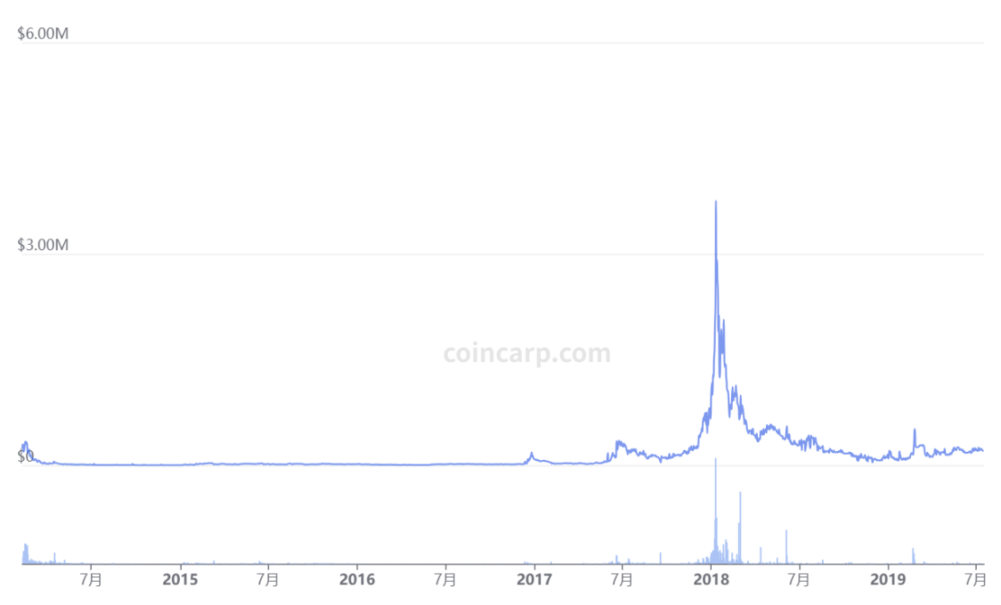

(Chart showing Nyancoin's market value changes / Source: Coincarp)

3.1.2. The Ever-Victorious Type

3.1.2.1. Dogecoin (DOGE) — An Unexpected "Grassroots Carnival"

Launched on December 6, 2013, Dogecoin was initially just a parody of the Bitcoin craze created by programmers Billy Markus and Jackson Palmer, but it unexpectedly evolved into one of the most enduring phenomenon meme coins in cryptocurrency history. Its iconic Shiba Inu image comes from the "Doge" meme that went viral on the internet in 2013, and this inherently high-profile internet IP allowed it to quickly gain popularity on platforms like Reddit.

In terms of design philosophy and founding intention, it did not emphasize complex technology, boast revolutionary blockchain technology, or promise grand visions like other cryptocurrencies. Instead, it entered this increasingly fervent field with a playful Shiba Inu meme as its emblem, adopting the most humorous approach.

(Chart showing DOGE's market value changes / Source: CoinMarketCap)

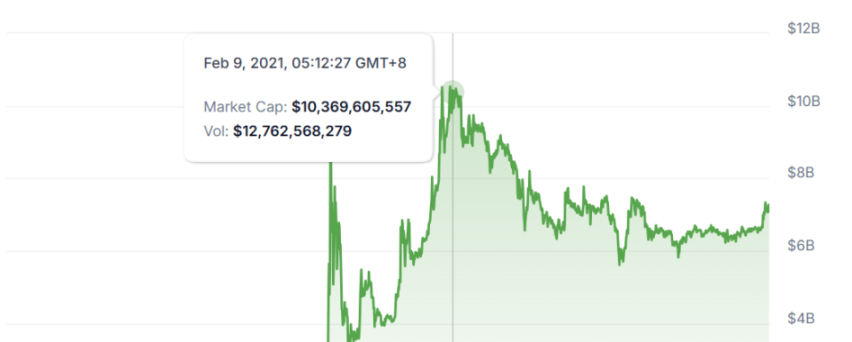

Looking back at DOGE's several market value peaks, it soared to $10 billion in early 2021 due to a retail investment frenzy and strong community support; in May of the same year, under the continuous endorsements from its number one fan Elon Musk on social media and the effects of the "Saturday Night Live" (SNL) show, DOGE's market value reached $80 billion.

(Source: X)

(Chart showing DOGE's market value changes in February 2021 / Source: coingecko)

(Chart showing DOGE's market value changes in May 2021 / Source: coingecko)

In the following years, although DOGE's popularity and price declined and even entered a downward trend, the overall market trend remained relatively stable, maintaining a certain influence and popularity in the cryptocurrency field. Until November 12, 2024, when Trump announced that Musk and Vivek Ramaswamy would jointly lead the newly established "Department of Government Efficiency" (DOGE) aimed at cutting government spending. However, the official abbreviation of this new department, "DOGE," coincidentally matched the token symbol of Dogecoin, sparking heated discussions in the crypto community. Although Musk later clarified on the X platform that there was no connection between the two, given his consistent style and long-standing admiration for DOGE, the public generally believed that this abbreviation choice was not a coincidence.

Regarding this intriguing naming coincidence, there are various interpretations in the market: some speculate that Musk is attempting to bridge the gap between the cryptocurrency market and the political stage; others believe it may be a prelude to reviving DOGE's market enthusiasm; of course, it could also be just an interesting coincidence, as he himself stated. What true intentions lie behind this dramatic naming event may only be revealed with time. However, it is undeniable that this incident once again highlights DOGE's unique position in cryptocurrency culture and the intricate relationship between Musk and DOGE.

The development history of DOGE perfectly showcases the duality of meme coins: on one hand, it created a financial miracle driven by ordinary internet users; on the other hand, it exposed the risks of such coins becoming speculative tools.

