TON does not provide a "get-rich-quick myth," but rather a Web3 imagination that is closer to real usage scenarios.

Author: Wayne_Zhang

Introduction

In the third quarter of 2024, the TON blockchain, leveraging the traffic entrance of Telegram, saw a rapid explosion of Tap-to-Earn mini-games, attracting hundreds of millions of users and creating a miracle of on-chain growth. Meanwhile, multiple TGE (Token Generation Events) of TON ecosystem projects also generated a strong wealth effect, making "TON / Telegram" a hot narrative center in Web3.

However, after the boom, TON is entering a cooling period that warrants caution. Similar to past Web3 narratives, will the aftermath of the bubble lead to consolidation or a return to zero? Is it a temporary pause in traffic, or is the value transformation yet to come?

At this juncture, we hope to reassess whether TON has the long-term potential to become a "super on-chain entrance" by using detailed data, ecological evolution paths, and technical stack layouts as entry points.

1. After the Tap-to-Earn Boom: The Cooling of TON's Popularity and Data Decline

According to the TON official website, TON (The Open Network) is a decentralized open internet aimed at bringing 500 million people on-chain, built using technology developed by the community through Telegram. Backed by the Web2 social platform Telegram, which has nearly 1 billion users, TON indeed has the potential to achieve its goal of bringing 500 million people into the on-chain world, and it achieved significant success in 2024:

Toncoin (TON Token) reached a market cap of over $25B, ranking in the Top 10 of crypto assets by market cap [1];

The Tap-to-Earn mini-game Hamster Kombat officially disclosed that it attracted over 300 million users [2];

The TON Blockchain saw a peak of over 700k+ new addresses per day, with daily active addresses exceeding 1.657M [3];

Several Telegram mini-game assets exceeded a market cap of $500M, and the on-chain DeFi TVL surged by over 5,500% in 2024 ……

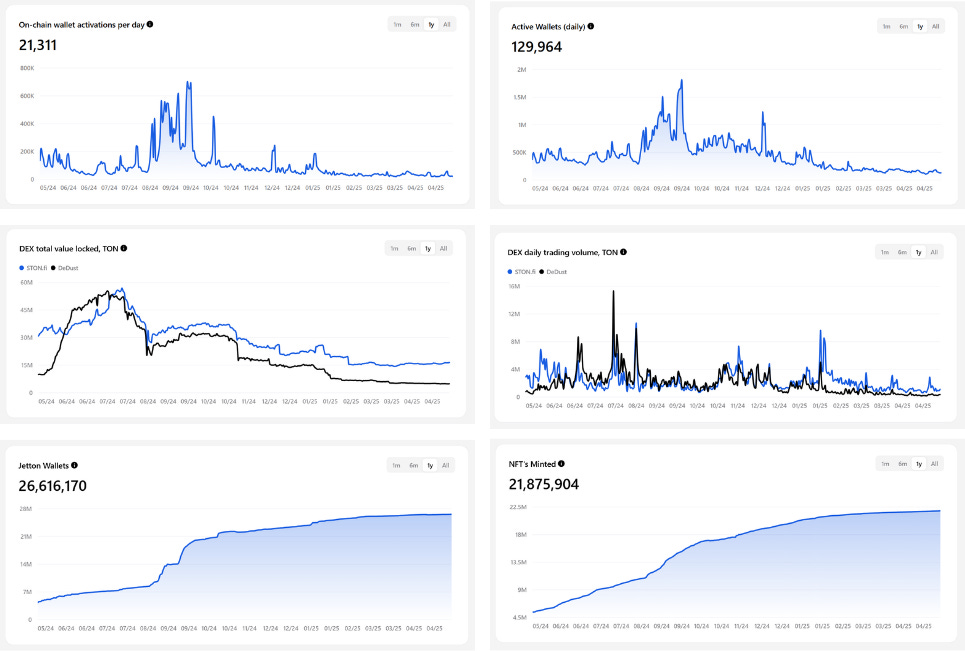

The dual miracles of traffic and wealth made TON one of the absolute focal points of Web3 narratives in 2024. However, similar to previous Web3 booms, short-term explosions are often accompanied by data declines. The TON ecosystem is currently experiencing a phase of "narrative cooling": as shown in Chart 1, whether it is the number of new wallets per day, active addresses, or the TVL and trading volume of core DEXs (Stone.fi and Dedust), all have significantly declined from their peak. Although there have been some short-term spikes, most were temporary rebounds driven by specific projects; looking at the annual trend, many indicators have returned to levels seen before the narrative launch.

However, not all signals are pessimistic. The number of Jetton Wallets (non-zero balance wallets) continues to rise steadily, indicating that the accumulation of basic users is still ongoing, albeit at a noticeably slower growth rate. Meanwhile, the number of NFT mints also continues to grow, suggesting that the on-chain application ecosystem is still being actively promoted.

