The core factor that gives Bitcoin an absolute leading advantage in market share within the blockchain is: brand.

Written by: Huang Shiliang

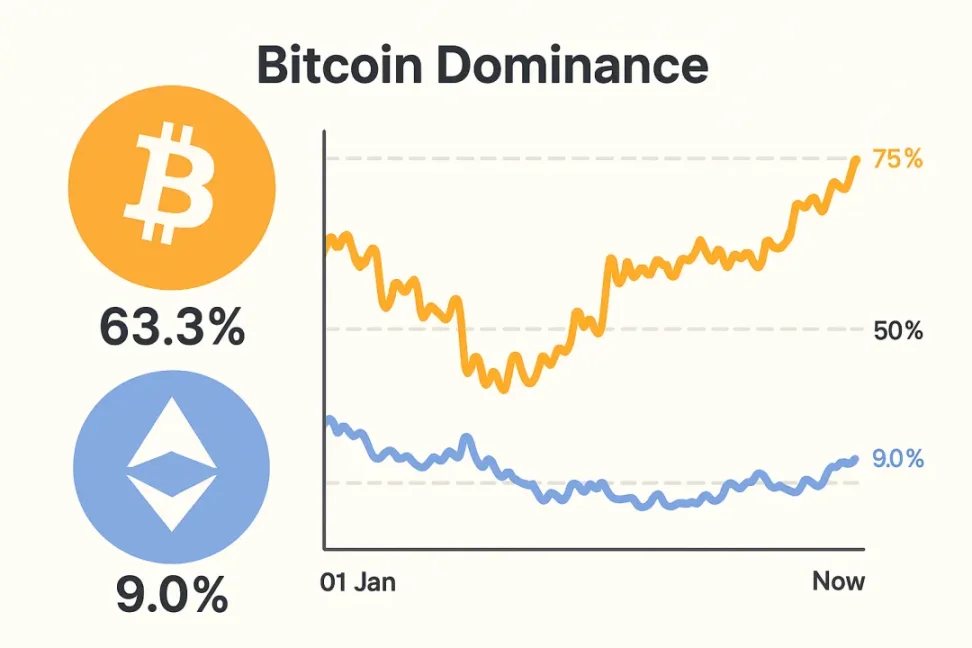

In the past year, Bitcoin's market share advantage in the cryptocurrency field has been expanding, and it has now reached a historical high of over 63%, the highest it has been in the past five years.

This number may be the biggest blow to ETH investors, rather than the ETH price itself. At least for me, it hit me hard enough that I could almost cry under the covers. If I had just laid flat five years ago, I wouldn't be in this situation today.

Since the ETH/BTC exchange rate dropped by 4%, I have been constantly asking myself, will this continue to fall? What should I do? Damn, it's really frustrating. I kept asking until it fell below 2%, completely speechless.

We need to seriously consider this question: Will Bitcoin's market share lead remain long-term? Should investing in cryptocurrencies just mean laying flat and letting BTC pull it up, without researching anything else?

I want to compare this with other industries to see if leading companies in other fields maintain dominance over the long term.

