It is expected that in the near future, USDT and/or USDC will top the list of US Treasury holders.

Written by: James Lavish

Translated by: Blockchain in Plain Language

An increasing number of voices now believe that "stablecoins are the future of crypto assets."

For instance, officials from the US Treasury, and possibly even central bankers.

But what exactly are stablecoins? Why are they so important? What problems do they solve for investors and the US Treasury?

Stablecoins in Plain Language

In simple terms, a stablecoin is a digital asset (crypto asset) designed to maintain a stable value.

How is this achieved?

By pegging its price to a reference asset, such as fiat currency, gold, or even a basket of assets.

The goal of stablecoin issuers is to combine the trading advantages of cryptocurrencies—fast settlement, programmability, and global accessibility—with the "price stability" of fiat currencies.

Before diving deeper, let's take a look at several types of stablecoins available in the market:

Fiat-backed stablecoins: Aim to maintain a 1:1 peg with a national currency (like the US dollar), commonly represented by USDT (Tether) and USDC (USD Coin).

Commodity-backed stablecoins: Pegged to physical assets, such as gold (for example, PAXG, which is backed by physical gold reserves).

Crypto-collateralized stablecoins: Backed by volatile cryptocurrencies as collateral, and use over-collateralization to manage price fluctuations.

Algorithmic stablecoins: Maintain price pegs through supply and demand algorithms rather than actual physical reserves. (For example, the 2022 failure of TerraUSD (UST) is a typical case of algorithmic stablecoin failure.)

Today, we will focus on dollar-pegged stablecoins and the initiatives surrounding them by the US Treasury and federal regulators.

Dollar-pegged stablecoins are primarily used as digital cash within crypto trading platforms and ecosystems. They play a critical role in trading, lending, decentralized finance (DeFi) applications, and cross-border payments.

Stablecoins like USDT and USDC are used by traders to transfer funds between exchanges or to temporarily hold assets during market uncertainty.

Unlike traditional banks, which are constrained by operating hours, liquidity limitations, and regulatory challenges, dollar stablecoins offer real-time settlement, global accessibility, and integration with smart contracts.

This makes them nearly indispensable in the 24/7 open crypto market.

But how reliable are they?

This leads to the issue of audits, which are used to verify the underlying assets of stablecoins.

Circle publicly discloses proof documents confirming that each USDC token is backed by 1:1 liquid dollar assets, including cash and short-term US Treasury securities. USDC is audited monthly by Grant Thornton LLP, making its transparency in the stablecoin space the gold standard.

Tether (USDT), on the other hand, has faced criticism for its lack of transparency and past contradictory information. Although it now publishes quarterly proofs and promises comprehensive audits, its reserves include less liquid assets like commercial paper. In 2021, Tether was fined $41 million by the US Commodity Futures Trading Commission (CFTC) for falsely representing its reserves. Nevertheless, USDT remains the largest stablecoin by trading volume globally, albeit with slightly higher reputational risk.

So, what happens when investors become concerned about the underlying assets and stability of stablecoins?

Stablecoins can "depeg," meaning they deviate from their pegged currency value.

For example, when Silicon Valley Bank collapsed, USDC dropped from $1 (its peg to the dollar) to $0.87, as investors worried about USDC's exposure at that bank.

USDC and the collapse of Silicon Valley Bank:

As of early March 2023, Circle had approximately $40 billion in USDC reserves.

Of that, $3.3 billion (about 8.25%) was held in cash deposits at Silicon Valley Bank.

When Silicon Valley Bank collapsed and was taken over by the Federal Deposit Insurance Corporation (FDIC), the market feared that Circle might not be able to access those funds immediately or fully.

This panic caused USDC to temporarily depeg, dropping to $0.87 on some exchanges, until the US government intervened to guarantee Silicon Valley Bank deposits, restoring it to $1.

For holders, this meant that if you held $100,000 in USDC, its value briefly dropped to $87,000 until the government intervened to guarantee deposits, at which point the peg was restored to $1.