Chart 1: TON Ecosystem Data Chart, Source: Ton Stat, 2025.05.20

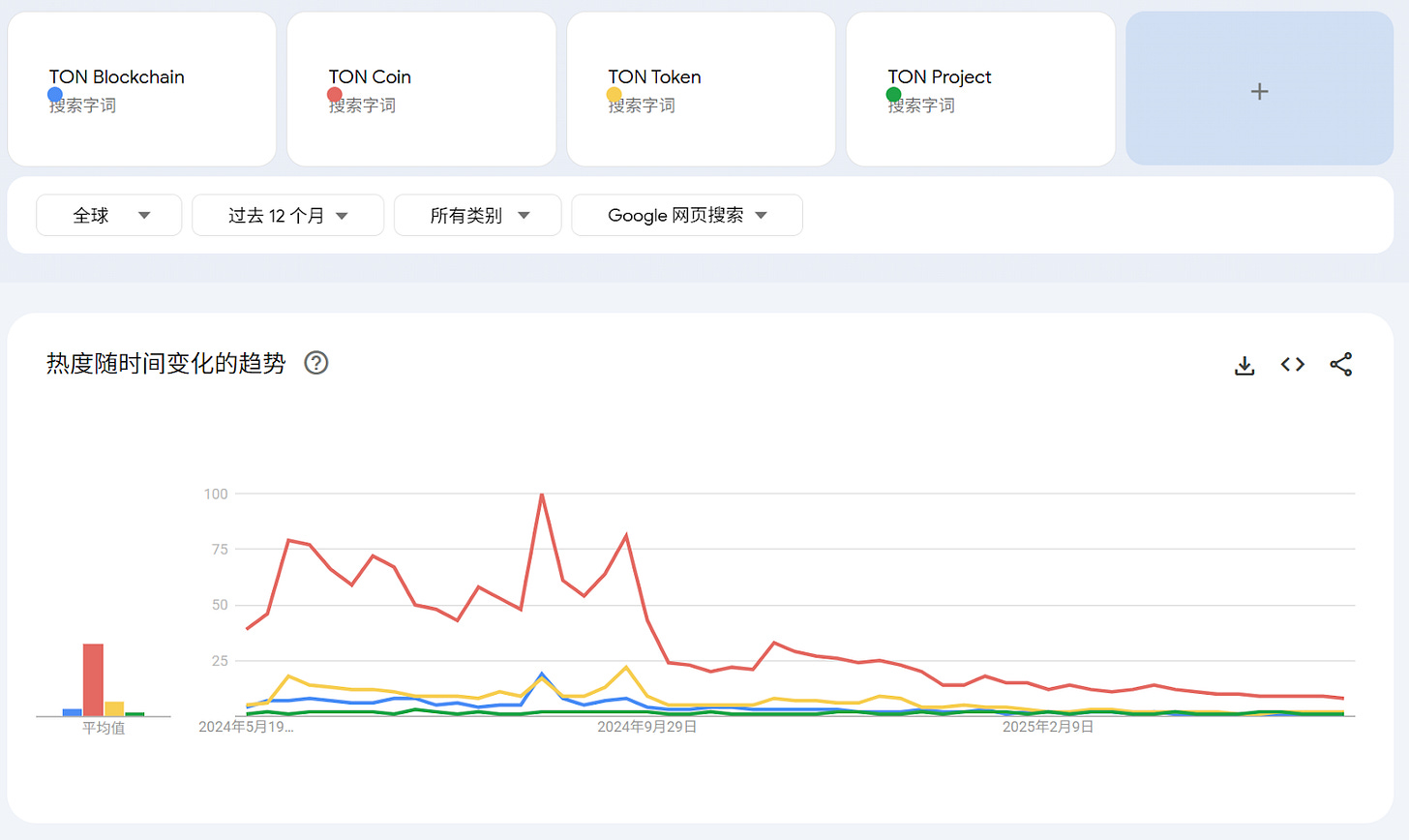

On the other hand, from the keyword trends on Google Trends, the overall search popularity of TON is also gradually declining, especially the attention to the ecosystem itself has decreased significantly, while the market's focus on Token prices remains stronger.

Chart 2: TON Keyword Browser Search Popularity, Source: Google Trends, 2025.05.21

However, a decline in data does not necessarily mean the end of the narrative. Similar examples are not uncommon: Bitcoin once experienced on-chain overload due to the inscription craze, but ultimately activity returned to a relatively stable level; Solana and Base, after experiencing a data halving, welcomed a user influx again and reached new highs with technical optimizations and ecological advancements.

Chart 3: Changes in On-Chain Data Trends for Solana and Base, Source: Artemis, 2025.05.22

Does TON also have the ability to complete a deep transformation from traffic to value after the boom subsides? Is it a brief dormancy, or will it become a "narrative relic"? The answer ultimately depends on actions. In the following content, we will analyze the changes quietly occurring in TON "after the tide recedes" from aspects such as organizational strategy, ecological construction, technological upgrades, and narrative transformation.

2. Major Moves: Team Restructuring, Compliance and New Markets, Infrastructure Development

Since its launch on Binance in August 2024, TON's narrative has entered a new phase. On the surface, the heat has cooled, but in reality, it is a period of accelerated layout: including team restructuring, regulatory compliance exploration, deep binding with Telegram, technical stack expansion, and developer incentives and capital injection aimed at the global market.

2.1 Leadership Changes and Compliance Efforts: TON Accelerates Its Path to Mainstream Adoption

At the beginning of 2025, personnel adjustments within the TON Foundation sent a clear signal: globalization and compliance will become the core strategic direction for the coming years.