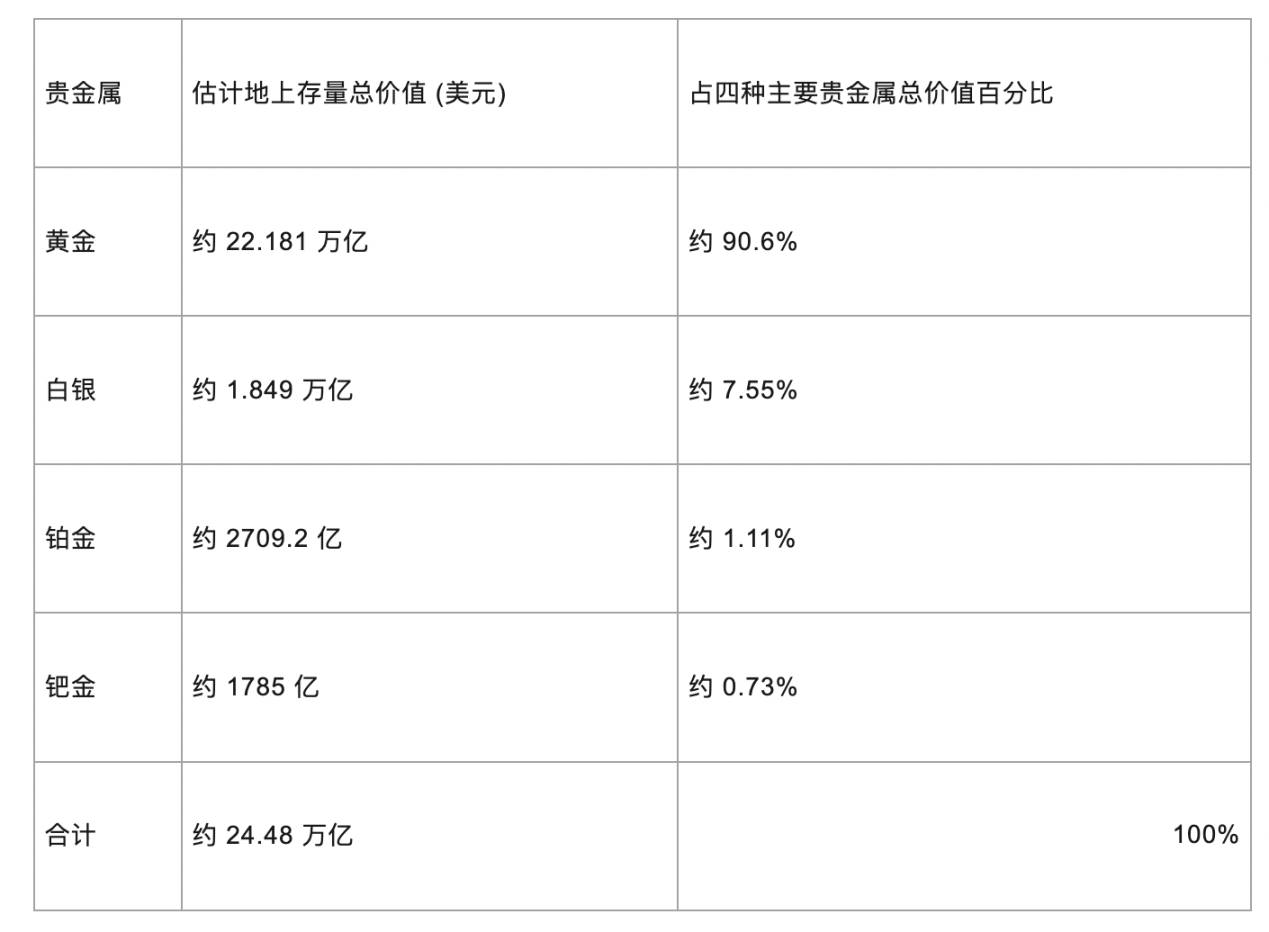

The most obvious comparison is gold. I had ChatGPT and Gemini research the market capitalization distribution of precious metals, as shown in the table below:

Table 1: Market Capitalization Distribution of Precious Metals

Gold's dominant market position mainly stems from its brand, which has been used as a currency and a means of value storage for thousands of years. The concept of brand has ingrained inherent imaginations in the human mind, creating a very high barrier.

I feel that Bitcoin is quite similar in this regard.

