Bitcoin should be our "mirror of thought."

Written by: Daii

It's not that you're not smart enough, nor that you lack information, but rather that we are all too accustomed to viewing today's world through yesterday's lens.

In 2011, when Nobel Prize-winning economist Paul Krugman reminded everyone that "at least for now, buying Bitcoin is a good investment," the price was only $7. By 2013, Zhihu user @Busch reiterated this viewpoint, garnering over 10,000 likes. Unfortunately, we still didn't take action.

Looking back at my old writings from 2020, I suddenly realized that the real reason we missed out on Bitcoin is that we often disguise fear with "rationality" and cover the unknown with "arrogance."

This article, which has already received 34,000 views and 400 likes, may serve as a mirror for us, reminding us that when the next "Bitcoin-level" opportunity arises, we should impose fewer self-limitations and muster more courage.

Perhaps the past cannot be changed, but the future is still in our hands. After reading, don't forget to share it with friends who, like us, are still on the sidelines.

Bitcoin should be our mirror!

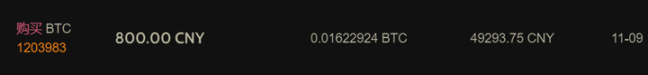

I can't remember when I first learned about Bitcoin, but it was definitely later than Wu Gang, who knew about it long before June 2009. Back then, it seemed like everything around was thriving. My first Bitcoin transaction was on November 9, 2017, when the price was $7,250. Just over a month later, on December 17, Bitcoin reached an all-time high of over $19,000, more than doubling from when I bought it. You must feel sorry for me, wondering why I didn't buy more. In fact, looking back, buying Bitcoin at that time wasn't the best opportunity, just as buying now isn't the best opportunity either. For the reasons, please refer to the previous article "Beware! Don't be fooled! Bitcoin has never had a bull market!"

My first transaction screenshot

What I regret more now is why I couldn't buy Bitcoin a bit earlier. This isn't just wishful thinking; it was indeed possible because as early as September 11, 2011, a Nobel Prize-winning economist recommended buying Bitcoin. At that time, the highest price for Bitcoin was only $7.025.

Economist Recommends Buying Bitcoin?

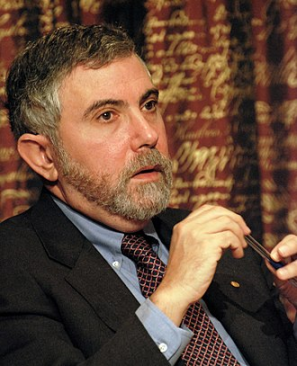

He is the economist who recommended buying Bitcoin, Paul Krugman, the 2008 Nobel Prize winner in Economics and a columnist for The New York Times. He received the Nobel Prize for his research on "international trade" and "the geographical distribution of economic activity." Krugman is an advocate of globalization, and his theories on international trade are currently being challenged by reality. This is a topic for another time.

Krugman in 2008

Next, let's take a look at his article recommending the purchase of Bitcoin. This is Krugman's earliest article about Bitcoin, titled "Golden Cyberfetters," published on September 7, 2011. You might find it tedious, but this date will appear repeatedly in this article; I want to emphasize that opportunity is essentially about timing.

Krugman's first article about Bitcoin, "Golden Cyberfetters," published on September 7, 2011

When you first see the title "Golden Cyberfetters," you might be puzzled. You can't blame yourself; this is a term coined by Krugman. The original term is "Golden fetters," which criticizes the gold standard from 1919 to 1939. Many in the economics community believe that the gold standard caused the Great Depression of the 1930s. The phrase "pouring milk down the drain" you see in textbooks refers to that time. The overall situation is complex; just remember that the gold standard led to the Great Depression, which was disastrous. Here, Bitcoin is metaphorically compared to digital gold. Because Bitcoin is also issued in limited quantities, with only 21 million coins, it implies that Bitcoin could also lead to deflation and economic depression. The reason is simple: because Bitcoin is issued in limited quantities, it encourages hoarding. Bitcoin is a new, digital-age gold standard that will ultimately lead to "hoarding, deflation, and depression."