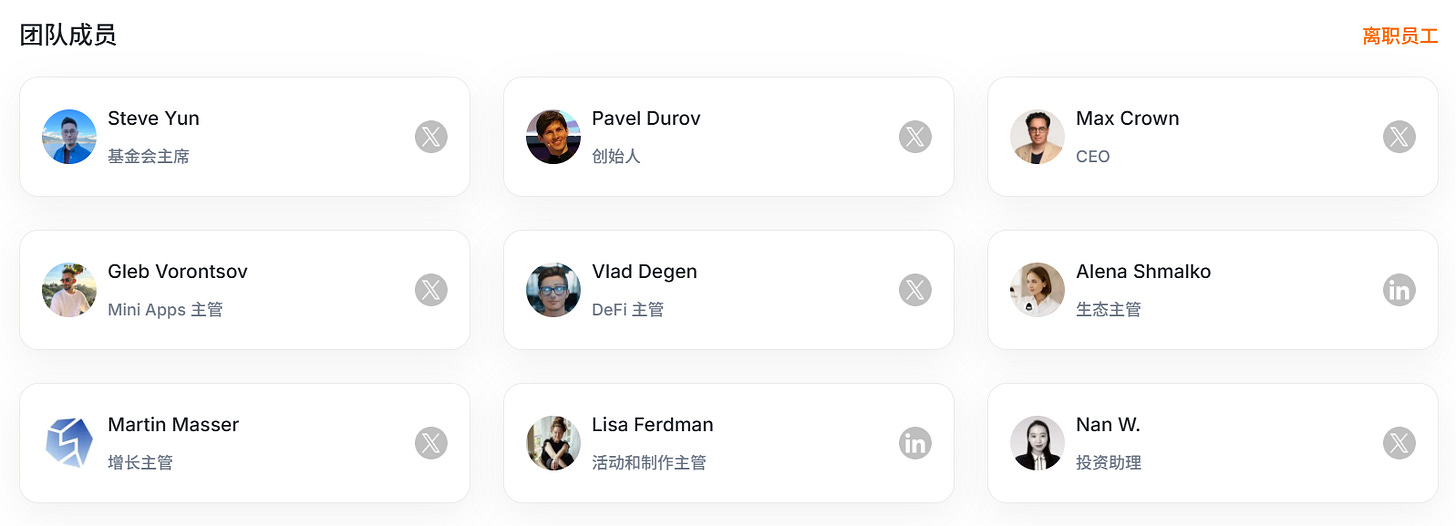

On January 15, former board member and founder of Kingsway Capital, Manuel Stotz, was appointed as the new president of the TON Foundation. Kingsway is a well-established investment firm managing billions of dollars in assets for U.S. investors, and Stotz's background brings a strong "traditional capital market" signal to TON. According to the official announcement, he will work alongside the former president and current board member Steve Yun to promote TON's international expansion, with a focus on the U.S. market—an active but highly regulated region seen as a key battleground in TON's strategy.

On April 24, the TON Foundation further appointed Maximilian Crown, co-founder of MoonPay, as CEO. MoonPay is a leading global crypto payment infrastructure company that has obtained compliance licenses in multiple jurisdictions, including the U.S., Australia, and the Netherlands. Crown has extensive global operational experience and compliance handling capabilities, and his appointment is widely viewed as a significant step for TON to formally embrace regulation and move towards global mainstream adoption [4].

Chart 4: Current Core Team Members of TON, Source: RootData

It is worth noting that Pavel Durov, the founder of Telegram and an early promoter of the TON blockchain, was briefly detained in August 2024 due to Telegram's alleged regulatory violations, returning to the public eye only in March 2025. Although the incident has not reached a conclusion, its timing coincides closely with the strategic adjustments of the TON Foundation, which may have indirectly prompted the team to place greater emphasis on regulatory issues, clearing obstacles for subsequent globalization efforts.

Recently, the TON Foundation has been actively communicating with U.S. regulatory agencies. According to the TON ecosystem report, the TON self-custody wallet is scheduled to launch in the U.S. in the second quarter of 2025 [5]. In March 2025, the TON Foundation disclosed that U.S. venture capital firms such as Sequoia Capital, Ribbit, and Benchmark hold over $400 million in Toncoin [6]. This can also be seen as significant evidence of TON's transformation towards compliance and globalization.

