The decentralized nature of cryptocurrency makes holders targets, where wealth and crisis coexist.

Written by: Oliver, Mars Finance

In May 2025, Bitcoin's price surpassed $110,000, and the myth of getting rich through cryptocurrency swept the globe, igniting the wealth dreams of countless individuals. However, behind this dazzling halo, a chilling undercurrent is surging: kidnapping cases targeting cryptocurrency holders are increasing at an alarming rate. From the brutal torture in a Manhattan mansion to the terrifying attempted kidnapping on the streets of Paris, from bizarre murders in Bali to the mysterious plane crash deaths of crypto tycoons, criminals are viewing holders of digital wealth as "moving vaults." Is this cryptocurrency craze a victory for financial freedom or a trap fraught with danger? Let us delve into these chilling cases and uncover the deadly price of crypto wealth.

The Nightmare in Manhattan

In May 2025, a luxurious townhouse in Manhattan became the terrifying stage for a crypto kidnapping case. According to The Washington Post, 28-year-old Italian crypto investor Michael Valentino Teofrasto Carturan was lured to an eight-bedroom mansion on May 6 and subsequently imprisoned for nearly three weeks. The main suspect, John Woeltz (37), and his accomplice, William Duplessie (32), used tools such as chainsaws, night vision goggles, and electric shock devices to beat, inject drugs, and psychologically torment Carturan, even hanging him from the rooftop of a five-story building, threatening to kill his family to force him to reveal his Bitcoin wallet keys. Carturan's escape was miraculous: on May 24, he took advantage of a guard's negligence and ran barefoot and bloodied into the street, seeking help from a traffic officer. When police searched the scene, they found cocaine and barbed wire; Woeltz was charged with kidnapping, assault, and illegal possession of firearms, and was denied bail. Duplessie surrendered on May 27, while a third suspect remains at large.

The brutality of this case is shocking, but what is even more disturbing is the trend it reflects. According to Decrypt, both Woeltz and Duplessie were investors in the cryptocurrency field, familiar with blockchain technology, which enabled them to accurately target and plan complex kidnapping operations. Carturan's wallet was believed to hold Bitcoin worth millions of dollars, and the criminals tracked his wealth through social media and blockchain analysis. This "high-tech + violence" crime model is rapidly spreading globally.

The Paris Crisis of Crypto Executives

France has become a "disaster zone" for crypto kidnappings. In 2025, French police recorded at least seven kidnapping or attempted kidnapping cases targeting cryptocurrency holders or their families, with shocking levels of brutality. According to The Guardian, on January 21, Ledger co-founder David Balland and his wife were kidnapped by an armed gang at their home in Méreau, central France. The kidnappers severed one of Balland's fingers and sent a video to his business partner Eric Larchevêque, demanding a ransom of 10 million euros in cryptocurrency. French police deployed 230 officers for a rescue operation, and the next day, they rescued Balland from a property in Châteauroux, finding his wife in the trunk of an old van, bound but unharmed. Nine suspects were arrested, including a 26-year-old leader with a prior kidnapping record.

On May 13, a more audacious attempted kidnapping occurred on the streets of Paris. Pierre Noizat's daughter and two-year-old grandson were attacked by three masked men in the 11th arrondissement, who tried to drag them into a white van. According to Le Parisien, Noizat's daughter fought back fiercely, and a passerby used a fire extinguisher to smash the van, forcing the kidnappers to flee. The video went viral on X platform, raising widespread concerns about safety in the crypto community. KOL Cbb0fe stated on X that he abandoned plans to attend the 2025 Cannes ETHCC conference due to safety concerns, saying, "The risk-reward is absolutely terrible."

In early May, the 56-year-old father of another crypto marketing entrepreneur was kidnapped in Paris, with the kidnappers demanding a ransom of 5 to 7 million euros, also severing the victim's finger to apply pressure. French police tracked the victim through mobile signals and rescued him from a house in Palaiseau, a suburb of Paris, arresting four suspects aged 20 to 27. French Interior Minister Bruno Retailleau announced the provision of a priority police hotline and security training for crypto entrepreneurs in an attempt to curb this "unprecedented threat."

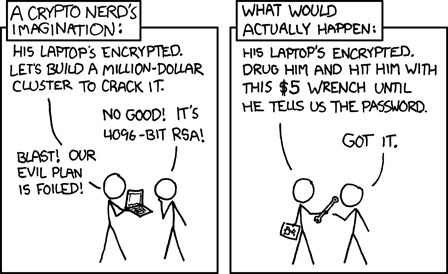

The Global Spread of "Wrench Attacks"

These cases are referred to in the industry as "wrench attacks," originating from an XKCD comic that satirizes the vulnerability of cryptocurrency's mathematical security in the face of physical violence. According to a report by Nefture Security, from 2022 to May 2025, there were at least 54 recorded cases of kidnapping, robbery, or home invasion targeting crypto holders globally, involving over $127.5 million, with the actual number likely higher. There were only 7 cases in 2022, which increased to 15 in 2024, and reached 15 in the first five months of 2025, indicating a sharp rise in this trend.

A case in Connecticut, USA, is particularly noteworthy. On August 25, 2024, Sushil and Radhika Chetal were attacked by six masked men while viewing a property in Danbury. Their son, Veer Chetal, was suspected of involvement in a $243 million Bitcoin theft, and the kidnappers were clearly targeting this. The assailants drove a white Honda Civic into the Chetal couple's Lamborghini and then dragged them into a truck. An off-duty FBI agent witnessed the incident, recorded the license plate, and called the police. The kidnappers crashed while fleeing, and police arrested most of the suspects, recovering some of the stolen Bitcoin.