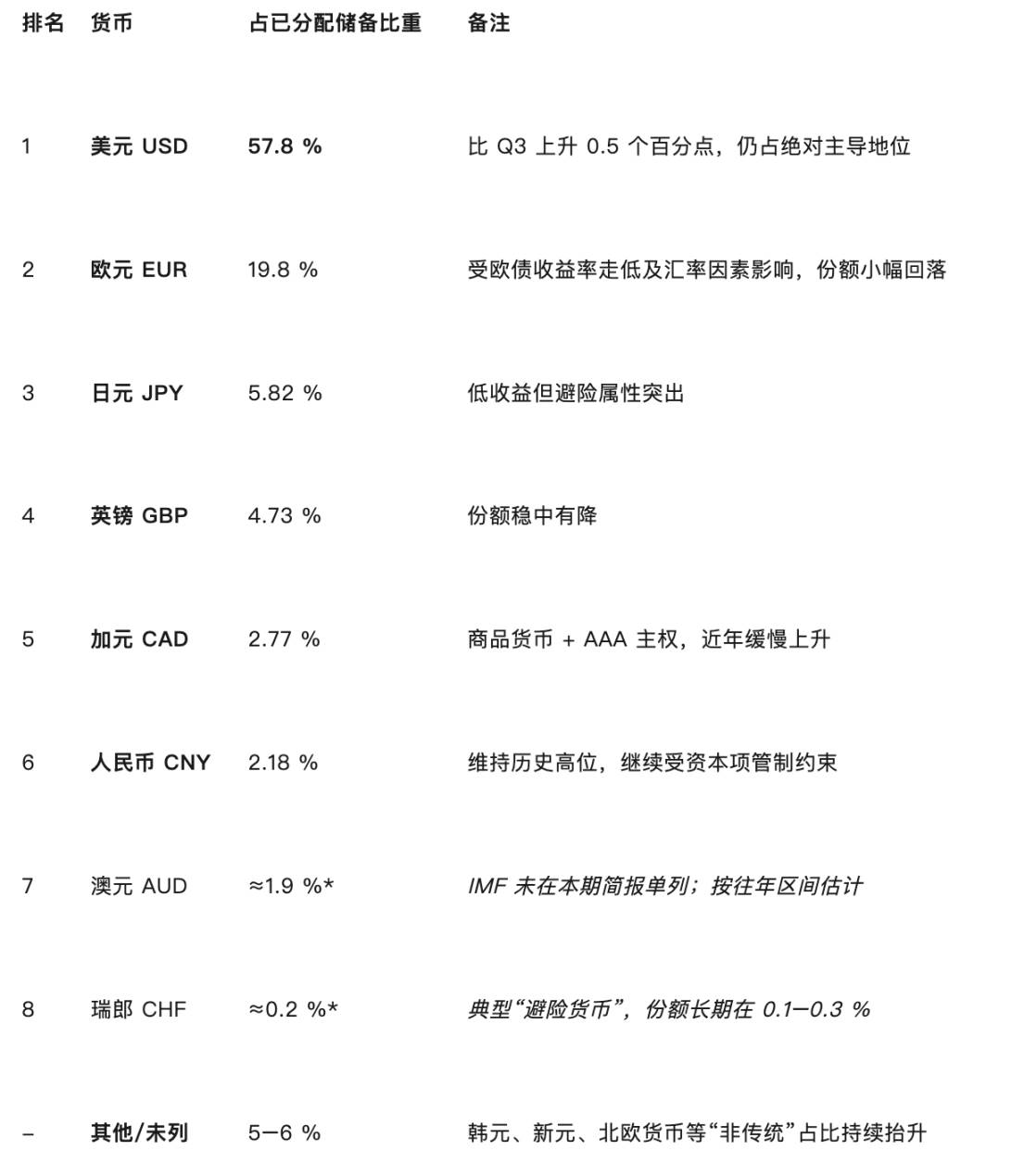

Another comparison worth considering is the proportion of various national fiat currencies in global foreign exchange reserves. ChatGPT and Gemini took on this task again.

Table 2: Global Foreign Exchange Reserve Currency Structure in Q4 2024

The US dollar holds an absolute monopoly position, primarily because the US is the world's largest economy, and the US Treasury market is irreplaceably deep. Major international trade, especially oil, is priced in dollars. Additional factors include the strength of US politics, culture, and the Federal Reserve.

However, the current trend may indicate a decline in the dollar's monopoly position, mainly due to challenges from the renminbi.

Compared to Bitcoin's market share in the cryptocurrency field, Bitcoin does not have the same advantages as the dollar; it has not created the most useful things in the blockchain world. Instead, the market's second-place player, Ethereum, is somewhat like the dollar, providing various infrastructures and use cases for the entire industry.