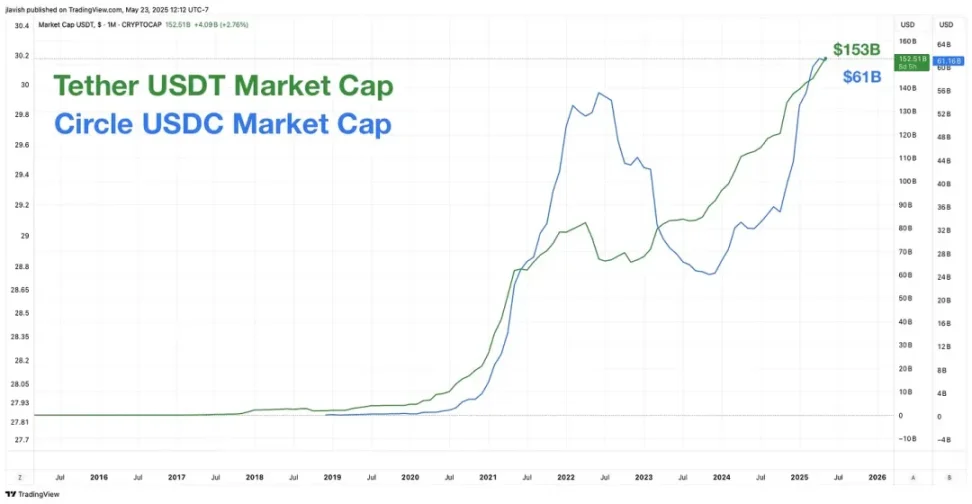

Since then, the stablecoin market has continued to thrive, with its importance and scale growing, and the total market capitalization of USDT and USDC now reaching $214 billion.

This has not gone unnoticed. With this growth, the US Treasury now views dollar stablecoins as a strategic extension of the dollar's influence.

In short, the Treasury needs stablecoins.

Why the US Treasury Needs Stablecoins

Simply put, stablecoins can facilitate the global use of the dollar, thereby driving demand for US Treasury securities.

Dollar-pegged stablecoins (like USDC and USDT) act as digital versions of the dollar, usable globally with just a smartphone and internet connection.

This extends the dollar's influence into regions without sound banking systems.

In fact, stablecoins serve as on-chain, permissionless dollars, enabling global users to store value, conduct cross-border transactions, and hedge against local currency risks.

This widespread demand reinforces the dollar's status as the world's reserve currency.

Circle CEO Jeremy Allaire has stated, "USDC does a better job of being the dollar overseas than many banks."

This is great; it helps the dollar be used globally, even benefiting populations in remote areas without bank accounts.

But how does this help the US Treasury?

The answer is simple.

To maintain a 1:1 peg, stablecoins must be backed by high-quality liquid assets. For most major issuers, this means primarily holding one specific type of security.

That's right, US Treasury securities.

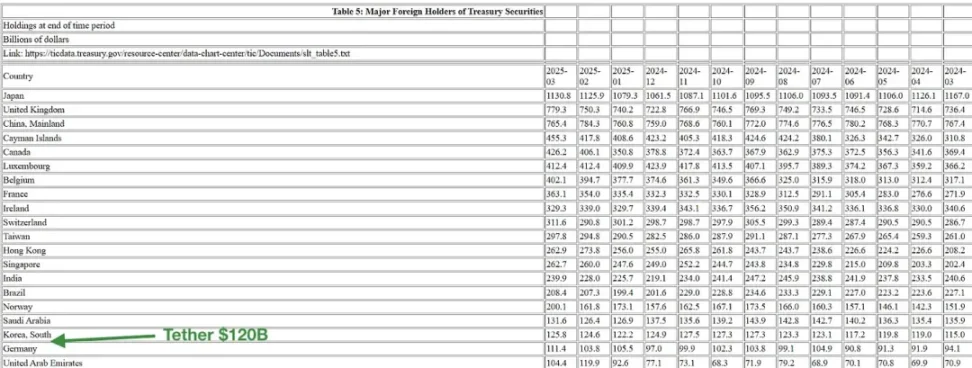

According to Tether's press release on May 1: "Tether… has reached a historic high in total exposure to US Treasuries, nearing $120 billion, including indirect Treasury exposure through money market funds and reverse repurchase agreements."

This places Tether among the top holders of US Treasuries:

In fact, Tether holds more Treasuries than Germany and the UAE. How did they reach this scale so quickly?

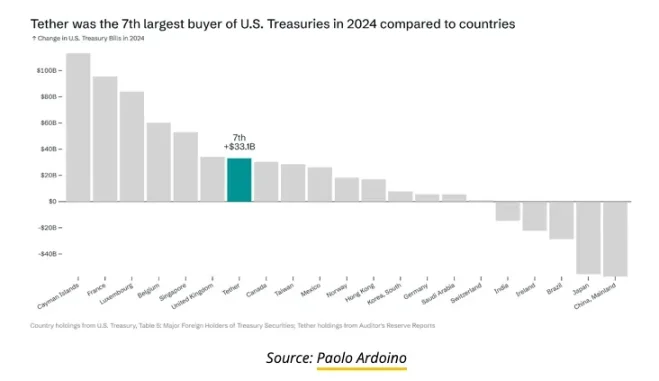

Last year, Tether was one of the top ten buyers of US Treasuries, increasing its holdings by $33.1 billion, becoming the seventh-largest net buyer, just behind the UK and ahead of Canada.

