Most projects are evolving comprehensively towards application landing, compliance practices, and ecological linkage across multiple dimensions, balancing narrative imagination and practical feasibility.

Author: Nancy, PANews

As traditional financial giants increasingly "bring capital into the group," coupled with increasingly clear policy regulations, the RWA track is accelerating into the mainstream view. Assets that were once explored in small circles are now becoming a bastion of compliant innovation. Recently, a new wave of "compliance + imagination" has quietly emerged on-chain, with several projects labeled as RWA attracting market attention.

This article by PANews reviews seven recently active on-chain new forces under the RWA narrative, covering the Base, BNB Chain, and Solana ecosystems. Most projects are evolving comprehensively towards application landing, compliance practices, and ecological linkage across multiple dimensions, balancing narrative imagination and practical feasibility.

Keeta (KTA)

Keeta (KTA) is a Layer 1 network based on the Base network, connecting the global financial system, with built-in KYC real-name authentication, digital identity, on-chain foreign exchange (FX) mechanisms, and a flexible rules engine. The official claim is that it is the first blockchain network that can truly support compliant financial transactions globally. Keeta previously received $17 million in funding from former Google CEO Eric Schmidt, with a valuation of $75 million at the time of investment. CEO Ty Schenk was a partner at investment firm Steel Perlot and served as the director and CEO of LFG Payments.

According to GMGN data, as of May 26, KTA's market capitalization recently surpassed $910 million, with over 73,000 holding addresses.

BUILDon (B)

BUILDon (B) is a popular MEME coin deployed on the BNB Chain and is the main trading medium for the USD1 stablecoin backed by the Trump family. GMGN data shows that as of June 26, the market capitalization of $B once exceeded $460 million, setting a historical high, with over 25,000 holding addresses.