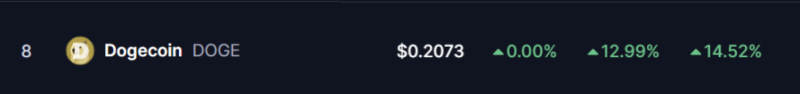

Remarkably, even in 2025, when the entire meme coin market is struggling, DOGE still maintains a daily trading volume of over $1 billion, with its market value consistently ranking in the top ten. Its community activity remains astonishingly vibrant, and it is believed that this advantage can always be transformed into market momentum at critical moments, creating a virtuous cycle.

It must be acknowledged that this digital currency, initially created as a joke, has now become a unique and enduring presence in the cryptocurrency world.

(Chart showing DOGE's market value ranking as of May 9, 2025 / Source: CoinMarketCap)

(Source: reddit)

Although meme coins during this period exhibited two distinctly different lifecycles and survival states, it is undeniable that they all had their own glorious moments. While the market performance of the former may not have been grand and their recognition far less than that of the latter, these projects still left a vivid mark in the timeline of meme coin development, becoming important milestones in witnessing the evolution of meme coin culture. Their rise and fall not only reflect the market's ongoing exploration of the meme coin model but also provide valuable lessons for future projects, leaving their unique imprint on the development map of cryptocurrency.

3.2. Dormancy / Eruption (2017-2021)

Entering 2017, meme coins began to shift from being mere joke coins to more complex ecological developments, with some projects attempting to integrate new concepts like DeFi and NFTs, but still primarily driven by speculation and community engagement. Based on the previous classification criteria, the coins from this stage can be divided into the following categories:

(Images are original; Source: Internet)

3.2.1. Meteoric Type

Similar to the "ephemeral type" mentioned earlier, they share a comparable development trajectory and historical direction — a short-term explosion followed by a rapid decline, disappearing like a meteor. These types of coins typically rely on speculative sentiment and short-term peaks in popularity rather than actual applications or community consensus.

3.2.1.1. Useless Ethereum Token (UET, 2017)

As the most honest scam in crypto history, UET was launched on June 17, 2017, during the height of the ICO (Initial Coin Offering) bubble, by developers under the pseudonym "UselessEthereumToken." Its official website directly stated: "This is a worthless token; buying it is a waste of money."

Is this reverse marketing or performance art-style fundraising? The project openly admitted that the token had no functionality, no team, and no roadmap, even stating in the FAQ on its website: "Why should I buy this token? — You shouldn't."

Its logo further deepened the irony, challenging the norm and breaking existing theorems, truly bringing an interesting fork in the cryptocurrency field.

(Source: X)

So unabashedly showcasing its "uselessness," UET still raised 310 ETH (approximately $93,000 at the time) within 48 hours, becoming one of the most absurd ICO cases in history.

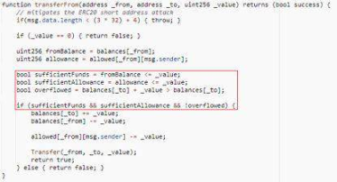

When discussing its token mechanism, it featured a naked "self-destruct" design. It can be said to have implemented 100% honest economics, with a fixed total supply of 1 billion, no inflation, and no destruction. All the raised ETH was transferred to the developers' address, with no promised use. Its zero-technical packaging and website Easter eggs constantly reinforced the absurd theatrical effect of this project: technically based on the most basic ERC-20 standard, it had no smart contract functionality and even had transfer restrictions not lifted.

Although UET's blatant attitude was shocking, the market response was not entirely negative. UET found its "kindred spirits" in the market and garnered a following. In its early days, some exchanges (like EtherDelta) listed UET out of curiosity, causing its price to briefly surge by 800%. Even a Reddit user initiated the "UET Challenge" — to see who could convince others to buy it with the most ridiculous reasons.

However, soon after the brief speculative frenzy ended, UET faced its own crisis and challenges. In early 2018, a security researcher discovered a critical vulnerability in the UET smart contract, which was subsequently exploited, causing UET's price to plummet and its market value to evaporate. After the 2018 bear market, UET's liquidity dried up, and it was ultimately marked as a "defunct project" by CoinGecko in 2020.

(Source: Internet)

(Source: CryptoRank)

This absurd success seems to confirm the irrational characteristics of the crypto market—despite UET's clear self-denial, the market still pays for the void narrative. When "worthlessness" can become a selling point, the frenzy belonging to this field has only just begun.

3.2.1.2. Hoge Finance (HOGE, 2021) — A Community-Driven Deflationary Experiment

Launched in 2021 on the Ethereum blockchain, HOGE's core positioning is not to achieve a technological disruption but to build a unique token economy through a deflationary model and community governance. Each transaction automatically destroys 1% of the tokens while distributing 1% to holders, attempting to drive value growth through scarcity. This design indeed attracted a large number of retail investors, making it one of the most active community tokens in a short period.

Unlike other cryptocurrencies, HOGE emphasizes and implements the concept and methods of "decentralization," allowing community members to vote on the project's development direction. This unique community-driven approach propelled rapid community growth and garnered sufficient attention for HOGE in the cryptocurrency market. Additionally, like DOGE, HOGE is also enthusiastic about charity and is committed to funding animal welfare projects, which further gained it considerable popularity and support. This popularity and support are directly reflected in the data, as discussions about HOGE remain active on major cryptocurrency forums and social media platforms.

(Source: reddit)

However, similar to other projects of its kind, HOGE's bottleneck quickly became apparent: despite a promising start, the lack of actual application scenarios led to its long-term reliance on speculative sentiment, ultimately failing to break through the limitations of meme coins, resulting in a prolonged downturn after its price decline.