In Australia, in May 2025, a crypto ATM was rammed and robbed in a shopping center in Melbourne, showing that criminals' targets have expanded to infrastructure. In 2024, a crypto event organizer in Las Vegas was kidnapped at home by armed assailants who forced him to transfer $4 million in cryptocurrency and NFTs; the victim was released in the desert but was left traumatized. In a 2022 case in South Africa, a trader was kidnapped and released after paying a $1 million Bitcoin ransom, highlighting how the irreversible nature of cryptocurrency facilitates criminals.

The Bizarre Deaths in the Crypto World: Accident or Conspiracy?

The dark side of cryptocurrency is not limited to kidnappings. In the second half of 2022, a series of bizarre deaths in the crypto world sparked widespread conspiracy theories. Russian billionaire Vyacheslav Taran died in a helicopter crash after taking off from Switzerland in December 2022; the accident occurred in good weather on the French-Italian border, with an experienced pilot, and another intended passenger canceling at the last minute. Tiantian Kullander, co-founder of Amber Group, died suddenly in his sleep in November of the same year at the age of 30, with the cause of death undisclosed. Nikolai Mushegian, co-founder of MakerDAO, drowned on a beach in Condado, Puerto Rico, having posted on X platform before his death that he was being targeted by the CIA and Mossad, although his family denied any connection between the tweet and his death. The suspicious circumstances surrounding these cases are unsettling: Taran's crash has been questioned as an assassination, Mushegian's tweet has been downplayed by his family, and Kullander's cause of death remains a mystery.

The 2023 murder case in Bali further deepened the atmosphere of conspiracy. 25-year-old Li Chiming and 22-year-old Cheng Jianan were found dead in a hotel in Indonesia, with police ruling it a "murder-suicide," but details such as the victims being found naked and the woman having fluid in her stomach raised questions. Rumors suggested that Li Chiming was involved in cryptocurrency trading, with assets of 200 million yuan, possibly making him a robbery target. A crypto community member, nnn, mourned Li Chiming on X platform, calling him a rising star in crypto trading, but the truth of the case remains unclear. These events have cast a shadow of unease over the crypto community: does the explosive growth of wealth come with a deadly curse?

In 2019, Gerald Cotten, the founder of Canadian exchange QuadrigaCX, died during a honeymoon trip in India due to complications from Crohn's disease, resulting in $190 million in cryptocurrency becoming inaccessible due to lost private keys. Clients questioned whether Cotten faked his death to escape responsibility, but no conclusive evidence has emerged. These bizarre events, along with kidnapping cases, form the "dark narrative" of cryptocurrency.

The Curse of Wealth: Why Are Crypto Holders Targets?

Why have cryptocurrency holders become prime targets for criminals? The answer lies in the unique properties of cryptocurrency. Assets like Bitcoin are stored in digital wallets, protected only by private keys or seed phrases, with transactions being irreversible and difficult to trace. Criminals identify targets through social media, blockchain analysis, or data leaks. For example, a 2020 data leak from Ledger exposed the addresses and account information of 270,000 users, and in 2024, Coinbase faced a data leak due to bribery of customer service, leading to hackers demanding a $20 million Bitcoin ransom. Michael Arrington, founder of TechCrunch, warned that mandatory KYC (Know Your Customer) policies could put high-net-worth users in danger, while former Coinbase CTO Balaji Srinivasan pointedly stated that KYC is "the root of security vulnerabilities."

The skyrocketing price of Bitcoin further heightens the risk. In 2025, Bitcoin surpassed $110,000, rising over 50% from 2024, creating a new class of wealthy individuals. Many investors flaunt their wealth on social media, inadvertently becoming targets. As French security expert Renaud Lifchitz stated on FRANCE 24, "When your wealth is stored in a digital wallet, and it only takes one key to transfer it, criminals only need a wrench to get it."

The Survival Path of the Crypto Industry

In the face of the wave of kidnappings, the cryptocurrency industry is taking action. In 2024, Coinbase paid $6.2 million for security expenses for CEO Brian Armstrong, exceeding the total of JPMorgan and Goldman Sachs combined. Private security companies like Infinite Risks International report a surge in demand for bodyguard services among crypto executives, with some high-net-worth individuals undergoing anti-kidnapping training to learn how to escape restraints or deal with violent threats.

The French government is providing priority police hotlines and security training for crypto entrepreneurs, and law enforcement personnel are receiving "anti-money laundering training for crypto assets." In 2025, the U.S. Department of Justice seized $2.5 million in crypto scam funds, demonstrating a focus on digital crime. Experts advise investors to avoid flaunting their wealth, use cold wallets to store assets, and adopt multi-signature wallets to diversify risk. A report from Nefture Security indicates that in 2025, small and medium investors also became targets, highlighting the urgent need for increased security awareness.

However, technological measures can only address part of the problem. The decentralized nature of cryptocurrency gives users complete control but also shifts the security responsibility onto individuals. As an anonymous crypto executive stated, "Your key is your wealth, but it is also your weakness." With Bitcoin prices continuing to rise, 2025 may become a peak year for "wrench attacks," and crypto holders must find a balance between wealth and security.

Conclusion: The Double-Edged Sword of Wealth and Crisis

From the chainsaw torture in Manhattan to the finger-severing threats in Paris, from the murder case in Bali to the mysterious plane crash deaths in the crypto world, the myth of getting rich through cryptocurrency is being overshadowed by a series of violent incidents. The decentralized dream of Bitcoin has brought financial freedom but has also made holders prey for criminals. In this game of wealth and crisis, the crypto community needs stronger security awareness, more comprehensive industry regulations, and protective policies. The brilliance of Bitcoin continues, but the undercurrents behind it remind us: the temptation of wealth may be more deadly than imagined.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。