The real RWA is a compliant financial product, and currently, it only exists overseas. Ordinary retail investors in the domestic market cannot purchase it.

Written by: Mankun

RWA has been ruined, and the five-piece funding scheme is online

Recently, I was scrolling through video accounts, and my eyes were almost blinded. Numerous accounts boast about "RWA tokens." Upon clicking in, I found that they are not legitimate RWA at all; they simply renamed their own issued tokens as "RWA" and started to ride the hype. Terms like "empowering the real economy," "combining virtual and real," and "the future of blockchain" are thrown around, leaving people confused. Even more absurd is the standard setup of these video accounts, which is like a "standard configuration" for funding schemes:

Whiteboard: A well-dressed "instructor" drawing on a whiteboard with a marker, calculating returns, sketching structures, making it seem like a real deal.

Red banners: Large characters on the background wall saying "Web3 Wealth Summit," "RWA Global Ecological Conference," etc., in red on white, festive like a New Year celebration.

Display boards: Walls full of "project introductions" and "global layouts," all in English and jargon, practically covering all four walls.

Cash counter + cash: A cash counter set up on-site, next to stacks of red bills, suggesting "invest and earn this much."

A group of elderly people sitting below, their eyes filled with "hopes of getting rich." You can just say whether to open the door or not! Years of experience as a lawyer tell me, if this isn't a funding scheme, then I’ll eat my keyboard!

Here are some on-site images reported from the video accounts for everyone to feel:

(The above images are from WeChat video accounts; feel free to identify yourself)

Scamming under the guise of "Web3 evangelists"

The names of these accounts are more impressive than the last, with titles like "Web3 Evangelist," "RWA Evangelist," "Blockchain Wealth Mentor." These terms are almost ruined by them, becoming pejorative. They particularly love to call themselves "industry pioneers," boasting about "deeply cultivating blockchain for ten years," but when you check, blockchain wasn't even popular ten years ago. What were you cultivating, buddy? P2P?

Even more ridiculous is that their video account homepage is filled with phrases like "leading everyone to embrace Web3" and "RWA is the future trend." When you click on the videos, it's all brainwashing tactics:

First, they throw a bunch of incomprehensible jargon at you, like "staking," "compound interest," "smart contracts," "algorithmic supply-demand balance," and after listening, the elderly only remember one thing—"invest and get rich."

Then they throw in a "once-in-a-lifetime opportunity," telling you "RWA is the ultimate form of blockchain; if you miss it, you'll regret it for life."

Finally, they come up with a "limited-time offer," such as "invest 10,000 now, get 5,000 tokens" or "referral commission of 30%," blatantly resembling a pyramid scheme.

Brother, where is such a good deal? The real RWA is a serious financial product involving asset securitization and compliance regulation; how could it be your turn to shout about it offline? These "evangelists" don't understand RWA at all; their "ecosystem" is just a funding scheme, specifically targeting the pensions of the elderly.

Why target the elderly? Because young people are hard to deceive

Have you noticed that the audience at these funding scheme offline events is all elderly people? Why? Because they can't deceive young people! Nowadays, those born in the '95s and '00s are very savvy with Web3, playing with meme coins effortlessly, and can easily check a contract address to see if a project is a scam. You want to hold offline lectures, use cash deposits, and recruit referrals? Sorry, they’ve already gone online to grab airdrops.

The elderly, on the other hand, are completely clueless about blockchain and Web3 concepts. Hearing high-sounding terms like "RWA" and "Web3," all they think about is: can make big money. They don't know how to check white papers or on-chain data; if the instructor casually paints a picture, they believe it. Not to mention these funding schemes are particularly good at "stirring emotions," saying things like "investing in RWA is to accumulate wealth for future generations" or "not investing means falling behind the times," and the elderly get excited and pull out their pensions.

I have to say a fair word: the elderly are not foolish; they just trust "experts" too much. Unfortunately, these "experts" are either stupid or malicious, specifically targeting places with information asymmetry, shearing the wool from the elderly. Don't they feel guilty?

The tricks of funding schemes: three moves + pyramid scheme flavor

The funding schemes riding the RWA concept can be summarized in three moves:

Build momentum: First, they hype RWA as "the ultimate windfall of blockchain," using a bunch of high-sounding terms to confuse you, then tell you "now is the last chance to get on board."