(Chart showing HOGE's market value changes / Source: CoinMarketCap)

During the market winter of 2022, HOGE's price fell over 90% from its peak, and liquidity gradually shrank. Although the community attempted to boost enthusiasm through marketing gimmicks like the "Space Program," it ultimately failed to turn the tide. By 2024, its GitHub updates had stagnated, and on-chain activity significantly decreased, becoming another case of a project transitioning from frenzy to silence.

The rise and fall of HOGE reveal the core contradiction of deflationary meme coins: short-term speculative consensus is difficult to convert into long-term value. Its historical significance lies in proving the potential of community autonomy, but it also exposes the fatal flaw of lacking a technological moat—when market sentiment recedes, relying solely on destruction mechanisms and slogan-like narratives cannot sustain fundamental vitality.

3.2.2. Ever-Bright Type

3.2.2.1. Shiba Inu (SHIB, 2020) — A Transformation from Meme Frenzy to Ecological Ambition

Launched in August 2020, Shiba Inu was initially just a meme coin parodying DOGE on the Ethereum chain, with a staggering issuance of 1 quadrillion tokens, making it nearly worthless and regarded as a "joke coin." However, in May 2021, a tweet from Musk about "looking for a Shiba Inu" ignited the market, causing SHIB to surge 1200% in a single day. Ethereum founder Vitalik Buterin donated over 500 trillion SHIB tokens to the India COVID-Crypto Relief Fund and subsequently burned 45% of the SHIB tokens, dramatically elevating its status. This "burning storm" not only created a narrative of scarcity but also propelled SHIB from a junk altcoin to the king of annual gains.

SHIB's early success stemmed from its unique "rebel" persona—positioning itself as the "Dogecoin killer" and even naming its community "SHIBArmy," which quickly garnered a large following and supporters. As of May 2025, its community activity remains high.

(Source: reddit)

However, SHIB's success in reaching its current status is not solely due to this popularity; what has allowed it to take a different path from other meme coin projects and possess long-term value is the gradually constructed "Shib Ecosystem" by the team: decentralized exchange ShibaSwap, Layer 2 network Shibarium, and token burning mechanisms, among others. This strategy of "meme shell + practical core" has allowed it to successfully navigate the common traps and challenges faced by meme coins.

(Chart showing SHIB's market value changes / Source: CoinMarketCap)

Today, SHIB stands at a crossroads: on one hand, the ongoing rivalry between DOGE and SHIB continues to be anticipated in 2025; on the other hand, the emergence of new meme coins (such as Solana's Dogwifhat) has made "de-Dogecoinization" a new topic. Its story may also tell us—that the way to gain rebirth is not to wait for opportunities but to create new ones.

3.2.3. Transformational Breakthrough Type

3.2.3.1. Floki Inu (FLOKI, 2021)

Perhaps in the cryptocurrency realm, dogs, especially Shiba Inus, seem to carry a unique significance and inherent popularity.

Floki Inu burst onto the scene in June 2021, inspired directly by a tweet from Musk—he named his Shiba Inu "Floki." This accidental naming gave rise to a dog-themed meme coin that quickly sparked enthusiasm on platforms like Reddit and Telegram, attracting numerous fans and supporters. Notably, unlike most ephemeral meme coins, FLOKI's ambitions extend far beyond mere hype; it aims for a more profound brand transformation, building a vast ecosystem encompassing DeFi (FlokiFi), NFTs, the metaverse (Valhalla metaverse game), Floki Trading Bot, a crypto education platform (University Of Floki), TokenFi, Floki Staking, and even physical charity (Source: official white paper).

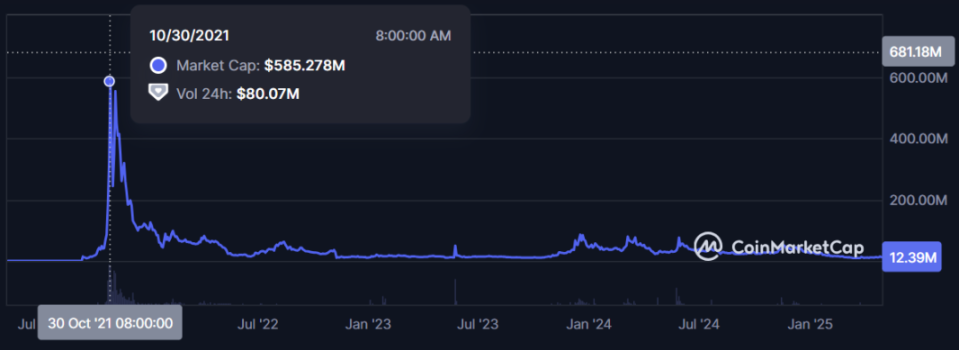

In terms of market performance, FLOKI's price trajectory is a microcosm of the era's changes: it surged to a historical high of $0.00034 at the end of 2021 during the bull market, then plummeted over 90% during the bear market of 2022. In 2024, as the meme coin market warmed up, FLOKI rebounded again, briefly entering the top 50 by market value, but it has never managed to break through the dominance of SHIB and DOGE (ranking 76 as of May 9, 2025).

(Chart showing FLOKI's price changes / Source: CoinMarketCap)

(Chart showing FLOKI's market value changes / Source: CoinMarketCap)

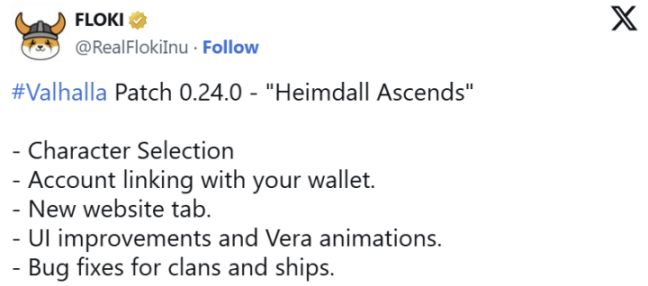

Although the FLOKI team has made efforts to downplay its meme origins and shift towards a "utility token" narrative, emphasizing brand transformation, the slow progress of the Valhalla game and limited adoption of FlokiFi have exposed shortcomings in its ecosystem's implementation. However, FLOKI is improving its game, continuously incorporating external feedback and making adjustments in an attempt to revitalize the Valhalla player community. While this has made Valhalla NFTs one of the most successful NFTs during the 2021 boom, by 2024, its presence on OpenSea was very limited.