Don't forget USDC. Although its market capitalization is smaller, USDC reports that over 75% of its reserves are invested in US government debt with maturities of three months or less (short-term Treasuries), with the remainder held in cash at major banks.

The combined demand from these issuers is now comparable to that of some mid-sized sovereign nations.

In a world of rising deficits and increased Treasury issuance, this demand is a welcome "lifeline" for Washington.

This new demand for Treasuries from non-sovereign entities is reshaping the traditional debt market:

Stablecoin reserves act as a balance sheet in pursuit of yield, favoring investments in safe assets like short-term Treasuries.

Unlike traditional banks, these issuers are not bound by Basel capital requirements or deposit insurance rules that limit the size of their balance sheets.

For example, Tether reported a net profit of over $13 billion in 2024, primarily from interest on its Treasury investment portfolio (with only about 100 employees in the company).

While this demand is crucial for the US Treasury, which is selling large amounts of debt, it also brings concentration risks and raises questions about transparency, redemption processes, and systemic risks.

We have already seen this with USDC and the Silicon Valley Bank incident; although the peg quickly restored after federal intervention, the event showed that confidence can evaporate rapidly.

If a redemption run occurs with USDT or USDC, it could force the rapid liquidation of tens of billions of dollars in Treasuries. This would ripple through the global repo market and short-term financing instruments.

Therefore, regulators—from the Treasury to the Financial Stability Oversight Council—view stablecoins as not only a technological and financial innovation but also as emerging systemically important institutions.

By anchoring US Treasuries, stablecoins have become buyers and amplifiers of the dollar's dominance. In the process, they… uh, bind the full power of US fiscal and regulatory authority.

This leads us to the GENIUS Act.

The GENIUS Act: Washington Joins the Discussion

Recognizing that stablecoins are no longer a fringe crypto concept but a major player in global liquidity and debt markets, policymakers have intervened with what they call "responsible innovation."

This is the GENIUS Act.

The full name of the act is the "Guiding and Ensuring National Innovation for US Stablecoins Act," introduced by Senators Bill Hagerty (Republican - Tennessee) and Kirsten Gillibrand (Democrat - New York), as a bipartisan legislative proposal.

Some key provisions of the act include:

Federal licensing: Issuers with a circulation exceeding $10 billion must obtain federal licenses and be subject to regulation.

Full reserve backing: Stablecoins must be backed 1:1 by high-quality liquid assets (such as US Treasuries and cash).

Mandatory audits: Issuers must undergo regular independent audits and publicly disclose reserve data (Tether, you need to pay attention).

Dual-track regulation: Smaller issuers with a circulation of less than $10 billion can operate under state-level regulation, keeping the ecosystem open to startups.

CBDC alternative: The act explicitly supports private sector dollar stablecoins as an alternative to central bank digital currencies (CBDCs).

What is the current legislative progress of the act?

The GENIUS Act was passed by the US Senate last week (May 19) with a bipartisan vote of 66 to 32. However, not everyone is in support.

Senator Elizabeth Warren has become one of the most vocal and sharp critics of the bill, warning that the GENIUS Act may lack sufficient consumer protections and could disproportionately benefit private crypto interests.

Warren has long argued that if the US is to issue a digital dollar, it should be issued and controlled by the public sector, possibly in the form of a central bank digital currency (CBDC), to better ensure consumer protection, financial stability, and minimize environmental impact.

However, CBDCs grant the government and banks absolute monitoring and control over every penny you have, down to each transaction.

They even have the ability to deny any or all transactions, as well as freeze or seize all your funds.

In any case, I believe that CBDCs are unlikely to be created and used in the US in the short term.

Back to the GENIUS Act.

The bill will next be submitted to the House of Representatives for consideration. Although it received strong bipartisan support in the Senate, the path in the House seems more complex.

Some House Republicans have proposed competing versions of stablecoin legislation, with key disagreements surrounding state-level regulatory authority, the role of the Federal Reserve, and the allocation of control between federal and state agencies.

Meanwhile, some House Democrats, in agreement with Senator Warren, believe that the bill may favor crypto insiders and lack the necessary consumer protections to prevent abuse or systemic risks.

Therefore, despite the strong momentum of the GENIUS Act, it is far from a done deal. More debate, negotiation, and possible amendments are expected before it reaches the President's desk.

Washington is essentially saying: well, stablecoins have taken root—we urgently need them to support the future unlimited issuance of US Treasuries—but we will ensure they are safe, sound, and structured.

Summary

In any case, I also believe that stablecoins will exist in the long term, and the GENIUS Act will ultimately be signed into law, providing a structure for stablecoins—which will only further solidify their position on the list of US Treasury holders.

I expect that in the near future, USDT and/or USDC will top that list. The largest holders of US Treasuries in the world.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。