This week, stablecoins continued to see small increases in issuance, with significant inflows into U.S. Bitcoin spot ETFs and minor inflows into Ethereum ETFs.

Author: Hotcoin Research

Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $3.34 trillion, with BTC accounting for 61.55%, amounting to $2.06 trillion. The market cap of stablecoins is $242.5 billion, with a 7-day increase of 0.12%, of which USDT accounts for 62.4%.

This week, BTC's price showed range-bound fluctuations, currently at $103,628; ETH exhibited upward fluctuations, currently at $2,599.

Among the top 200 projects on CoinMarketCap, a small number increased while most decreased, including: WIF with a 7-day increase of 44.8%, RAY with a 7-day increase of 19.4%, ETHFI with a 7-day increase of 114.52%, and NXPC with a 7-day increase of 75.9%.

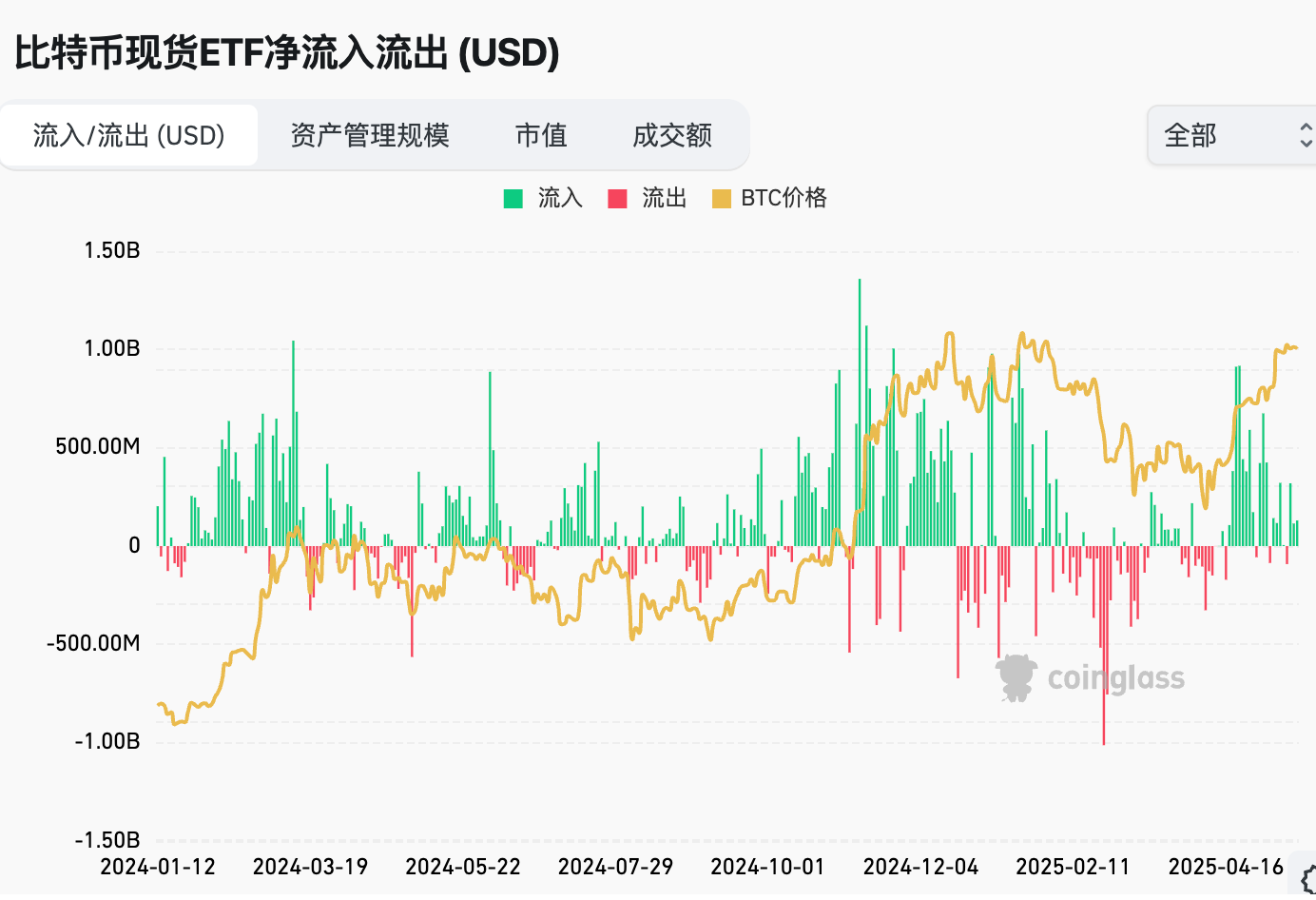

This week, the net inflow into U.S. Bitcoin spot ETFs was $607.8 million; the net inflow into U.S. Ethereum spot ETFs was $41.8 million.

The "Fear & Greed Index" on May 16 was 69 (lower than last week), indicating a sentiment of greed over the past 7 days.

Market Forecast:

This week, stablecoins continued to see small increases in issuance, with significant inflows into U.S. Bitcoin spot ETFs and minor inflows into Ethereum ETFs. Due to the easing of global tariff conflicts, U.S. April CPI and PPI data came in below expectations, with BTC hovering around $103,000. Some altcoins saw slight increases, notably the new project Launchcoin, which had a 7-day increase of 2650%. There are still phase-based profit opportunities in the market, with a focus on Hotcoin's new coin list. Greed sentiment has eased compared to last week. The probability of the Federal Reserve cutting rates by 25 basis points in June is only 6.7%, lower than last week, making a June rate cut unlikely, with attention turning to July. Although there are positive economic fundamentals, the market still faces significant uncertainty until new liquidity enters. The outlook for the market in 2025 remains optimistic. However, liquidity shortages are common in summer, so partial profit-taking is recommended.

Understanding Now

Review of Major Events of the Week

On May 11, Defillama founder 0xngmi posted on X platform that hackers managed to breach one address in Lido's oracle multi-signature, exposing their whereabouts after stealing 1.4 ETH. 0xngmi added that it might be worth placing some simple coins in multi-signature wallets to act as canaries and alert when the wallet is compromised;