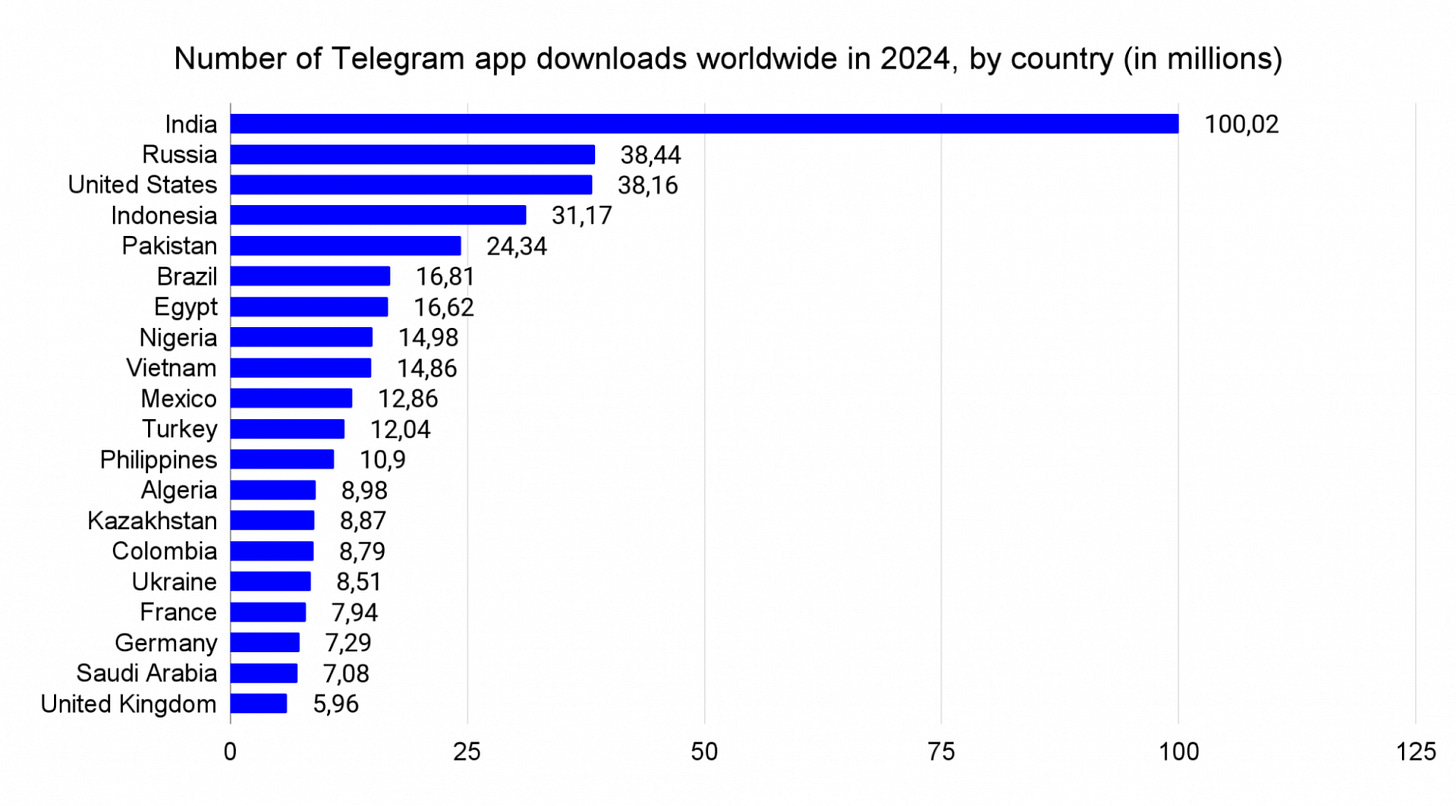

From the global distribution of Telegram users (Chart 5), if TON hopes to convert them into Web3 users, it must meet the regulatory requirements for crypto assets in various countries. Otherwise, it will not only struggle to implement applications in key markets but may also pose potential legal and business risks to Telegram itself.

In fact, the global expansion of the TON wallet has already begun. Since November 2023, TON has initiated phased promotions in several African countries, subsequently expanding to the Middle East, Europe, and multiple markets in the Asia-Pacific region, paving the way for future global compliance.

Chart 5: Telegram Download Volume by Country in 2024, Source: CPA.RIP

2.2 TON × Telegram: Deep Integration, Binding Ecological Entry

In January 2025, Telegram officially designated TON as the sole blockchain infrastructure for its evolving mini-application ecosystem, with the core being the use of the TON Connect protocol to seamlessly connect Telegram mini-apps with blockchain wallets, thereby simplifying user interactions with decentralized applications within the messaging app. This exclusive protocol establishes TON as the actual blockchain layer for Telegram's nearly 1 billion users. This positions TON to potentially become the "WeChat Pay of Web3," fully leveraging Telegram's massive network effects.

In terms of the payment system, Telegram has committed to exclusively accepting Toncoin as a non-legal tender payment currency within its ecosystem, applicable to scenarios including Telegram Stars, Premium memberships, the advertising system (Telegram Ads), and payment gateway services (Telegram Gateway). Developers and channel operators can directly receive income through Toncoin, initially establishing an internal payment and revenue distribution system based on Toncoin.

At the same time, payment service provider RedotPay has supported Toncoin and USDt (the USDT version on the TON chain), integrating with mainstream payment methods such as Apple Pay, Google Pay, and Alipay, which can be used at over 130 million offline merchants worldwide, further expanding TON's payment capabilities in the real world.

The TON Space wallet has also recently introduced the ability to pay transaction fees using Telegram Stars, which is essentially a form of crypto "abstraction" solution, allowing users to complete transactions without needing to understand complex on-chain operations. This approach differs from traditional chain abstraction solutions, relying not only on massive entry traffic but also promoting the transformation of on-chain applications towards "lifestyle" and "normalization." According to official plans, starting in the second quarter of 2025, U.S. users will be able to directly experience TON wallet services within Telegram, further bridging Web2 consumption scenarios with on-chain asset management [7].

2.3 Ecosystem: From Mini-Game Craze to Diversified Track Expansion

The first wave of the TON ecosystem boom was primarily driven by mini-games. Under the combination of "airdrop incentives + easy to get started," users quickly flocked in. For example, the airdropped game "Hamster Kombat," which peaked at 300 million monthly active users in July 2024, saw its active users drop to only 52 million by November, resulting in an over 86% user loss in just a few months [8]. While simple and replicable game mechanics can create a "growth illusion" in the short term, they struggle to achieve long-term user retention and expose the homogenization issues in the early stages of the ecosystem.

In response to this situation, TON is focusing on expanding its builder ecosystem while accelerating infrastructure development. In April 2025, TON announced a strategic partnership with Chinese gaming giant KingNet (which has over 100 million users) and held its first large-scale game developer conference in Asia, attracting dozens of studios from the WeChat ecosystem to explore how to build Web3 applications based on Telegram and TON.