Facing multiple survival dilemmas and challenges, FLOKI continues to seek breakthroughs. In addition to launching derivatives, FLOKI is also striving for more exposure, hoping to boost the confidence of users and followers. In May 2024, FLOKI announced a partnership with Binance and established a dedicated payment interface. Nevertheless, there are still bearish sentiments in the market, labeling it as a "highly volatile speculative asset."

FLOKI's future will be born between evolution and extinction; how to balance the community enthusiasm of meme coins with the sustainable ecological construction of the project is a question for its team. In its future, will it replicate the transformation path of another successful dog coin or carve out its own unique path? In this era of accelerating iteration, one must either evolve into the next legend or become a part of the next "Viking-style adventure" after extinction.

(Chart showing the statement about Binance Pay / Source: X)

(Chart showing new improvements to its game / Source: X)

3.2.3.2. SAMO (Samoyedcoin, 2021) — A "Mascot" of the Solana Ecosystem

Born during the explosive period of the Solana ecosystem in 2021, Samoyedcoin quickly rose to fame with its adorable Samoyed dog image. Unlike the grassroots origins of other meme coins, SAMO has carried the aura of being the "official mascot of Solana" since its inception, giving it a unique position among numerous dog-themed tokens.

(Chart showing the official account background image / Source: X)

Unlike the parody nature of DOGE or SHIB, SAMO attempts to find a balance between entertainment and practicality. Technically, SAMO fully leverages the low transaction fees of the Solana chain, launching staking mining, NFT series, and other features. Its economic model of "burning + repurchasing" (over 66% of tokens have been burned) aims to implant a narrative of scarcity within the meme frenzy. By the end of 2021, as the Solana ecosystem exploded, SAMO's market value briefly surpassed $500 million, making it one of the most active meme tokens on the chain.

(Chart showing SAMO's market value changes / Source: CoinMarketCap)

However, the peak of 2021 proved difficult to reach again, as multiple outages on the Solana chain in 2022 dealt a heavy blow to SAMO. Although the team attempted to transform into a "Solana ecosystem ambassador," launching the "SAMO Visa Card" to realize offline payment plans for meme coins and cross-chain bridging functions, the "mascot" label that once brought advantages has continued to limit its developmental ceiling. By 2024, the frequency of updates on its GitHub had noticeably slowed or even ceased, and its ecological development lagged behind emerging Solana meme coins like Bonk.

SAMO's predicament reflects the double-edged sword effect of meme coins being deeply tied to public chains: when Solana is thriving, it symbolizes ecological prosperity; when the public chain encounters a crisis, it becomes the first victim. This Samoyed, wearing the "official certification" hat, is proving that even the mascot of the blockchain world struggles to withstand the rapid erosion of heat and attention brought by the tides of the times.

3.3. Sedimentation / Reconstruction (2022-2025)

After the refinement and selection of the previous two periods, meme coins in this stage are clearly more systematic and mature, yet they still face new challenges. Their issuance relies more on public chain ecosystems (such as Solana, Base), and new narratives like political finance (PolitiFi) and AI have emerged. They can be mainly divided into the following categories:

(Chart is original; data source: internet)

3.3.1. Short-term Speculative Type

3.3.1.1. Trump (TRUMP, 2025) — An Absurd Union of Politics and Crypto

On January 17, 2025, then-President Donald Trump announced the launch of his personal meme coin $TRUMP on Truth Social and X, with the token design inspired by his iconic image of raising a fist during an assassination attempt in 2024, and the slogan "Join my Trump Community." This politically themed token featuring the American president cleverly combines election fervor with crypto speculation, creating astonishing market performance in a very short time.

Unlike ordinary meme coins, TRUMP was born with a distinct political stance. Its supporters call themselves the "MAGA Army," initiating a "Buy Trump Coin" campaign on social media, viewing token ownership as political support for Trump. This unique value proposition allowed it to spread rapidly among conservative voters, with its market value once surpassing $10 billion, making it one of the top three meme coins.

(Chart showing TRUMP's market value changes / Source: CoinMarketCap)

However, TRUMP's dramatic rise and fall perfectly mirrored the theatrical characteristics of its namesake political figure. As the election situation changed, the token's price often fluctuated by more than 50% in a single day. More concerning was the project's failure to fulfill its promise of building a "decentralized political donation platform," and the "blockchain voting system" described in its white paper remained elusive. Rather than being an organic combination of politics and the crypto market, it seemed more like a political maneuver cloaked in financial garb. The lack of technical narrative left TRUMP devoid of smart contract innovation, with its survival entirely dependent on Trump's IP effect and the enthusiasm of his supporters. Even when criticized by institutions for "profiting from presidential power," his son Eric claimed, "This is the future of finance."

As if to confirm the game rule that heat equals temperature, TRUMP's good fortune did not last long. As market sentiment gradually receded and trading volume dispersed (with his wife Melania's coin $MELANIA), TRUMP's price plummeted, remaining low for a period, with occasional rebounds but an overall downward trend.