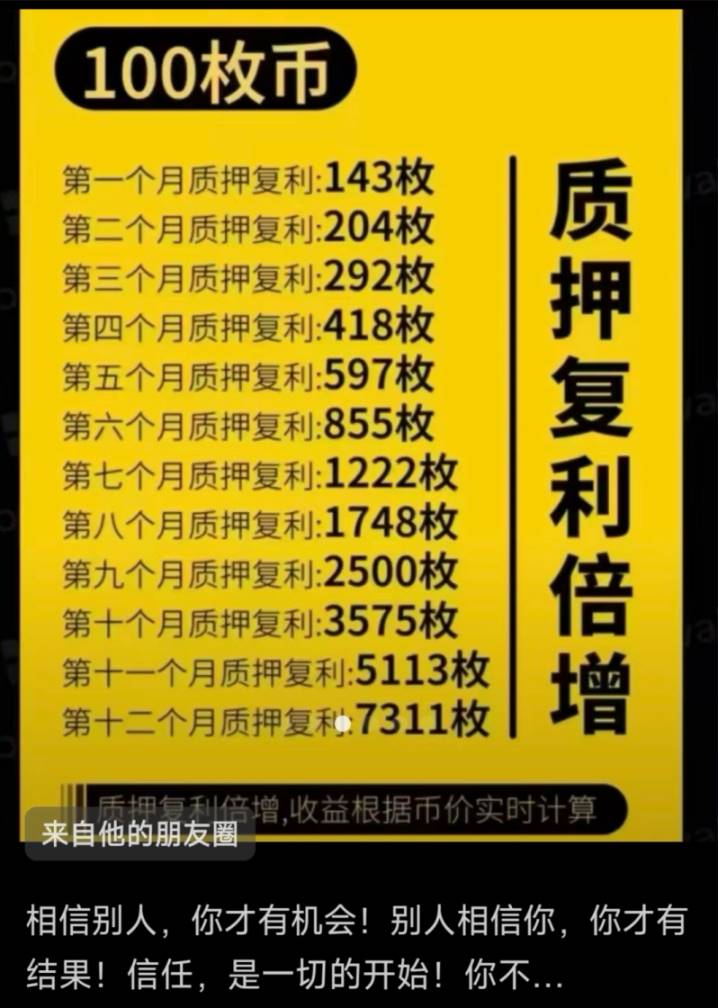

Paint a picture: They calculate returns, often claiming "annualized 50%" or "double in six months," and present a bunch of "success stories," which are actually all photoshopped or manipulated data.

Urge orders: Limited-time offers, referral commissions, team bonuses—blatantly pyramid scheme models, forcing you to quickly fork over money and bring relatives and friends to "get rich."

Even more disgusting is that they love to hold "offline experiences." They rent a hotel conference room, set up a cash counter and cash, and find a few actors on-site shouting "invest 100,000, already earned 500,000." The elderly see this, their blood heats up, and they immediately pull out their money. Brother, this isn't called investing; this is called falling into a trap!

These funding schemes' "RWA tokens" have no underlying asset support at all. The real RWA, like those issued in Hong Kong, has financial products as the middle layer, with valuable and income-generating assets as the underlying layer, clear cash flow, and regulatory backing. What are your tokens even invested in? What can they use to empower the real economy? Your mouth?

How "criminal" is running a funding scheme? Let's calculate how many years they could serve

As a justice-minded lawyer, I can’t stand this blatant scamming funding scheme. Don’t think that just because you put on the "RWA" vest, no one will care. Issuing and promoting virtual currencies domestically, especially running funding schemes, touches the legal red line. Let’s go through what crimes these people might commit and how many years they could face:

- Illegal absorption of public deposits

Don’t think that renting a conference room in a five-star hotel and finding a few actors in suits can package illegal fundraising as "financial innovation." According to the Supreme Court's judicial interpretation, if four characteristics are met, it constitutes illegal absorption of public deposits:

- Illegality: Not approved by financial regulatory authorities

- Publicity: Publicly promoted to society through media, promotional meetings, etc.

- Inducement: Promising capital return or providing returns

- Sociality: Absorbing funds from unspecified objects

Those "RWA evangelists" frantically shouting into the camera in video accounts, who isn’t saying "capital protection and interest," "static returns," "dynamic rewards"? Some even directly hold large meetings at community activity centers, demonstrating how to exchange RMB for U, practically tattooing the "four characteristics" standard on their foreheads while dancing in the street.