On May 12, the White House announced that the U.S. reached a trade agreement with China in Geneva;

On May 13, S&P Dow Jones Indices announced that cryptocurrency exchange Coinbase (COIN.O) will be included in the S&P 500 Index, replacing Discover Financial. Coinbase will become the first pure crypto company to join the S&P 500 Index, with COIN's stock price rising 9.5% in after-hours trading;

On May 13, market news reported that Trump’s company Truth Social denied rumors of issuing a meme coin;

On May 13, SEC Chairman Paul Atkins announced his vision for crypto regulation, indicating a more favorable approach to digital assets;

On May 13, blockchain cloud service company Nirvana Labs completed a $6 million seed extension round, co-led by Jump Crypto and Crucible Capital, with participation from RW3 Ventures, Castle Island, Hash3 VC, and others;

On May 14, AI agent platform Virtuals Protocol announced on social media that the VIRTUAL staking feature is now live. By locking VIRTUAL, users will receive veVIRTUAL, the voting escrow version of the token, representing long-term collaboration, deeper protocol utility, and future governance power;

On May 14, TheBlock reported that the U.S. SEC postponed its decision on BlackRock's iShares Bitcoin Trust's physical redemption mechanism, requesting public comments on the proposal. The current cash redemption model requires custodians to sell Bitcoin before returning cash to investors. Analysts noted that if physical redemption is approved, it would enhance ETF trading efficiency. Additionally, proposals for Grayscale's Litecoin Trust and Grayscale's Solana Trust were also postponed, and the 21Shares Dogecoin ETF entered the public comment phase;

On May 14, Robinhood's competitor, online brokerage eToro, raised approximately $310 million in its initial public offering (IPO) in the U.S.;

On May 14, the Ethereum Foundation announced the launch of a "trillion-dollar" security plan, a comprehensive initiative aimed at upgrading Ethereum's security and helping the world transition to on-chain. The plan includes "full-stack security mapping," "key area breakthroughs," and "security awareness upgrades";

On May 15, CoinMarketCap officially launched the CMC Launch platform, with the first project being the decentralized perpetual trading platform Aster ($AST);

On May 15, U.S. lawmakers stated that Trump's involvement in crypto complicates legislation, but the stablecoin and market structure bills are still expected to pass before August;

On May 16, Coinbase faced a dual blow of "SEC investigation" and "hacker stealing user data" during trading hours.