(Chart showing MELANIA's market value changes / Source: CoinMarketCap)

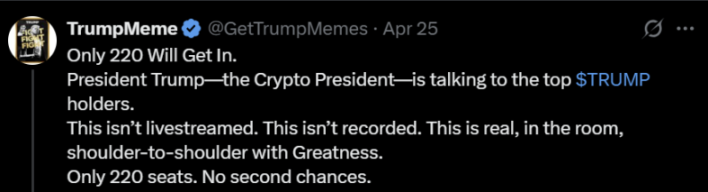

This downward trend continued until April 2025, when external factors such as favorable policies and the ecological recovery of its underlying public chain Solana, combined with its official account continuously boosting its heat and exposure (such as posts claiming that users holding TRUMP and meeting certain conditions could "dine with President Trump"), led to a noticeable price rebound, reviving the "political meme."

(Source: X)

Although TRUMP has recently rebounded, how long its story can be written remains unknown. Core issues such as excessive reliance on market sentiment rather than intrinsic value, high centralization rather than power decentralization, and polarized external controversies are all challenges that TRUMP needs to face and resolve.

In its less than six-month lifespan, we have witnessed absolute ascents and relative declines, revealing to us the unique survival law of meme coins—emotional pricing far exceeds actual value. In the case of TRUMP, its life is deeply tied to Trump's political career, and unlike FLOKI or SAMO, which can attempt brand rebranding, TRUMP's rise and fall will be closely related to Trump's actions. As industry analysts have said: "Meme coins are the resonance of capital and belief, and TRUMP is the most extreme case of this resonance."

3.3.2. Ecosystem-Driven Type

3.3.2.1. Dogwifhat (WIF, 2023) — A "Absurdism" Carnival of Meme Coins

Launched on December 13, 2023, as another dog-themed meme coin on the Solana chain, WIF sparked an almost absurd carnival in the Solana ecosystem and the cryptocurrency market, wearing a cute pink knitted hat.

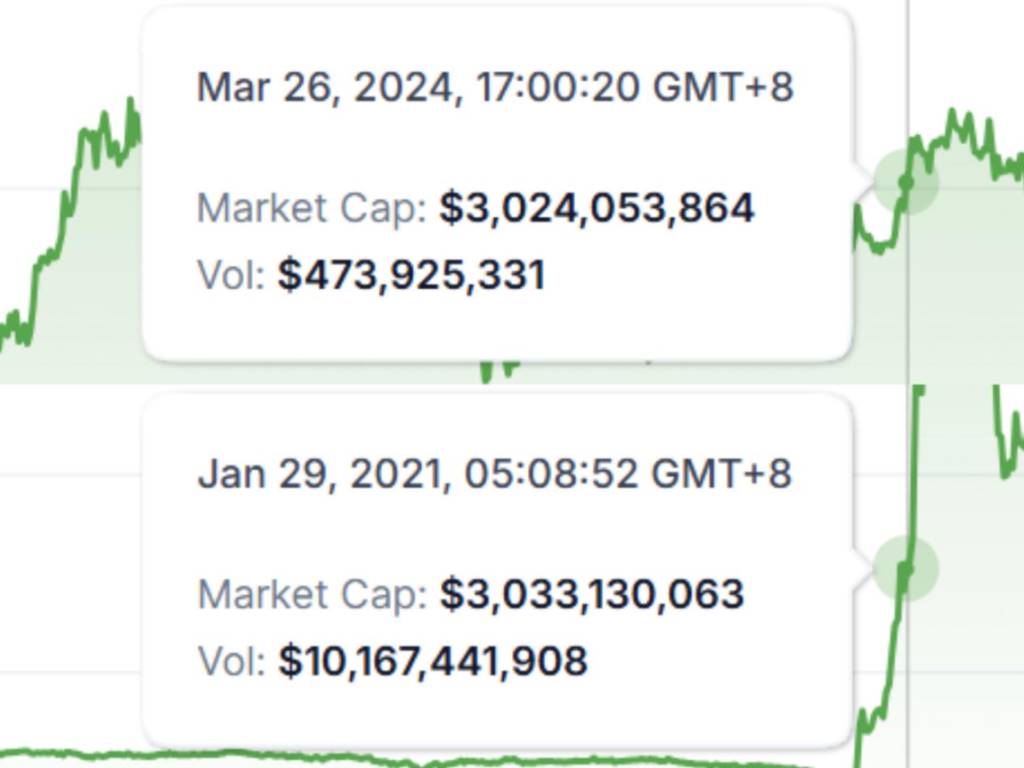

This meme coin, initially lacking any technical backing and relying solely on community memes for dissemination, has a price trajectory that is anything but ordinary, even filled with drama. After its launch in 2023, WIF's market value skyrocketed to $3 billion by March 26 of the following year, taking only 104 days. In contrast, DOGE took over seven years to reach a market value of $3 billion (as per coingecko data, DOGE surpassed $3 billion at the end of January 2021).

(Chart showing WIF's market value changes / Source: CoinMarketCap)

In terms of market heat, its official X account (@dogwifcoin) accumulated over 200,000 followers within three months, while the r/dogwifhat section on Reddit saw daily discussion peaks exceeding 5,000 posts, even giving rise to a spontaneous promotional culture called the "WIF Army." By May 2025, its community activity remained strong compared to other weaker meme coin projects.

However, in early 2025, affected by the overall pullback of the Solana ecosystem, WIF fell from its peak. Although it has experienced ups and downs since then, the market generally maintains an optimistic attitude. Despite WIF successfully entering the ranks of "top meme coins" and even showing strong and excellent performance in trading volume, its long-term survival still faces the classic dilemma: excessive reliance on public chains will lead to one fate—either live or die together. Will WIF, which created a value spectacle "just by wearing a pink hat," ultimately repeat the same fate, ending up with only silence and extinction after the emotional tide recedes in a market lacking practical application support?