So to the extent that the experiment tells us anything about monetary regimes, it reinforces the case against anything like a new gold standard – because it shows just how vulnerable such a standard would be to money-hoarding, deflation, and depression.

However, theory and practice are separated by Krugman. Although he is not optimistic about Bitcoin's future, he does not kick it while it's down. He merely acknowledges Bitcoin's extreme volatility and believes that "so far, buying Bitcoin has been a good investment."

So how's it going? The dollar value of that cybercurrency has fluctuated sharply, but overall it has soared. So buying into Bitcoin has, at least so far, been a good investment.

As a side note, in that blog, Krugman also discussed another principle: the monetary system we want should not make people rich just by holding money; rather, it should facilitate transactions and enrich the economy as a whole. He believes that "Bitcoin" is a currency that makes people rich just by holding it, which is fundamentally flawed. So, is this true? This is unrelated to this article, but it's interesting; we can discuss it another day.

What we want from a monetary system isn't to make people holding money rich; we want it to facilitate transactions and make the economy as a whole rich.

Back to the main point. You might say, wait, you definitely won't seize this opportunity because your English isn't good. No worries, we have Zhihu. On November 22, 2013, the news of Nobel laureate Krugman recommending Bitcoin was first brought to the Chinese-speaking world by @Busch in the form of a Zhihu Q&A. See, our Zhihu is impressive. Moreover, @Busch even shared a story for everyone. Remarkably, this answer received 12,000 likes.

The answer about Bitcoin that received 12,000 likes

This is that Zhihu Q&A. The question was: How does the economics community view Bitcoin? The responder, @Busch, has since received 12,805 likes. 12,000 likes is truly impressive.

The story behind those 12,000 likes is significant. We should also temporarily set aside our utilitarian mindset and take a moment to appreciate this good story.

The story is real and is about the "Capitol Hill Babysitting Cooperative." It began with a group of young parents working in Congress who wanted to solve the problem of having no one to take care of their children while they socialized. Thus, they established this mutual aid organization. Upon joining, each person received 20 hours of babysitting vouchers, with each voucher corresponding to a certain amount of babysitting service. Parents providing services could earn babysitting vouchers, which they could later give to others when someone helped take care of their child. Of course, there were more management details, but they considered many issues.

The Capitol Hill Babysitting Cooperative in 2000

The half-hour babysitting voucher issued by the cooperative

However, reality is harsh, and eventually, problems arose. Not long after it started, the cooperative was on the brink of collapse. People were unwilling to spend vouchers to have others babysit their children; instead, they preferred to earn more vouchers for their own future needs.

@Busch believes that the recession was caused by insufficient output, and the reason was the lack of babysitting vouchers.

If we view this babysitting cooperative as an economy, with babysitting services as its output (GDP), this aligns with the classic definition of recession. The cause of the recession lies in the deflation within the economy, specifically the insufficient number of babysitting vouchers.

Using this story, @Busch first criticizes Bitcoin's anti-inflation characteristics. Because of it, there will be a lot of hoarding behavior, ultimately leading to deflation and, consequently, economic depression. This is also the core idea expressed in Krugman's "Golden Cyberfetters." You should know that the limited issuance of 21 million is the most vulnerable point of Bitcoin and was also the first point of attack.

If it truly becomes, as some fervent speculators claim, "the currency of the future," "the global currency," the outcome for the global economy would be just like that of the Capitol Hill babysitting cooperative.