Macroeconomics

On May 13, the U.S. April unadjusted CPI year-on-year was 2.3%, expected 2.40%, previous value 2.40%;

On May 15, the U.S. April PPI year-on-year was 2.4%, expected 2.5%, previous value revised from 2.70% to 3.4%. The PPI year-on-year has declined for the third consecutive month, marking a new low since September of last year;

On May 15, market news reported that the U.S. Securities and Exchange Commission decided to postpone its resolution on the 21SHARES spot Polkadot (DOT) ETF application;

On May 16, according to CoinPost, Japanese listed company Remixpoint announced the purchase of an additional 32.83 BTC, bringing its total Bitcoin holdings to 648.82 BTC, with a current market value of approximately 9.91 billion yen;

On May 16, according to CME's "FedWatch": The probability of the Federal Reserve maintaining interest rates in June is 93.3%, while the probability of a 25 basis point rate cut is 6.7%.

ETF

According to statistics, from May 12 to May 16, the net inflow into U.S. Bitcoin spot ETFs was $607.8 million; as of May 16, GBTC (Grayscale) had a total outflow of $22.944 billion, currently holding $19.635 billion, while IBIT (BlackRock) currently holds $65.435 billion. The total market value of U.S. Bitcoin spot ETFs is $125.131 billion.

The net inflow into U.S. Ethereum spot ETFs was $41.8 million.

Envisioning the Future

Upcoming Events

Bitcoin 2025 will be held from May 27 to 29 in Las Vegas, USA;

NFT NYC 2026 will be held from June 23 to 25, 2025, in New York, USA.

Project Progress

- DeFi Development approved a 1-for-7 stock split, with shareholders set to receive an additional six shares on May 19. If approved by Nasdaq, trading will resume on May 20 based on the adjusted shares.

Important Events

- On May 20, the Reserve Bank of Australia will announce its interest rate decision.

Token Unlocking

Pyth Network (PYTH) will unlock 2.13 billion tokens on May 19, valued at approximately $399 million, accounting for 58.62% of the circulating supply;

Pixels (PIXEL) will unlock 89.37 million tokens on May 19, valued at approximately $4.94 million, accounting for 1.79% of the circulating supply;

Polyhedra (ZKJ) will unlock 15.5 million tokens on May 19, valued at approximately $31.9 million, accounting for 1.55% of the circulating supply;

Pyth Network (PYTH) will unlock 2.83 billion tokens on May 20, valued at approximately $472 million, accounting for 28.33% of the circulating supply;

Bittensor (TAO) will unlock 216,000 tokens on May 21, valued at approximately $95.47 million, accounting for 1.03% of the circulating supply.

About Us

Hotcoin Research, as the core investment research hub of the Hotcoin ecosystem, focuses on providing professional in-depth analysis and forward-looking insights for global crypto asset investors. We have built a "trend analysis + value discovery + real-time tracking" integrated service system, offering in-depth analysis of cryptocurrency industry trends, multi-dimensional assessments of potential projects, and all-day market volatility monitoring, combined with weekly live strategy broadcasts of "Hotcoin Selected" and daily news briefings of "Blockchain Today," providing precise market interpretations and practical strategies for investors at different levels. Leveraging cutting-edge data analysis models and industry resource networks, we continuously empower novice investors to establish cognitive frameworks and assist professional institutions in capturing alpha returns, collectively seizing value growth opportunities in the Web3 era.

Risk Warning

The cryptocurrency market is highly volatile, and investment carries risks. We strongly recommend that investors fully understand these risks and invest within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail: labs@hotcoin.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。