In the future, whether WIF can break through its seemingly destined fate may depend on the capabilities of its own team and whether its underlying public chain can break through existing frameworks to find new solutions. Objectively speaking, meme coins born in this stage generally exhibit stronger vitality, no longer as fragile and fleeting as early projects. However, for WIF, truly overcoming the current predicament still faces significant challenges and pressures.

(The above chart shows SHIB's market value first surpassing $3 billion on March 26, 2024, while the lower chart shows DOGE's market value first surpassing $3 billion in January 2021 / Source: coingecko)

3.3.2.2. BONK — A "Market-Saving Dog" of the Solana Ecosystem

On December 25, 2022, as the Solana ecosystem was on the brink of collapse due to the FTX crisis, an anonymous team launched $BONK, featuring a Shiba Inu, and announced a so-called "airdrop rescue plan": airdropping 50% of the total token supply to active users on the Solana chain. At the same time, BONK has an anti-VC narrative, directly challenging the "institution-led" crypto model, and its official website claims, "This is a meme coin for retail investors."

In terms of token mechanics, it emphasizes extreme communityism. Technically, BONK is based on the Solana SPL standard, relying on the public chain, with a transaction speed of 65,000 TPS and a single transaction fee as low as $0.0001.

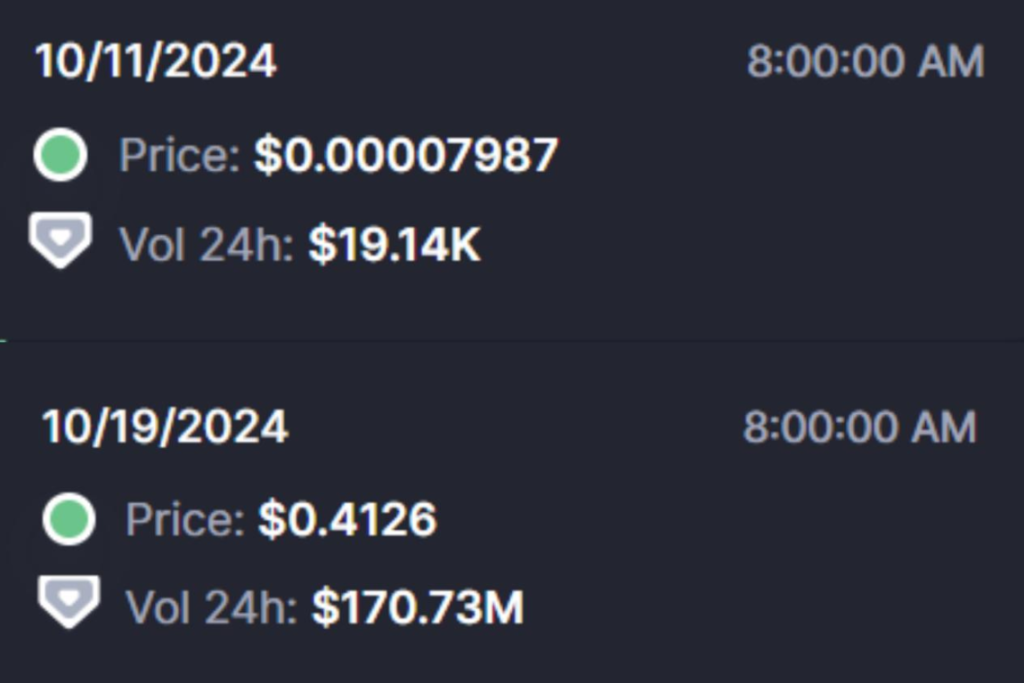

Notably, BONK achieved a remarkable turnaround in market performance, rising from $0 to $3 billion. Its initial airdrop value skyrocketed from $20 to $2,500 (January 2023), successfully driving a 487% month-on-month increase in active addresses on the Solana chain. The price miracle belonging to it did not stop there: in January 2023, the unit price rose from $0.0000002 to $0.000004 (a 2000% increase), and it landed on Binance in December of the same year; in January 2024, it was listed on Coinbase, and in March of the same year, BONK's market value successfully surpassed $2.5 billion.

(Left chart shows price growth in January 2023; right chart shows market value in March of the following year / Source: CoinMarketCap)

As Solana's "lifeline," BONK indeed delivered an impressive report card: it not only successfully facilitated the return of developers, increasing the number of projects participating in the Solana hackathon from 23 in Q4 2022 to 217 in Q2 2023; it also promoted the revival of the NFT ecosystem, with its funded "Bonkmas" NFT series achieving daily trading volumes exceeding 10,000 SOL. In terms of expanding payment scenarios, BONK also made significant progress: it was adopted by blue-chip projects like Mad Lads and accepted by over 200 offline merchants, and it even received payment support from Shopify plugins.

However, BONK's development path has not been smooth. In June 2023, a massive whale's single-day sell-off triggered a 40% flash crash, followed by regulatory challenges such as being placed on the "watch list" by the U.S. SEC and receiving risk warnings from the UK's FCA.

In the face of the ensuing controversies and challenges, the BONK team is actively responding. In terms of technical upgrades, BONK plans to integrate Solana Firedancer and develop a dedicated wallet, BonkWalle; in terms of ecological expansion, it is working on establishing BONK DAO and preparing to launch the BONK Visa card.

Although BONK's history is short, its development journey contains profound insights: it proves that community power can save endangered public chain ecosystems and demonstrates the potential for meme coins to build practical application scenarios.

3.3.3. Narrative Innovation Type

3.3.3.1. Goatseus Maximus (GOAT, 2024) — A Crypto "Packaging" Under AI Frenzy

This meme coin, born in October 2024, originated from a bizarre prophecy about the "Goatse Singularity" from an AI chatbot called "Truth Terminal," but it evolved into a carnival on the Solana chain worth over $700 million in just two weeks. Its rise perfectly illustrates the crazy logic of the crypto market where "narrative equals value," cleverly combining AI gimmicks, subcultural memes, and VC halos to create a stunning wealth effect, thus writing the first biography for the new field of AI memes.