According to the latest sentencing standards, individuals illegally absorbing public deposits exceeding 1 million or targeting more than 150 people face three to ten years of imprisonment. Those running "hundred-city linkage" or "ten-thousand-person conferences" are likely to spend a long time in prison.

2. Fundraising fraud

If illegal absorption of public deposits is "blindly running," then fundraising fraud is "running with a knife"—the core difference lies in whether there is an "intent to illegally occupy." Mankun lawyer teaches you three tricks to identify:

- Look at the flow of funds: Is the money going into personal accounts or corporate accounts? Is it being squandered or transferred?

- Look at project authenticity: Are there verifiable underlying assets? Such as real estate, equity, supply chain documents, or other physical or rights certificates?

- Look at team background: Do the founders dare to show their faces? Do they dare to use real names? Do they dare to disclose business licenses and financial licenses?

Those running "RWA funding schemes" have white papers that are more perfunctory than elementary school essays, and team introductions are filled with titles like "blockchain experts" and "Wall Street returnees," not even daring to show a real photo. Even more laughable is that the so-called "empowering the real economy" is just renting a shared office for a photo op, what’s the difference from when e-rent treasure rented a fishing platform at the state guesthouse for a meeting?

According to the Criminal Law, if the amount of fundraising fraud is particularly large (over 5 million), the maximum penalty can be life imprisonment. Those who deceive the elderly into betting their pensions should really let them experience the taste of "tears behind bars."

3. Organizing and leading pyramid scheme activities

Now funding schemes have learned to be clever, no longer engaging in "three-level distribution" but playing "community consensus," yet the essence remains unchanged. As long as these three characteristics are met, it’s just a pyramid scheme in disguise:

- Entry fee: Must buy tokens/stake to qualify

- Recruiting: Developing downlines to unlock higher returns

- Team compensation: Earnings directly linked to the performance of downlines

This lawyer has seen a certain "RWA ecosystem" system table and exclaimed insider knowledge: static returns of at least 1% daily, dynamic returns with direct push rewards of 30%, and indirect push can still earn 10%. This compound interest model is even more extravagant than a Ponzi scheme. Even more outrageous, they also hold "city nodes" and "super nodes" ranking competitions, taking pyramid schemes to a new height in blockchain.

According to judicial interpretations, if there are more than 30 participants in the organization and the levels exceed three, prosecution will be initiated. Those team leaders who send "good news" in WeChat groups every day are likely to memorize the "Pyramid Scheme Prevention Manual" backward.

Finally, let me shout: Azu, stop it! Don’t think that hiding behind video accounts means no one will check. On-chain data, fund flows, promotional records—police officers can find out everything in a minute. Do you really think the Criminal Law is just for show? Prison food is not as appealing as your "annualized 50%!"

Conclusion

Elderly friends, protect your pensions

At this point, I really have to shout for the elderly: stop embracing "RWA"! These funding schemes' "RWA tokens" have nothing to do with real RWA. The real RWA is a compliant financial product, and currently, it only exists overseas. Ordinary retail investors in the domestic market cannot purchase it. What you see in video accounts and offline lectures as "RWA" is just a scam token; 80% of the money invested will likely go down the drain.

Elderly friends, investing is not gambling, and blockchain is not magic. If you want to manage your finances, go to the bank and buy some government bonds or funds, steady and secure. Don’t believe those "annualized 50%" or "double in six months" nonsense; money doesn’t just fall from the sky; it only falls into traps. Protect your pensions and don’t let "Web3 evangelists" scam away your hard-earned savings.

Project parties, get lost!

Finally, I want to say to those project parties riding the RWA concept to run funding schemes: get lost! Don’t think that just because you put on the "RWA" vest, you can do whatever you want; the law’s eyes are sharp. Every record you make in video accounts, WeChat groups, and offline lectures is evidence; every token you issue has a clear on-chain address. The police aren’t looking for you yet; it’s just not the right time. When the day comes to catch you, you won’t have time to cry.

Lastly, we remind all investors, especially middle-aged and elderly friends, to be vigilant against funding scheme fraud under the RWA concept. Before investing, be sure to understand the authenticity and legality of the project to avoid blindly following the crowd. At the same time, we also call on regulatory authorities to strengthen the crackdown on such fraudulent activities to maintain the stability of the financial market and protect the legitimate rights and interests of investors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。