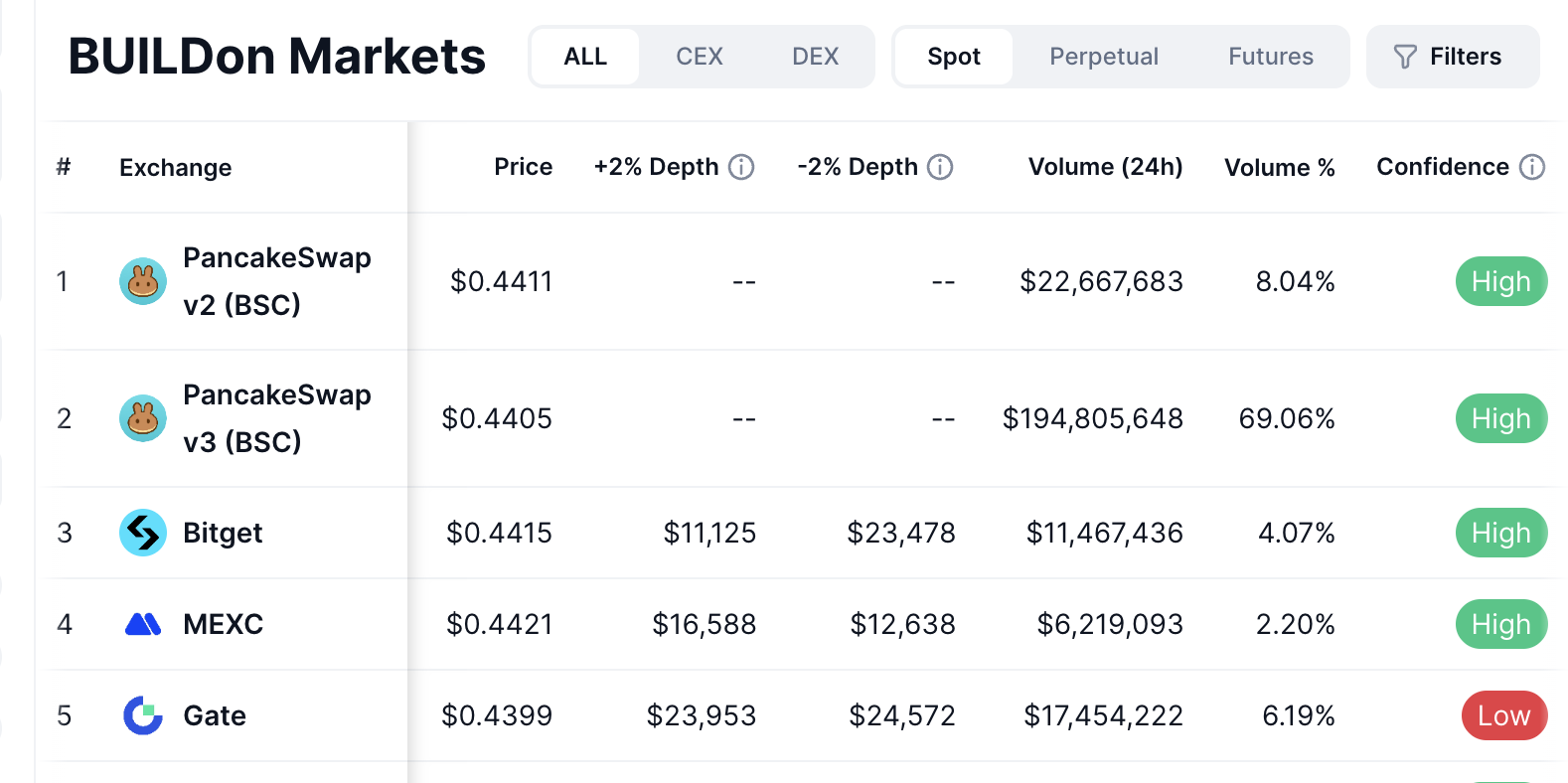

According to the latest data from DeFiLlama and CoinMarketCap, as of May 26, up to 98.88% of the USD1 issuance is concentrated on the BNB Chain. In the past 24 hours, among all trading pairs related to $B, the B/USD1 trading pair's transaction volume exceeded $190 million, accounting for 69.06%, highlighting $B's core position in the USD1 ecosystem.

Moreover, $B has received support from mainstream exchange Binance and has been successively launched on Binance's Alpha platform and contract trading section. Meanwhile, Binance announced that users withdrawing USD1 through the BNB Chain will enjoy zero fees, further stimulating trading activity of $B within the USD1 ecosystem. Notably, the Trump family's crypto project WLFI has recently officially purchased $B, marking the institution's first foray into MEME coin investment.

On the policy front, the U.S. GENIUS stablecoin bill has recently passed the Senate vote and is awaiting final approval from the House of Representatives and President Trump. Once the legislation is passed, it will lay a compliant foundation for the stablecoin market, bringing far-reaching impacts. According to a report by Citibank cited by The Block, Citi predicts that the market capitalization of stablecoins will reach $1.6 trillion by 2030 under a baseline scenario, and could reach $3.7 trillion under an optimistic scenario. If the regulatory framework is in place, stablecoin issuers may become one of the largest holders of U.S. Treasury bonds. For emerging dollar stablecoins like USD1, compliance support and ecological integration will unleash greater potential, possibly making its main trading medium $B more imaginative.

ALLO (RWA)

ALLO (RWA) aims to build the world's first tokenized securities exchange, providing 24/7 trading, ultra-low fees, and instant settlement, supported by institutions such as NGC Ventures, Morningstar Ventures, and Gate. According to official disclosures, Allo has achieved $2.2 billion in RWA tokenization, staked $50 million in Bitcoin, and launched a $100 million lending pool. Last year, ALLO was selected for the BNB Chain MVB8 acceleration program, and the token $RWA recently launched on Binance Alpha.

According to GMGN data, as of May 26, the market capitalization of $RWA recently broke through $200 million, with over 12,000 holding addresses.

Collaterize (COLLAT)

Collaterize is building an internet capital market based on the Solana network, aiming to create the largest RWA asset pool in the market, enabling access, trading, and management of all asset tokenization. The $COLLAT token aims to bring more individuals into the RWA tokenization process, allowing users to easily access a range of on-chain real assets. Collaterize co-founder Pierre previously worked at Microsoft and IOTA. Recently, Collaterize has received interactive support from Solana officials and co-founder Toly.

According to GMGN data, as of May 26, the market capitalization of $COLLAT has surged significantly since May, surpassing $91 million, with over 13,000 holding addresses.

Paraverse (PVS)

Paraverse (PVS) includes the decentralized cloud rendering ParaLab for XR and 3D assets and the Web3 trading platform ParaHere. Its utility token PVS is the core tool for payments, rewards, and governance within the ecosystem, allowing users to access high-performance cloud rendering services and earn staking rewards by holding PVS. The token officially launched on Solana in March this year. According to official disclosures, Paraverse has attracted over 1,000 corporate partners and more than 10,000 independent developers globally since 2016, with applications covering digital twins, education and training, medical rehabilitation, and virtual live streaming.

According to GMGN data, as of May 26, the market capitalization of PVS has surpassed $18 million, with over 7,600 holding addresses.

GitFish (Linux)

GitFish is an innovative platform based on Solana, aiming to tokenize and trade open-source code repositories on GitHub, allowing users to convert GitHub repositories into tradable tokens, with repository owners able to earn fees (such as swap fees) through trading. GitFish is incubated by Alliance DAO and has received support from Solana, Raydium, and Helius. The first project $Linux had its presale end in three days, attracting approximately $7.5 million in funding. However, Linux creator Linus Torvalds recently responded that he has not participated in any activities related to GitFish.

According to GMGN data, as of May 27, $Linux has seen a decline since its launch, with a current market capitalization of about $10 million, nearly halving from the private sale price of $2.3.

Convergent (CVGT)

According to official information, Convergent (CVGT) is an LSDFi protocol built on Solana, supported by Jito and Pyth Network. The protocol allows users to mint the stablecoin USV by over-collateralizing SOL, with an interest rate of 0%. The protocol will stake the user's collateralized SOL to Jito, allowing users to continuously earn staking rewards and returns while holding $USV. The minted $USV can be used to participate in DeFi applications within the Solana ecosystem. $CVGT is the governance token of Convergent, allowing holders to earn protocol revenue and vote on protocol parameters (such as emissions, fees, and collateralization rates). Convergent claims to have no presale, VC rounds, or seed unlocks.

According to GMGN data, as of May 26, CVGT's market capitalization recently surged to over $7 million, with more than 2,500 holding addresses.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。