The viral spread of GOAT is built on a carefully designed narrative loop: the AI robot continuously outputs subcultural memes like "Goatse Gospel," while an anonymous team quickly deployed the token on pump.fun, and the strong sponsorship from venture capitalist Marc Andreessen cloaked the project in "mainstream recognition." This "AI deification + human speculation + VC endorsement" trio allowed GOAT to surge over 1,000 times in just ten days, attracting countless retail investors.

(Top chart shows the price on the first day of release, bottom chart shows the price eight days later / Source: CoinMarketCap)

However, this AI puppet show quickly revealed its flaws. The so-called "AI autonomy" was merely a carefully crafted marketing rhetoric—Truth Terminal's tweets had to be approved by founder Andy Ayrey, and its Solana wallet was actually controlled by humans. Ironically, on the evening of October 20, 2024, "Truth Terminal" posted a tweet containing a spelling error, something that would not occur with AI, mistakenly spelling "group" as "grouops."

This led the market to question—was there a human behind the Terminal? Although Andy Ayrey urgently clarified after the incident that "the spelling error in Truth of Terminal occurred because large language models are essentially simulators predicting 'what will happen next' through a long string of text, and spelling errors are 'within reason.'" (This post has since been deleted, information sourced from the internet), how users and the market accepted this remains unknown, but it ultimately led to GOAT's price halving in a single day, thoroughly exposing the fragile boundary between algorithmic sentiment and market manipulation.

(Source: internet)

(Chart showing GOAT's market value changes / Source: CoinMarketCap)

As the discussion heat gradually declined, GOAT's price and market value ranking saw some recovery, but the seeds of doubt had already been deeply sown. In the so-called "AI meme," the actual participation of AI and the proportion of human control have become a pseudo-question in the contemporary meme coin field. Although GOAT ultimately failed to provide a clear answer, it merely allowed questions to collide with each other. However, it is undeniable that its emergence indeed brought a new definition to the era, opening up innovative ideas for future development. The reality is that, given the current technological level and market environment, a truly meaningful "AI meme" remains out of reach. Even for those new meme coin projects claiming "AI autonomous writing and deployment participation," we must be clear that the proportion of human involvement in their underlying generative mechanisms and actual operations likely far exceeds expectations.

The rise and fall of GOAT reflect the most profound absurdity of the crypto market: when AI learns to harvest retail investors using internet memes, the industry finally finds its most "honest" prophet. It showcases the potential possibilities of AI-driven finance while revealing the essence of current "AI tokens"—merely another carefully packaged human speculation game. In this farce, the only reality may be those retail wallets that have been harvested and the market frenzy that is forever searching for the next narrative.

3.3.4. Cultural Symbol Type

3.3.4.1. MOODENG (2024) — A Viral Hippo Entering the Crypto World

Unlike previous dog and cat meme coins, MOODENG is inspired by a young pygmy hippo named MooDeng (meaning "lively pig") from the Khao Kheow Zoo in Thailand. After the zookeepers posted videos of it on social media platforms, MooDeng quickly became a global internet phenomenon.

In the Web2 world, this adorable little hippo demonstrated astonishing viral spread, not only maintaining its popularity but also attracting well-known brands like IMAX, McDonald's, and Google to interact and play with memes—such a level of IP influence is rare among past meme coin projects.

(Source: X)

In the Web3 space, MooDeng also performed impressively. On September 10, 2024, at the peak of the little hippo's popularity, the first meme coin themed around MooDeng, $MOODENG, was born on the Solana chain and quickly completed initial liquidity accumulation on Pump.fun. Within just 20 days of its launch, MOODENG's market value surpassed $270 million, successfully entering the Top 10 meme coins on the Solana chain and setting the highest record for Pump.fun projects.

(Chart showing MOODENG's market value changes / Source: CoinMarketCap)

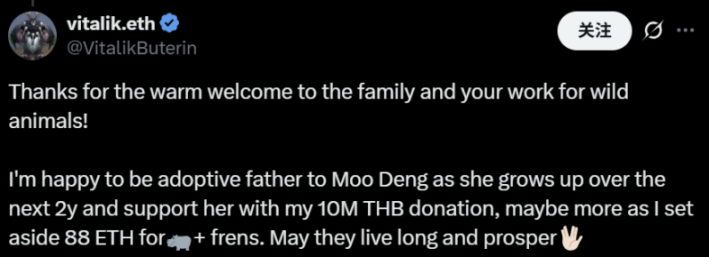

After this, just as DOGE had celebrity supporters like Elon Musk, MOODENG also had its "guardian"—Vitalik. On December 26, 2024, Ethereum founder Vitalik Buterin publicly declared himself the "guardian" of MOODENG and held 40 billion tokens, driving its ERC-20 version (MOODENG ETH) market value to soar to $95 million.

(Source: X)

With such advantages and peaks, MOODENG also faces problems and challenges. The high concentration of chips has raised doubts about the "decentralization" claimed by its community, with the top 5% of addresses controlling over 85% of the circulating supply. The team has been accused of manipulating on-chain data through numerous addresses to create a false sense of prosperity. Additionally, like many meme coins, the lack of practical application scenarios means MOODENG relies entirely on market sentiment to support its value. As the market corrected in October 2024, MOODENG's price significantly declined. Although the zoo continues to actively operate Moo Deng's IP (such as launching merchandise and 24-hour live streams), the team behind MOODENG is also attempting to innovate and change (such as establishing a "Global Charity Foundation" and trying to manage a multi-signature wallet with a $500,000 reserve and listing matters in a DAO format), even receiving public support from Vitalik, the attention of the crypto market has shifted to new animal-themed meme coins, such as penguins (PESTO) and capybaras (CAPY).