In fact, the conclusion is quite the opposite. The reason for the recession is not the insufficient number of babysitting vouchers, nor is it due to insufficient output, but rather a lack of demand, which has been clearly articulated by economists in papers. @Busch compared the certainty of the number of babysitting vouchers to the limited total supply of Bitcoin, making it easier for people to understand complex economic principles. The conclusion is simple: if Bitcoin becomes an international currency, the outcome will be similar to that of babysitting vouchers, leading to deflation and making it difficult for the babysitting cooperative to sustain itself, which is akin to an economic depression. Indeed, the explanation is concise, vivid, and illustrative, earning 12,000 likes as it should.

However, this story has been misused. The shortcomings of @Busch's answer are unrelated to this article; we can discuss them another day, and you can look for them in the WeChat public account.

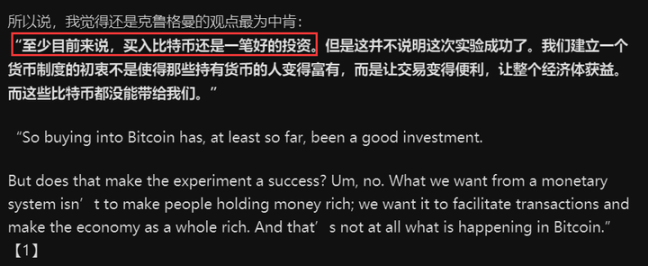

The key point is here: now we will discuss what you are most concerned about. Do not think that @Busch intended to discourage everyone from buying Bitcoin through his Q&A. The reality is quite the opposite; he specifically quoted Krugman's words from that article, "At least for now, buying Bitcoin is still a good investment," and he even bolded it to remind everyone.

Screenshot from the Zhihu Q&A with 12,000 likes regarding Krugman's recommendation to buy Bitcoin

Alright, please note that there are two time points representing potential opportunities for you to buy Bitcoin. One is the date of Krugman's article publication, September 7, 2011; the other is around November 22, 2013, when @Busch quoted his article in the Zhihu Q&A.

It is a very rare signal for a Nobel Prize-winning economist to recommend buying Bitcoin. However, even if you had the opportunity to see such a signal, you still might not buy it. Why is that? This is what this article aims to convey. Let's analyze them one by one.

Why might you not buy?

If you were lucky enough to see Krugman's recommendation to buy Bitcoin on September 7, 2011, you still might not buy. Just look at the price trend at that time, and you'll understand. The price of Bitcoin was $7.025, having just dropped from a historical high of $29 a month prior. Note that the reason the chart below does not show a cliff-like drop is that it uses a logarithmic scale, which helps you focus on trends. If you want to understand more about logarithmic scales, please refer to the previous article "Beware! Don't be fooled! Bitcoin has never had a bull market!" Don't blame me for repeatedly recommending this article; many people currently believe we are in a bull market, and I don't want my readers to be misled.

Bitcoin price trend before September 2011 (logarithmic scale)

Looking at the following price chart on a normal scale, you would be even less likely to buy. The steepness of the decline far exceeds that of the logarithmic scale above. It's more intuitive and frightening; this is a typical "bear market." As the saying goes, "In a bear market, no one speaks of a bottom." You decide to wait a bit longer. Sure enough, as you expected, the price continues to drop. By November 11, 2011, Bitcoin was only $2.10, and at this point, you would be more inclined to believe Krugman's prediction that Bitcoin would not succeed. You would feel lucky that you didn't listen to him back then; otherwise, you would have suffered significant losses.

However, looking back today, you actually missed an opportunity.

From September 2011 to January 2020, Bitcoin's price was in a downward trend

Now let's talk about the second time point, November 22, 2013, which is also when you, as a Chinese reader, were most likely to see Krugman's recommendation to buy Bitcoin on Zhihu. Would you buy it? Still not necessarily. Look at the chart below; two years later, the price of Bitcoin had increased nearly 100 times, rising from $7 to $675, an unprecedented increase in history. If this isn't a bubble, what is? Even more frightening, the price was still on the rise at that time, reaching $1,052 within 20 days, a new historical high. The extreme price volatility would make you start to doubt Krugman's statement; the risks are too high. More likely, you would decide to back off, thinking there are plenty of opportunities in the world, so why bother competing with Bitcoin?