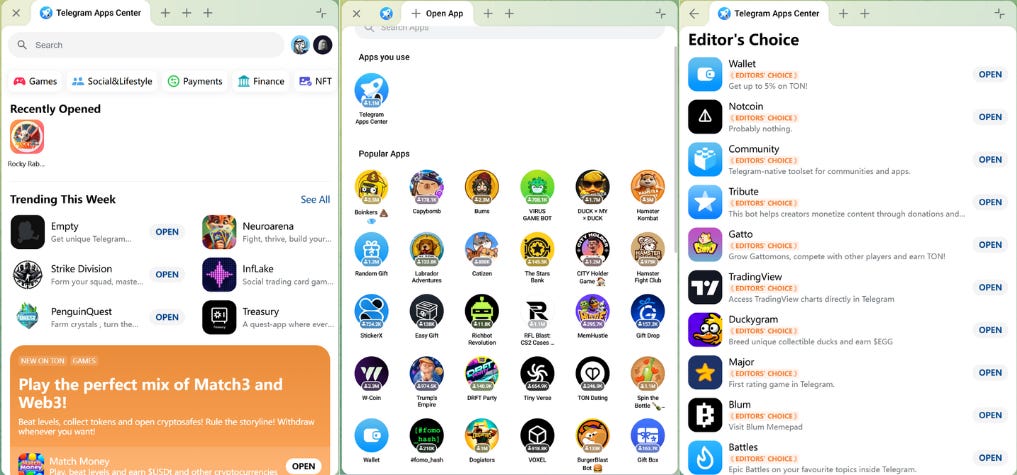

With the launch of the Telegram App Center feature, users can directly explore integrated third-party applications within the platform. An increasing number of TON ecosystem applications are making it onto recommendation lists, no longer limited to gaming categories but also including social, payment, DeFi, NFT, and other dimensions, marking the initial expansion of its application ecosystem.

Chart 6: Screenshot of the Telegram App Center Application Interface, Source: Telegram Product Page Screenshot