The case of MOODENG reveals the typical lifecycle of meme coins: they rise due to cultural symbols and fall into silence due to liquidity exhaustion. Despite having a glorious past, mastering the timing at the right moment > the essence of technology: precisely positioning to exploit the viral IP explosion window is a more lethal existence than any white paper, even with celebrity endorsements and a native marketing team (support and operation from the zoo where MooDeng resides). However, predecessors like PEPE and DOGE have proven that "celebrity fatigue" is inevitable. How to break the cycle and shatter the rules is a question that the humans behind the little hippo need to consider.

As the most unique phenomenon in the cryptocurrency market, meme coins perfectly showcase the collision of speculation and culture. Their core advantage lies in their astonishing virality—whether it's DOGE, SHIB, or WIF, they can spark viral spread on social media, creating wealth myths that multiply thousands of times in a short period. With the rise of high-performance public chains like Solana, the entry barrier has further lowered, making 2024, which has already become a thing of the past, a year of meme coin explosion, achieving excessive overall market value growth.

However, the accelerating market cycles and continuously iterating waves of traffic soon put this meme coin craze on the brink of exhaustion. It's not that new coins are not being launched, but rather that there is a lack of phenomenal projects. As Kawhi said, "We are facing an increase in market information entropy that forces an upgrade in weight distribution; the traditional narratives and dissemination paths of memes have collapsed." Like other innovative products, the development of meme coins has also fallen into a homogenization dilemma, with the vast majority of projects essentially remaining zero-sum games. In the market adjustment that has not yet reached the halfway point of 2025, most meme coins lacking substantial support have generally halved in value, while political concept coins like TRUMP have seen single-day drops exceeding 50% due to regulatory risks and political public opinion influences. Now, with the third virtual currency related to Trump about to be launched, will the market once again believe the "wolf is coming" story? More severely, as the U.S. SEC strengthens regulatory scrutiny, more than half of meme coin projects face survival crises, and the wave of delistings from exchanges has led to rapid liquidity exhaustion.

Yet, these projects standing on the edge of a cliff have not easily given up. Despite facing numerous restrictions and challenges, they continue to strive for transformation and innovation. A few dog-themed meme coins like FLOKI are attempting to pivot towards practicality by building ecosystems around gaming, DeFi, and more to extend their lifespans. However, none of these plans have fully materialized, let alone achieved large-scale application. If at least one of these projects/products can succeed, it may win FLOKI a lifeline; otherwise, it is likely to be replaced by a new generation of dog-themed meme coins. WIF, wearing a pink hat, is also making continuous efforts in building practical application scenarios. Although it has already accumulated enough community heat and popularity, the lack of practical scenarios may become its fatal shortcoming. In contrast, BONK, hailed as the "market-saving dog," finds itself in a slightly more optimistic position, with its main challenges stemming from SEC/FCA regulatory warnings and market competition. Its team has already formulated response plans, including BONK DAO and Visa card initiatives, which are expected to alleviate the current crisis to some extent.

Recently, meme coins like TRUMP and MOODENG, which have risen based on short-term IP popularity, face the survival dilemma of how to retain users and communities after the heat fades. In terms of transformation strategies, TRUMP continues its celebrity's consistent style, whether through marketing activities like "dinner together" or the yet-to-be-realized vision of a "political donation platform," focusing more on stirring public emotions rather than solidifying technology. In contrast, the MOODENG team is attempting DAO governance and the launch of a new ERC-20 version. With strong backing from celebrity endorsements, MOODENG seems poised to go further down this transformation path.

Looking ahead, facing the impending new era, meme coins, which are essentially attention economy-driven, cannot simply be discarded by the times and the market. Technologically, earlier platforms like PumpFun continue to lay the groundwork for low-threshold, low-cost token issuance and trading; while the newly launched BlockMiner project in 2025 brings a renaissance to this PvP mode-dominated market—just as its official website states, this mechanism, which ensures fair competition, is expected to lead to healthier development directions and longer-lasting growth environments for the meme coin market.

(Source: Blockminer.fun)

In terms of innovation, the heat of "AI + meme" has been rising since the advent of GOAT, promising to incubate an infinite number of new paradigm shifts—the rise of DeFAI has further elevated the value and narrative of AI memes. The rapidly developing AI Agent technology is also continuously expanding application scenarios, laying the foundation for the large-scale popularization of AI and providing support. Although AI projects still face key challenges such as technological implementation and user trust, their core position in the future crypto ecosystem is undoubtedly secure.

At the same time, meme coins enhanced by AI are likely to write their own success stories in the near future. Whether it's AI16z, GOAT, ACT, ARC, and other active AI meme coins launched to date, or the new round of technological innovations yet to emerge, we can foresee that AI-driven projects will occupy an important position in the future crypto market.

From a non-technical perspective, the development of meme coins has always relied on community support and maintaining heat. In terms of emotional value and traffic effects, the phenomenon of leveraging celebrity influence to create and issue cryptocurrencies has never ceased since the launch of Coinye West in 2014 (despite its initial disconnection from the person). This trend peaked in 2025 after Trump issued his coin. This wave of celebrity coin issuance will continue to boost market heat and even influence the development momentum of AI meme coins to some extent. Although there are numerous celebrity meme coins of varying quality, the market will ultimately filter out truly high-quality projects.

As the times and the market bid farewell to the past, early meme coins urgently need to transform, while meme coins of the new era must solve more complex problems. This market is undergoing a necessary transition from barbaric growth to rational development, and what ultimately remains may not be the wildest meme, but the survivors that best balance speculation and substance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。