Thus, the second opportunity to buy Bitcoin slipped away.

On November 22, 2013, when Krugman's thoughts reached China, the price of Bitcoin was $675

To help you appreciate how rare it is for an economist, especially a Nobel Prize-winning economist, to recommend buying Bitcoin, you need to understand the current mainstream views on Bitcoin. From this, you can also grasp how precious these two opportunities were.

Is Bitcoin a bubble?

It is common for economists to make recommendations, but it is rare for a Nobel Prize-winning economist to recommend buying Bitcoin. That one recommendation can be seen as an accident, and it has never happened again since. On the contrary, Krugman began to denounce Bitcoin.

Since September 7, 2011, Krugman's attitude toward Bitcoin has become unequivocal; he began to openly oppose it. The following chart shows a list of articles he published in The New York Times regarding Bitcoin. From the titles of the articles, we can clearly see how resolutely he opposes Bitcoin. April 14, 2013, "The Anti-Social Network"; January 29, 2018, "Bubble, Bubble, Fraud and Trouble"; July 31, 2018, "Why I Am a Cryptocurrency Skeptic."

List of some of Krugman's New York Times columns related to Bitcoin

Especially in the article from January 29, 2018, he recounted how a barber asked him whether he should buy Bitcoin while getting a haircut. He was so angry that he wrote an article with the title containing the word "bubble" twice: "Bubble, Bubble, Fraud and Trouble." The conclusion of that article vividly showcased his anger toward Bitcoin: Yes, my barber should not buy Bitcoin. This will end badly, and the sooner it does, the better.

So no, my barber shouldn’t buy Bitcoin. This will end badly, and the sooner it does, the better.

I will take a wild guess: on January 29, 2018, the price of Bitcoin was over $11,000, having dropped more than $8,000 from the historical high of over $19,000 just a month prior. Perhaps Krugman himself was caught in a position; otherwise, why would he be so angry? Just a joke, don't take it seriously, though it might also be true.

On January 29, 2018, Bitcoin's price was over $11,000

Bitcoin will not stop selling to economists just because they generally oppose it. There is an anonymous forum where American economics graduates, teachers, and job seekers often post, and because it is anonymous, you might hear true news or false news. This forum is called "Economics Job Market Rumors" (EJMR), and the website is: econjobrumors.com. There is a bold post from three years ago titled: "Not buying Bitcoin now is the biggest mistake of your life." A disclaimer: since this is a rumor, it cannot serve as evidence of any economist's purchase of Bitcoin; I am just sharing it as gossip.

A post from three years ago on the EJMR anonymous forum: "Not buying Bitcoin now is the biggest mistake of your life"

Turning back to China, successful businessman Jack Ma also joined the ranks of those denouncing Bitcoin. He stated that Bitcoin is a bubble, very seriously and solemnly. This was during the Second World Intelligence Congress on May 16, 2018. This conference is quite significant, as you can see from its organizing bodies: the National Development and Reform Commission, the Ministry of Science and Technology, the Ministry of Industry and Information Technology, the Cyberspace Administration of China, the Chinese Academy of Sciences, the Chinese Academy of Engineering, the China Association for Science and Technology, and the Tianjin Municipal People's Government.

At the Second World Intelligence Congress on May 16, 2018, Jack Ma stated that blockchain is not a bubble, but Bitcoin is a bubble.

Jack Ma's exact words were, "Blockchain is currently a hot term; first, blockchain is not a bubble, but today's Bitcoin is a bubble. Bitcoin is just a very small application of blockchain."

The key issue is that at that time, Bitcoin's price had just dropped from a high of over $19,000 to only over $8,200, having fallen another $3,000 since Krugman published his angry column "Bubble, Bubble, Fraud and Trouble." This also seems to prove that Ma was not wrong; Bitcoin is indeed a bubble that is bursting.