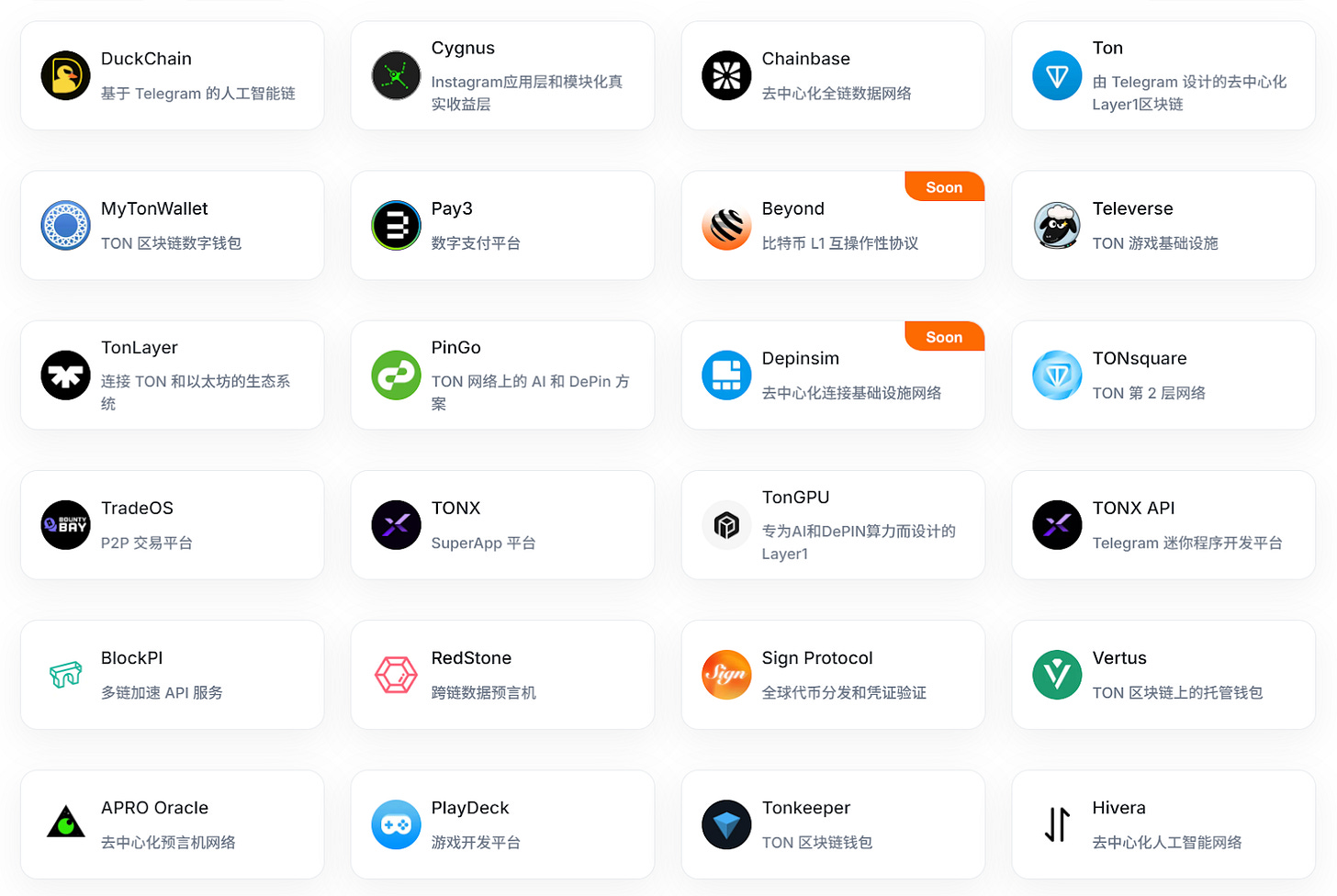

According to data from RootData, among the 187 TON projects recorded, about 14% focus on infrastructure. In addition to underlying services such as oracles and wallets, there are also development assistance platforms like TONXAPI and Play Deck, which lower the technical barriers for new builders and accelerate the sustainable development of the ecosystem.

Chart 7: Basic Projects of the TON Ecosystem (Partial), Source: RootData

Beyond gaming, the TON ecosystem is expanding into multiple new narrative tracks, including PayFi, RWA (to be detailed later), as well as applications in AI, contract trading (Perp DEX), DePIN, and more. For example:

Jointly launched a TON perpetual contract DEX incentive program with GMX;

Launched a bounty program with the AI Agent operating system ElizaOS;

Collaborated with aggregator protocol Jupiter to promote the development of TON ecosystem aggregators……

The ecological potential has also attracted positive responses from institutional funding. In September 2024, Foresight Ventures and Bitget invested $30 million in TON, and the following month, Gate.io announced an additional investment of $10 million to promote Telegram application development [9]. At the beginning of 2025, former TON Foundation president Steve Yun launched a venture capital fund, TVM Ventures, with an initial scale of $100 million, focusing on supporting DeFi, PayFi, and underlying infrastructure projects, further strengthening TON's developer appeal and ecological moat.

2.4 Technical Upgrades: Advancements in High Performance and Scalability

According to the roadmap released by TON for the first half of 2025, the core goals of its technical iteration are to alleviate congestion, enhance scalability, and improve stability. This round of updates covers four major directions, reflecting TON's evolution towards a "high-load, high-frequency application blockchain":

1. Accelerator Mainnet Upgrade

This is the most significant architectural upgrade since TON's establishment, aiming to achieve an "Infinite Sharding" mechanism and significantly enhance the network's stability and scalability. Key improvements include:

Shard chain tracking optimization: Nodes will only need to track the main chain and its associated specific shard chains, rather than tracking all shard chains, which will significantly reduce resource consumption and improve node processing performance.

Separation of validator functions: TON will subdivide the originally unified validator role into "Collators" and "Validators," improving overall verification efficiency through task parallel processing.

These improvements will help the TON network maintain stable block generation speed and transaction processing capacity under high load while reducing reliance on hardware.

2. Layer 2 Payment Network

TON plans to launch a Layer 2 payment network similar to the Bitcoin Lightning Network, focusing on instant transactions and extremely low-cost asset exchange experiences. Currently, this network is in the testing phase and will support various token assets, including Jetton, suitable for high-frequency trading, mini-game payments, and other scenarios. The implementation of this solution is expected to further enhance TON's actual usage in daily user payments and the gaming ecosystem.

3. BTC Teleport Cross-Chain Bridging (Already Implemented)

BTC Teleport is a mechanism designed to enable cross-chain asset transfers between TON and the Bitcoin network. This mechanism simplifies the cross-chain interaction process through a peer-to-peer bridging method, significantly lowering the user entry barrier and costs. This will enhance the interoperability between TON and mainstream public chains, paving the way for its expansion in DeFi, asset management, and other scenarios.

4. Optimization and Upgrade of Technical Tools

To improve the operational efficiency of validators and the security of the system, TON has launched features including MyTonCtrl backup and recovery, a validator Telegram notification bot, and a web dashboard, and plans to strengthen the incentive and penalty mechanisms for validators. For example, nodes that fail to successfully produce blocks within designated rounds will face more severe penalties. Additionally, a new version of TON Proxy is under development, aimed at enhancing DDoS attack protection capabilities, further ensuring the network's stability and security. Furthermore, TON's official API interface will also add features such as operation simulation, querying pending transactions, and domain name management [10].

The DOGS airdrop event in August 2024 served as a "stress test" for the TON tech stack. At that time, the network experienced a 3-hour interruption due to overload and validator consensus loss, exposing architectural bottlenecks under extreme concurrency. The ongoing 2025 roadmap is a direct technical response to this event. A series of measures, including mainnet architecture reconstruction (Accelerator), Layer 2 network testing, and cross-chain bridge deployment, signify that TON is transforming from a "high TPS showcase chain" to a truly scalable and resilient general Layer 1.

TON's technical direction does not pursue "lowest fees" or "single transaction speed limits," but rather supports diverse scenarios through a modular structure—especially high-frequency interactions around payments, gaming, social, and light financial applications. In the future, in addition to the payment-focused Layer 2 network, multiple functional dedicated Layer 2s may emerge to build exclusive operational channels for different applications, achieving highly adaptable on-chain architecture expansion.

3. Financial Narrative Reconstruction: Extending from DeFi to PayFi and RWA

3.1 From Trading Heat to Asset Depth: TON DeFi's Ecological Supplement

Although TON ranks among the top public chains in terms of on-chain active addresses and transaction frequency, the depth of its DeFi ecosystem still falls short of this traffic level. According to DeFiLlama data, as of now, TON's TVL is only about $115 million, ranking 36th among mainstream public chains. This "high activity - low lock-up" contrast has raised some market skepticism: "Is TON just another gathering place for 'haircutters'?"