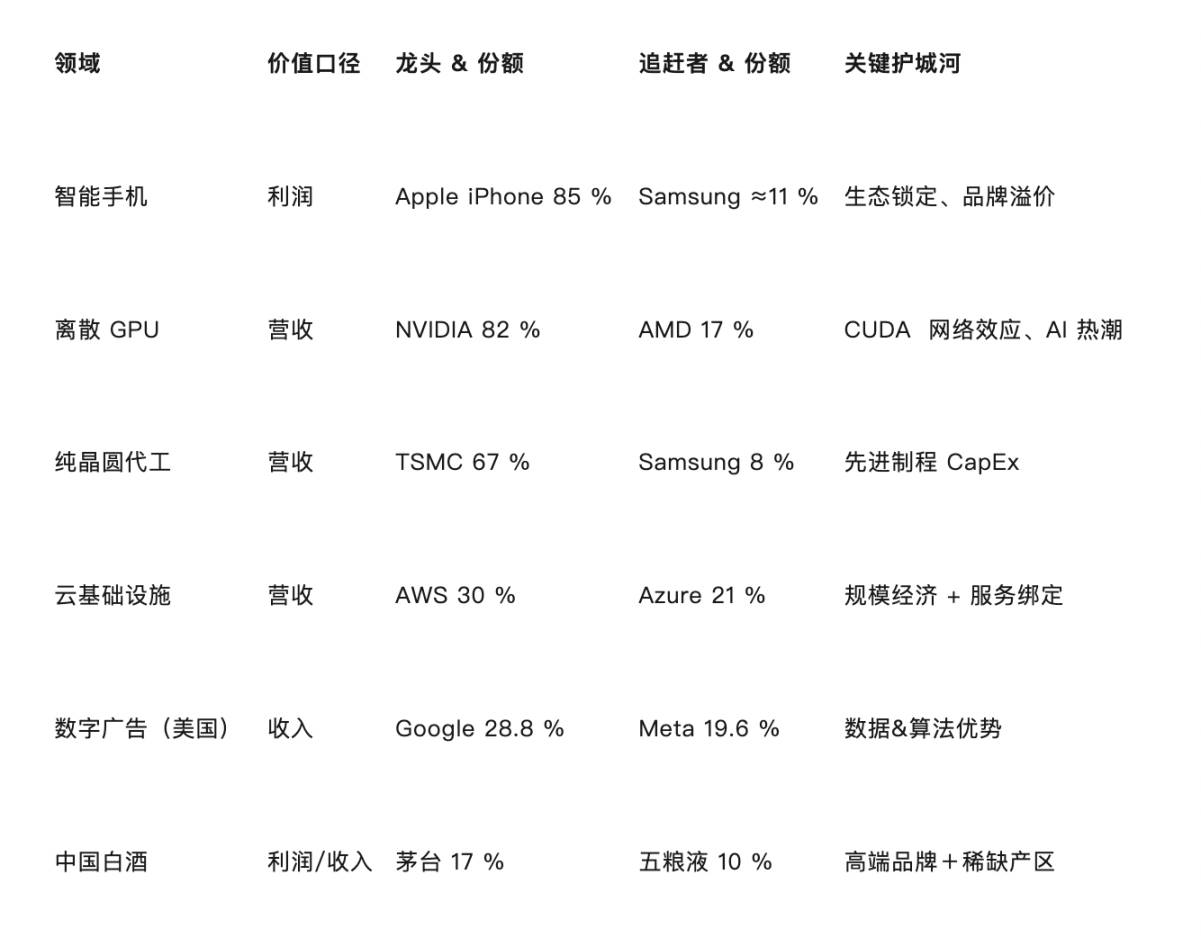

Now let's take a look at the situation of major well-known companies.

Please note that for effective comparison, I am using the share of "value captured" by the company, which is directly related to profitability, rather than market share (like user numbers) or stock market capitalization distribution.

Table 3: Profitability Share of Well-Known Companies Among Peers

From the above three categories of cases, we can summarize several mechanisms of value capture.

Brand and premium: iPhone, Moutai, gold, BTC are undoubtedly part of this.

Technical/capital barriers: NVIDIA, TSMC

Network effects: AWS, Google

Resource scarcity or sovereign backing: gold, US dollar (Bitcoin may relate to this)

Economies of scale: Amazon Web Services, TSMC foundry, NVIDIA GPUs

I believe the core factor that gives Bitcoin an absolute leading advantage in market share within the blockchain is: brand.

The ability of a brand to capture value in its industry allows the iPhone to capture 85%, and gold to capture 90%.

If competition among cryptocurrencies ultimately relies on brand, then Bitcoin's current market share of 63% is not high.

If that's the case, ETH holders really have something to cry about.

But can we believe that brand is the absolute core of coins and blockchain?

Shouldn't it be decentralization, network effects, user numbers, and the implementation of application scenarios?

I do not have a final answer yet.

But never underestimate the value of a brand.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。