On May 16, 2018, Bitcoin's price was $8,291, less than half of its historical high

Upon careful reflection, whether you did not buy Bitcoin or whether Krugman and Ma said Bitcoin is a bubble, both are quite reasonable and are the results of rational decision-making.

However, 11 years have passed, and our rationality has made our eyes uncomfortable (watching the rise), and our rationality has made our pockets uncomfortable (not earning). We can't keep deceiving ourselves every day, thinking that Bitcoin is still a bubble and that eventually, everything will vanish. Wouldn't that make us like Xianglin's sister (brother)? We have to ask ourselves: Is it rationality that is wrong? Should we act like gamblers, going crazy, to have a chance at reaping the benefits of Bitcoin? No, rather, it is possible that we have done something wrong ourselves.

What exactly did we do wrong?

Rationality is not the problem. The problem lies with us; we have misapplied our rationality. Our survival instinct demands that we prioritize safety and avoid risks, making it very easy for us to dismiss something new, as new things imply immaturity and risk.

Ultimately, it is our lack of tolerance for new things. More often than not, our hearts are filled with fear. Just think about it: how scared must the first person to eat crab have been? Otherwise, we wouldn't use the phrase "the first person to eat crab" to praise those heroes who dare to be pioneers. Eating crab is still a personal choice, but once it rises to the societal level, the issues become much more complex.

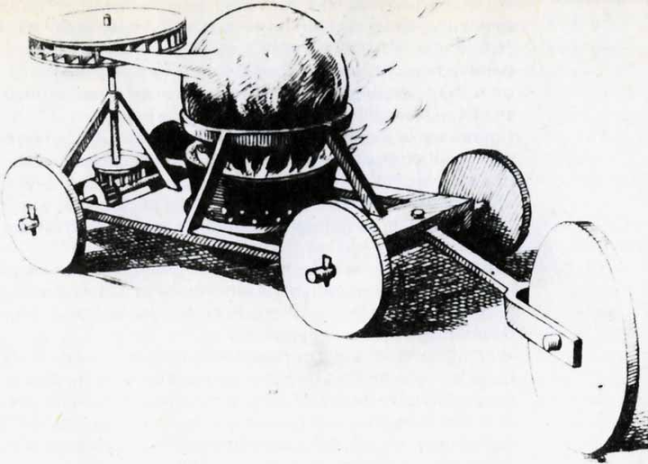

Take a look at the "Red Flag Act" in 19th century Britain, and you'll understand that the "criticism" faced by automobiles at that time was no less than that faced by Bitcoin today. When cars were first invented, they were generally inferior to horse-drawn carriages. In other words, the carriages were opposed. Of course, carriages cannot speak; it is we humans who oppose. In the beginning, cars were poor in both comfort and stability. The prototype of a car from 1678 looks like a "monstrosity." These are secondary; the key issue is the loud noise. When a car suddenly passes by you, it often gives you a fright. In 1865, the British enacted the "Red Flag Act" to "regulate" the driving of automobiles. At that time, the biggest advantage of cars was that they were "fast."

Car from 1678

The "Red Flag Act" of 1865 stipulated that the maximum speed of cars could not exceed 4 miles per hour, equivalent to 6 kilometers per hour, and in urban areas, it had to be halved. A fine of £10 was imposed for speeding. Even more outrageous, the act required that each vehicle must have at least three people to operate it, with one person walking 60 yards (about 55 meters) ahead of the car. This person was responsible for directing traffic, alerting pedestrians, and assisting the passage of horses and carriages. The person in front would carry a small red flag, which is also the origin of the name "Red Flag Act."