The emergence of this situation has its objective background: the TON ecosystem has experienced explosive growth, while DeFi, as a type of "slow work" infrastructure, finds it challenging to quickly fill the product chain and operational loop in a short time. On one hand, developers need time to build high-quality contracts and protocols; on the other hand, most of TON's early DeFi applications continued the traditional web interaction logic, failing to achieve efficient collaboration with the Telegram mini-program ecosystem. As a result, during the initial wave, centralized exchanges (CEX) benefited the most, attracting a large number of new user registrations and transactions.

To address this shortcoming, the TON team has begun to systematically improve the DeFi ecosystem and fully showcased its DeFi module layout at the Hong Kong Web3 event in April 2025.

Chart 8: Current Status of the TON DeFi Ecosystem, Source: Youtube

In the T1 layer, the core DeFi functions include cross-chain bridges, collateralized stablecoin CDPs, AMM protocols, lending, and liquid staking (LSD). These are the foundations for building more complex financial products. Based on this, TON is promoting the development of more advanced applications, including yield farming, derivatives, options, yield tokenization, vaults, and launch platforms:

STON.fi launched Omniston, a decentralized liquidity aggregation protocol aimed at simplifying liquidity management within the ecosystem;

The decentralized perpetual contract trading platform Storm Trade continued to grow in 2025, peaking at TVL in February;

The yield tokenization protocol FIVA reached a TVL of $1 million within days of its launch, achieving a trading volume of $28 million…

In addition to the core DeFi applications mentioned above, TON is also continuously integrating more important DeFi partners, among which the most representative are Tether and Ethena, two major stablecoin issuers.

USDT issued by Tether was officially deployed on the TON chain in April 2024 and has seen rapid growth. Within just five months of its launch, the circulating supply of USDT surpassed $1 billion. This stablecoin has been integrated into the Telegram app for direct transfers and is widely used in payment scenarios for Telegram mini-apps and Web3 services, including creator tips, digital service fee settlements, content monetization, and more, further enriching TON's payment ecosystem.

At the same time, TON is also advancing cooperation with Ethena to integrate its synthetic dollar asset USDe, which has a TVL of over $6 billion. Through this integration, TON plans to introduce stable dollar savings and yield acquisition channels to Telegram's extensive user base, especially benefiting users in markets where it is difficult to conveniently access dollar assets. This initiative not only strengthens TON's strategic position in the stablecoin ecosystem but also injects more long-term valuable financial infrastructure into its DeFi system.

3.2 PayFi and RWA: Connecting On-Chain Yields to Real-World Value

At the TON Day event, the official team systematically proposed a "dual-driven" financial application architecture for the first time, showcasing its on-chain financial design built around the Telegram mini-program ecosystem. The overall structure is divided into three layers:

Core DeFi Layer: Includes various DeFi infrastructures and protocols that have been continuously improved, emphasizing technical performance and compliance frameworks;

Real Yield Layer: Provides sustainable yield support for upper-layer applications through stablecoins, RWA yields, and staked asset pools;

Retail TMA Layer: Utilizing the Telegram mini-program ecosystem, it builds user-side products including PayFi wallets, on-chain savings, yield games, and swap aggregators, which are key paths to activate a large number of Web2 users.

Chart 9: Telegram Mini-Program Application Layer, Source: Youtube

In this architecture, PayFi and RWA have become the two new narrative mainlines with the most strategic value for TON. Around them, TON is gradually establishing a multi-layer yield承接 network that encompasses both on-chain and off-chain.

Bottom Layer: By integrating off-chain real financial assets through mechanisms like the Telegram Bond Fund (a $500 million RWA asset pool), this layer provides verifiable and quantifiable sources of real yield for the entire system. This layer is a key pivot for TON's attempt to "chain-reform" traditional financial product logic.

Middle Layer: Through protocols like Ethena's USDe synthetic dollar and Yield Tokenization, these underlying yields are split, combined, and redistributed to form programmable interest rate anchoring tools. This mechanism not only enhances asset liquidity but also makes "yields" themselves combinable and usable across protocols, becoming the "interest rate cornerstone" of the TON financial ecosystem.

Top Layer: Front-end products are built based on high-frequency interaction scenarios in Telegram, presenting on-chain financial capabilities to end users in a familiar way. Through interfaces like Wallet Earn and Banking mini-programs, users can directly receive USDT rewards, participate in savings, or make financial allocations without needing to understand complex concepts like synthetic stablecoins, staking pools, or RWA assets, thus completing a natural transition from Web2 users to on-chain financial users.

Taking PayFi as an example, it is not only an extension of the Telegram wallet's functionality but also an interactive hub connecting "daily payments + on-chain wealth management." Users can use the Tap & Pay feature provided by Oobit to make real-time payments with USDt at over 100 million retailers worldwide; at the same time, they can receive USDT rewards and participate in yield management through Wallet Earn. Throughout this process, users can complete the on-chain wealth management experience without needing to understand terms like smart contracts, asset anchoring, or off-chain mapping. This design of "light experience + high financiality" is naturally converting Telegram users into Web3 financial users.