Stipulated that self-propelled vehicles should be accompanied by a crew of three; if the vehicle was attached to two or more vehicles an additional person was to accompany the vehicles; a man with a red flag was to walk at least 60 yd (55 m) ahead of each vehicle, who was also required to assist with the passage of horses and carriages. The vehicle was required to stop at the signal of the flagbearer. (Section 3) Additionally, vehicles were also required to have functional lights, and not sound whistles or blow off steam whilst on the road. (Section 3) A speed limit of 4 mph (2 mph in towns) was imposed for road locomotives, with a fine of £10 for contravention. (Section 4)

Reading the text, you might not yet grasp the severity of the speed restrictions imposed by the act. If you think about it carefully, you'll realize that this rule is quite harsh, even a bit "malicious." Because the car is in motion, but there must always be a person not far in front of it, and this person is only allowed to walk. Just think about how fast this car could go.

A person with a red flag in front of the car, the origin of the Red Flag Act

The above photo was taken in 1896, the same year the "Red Flag Act" was repealed after 31 years of enforcement. The driver is Charles Rolls, one of the co-founders of Rolls-Royce. This photo was likely taken to commemorate that era, showing the standard configuration for driving a car: three people, one walking in front with a small red flag. If you're interested in this history, you can check out "When Cars Appeared, Carriages Opposed."

Science fiction writer Liu Cixin

Science fiction writer Liu Cixin said in "The Three-Body Problem": Weakness and ignorance are not obstacles to survival; arrogance is. Our intolerance, from the perspective of other species, is a form of arrogance. Arrogance is a social gene of humanity. Because we indeed possess the intelligence to look down on other Earth beings. Arrogance is not something we pursue deliberately; sometimes, it is our harshness; more often, it is expressed through our intolerance of new things.

The "Red Flag Act" has become history, while "Bitcoin is a bubble" continues…

Conclusion

Fortunately, the long-established economic publication "The Economist," which began in 1843, has set aside its arrogance. On October 29, 2020, they published an article that received acclaim. The title of the article is "Getting Down with the Cool Kids on Bitcoin," with the subtitle "How Investors Might Learn to Stop Worrying and Love Crypto," and the illustration features the Bitcoin symbol. The "cool kids" refer to the "Blitz Kids," who frequently attended the Tuesday Club Nights in Covent Garden, London, from 1979 to 1980. They were praised for initiating the New Romantic subculture movement. This may require an understanding of British cultural history to fully appreciate their significance. You just need to know that this group of cool kids is not simple; they are contributors to British culture, and many famous figures emerged from among them.

Illustration from "The Economist" article "Getting Down with the Cool Kids on Bitcoin" on October 29, 2020

The article states: Bitcoin is a pretty tiny club. Beside it, gold looks as capacious as Wembley Stadium. The market value of all Bitcoin is just 1-2% of the value of all the gold above ground. Scarcity is a trait of many things that are perceived to have value.

Bitcoin is a pretty tiny club. Beside it, gold looks as capacious as Wembley Stadium. The market value of all bitcoin is just 1-2% of the value of all the gold above ground. Scarcity is a trait of many things that are perceived to have value.

At the end of the article, it quotes the words of the representative of the "cool kids," Steve Strange: "The best move I ever made was turning Mick Jagger away at the door."

Steve Strange, who sadly died in 2015, understood this fully. "The best move I ever made was turning Mick Jagger away at the door," he said.

The Mick Jagger he turned away is a famous British rock singer, while at that time, the cool kid who pushed him away and did not let him enter the club, Steve Strange, was still young and unknown. The author seems to imply that we should not be abandoned by the current cool kids playing with Bitcoin; we should actively join, as the Bitcoin club will not perish because of our non-participation.

Indeed. Cars are already our friends, and horse-drawn carriages have long entered history. We are also about to forget the arrogance of the "Red Flag Act." Now, Bitcoin has arrived, and because of past arrogance, we have lost one opportunity after another to reap the benefits of Bitcoin.

Interests are always temporary. If we cannot learn to set aside our arrogance when facing new things, we will lose even more "Bitcoin-level" opportunities. In this sense, remembering those missed Bitcoin opportunities will make us less arrogant, more humble, and open us up to more new opportunities.

Bitcoin should become our "mirror of thought."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。