In the direction of RWA, TON is attempting to build underlying infrastructure for "on-chain brokers" and "on-chain savings banks." For example, the Telegram Bond Fund launched in collaboration with Libre and the TON Foundation allows users to participate in investments in fixed-income products like dollar bonds on-chain, with plans to support the on-chain integration of low-value, fragmented assets in the future. At the same time, Ethena's synthetic stablecoin USDe will be connected to offline consumption through debit cards, bringing new consumer finance scenarios to RWA applications.

Essentially, what TON is building is not an isolated financial protocol but an "on-chain yield network" constructed around Telegram: Telegram serves as the user entry point and traffic distribution, PayFi is positioned at the front-end interaction layer, connecting on-chain wealth management with daily payment scenarios; RWA assets act as the underlying value anchor, injecting real yields into the financial system; and stablecoins and yield tokenization protocols, including USDe, take on the functions of yield on-chain anchoring and distribution. Through this closed-loop path, TON is expected to naturally guide Web2 users into the on-chain financial ecosystem, completing the entire experience from asset integration to yield realization without increasing cognitive barriers.

### The Road Ahead for TON: A Period of Accumulation for the Super Entry or a Castle in the Air?

TON's "traffic miracle" stems from the ecological nesting of Telegram and the viral spread of the Tap-to-Earn mechanism. However, as the enthusiasm wanes, user stickiness declines, and on-chain data recedes, a key question arises: Can the TON ecosystem establish a sustainable "traffic-to-value" model?

The answer may be written by TON's own strategy.

From a developmental pace perspective, TON has not rushed to repeat the high-frequency stimulation operation of Tap to Earn but has entered a deeper phase of infrastructure accumulation. This is similar to Solana's engineering repair period after the meme coin frenzy or Base's deep cultivation moment after the Friend.tech tide receded. TON's current development strategy also reveals a similar idea: switching from "blockbuster narratives" to a value path of "high-frequency necessities + long-term accumulation."

At the core of all this is Telegram—one of the Web2 platforms closest to the "super entry" standard:

Entry Advantage: Nearly 1 billion user social entry + one-stop wallet (TON Space) + Telegram App Center;

Dual-Driven Payment and Wealth Management: PayFi connects offline payments, while RWA builds a new paradigm of "on-chain wealth management";

Protocol-Level Nesting: TON Connect and Stars' fee mechanism essentially constructs the foundational infrastructure for chain abstraction;

Technical Stack Implementation: The Accelerator mainnet upgrade + Layer 2 payment network + BTC cross-chain bridge, etc., are all strengthening TON's infrastructure capacity.

From this perspective, TON's future does not resemble a "castle in the air" but rather looks like the construction of a new digital economic hub. However, this hub is not built for DeFi enthusiasts but for the next batch of Web2 users.

Nonetheless, TON's future still faces three major challenges:

The gap between user quality and financial depth: Despite having over 100 million monthly active users and frequent mini-games, whether users truly understand DeFi, participate in on-chain activities, and use Toncoin instead of just "grabbing airdrops" remains a question mark.

The difficulty of closing the application value loop on-chain: Lightweight, embedded applications (such as mini-games, transfers, advertising, payments) have a natural traffic advantage, but this "use and go" model also brings challenges: user behavior is difficult to solidify into on-chain assets, identities, data, or long-term retention. Unlike the Ethereum ecosystem, where wallet binding, DeFi participation, and NFT assets form on-chain profiles, most current TON users are merely "lightweight on-chain copies" of Telegram users, with low on-chain asset activity and interaction depth.

Uncertainty in compliance routes: Although TON is actively embracing regulation, such as appointing the co-founder of MoonPay as CEO, whether the combination of Telegram + TON can be sustainable in high-pressure regulatory markets like the U.S. and the EU remains to be seen.

In other words, TON is at a critical point of "from attention to value accumulation." Whether it will gradually solidify high-frequency interactions into financial and service entry points like WeChat mini-programs, or become another fleeting traffic illusion, largely depends on the team's execution ability, the ecosystem's self-evolution capability, and the wisdom of responding to the regulatory environment. However, compared to WeChat, TON and Telegram have the advantage of being able to "cross the river by feeling the stones." It is believed that the next 6-12 months will be a key window for the TON ecosystem to shift from "narrative-driven" to "fundamental value-supported."

### Conclusion

The story of TON is an attempt to transition "from platform traffic to on-chain value." It is neither like Ethereum, which builds a financial universe from the developer community, nor like Solana, which is driven by technology and meme catalysis. It is a Web3 popularization experiment centered on users, with entry as the hub and light experience as the weapon.

From Tap-to-Earn to PayFi, from the explosion of popularity to the accumulation of infrastructure, TON's evolutionary path actually presents an important signal: the next wave of Web3 popularization revolution may not occur within the crypto community but quietly unfold in the daily lives of hundreds of millions of Web2 users.

Whether TON can truly seize this opportunity to evolve from "the super entry on-chain" to "the super application platform on-chain" still requires time to verify. But regardless of success or failure, it provides a sample worth observing—a sample that does not guide users with "DeFi yield" but instead leads them to gradually touch the chain and use the chain through familiar interfaces, lightweight payments, mini-games, and social experiences.

This is an experiment, and it is also a gamble. However, in the current unresolved bear market, what TON offers is not a "get-rich-quick myth" but a Web3 imagination that is closer to real use scenarios. It may not be achieved overnight, but through a series of small openings and real demands, it may be nurturing the possibility of the next round of genuine Web3 large-scale transformation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。